Water Analysis Instrumentation Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442296 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Water Analysis Instrumentation Market Size

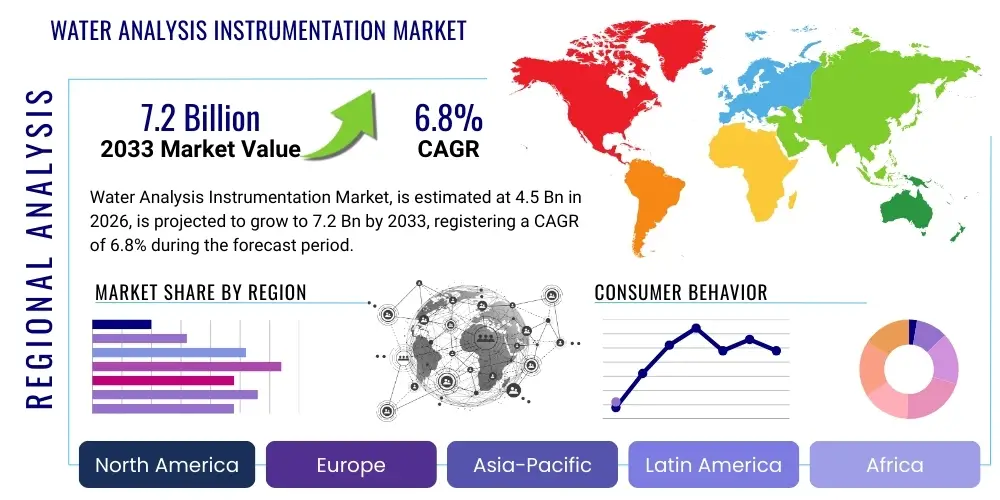

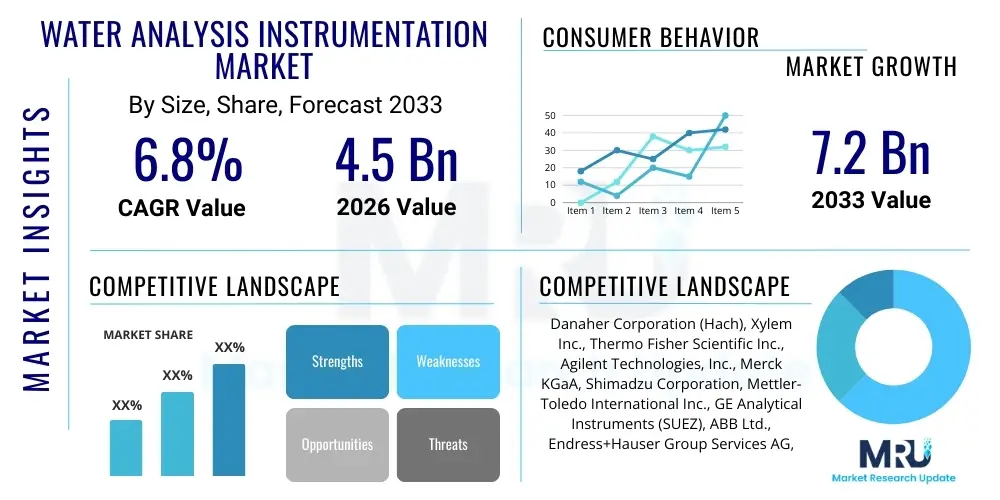

The Water Analysis Instrumentation Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.2 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by intensifying global regulatory pressure concerning water quality, coupled with rapid industrialization and urbanization across developing economies, necessitating precise and continuous monitoring of water resources for both environmental protection and public health safety. The escalating demand for sophisticated monitoring equipment in wastewater treatment plants, industrial process control, and laboratory research underscores the robust expansion forecast for this essential sector of environmental technology.

Water Analysis Instrumentation Market introduction

The Water Analysis Instrumentation Market encompasses a diverse range of devices and systems designed for measuring physical, chemical, and biological characteristics of water across various matrices, including drinking water, wastewater, surface water, and industrial process fluids. The product landscape is highly varied, comprising laboratory-based instruments such as spectrophotometers, Total Organic Carbon (TOC) analyzers, and high-performance liquid chromatographs (HPLC), alongside field-deployable portable instruments and continuous online monitoring systems utilizing advanced sensor technologies. These instruments provide critical data for maintaining regulatory compliance, optimizing industrial processes, ensuring public health standards, and supporting environmental research initiatives globally. Continuous technological innovation, particularly in sensor miniaturization and integrating Internet of Things (IoT) capabilities, is enhancing the efficiency, accuracy, and accessibility of water quality monitoring, broadening the market’s applicability beyond traditional municipal and industrial sectors.

Major applications for water analysis instrumentation span municipal water treatment facilities, where regulatory adherence to potable water standards is paramount, and industrial sectors such such as power generation, pharmaceuticals, food and beverage, and chemical manufacturing, where water purity directly impacts product quality and operational integrity. The benefits derived from utilizing these instruments are substantial, including early detection of contaminants, reduction in operational costs through optimized chemical dosing, prevention of equipment corrosion or fouling, and overall environmental stewardship. The increasing complexity of emerging contaminants, such as microplastics and persistent organic pollutants, mandates the adoption of highly sensitive and precise analytical tools, consequently fueling market growth. Furthermore, the global scarcity of freshwater resources necessitates efficient water management and reuse strategies, making accurate and real-time analysis indispensable for sustainable practices and long-term resource security.

Driving factors propelling this market include the global implementation of stricter water quality regulations, notably in North America and Europe, which necessitates mandatory testing and reporting protocols. Rapid infrastructural development and population growth in Asia Pacific countries are placing immense strain on existing water treatment capacity, thus increasing the procurement of advanced analytical equipment for expansion and modernization projects. Furthermore, technological advancements leading to the development of robust, low-maintenance, and multi-parameter instruments are lowering the barrier to entry for smaller users and extending monitoring capabilities to remote or previously inaccessible locations. The transition towards decentralized water treatment systems and the rising acceptance of process analytical technology (PAT) within industrial settings are also significant drivers stimulating demand across various instrument types, ensuring sustained market expansion throughout the forecast period.

Water Analysis Instrumentation Market Executive Summary

The global Water Analysis Instrumentation Market is characterized by robust growth, propelled primarily by stringent environmental regulations and the urgent need for infrastructure upgrades in emerging economies. Key business trends indicate a strong move toward digitalization and connectivity, transforming traditional instruments into smart, interconnected devices capable of real-time data transmission and integration with broader enterprise resource planning (ERP) and laboratory information management systems (LIMS). Leading market players are focusing heavily on strategic mergers and acquisitions to consolidate technological expertise, particularly in advanced sensor technologies and software analytics, enhancing their competitive positioning and offering integrated solutions that simplify the monitoring workflow for end-users. Sustainability is a core focus, driving demand for instruments that support resource efficiency, water recycling, and the detection of complex emerging contaminants, aligning market development with global environmental objectives and fostering long-term resilience in water management practices across diverse sectors.

Regionally, the market exhibits differential growth patterns; North America and Europe maintain dominance due to established regulatory frameworks, high levels of industrial automation, and significant investment in research and development activities focused on water purity standards. However, the Asia Pacific region is forecast to demonstrate the highest Compound Annual Growth Rate, driven by massive investments in new water infrastructure projects, necessitated by rapid urbanization, substantial population growth, and escalating pollution levels in major industrial hubs across China, India, and Southeast Asia. Latin America and the Middle East & Africa are also emerging as crucial growth avenues, stimulated by efforts to address water scarcity, improve sanitation facilities, and modernize aging utility networks, creating burgeoning opportunities for both benchtop and field-deployable instrumentation providers.

Segment trends highlight the dominance of continuous online analysis instruments due to their capability for immediate monitoring and automatic control feedback, critical for high-throughput industrial processes and municipal operations seeking proactive system management. Among technologies, electrochemical sensors remain foundational, but the fastest growth is observed in photometric and spectroscopic methods, favored for their accuracy in detecting trace levels of organic and inorganic compounds. End-user demand is heavily concentrated in the municipal sector, but the increasing necessity for stringent process control and compliance in industrial sectors, particularly power generation, oil and gas, and chemicals, is rapidly accelerating industrial segment revenue. This diversified demand landscape across product types, applications, and end-users ensures a balanced and resilient market structure, capitalizing on global efforts toward enhanced water safety and resource optimization.

AI Impact Analysis on Water Analysis Instrumentation Market

Common user questions regarding AI's impact on water analysis instrumentation frequently revolve around how Artificial Intelligence can enhance predictive maintenance capabilities, transition data management from reactive reporting to proactive decision-making, and improve the accuracy and speed of anomaly detection in complex water matrices. Users are keenly interested in the integration of AI algorithms for automatic calibration and drift correction in online sensors, thereby reducing the need for manual intervention and lowering operational expenditures. Furthermore, there is significant inquiry into AI's role in correlating disparate data sources—such as weather patterns, pump performance, and sensor readings—to build predictive models for contamination events or infrastructure failure. The key themes summarized from these inquiries underscore expectations for automation, efficiency gains, enhanced data interpretation, and a paradigm shift from simple monitoring to intelligent, self-optimizing water treatment and distribution systems, ensuring higher operational reliability and better regulatory compliance outcomes.

AI deployment is rapidly transforming the operational landscape of water analysis, moving beyond simple automation to sophisticated pattern recognition and predictive analytics. Machine learning models are increasingly utilized to analyze vast datasets generated by interconnected sensor networks, identifying subtle changes in water quality parameters that might indicate an emerging contamination issue or an inefficient treatment process before human operators can detect it. This proactive diagnostic capability significantly reduces response times, minimizes potential environmental harm, and optimizes chemical usage in treatment facilities, contributing directly to cost savings and improved environmental performance. The integration of AI also facilitates the development of self-learning instrument systems that adapt to varying environmental conditions and calibrate themselves autonomously, enhancing the reliability of measurements taken in dynamic field settings.

The future trajectory involves deploying edge AI directly onto sensor platforms, enabling instruments to process complex analytical data locally and instantly flag critical events, minimizing latency associated with cloud processing. This capability is crucial for real-time monitoring applications, such as drinking water network security or immediate industrial process control adjustments. AI’s ability to interpret complex spectral data from advanced instruments like mass spectrometers and sophisticated photometric analyzers also allows for the faster and more accurate identification of unknown or emerging pollutants. Consequently, AI acts not only as an operational enhancer but also as a fundamental tool for advancing analytical science within the water industry, setting a new benchmark for comprehensive water quality assurance and facilitating the management of increasingly complex water challenges.

- AI enables predictive maintenance of instrumentation, drastically reducing unscheduled downtime and optimizing service schedules.

- Machine learning algorithms enhance data anomaly detection, providing early warnings for water contamination events or treatment failure.

- AI integration facilitates sophisticated multi-parameter data correlation for comprehensive system diagnostics and operational optimization.

- Automated calibration and drift compensation using AI increase the long-term accuracy and reliability of online analytical instruments.

- Natural Language Processing (NLP) is being utilized to improve reporting and regulatory documentation generation based on analytical data.

- Deep learning models expedite the classification and identification of microbiological or chemical contaminants from complex sensor inputs.

DRO & Impact Forces Of Water Analysis Instrumentation Market

The Water Analysis Instrumentation Market is fundamentally shaped by the synergistic interplay of stringent global regulatory mandates requiring continuous water quality assurance (Drivers), substantial initial capital expenditure and the need for highly skilled technicians (Restraints), and the burgeoning opportunity presented by technological convergence, specifically the integration of IoT and AI into sensing platforms (Opportunities). The impact forces driving this market are primarily exerted by governmental and environmental agencies enforcing tighter limits on discharged pollutants and mandating elevated standards for potable water across municipal and industrial domains. Conversely, the market faces friction from economic volatility affecting public spending on infrastructure and the inherent technical challenges associated with maintaining the precision and stability of complex analytical equipment in harsh operating environments. Ultimately, the powerful societal demand for sustainable water management and resource efficiency dictates the long-term direction and growth momentum of this critical sector, necessitating innovation that balances cost effectiveness with analytical performance.

Key drivers include the global crisis of water scarcity and the pervasive threat of pollution from industrial activities and agricultural runoff, prompting governments worldwide to implement expansive monitoring networks and upgrade existing laboratory facilities. The necessity for advanced analytical instrumentation to detect trace amounts of emerging contaminants, such as PFAS (Per- and Polyfluoroalkyl Substances) and pharmaceuticals, is a significant technological driver pushing demand for highly sensitive detection systems. Moreover, the accelerating adoption of continuous monitoring systems in industrial settings is driven by the desire to optimize chemical processes, minimize waste generation, and achieve real-time process control, which directly contributes to operational efficiencies and compliance targets. These interwoven drivers collectively ensure a sustained and high-level demand for accurate and reliable water analysis instrumentation throughout the forecast period, especially in infrastructure-heavy sectors.

Restraints impeding market potential primarily involve the high upfront cost associated with sophisticated online analyzers and benchtop systems, which can be prohibitive for smaller municipalities or businesses operating under tight budgetary constraints. The complexity of maintaining, calibrating, and troubleshooting high-tech instruments requires specialized training and qualified personnel, posing a challenge, particularly in developing regions lacking sufficient technical expertise. Additionally, the rapid pace of technological change often results in rapid instrument obsolescence, requiring continuous investment in upgrades. However, these restraints are mitigated by significant opportunities, including the growing trend toward miniaturization, creating low-cost, portable, and user-friendly devices accessible to a wider user base. The focus on water reuse and zero liquid discharge (ZLD) technologies presents a massive opportunity for specialized instrumentation required for high-purity water monitoring, while public-private partnerships offer funding mechanisms to overcome initial financial hurdles, accelerating overall market penetration in underserved geographies.

Segmentation Analysis

The Water Analysis Instrumentation Market is extensively segmented based on criteria such as product type, application, end-user industry, and deployment methodology, providing a detailed view of market structure and competitive dynamics. Product segmentation covers a broad spectrum, ranging from basic electrochemical meters (pH, Conductivity, Dissolved Oxygen) to advanced analytical equipment including spectrometry, chromatography, and specialized TOC analyzers. Deployment segmentation is critical, differentiating between laboratory-based benchtop instruments requiring controlled environments, portable devices designed for field sampling and quick verification, and continuous online analyzers integrated directly into process streams for real-time monitoring and control. This complex segmentation allows manufacturers to target specific regulatory and operational needs across diverse water analysis scenarios, ensuring tailored solutions for accurate parameter measurement.

Application analysis highlights the primary uses of these instruments, dividing the market into areas such as water and wastewater treatment, environmental monitoring, industrial process control, and laboratory testing and research. Industrial applications, covering sectors like power generation, oil & gas, chemicals, and food & beverage, are increasingly demanding high-precision, robust instrumentation capable of functioning reliably under extreme conditions and complying with strict internal purity standards. The end-user segment clearly delineates demand between the municipal sector, which prioritizes large-scale compliance testing, and the industrial sector, which focuses on process optimization and effluent management. The interplay between these segments determines the allocation of R&D resources toward developing specialized analytical techniques suitable for detecting trace contaminants in complex matrices, thereby maintaining high analytical standards across all operational environments.

The segmentation structure reflects the market's maturity and specialization, allowing for targeted competitive strategies and technological focus. For instance, the rise in demand for continuous monitoring in critical infrastructure mandates innovation in sensor robustness and connectivity (IoT/IIoT). Conversely, increasing public awareness and regulatory enforcement related to persistent pollutants drives the chromatography and spectroscopy segment, which offers unparalleled sensitivity and selectivity. The consistent evolution of analytical challenges ensures that no single product type dominates, fostering innovation across the entire instrumentation portfolio, leading to a balanced market ecosystem designed to meet the growing global complexity of water quality assessment and management mandates.

- Product Type:

- Laboratory Analyzers (e.g., Spectrophotometers, TOC Analyzers, Titrators)

- Portable Instruments (e.g., Handheld Meters, Multiparameter Probes)

- Online/Process Analyzers (e.g., Continuous Monitors, Sensors, Controllers)

- Technology:

- Electrochemical

- Photometric/Spectroscopic

- Chromatography

- Total Organic Carbon (TOC) Analyzers

- Turbidity Meters and Nephelometers

- Application:

- Water and Wastewater Treatment

- Environmental Monitoring (Surface Water, Groundwater)

- Industrial Process Control

- Laboratory Testing

- End-User:

- Municipal Water Utilities

- Industrial Sector (Power Generation, Oil & Gas, Chemicals, Food & Beverage, Pharmaceuticals)

- Government & Academic Research

- Parameter Measured:

- pH and ORP

- Dissolved Oxygen (DO)

- Conductivity and Salinity

- Turbidity and Suspended Solids

- Nutrients (Nitrate, Phosphate, Ammonia)

- Heavy Metals and Toxins

Value Chain Analysis For Water Analysis Instrumentation Market

The value chain for the Water Analysis Instrumentation Market begins with the upstream segment involving the sourcing of highly specialized raw materials, including high-purity chemicals necessary for reagents, sophisticated electronic components for sensor fabrication (e.g., optical detectors, microprocessors, and specialized membranes), and high-grade plastics and metals required for instrument housing and durability. Manufacturers rely heavily on specialized suppliers for proprietary sensor technologies and precision engineering capabilities. Research and development activities, which represent a significant value-add component, focus on enhancing analytical accuracy, ensuring ruggedness for field use, and integrating smart features such as IoT connectivity and self-diagnostic capabilities, establishing a robust foundation of intellectual property critical for market differentiation and competitive advantage.

The middle segment of the value chain involves the complex assembly and manufacturing of instruments, followed by rigorous quality assurance and calibration processes that meet international standards (e.g., ISO certifications and regulatory body approvals). This phase is capital-intensive and requires advanced manufacturing facilities. The downstream activities focus on distribution, which utilizes both direct sales channels for major industrial and municipal contracts, and indirect channels relying on specialized regional distributors, value-added resellers (VARs), and channel partners who provide crucial localized support, training, and maintenance services. The complexity and high cost of instrumentation often necessitate highly technical sales engineers capable of providing detailed application advice and system integration support to end-users in specialized sectors like pharmaceuticals or nuclear power.

The final stage encompasses post-sales services, which are vital for long-term customer relationships and recurring revenue generation. This includes ongoing technical support, mandatory instrument calibration, preventative maintenance contracts, and the provision of replacement parts and consumables (such as reagents, electrodes, and membranes). Direct sales models often perform high-level installation and training, whereas indirect channels handle routine servicing, particularly in geographically fragmented markets. The efficiency of this service network significantly impacts customer satisfaction and instrument lifespan. The emphasis on connectivity is strengthening the service side, allowing manufacturers to offer remote diagnostics and software updates, adding significant value and streamlining the entire operational lifecycle of the analytical instruments deployed globally.

Water Analysis Instrumentation Market Potential Customers

The primary end-users and potential buyers of water analysis instrumentation span a wide array of public and private entities whose operations are intrinsically linked to the quality and management of water resources. Municipal water utilities and wastewater treatment plants constitute the largest and most foundational customer base, driven by regulatory mandates to ensure compliance with national and international drinking water standards and effluent discharge limits. These entities require a comprehensive suite of instrumentation, ranging from continuous online monitors for turbidity, chlorine, and pH, utilized in plant operations, to sophisticated laboratory instruments necessary for mandated monthly and quarterly compliance testing, ensuring public health safety and optimal system performance across vast distribution networks.

The industrial sector represents the most diverse and rapidly growing customer segment, encompassing critical verticals such as power generation, particularly thermal and nuclear plants requiring ultra-pure water to prevent scaling and corrosion in boilers and cooling towers. The chemical and petrochemical industries utilize high-precision instruments for process water quality control, ensuring product consistency and safety. Furthermore, the pharmaceutical and biotechnology sectors have exceptionally stringent requirements for USP grade water (e.g., Water for Injection, Purified Water), necessitating advanced TOC analyzers, conductivity meters, and microbiological testing equipment to maintain aseptic conditions and product quality throughout complex manufacturing cycles. The food and beverage industry also heavily relies on these instruments to monitor source water quality and cleaning processes, preventing contamination and preserving brand integrity.

Additionally, other significant potential customers include governmental environmental protection agencies, which utilize field-deployable and monitoring systems for large-scale ecological assessments and pollutant tracking in rivers, lakes, and oceans. Academic and independent commercial research laboratories purchase advanced spectroscopic and chromatographic instruments for fundamental research into emerging contaminants, toxicology, and water treatment innovation. These research institutions often drive demand for the highest precision and sensitivity levels available. The burgeoning sectors of agriculture (for irrigation quality management) and construction/mining (for discharge control) also represent specialized market niches demanding rugged, field-ready instruments capable of reliable performance in challenging, remote operating environments, solidifying a broad and diverse potential customer landscape.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Danaher Corporation (Hach), Xylem Inc., Thermo Fisher Scientific Inc., Agilent Technologies, Inc., Merck KGaA, Shimadzu Corporation, Mettler-Toledo International Inc., GE Analytical Instruments (SUEZ), ABB Ltd., Endress+Hauser Group Services AG, Horiba Ltd., Hanna Instruments, Inc., Testo SE & Co. KGaA, Metrohm AG, Lovibond Tintometer GmbH, WTW GmbH, Focused Photonics Inc. (FPI), Teledyne Technologies Incorporated, AQUALYTIC GmbH, Skalar Analytical B.V. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Water Analysis Instrumentation Market Key Technology Landscape

The technological landscape of the Water Analysis Instrumentation Market is undergoing a rapid evolution characterized by convergence, miniaturization, and enhanced data processing capabilities, moving toward "smart" instruments capable of autonomous operation. A central focus is the development of next-generation smart sensors utilizing advancements in microfluidics and nanotechnology. These smart sensors offer increased sensitivity, reduced sample size requirements, and enhanced selectivity for complex analytes, often integrating multiple parameters into a single, compact probe. Furthermore, these sensors are increasingly embedded with edge computing capabilities, allowing for localized data processing, drift correction, and self-diagnostics before transmitting only critical information, optimizing bandwidth usage and system responsiveness in real-time online monitoring applications critical for environmental safety and industrial efficiency.

Significant innovation is also occurring within optical and spectroscopic methodologies, including advanced UV-Vis spectrophotometry, fluorescence spectroscopy, and Fourier Transform Infrared (FTIR) technology, particularly adapted for non-contact, high-speed analysis. These technologies are vital for quickly identifying organic pollutants and quantifying parameters like TOC and BOD without relying on wet chemical methods, thereby reducing reagent consumption and turnaround time. Furthermore, the integration of wireless communication standards, such as 5G and various Industrial Internet of Things (IIoT) protocols, ensures seamless data integration from distributed field sensors into centralized Laboratory Information Management Systems (LIMS) or supervisory control and data acquisition (SCADA) systems. This enhanced connectivity is crucial for maintaining compliance records and facilitating centralized system management across geographically dispersed water networks.

Another major technological trend involves the continued refinement of laboratory-grade instrumentation, specifically in chromatography (HPLC, GC) coupled with advanced mass spectrometry (MS/MS and High-Resolution MS). These highly sensitive systems are essential for the definitive identification and quantification of emerging contaminants at parts-per-trillion levels, crucial for research and regulatory bodies setting new environmental quality standards. Coupled with sophisticated data analysis platforms leveraging Artificial Intelligence, these advanced instruments provide unparalleled analytical depth, allowing operators to move beyond simple parameter measurement to comprehensive chemical fingerprinting. The collective shift towards these connected, high-precision, and automated technologies fundamentally strengthens the market’s capability to address increasingly complex global water challenges, ensuring long-term operational sustainability and analytical reliability across all deployment scenarios.

Regional Highlights

- North America (NA): The North American market is characterized by robust regulatory frameworks established by the EPA and state-level agencies, driving continuous demand for high-end, compliant instrumentation. The maturity of industrial sectors, combined with significant private investment in advanced water treatment technologies and digital infrastructure (IoT integration), ensures NA remains a leading adopter of online analytical systems and sophisticated laboratory testing equipment for trace contaminant detection. Technological innovation and stringent enforcement of the Safe Drinking Water Act and Clean Water Act are the primary revenue generators, focusing heavily on modernizing aging utility infrastructure and addressing emerging pollutants like PFAS. The US and Canada represent major consumption hubs due to their high industrial activity and focus on environmental sustainability, demanding reliable, automated, and certified analysis instruments.

- Europe: European demand is largely propelled by the EU Water Framework Directive and specific regulations governing drinking water quality and industrial effluent. Germany, France, and the UK are key markets, showcasing high penetration of continuous monitoring systems and a strong focus on circular economy principles, leading to substantial investment in instrumentation that supports water recycling and reuse. Europe leads in the adoption of advanced, resource-efficient instruments, often prioritizing vendors that demonstrate low energy consumption and sustainable manufacturing practices, reflecting the region's overall environmental consciousness and leadership in green technology development. The market emphasizes precision and traceability, supported by a dense network of accredited testing laboratories.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, driven by explosive population growth, rapid industrial expansion, and massive governmental investment in new and modernized water infrastructure across China, India, and Southeast Asia. Escalating pollution levels in major urban and industrial centers necessitate the rapid deployment of water analysis instruments to enforce nascent regulatory standards and manage public health risks. While price sensitivity exists, the sheer scale of infrastructural projects and the urgency to address severe water quality issues are accelerating the procurement of both fundamental monitoring equipment and advanced analytical systems, creating immense opportunities for international manufacturers expanding their manufacturing and distribution capabilities regionally.

- Latin America (LATAM): The LATAM market, including Brazil and Mexico, demonstrates substantial potential stemming from inadequate access to sanitation infrastructure and the modernization of public utilities. Market growth is heavily influenced by foreign investment and government initiatives focused on infrastructure development and improving drinking water coverage. While adoption rates for high-end, complex instruments are moderate, there is a consistent and growing demand for portable, durable, and cost-effective instrumentation required for decentralized testing and operational monitoring in resource-constrained environments. Regulatory enforcement is gradually strengthening, providing a long-term catalyst for market maturation.

- Middle East and Africa (MEA): MEA faces critical water scarcity challenges, making the region a key market for instrumentation related to desalination, water reuse, and stringent resource management. Countries like Saudi Arabia, UAE, and Israel drive demand for highly specialized online analyzers used in desalination plants and industrial facilities (especially oil and gas). The African subregion, while highly fragmented, presents opportunities for robust, low-maintenance instruments required for monitoring water quality in public health programs and remote rural settings, often supported by international development aid and localized governmental initiatives focusing on basic compliance and infrastructure setup.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Water Analysis Instrumentation Market.- Danaher Corporation (Hach)

- Xylem Inc.

- Thermo Fisher Scientific Inc.

- Agilent Technologies, Inc.

- Merck KGaA

- Shimadzu Corporation

- Mettler-Toledo International Inc.

- GE Analytical Instruments (SUEZ)

- ABB Ltd.

- Endress+Hauser Group Services AG

- Horiba Ltd.

- Hanna Instruments, Inc.

- Testo SE & Co. KGaA

- Metrohm AG

- Lovibond Tintometer GmbH

- WTW GmbH

- Focused Photonics Inc. (FPI)

- Teledyne Technologies Incorporated

- AQUALYTIC GmbH

- Skalar Analytical B.V.

Frequently Asked Questions

Analyze common user questions about the Water Analysis Instrumentation market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Water Analysis Instrumentation Market?

The foremost driver is the implementation of increasingly strict global regulatory standards concerning water quality and environmental discharge, compelling municipal utilities and industrial operators to adopt advanced, continuous monitoring instrumentation to ensure compliance and avoid severe penalties, coupled with increasing public awareness regarding health risks associated with contaminated water sources.

Which technology segment is expected to show the highest growth rate during the forecast period?

The Spectroscopic and Photometric technology segment is anticipated to register the highest growth rate, primarily due to its non-contact analysis capabilities, enhanced sensitivity for detecting emerging contaminants (e.g., pharmaceuticals, microplastics), and its ability to be seamlessly integrated into high-speed, multi-parameter online monitoring systems for industrial process control and environmental surveillance networks.

How is the integration of IoT and AI influencing water analysis instrumentation?

IoT integration enables real-time data collection and remote management of distributed sensor networks, while AI leverages this massive data flow for predictive maintenance, automated anomaly detection, and optimizing treatment processes. This shift transforms monitoring from reactive testing to proactive, intelligent water resource management and drastically improves operational efficiency and response times.

What are the key challenges faced by manufacturers in the Water Analysis Instrumentation Market?

Key challenges include managing the high initial capital investment required for complex analytical systems, mitigating technical obsolescence due to rapid technological innovation, addressing the high demand for specialized technical expertise for maintenance, and navigating the complexity of global regulatory divergence across major operating regions and emerging economies.

Which end-user segment accounts for the largest share of the water analysis instrumentation revenue?

The Municipal Water Utilities segment currently holds the largest market share. This dominance is attributable to the essential governmental function of providing safe drinking water and managing extensive wastewater treatment operations, both of which require mandatory, large-scale deployment of instrumentation for regulatory adherence and continuous operational stability across expansive infrastructure systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager