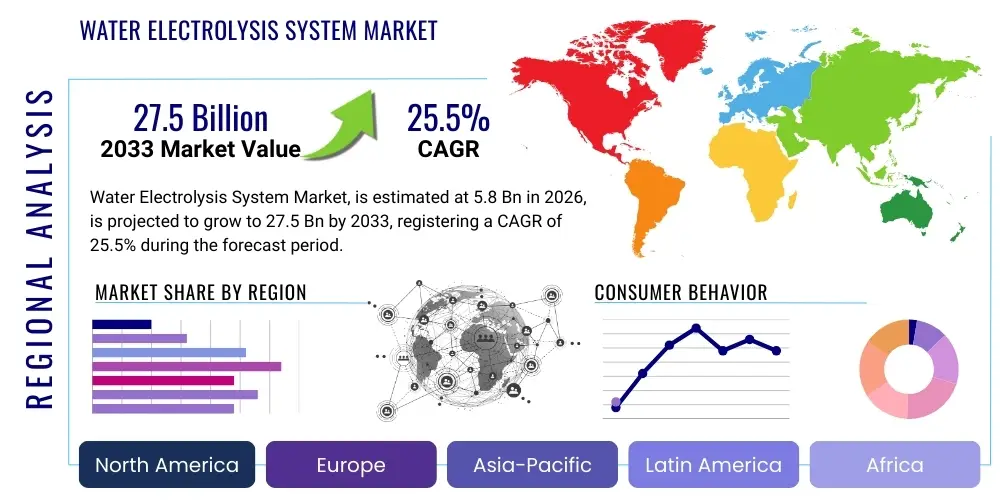

Water Electrolysis System Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443499 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Water Electrolysis System Market Size

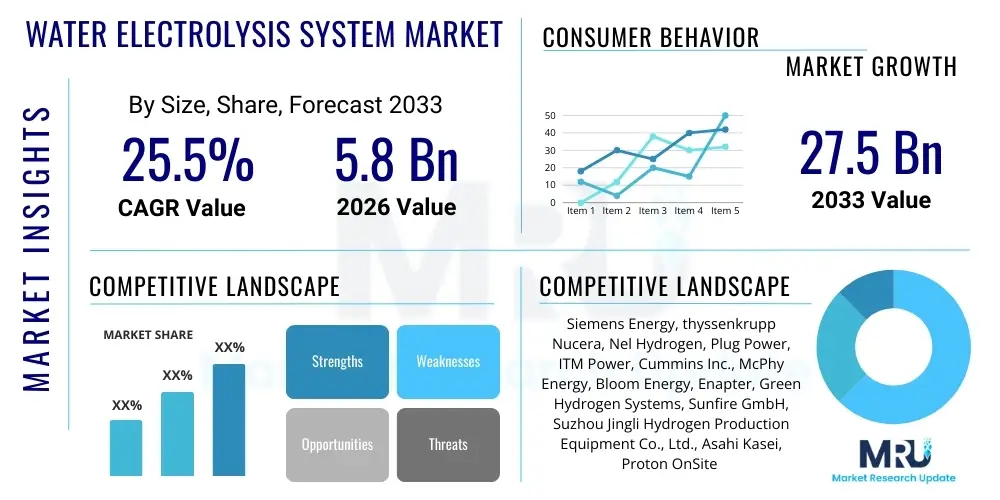

The Water Electrolysis System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 25.5% between 2026 and 2033. The market is estimated at USD 5.8 Billion in 2026 and is projected to reach USD 27.5 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating global push toward decarbonization and the urgent need to integrate intermittent renewable energy sources, such as solar and wind, through scalable energy storage solutions like green hydrogen production. The aggressive implementation of national hydrogen strategies across major economies, particularly in Europe and Asia Pacific, is creating massive demand for high-efficiency, large-scale electrolysis units, cementing the market’s trajectory toward significant value creation over the forecast horizon.

Water Electrolysis System Market introduction

The Water Electrolysis System Market encompasses the technologies and equipment designed to split water (H₂O) into hydrogen (H₂) and oxygen (O₂) using electricity, particularly focusing on systems powered by renewable energy, thus producing "green hydrogen." These systems are crucial components in the emerging global hydrogen economy, serving as the primary technological pillar for sustainable fuel and industrial feedstock generation. The core technologies include Proton Exchange Membrane (PEM) electrolysis, Alkaline Electrolysis (AEL), and Solid Oxide Electrolysis Cells (SOEC), each offering distinct advantages in terms of efficiency, capital cost, and operational temperature, thereby catering to varied application requirements across different industries.

Major applications of green hydrogen derived from these systems span several critical sectors. Industrially, hydrogen is vital for ammonia production (fertilizers), methanol synthesis, and refining processes, replacing fossil-fuel-derived gray hydrogen to significantly lower the carbon footprint of these foundational industries. Furthermore, in the energy transition context, water electrolysis systems facilitate large-scale energy storage, power grid balancing, and direct utilization in fuel cells for transportation (heavy-duty vehicles, maritime shipping) and combined heat and power generation. The rapid development of modular and containerized electrolysis solutions is also expanding their use in decentralized renewable energy projects.

The market's robust growth is underpinned by several powerful driving factors. These include mandatory carbon emission reduction targets set by international agreements and national governments, resulting in favorable policy frameworks, substantial public and private investment incentives, and subsidies for green hydrogen projects. The declining costs of renewable energy—the primary input for green hydrogen—are making electrolytic hydrogen increasingly cost-competitive. Moreover, technological advancements, such as improved catalyst materials and enhanced stack durability, are boosting system efficiency and reducing the overall Levelized Cost of Hydrogen (LCOH), accelerating adoption across diverse commercial and industrial landscapes globally.

Water Electrolysis System Market Executive Summary

The Water Electrolysis System Market is characterized by intense technological competition and unprecedented growth, largely steered by global business trends focusing on energy security and sustainability mandates. Key business trends show a significant shift towards large-scale, gigawatt-level manufacturing capacity expansion by established and emerging players, primarily targeting mass production to achieve economies of scale and further reduce hardware costs. Strategic partnerships and mergers between electrolyzer manufacturers and renewable energy developers, as well as oil and gas majors, are rapidly accelerating project deployment timelines, driving innovation in system integration and optimization across the hydrogen value chain.

Regionally, Europe leads the market in terms of installed capacity and policy support, driven by the ambitious European Green Deal and specific hydrogen strategies targeting domestic supply chains and international import corridors. Asia Pacific, spearheaded by China, Japan, and South Korea, is experiencing the fastest growth rate, fueled by substantial domestic renewable energy deployment and the need to decarbonize heavy industry and mobility. North America, particularly the United States, is seeing a dramatic uptake following substantial government funding and tax credits, notably the Production Tax Credit (PTC) under the Inflation Reduction Act (IRA), which significantly lowers the operating cost of green hydrogen production and incentivizes rapid deployment.

Segment trends highlight the dominance of Alkaline Electrolyzers (AEL) in terms of current installed capacity due to their proven reliability and lower capital expenditure, making them attractive for very large-scale, centralized projects. However, Proton Exchange Membrane (PEM) Electrolyzers are rapidly gaining market share, driven by their superior dynamic response, which is essential for pairing efficiently with intermittent renewable sources, and increasing power density. The emerging Solid Oxide Electrolysis Cells (SOEC) segment promises the highest efficiency by utilizing waste heat, signaling its long-term potential for integration with industrial processes or nuclear energy, fundamentally reshaping the future competitive landscape of the market.

AI Impact Analysis on Water Electrolysis System Market

Common user inquiries regarding the influence of Artificial Intelligence (AI) on the Water Electrolysis System Market frequently revolve around optimizing operational efficiency, predicting maintenance needs, and intelligently integrating electrolyzers with volatile renewable energy grids. Users are keenly interested in how AI can manage the complex dynamic load profiles inherent to renewable power sources, inquiring about the feasibility of AI-driven predictive control systems that maximize hydrogen output while minimizing system degradation. Concerns often focus on the required sensor infrastructure, data security, and the return on investment (ROI) of implementing advanced AI algorithms for real-time monitoring and anomaly detection in large-scale hydrogen plants. The overarching expectation is that AI will be the crucial differentiator enabling high utilization factors and ensuring the economic viability of green hydrogen projects globally.

AI's influence is pivotal across the entire lifecycle of water electrolysis systems, from design and manufacturing to large-scale operation and maintenance. In the design phase, machine learning algorithms are utilized for rapid material screening and optimization of catalyst composition, accelerating R&D cycles and identifying high-performance, durable, and cost-effective materials. Operationally, AI-driven predictive maintenance models analyze telemetry data, stack performance metrics, and external environmental factors (like temperature and humidity) to forecast component failure, thereby minimizing unplanned downtime and maximizing the system's availability and lifespan, which is critical for reducing the Levelized Cost of Hydrogen (LCOH).

Furthermore, AI plays an instrumental role in smart grid integration. By employing advanced forecasting models, AI systems predict renewable energy availability (e.g., wind speed, solar irradiance) and electricity market price fluctuations in real-time. This allows the electrolyzer system to modulate its power consumption dynamically—ramping up during periods of high renewable availability and low energy prices, and curtailing production when prices surge—optimizing profitability and maximizing the utilization of excess green power that would otherwise be curtailed. This intelligent load management is fundamental for establishing water electrolysis as a viable, flexible grid balancing service, rather than just an energy consumer.

- AI-driven Predictive Maintenance: Minimizing downtime and extending stack life through real-time data analysis and anomaly detection.

- Optimized Load Following: Utilizing machine learning for dynamic adjustment of power input based on renewable energy intermittency and grid price signals.

- Material Informatics: Accelerating R&D for catalysts and membranes through algorithmic screening and performance prediction.

- Enhanced System Modeling: Creating digital twins for performance simulation, operational testing, and scenario planning before physical deployment.

- Supply Chain Optimization: Using AI to manage complex logistics for large-scale electrolyzer component manufacturing and global distribution.

DRO & Impact Forces Of Water Electrolysis System Market

The dynamics of the Water Electrolysis System Market are profoundly influenced by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape the market's growth trajectory and inherent risk profile. The primary drivers are the governmental policy mandates targeting Net Zero emissions, coupled with extensive financial support and regulatory certainty, which significantly de-risk large capital investments in green hydrogen infrastructure. The rapidly declining capital cost of renewable energy, particularly solar and wind power, directly lowers the primary operational expense for electrolytic hydrogen, thereby accelerating its cost parity with traditional gray hydrogen in certain regions. These compelling drivers are creating an ecosystem where green hydrogen is transitioning from a niche technology to a fundamental pillar of global energy systems, necessitating a rapid scale-up in manufacturing and deployment.

Conversely, the market faces significant restraints that slow down immediate mass commercialization. The high initial Capital Expenditure (CapEx) associated with setting up large-scale electrolysis facilities remains a substantial barrier, especially for emerging economies, despite recent cost reductions. Furthermore, the inherent complexity in establishing robust, reliable supply chains for critical components, such as iridium used in PEM catalysts, creates bottlenecks and price volatility. Regulatory uncertainty surrounding standards for hydrogen purity, transportation, and storage in some jurisdictions also complicates cross-border trade and large-scale project execution, demanding coordinated policy efforts to standardize technical specifications and certification processes across the industry.

However, the opportunities for market expansion are substantial and transformative. The large-scale decarbonization of 'hard-to-abate' sectors, including heavy industry (steel, cement) and long-haul transportation (maritime, aviation), presents an immense, untapped demand potential for green hydrogen and its derivatives (e.g., green ammonia, sustainable aviation fuel). Technological breakthroughs focusing on enhancing the durability and efficiency of next-generation electrolysis technologies, such as SOEC, promise to unlock new levels of performance and cost competitiveness. Moreover, the growing global consensus on carbon border adjustment mechanisms and premium pricing for certified green products will increasingly favor electrolysis systems that guarantee ultra-low-carbon hydrogen production, positioning market leaders for exponential growth.

Segmentation Analysis

The Water Electrolysis System Market is strategically segmented across several critical dimensions, including product type, capacity, application, and end-user, to provide granular market insights into technology adoption trends and specific demand drivers. Product segmentation is crucial as it reflects the current state of technological maturity and performance characteristics, identifying the competitive niches of Alkaline (AEL), PEM, and SOEC technologies. Capacity segmentation, from small-scale (kW range) to industrial-scale (MW/GW range), determines the appropriate technology choices based on project scope, with smaller systems often favoring PEM for quick response, while larger projects rely on AEL for cost efficiency or PEM for grid balancing flexibility.

Application analysis differentiates between utilizing hydrogen for captive industrial consumption (e.g., ammonia production or refining), energy storage and grid injection (Power-to-Gas), and mobility (fuel cell vehicles, fueling stations). This segmentation highlights that while industrial applications currently represent the largest volume consumers, grid stabilization and mobility are poised for the highest growth rates due to regulatory push. Finally, end-user segmentation examines demand across major industries such as chemicals, oil and gas, utilities, and transportation, revealing the differing adoption barriers and investment priorities for green hydrogen integration within each sector.

Understanding these segments is essential for strategic planning, enabling market participants to tailor their technological offerings, supply chain strategies, and pricing models to meet the unique performance requirements and regulatory landscapes of diverse customer bases. The current market trend shows a concerted effort by manufacturers to scale up production of modular units suitable for both decentralized applications and large, centralized hydrogen hubs, indicating a harmonization of segment-specific requirements toward flexible, high-capacity solutions capable of meeting the escalating global demand for decarbonization tools.

- Technology Type:

- Alkaline Water Electrolysis (AEL)

- Proton Exchange Membrane (PEM) Electrolysis

- Solid Oxide Electrolysis Cell (SOEC)

- Anion Exchange Membrane (AEM) Electrolysis

- Capacity:

- Small-Scale (<1 MW)

- Medium-Scale (1 MW - 50 MW)

- Large-Scale (>50 MW)

- Application:

- Industrial Feedstock (Ammonia, Methanol, Refining)

- Power-to-Gas (Grid Injection, Energy Storage)

- Mobility and Transportation

- Building Heat and Power

- End-User Industry:

- Chemical and Petrochemical

- Utilities and Power Generation

- Manufacturing and Heavy Industry (Steel, Cement)

- Transportation (Road, Rail, Maritime)

Value Chain Analysis For Water Electrolysis System Market

The value chain for the Water Electrolysis System Market spans raw material sourcing, component manufacturing, system assembly, project deployment, and long-term maintenance and operation, illustrating a complex web of specialized activities. The upstream segment is defined by the procurement of critical raw materials, notably specialized catalysts (e.g., iridium, platinum for PEM; nickel for AEL), high-performance membrane materials, and essential stack components like bipolar plates and power electronics. Suppliers specializing in these high-tolerance components hold significant leverage, particularly given the global supply constraints for rare earth and platinum group metals, which are vital for achieving high-efficiency performance and durability in both PEM and SOEC technologies. This early stage of the value chain is critical for cost control and technological differentiation, requiring robust supplier qualification and diversification strategies.

Midstream activities involve the design, fabrication, and assembly of the electrolysis stack and the entire balance of plant (BOP), including power supplies, water purification units, gas conditioning systems, and compression equipment. Original Equipment Manufacturers (OEMs) specializing in electrolyzer technology stack assembly dominate this stage, focusing heavily on modularization and standardization to improve manufacturing scalability and reduce lead times. Distribution channels are highly professionalized, primarily relying on direct sales and engineering, procurement, and construction (EPC) contractors who manage large-scale project execution. Indirect channels, such such as distributors or specialized system integrators, are often used for smaller, decentralized applications, providing localized support and maintenance services.

The downstream sector encompasses the integration of the electrolysis system with the energy source (typically renewable energy farms), the physical installation, commissioning, and the subsequent operational life, including hydrogen storage and delivery infrastructure. Key downstream stakeholders are renewable energy developers, major industrial consumers, and utility companies who serve as the primary customers and operators of these systems. Furthermore, long-term maintenance and service contracts, often leveraging remote monitoring and AI-driven predictive analytics, represent a growing and high-margin segment of the downstream value chain, ensuring system reliability and optimizing operational efficiency over the 20- to 30-year lifespan of the electrolysis plant, thereby securing consistent revenue streams for OEMs and service providers.

Water Electrolysis System Market Potential Customers

The primary target audience and potential customers for Water Electrolysis Systems are diverse, spanning multiple heavy energy-consuming sectors that require decarbonization. The most significant buyers are large industrial entities, particularly those in the chemical and petrochemical sectors (for green ammonia and methanol production), and refineries seeking to reduce their carbon intensity by substituting gray hydrogen feedstock. These buyers prioritize system longevity, reliability, and low operational expenditure, often requiring solutions at the 100 MW+ scale to match their vast consumption needs and ensure supply stability for continuous process operations.

Another major customer segment consists of global utility companies and independent power producers (IPPs). These organizations purchase electrolysis systems primarily for large-scale energy storage applications (Power-to-Gas) and grid balancing services, aiming to mitigate the intermittency challenges posed by high penetration of solar and wind power. For this segment, the critical purchase criteria are fast ramp-up/ramp-down capabilities (favoring PEM technology) and overall system flexibility, enabling them to maximize value extraction from fluctuating electricity markets while ensuring grid stability and reliable capacity provision.

Furthermore, emerging sectors, including mobility providers and heavy transport operators (maritime ports, logistics hubs), represent a high-growth segment, although current procurement volumes are smaller. These customers require modular, robust systems to supply hydrogen fueling stations for captive fleets or commercial road/rail transport, focusing on ease of deployment, safety standards, and decentralized operability. Government entities, research institutes, and defense organizations also procure small-to-medium scale systems for localized energy independence, R&D testing, and specialized applications, rounding out the diverse base of end-users driving demand across the Water Electrolysis System Market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.8 Billion |

| Market Forecast in 2033 | USD 27.5 Billion |

| Growth Rate | CAGR 25.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Siemens Energy, thyssenkrupp Nucera, Nel Hydrogen, Plug Power, ITM Power, Cummins Inc., McPhy Energy, Bloom Energy, Enapter, Green Hydrogen Systems, Sunfire GmbH, Suzhou Jingli Hydrogen Production Equipment Co., Ltd., Asahi Kasei, Proton OnSite (now Nel Hydrogen), Giner Inc., Hydro-Québec, Next Hydrogen, Kobelco Eco-Solutions, Shandong Saikesaisi Hydrogen Energy Co., Ltd., Shanghai Electric |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Water Electrolysis System Market Key Technology Landscape

The technology landscape of the Water Electrolysis System Market is characterized by the coexistence and intense competition among three primary technologies: Alkaline Electrolysis (AEL), Proton Exchange Membrane (PEM) Electrolysis, and Solid Oxide Electrolysis Cells (SOEC), alongside the emerging Anion Exchange Membrane (AEM) technology. AEL represents the most mature and widely deployed technology, utilizing liquid electrolytes and non-noble metal catalysts, which results in lower capital costs and robust, long-term performance. However, AEL systems exhibit slower dynamic response times and operate at lower current densities compared to PEM, making them less ideal for direct coupling with the rapid fluctuations of intermittent renewable power sources, thus often requiring buffering systems when deployed for grid-flexible operations.

PEM electrolysis, leveraging a solid polymer electrolyte, offers superior power density, compact size, and extremely fast response times, enabling seamless integration with solar and wind farms for effective load balancing and rapid startup/shutdown cycles. This flexibility makes PEM highly attractive despite its reliance on scarce and expensive noble metal catalysts (iridium and platinum). Technological efforts within PEM development are focused intensely on reducing the catalyst loading, developing alternative materials, and enhancing the durability of the membrane to lower the overall LCOH and improve competitiveness against AEL for large-scale applications. Ongoing innovation aims to achieve significant economies of scale in PEM stack manufacturing to align capital costs closer to those of AEL systems.

SOEC technology stands out due to its high electrical efficiency, achieving hydrogen yields significantly higher than AEL or PEM, primarily because it operates at high temperatures (700°C to 1000°C). This high temperature allows the system to utilize external heat sources, such as waste heat from industrial processes or nuclear reactors, dramatically lowering the electrical energy consumption required for splitting water vapor. While offering unparalleled efficiency, SOEC systems face challenges related to material degradation, long startup times, and system complexity associated with high-temperature operation, restricting their immediate deployment to projects where a consistent, high-temperature heat source is readily available, positioning SOEC as a major long-term technology for large industrial hubs.

Regional Highlights

The global distribution and growth trajectory of the Water Electrolysis System Market show distinct regional patterns, driven by localized policy environments, renewable energy penetration, and existing industrial structures. Europe currently holds the leadership position, fueled by highly aggressive decarbonization targets under the REPowerEU plan and National Hydrogen Strategies (e.g., Germany, Netherlands). The region has committed massive public and private funding to establish hydrogen valleys and corridors, supporting domestic electrolyzer manufacturing capacity and cross-border infrastructure, creating a mature market focused on large-scale industrial integration and power grid balancing services.

Asia Pacific (APAC) represents the fastest-growing region, primarily due to the massive renewable energy capacity additions in China and India, coupled with strong governmental initiatives in Japan and South Korea to secure green hydrogen imports and establish domestic production capabilities. China is emerging as a global powerhouse in low-cost electrolyzer manufacturing, leveraging its manufacturing prowess to accelerate deployment. APAC demand is primarily driven by the need to decarbonize vast industrial complexes (steel, petrochemicals) and transition heavily polluting urban mobility sectors, leading to significant investment in both Alkaline and PEM technologies optimized for regional scale requirements.

North America, particularly the United States, is experiencing a catalytic market transformation due to the Inflation Reduction Act (IRA), which provides unprecedented financial incentives, including the 45V Clean Hydrogen Production Tax Credit. This policy has fundamentally altered the economics of green hydrogen, making it competitive with traditional hydrogen sources in certain locations. The focus in North America is on massive, integrated energy projects—combining large solar/wind farms with gigawatt-scale electrolyzers—to serve regional industrial clusters and export opportunities, leading to rapid expansion plans announced by major international and domestic players.

- North America: Driven by the US Inflation Reduction Act (IRA) and supportive state policies; focus on centralized production hubs and industrial decarbonization.

- Europe: Market leader characterized by strong policy support (European Green Deal, H2 corridors); prioritizing green hydrogen deployment for grid balancing and sector coupling.

- Asia Pacific (APAC): Fastest growing market; significant capacity expansion driven by China's manufacturing scale and demand from Japan and South Korea for clean energy imports and domestic industrial transition.

- Middle East and Africa (MEA): Emerging as a major low-cost green hydrogen export hub, capitalizing on abundant solar resources; focused on gigawatt-scale projects in nations like Saudi Arabia (NEOM) and the UAE.

- Latin America: High potential driven by abundant hydro and wind resources (e.g., Chile, Brazil); projects focused on green ammonia and methanol export, benefiting from low renewable electricity prices.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Water Electrolysis System Market.- Siemens Energy

- thyssenkrupp Nucera

- Nel Hydrogen

- Plug Power

- ITM Power

- Cummins Inc.

- McPhy Energy

- Bloom Energy

- Enapter

- Green Hydrogen Systems

- Sunfire GmbH

- Suzhou Jingli Hydrogen Production Equipment Co., Ltd.

- Asahi Kasei

- Giner Inc.

- Hydro-Québec

- Next Hydrogen

- Kobelco Eco-Solutions

- Shandong Saikesaisi Hydrogen Energy Co., Ltd.

- Shanghai Electric

- Ataka Engineering Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Water Electrolysis System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the current primary driver of growth in the Water Electrolysis System Market?

The primary driver is the global mandate for decarbonization, coupled with government incentives like the US IRA and European subsidies, which are making green hydrogen economically competitive by reducing capital costs and guaranteeing production value for electrolytic systems.

How do PEM and Alkaline Electrolyzers differ in application?

PEM electrolyzers are favored for dynamic applications requiring fast response times, such as coupling with intermittent solar and wind power. Alkaline electrolyzers are preferred for large-scale, steady-state industrial hydrogen production due to their lower initial capital costs and reliance on non-noble metal catalysts.

What is the main challenge limiting the widespread adoption of green hydrogen produced by electrolysis?

The main challenge remains the high initial Capital Expenditure (CapEx) for large-scale electrolysis projects and the reliance on expensive critical raw materials (e.g., iridium for PEM), although technological scaling and material substitution efforts are rapidly mitigating these costs.

Which region currently leads the world in deployed electrolysis capacity?

Europe currently leads in terms of policy-driven deployed capacity and established hydrogen infrastructure, heavily supported by the European Green Deal and extensive national hydrogen strategies aimed at achieving energy independence and sustainability targets.

How does Solid Oxide Electrolysis Cell (SOEC) technology achieve higher efficiency?

SOEC achieves superior efficiency by operating at high temperatures (up to 1000°C), which allows the conversion process to utilize thermal energy (heat) instead of solely electrical energy to split water vapor, significantly reducing the required electricity input per kilogram of hydrogen produced.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager