Water Leak Detection Systems Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442534 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Water Leak Detection Systems Market Size

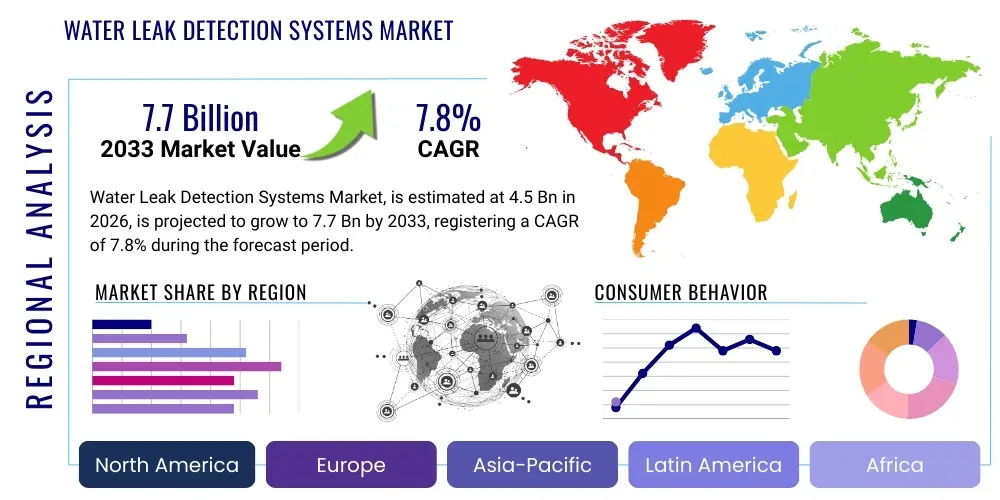

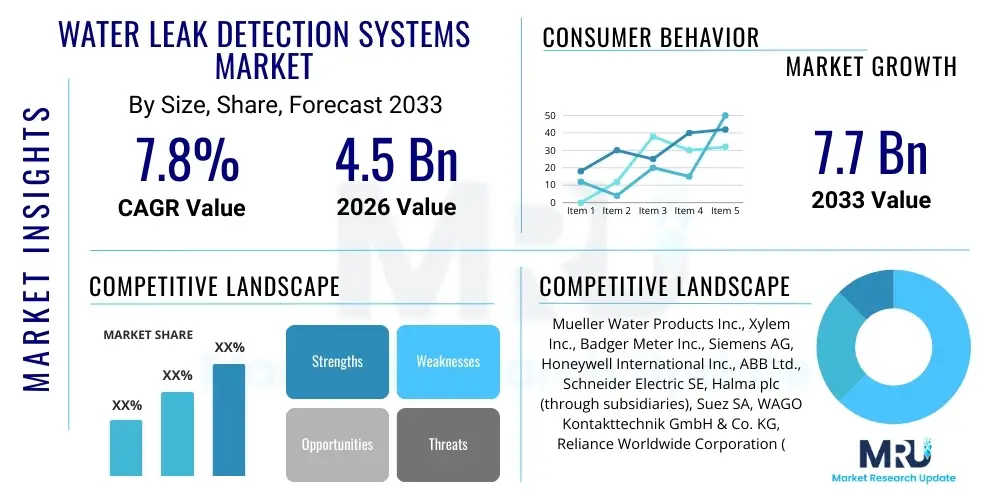

The Water Leak Detection Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.7 Billion by the end of the forecast period in 2033.

Water Leak Detection Systems Market introduction

The Water Leak Detection Systems Market encompasses advanced technological solutions designed to proactively identify and locate unintended water releases within infrastructure, residential, commercial, and industrial settings. These systems utilize a range of technologies, including acoustic sensors, pressure sensors, electromagnetic sensors, and conductive cables, to prevent significant water loss, mitigate structural damage, and minimize financial expenditure associated with undetected leaks. The primary application spans critical infrastructure management, smart home integration, and large-scale industrial process monitoring, transitioning the industry from traditional reactive maintenance models to sophisticated predictive water management.

The core product portfolio includes both permanent monitoring systems installed within piping networks or building fabrics, and portable detection devices utilized by utility services for survey and repair operations. Key driving factors include the escalating global issue of Non-Revenue Water (NRW), which places immense financial strain on municipal water bodies, coupled with increasingly stringent governmental regulations mandating efficient water usage and infrastructure integrity checks. Furthermore, the growing adoption of smart home technologies and IoT integration in commercial properties is catalyzing demand for integrated, real-time monitoring solutions that offer immediate alerts and remote shut-off capabilities.

Benefits derived from the adoption of these detection systems are multifaceted, encompassing environmental conservation through reduced water wastage, substantial operational cost savings for municipalities and building owners, and enhanced safety by preventing catastrophic failures or mold growth associated with prolonged leaks. The market landscape is characterized by continuous innovation, particularly the integration of Artificial Intelligence and machine learning algorithms that enhance sensor data interpretation, improve leak localization accuracy, and significantly reduce false positive alerts, thereby optimizing maintenance schedules and resource allocation across diverse end-user sectors.

Water Leak Detection Systems Market Executive Summary

The Water Leak Detection Systems Market is experiencing robust growth driven by infrastructural obsolescence in developed economies and rapid urbanization in emerging markets, necessitating reliable water security measures. Key business trends include the convergence of hardware manufacturing with specialized data analytics services, shifting market competition towards comprehensive, service-based platforms rather than merely selling standalone sensors. Regional trends show North America and Europe leading in terms of adoption due to mature regulatory frameworks and substantial investment in smart utility infrastructure, while the Asia Pacific region is forecast to demonstrate the highest growth rate, fueled by massive government initiatives aimed at upgrading outdated municipal water supply networks and accommodating new construction projects with modern monitoring requirements.

Segment trends highlight the dominance of the Acoustic/Ultrasonic technology segment, which remains critical for large-diameter pipe inspection and underground leak localization, though the Sensor-based segment, particularly leveraging cable and spot sensors, is seeing rapid proliferation within residential and commercial building management systems. The municipal segment continues to be the largest consumer, driven by urgent needs to reduce NRW losses that often exceed 30% in older systems. Simultaneously, the residential segment is emerging as a significant growth vector, catalyzed by insurance incentives for homeowners to install preventative smart leak detection devices.

The overall market trajectory is defined by digitalization and integration. Successful market participants are focusing on developing interoperable systems that seamlessly communicate with existing Building Management Systems (BMS) and Supervisory Control and Data Acquisition (SCADA) systems. The shift towards non-invasive detection methods, coupled with the optimization of wireless communication protocols (like LoRaWAN and Narrowband IoT), is simplifying deployment, reducing installation costs, and expanding the feasibility of deploying these systems in previously inaccessible or highly complex environments, thereby widening the total addressable market globally.

AI Impact Analysis on Water Leak Detection Systems Market

Common user questions regarding AI's influence in the Water Leak Detection Systems Market revolve primarily around its capacity for predictive accuracy, its role in filtering environmental noise from true leak signals, and its ability to integrate disparate data sources (like flow rates, pressure fluctuations, and acoustic readings) for holistic system health assessment. Users frequently inquire about the cost-benefit analysis of implementing deep learning models for anomaly detection versus traditional threshold-based alarming, and the requirements for data infrastructure needed to support sophisticated machine learning algorithms in operational utility environments. There is a strong expectation that AI will transition these systems from reactive alerting tools to genuinely predictive maintenance platforms.

AI, specifically through machine learning and deep learning models, is fundamentally transforming the interpretation of sensor data, providing unparalleled accuracy in identifying the characteristics and location of leaks, particularly in noisy, complex subterranean environments. Traditional acoustic leak detection relies heavily on human interpretation of correlation data; however, AI models are trained on vast datasets of historical leak signatures, environmental vibrations, and pipe material resonance patterns, allowing systems to automatically classify detected anomalies. This reduction in reliance on manual analysis significantly decreases response times and minimizes the incidence of costly false positives, which historically plagued the industry and eroded user trust in automated systems. Furthermore, reinforcement learning is being utilized to optimize the deployment strategy of mobile monitoring units, ensuring maximum network coverage with minimal operational overhead.

The integration of AI also facilitates comprehensive network-wide pressure transient analysis. By modeling the normal pressure behavior across various district metered areas (DMAs), AI algorithms can detect minute deviations indicative of developing leaks or potential pipe bursts long before conventional pressure drops become noticeable. This capability shifts the focus from merely detecting the existence of a leak to predicting the likelihood of a leak based on subtle environmental or operational changes, such as ground movement or temperature variations affecting pipe elasticity. The future of the market is anchored in these predictive maintenance capabilities, ensuring that remediation efforts are prioritized based on assessed risk and potential impact, optimizing capital expenditure for utility providers globally.

- Enhanced anomaly detection using deep learning on acoustic and vibration data.

- Reduced false positives by filtering environmental noise and classifying leak signatures automatically.

- Predictive maintenance scheduling based on risk assessment of pipe segment integrity.

- Optimization of sensor placement and network monitoring efficiency.

- Integration of flow, pressure, and acoustic data for holistic system health monitoring.

DRO & Impact Forces Of Water Leak Detection Systems Market

The market is predominantly driven by the critical need to conserve finite water resources amidst global climate stress and the imperative to reduce vast financial losses associated with Non-Revenue Water (NRW). Restraints primarily involve the high capital expenditure required for large-scale municipal deployment, particularly the complexity of retrofitting older infrastructure with modern sensing technology, alongside challenges related to data security and integration compatibility. Significant opportunities arise from the proliferation of low-power, long-range wireless communication standards (IoT), making real-time monitoring scalable and affordable for residential and smaller commercial deployments, as well as mandatory compliance standards pushing for proactive infrastructure management. These forces collectively exert a strong impact on market dynamics, prioritizing innovation in non-invasive and easy-to-deploy sensing solutions.

A major driver is the persistent and growing inadequacy of aging water infrastructure across North America and Europe, where pipes often exceed their intended operational lifespan, leading to frequent bursts and chronic leakage. Government bodies and public utilities are increasingly recognizing that the cost of inaction far outweighs the investment in preventative detection systems. Furthermore, global awareness regarding water scarcity, coupled with population growth, places immense pressure on utilities to maximize operational efficiency and accountability. This sustained regulatory and environmental pressure ensures continued budgetary allocation towards advanced detection and monitoring technologies, solidifying the demand curve across utility segments.

The primary restraining force centers around the complex total cost of ownership (TCO) for comprehensive systems. While sensor costs are decreasing, the expenses associated with data transmission, storage, sophisticated AI-driven analytics software, and the skilled personnel required to manage these systems often present significant financial hurdles, particularly for smaller, municipally owned utilities. However, this restraint is being counteracted by the emergence of SaaS (Software as a Service) models, which offer lower upfront costs and manageable subscription fees for accessing high-end analytics. The core opportunity lies in the synergistic relationship between smart city initiatives and water monitoring, leveraging existing communications networks and IoT platforms to scale detection capabilities rapidly and cost-effectively across urban environments.

Segmentation Analysis

The Water Leak Detection Systems Market is systematically segmented based on technology, end-user application, and installation type, reflecting the diverse requirements of different market participants, from large public utilities managing vast subterranean networks to individual homeowners seeking property protection. This segmentation is crucial for understanding specific growth pockets, as technological preferences vary widely; for instance, acoustic technologies dominate municipal infrastructure, while cable sensors are preferred in commercial data centers and sensitive building environments. Analyzing these segments helps vendors tailor solutions and marketing strategies, ensuring alignment with the distinct operational and regulatory demands of each end-user category.

By technology, the market is differentiated by the method of detection—acoustic, which uses sound waves to locate leaks; non-acoustic (including pressure, flow, and chemical tracers); and sensor-based systems utilizing conductive cables or probes for spot detection. Acoustic methods are essential for long-distance pipeline monitoring, providing foundational data for network assessment, whereas sensor-based solutions are critical for precision monitoring in confined spaces. The rapid advancements in wireless, non-acoustic technologies, especially those leveraging ultrasonic flow measurement and IoT connectivity, are beginning to disrupt traditional dominance, offering easier installation and reduced maintenance requirements across all market segments.

From an end-user perspective, the municipal sector holds the largest market share due to the scale of public water networks and the high volume of NRW they contend with. However, the commercial and industrial sectors, including hospitality, data centers, and manufacturing plants, are exhibiting the fastest growth due to the high costs associated with downtime and regulatory penalties related to water damage and waste. The increasing adoption of insurance-mandated smart devices further accelerates the growth of the residential segment, transforming household water management into a monitored, technologically integrated component of smart living infrastructure.

- By Technology:

- Acoustic/Ultrasonic

- Sensor Based (Hydrostatic, Optic Fiber, Cable, Point Sensors)

- Flow and Pressure Monitoring

- By Installation Type:

- Permanently Installed

- Portable/Handheld

- By End-User:

- Municipal (Water Utilities)

- Commercial (Data Centers, Hospitality, Offices)

- Residential

- Industrial (Manufacturing, Oil & Gas)

- By Component:

- Sensors

- Data Loggers and Receivers

- Software and Analysis Platform

Value Chain Analysis For Water Leak Detection Systems Market

The value chain for Water Leak Detection Systems begins with upstream activities focused on the sophisticated design and manufacturing of core components, specifically high-sensitivity acoustic transducers, advanced conductive sensor cables, and robust low-power communication modules (e.g., NB-IoT chipsets). This stage is characterized by intense R&D investment to miniaturize sensors, improve battery life, and enhance data precision under harsh environmental conditions. Key material sourcing involves specialized polymers for sensor protection and rare-earth magnets for specific acoustic measurement tools. Upstream providers often specialize in niche technological areas, such as developing proprietary algorithms for signal processing and noise cancellation, providing the foundational technological advantage.

Midstream operations involve the system integrators and solution providers who assemble these components into cohesive, deployable systems. This critical phase includes software development for data aggregation, cloud hosting, and the creation of user interfaces (dashboards and mobile applications) that enable end-users (utilities or property managers) to interpret alerts effectively. Distribution channels are varied: Direct sales models are common for large-scale municipal projects involving custom installations and long-term service contracts, leveraging specialized engineering consultants. Indirect channels, such as wholesale distributors and specialized electrical/plumbing suppliers, dominate the flow of standardized, smaller systems (like smart home units) to commercial installers and retailers.

Downstream activities focus on deployment, commissioning, and ongoing maintenance. For municipal clients, specialized field teams are required for in-ground installation, calibration, and integration with existing SCADA or Geographic Information Systems (GIS). Post-installation services, including remote monitoring, cloud analytics subscription services, and preventative maintenance contracts, represent a significant and growing revenue stream. The successful downstream delivery relies heavily on robust after-sales support and the continuous update of predictive analytics software, ensuring high operational uptime and sustained value generation for the end-user by actively reducing water losses and infrastructure degradation.

Water Leak Detection Systems Market Potential Customers

The primary and most significant customer segment for Water Leak Detection Systems comprises municipal water utilities and governmental water management bodies worldwide. These entities are driven by regulatory compliance, public accountability for water conservation, and the urgent necessity to curb Non-Revenue Water (NRW) losses, which pose substantial economic and ecological burdens. Their purchasing decisions are complex, often requiring proof-of-concept testing, long procurement cycles, and focusing heavily on system scalability, robustness for underground deployment, and compatibility with existing infrastructure management software (GIS, SCADA). Their adoption typically focuses on acoustic correlation and advanced flow/pressure monitoring technologies.

The secondary customer base includes high-value commercial and institutional establishments where water damage poses extreme risks, such as data centers, hospitals, museums, and high-rise commercial office buildings. For these customers, the primary motivator is risk mitigation—preventing operational downtime, protecting valuable assets, and avoiding massive insurance claims resulting from system failures. They favor non-acoustic, sensor-based systems (like cable detection) capable of providing precise, localized alerts within defined zones (e.g., server rooms, basement areas, and critical mechanical plant rooms). The purchasing cycle here is often integrated with general building management system (BMS) upgrades or new construction project specifications, prioritizing rapid alert functionality and low maintenance requirements.

A rapidly expanding segment is the residential sector, driven by insurance industry mandates, increasing awareness of environmental impacts, and the convenience offered by smart home technology integration. Homeowners and property management companies are seeking affordable, DIY-installable systems that offer simple smartphone alerts and, crucially, remote water shut-off capability in emergencies. This segment primarily consumes point-of-use sensors and integrated smart meter solutions. Finally, industrial users—particularly those in manufacturing, chemical processing, and oil and gas—represent specialized customers focused on protecting critical processes and meeting strict environmental discharge regulations, necessitating rugged, chemical-resistant sensor technologies tailored for specific operational environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.7 Billion |

| Growth Rate | CAGR 7.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mueller Water Products Inc., Xylem Inc., Badger Meter Inc., Siemens AG, Honeywell International Inc., ABB Ltd., Schneider Electric SE, Halma plc (through subsidiaries), Suez SA, WAGO Kontakttechnik GmbH & Co. KG, Reliance Worldwide Corporation (RWC), TTK S.A.S., ZEROWISE Technologies, FLIR Systems, Gutermann AG, Seba Dynatronic Mess- und Ortungstechnik GmbH, Prysmian Group, Aqua Metro AG, High Tide Technologies, LeakTronics. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Water Leak Detection Systems Market Key Technology Landscape

The technological landscape of the Water Leak Detection Systems Market is undergoing rapid evolution, shifting from traditional, localized acoustic listening devices to networked, data-intensive sensing solutions integrated with advanced connectivity protocols. One of the most significant advancements is the deployment of permanent noise loggers equipped with sophisticated filtering capabilities, enabling continuous, remote monitoring of pipeline segments without requiring manual, periodic surveys. These loggers, increasingly powered by ultra-low-power IoT chips (like those compliant with LoRaWAN or NB-IoT standards), can transmit minimal data packets over long distances, drastically reducing the total cost and complexity of establishing a comprehensive monitoring network, especially in geographically dispersed municipal systems.

Another crucial technological frontier is the adoption of Fiber Optic Distributed Acoustic Sensing (DAS). DAS systems utilize existing or newly installed fiber optic cables alongside pipelines to monitor vibrations and acoustic activity continuously over tens of kilometers. This technology transforms the fiber cable itself into an array of highly sensitive microphones, offering real-time, high-resolution spatial awareness of leaks, ground intrusion, or unauthorized activity along the pipeline route. While the initial setup cost is high, its superior range, precision, and multi-functional monitoring capabilities (security and integrity) make it increasingly appealing for critical trunk pipelines and oil & gas applications, significantly impacting the high-pressure pipeline segment.

Furthermore, the sensor market is being revolutionized by non-invasive magnetic and ultrasonic flow measurement technologies. These non-intrusive devices can be clamped onto the exterior of pipes, eliminating the need for expensive and disruptive pipe cutting and integration work. When combined with smart algorithms, these systems can accurately infer the presence and magnitude of a leak by analyzing subtle flow anomalies and pressure waves. These advancements are instrumental in facilitating rapid deployment in environments where system downtime must be minimized, accelerating the adoption rate within industrial and retrofitting commercial projects globally and enhancing the overall efficacy and reliability of remote water auditing procedures.

- Distributed Acoustic Sensing (DAS): Leveraging fiber optics for high-resolution, long-distance monitoring.

- IoT-Enabled Noise Loggers: Permanent, low-power acoustic sensors utilizing LoRaWAN/NB-IoT for widespread deployment.

- Pressure Transient Analysis Software: Utilizing algorithms to detect pressure wave changes indicative of leak inception.

- Non-Invasive Ultrasonic Flow Meters: Clamp-on devices simplifying installation and providing accurate flow data for leak calculation.

- Conductive Sensing Cables: Advanced polymer-coated cables used for pinpoint detection in data centers and internal building environments.

Regional Highlights

North America maintains a dominant position in the Water Leak Detection Systems Market, primarily driven by substantial governmental and private sector investments focused on replacing and modernizing severely aging municipal water infrastructure, particularly across the Great Lakes and Northeast regions of the United States and Canada. High environmental awareness, coupled with robust regulatory mandates aimed at reducing water waste, creates a strong, sustained demand for advanced detection technologies. The region is characterized by high technological maturity, rapid adoption of IoT integration in both commercial and residential construction, and the presence of numerous key market players specializing in sophisticated data analytics and acoustic correlation techniques. Furthermore, the insurance sector actively promotes the installation of smart home leak detection devices, providing a significant commercial push.

Europe represents another mature and technologically advanced market, distinguished by strict EU directives concerning water quality and resource management. Countries like the UK, Germany, and France have aggressive targets for Non-Revenue Water reduction, spurring significant utility investment in permanent monitoring networks and advanced pressure management systems. The European market leads in the application of pressure management and transient analysis software, aiming not just to find leaks but to prevent them by optimizing network pressures. The region's focus on Smart City infrastructure also provides a conducive environment for the deployment of networked leak detection sensors that seamlessly integrate with broader urban data platforms.

The Asia Pacific (APAC) region is projected to experience the fastest growth throughout the forecast period. This rapid expansion is attributable to accelerated urbanization, the establishment of vast new water networks to support soaring populations, and substantial infrastructure spending by governments in populous nations like China and India. While parts of APAC still rely on older, less efficient systems, the adoption rate of modern, scalable solutions is rapidly accelerating, often skipping generations of technology to implement cutting-edge IoT and satellite-based monitoring systems directly. Challenges remain regarding fragmented water governance and financial limitations, but large-scale public-private partnerships focused on modernizing mega-city water supply chains are unlocking massive market opportunities for leak detection system vendors.

- North America: Market leader due to infrastructure replacement programs, high technological adoption, and strong regulatory environment favoring water efficiency.

- Europe: High market maturity driven by stringent EU water directives and strong focus on pressure management and preventative leak strategies.

- Asia Pacific (APAC): Highest growth region fueled by rapid urbanization, massive new infrastructure projects, and increasing governmental focus on water security and NRW reduction.

- Latin America & MEA (Middle East & Africa): Emerging markets characterized by initial high growth potential, often focused on commercial and large industrial projects where water scarcity mandates efficient resource management.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Water Leak Detection Systems Market.- Mueller Water Products Inc.

- Xylem Inc.

- Badger Meter Inc.

- Siemens AG

- Honeywell International Inc.

- ABB Ltd.

- Schneider Electric SE

- Halma plc (through subsidiaries)

- Suez SA

- WAGO Kontakttechnik GmbH & Co. KG

- Reliance Worldwide Corporation (RWC)

- TTK S.A.S.

- ZEROWISE Technologies

- FLIR Systems

- Gutermann AG

- Seba Dynatronic Mess- und Ortungstechnik GmbH

- Prysmian Group

- Aqua Metro AG

- High Tide Technologies

- LeakTronics

Frequently Asked Questions

Analyze common user questions about the Water Leak Detection Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Non-Revenue Water (NRW) and how do leak detection systems reduce it?

NRW is water that has been produced and distributed but is "lost" before reaching customers, primarily through physical leaks, burst pipes, and unauthorized consumption. Advanced leak detection systems—such as acoustic sensors and pressure monitors—identify the exact location of these physical losses in real time, allowing utilities to prioritize and execute repairs quickly, thus significantly minimizing water wastage and maximizing accountable revenue.

How effective are AI and Machine Learning in improving acoustic leak detection accuracy?

AI drastically enhances accuracy by analyzing complex acoustic signatures and filtering out ambient noise (traffic, pumping, construction) that confuse traditional correlation systems. Machine learning models, trained on millions of data points, reliably classify the vibration patterns associated only with actual leaks, leading to a substantial reduction in false positives and improved technician deployment efficiency.

What are the primary differences between permanently installed and portable leak detection systems?

Permanently installed systems (e.g., IoT noise loggers or cable sensors) provide continuous, 24/7 monitoring and are crucial for network-wide surveillance or high-risk commercial areas, offering immediate alerts. Portable systems (e.g., handheld correlators or ground microphones) are used by field technicians for focused, on-demand surveys or to pinpoint the final location of a leak identified by a permanent system.

Which end-user segment drives the largest market demand for water leak detection?

The Municipal Water Utilities segment currently drives the largest demand due to the immense scale of urban and rural water distribution networks and the critical public health and economic implications of high Non-Revenue Water levels. They require robust, scalable solutions for subterranean pipeline infrastructure management and integrity monitoring.

What role do IoT technologies play in the future growth of the leak detection market?

IoT (Internet of Things) protocols, particularly LoRaWAN and NB-IoT, are pivotal, enabling affordable and extensive deployment of wireless sensors over large geographical areas with minimal power consumption. This low-cost, real-time connectivity facilitates the transition to predictive monitoring platforms, making advanced leak detection accessible for smaller utilities and mass market residential applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager