Water Metal Atomizer Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443434 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Water Metal Atomizer Market Size

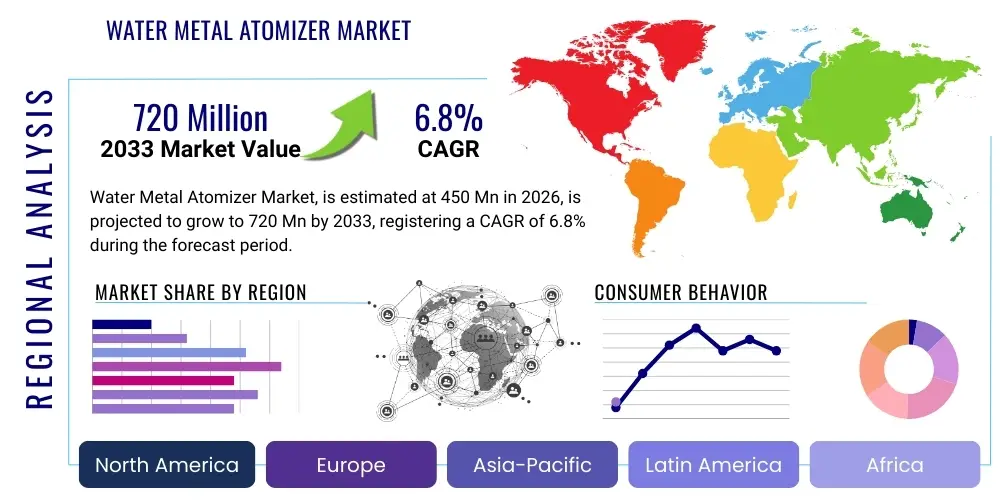

The Water Metal Atomizer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 720 Million by the end of the forecast period in 2033. This steady growth is primarily attributed to the expanding demand for high-quality metal powders in advanced manufacturing sectors, particularly additive manufacturing (AM) and metal injection molding (MIM). Water atomization offers a cost-effective and scalable method for producing irregularly shaped, high-surface-area metal particles, making it indispensable for applications requiring superior green strength and tailored particle size distribution. The market size expansion reflects increased investment in developing high-throughput water atomization systems capable of handling a wider range of alloys, including stainless steels and specialized superalloys, crucial for the aerospace and automotive industries.

Water Metal Atomizer Market introduction

Water metal atomization is a process utilized in powder metallurgy where a stream of molten metal is fragmented into fine droplets using high-pressure water jets, subsequently solidifying into metal powder. This technology is critical for producing powders suitable for various manufacturing techniques, including Metal Injection Molding (MIM), brazing, thermal spraying, and increasingly, specific Additive Manufacturing (AM) processes that benefit from irregular particle morphology. The primary benefits of water atomization include its high production yield, cost efficiency, and ability to process a broad spectrum of ferrous and non-ferrous metals, resulting in powders with controlled oxygen content and excellent flow characteristics necessary for complex parts manufacturing. Driving factors for market growth include the global trend toward lightweighting in transportation, the proliferation of 3D printing technologies requiring diverse material inputs, and stringent quality demands from end-user industries like electronics and medical devices, pushing manufacturers to adopt advanced and reliable powder production methods.

Water Metal Atomizer Market Executive Summary

The Water Metal Atomizer Market is experiencing robust growth driven by significant technological advancements in powder metallurgy and high global demand for irregularly shaped metal powders across pivotal industrial applications. Business trends indicate a strong focus on automation and process control within atomization facilities to enhance powder consistency and reduce operational costs, with manufacturers increasingly investing in systems capable of producing fine powders below 45 microns. Regionally, Asia Pacific, led by China and India, dominates the market due to its burgeoning automotive and electronics manufacturing bases, while North America and Europe maintain strong momentum through high adoption rates in additive manufacturing and specialized aerospace applications. Segment trends highlight stainless steel and tool steel powders as the highest volume contributors, while the adoption of water atomized powders in specialized applications like brazing and thermal spray coatings continues to demonstrate consistent upward trajectory, spurred by improved control over particle size distribution and morphology achieved through modernized atomization nozzles and cooling techniques.

AI Impact Analysis on Water Metal Atomizer Market

User queries regarding the impact of Artificial Intelligence (AI) on the Water Metal Atomizer Market predominantly center on optimizing process parameters, improving powder consistency, and predictive maintenance. Users are concerned with how AI can mitigate the inherent complexities of water atomization, such as maintaining consistent jet pressure, molten metal flow rates, and predicting cooling dynamics, which directly influence particle size distribution and oxygen absorption. Key themes revolve around leveraging machine learning to analyze massive datasets generated during atomization runs to achieve 'right-first-time' production, reducing waste, and automating quality control measures, thus positioning AI as a critical enabler for scaling high-quality, customized metal powder production for demanding sectors like aerospace and medical devices.

- AI algorithms optimize water jet pressure and flow rates in real-time to maintain desired particle size distribution (PSD).

- Predictive maintenance schedules for atomizer nozzles and pumps, reducing unplanned downtime and maximizing operational efficiency.

- Machine learning models analyze sensor data (temperature, pressure, acoustic emissions) to predict defects and oxygen contamination in powders.

- Automated quality control systems use image recognition and deep learning to classify powder morphology and screen for inconsistent particles faster than traditional methods.

- Enhanced supply chain logistics and inventory management for raw materials and finished powder stocks through demand forecasting AI tools.

DRO & Impact Forces Of Water Metal Atomizer Market

The Water Metal Atomizer Market growth is fundamentally propelled by the increasing necessity for cost-effective, high-volume production of specific powder types, particularly for Metal Injection Molding (MIM) and traditional pressed and sintered components. Restraints include the inherent limitation of water atomization in producing perfectly spherical powders, which are essential for many high-energy laser-based Additive Manufacturing (AM) processes, and the significant energy consumption associated with the process. Opportunities arise from developing hybrid atomization technologies and refining inert gas treatment systems post-atomization to expand the range of alloys processable while minimizing oxidation. The impact forces are characterized by stringent quality standards in end-use sectors driving innovation in process control, coupled with intense price competition from gas atomization alternatives for premium applications, compelling water atomizers to focus on cost leadership and high-volume consistency.

Market Drivers: Increasing Demand for Cost-Effective Powder Solutions

A primary driver for the Water Metal Atomizer Market is the expansive growth of the Metal Injection Molding (MIM) industry, especially within consumer electronics, medical instruments, and small mechanical components. MIM relies heavily on irregularly shaped, high-surface-area powders derived efficiently from water atomization, which provide superior 'green strength'—the ability of the molded component to hold shape before sintering. This strength is crucial for handling complex, miniature parts, giving water-atomized powders a distinct competitive advantage over spherical alternatives in this high-volume manufacturing segment. Furthermore, the inherent economic efficiency of the water atomization process, particularly for processing large quantities of stainless steel, tool steel, and low-alloy steels, positions it as the preferred method for mass-market applications where cost per kilogram is a critical performance metric.

Secondly, the escalating adoption of specialized coatings and brazing applications across the automotive and aerospace maintenance, repair, and overhaul (MRO) sectors fuels the demand for water-atomized powders. These applications often require powders with specific characteristics regarding flowability and packing density, which are finely tunable through controlled water jet pressure and melt temperature. The drive toward using more environmentally benign materials and extending the lifespan of critical components through high-performance coatings, such as those applied via thermal spray techniques, necessitates a steady, reliable supply of high-purity water-atomized powders. These drivers collectively solidify the market's trajectory toward sustained expansion, particularly in regions undergoing rapid industrialization and modernization of manufacturing infrastructure.

- High green strength requirement for MIM and P&S applications.

- Cost-effectiveness and high throughput capacity for common alloys (e.g., Stainless Steel).

- Expanding use in brazing, thermal spraying, and surface coating technologies.

- Growing industrialization and infrastructure investment in APAC nations.

Market Restraints: Material Limitations and Quality Challenges

A significant restraint facing the Water Metal Atomizer Market is the inherent technological difficulty in producing highly spherical powders required by advanced Additive Manufacturing (AM) technologies, particularly selective laser melting (SLM) and electron beam melting (EBM). The rapid cooling and high kinetic energy involved in water atomization typically yield irregular, often tear-drop shaped particles, which negatively impact the powder bed density and flow characteristics crucial for precise layer-by-layer AM processes. While water atomization excels in cost and volume, its inability to consistently achieve the near-perfect sphericity and narrow particle size distribution (PSD) demanded by high-end AM applications limits its penetration into the most lucrative segments of the powder market, creating a competitive disadvantage against gas atomization.

Furthermore, the intimate contact between the molten metal stream and the high-pressure water jets introduces a higher risk of oxide formation and hydrogen pick-up compared to inert gas atomization processes. Controlling the final oxygen content, especially when processing highly reactive metals or sophisticated superalloys, presents a persistent challenge that necessitates complex, often costly, secondary processing steps like deoxidation or annealing in a vacuum or inert atmosphere. These post-processing requirements increase the overall production cost and cycle time, eroding the inherent cost advantage of water atomization. Overcoming these quality constraints requires significant investment in specialized equipment, thereby restraining market access for smaller producers and hindering broader adoption across highly sensitive applications.

- Inability to consistently produce high-sphericity powders required for advanced AM techniques.

- Higher susceptibility to oxidation and hydrogen pick-up during the atomization process.

- Energy-intensive operation and high capital expenditure for advanced filtration and recirculation systems.

- Competition from advanced gas atomization and plasma atomization methods in high-value segments.

Market Opportunities: Hybrid Technology and Custom Alloy Development

A substantial opportunity for market participants lies in the development and commercialization of hybrid atomization technologies that integrate the cost efficiency of water atomization with enhanced control over powder properties. Hybrid approaches, such as combining water fragmentation with subsequent gas-jet shaping or employing sophisticated melt conditioning techniques prior to atomization, offer the potential to mitigate the irregular particle morphology traditionally associated with water atomization. Successfully implementing these hybrid systems would allow water atomizers to tap into higher-margin applications, including specific directed energy deposition (DED) processes in AM that can tolerate less spherical powders, while maintaining a competitive cost structure relative to pure gas atomization.

Another key avenue for growth is the collaboration between atomization equipment manufacturers and end-users to develop custom alloy powders tailored for specific next-generation applications. As industries like electric vehicles (EVs) and renewable energy require novel magnetic, thermal, and structural materials, there is an increasing need for specialized, small-batch alloy powders that water atomization can efficiently produce due to its flexibility. By focusing on niche, high-performance alloys (e.g., certain soft magnetic materials or specific ferrous superalloys), market players can differentiate themselves from large-scale commodity powder producers. This strategic focus on high-value custom powders, leveraging process flexibility and quick turnover times, represents a significant pathway for market expansion and value creation over the forecast period.

- Development and adoption of hybrid water-gas atomization processes to improve particle shape.

- Focus on specialized, custom ferrous and non-ferrous alloy powders for EV and aerospace components.

- Expanding geographic footprint in emerging manufacturing hubs in Southeast Asia and Latin America.

- Integration of advanced sensor technology and AI for precision process control and minimization of post-processing needs.

Impact Forces: Competitive Dynamics and Regulatory Standards

The intensity of competitive rivalry in the Water Metal Atomizer Market is high, driven by the presence of large, integrated metal powder producers and several niche equipment suppliers. This competitive dynamic exerts downward pressure on powder prices, forcing companies to continuously optimize operational efficiency and throughput capacity. The primary impact force stems from the constant technological race between water and gas atomization, where advancements in gas atomization pose a persistent threat by lowering production costs for spherical powders. Consequently, water atomization manufacturers are forced to double down on their inherent advantages: high volume production and low cost for specific applications like MIM, requiring continuous R&D investment in cooling systems and melt stream management to maintain market relevance.

Furthermore, stringent industry standards and regulatory requirements, particularly those governing material traceability and performance in the medical and aerospace fields, significantly impact market operation. Atomizer manufacturers must comply with ISO certifications and customer-specific quality protocols related to powder particle size distribution, chemical purity, and defect analysis. This necessity mandates substantial investment in quality control infrastructure, specialized laboratory equipment, and robust documentation systems. The external force of regulatory compliance acts as a significant barrier to entry for new players, while simultaneously driving established market leaders toward achieving higher, quantifiable standards of powder consistency, thereby elevating the overall quality benchmark across the market.

- High competitive rivalry leading to margin compression and demand for continuous efficiency improvements.

- Stringent quality and regulatory standards (e.g., ISO, ASTM) in automotive and medical sectors.

- Technological substitution risk posed by continuous improvements in lower-cost gas atomization systems.

- Volatile commodity prices impacting the cost of raw metal inputs and energy.

Segmentation Analysis

The Water Metal Atomizer Market is comprehensively segmented based on material type, distinguishing between ferrous and non-ferrous metals, and by application, targeting specific manufacturing processes such as Metal Injection Molding (MIM), Additive Manufacturing (AM), and specialized coatings. The Material Type segment is critical as it dictates the required atomization parameters and post-processing steps; ferrous materials, including stainless steels and tool steels, dominate the volume due to their wide use in structural and tooling components, leveraging the cost-efficiency of water atomization. The Application segment highlights the demand divergence, with MIM acting as the primary consumer of water-atomized powders due to green strength requirements, while the nascent adoption within AM processes signals future potential as hybrid technologies mature. Analyzing these segments provides a clear understanding of market dynamics, growth pockets, and competitive positioning across the value chain, revealing specific areas for strategic investment.

- Material Type

- Ferrous Metals (Stainless Steel, Tool Steel, Low Alloy Steel)

- Non-Ferrous Metals (Copper, Bronze, Brass, Nickel-Based Alloys)

- Application

- Metal Injection Molding (MIM)

- Additive Manufacturing (AM)

- Brazing and Soldering

- Thermal Spraying and Coatings

- Press and Sinter (P&S)

- Technology

- High-Pressure Water Atomization

- Low-Pressure Water Atomization

Segmentation by Material Type

The Ferrous Metals segment is the cornerstone of the Water Metal Atomizer Market, accounting for the largest share in terms of volume and value. This dominance is due to the inherent suitability of water atomization for producing high volumes of stainless steel (e.g., 316L, 17-4PH) and low-alloy steel powders, which are essential inputs for the MIM and traditional P&S industries globally. Ferrous materials are relatively tolerant of the rapid cooling rates and slight oxidation characteristic of the water process, allowing producers to capitalize on the technology's high throughput and low operating costs. The demand from the automotive sector for complex structural parts and from the tooling industry for high-wear components ensures the sustained growth and technological focus on refining the atomization parameters for these widely used alloys, particularly concerning achieving optimal flowability for complex molds.

Conversely, the Non-Ferrous Metals segment, encompassing copper, bronze, brass, and nickel-based alloys, represents a high-growth, albeit smaller, segment. While nickel-based alloys are often processed using gas atomization due to their reactivity, water atomization is extensively used for copper and copper-based alloys, primarily for electrical contacts, friction materials, and certain P&S applications requiring high conductivity or specialized mechanical properties. The challenge in this segment is managing the increased reactivity of some non-ferrous metals with water, demanding highly controlled processing environments and sophisticated post-atomization handling. Market players are investing in specialized equipment to handle non-ferrous melts, aiming to capture the growing demand from the electronics and renewable energy sectors, which increasingly require bespoke non-ferrous powder formulations for high-performance applications.

The future trajectory suggests an expansion in the Non-Ferrous category as manufacturers find cost-effective ways to mitigate the oxidation challenges. However, the sheer volume requirements and established supply chains centered around ferrous powders for mass production will ensure the Ferrous Metals segment retains its dominant position throughout the forecast period. Strategic focus remains on optimizing the production of fine ferrous powders (<45 µm) to meet the stringent requirements of miniaturized MIM components, which are vital for consumer electronics and handheld medical devices.

Segmentation by Application

The Metal Injection Molding (MIM) segment is the largest end-user of water-atomized metal powders globally, reflecting the technology's inherent suitability for this application. MIM demands powders with high surface roughness and irregular shape to ensure superior particle interlocking and green strength during the molding phase, prerequisites that water atomization efficiently delivers. The rapid expansion of MIM in producing small, complex parts for sectors such as telecommunications, industrial machinery, and automotive sensors directly drives the consumption of water-atomized powders, particularly high-grade stainless steels. Market growth in this segment is intrinsically linked to the continued miniaturization trend and the necessity for high-volume, repeatable manufacturing processes, solidifying MIM’s role as the market's primary revenue generator.

The Thermal Spraying and Coatings segment also utilizes water-atomized powders extensively. These applications benefit from the irregular particle shape, which often provides better mechanical interlocking with the substrate during the coating process, enhancing durability and adhesion. Applications range from wear-resistant coatings on engine components to protective layers on industrial tooling. Meanwhile, the Additive Manufacturing (AM) segment, while dominated by gas-atomized spherical powders, represents a critical future opportunity. Water-atomized powders, particularly when post-processed or used in hybrid atomization methods, are gaining traction in less restrictive AM technologies like binder jetting, where particle shape is less critical than cost and raw material availability. The Press and Sinter (P&S) segment, a traditional user, continues to rely on water-atomized powders for components requiring high density and strength at low production costs, ensuring a stable, consistent demand base.

The synergistic relationship between the high-volume capacity of water atomization and the scalability needs of MIM and P&S operations ensures that these segments will remain the core drivers of market revenue. However, the highest rate of adoption and value growth is projected within the niche AM segment, particularly binder jetting, as powder manufacturers successfully optimize water-atomized powders to meet the specific flow and density requirements of these emerging rapid prototyping and production technologies. Companies are strategically positioning themselves to bridge the gap between cost efficiency and quality required for these advanced manufacturing techniques.

Segmentation by Technology

The Water Metal Atomizer Market is segmented technologically primarily into High-Pressure Water Atomization (HPWA) and Low-Pressure Water Atomization (LPWA), distinguishing the mechanisms used to fragment the molten metal stream. HPWA is the dominant method, characterized by water jets operating above 50 MPa (MegaPascals), which are instrumental in achieving very fine particle sizes, often below 45 microns. This high-pressure environment maximizes the kinetic energy transfer to the molten stream, resulting in the irregular, fine morphology highly sought after by the MIM and specialized brazing industries. HPWA systems offer superior control over the mean particle size and particle size distribution (PSD), making them essential for producing high-quality feedstock powders for miniaturized components where precise dimensions and high packing density are paramount. The continued refinement of nozzle design and pump technologies drives efficiency improvements in this dominant segment.

Low-Pressure Water Atomization (LPWA), involving pressures typically below 50 MPa, is utilized primarily for producing coarser metal powders, often above 100 microns, generally favored for traditional Press and Sinter (P&S) applications, specialized friction materials, and certain industrial filters. While less common for producing the fine powders required by modern AM and MIM, LPWA is more cost-effective for large-volume industrial commodity powders where particle shape irregularity is acceptable or even desirable, and the stringent fineness requirements of advanced applications are absent. LPWA systems typically have simpler operational requirements and lower energy consumption per ton compared to HPWA, appealing to manufacturers prioritizing output volume over particle finesse.

Future technology focus is heavily skewed toward enhancing the HPWA segment. Manufacturers are integrating advanced closed-loop control systems and sensors to monitor and adjust water jet velocity and impact angle in milliseconds, aiming to narrow the PSD and minimize satellite formation, thereby enhancing the overall powder quality. The drive for continuous improvement in HPWA is crucial for maintaining competitiveness against gas atomization, particularly in high-volume, high-specification ferrous powder production, which remains the core market strength.

Value Chain Analysis For Water Metal Atomizer Market

The value chain for the Water Metal Atomizer Market begins upstream with raw material procurement (ingots and scrap metal), followed by specialized equipment manufacturing (furnaces, nozzles, pumps). Midstream, the core process involves melting, atomization, powder collection, drying, and classification (sieving). Downstream activities include advanced powder processing (e.g., deoxidation, annealing, blending), packaging, and distribution to end-user industries such as automotive, aerospace, and medical device manufacturers. Distribution channels are varied: large producers often use direct sales to major OEMs or integrated MIM companies, while smaller volumes and specialized alloys rely on indirect channels via specialized metal powder distributors and agents. The value chain is highly dependent on effective logistics, quality control at the classification stage, and minimizing energy and water usage to ensure cost competitiveness and sustainability throughout the production cycle.

Water Metal Atomizer Market Potential Customers

The primary end-users and potential customers of the Water Metal Atomizer Market are companies operating within the specialized powder metallurgy ecosystem. This includes large-scale Metal Injection Molding (MIM) parts fabricators and service bureaus that require high volumes of cost-effective, irregularly shaped stainless steel and low-alloy powders for producing components such as firearm parts, medical tools, and small electronic connectors. Furthermore, traditional Press and Sinter (P&S) manufacturers, particularly those in the automotive sector producing gears, bushings, and structural parts, are significant buyers. The market also caters to specialized niche customers in brazing and thermal spray coating services, who demand specific chemistries and particle distributions for surface enhancement. Finally, emerging customers include firms adopting advanced manufacturing techniques like Binder Jetting Additive Manufacturing, which utilizes water-atomized powders as feedstock due to its economic viability compared to other AM powders.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 720 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Höganäs AB, Sandvik AB (Osprey Powder), Pometon Powder, Ametek Inc. (Reading Alloys), GKN Powder Metallurgy, Jiangsu Tianda Group, Rio Tinto Metal Powders, CNPC Powder, Carpenter Technology Corporation, Linde PLC, Nanoval GmbH & Co. KG, ACuPowder International, Praxair S.T. Technology, Advanced Nanotechnologies, Shanghai Powder Metallurgy Institute (SPMI), Metal Powder Products (MPP), Zenith Sintered Products, SCM Metal Products, PyroGenesis Canada Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Water Metal Atomizer Market Key Technology Landscape

The technological landscape of the Water Metal Atomizer Market is dominated by advancements aimed at increasing operational efficiency, refining powder morphology, and mitigating contamination. Core technology revolves around the design of the atomization nozzle and the precise control of the molten metal stream. Modern systems increasingly utilize sophisticated multi-orifice nozzles, designed using computational fluid dynamics (CFD) modeling, which allow for better control over the water jet convergence angle and velocity, leading directly to a narrower particle size distribution (PSD) and reduced satellite formation. Furthermore, the integration of advanced process control systems, leveraging high-frequency sensors to monitor parameters like melt temperature, flow rate, and water pressure in real-time, is crucial for maintaining powder consistency across large production batches, directly impacting final product quality for demanding applications like MIM.

A secondary, but highly critical, technological focus is on enhancing post-atomization processing, particularly powder drying and deoxidation. The inherent high oxygen content resulting from the process necessitates the use of fluidized bed dryers and specialized vacuum annealing furnaces. Innovations are centering on developing closed-loop water recirculation systems with improved filtration and deionization capabilities to ensure the purity of the atomizing medium, thereby minimizing the risk of secondary contamination. This focus on minimizing oxidation without excessively increasing operational costs is driving R&D efforts, often involving inert gas shrouding of the melt stream immediately before contact with the water jets, offering a hybrid approach to quality control.

Looking ahead, the market is poised to see greater adoption of specialized equipment for handling reactive alloys and the increasing implementation of AI-driven control modules. These AI systems analyze historical production data to predict equipment failure (e.g., nozzle wear) and autonomously adjust process variables to maintain target PSD and morphology, maximizing yield. This shift toward intelligent manufacturing represents the future of water atomization, promising higher quality powders, faster cycle times, and reduced reliance on manual process optimization, thereby bridging the quality gap with gas-atomized alternatives for specific advanced applications.

Regional Highlights

- Asia Pacific (APAC): Dominates the global market share due to unparalleled growth in manufacturing sectors, particularly automotive production in China, electrical component manufacturing in South Korea, and escalating demand for construction and tooling materials in India. The region benefits from lower operating costs and government initiatives supporting indigenous powder metallurgy development, making it the highest volume producer and consumer of water-atomized powders, specifically for MIM and P&S applications.

- North America: Characterized by high-value applications in aerospace, defense, and specialized medical device manufacturing. While not the largest volume producer, the region exhibits significant demand for high-specification ferrous and nickel-based water-atomized powders used in specialized coatings and advanced MIM components. Innovation focus here is often on integrating advanced sensors and automated process controls.

- Europe: Exhibits robust market stability, driven by strong automotive, machinery, and industrial components sectors, especially in Germany and Italy. European manufacturers prioritize quality and environmental sustainability, leading to investments in highly efficient water recirculation and energy-saving atomization systems, maintaining strong market positions in the high-quality P&S and specialized brazing segments.

- Latin America & Middle East & Africa (LAMEA): These regions represent emerging markets with increasing industrialization, particularly in mining, oil & gas, and basic infrastructure development. Demand growth is steady but concentrated, focused primarily on essential industrial parts and construction materials requiring cost-effective, high-volume ferrous powders, driven by infrastructure projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Water Metal Atomizer Market.- Höganäs AB

- Sandvik AB (Osprey Powder)

- Pometon Powder

- Ametek Inc. (Reading Alloys)

- GKN Powder Metallurgy

- Jiangsu Tianda Group

- Rio Tinto Metal Powders

- CNPC Powder

- Carpenter Technology Corporation

- Linde PLC (though primarily gas supplier, impacts atomization)

- Nanoval GmbH & Co. KG

- ACuPowder International

- Praxair S.T. Technology (now part of Linde)

- Advanced Nanotechnologies

- Shanghai Powder Metallurgy Institute (SPMI)

- Metal Powder Products (MPP)

- Zenith Sintered Products

- SCM Metal Products

- PyroGenesis Canada Inc.

- DSM Powder Metallurgy

Frequently Asked Questions

Analyze common user questions about the Water Metal Atomizer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between water atomization and gas atomization?

Water atomization uses high-pressure water jets to fragment molten metal, resulting in irregular, high-surface-area particles ideal for Metal Injection Molding (MIM) and high green strength applications. Gas atomization uses inert gas jets (like Argon), producing smoother, spherical particles preferred for laser-based Additive Manufacturing (AM) due to superior flowability.

Which application segment consumes the largest volume of water-atomized metal powders?

The Metal Injection Molding (MIM) segment is the largest consumer. MIM processes highly benefit from the irregular morphology and high surface area of water-atomized powders, which enhance green strength necessary for handling complex, miniaturized components before sintering.

What are the main quality challenges associated with water atomized powders?

The primary challenges include higher risk of oxidation and hydrogen pick-up due to the use of water, which necessitates costly post-processing steps like annealing or deoxidation. Additionally, the irregular particle shape limits widespread adoption in highly demanding, spherical-powder-reliant AM technologies.

Which region dominates the Water Metal Atomizer Market in terms of volume?

The Asia Pacific (APAC) region, driven primarily by China and India, dominates the market in terms of production volume and consumption. This is due to rapid industrialization, extensive automotive manufacturing, and mass production needs for MIM and Press and Sinter (P&S) components.

How is AI expected to influence water atomization technology in the next five years?

AI is expected to enhance process control by optimizing parameters (pressure, flow rate) in real-time, leading to narrower particle size distribution (PSD) and reduced waste. AI also supports predictive maintenance for critical equipment like atomization nozzles, minimizing operational downtime.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager