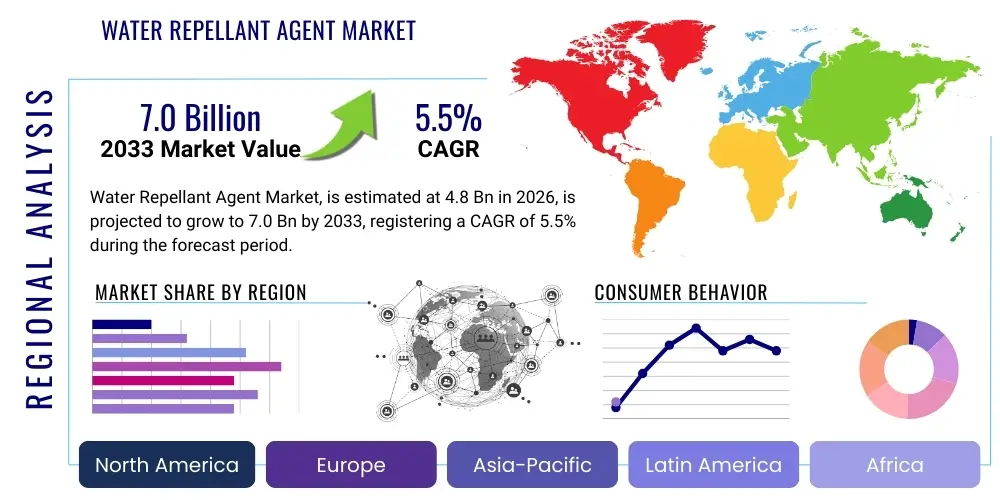

Water Repellant Agent Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442656 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Water Repellant Agent Market Size

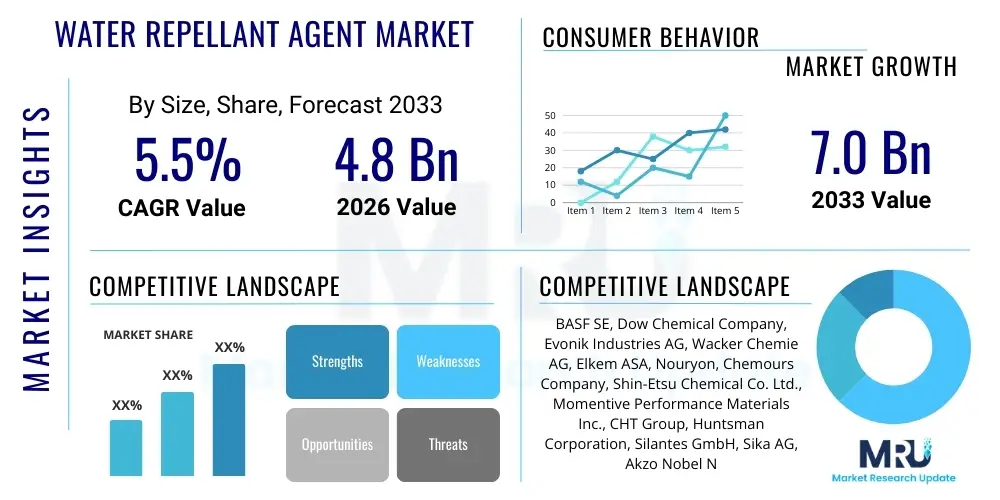

The Water Repellant Agent Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 7.0 Billion by the end of the forecast period in 2033. This consistent expansion is underpinned by increasing global focus on infrastructure durability, coupled with stringent regulatory standards mandating protective measures for buildings and textiles against moisture damage. The rising demand from the construction sector, particularly in emerging economies where massive urbanization projects are underway, serves as the principal catalyst for market expansion, driving innovation in sustainable and long-lasting protective chemistries. Furthermore, the growing use of water repellant agents (WRAs) in high-performance coatings for the automotive and aerospace industries contributes significantly to the overall revenue growth trajectory.

Water Repellant Agent Market introduction

Water Repellant Agents (WRAs) are specialized chemical formulations designed to inhibit the absorption of water by various porous and non-porous substrates, thereby protecting them from water-induced degradation, efflorescence, microbial growth, and freeze-thaw cycles. These agents modify the surface tension of materials, creating a hydrophobic layer without significantly altering the aesthetic or breathability characteristics of the treated substrate. The primary product descriptions include silane and siloxane-based compounds, fluoropolymers, metal stearates, and specialized wax emulsions, each tailored for specific performance requirements and application environments. The fundamental benefit of utilizing WRAs lies in extending the operational lifespan and maintaining the structural integrity of materials like concrete, masonry, wood, textiles, and leather goods, reducing maintenance costs and enhancing material performance under diverse environmental conditions.

Major applications of water repellant agents span critical industrial sectors, predominantly led by the construction industry where they are vital for waterproofing structures such as bridges, roads, commercial buildings, and residential properties. Beyond construction, the textile industry utilizes these agents extensively to impart stain resistance and weatherproofing to apparel and technical fabrics, optimizing consumer comfort and durability. Driving factors for market growth include the rising imperative for sustainable infrastructure resilient to extreme weather patterns, technological advancements leading to superior nano-scale hydrophobic solutions, and increasing consumer awareness regarding product protection and longevity. The adoption of WRAs is rapidly increasing in the transportation sector, especially for protective coatings in automotive and marine applications to prevent corrosion and material deterioration caused by prolonged moisture exposure.

Water Repellant Agent Market Executive Summary

The global Water Repellant Agent market exhibits robust growth characterized by shifting business trends towards eco-friendly and bio-based formulations, driven by stringent environmental regulations, particularly in developed regions like Europe and North America. Key business trends indicate a consolidation among major chemical manufacturers focusing on vertical integration to control the supply chain of critical raw materials, such as silicones and fluorocarbons, while smaller specialized firms concentrate on niche, high-performance applications like superhydrophobic coatings and self-healing materials. The strategic focus on water-based emulsions over solvent-based systems is a predominant trend influencing R&D investments, aiming for reduced Volatile Organic Compound (VOC) emissions and enhanced user safety during application, thereby aligning with global sustainability mandates and end-user preferences for greener solutions. Pricing sensitivity remains a competitive factor, compelling manufacturers to optimize production processes through operational efficiencies and scale.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, primarily fueled by massive infrastructure investment in China, India, and Southeast Asian nations, coupled with rapid industrialization and urbanization requiring durable construction materials. North America and Europe maintain significant market shares, characterized by high adoption rates of advanced, high-performance agents in renovation projects and regulatory pressure to maintain existing aging infrastructure using durable protective systems. Segmentation trends reveal that silane/siloxane-based agents dominate the market share due to their proven longevity and efficacy, particularly in concrete protection, while the fluoropolymer segment, despite facing environmental scrutiny (PFAS/PFOA restrictions), commands premium pricing in specialized, high-performance textile and leather applications where unparalleled water and oil repellency is required. Technology trends favor easy-to-apply, single-component systems, minimizing on-site complexity and ensuring uniform coating quality across various construction sites and manufacturing processes.

AI Impact Analysis on Water Repellant Agent Market

Common user questions regarding AI's impact on the Water Repellant Agent market often revolve around optimizing material formulation, enhancing quality control consistency, and predicting material performance longevity under varied environmental stress. Users are keen to understand how AI and Machine Learning (ML) can accelerate the discovery of novel hydrophobic chemistries, potentially moving away from restricted chemicals like fluorocarbons, and simultaneously reducing the expensive and time-consuming physical testing required for new product validation. The general expectation is that AI will streamline research and development (R&D) cycles, allowing manufacturers to quickly customize formulations based on specific substrate characteristics (e.g., concrete porosity, textile weave density) and desired longevity parameters. Furthermore, there is significant interest in how predictive modeling can inform manufacturers about optimal production schedules and inventory management, thereby minimizing waste and operational costs in a complex chemical manufacturing environment.

The integration of AI algorithms, particularly deep learning models, is revolutionizing the computational chemistry aspect of WRA development. By analyzing vast datasets of chemical structures, performance metrics, and application conditions, AI can rapidly identify optimal molecular combinations for enhanced hydrophobicity, thermal stability, and UV resistance, surpassing traditional trial-and-error methods. This shift allows manufacturers to design "smart" water repellant systems that respond dynamically to environmental cues or self-heal minor surface damage. Furthermore, AI-driven process optimization in manufacturing facilities, utilizing sensor data from mixing tanks and application lines, ensures rigorous quality control by detecting minute deviations in viscosity, concentration, and dispersion, guaranteeing product consistency batch-to-batch, which is crucial for achieving expected performance on end-user materials. This level of precision is fundamentally enhancing product reliability and reducing warranty claims in high-stakes applications.

- AI-driven Formulation Discovery: Accelerates the identification of novel, high-performance, and environmentally benign hydrophobic chemistries.

- Predictive Performance Modeling: Uses ML to simulate WRA durability, weathering resistance, and lifespan across different climatic conditions, reducing physical testing time.

- Optimized Manufacturing Processes: Utilizes sensor data and algorithms for real-time quality control, ensuring consistent concentration and dispersion of active ingredients.

- Supply Chain and Inventory Management: AI predicts demand fluctuations and optimizes raw material procurement, enhancing efficiency and minimizing operational waste.

- Smart Coatings Development: Facilitates the R&D of self-healing or dynamically responsive superhydrophobic coatings using computational chemistry.

DRO & Impact Forces Of Water Repellant Agent Market

The Water Repellant Agent Market is primarily driven by global infrastructure growth, particularly in developing nations, coupled with stringent government mandates for durable and energy-efficient building materials that resist moisture damage and subsequent thermal degradation. Conversely, the market faces significant restraints from volatile raw material prices, specifically for silicones and fluorocarbons, and increasing regulatory pressure, especially concerning the use of Per- and Polyfluoroalkyl Substances (PFAS) in textile treatments, forcing manufacturers to invest heavily in reformulation and seeking viable, cost-effective alternatives. Opportunities for market expansion reside predominantly in the development and commercialization of nano-technology-based, bio-degradable, and sustainable water-based WRAs, targeting high-growth niche applications such as aerospace components, medical devices, and advanced moisture barrier films, leveraging superior performance characteristics and favorable environmental profiles to capture premium market segments. These dynamics collectively shape the competitive landscape and technological investment priorities within the industry.

The primary Drivers include the need to protect aging infrastructure in developed economies from degradation and environmental weathering, alongside the rapid expansion of construction in APAC and MEA regions. The enhanced performance benefits, such as improved energy efficiency in buildings (by preventing moisture ingress into insulation) and extended product lifespan for consumer goods (textiles, footwear), further solidify market growth. Technological advancements enabling the production of more effective, yet breathable, hydrophobic films are expanding application scope beyond traditional masonry and into advanced composite materials. Furthermore, the rising incidence of extreme weather events globally highlights the critical need for resilient, waterproof structures, increasing the adoption rates of high-performance WRAs in vulnerable geographic areas, driving demand from construction and civil engineering firms focused on long-term project reliability and structural integrity.

Restraints center around the complexity and cost associated with regulatory compliance, particularly the phase-out of certain high-performance chemicals due to environmental or health concerns, compelling continuous and expensive R&D efforts. The performance gap between traditional, solvent-based WRAs and newer, environmentally friendly water-based alternatives sometimes limits rapid adoption in applications requiring extreme durability. Market penetration is also challenged by a lack of standardization in testing and certification processes across various geographies, leading to confusion among end-users regarding product effectiveness and suitability for specific environments. Finally, the commoditization of basic WRA chemistries puts constant pressure on pricing and profit margins for manufacturers specializing in high-volume, standard products, necessitating consistent product differentiation.

Opportunities are significant within the realm of nanotechnology, allowing for the creation of superhydrophobic surfaces with superior contact angles and self-cleaning capabilities, applicable across diverse high-value industries. The shift towards sustainable chemistry opens doors for novel bio-based and mineral-derived repellant agents that offer a strong competitive advantage in environmentally conscious markets. Furthermore, developing customized WRA solutions for specialized substrates, such as cross-laminated timber (CLT) or high-performance composites used in electric vehicle manufacturing, represents untapped potential. The growing trend of DIY and consumer repair markets also presents an opportunity for developing user-friendly, highly effective WRA products for retail distribution, capitalizing on home improvement and maintenance demands. The Impact Forces are high due to the non-discretionary nature of waterproofing in major end-use sectors, ensuring sustained demand despite economic fluctuations, though regulatory compliance exerts a powerful, transformative force on product development.

Segmentation Analysis

The Water Repellant Agent Market is fundamentally segmented based on chemical Type, Technology, and end-use Application, reflecting the diverse material science requirements and performance specifications demanded by various industries. The segmentation is critical for market stakeholders as it dictates formulation complexity, pricing strategy, and target marketing efforts. Dominant chemical types, such as silane and siloxane, provide long-term, durable protection primarily to mineral substrates like concrete and stone, while fluoropolymers offer superior liquid repellency vital for textile finishing. The segmentation by technology distinguishes between traditional solvent-based systems, valued for deep penetration and rapid curing in certain climates, and modern water-based emulsions, favored globally for their lower VOC profile and enhanced safety.

Application segmentation illustrates the varied demand patterns across major sectors: Construction remains the largest consumer due to the volume of materials requiring waterproofing, ranging from roads and tunnels to residential facades. The Textile and Leather industries follow closely, utilizing WRAs for functional apparel and durable goods, focusing heavily on breathability and feel alongside repellency. Other crucial segments include Automotive, utilizing specialized agents for windshields, interior fabrics, and underbody coatings to prevent corrosion, and electronics, where micro-coatings protect sensitive components from moisture damage. Understanding the interplay between Type, Technology, and Application is essential for manufacturers to align their R&D pipeline with specific market needs, focusing on customized solutions that optimize cost-effectiveness and performance across these disparate end-use environments.

- By Type:

- Silane/Siloxane

- Fluoropolymers

- Metal Stearates

- Wax Emulsions

- Others (e.g., Silicon-based polymers, Specialty Polymers)

- By Technology:

- Water-based

- Solvent-based

- Powder/Solid Form

- By Application:

- Construction (Building Exteriors, Roads, Bridges, Tunnels)

- Textiles (Apparel, Technical Fabrics, Non-woven materials)

- Leather

- Automotive (Vehicle Coatings, Interior Protection)

- Others (e.g., Electronics, Paper, Medical Devices)

Value Chain Analysis For Water Repellant Agent Market

The value chain for the Water Repellant Agent market begins with the procurement of critical upstream raw materials, predominantly specialized chemicals such as silanes, siloxanes, fluorine-based intermediates, and various petrochemical derivatives used as solvents or emulsifiers. This upstream segment is characterized by high capital intensity and reliance on a few global chemical giants, which often dictate pricing volatility based on crude oil prices and specific commodity chemical market dynamics. Manufacturers of WRAs (Tier 2 players) then engage in complex synthesis and formulation processes, blending these raw materials with proprietary additives, catalysts, and stabilizers to achieve the desired performance attributes (e.g., viscosity, penetration depth, curing time, and environmental profile). Efficiency in manufacturing, including scale economies and rigorous quality control protocols, is vital for maintaining competitive pricing and ensuring product consistency, especially for high-volume construction applications.

The downstream segment involves sophisticated distribution and logistics networks tailored to the specific end-use sector. For the construction market, distribution often relies on large, specialized chemical distributors, construction material suppliers, and direct sales channels to large infrastructure projects or major construction firms. These channels require technical support and on-site guidance to ensure correct product application and optimal performance. Conversely, products destined for the textile and automotive industries are often sold directly to large industrial finishers and manufacturers, sometimes involving strategic supply contracts and rigorous certification processes. The complexity of the distribution channel is further segmented by product form: bulk liquid shipments for industrial applications versus smaller, packaged retail units for specialized application contractors or consumer DIY markets.

Distribution channels are categorized into direct and indirect methods. Direct sales are common for high-value, customized, or technically complex formulations where direct manufacturer involvement in specification and application advice is necessary. This includes sales to large infrastructure projects or key automotive OEMs. Indirect channels involve utilizing a network of third-party distributors, wholesalers, and specialized agents, which provides broader geographical reach, particularly in fragmented markets like smaller-scale residential construction and consumer retail. The effectiveness of the value chain is increasingly reliant on minimizing logistical costs and ensuring rapid response to market demand, prompting investment in digital supply chain management tools and localized blending facilities to reduce shipping distances and inventory holding costs across critical regional hubs.

Water Repellant Agent Market Potential Customers

The primary consumers and potential customers of Water Repellant Agents span several capital-intensive and consumer-focused industries that prioritize material durability and protective performance against moisture ingress. The largest segment of buyers consists of construction contractors, infrastructure developers, and concrete repair specialists who purchase WRAs for protecting roads, bridges, tunnels, commercial buildings, and historical structures. These buyers prioritize long-term performance, compatibility with existing substrates (e.g., concrete density, porosity), and ease of application, often driven by government specifications and engineering standards demanding extended maintenance cycles and structural longevity. They typically procure in bulk quantities, valuing robust supply chain reliability and consistent technical support from the manufacturer.

Another major category of customers includes textile manufacturers and finishers, particularly those specializing in functional and technical fabrics such as outdoor gear, military uniforms, and automotive upholstery. These customers demand WRAs (often fluoropolymers or specialized silicones) that provide excellent water and stain resistance while maintaining the fabric's breathability, hand feel, and colorfastness. Purchasing decisions in this sector are heavily influenced by environmental certifications (e.g., compliance with zero discharge limits and PFAS restrictions) and the performance efficiency measured by standardized tests like the AATCC spray rating. The third key customer base involves automotive original equipment manufacturers (OEMs) and aftermarket service providers, who use WRAs for protective coatings on metal components to prevent rust, on interior fabrics to resist spills, and specialized coatings for glass components to enhance visibility and safety.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 7.0 Billion |

| Growth Rate | CAGR 5.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Dow Chemical Company, Evonik Industries AG, Wacker Chemie AG, Elkem ASA, Nouryon, Chemours Company, Shin-Etsu Chemical Co. Ltd., Momentive Performance Materials Inc., CHT Group, Huntsman Corporation, Silantes GmbH, Sika AG, Akzo Nobel N.V., PPG Industries Inc., 3M Company, Archroma Management LLC, Solvay S.A., Resil Chemicals Pvt. Ltd., Harmony Chemical Industry Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Water Repellant Agent Market Key Technology Landscape

The technological landscape of the Water Repellant Agent market is rapidly evolving, driven primarily by the pursuit of superior durability, enhanced environmental profiles, and novel application methods. One of the most disruptive technologies is the advent of nanotechnology, specifically the utilization of nanoscale particles and materials like modified silica or titania to create highly structured superhydrophobic surfaces. These nano-coatings achieve water contact angles exceeding 150 degrees, providing exceptional water and self-cleaning properties (the Lotus Effect) far surpassing conventional macro-scale chemical treatments. Nanotechnology enables ultra-thin, highly effective barriers that do not compromise the aesthetic finish or breathability of high-end materials such as technical apparel and architectural facades, addressing a key limitation of older, film-forming treatments. Investment in scalable and cost-effective nano-manufacturing techniques remains a priority for market leaders seeking a competitive edge in premium applications.

The second crucial area of innovation revolves around sustainable chemistry and the shift from solvent-based systems to low-VOC, water-based formulations, and the exploration of bio-based or mineral-derived active ingredients. Regulatory scrutiny, particularly the restrictions on PFAS chemicals, has catalyzed extensive research into alternative chemistries that can deliver comparable performance without the associated environmental persistence issues. Bio-based WRAs, often derived from renewable resources such as plant oils, waxes, or specialized polymers, are gaining traction, appealing to the growing consumer demand for eco-certified products, especially in the textile and consumer goods sectors. This technological transition requires significant investment in complex emulsification techniques to ensure stability and uniform application of these inherently diverse, natural-source materials, ensuring they meet rigorous industrial performance standards for weathering and longevity.

Furthermore, the market is witnessing advancements in smart and multifunctional coatings, which integrate water repellency with other protective characteristics. Examples include WRAs that also incorporate antimicrobial properties, essential for applications in damp environments or medical settings, or agents designed for high UV stability and fire retardancy, crucial for construction materials. The technological maturity in silane and siloxane chemistry continues to improve, focusing on optimizing oligomer size and reactivity to achieve deeper penetration into porous substrates like concrete, resulting in superior long-term resistance to chloride ingress and efflorescence. This ongoing refinement of established chemical families, coupled with radical advancements in nanotechnology and sustainability, characterizes the dynamic and highly competitive nature of the water repellant agent technology landscape.

Regional Highlights

The global distribution of the Water Repellant Agent market showcases distinct regional growth drivers and adoption trends, reflecting varying levels of infrastructural development, climatic conditions, and regulatory environments. Asia Pacific (APAC) currently dominates the market volume and is projected to register the highest growth rate during the forecast period. This dominance is directly attributable to the unprecedented scale of construction and infrastructure development across countries like China, India, and ASEAN nations, where rapid urbanization necessitates massive investments in durable housing, commercial spaces, and transportation networks. Furthermore, the region’s expansive textile manufacturing base utilizes significant volumes of WRAs for fabric finishing. The challenge in APAC lies in the fragmented nature of the market and the prevalence of local, lower-cost alternatives, though demand for high-performance, branded WRAs is rising due to increased foreign direct investment in quality-focused infrastructure projects.

North America represents a mature yet high-value market, characterized by stringent performance requirements, a strong emphasis on maintaining existing, aging infrastructure (e.g., bridges and highways), and high adoption rates of advanced, often premium-priced, water repellant technologies. Regulatory trends, particularly focusing on limiting VOC emissions and eliminating PFOA/PFOS compounds, drive innovation towards sophisticated water-based and bio-friendly formulations. The construction sector in the U.S. and Canada is a key consumer, prioritizing long-lasting protection against severe weather cycles, including intense freeze-thaw events. The region also hosts significant R&D activities, particularly in specialized fields such as aerospace and advanced automotive coatings, ensuring continuous demand for cutting-edge hydrophobic solutions.

Europe stands out due to its leadership in sustainable construction and environmental regulation, propelling the rapid adoption of eco-certified WRAs. The REACH regulation and specific national legislation regarding chemical usage strongly influence product development, favoring low-toxicity and sustainable materials. Western European countries exhibit high demand for WRAs in renovation and preservation projects, particularly for historical masonry and public works, where material authenticity and breathability are paramount. Central and Eastern Europe show steady growth, supported by EU cohesion funds directed towards modernizing infrastructure. The Middle East and Africa (MEA), while smaller, are emerging as critical markets, particularly the GCC countries, where massive construction projects driven by economic diversification require specialized WRAs to combat high temperatures, dust, and corrosive saline environments, necessitating materials engineered for extreme durability and UV resistance.

- North America: Focus on high-performance infrastructure maintenance; strong regulatory push for low-VOC and sustainable formulations; significant market for advanced automotive and aerospace coatings.

- Europe: Driven by strict environmental regulations (REACH); high adoption of water-based and bio-based WRAs; mature market emphasizing renovation and preservation of historical structures.

- Asia Pacific (APAC): Largest volume market fueled by massive urbanization and infrastructure growth (China, India); high demand across construction and textile manufacturing; rapid growth expected.

- Latin America (LATAM): Growing construction activities, particularly in Brazil and Mexico; increasing focus on modern waterproofing techniques to combat heavy rainfall and humidity.

- Middle East & Africa (MEA): Emerging demand linked to mega-projects in GCC nations; requires specialized WRAs engineered for extreme heat, salinity, and UV exposure; focus on durability and energy efficiency.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Water Repellant Agent Market.- BASF SE

- Dow Chemical Company

- Evonik Industries AG

- Wacker Chemie AG

- Elkem ASA

- Nouryon

- Chemours Company

- Shin-Etsu Chemical Co. Ltd.

- Momentive Performance Materials Inc.

- CHT Group

- Huntsman Corporation

- Silantes GmbH

- Sika AG

- Akzo Nobel N.V.

- PPG Industries Inc.

- 3M Company

- Archroma Management LLC

- Solvay S.A.

- Resil Chemicals Pvt. Ltd.

- Harmony Chemical Industry Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Water Repellant Agent market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a water repellant and a waterproofing agent?

Water repellant agents (WRAs) modify the surface tension of a substrate, typically maintaining its breathability by not sealing pores completely, allowing moisture vapor to escape while blocking liquid water ingress. Waterproofing agents, conversely, typically form an impermeable barrier (a membrane or film) that blocks both liquid water and moisture vapor, often necessary for below-grade applications or areas with constant hydrostatic pressure. WRAs are often used on above-ground masonry, while waterproofing is used for basements or roofs.

Which chemical type dominates the Water Repellant Agent market and why is it preferred in construction?

Silane and siloxane-based chemistries dominate the construction segment. They are preferred because they penetrate deeply into porous mineral substrates like concrete and stone, reacting chemically to form a permanent, hydrophobic lining within the pores. This structure ensures superior longevity, UV resistance, and minimal visual change to the substrate, providing durable protection against efflorescence and freeze-thaw damage that extends the lifespan of critical infrastructure.

How are environmental regulations, specifically regarding PFAS, impacting the textile water repellant segment?

Environmental regulations, particularly the phase-out of PFOA and the increasing scrutiny on the entire class of PFAS (Per- and Polyfluoroalkyl Substances) due to their persistence, are causing a significant disruption. Textile manufacturers are rapidly transitioning from traditional C8 and C6 fluoropolymers to shorter-chain fluorinated alternatives or, increasingly, to high-performance, non-fluorinated chemistries (e.g., silicone-based or polyurethane dispersions) to maintain compliance and meet consumer demand for sustainable apparel.

What are the key technological advancements driving performance improvements in WRAs?

The primary technological advancements include the application of nanotechnology to create superhydrophobic surfaces (Lotus Effect), enhancing self-cleaning and repellency; the development of high-solids, low-VOC water-based formulations to improve safety and environmental compliance; and advancements in bio-based chemistries derived from renewable resources, offering competitive, sustainable performance options for various industrial and consumer applications.

Which geographical region is expected to demonstrate the fastest growth rate for Water Repellant Agents?

Asia Pacific (APAC) is projected to exhibit the fastest growth rate. This acceleration is due to substantial public and private investment in massive infrastructure projects, rapid urbanization requiring extensive residential and commercial construction, and the expansion of key manufacturing sectors like textiles and automotive across major economies such as China, India, and Southeast Asian nations, generating high demand for protective chemical solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager