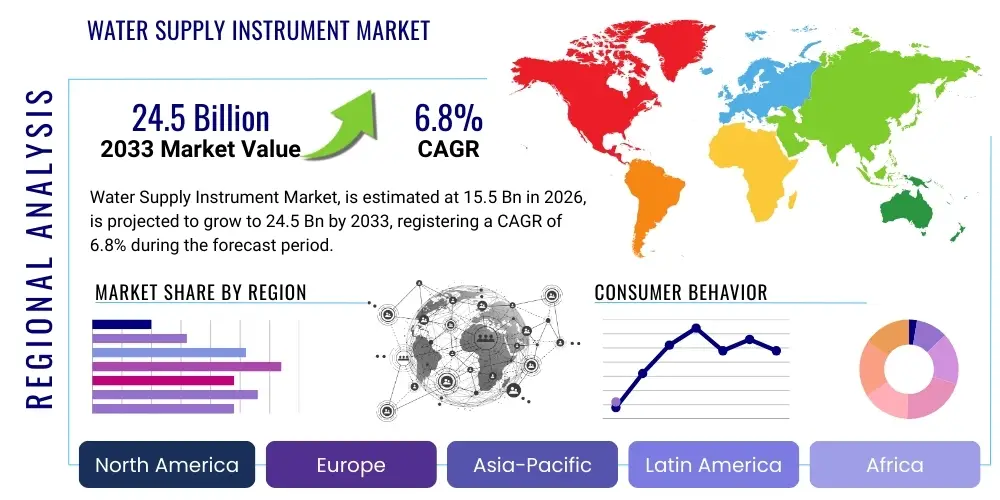

Water Supply Instrument Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441639 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Water Supply Instrument Market Size

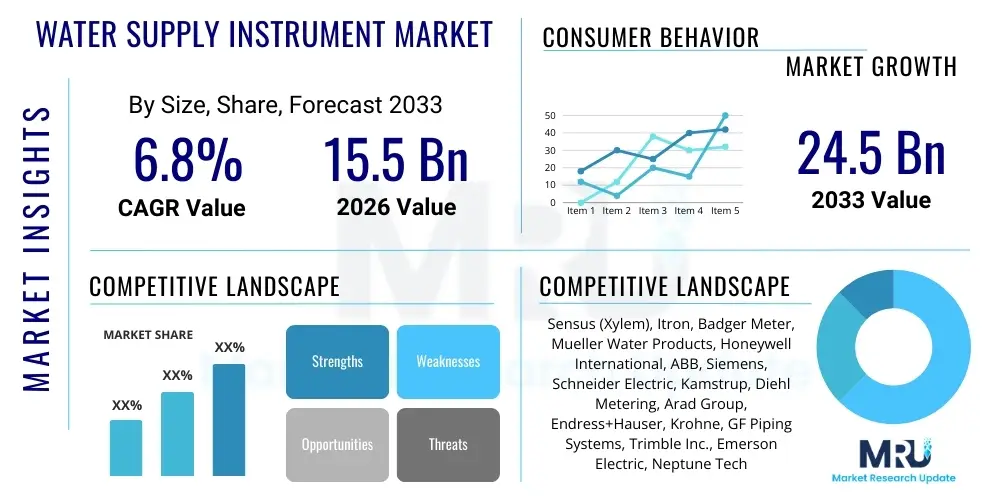

The Water Supply Instrument Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 15.5 Billion in 2026 and is projected to reach USD 24.5 Billion by the end of the forecast period in 2033.

Water Supply Instrument Market introduction

The Water Supply Instrument Market encompasses a diverse range of devices and systems essential for the efficient measurement, monitoring, control, and regulation of water flow, pressure, quality, and leakage across municipal, industrial, and agricultural sectors. These instruments include advanced flow meters (ultrasonic, electromagnetic, mechanical), pressure gauges, water quality sensors, level transmitters, and sophisticated data logging and telemetry systems. The fundamental objective of these instruments is to optimize water resource management, ensure equitable distribution, and significantly reduce Non-Revenue Water (NRW) losses, which remains a critical challenge globally for utility providers.

Key applications of water supply instruments span from large-scale water treatment plants and complex transmission pipelines to localized distribution networks and end-user metering points. These instruments are integral in monitoring purification processes, verifying compliance with stringent environmental and health regulations, and enabling proactive maintenance strategies through precise data acquisition. The benefits derived from the adoption of modern water supply instrumentation include enhanced operational efficiency, reduced energy consumption associated with pumping, accurate billing, and improved public health outcomes through continuous water quality assurance.

Market expansion is principally driven by accelerating global urbanization, which necessitates substantial investments in new and upgraded water infrastructure. Furthermore, the increasing scarcity of freshwater resources, coupled with stricter regulatory mandates concerning water conservation and quality, compels utilities worldwide to adopt intelligent instrumentation solutions. The shift towards smart water networks, leveraging IoT (Internet of Things) and cloud computing for real-time monitoring and predictive analytics, serves as a primary catalyst pushing market growth and technological innovation in this crucial sector.

Water Supply Instrument Market Executive Summary

The global Water Supply Instrument Market is experiencing robust expansion, fundamentally driven by the pervasive necessity for aging infrastructure renewal and the urgent global mandate for sustainable water management practices. Business trends indicate a strong shift towards digitalization, with key players focusing heavily on developing integrated smart metering solutions (AMI/AMR) that facilitate two-way communication, detailed usage analysis, and automated leak detection. This digital transformation is fostering significant market activity in software and data analytics services bundled with hardware sales, transforming traditional instrument manufacturers into comprehensive solution providers capable of offering holistic water intelligence platforms. Furthermore, mergers and acquisitions remain prevalent, as larger entities seek to consolidate specialized technology, particularly in advanced sensor fabrication and secure data transmission protocols.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, propelled by massive government investment in urban infrastructure development, particularly in emerging economies like China and India, aimed at extending safe water access to rapidly expanding populations. North America and Europe, characterized by established and sophisticated utility markets, show higher adoption rates for advanced instruments focused on efficiency optimization and leakage control in mature networks. Regulatory frameworks across these regions, emphasizing water conservation and NRW reduction targets, are critical accelerators for instrument deployment, particularly for high-precision flow measurement and pressure management tools.

Segmentation analysis highlights the increasing dominance of the smart meters segment due to utility digitalization mandates, offering unparalleled granularity in consumption data. Technologically, non-invasive measurement techniques, such as ultrasonic flow meters, are gaining significant traction over traditional mechanical meters due to their accuracy, minimal maintenance requirements, and capability to integrate seamlessly into existing pipeline networks. The industrial end-use segment is also seeing increased demand, driven by internal corporate sustainability goals and the necessity for accurate water usage accountability in manufacturing processes, further reinforcing the market's trajectory towards high-value, intelligent instrumentation.

AI Impact Analysis on Water Supply Instrument Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Water Supply Instrument Market often center on how AI enhances predictive maintenance, optimizes network operations, and improves the accuracy of leak detection using existing sensor infrastructure. Users frequently inquire about the integration challenges of migrating legacy systems to AI-enabled platforms, the required data processing infrastructure, and the return on investment (ROI) from implementing AI algorithms for Non-Revenue Water (NRW) management. There is also significant interest in AI's role in correlating various datasets—such as pressure, flow, temperature, and historical consumption patterns—to create high-fidelity digital twins of water distribution networks, enabling better forecasting and resource allocation. The overall sentiment points toward high expectations for AI to move the industry from reactive maintenance to truly predictive and autonomous network control, fundamentally transforming how water utilities operate and manage their vast assets.

AI is transforming water supply instrumentation by shifting the focus from simple data collection to advanced data interpretation and automated decision-making. By applying machine learning models to the massive datasets generated by smart meters, IoT sensors, and Supervisory Control and Data Acquisition (SCADA) systems, AI can rapidly identify anomalies indicative of pipe bursts, instrument malfunctions, or tampering. This capability significantly reduces response times and minimizes water loss and infrastructure damage. Furthermore, AI algorithms are being deployed to optimize pumping schedules based on real-time demand forecasting and variable electricity pricing, leading to substantial energy cost savings—a major operational expense for water utilities globally. The precision offered by AI in predictive modeling is accelerating the adoption of high-fidelity, interoperable instrumentation capable of feeding continuous, reliable data streams.

- Enhanced Predictive Maintenance: AI models analyze historical sensor data (e.g., vibration, pressure transients) to forecast instrument failure, minimizing downtime and optimizing calibration schedules for flow meters and sensors.

- Optimized Pumping and Energy Use: AI uses real-time demand data and energy tariffs to automatically adjust pump speeds and operational schedules, reducing electricity consumption by 10-20% in optimized networks.

- Advanced Leak Detection and Localization: Machine learning algorithms process correlated data from pressure sensors and acoustic correlators to pinpoint leak locations with greater accuracy than traditional methods, drastically reducing NRW.

- Digital Twin Creation and Simulation: AI facilitates the construction and dynamic calibration of high-fidelity digital twins of water networks, allowing utilities to simulate the impact of infrastructure changes or extreme weather events on supply instruments.

- Automated Water Quality Monitoring: AI processes continuous data streams from water quality sensors, identifying subtle chemical or microbial changes immediately, ensuring rapid regulatory compliance and public safety responses.

- Improved Customer Consumption Forecasting: AI analyzes historical usage patterns, demographic data, and weather inputs to provide highly accurate demand forecasts, improving resource planning and infrastructure sizing for new instrument deployments.

- Cybersecurity and Anomaly Detection: Machine learning models monitor network traffic and instrument communication logs to identify and flag unusual access patterns or data manipulation attempts, securing critical infrastructure components.

DRO & Impact Forces Of Water Supply Instrument Market

The market for water supply instruments is powerfully shaped by a dynamic interplay of propelling drivers, systemic constraints, emerging opportunities, and competitive impact forces. The primary drivers revolve around the global crisis of water scarcity, coupled with the necessity for massive Non-Revenue Water (NRW) reduction to preserve financial viability and environmental sustainability for utility providers. Regulatory mandates favoring smart metering and advanced monitoring systems, particularly in densely populated urban centers, further accelerate adoption. Conversely, the market faces significant restraints, including the high initial capital expenditure required for large-scale infrastructure upgrades and smart grid implementation, alongside bureaucratic hurdles and the long procurement cycles characteristic of public sector utilities. Overcoming these financial and logistical challenges often dictates the speed of technological diffusion.

Opportunities within the sector are largely concentrated in the development and deployment of sensor fusion technologies, integrating flow, pressure, and acoustic monitoring into single, highly efficient units suitable for harsh underground environments. Furthermore, untapped markets in developing nations, where rudimentary infrastructure is common, present substantial long-term growth potential for basic and moderately priced metering solutions. The rise of private sector involvement through public-private partnerships (PPPs) in water management projects also creates lucrative avenues for instrument manufacturers to deploy turnkey solutions combining hardware, software, and services. Focusing on cybersecurity integration within IoT instruments is also a major opportunity, given the critical nature of water infrastructure.

The core impact forces shaping the competitive landscape include intense pressure from end-users to reduce the Total Cost of Ownership (TCO) through instruments requiring minimal calibration and maintenance, favoring technologies like ultrasonic or magnetic flow meters over mechanical alternatives. Technological innovation remains a profound competitive force, driving continuous enhancements in sensor accuracy and battery life. Strategic collaborations between instrument manufacturers, communication technology providers (e.g., 5G providers), and data analytics firms are becoming essential for delivering integrated smart water solutions, thereby consolidating market power among those who offer comprehensive, interoperable platforms. Ultimately, the successful navigation of regulatory shifts, technological obsolescence, and demands for greater resilience dictates market success.

- Drivers:

- Escalating Global Water Scarcity and the imperative for conservation across municipal and agricultural sectors.

- Increasing governmental and regulatory pressure to reduce Non-Revenue Water (NRW) losses and improve network efficiency.

- Rapid global urbanization leading to significant expansion and modernization of existing water distribution infrastructure.

- Technological advancements in IoT, sensor miniaturization, and secure, low-power wide-area network (LPWAN) communication protocols enabling smart water networks.

- Restraints:

- Substantial initial capital investment required for deploying advanced smart metering infrastructure and upgrading legacy pipe networks.

- Lack of standardized communication protocols and interoperability issues between instruments from different vendors and existing SCADA systems.

- Long lifespan of traditional infrastructure leading to slow adoption cycles for new technologies in established utility companies.

- Security concerns regarding the vulnerability of interconnected smart water devices (IoT instruments) to cyberattacks.

- Opportunities:

- Significant growth potential in emerging economies requiring foundational infrastructure and basic metering solutions.

- Development of highly specialized, resilient sensors for extreme environments (e.g., high pressure, corrosive water).

- Expansion of Software-as-a-Service (SaaS) models bundled with instrumentation for data analytics, predictive maintenance, and operational insights.

- Utilization of satellite imagery and advanced geospatial analysis combined with instrument data for holistic resource monitoring.

- Impact Forces:

- Buyer Power: High, as large municipal utilities demand customized solutions, long-term support contracts, and demonstrable ROI on instrument deployment.

- Supplier Power: Moderate to High, particularly for niche suppliers providing proprietary sensor technology (e.g., advanced acoustic sensors).

- Threat of New Entrants: Moderate, as high R&D costs, stringent regulatory compliance, and established vendor relationships create significant entry barriers.

- Threat of Substitutes: Low to Moderate, as dedicated physical instruments are largely irreplaceable, though data analytics substitutes for some manual inspection processes.

- Competitive Rivalry: High, driven by product differentiation (accuracy, battery life, connectivity) and global tender competition.

Segmentation Analysis

The Water Supply Instrument Market is systematically segmented based on key attributes including instrument type, technology employed, end-user industry, and application area. This segmentation provides a nuanced view of market dynamics, revealing where investment is flowing and which technological approaches are gaining dominance. Instrument type segmentation is pivotal, differentiating between measurement devices such as flow meters, pressure sensors, and level sensors, with flow meters generally constituting the largest and most critical segment due to their necessity in billing and distribution control. Understanding these segments is crucial for manufacturers to tailor their R&D efforts and marketing strategies towards specific operational needs, whether they pertain to high-accuracy industrial metering or large-volume municipal monitoring.

The technological categorization highlights the shift from traditional mechanical instruments to advanced electronic solutions. The rapid adoption of ultrasonic and electromagnetic flow meters is a defining trend, driven by the desire for zero moving parts, reduced maintenance, and superior accuracy, especially important in Non-Revenue Water (NRW) reduction programs. Concurrently, the proliferation of Internet of Things (IoT) connectivity across all instrument types is creating a distinct sub-segment of 'smart' instruments, which offer real-time data transmission and integration into centralized management platforms. This technological evolution allows utilities to move away from manual meter reading and sporadic monitoring towards continuous, data-driven network management.

Segmentation by end-user clarifies the varied demands placed on instruments across different sectors. The municipal segment remains the primary market driver, necessitating robust, scalable instruments for large distribution networks and residential metering. However, the industrial sector (including power generation, manufacturing, and chemicals) demands instruments with extreme precision and resilience against corrosive substances, driving specialization. The agricultural segment, while traditionally reliant on simpler systems, is increasingly adopting smart instruments for precise irrigation control to manage water scarcity, representing a high-growth opportunity for sensor providers focused on remote area applications and durability.

- By Instrument Type:

- Flow Meters (Electromagnetic, Ultrasonic, Mechanical, Coriolis, Differential Pressure)

- Pressure Sensors and Transmitters

- Water Quality Sensors (pH, Conductivity, Turbidity, Dissolved Oxygen)

- Level Sensors and Gauges

- Data Loggers and Telemetry Units

- Leak Detection Equipment (Acoustic Correlators, Ground Microphones)

- By Technology:

- Traditional/Mechanical Instruments

- Smart/Connected Instruments (AMI/AMR Systems)

- IoT-Enabled Sensors

- By End-User:

- Municipal Water Utilities (Distribution, Treatment, Residential Metering)

- Industrial Sector (Manufacturing, Power Generation, Pulp & Paper, Chemical Processing)

- Agricultural Sector (Irrigation Management, Farm Monitoring)

- By Application:

- Water Treatment and Filtration

- Water Distribution Network Monitoring

- Non-Revenue Water (NRW) Management

- Billing and Consumption Measurement

- Process Control and Automation

Value Chain Analysis For Water Supply Instrument Market

The value chain of the Water Supply Instrument Market begins with upstream activities focused on the meticulous sourcing and processing of raw materials, including specialized plastics, corrosion-resistant metals (such as stainless steel and alloys), and sophisticated electronic components like microprocessors, sensors, and communication chips. The success at this stage relies heavily on establishing stable supply chains for high-precision components, which are often subject to global semiconductor shortages or specialized material constraints. Core instrument manufacturing then involves highly technical processes such as advanced sensor fabrication (e.g., ultrasonic transducers), encapsulation for extreme environmental protection, and integration of complex software for data processing and communication functionality. Quality control, testing, and regulatory compliance (e.g., accuracy certifications) are paramount and contribute significantly to the instrument's final value proposition.

Midstream activities primarily encompass the intricate distribution network, which typically involves specialized local distributors, system integrators, and value-added resellers (VARs) who bridge the gap between manufacturers and diverse end-users, especially municipal utilities. Direct sales channels are often utilized for large-scale public tenders or strategic industrial clients, while indirect channels provide localized installation, maintenance support, and integration services tailored to specific regional infrastructure requirements. Effective logistics, inventory management, and technical training for installation teams are essential components of this stage, ensuring instruments are deployed correctly and calibrated efficiently within complex network environments. The consulting services offered during the system integration phase, particularly for smart network rollouts, add substantial value.

Downstream activities focus on the end-users—municipal, industrial, and agricultural sectors—where the instruments are installed, commissioned, and maintained. This stage is dominated by operations, maintenance, and ongoing service contracts, including calibration, repair, and software updates (firmware and data analytics platforms). Direct engagement with end-users through service level agreements (SLAs) ensures the instruments maintain their accuracy and functionality over their expected lifespan, which is often measured in decades for certain utility infrastructure components. The data generated by these instruments then feeds into the downstream decision-making process, enabling proactive resource management, billing accuracy, and capital improvement planning, thereby completing the cycle of value generation.

Water Supply Instrument Market Potential Customers

The primary end-users and buyers in the Water Supply Instrument Market are dominated by public and private sector utility companies responsible for water withdrawal, treatment, and distribution within municipal boundaries. These entities, faced with aging infrastructure, rising operational costs, and mounting pressure to conserve water, represent the largest purchasing segment. Their purchasing decisions are highly centralized, governed by rigorous public tendering processes, long-term planning cycles, and strict adherence to governmental standards for accuracy and reliability. Key purchase drivers for utilities include compliance requirements related to non-revenue water (NRW) reduction, mandates for universal residential metering, and the strategic objective of migrating to smart grid infrastructure (AMI) to facilitate remote monitoring and automated billing processes.

Beyond municipal organizations, the industrial sector constitutes a critical and growing customer segment. Industries such as oil and gas, power generation (especially thermal power plants requiring immense cooling water), food and beverage processing, and chemical manufacturing require highly specialized instruments. These industrial users focus on process control, regulatory compliance related to effluent discharge, and internal water management to meet corporate sustainability goals and reduce operational expenses associated with water consumption and treatment. Their requirements typically lean towards high-pressure, high-temperature, or chemically resistant instruments with superior precision (e.g., Coriolis flow meters for critical measurement), often prioritizing durability and specialized calibration services over sheer volume.

The agricultural sector, particularly in regions characterized by water stress and extensive irrigation, represents a high-potential market. Farmers and large agribusinesses are increasingly adopting smart flow meters and connected soil moisture sensors to optimize irrigation timing and volume, moving away from wasteful flood irrigation. This segment is characterized by demand for durable, battery-powered instruments suitable for remote, off-grid installation, often integrated with telemetry systems for remote monitoring and control. Furthermore, engineering, procurement, and construction (EPC) firms involved in developing large infrastructure projects (dams, pipelines, pumping stations) act as indirect but significant customers, specifying and procuring instruments as part of large, integrated project bundles, influencing technology selection early in the project lifecycle.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.5 Billion |

| Market Forecast in 2033 | USD 24.5 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sensus (Xylem), Itron, Badger Meter, Mueller Water Products, Honeywell International, ABB, Siemens, Schneider Electric, Kamstrup, Diehl Metering, Arad Group, Endress+Hauser, Krohne, GF Piping Systems, Trimble Inc., Emerson Electric, Neptune Technology Group, Master Meter, McCrometer, Elster Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Water Supply Instrument Market Key Technology Landscape

The technological landscape of the Water Supply Instrument Market is undergoing rapid transformation, fundamentally driven by the convergence of digital communication and advanced sensing mechanisms. Non-invasive measurement technologies, particularly ultrasonic and electromagnetic flow meters, have become the industry benchmark. Ultrasonic meters leverage acoustic signals to measure flow rates, offering advantages such as high accuracy, zero pressure loss, and the absence of moving parts, drastically reducing wear and maintenance needs. Electromagnetic meters, conversely, are ideal for conductive fluids and highly reliable in harsh conditions. Both technologies support wide dynamic ranges and are essential in sophisticated Non-Revenue Water (NRW) management programs, replacing older, less precise mechanical turbine meters in critical applications.

The integration of Information and Communication Technology (ICT) forms the second pillar of the technology landscape, revolving around Advanced Metering Infrastructure (AMI) and Advanced Meter Reading (AMR) systems. These technologies incorporate embedded communication modules (utilizing LoRaWAN, NB-IoT, or proprietary protocols) directly into instruments, enabling secure, two-way data transmission between the instrument and the utility's central data platform. This shift enables real-time monitoring of consumption, automated tamper detection, and remote shut-off capabilities, which are crucial for smart city initiatives. Furthermore, the development of robust data management platforms and cloud-based analytics, often incorporating AI and machine learning, allows utilities to convert the vast streams of instrument data into actionable operational intelligence for predictive maintenance and demand forecasting.

Pervasive sensor technology innovation extends beyond flow measurement into pressure and water quality monitoring. High-precision pressure sensors are now equipped with transient pressure logging capabilities, essential for identifying surge events that can cause pipe bursts. Leak detection is also seeing significant technological advances, utilizing highly sensitive acoustic correlators, hydrophones, and correlating loggers that communicate wirelessly. Future trends indicate significant investment in multi-parameter probes that combine flow, temperature, conductivity, and residual chlorine measurement into a single, compact unit, providing a more holistic view of network health and water quality compliance directly at the distribution point, significantly improving the efficacy and responsiveness of water network management systems.

Regional Highlights

The global Water Supply Instrument Market exhibits significant regional disparities in terms of technological adoption and market maturity, largely reflecting local investment priorities and regulatory environments. North America and Europe represent mature markets characterized by stringent regulatory oversight regarding water quality, substantial existing infrastructure, and high labor costs. This environment drives demand for advanced, low-maintenance instruments such as smart meters (AMI) and high-precision sensors optimized for Non-Revenue Water (NRW) reduction and system efficiency, prioritizing high-value solutions that reduce operational expenditure over the long term. These regions are leading the development and application of digital twin technologies and advanced data analytics platforms integrated with instrumentation.

Asia Pacific (APAC) is projected to be the engine of market growth, driven by rapid urbanization and large-scale government programs aimed at expanding access to safe drinking water and sanitation across populous countries like China, India, and Southeast Asian nations. While there is a significant demand for basic mechanical and electronic meters for new installations, the region is simultaneously witnessing aggressive adoption of smart metering technology in major metropolitan areas to combat water theft and improve billing efficiency. Capital deployment in APAC is substantial, focusing on building resilient and modern infrastructure from the ground up, contrasting with the retrofit focus often seen in Western markets.

- North America: High investment in AMI deployment and infrastructure renewal to combat aging systems; strict regulations driving demand for leak detection and high-accuracy industrial flow meters.

- Europe: Focus on EU water directives compliance, robust adoption of advanced ultrasonic and magnetic flow meters for accurate consumption billing, and strong emphasis on sustainability and energy optimization in water networks.

- Asia Pacific (APAC): Highest growth rate globally, fueled by massive infrastructure projects, urbanization, and government initiatives to install comprehensive metering and leakage management systems in rapidly expanding urban centers.

- Latin America: Growing need for solutions to address high NRW rates and inadequate billing infrastructure; increasing adoption of prepaid metering systems and basic electronic flow meters in developing municipal areas.

- Middle East and Africa (MEA): Driven by intense water scarcity, high demand for desalination plant instrumentation (requiring specific corrosion resistance), and development of new distribution networks, particularly in the Gulf Cooperation Council (GCC) states.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Water Supply Instrument Market.- Xylem Inc. (Including Sensus)

- Itron, Inc.

- Badger Meter, Inc.

- Mueller Water Products, Inc.

- Honeywell International Inc.

- ABB Ltd.

- Siemens AG

- Schneider Electric SE

- Kamstrup A/S

- Diehl Metering (Diehl Group)

- Arad Group

- Endress+Hauser Group Services AG

- Krohne Group

- GF Piping Systems (Georg Fischer AG)

- Trimble Inc.

- Emerson Electric Co.

- Neptune Technology Group Inc.

- Master Meter, Inc.

- McCrometer, Inc.

- Elster Group (now owned by Honeywell/Itron depending on segment)

- Zenner International GmbH & Co. KG

- Hydrometer Group (Diehl Metering)

- Telemetrica S.L.

- Apator Group

- Silver Spring Networks (now part of Itron)

- Armet Group

- BMETERS S.r.l.

- Tianjin Maike Automation Instrument Co., Ltd.

- Shanghai Huifeng Instrument Co., Ltd.

- Qingdao Changyu Water Meter Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Water Supply Instrument market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Non-Revenue Water (NRW) and how do water supply instruments help in its reduction?

Non-Revenue Water (NRW) is the volume of water produced and supplied by utilities that is lost before reaching customers, typically due to physical losses (leakage) or commercial losses (inaccurate metering, theft). Water supply instruments, particularly high-precision flow meters (ultrasonic, magnetic), pressure monitoring sensors, and advanced leak detection acoustic correlators, provide the precise data necessary to quantify losses, identify pressure anomalies causing pipe bursts, and pinpoint the exact location of leaks, enabling targeted repair and substantial NRW reduction.

What is the primary difference between AMI and AMR systems in the context of water metering?

Advanced Metering Infrastructure (AMI) represents a fully integrated, two-way communication network that allows utilities to not only collect meter data remotely (like AMR) but also send commands back to the meter, facilitating functions like remote shut-off, firmware updates, and real-time demand response. Advanced Meter Reading (AMR) is simpler, primarily enabling one-way, automated data collection, usually via drive-by or fixed network reading. AMI offers greater operational control, efficiency, and real-time data granularity essential for smart water management.

Which technology segment of flow meters is seeing the fastest growth and why?

The ultrasonic flow meter segment is currently experiencing the fastest growth. This is due to their inherent advantages, including superior accuracy, reliability, and low maintenance requirements because they contain no moving parts susceptible to wear or debris blockage. Furthermore, their compatibility with IoT connectivity and smart metering systems makes them ideal for modern network upgrades, where precise, maintenance-free operation over long periods is a critical factor for utilities focusing on Total Cost of Ownership (TCO).

What are the major challenges associated with deploying smart water instruments in existing infrastructure?

Major challenges include ensuring seamless interoperability between new smart instruments and decades-old SCADA or IT systems, addressing the high upfront capital costs required for mass deployment, and navigating communication complexities, especially in dense urban areas or remote rural settings where reliable network coverage is inconsistent. Utilities must also manage the complexity of data integration, requiring specialized cybersecurity measures and personnel training to utilize advanced analytics platforms effectively.

How is predictive maintenance enabled by instruments impacting utility operations?

Predictive maintenance leverages data collected from various instruments—such as pressure transducers logging transient events, flow meters indicating performance degradation, and vibration sensors—which is then analyzed using machine learning algorithms. This analysis allows utilities to anticipate potential failures in pumps, valves, or the instruments themselves before they occur, scheduling maintenance proactively. This capability drastically reduces unexpected downtime, minimizes emergency repair costs, and ensures continuous, reliable service delivery across the water network.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager