Water Treatment Cyanuric Acid Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441508 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Water Treatment Cyanuric Acid Market Size

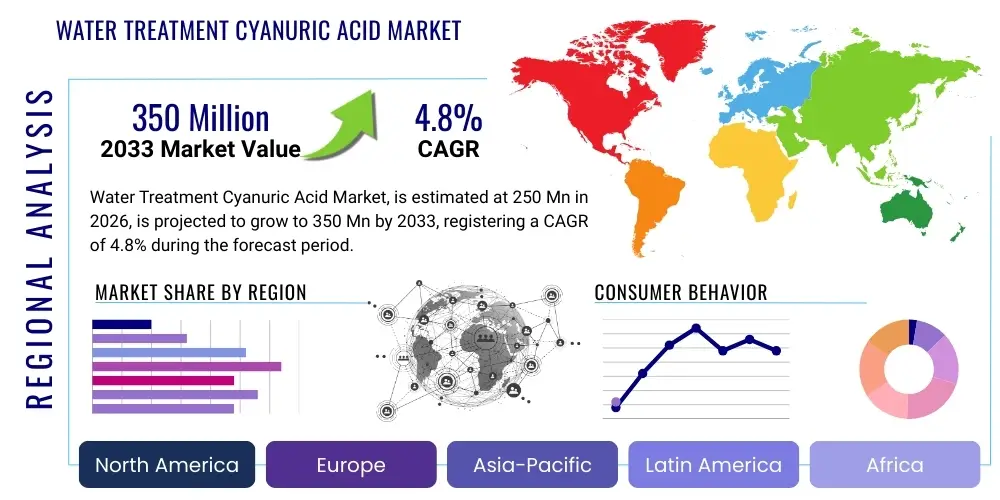

The Water Treatment Cyanuric Acid Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 250 Million in 2026 and is projected to reach USD 350 Million by the end of the forecast period in 2033.

Water Treatment Cyanuric Acid Market introduction

The Water Treatment Cyanuric Acid market encompasses the global production, distribution, and consumption of cyanuric acid (CYA) primarily used as a stabilizer for chlorine in recreational water bodies and specific industrial water treatment processes. Cyanuric acid, chemically C3H3N3O3, significantly reduces the degradation of hypochlorous acid (active chlorine) caused by ultraviolet (UV) radiation, making chlorine last substantially longer in outdoor applications like swimming pools, spas, and water parks. This stabilizing effect minimizes the necessity for continuous chlorine replenishment, thereby offering cost efficiencies and maintaining consistent disinfection levels, which is crucial for public health safety and water quality management.

The product is commercially available in various forms, predominantly granular, powder, and liquid concentrates, catering to diverse application methods and scales of operation. While swimming pools and spas remain the dominant application segment, cyanuric acid also finds niche applications in industrial water cooling towers and select wastewater treatment facilities where prolonged chlorine efficacy is paramount. Its primary function is not disinfection itself, but rather protecting the primary disinfectant from environmental degradation, thereby ensuring that water systems remain free of pathogens, algae, and organic contaminants. The market structure is highly dependent on regulatory standards concerning maximum allowable concentrations (MACs) of CYA, which vary significantly across different geographical regions.

Key market benefits driving adoption include enhanced chlorine efficiency, reduction in chemical consumption costs, and maintenance of stable disinfection residuals, particularly in regions with high solar intensity. Furthermore, the global rise in recreational water facilities, coupled with stringent public health regulations mandating clear water standards, continues to underpin market expansion. However, the industry faces constraints related to balancing the stabilizing effect with potential chlorine lock issues at excessive concentrations, prompting continuous research into optimal dosing strategies and alternative stabilization technologies. Overall, the foundational role of cyanuric acid in maintaining water hygiene ensures its continued significance in the global water treatment chemical landscape.

Water Treatment Cyanuric Acid Market Executive Summary

The Water Treatment Cyanuric Acid market demonstrates robust growth, primarily fueled by the accelerating construction of residential and commercial swimming pools globally, coupled with increasingly rigorous public health mandates concerning water safety and disinfection efficacy. Business trends indicate a shift toward higher-purity granular and stabilized chlorine product formulations that offer easier handling and precise dosing. Major manufacturers are focusing on backward integration to secure raw material supply, particularly urea and chlorine compounds, to maintain competitive pricing and production stability. Furthermore, technological advancements are being directed toward developing smart water management systems that integrate sensors for real-time monitoring of CYA levels, addressing previous concerns regarding over-stabilization and chlorine lock phenomena.

Regional trends highlight the Asia Pacific (APAC) region as the fastest-growing market, driven by rapid urbanization, rising disposable incomes leading to increased adoption of private pools in developing nations like China and India, and significant infrastructure investment in public water amenities. North America and Europe, while mature, maintain substantial market shares due to high existing pool density and strict regulatory frameworks governing water chemistry. Segments trends emphasize the dominance of the residential and commercial swimming pool application segments. Within product types, granular and powder forms are preferred due to their stability and ease of storage, though liquid formulations are gaining traction in large-scale municipal applications requiring automated dosing systems. The industrial application segment, particularly cooling towers, is showing moderate growth as industries seek specialized water treatment solutions to prevent equipment corrosion and biofouling efficiently.

The market faces inherent challenges, notably the regulatory scrutiny concerning the accumulation of cyanuric acid in treated water, which can potentially diminish chlorine's effectiveness at high levels. Despite these restraints, the market remains fundamentally strong, buoyed by the undeniable economic benefits and operational efficiencies CYA provides in chlorine stabilization. Strategic acquisitions and capacity expansions are anticipated among key players to consolidate market share and capitalize on emerging opportunities in regions where water treatment infrastructure is rapidly developing. The long-term outlook remains positive, contingent upon manufacturers’ ability to innovate around regulatory constraints and provide sustainable, high-performance stabilization solutions tailored for various water environments.

AI Impact Analysis on Water Treatment Cyanuric Acid Market

User inquiries regarding AI's impact on the Water Treatment Cyanuric Acid market commonly revolve around predictive maintenance, optimization of chemical dosing, and the development of next-generation smart water chemistry monitoring tools. Key themes include whether AI can minimize the issue of "chlorine lock" caused by excessive CYA, how machine learning algorithms can predict optimal CYA levels based on real-time environmental factors (UV index, temperature, bather load), and the potential for AI-driven automation to reduce reliance on manual testing and human error in chemical management. Users are also concerned about the integration costs and the reliability of AI systems in demanding outdoor or industrial water environments. The overall expectation is that AI will enhance the precision, sustainability, and efficiency of cyanuric acid usage, moving the industry towards proactive, rather than reactive, chemical management strategies.

- AI-Powered Dosing Optimization: Machine learning algorithms analyze historical usage, environmental data (UV, temperature, rainfall), and real-time sensor readings to precisely calculate and adjust the required cyanuric acid concentration, preventing chemical waste and maximizing chlorine efficacy.

- Predictive Maintenance and Chlorine Lock Prevention: AI models predict the rate of CYA accumulation and potential chlorine depletion issues, issuing alerts or automatically adjusting dosing systems before concentrations reach problematic levels, significantly enhancing water safety.

- Smart Water Chemistry Monitoring: Integration of AI with IoT sensors for continuous, autonomous monitoring of water parameters, including free chlorine, combined chlorine, pH, and CYA, providing actionable insights through cloud-based platforms.

- Enhanced Regulatory Compliance: AI systems automatically log and verify compliance with local health and safety regulations regarding maximum CYA thresholds, simplifying reporting requirements for commercial and municipal operators.

- Supply Chain and Inventory Forecasting: AI algorithms optimize the procurement and inventory management of cyanuric acid and related stabilizers, forecasting demand based on seasonal fluctuations and regional trends, improving supply chain resilience.

DRO & Impact Forces Of Water Treatment Cyanuric Acid Market

The dynamics of the Water Treatment Cyanuric Acid market are dictated by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively constitute the Impact Forces shaping industry growth and strategic direction. The primary driver is the necessity for cost-effective chlorine stabilization in open-air water systems, ensuring persistent disinfection against pathogens. Restraints mainly center on increasing regulatory pressure regarding maximum acceptable CYA levels in water, stemming from concerns about reduced chlorine effectiveness at high concentrations. Opportunities lie in developing advanced formulations and integrated sensor technologies that offer real-time control and optimize dosing, mitigating the current restraints and expanding application into sophisticated industrial and municipal systems. These forces interact to push manufacturers toward higher purity products and integrated digital solutions.

Drivers: The explosive global growth in recreational facilities, particularly swimming pools in emerging economies, is a critical driver. As urbanization and middle-class expansion accelerate in regions like APAC, the demand for residential and commercial pools requiring stabilization increases exponentially. Furthermore, stringent global health and safety standards mandate effective, continuous disinfection, bolstering the consumption of cyanuric acid, which remains the most economical and effective UV stabilizer for chlorine. The inherent stability and ease of handling of CYA compared to alternatives further solidify its market position, particularly for smaller pool operators who require straightforward chemical management.

Restraints: The most significant restraint is the regulatory backlash against high concentrations of CYA. Health authorities in several major markets have begun imposing stricter limits (e.g., maximum 50 ppm or 100 ppm), driven by research suggesting that excessive CYA can inhibit chlorine’s ability to kill certain protozoa and viruses, leading to potential health risks. This regulatory environment forces end-users to adopt more sophisticated monitoring and dilution methods, sometimes leading to temporary substitution with alternative sanitizers. Additionally, fluctuations in raw material prices, particularly urea, which is essential for CYA synthesis, introduce cost volatility that can constrain manufacturer margins and hinder market predictability.

Opportunities: Significant growth opportunities exist in the integration of sensor technology and IoT-enabled dosing systems. Developing smart solutions that precisely monitor and control CYA levels, automatically balancing them with free chlorine, will resolve the primary restraint of "chlorine lock" and enhance overall water quality management. Moreover, the exploration of novel applications in non-recreational water treatment, such as closed-loop industrial water circuits in sectors like energy and manufacturing, represents an untapped market potential. The shift towards sustainable chemical manufacturing practices and developing 'green' formulations of stabilizers also presents a strong opportunity for market differentiation and compliance with environmental, social, and governance (ESG) standards.

Segmentation Analysis

The Water Treatment Cyanuric Acid Market is meticulously segmented based on product type, application, and end-user, allowing for a nuanced understanding of market dynamics and tailored strategic approaches. Product type segmentation distinguishes between the physical forms of the chemical, recognizing that usability and application method significantly influence purchase decisions. Application analysis focuses on the primary environments where CYA is used, with swimming pools dominating, but industrial and wastewater treatment areas offering crucial diversification. Finally, end-user segmentation separates the market into residential, commercial, industrial, and municipal purchasers, reflecting differences in volume requirements, regulatory compliance standards, and sophistication of chemical handling infrastructure.

The analysis of these segments reveals that the granular form remains the preferred choice in the residential and small commercial segments due to ease of storage and manual application. In contrast, larger facilities and municipal operations are increasingly adopting liquid or powdered forms suitable for automated dosing systems. The segmentation framework is critical for stakeholders, as it highlights areas of high growth, such as the increasing demand for commercial pool stabilization in tourism-heavy regions, and identifies regulatory challenges unique to specific segments, such as the tight concentration limits in public municipal water systems. This detailed view supports investment decisions and targeted marketing efforts within the water chemistry sector.

- By Type:

- Granular Cyanuric Acid

- Powdered Cyanuric Acid

- Liquid Cyanuric Acid Solutions

- By Application:

- Swimming Pools and Spas (Recreational Water)

- Industrial Water Treatment (Cooling Towers, Boiler Feed Water)

- Wastewater Treatment

- By End-User:

- Residential

- Commercial (Hotels, Resorts, Water Parks)

- Industrial

- Municipal

Value Chain Analysis For Water Treatment Cyanuric Acid Market

The value chain for the Water Treatment Cyanuric Acid market begins with the procurement of essential raw materials, primarily urea and sometimes chlorine or ammonia derivatives, which constitute the upstream activities. Urea production, being largely tied to the fertilizer and general chemical industries, introduces external price volatility that manufacturers must manage. Upstream manufacturing involves complex chemical synthesis processes, often requiring high energy input and specialized equipment to achieve the high purity levels necessary for water treatment applications. Efficiency in raw material sourcing and conversion is crucial for cost optimization at this stage. Major global chemical companies often integrate this production step to control quality and cost, benefiting from economies of scale.

The middle segment of the value chain involves the synthesis, formulation (into powder, granular, or liquid forms), packaging, and branding of the final product. Distribution channels form the downstream link, categorized into direct sales and indirect sales. Direct channels involve large volume sales to major commercial end-users (e.g., large municipal water districts or chemical distributors) through negotiated contracts. Indirect channels rely heavily on specialized chemical distributors, pool supply wholesalers, and retail chains (for residential consumers). The efficiency of the distribution network, including logistics for handling bulk chemical shipments, directly impacts market penetration and accessibility, especially in geographically dispersed residential markets.

Downstream analysis focuses on the end-users—residential pool owners, commercial resorts, and industrial facilities—who rely on ease of access, technical support, and product reliability. The role of technical service providers and pool maintenance professionals is vital, as they often serve as key influencers and purchasers, guiding end-users toward specific brands and formulations. Profit margins tend to be highest at the specialized formulation and retail distribution stages, highlighting the importance of brand recognition and effective marketing strategies. Disruptions in either raw material supply (upstream) or regulatory changes (downstream) regarding product usage can significantly impact the overall profitability and stability of the entire value chain.

Water Treatment Cyanuric Acid Market Potential Customers

The primary consumers and buyers of water treatment cyanuric acid are entities responsible for maintaining the chemical balance and sanitary conditions of large volumes of water exposed to sunlight, predominantly in recreational and cooling applications. The largest segment of potential customers includes operators of swimming pools and spas, encompassing both the vast residential market and the high-volume commercial sector, such as hotels, fitness centers, community pools, and resorts. These customers require regular, high-quality stabilizing agents to ensure chlorine efficacy and reduce operational costs associated with chemical replenishment.

Beyond the recreational sector, industrial facilities utilizing large evaporative cooling towers represent a significant customer base. In these industrial settings, water is constantly recirculated and often exposed to UV radiation, making stabilization necessary to prevent biofouling and maintain equipment integrity. Municipal water treatment facilities, particularly those dealing with recycled or non-potable water systems, also constitute potential buyers, although their usage is highly localized and subject to stringent regional environmental regulations. Finally, specialized chemical distributors and wholesale suppliers serve as crucial intermediaries, purchasing bulk quantities from manufacturers and distributing them to the fragmented end-user market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 250 Million |

| Market Forecast in 2033 | USD 350 Million |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nippon Shokubai, Olin Corporation, Chemtura Corporation, FMC Corporation, BASF SE, Kemira, Solvay, Occidental Petroleum Corporation (OxyChem), ICL Group, Shandong Xinlong Group, Shandong Hualu-Fengyuan Chemical Co., Ltd., Zaozhuang Ruibang Chemical Co., Ltd., Hebei Jinchangsheng Chemical Co., Ltd., Inner Mongolia Xinghui Chemical Co., Ltd., TCI Chemicals, Lonza Group, Sachtleben Chemie GmbH, Water Treatment Products Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Water Treatment Cyanuric Acid Market Key Technology Landscape

The technology landscape in the Water Treatment Cyanuric Acid market is broadly divided into two main areas: optimization of manufacturing processes and enhancement of application technologies. On the manufacturing front, companies are continuously refining synthesis routes, moving towards more energy-efficient and high-yield processes, often involving advanced catalytic systems, to produce high-purity, low-impurity CYA. This focus on purity is driven by the necessity to comply with increasingly strict water quality standards globally. Furthermore, sophisticated granulation and micronization techniques are employed to create tailored particle sizes and densities, optimizing dissolution rates for different end-user applications, whether it be rapid dissolution for liquid systems or slow-release for stabilized tablets.

The most significant technological advancements, however, are occurring at the point of application, focusing on mitigating the core limitation of CYA—the "chlorine lock" effect at high concentrations. This includes the development and integration of highly selective sensors based on electrochemical or photometric principles that accurately and instantaneously measure cyanuric acid levels in conjunction with free chlorine residuals. These sensors are integrated into Internet of Things (IoT) platforms and smart pool controllers. These systems allow for remote monitoring, automated dosage adjustments, and historical data logging, moving the market away from traditional, less accurate manual testing kits. The implementation of such smart technologies promises safer, more efficient, and more sustainable water management practices by ensuring optimal stabilization without compromising disinfection power.

Furthermore, technology is being applied to develop complex, integrated sanitizer products, such as trichloroisocyanuric acid (TCCA) and dichloroisocyanuric acid (DCCA), where CYA is chemically bonded with chlorine. Technological efforts are concentrated on improving the stability and dissolution profile of these composite products, ensuring a steady, reliable release of both chlorine and stabilizer. Research is also ongoing into alternative, non-CYA based stabilizing agents or novel chemical modifications that offer UV protection while avoiding the regulatory complications associated with high CYA accumulation. This innovation push is essential for long-term market sustainability, especially as environmental concerns regarding chemical runoff and water discharge regulations tighten globally.

Regional Highlights

The global market for Water Treatment Cyanuric Acid exhibits distinct regional consumption patterns and growth trajectories, heavily influenced by climate, recreational infrastructure, and regulatory stringency. North America, particularly the United States, represents a mature but substantial market, characterized by high residential pool ownership, strong awareness of water chemistry, and well-established distribution networks. Consumption here is driven primarily by seasonal demand for pool maintenance and strict adherence to commercial pool operating standards, though regulatory efforts to manage high CYA levels introduce complexity.

Europe shows steady growth, particularly in Mediterranean countries with warm climates that support high swimming pool density (e.g., Spain, France, Italy). However, European regulations (e.g., REACH compliance) and often more cautious approaches to chemical use in public water systems mean that the market operates under stricter controls, favoring high-quality, traceable chemical inputs. The adoption of smart dosing systems is notably increasing in this region to optimize chemical use and reduce environmental impact.

Asia Pacific (APAC) is identified as the powerhouse of future growth. Rapid economic development, surging disposable incomes, and mass urbanization in countries like China, India, and Southeast Asian nations are driving massive infrastructure projects, including hotels, resorts, and private communities with extensive recreational water facilities. While regulatory frameworks are still evolving in some countries, the sheer volume of new construction ensures high demand for basic and advanced CYA products. The Middle East and Africa (MEA), especially Gulf Cooperation Council (GCC) countries, present a specialized high-growth segment, where extreme heat and high UV exposure necessitate robust stabilization solutions for commercial pools and cooling systems, though market size remains comparatively smaller than APAC or North America.

- North America (U.S., Canada, Mexico): Dominant market share due to extensive existing infrastructure; driven by strong residential demand and adherence to seasonal maintenance cycles. Focus on premium, high-purity stabilizer blends and advanced monitoring systems.

- Europe (Germany, France, U.K., Italy, Spain): Mature market with steady growth; stringent regulatory compliance (e.g., pool operating licenses) drives demand for highly controlled, verifiable dosing methods. High seasonal demand in Southern Europe.

- Asia Pacific (China, India, Japan, Southeast Asia): Fastest-growing region, fueled by rapid expansion of commercial resorts, urbanization, and construction of new residential amenities. Market is highly sensitive to price and quality standardization is an emerging trend.

- Latin America (Brazil, Argentina): Moderate growth tied to tourism and residential development; market penetration is increasing as awareness of proper water chemistry improves. Vulnerable to economic volatility impacting consumer spending on pool chemicals.

- Middle East & Africa (UAE, Saudi Arabia, South Africa): Niche, high-value market driven by necessity due to intense UV radiation and high temperatures, demanding maximum stabilization efficacy for both recreational and industrial cooling water.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Water Treatment Cyanuric Acid Market.- Nippon Shokubai

- Olin Corporation

- Chemtura Corporation

- FMC Corporation

- BASF SE

- Kemira

- Solvay

- Occidental Petroleum Corporation (OxyChem)

- ICL Group

- Shandong Xinlong Group

- Shandong Hualu-Fengyuan Chemical Co., Ltd.

- Zaozhuang Ruibang Chemical Co., Ltd.

- Hebei Jinchangsheng Chemical Co., Ltd.

- Inner Mongolia Xinghui Chemical Co., Ltd.

- TCI Chemicals

- Lonza Group

- Sachtleben Chemie GmbH

- Water Treatment Products Ltd.

- Kao Corporation

- Mitsubishi Chemical Corporation

Frequently Asked Questions

Analyze common user questions about the Water Treatment Cyanuric Acid market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of cyanuric acid (CYA) in water treatment?

The primary function of cyanuric acid is to stabilize chlorine (hypochlorous acid) in water exposed to sunlight, preventing rapid degradation caused by ultraviolet (UV) radiation. This stabilization prolongs chlorine's disinfection effectiveness, particularly in outdoor swimming pools and spas.

How does the "chlorine lock" effect relate to cyanuric acid?

Chlorine lock occurs when cyanuric acid levels become excessively high, binding too much of the free chlorine. This phenomenon significantly reduces the active chlorine's ability to kill pathogens quickly and efficiently, potentially compromising water safety and sanitation standards.

Which geographical region exhibits the fastest growth rate for CYA consumption?

The Asia Pacific (APAC) region is projected to be the fastest-growing market for Water Treatment Cyanuric Acid due to rapid urbanization, increasing construction of commercial resorts and residential pools, and expanding regulatory oversight of water hygiene standards.

What are the key technological advancements impacting CYA usage?

Key technological advancements include the integration of highly selective IoT sensors and AI-driven automated dosing systems. These technologies provide real-time monitoring and precise control over CYA and chlorine levels, optimizing chemical efficacy and mitigating the risks associated with over-stabilization.

What are the main regulatory challenges faced by the CYA market?

The main challenges stem from increasing regulatory scrutiny worldwide regarding maximum allowable concentrations of cyanuric acid. Health organizations are implementing stricter limits (e.g., 50-100 ppm) to ensure that chlorine retains sufficient disinfection power against resistant microorganisms.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager