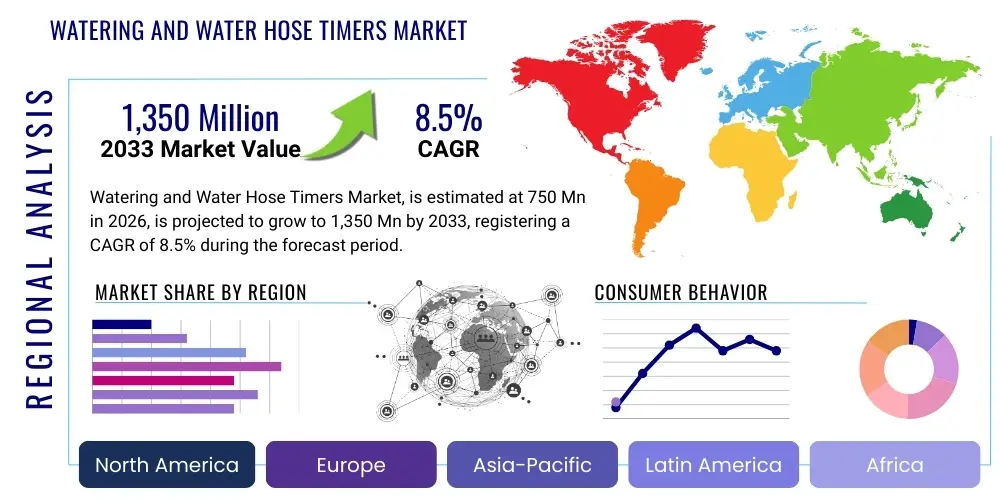

Watering and Water Hose Timers Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442565 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Watering and Water Hose Timers Market Size

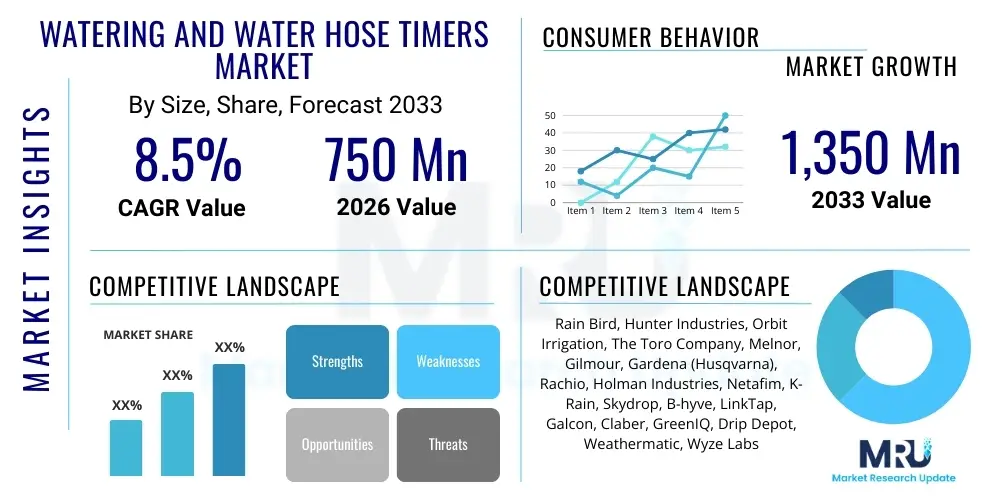

The Watering and Water Hose Timers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 750 Million in 2026 and is projected to reach USD 1,350 Million by the end of the forecast period in 2033.

Watering and Water Hose Timers Market introduction

The Watering and Water Hose Timers Market encompasses devices designed to automate irrigation schedules, ranging from simple mechanical dial systems to highly sophisticated, smart internet-of-things (IoT) enabled controllers. These products are fundamentally utilized across residential gardening, commercial landscaping, municipal green spaces, and small-scale agricultural operations to ensure optimal water delivery based on preset or dynamically calculated schedules. The core objective of these timers is enhancing efficiency, promoting water conservation, and reducing manual labor associated with consistent watering routines. As global populations face increased pressure from drought conditions and stringent water usage regulations, the adoption of these automated solutions has surged, positioning them as essential tools for modern water management.

Products within this market are broadly categorized into three main types: mechanical timers, which are cost-effective and easy to use but offer limited scheduling precision; digital timers, which allow for complex scheduling (multiple starts/stops, custom durations) but require battery power; and smart timers, which connect via Wi-Fi or Bluetooth to leverage real-time data inputs such as localized weather forecasts, soil moisture levels, and plant-specific needs. The evolution toward smart timers is a major trajectory, driven by consumer demand for integrated home automation systems and the environmental imperative to minimize water waste. These advanced timers often integrate seamlessly with existing smart home ecosystems, offering remote control and granular reporting on water consumption, which provides significant value to environmentally conscious end-users.

The primary applications of watering and water hose timers are centered around maximizing resource utilization. In residential settings, they ensure lawns and gardens receive consistent care even when homeowners are absent. For commercial applications, particularly in landscaping for corporate parks or public amenities, timers guarantee professional maintenance standards while managing utility costs effectively. Major driving factors propelling this market include increasingly erratic climate patterns necessitating predictive irrigation, government incentives promoting water-efficient technologies, and advancements in sensor technology that make precise, localized watering possible. Furthermore, the convenience offered by setup and control via smartphone applications is making automated watering increasingly accessible to the mass consumer base, fueling market expansion across developed and rapidly developing economies.

Watering and Water Hose Timers Market Executive Summary

The Watering and Water Hose Timers Market is characterized by robust growth, primarily propelled by global water scarcity concerns and rapid technological integration, specifically the proliferation of IoT devices in residential and commercial sectors. Business trends show a strong shift towards vertical integration among leading manufacturers, focusing on incorporating proprietary software and AI-driven predictive analytics into their smart timer offerings, thereby creating higher barriers to entry for new competitors relying solely on hardware. Furthermore, there is a pronounced consolidation trend, where large gardening and smart home companies are acquiring smaller, innovative technology specialists to enhance their patent portfolio and accelerate time-to-market for advanced features like weather-based scheduling and fault detection. Distribution channels are diversifying, with e-commerce platforms experiencing exceptional growth due to the consumer preference for easy comparison, installation tutorials, and direct-to-consumer (D2C) purchasing models, bypassing traditional retail intermediaries for smart products.

Regional trends clearly indicate that North America and Europe currently dominate the market share, driven by high consumer spending on home improvement, established regulatory frameworks promoting water efficiency, and high penetration rates of smart home devices. Specifically, drought-prone states and regions in the Western US and Southern Europe are key adoption centers, where the financial and legal consequences of water overuse incentivize the immediate deployment of precision watering tools. Asia Pacific (APAC), however, represents the highest growth trajectory, primarily fueled by urbanization, increasing disposable incomes leading to greater investment in aesthetically pleasing landscapes, and the modernization of small-to-medium-scale agricultural practices in countries like China, India, and Australia. These regions are quickly transitioning directly to digital and smart timers, often skipping the mechanical phase entirely, leveraging newly built infrastructure to support widespread IoT connectivity.

Segmentation trends highlight the overwhelming consumer preference moving away from basic mechanical timers toward sophisticated digital and, critically, smart timers. The Smart/IoT segment is projected to exhibit the fastest Compound Annual Growth Rate, driven by its unparalleled ability to offer adaptive scheduling that minimizes water waste and maximizes plant health. While mechanical timers maintain relevance in niche, low-tech, or extremely cost-sensitive markets, the broader momentum is dictated by features such as multi-zone control, integration with third-party weather services (e.g., Rachio, Hunter Industries), and diagnostic capabilities. Moreover, the commercial application segment is seeing significant technological uptake, as large businesses and municipalities prioritize return on investment (ROI) through substantial long-term savings on water bills, justifying the higher initial capital expenditure required for industrial-grade smart irrigation systems and controllers.

AI Impact Analysis on Watering and Water Hose Timers Market

The introduction of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally transforming the Watering and Water Hose Timers Market, shifting the paradigm from static, calendar-based scheduling to dynamic, predictive irrigation management. Users frequently ask: "How accurately can AI predict watering needs?", "What specific data points does AI analyze?", and "Does AI integration make the timers too complex or expensive for the average homeowner?". The central theme identified from these queries is the expectation that AI should deliver maximized efficiency and water savings with minimal user intervention. AI algorithms are designed to process complex environmental variables—including evapotranspiration rates, historical rainfall data, localized microclimates, soil type, and specific plant databases—to generate optimized watering runtimes and start times. This level of complexity is managed by the AI backend, resulting in a streamlined user experience where the system autonomously adapts to changing conditions, a significant upgrade from traditional models requiring constant manual adjustment based on subjective observations.

AI's primary influence lies in its ability to facilitate "true predictive scheduling." Instead of merely shutting off the water when rain is forecast (basic digital functionality), AI models assess the probability and intensity of future weather events, calculating how much water is already stored in the root zone and determining the exact volume required to avoid underwatering stress or overwatering saturation. This optimization capability allows smart timer brands to promise substantial water usage reductions, often exceeding 30% compared to fixed schedules, which is a powerful market differentiator. Concerns about complexity and cost are addressed through user-friendly interfaces (UIs) and decreasing hardware costs, making AI-driven features more accessible. Furthermore, AI contributes to preventative maintenance by monitoring flow rates and identifying leaks or equipment malfunctions in real-time, providing proactive alerts to the user.

The integration of deep learning models enables timers to learn the specific watering profile of a user's property over time, refining algorithms based on observed outcomes of past watering cycles, a capability known as "self-calibration." This ongoing optimization means the watering effectiveness improves with every season. This superior performance capability not only addresses acute consumer needs related to drought management and lawn health but also aligns perfectly with global sustainability goals. The market impact is profound, establishing adaptive, AI-powered systems as the new industry benchmark, accelerating the obsolescence of purely mechanical or non-connected digital alternatives, and driving intense investment in data science capabilities within irrigation technology companies.

- Enhanced Predictive Scheduling: AI analyzes hyperlocal weather, historical data, and soil metrics to determine optimal irrigation schedules dynamically, minimizing runoff and waste.

- Autonomous System Learning: Machine Learning algorithms continuously refine watering strategies based on observed plant health and past water consumption feedback.

- Flow Monitoring and Leak Detection: AI detects anomalous flow patterns indicative of system leaks, burst pipes, or clogged nozzles, triggering immediate alerts and shut-offs.

- Microclimate Zoning: Sophisticated models create precise watering zones within a single property, compensating for sun exposure, slope, and varying soil compositions.

- Integration with Smart Ecosystems: AI facilitates seamless communication with other IoT devices (e.g., smart thermostats, rain sensors) for centralized home energy and resource management.

DRO & Impact Forces Of Watering and Water Hose Timers Market

The market dynamics of Watering and Water Hose Timers are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), significantly shaped by environmental impact forces. A primary driver is the escalating global concern over freshwater scarcity, exacerbated by climate change and prolonged droughts across critical agricultural and residential zones. This environmental pressure is coupled with increasingly stringent government regulations and municipal pricing structures designed to penalize excessive water use, creating a clear financial incentive for consumers and businesses to adopt efficient, timer-controlled irrigation systems. The consumer trend toward smart home integration also acts as a powerful driver, as users seek integrated solutions controllable via voice commands or centralized mobile applications, accelerating the adoption of technologically advanced timers over legacy mechanical models. This combination of ecological necessity, regulatory impetus, and technological convergence forms a powerful tailwind supporting market growth, particularly in the high-value smart segment.

However, the market faces significant restraints that slow potential adoption. The primary challenge remains the high initial cost of advanced smart watering systems compared to basic, non-automated hose connectors. While the long-term water savings often justify the expense, the upfront capital expenditure can be prohibitive for budget-conscious homeowners or small enterprises. Furthermore, the complexity associated with the installation, setup, and maintenance of smart, multi-zone controllers, particularly the integration with existing plumbing and Wi-Fi networks, represents a steep learning curve for non-technical users, leading to customer hesitation and dependency on professional installation services. Battery lifespan and connectivity reliability issues inherent to many remote IoT devices also pose ongoing performance challenges, impacting user satisfaction and product dependability in critical irrigation scenarios.

Opportunities for market penetration and expansion are extensive, predominantly fueled by the ongoing evolution of IoT and sensor technology. The development of low-power wide-area network (LPWAN) technologies, such as LoRaWAN and Narrowband IoT (NB-IoT), promises to enhance device longevity and communication range, overcoming previous battery life restraints. Additionally, emerging markets in Asia and Latin America represent vast, untapped potential, especially as their middle classes grow and invest more heavily in residential landscaping and small-scale commercial agriculture. Another crucial opportunity lies in forging strategic partnerships between timer manufacturers and utility companies, allowing utilities to offer rebates or subsidized smart timers to consumers, further accelerating adoption and promoting widespread water efficiency measures enforced through utility-controlled shut-off or advisory systems. The impact forces are thus heavily weighted toward sustainability and technological advancement, pushing the market toward smarter, more data-driven solutions.

Segmentation Analysis

The Watering and Water Hose Timers Market is segmented based on product type, application, connectivity, and distribution channel, providing a granular view of consumer preferences and technological adoption rates across different end-use sectors. The core segmentation by product type—Mechanical, Digital, and Smart—determines the level of automation, complexity, and price point, with the smart segment showing exponential growth due to its superior efficiency and integration capabilities. Analysis across these segments confirms that while digital timers currently hold a significant revenue share due to their balanced cost-to-feature ratio, the long-term market trajectory is heavily skewed toward connected devices, signaling a mature market shift toward data-driven resource management rather than simple time-based control. This structural segmentation allows manufacturers to tailor marketing strategies and product development to target specific user profiles, such as the environmentally conscious, high-income homeowner opting for smart solutions, versus the budget-focused user preferring simple mechanical reliability for basic seasonal tasks.

Further analysis by application underscores the divergent needs of the residential, commercial, and agricultural sectors. The residential segment, encompassing typical backyard gardening and lawn care, constitutes the largest volume market, prioritizing user-friendliness and affordable digital or basic smart connectivity. Conversely, the commercial and municipal segments, which include large parks, sports fields, and corporate campuses, focus on durability, multi-zone capacity, and advanced reporting features that ensure compliance with water usage quotas and maximize operational efficiency across expansive areas. Agricultural applications, particularly small farms utilizing hose-based systems, demand robust, weather-resistant timers capable of handling large flow rates and integrating with specialized fertigation systems. Understanding these application-specific requirements is critical for product positioning and for capturing market share in high-value B2B sectors that require commercial-grade reliability and scalability.

Connectivity segmentation further dissects the smart timer market into Wi-Fi, Bluetooth, and hybrid models. Wi-Fi remains the dominant choice for premium smart systems due to its robust remote access and integration potential with cloud services for weather tracking and AI processing. Bluetooth systems appeal to users requiring localized control or simple programming without reliance on external network infrastructure, often serving as a bridge technology for basic smart features. The distribution channel segmentation, encompassing online retail, specialized gardening stores, hardware retailers, and professional distributors, reveals that the online channel is rapidly gaining prominence, particularly for smart and advanced digital timers, driven by detailed product reviews, competitive pricing, and ease of access to complex product specifications and installation guides. This segmentation framework is vital for optimizing supply chain management and pricing strategies to meet the specific demands of each market niche.

- By Product Type:

- Mechanical Timers (Simple setup, low cost, limited precision)

- Digital Timers (Programmable schedules, multi-day cycles, battery operated)

- Smart/IoT Timers (Wi-Fi/Bluetooth enabled, weather integration, remote control, AI-driven)

- By Application:

- Residential (Gardens, lawns, patios)

- Commercial & Municipal (Corporate landscaping, parks, public gardens)

- Small-Scale Agriculture (Hobby farms, small vineyards, nurseries)

- By Distribution Channel:

- Online Retail (E-commerce platforms, brand websites)

- Offline Retail (Hardware stores, specialized garden centers)

- By Flow Capacity:

- Low Flow (Drip irrigation, potted plants)

- High Flow (Standard hose timers, sprinklers)

Value Chain Analysis For Watering and Water Hose Timers Market

The value chain for the Watering and Water Hose Timers Market begins with the upstream procurement and manufacturing of key components, which include specialized plastics and polymers for housing and internal gears, semiconductor chips and microcontrollers for digital and smart devices, sensors (such as rain and soil moisture sensors), and advanced connectivity modules (Wi-Fi/Bluetooth). Upstream analysis highlights a high degree of reliance on specialized electronics suppliers, particularly for smart timers, making this segment vulnerable to global supply chain fluctuations, such as chip shortages. Manufacturers often engage in highly automated assembly processes to ensure precision and water resistance, focusing heavily on quality control to minimize product failure rates due to leakage or electronic malfunction. The integration of proprietary software and cloud services for smart timers adds a critical, intangible value layer in this phase, often differentiating market leaders based on their data analytics and user interface capabilities rather than physical hardware alone.

The midstream involves the core manufacturing, assembly, and initial branding, followed by logistics and distribution. The efficiency of the distribution channel is paramount, as timers are often seasonal products (peaking in spring and summer). Distribution is segmented into direct and indirect channels. Direct channels involve manufacturers selling high-end, complex systems directly to commercial installers or municipalities, ensuring proper system integration and maintenance contracts. Indirect channels utilize a broad network of distributors, wholesalers, and retail chains (both brick-and-mortar and online) to reach the mass residential consumer. The rise of e-commerce has significantly compressed the timeline and cost associated with reaching end-users, forcing traditional retailers to enhance their in-store technical support and inventory management to remain competitive, particularly against D2C brands offering superior pricing and often better post-sale support for smart products.

Downstream analysis focuses on the final consumption and after-sales service. The downstream process involves specialized professional installers (especially for complex multi-zone systems in commercial settings) and the end-user (homeowner or facility manager). After-sales support, firmware updates, and cloud service maintenance are critical components of the value proposition for smart timers, influencing brand loyalty and repeat purchases. Potential bottlenecks in the value chain include reliance on a few key sensor manufacturers and the complexity of managing global regulatory compliance regarding water usage and electrical certifications. Therefore, optimizing distribution to efficiently handle seasonal inventory swings and investing heavily in reliable cloud infrastructure and responsive customer support are essential strategies for maximizing profitability and maintaining competitive advantage in the highly sensitive consumer durables market.

Watering and Water Hose Timers Market Potential Customers

The potential customer base for Watering and Water Hose Timers is highly diversified, encompassing residential users, commercial enterprises, municipal organizations, and small-to-medium agricultural entities. The residential sector represents the largest volume of potential customers, particularly affluent and middle-class homeowners who are investing in lawn care, landscaping, and automated home technologies. These end-users are primarily motivated by convenience, the desire for lush, healthy outdoor spaces, and increasingly, the need for water conservation prompted by local restrictions or rising utility costs. They are the prime target for digital and user-friendly smart timers, favoring products that offer simple mobile app control and integration with existing smart home ecosystems like Amazon Alexa or Google Home. Marketing strategies aimed at this group emphasize ease of installation and guaranteed water savings.

Commercial customers constitute a high-value segment, including property management firms, owners of large business parks, golf courses, and hospitality venues. These buyers prioritize robust, scalable, and multi-zone capable systems that offer detailed usage reporting for billing and operational efficiency. Their purchasing decisions are primarily driven by Return on Investment (ROI) derived from minimized water utility costs and reduced labor time spent manually monitoring irrigation. They often rely on professional landscape architects and certified irrigation specialists to specify and install high-end smart controllers, making the B2B distribution channel critical. Similarly, municipal organizations—responsible for watering public parks, sports fields, and road medians—require industrial-grade reliability, compliance with public works standards, and the ability to manage vast, complex irrigation networks from a centralized control platform, often favoring specialized commercial brands.

Finally, a growing segment comprises small-to-medium agricultural producers, including nurseries, vineyards, and specialty crop growers who utilize localized hose systems or micro-irrigation setups. While large-scale agriculture employs sophisticated field-wide systems, smaller entities rely on hose timers to automate drip systems or overhead watering during critical growth stages. These customers demand timers that are rugged, UV-resistant, and capable of integrating with low-pressure systems or specialized fertilizer injection equipment (fertigation). Their purchasing motivation is directly tied to maximizing crop yield and minimizing inputs, requiring systems that offer highly precise scheduling and reliable performance under varied field conditions. Targeting these distinct customer segments requires tailored product features, distribution networks, and informational content focused on the unique value proposition relevant to their specific operational needs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 750 Million |

| Market Forecast in 2033 | USD 1,350 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Rain Bird, Hunter Industries, Orbit Irrigation, The Toro Company, Melnor, Gilmour, Gardena (Husqvarna), Rachio, Holman Industries, Netafim, K-Rain, Skydrop, B-hyve, LinkTap, Galcon, Claber, GreenIQ, Drip Depot, Weathermatic, Wyze Labs |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Watering and Water Hose Timers Market Key Technology Landscape

The technology landscape of the Watering and Water Hose Timers Market is rapidly evolving, driven primarily by the maturation of the Internet of Things (IoT) ecosystem and advancements in low-power wireless communication. The core technological shift involves integrating microcontrollers and connectivity modules (Wi-Fi, Bluetooth Low Energy, and increasingly LPWAN protocols like LoRaWAN) directly into the timer mechanism. Wi-Fi remains essential for full smart functionality, allowing timers to connect to cloud-based servers which host the complex weather prediction algorithms and AI analysis engines. Bluetooth often serves as a complementary technology, facilitating easy local setup and allowing localized control via a smartphone even if the Wi-Fi network is temporarily unavailable, thereby enhancing user flexibility and system reliability. Manufacturers are continuously optimizing antenna design and embedded software to ensure stable outdoor connectivity and minimal power consumption, crucial for battery-operated devices.

Beyond connectivity, the incorporation of advanced sensing technology is central to the high performance of modern smart timers. Sophisticated soil moisture sensors, which communicate wirelessly with the timer controller, provide critical, real-time feedback on the water level available to the plant roots, allowing the system to override static schedules based on actual need. These sensors use techniques such as Frequency Domain Reflectometry (FDR) or Time Domain Reflectometry (TDR) to accurately measure volumetric water content in the soil. Furthermore, integration with third-party weather data APIs (Application Programming Interfaces) is standard, but the key technological edge is provided by proprietary software that interprets large datasets—including projected evapotranspiration rates and hyper-localized radar data—to adjust watering duration minutes before execution. This data processing capability differentiates high-end smart timers from basic rain-delay features.

Furthermore, the focus is shifting towards platform and ecosystem integration. Leading manufacturers are developing open APIs that allow their timers to interact smoothly with other smart home hubs, security systems, and energy management platforms, creating a holistic smart property solution. This technological move towards interoperability is critical for mass market adoption and reduces consumer friction related to using multiple proprietary apps. On the hardware front, advancements in solenoid valve technology are increasing durability and reducing the power required for actuation, extending battery life significantly. The application of sophisticated materials science ensures that hose timers can withstand extreme temperature fluctuations and UV exposure typical of outdoor installations, guaranteeing long-term mechanical reliability alongside advanced electronic functionality.

Regional Highlights

Regional dynamics significantly shape the demand and technological adoption rates within the Watering and Water Hose Timers Market, reflecting varied climate conditions, regulatory environments, and consumer spending habits. North America, particularly the United States, represents the largest and most mature market segment, driven by a strong culture of homeownership, large landscaping investments, and chronic drought issues in Western and Southwestern states. High adoption of smart home technology and high disposable incomes enable consumers to readily invest in premium, AI-driven timers like Rachio and Hunter, viewing them as long-term cost-saving tools. Regulatory incentives and local municipal rebates for installing water-efficient irrigation further bolster market penetration, making this region a global leader in both innovation and market share.

Europe constitutes a highly significant market, characterized by stringent environmental regulations and a strong emphasis on water conservation, especially in Southern countries like Spain, Italy, and Greece, which experience severe summer heat and water shortages. While the mechanical and digital segments maintain strong presence due to smaller garden sizes and historical preference, the market is rapidly migrating towards smart controllers. Germany, the UK, and Scandinavian countries focus heavily on quality and durability, favoring European brands like Gardena. The key regional differentiator in Europe is the focus on integrated systems compliant with complex EU environmental directives, necessitating product features that are highly accurate, verifiable, and optimized for sustainable operation.

The Asia Pacific (APAC) region is projected to experience the fastest growth during the forecast period. This rapid expansion is primarily fueled by accelerated urbanization, increasing household wealth leading to investment in residential landscaping, and the modernization of water infrastructure in major economies. Countries like Australia, which frequently suffers from extreme water scarcity, exhibit high demand for advanced, water-efficient technology. China and India are seeing a surge in demand driven by both high-end residential complexes and the need for more efficient watering solutions in commercial nurseries and small agricultural plots. However, adoption rates are highly variable based on local electricity and internet penetration, often leading to a fragmented market where robust digital timers coexist with basic mechanical units.

- North America: Dominant market share due to high consumer technology adoption, frequent drought conditions, and strong regulatory support for water conservation technology.

- Europe: High focus on environmental compliance and quality, with significant growth in smart timers driven by Southern European water crises and Central European gardening culture.

- Asia Pacific (APAC): Fastest growing region, fueled by urbanization, increasing disposable income, and modernization of small-scale irrigation, particularly in Australia and China.

- Latin America and MEA: Emerging markets characterized by lower initial penetration but rapid growth potential as infrastructure improves and water conservation awareness increases in high-stress agricultural areas.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Watering and Water Hose Timers Market.- Rain Bird Corporation

- Hunter Industries Inc.

- The Toro Company

- Orbit Irrigation Products, Inc. (B-hyve)

- Melnor, Inc.

- Gardena (Husqvarna Group)

- Rachio, Inc.

- Holman Industries

- Gilmour (Robert Bosch Tool Corporation)

- Netafim Ltd.

- K-Rain Manufacturing Corporation

- Skydrop LLC

- LinkTap Pty Ltd.

- Galcon Ltd.

- Claber S.p.A.

- GreenIQ

- Weathermatic

- Drip Depot

- Wyze Labs, Inc.

- Amico Group Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Watering and Water Hose Timers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between digital and smart hose timers?

Digital timers operate on preset, fixed schedules programmed by the user. Smart timers (IoT enabled) connect to Wi-Fi to access real-time data, such as local weather forecasts and soil moisture readings, allowing them to adjust schedules dynamically and autonomously for optimal water savings and plant health.

How much water can a smart watering timer realistically save?

Smart watering timers, particularly those utilizing AI and predictive scheduling based on evapotranspiration rates, often result in verifiable water consumption reductions ranging from 20% to 50% compared to traditional fixed-schedule or manual watering methods, directly impacting utility costs and environmental sustainability.

Are smart watering timers compatible with all existing hose spigots and sprinkler systems?

Most hose timers are designed with universal fittings (e.g., standard garden hose threads) for easy installation on outdoor spigots. Smart controllers designed for in-ground sprinkler systems require professional installation but are generally compatible with standard valve wiring and existing sprinkler zones.

What connectivity technology is most reliable for outdoor smart timers?

While Wi-Fi provides essential connectivity for cloud-based data processing, outdoor reliability is enhanced by Bluetooth for local setup and emerging Low-Power Wide-Area Networks (LPWAN) like LoRaWAN, which offer greater range and significantly extended battery life for remote devices not reliant on continuous Wi-Fi signal strength.

What key factors should commercial landscapers consider when selecting a multi-zone timer system?

Commercial users should prioritize durability, the number of programmable zones (multi-zone capacity), integration with advanced flow sensors for fault detection, robust cloud reporting capabilities for usage auditing, and scalability to manage expansive properties or multiple sites from a single centralized dashboard.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager