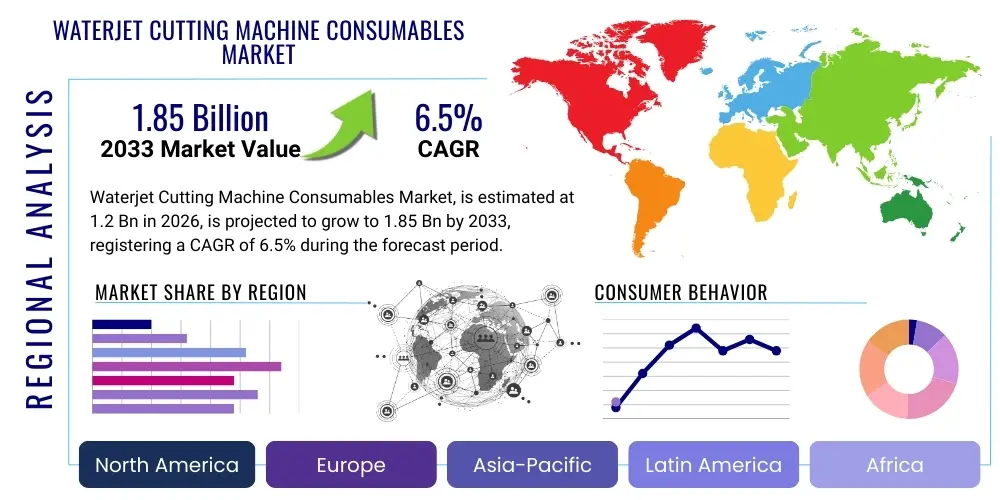

Waterjet Cutting Machine Consumables Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443269 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Waterjet Cutting Machine Consumables Market Size

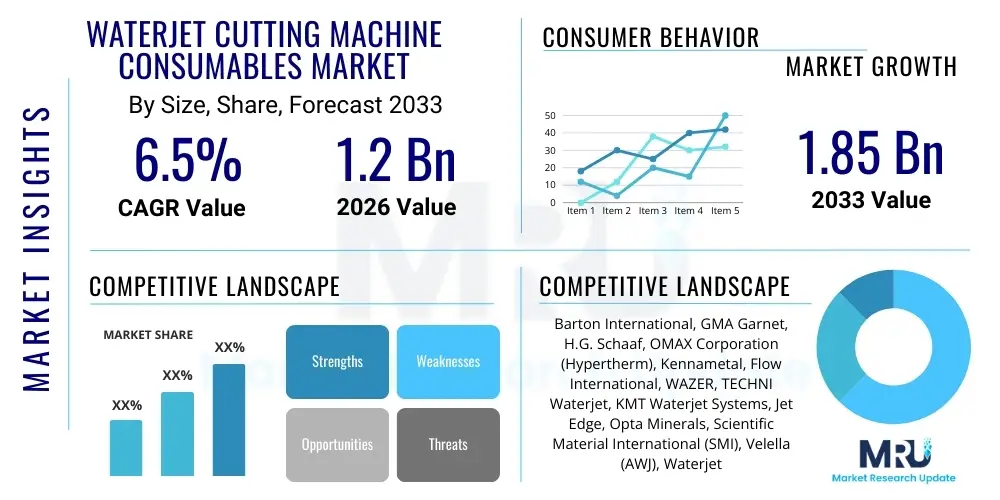

The Waterjet Cutting Machine Consumables Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 1.85 Billion by the end of the forecast period in 2033. This consistent expansion is fundamentally driven by the rising adoption of precision cutting technologies across diverse industrial sectors, notably aerospace, automotive manufacturing, and general fabrication. The inherent benefits of waterjet technology, such as cold cutting capabilities preventing material warping and high versatility across various material types, cement its position as a critical manufacturing tool, directly necessitating a sustained demand for high-quality consumables.

The valuation reflects the indispensable role of consumables, particularly abrasive materials like garnet, focusing tubes, and high-pressure seals, in maintaining the operational efficiency and output quality of waterjet systems. As industrial automation accelerates globally, the operational hours of waterjet machinery are increasing, consequently driving up the replacement frequency of wear parts. Furthermore, technological advancements in abrasive quality and nozzle design, aimed at extending operational life and improving cut precision, are contributing positively to the overall market value by justifying premium pricing for advanced materials. The market dynamics are highly sensitive to manufacturing output trends and capital expenditure cycles in key industrial economies.

Waterjet Cutting Machine Consumables Market introduction

The Waterjet Cutting Machine Consumables Market encompasses the essential, replaceable components necessary for the continuous, effective operation of waterjet cutting systems. These systems utilize high-pressure water, often mixed with abrasive particles (abrasive waterjet cutting), to precisely cut a vast array of materials, from soft foam to hardened steel and composites. Key consumables include abrasive media (primarily garnet), focusing tubes or nozzles, mixing chambers, high-pressure seals, pump components (like check valves and poppets), and orifice assemblies (jewels). The performance and lifespan of these consumables directly impact the operational cost, cutting speed, and accuracy of the waterjet machine, making their quality and timely replacement crucial for manufacturing efficiency.

Major applications span highly regulated industries such as aerospace, where precision cutting of exotic materials is paramount; the automotive sector for custom component fabrication and tool making; and construction and stone processing for intricate tile and structural element cutting. The fundamental benefits driving the market include the technology's ability to execute cold cutting, thereby eliminating the heat-affected zones (HAZ) common with laser or plasma cutting; superior edge quality requiring minimal secondary finishing; and exceptional material versatility. Driving factors for market growth include the increasing need for custom fabrication, the shift towards lighter and stronger composite materials that are challenging to cut conventionally, and the expanding global investment in industrial automation and modernized manufacturing facilities, particularly in emerging economies.

Waterjet Cutting Machine Consumables Market Executive Summary

The Waterjet Cutting Machine Consumables Market is characterized by robust growth, primarily fueled by the accelerating industrial adoption of precision manufacturing techniques and the inherent operational necessity for constant consumable replacement. Business trends indicate a strong move toward high-quality, long-life consumables, driven by manufacturers seeking to minimize machine downtime and enhance cost-efficiency over the long term. Strategic partnerships between abrasive suppliers and OEMs are becoming prevalent to optimize consumable performance specific to new machine architectures. Furthermore, sustainability is emerging as a key business imperative, with increasing focus on optimizing abrasive recycling processes and utilizing domestically sourced materials to stabilize supply chains and reduce logistics costs, particularly in North America and Europe.

Regional trends reveal Asia Pacific (APAC) as the fastest-growing market, driven by massive expansions in Chinese and Indian manufacturing sectors, coupled with significant investment in advanced machinery across Southeast Asia. North America and Europe remain mature markets, emphasizing technological refinement, high-pressure efficiency, and automation integration within waterjet systems, sustaining steady demand for premium consumables. Segment trends highlight abrasive garnet dominance due to its volumetric consumption rate, while high-tech components like diamond orifices and ceramic focusing tubes are showing significant growth in value, reflecting the industry's pursuit of higher operational pressures (above 60,000 PSI) and improved durability. The automotive and aerospace sectors represent the most lucrative end-use segments due to stringent quality requirements and high throughput demands, necessitating reliable, premium-grade consumables.

AI Impact Analysis on Waterjet Cutting Machine Consumables Market

Common user inquiries regarding AI's influence on the Waterjet Cutting Machine Consumables Market center around predictive maintenance, optimization of abrasive flow rates, and quality control integration. Users are keen to understand how AI-driven analytics can extend the lifespan of costly components like focusing tubes and orifices, thereby reducing consumable expenditure. Key concerns relate to the complexity and cost of implementing AI monitoring systems onto existing machinery (retrofitting) and the perceived data privacy risks associated with uploading machine operational parameters to cloud-based diagnostic platforms. Expectations are high regarding AI’s ability to drastically reduce machine downtime by accurately forecasting component failure and optimizing cutting paths based on material properties, which would ensure maximized abrasive efficiency and minimized material wastage.

The primary themes emerging from this analysis revolve around efficiency gains and predictive diagnostics. AI algorithms, leveraging sensor data (pressure, vibration, flow rates), can establish baseline operational profiles and flag anomalies indicative of incipient wear in seals or focusing nozzles long before catastrophic failure. This shift from reactive maintenance to prescriptive maintenance fundamentally alters the purchasing cycle of consumables, enabling just-in-time procurement and reducing inventory costs. Furthermore, AI can optimize abrasive metering systems, ensuring the precise amount of garnet is used for a given cut thickness and material, directly impacting the largest consumable cost factor—the abrasive media—leading to substantial operational savings for end-users and a more streamlined demand pattern for suppliers.

- AI enables predictive maintenance, extending the life of focusing tubes and seals.

- Optimization of abrasive feed rate reduces garnet consumption, lowering operational costs.

- Real-time quality control integration uses machine learning to ensure cut accuracy, reducing rework.

- Automated fault detection minimizes unscheduled downtime, stabilizing demand patterns for suppliers.

- AI modeling assists in developing next-generation, longer-lasting consumable materials based on wear patterns.

- Enhanced inventory management for consumables based on forecasted usage rates and machine fleet health.

DRO & Impact Forces Of Waterjet Cutting Machine Consumables Market

The Waterjet Cutting Machine Consumables Market is shaped by a confluence of influential factors, categorized as Drivers, Restraints, and Opportunities. Market drivers primarily stem from the increasing global requirement for high-precision, complex component manufacturing, particularly in aerospace and medical devices, where tight tolerances are mandatory. The inherent versatility of waterjet technology, capable of cutting heat-sensitive and reflective materials (e.g., copper, titanium) where laser cutting is suboptimal or impossible, guarantees sustained adoption. These technological advantages, coupled with the mandatory replacement nature of consumables, ensure a consistent and growing revenue stream for market participants. The rapid industrialization and expansion of the manufacturing base in developing regions, especially across Asia, further amplify demand, creating high-volume consumption areas.

However, significant restraints temper this growth trajectory. The most pronounced restraint is the high initial capital investment required for sophisticated waterjet cutting systems, which can deter Small and Medium Enterprises (SMEs) from adoption. Furthermore, the handling and disposal of spent abrasive material, which often contains trace amounts of the cut substrate (heavy metals), present environmental and regulatory challenges that vary widely by region, imposing compliance costs on operators. Another key restraint is the fluctuating cost and availability of high-quality abrasive garnet, which is a globally traded commodity subject to mining regulations and geopolitical supply chain volatility, directly impacting end-user operating expenditures and profit margins for consumable suppliers.

Opportunities within the market revolve around innovation and sustainability. The growing adoption of advanced ultra-high-pressure (UHP) systems (exceeding 90,000 PSI) necessitates the development of new, extremely durable, and resistant focusing tubes and seals, offering a premium market segment for specialized materials like industrial diamonds and advanced ceramics. Furthermore, the drive for environmental responsibility provides a strong opportunity for companies specializing in sophisticated abrasive recycling and reclamation systems, transforming a disposal cost into a resource management benefit. Technological refinement in automation, specifically the integration of 5-axis and robotic waterjet cutting, opens new application possibilities in intricate 3D shaping, leading to increased machine utilization and higher demand for reliable, long-life consumables.

Segmentation Analysis

The Waterjet Cutting Machine Consumables Market is comprehensively segmented based on Type, Application, and Distribution Channel, reflecting the diverse operational requirements and supply chain structures of the industry. The segmentation by Type is critical as it delineates revenue streams generated by high-volume, low-cost items (like abrasive garnet) versus lower-volume, high-value, technical components (like focusing nozzles and orifices). This granular view allows suppliers to target their product development and inventory strategies effectively. Understanding the application segmentation—ranging from high-stakes aerospace projects to routine metal fabrication—is essential for predicting demand volatility and setting appropriate quality standards, as requirements in the defense sector, for instance, are far more stringent than in general fabrication.

The segmentation by Distribution Channel is paramount for market access and efficiency. The channel dictates how frequently consumables reach the end-user and the associated logistical costs. Original Equipment Manufacturers (OEMs) often prefer to supply proprietary seals and high-precision nozzles directly or through certified distributors to ensure system compatibility and maintain quality control, commanding a premium price. Conversely, abrasive media, due to its bulk nature and standardized specifications, is frequently handled through independent distributors and specialized raw material suppliers. This multi-layered distribution network contributes to market fragmentation but ensures broad accessibility for all end-users, regardless of their machine manufacturer.

- By Type:

- Abrasive Garnet (e.g., Alluvial, Rock)

- Focusing Tubes/Nozzles (e.g., Carbide, Ceramic)

- Orifices/Jewels (e.g., Sapphire, Ruby, Diamond)

- High-Pressure Seals and Kits (e.g., UHMW, Polyurethane)

- Mixing Chambers and Assemblies

- Pump Components (Check Valves, Cylinders, Poppets)

- By Application/End-User:

- Automotive (Parts manufacturing, tooling)

- Aerospace & Defense (Composite and metal cutting)

- Metal Fabrication and General Manufacturing

- Stone, Tile, and Glass Cutting

- Electronics and Circuit Board Manufacturing

- Medical Devices and Instruments

- By Distribution Channel:

- Original Equipment Manufacturers (OEMs)

- Authorized Distributors and Resellers

- Third-Party Suppliers/Aftermarket Providers

- Direct Sales Channel

Value Chain Analysis For Waterjet Cutting Machine Consumables Market

The value chain for the waterjet consumables market is complex, starting with the extraction and processing of raw materials. Upstream activities are dominated by mining operations, specifically for high-quality abrasive garnet, which involves exploration, extraction, washing, screening, and precise grading to meet stringent waterjet specifications (e.g., Mesh 80, Mesh 120). This stage is capital-intensive and subject to geological and environmental constraints. For high-tech components like orifices, the upstream involves synthetic diamond or sapphire jewel manufacturing and precision machining of tungsten carbide or advanced ceramics for focusing tubes. Quality control at this foundational stage is vital, as material purity and consistency directly influence cutting performance and consumable lifespan.

Midstream activities involve the conversion of raw materials into finished consumables. Component manufacturers, which often include specialized engineering firms and OEMs, assemble high-pressure seals, mixing chambers, and integrate the orifices into the nozzle assemblies. Distribution channels play a critical role in bridging the gap between component manufacturers and the global end-user base. Direct sales channels, utilized heavily by major OEMs, ensure specialized support and guaranteed compatibility for proprietary parts, often targeting large industrial clients. Indirect channels, involving third-party distributors and aftermarket retailers, handle the majority of abrasive media and standardized wear parts, providing necessary logistical efficiency and localized inventory management, crucial for high-volume, global consumption.

Downstream activities focus on the delivery, installation, and usage of the consumables by end-users across various manufacturing sectors. The downstream success relies heavily on efficient inventory management at the user level to minimize downtime. Aftermarket support, technical service, and educational resources provided by suppliers are integral to the value proposition, ensuring users maximize the lifespan and effectiveness of their consumables. Furthermore, the increasingly important reverse logistics segment, dealing with the collection and reprocessing of spent abrasive material for potential reuse or environmentally sound disposal, is now integrated into the modern value chain, driven by sustainability pressures and resource efficiency goals.

Waterjet Cutting Machine Consumables Market Potential Customers

The primary customers for Waterjet Cutting Machine Consumables are entities operating waterjet cutting systems across diverse industrial landscapes that require high-precision, non-thermal material processing. These end-users are characterized by their need for frequent consumable replacement due to the inherent wear nature of the cutting process, particularly abrasive waterjet cutting which consumes garnet at rates determined by cutting time and pressure settings. Large-scale manufacturing facilities in sectors such as aerospace and automotive are major volume buyers, often requiring specialized, certified consumables that meet stringent quality and traceability standards. Their consumption is continuous and often managed through long-term supply agreements with key manufacturers or distributors to ensure supply chain stability.

Beyond the high-volume industrial players, the market extends to thousands of smaller custom fabrication shops, job shops, and design studios. These customers prioritize flexibility, fast turnaround times, and accessibility of parts, often relying heavily on local and regional aftermarket distributors for their needs. Furthermore, niche customers in stone/tile artistry, glass fabrication, and medical device manufacturing also represent critical demand pockets, particularly seeking consumables optimized for cutting extremely hard, brittle, or intricate materials. The growth of industrial prototyping and rapid manufacturing services, utilizing waterjet systems for diverse material handling, continues to broaden the potential customer base globally, increasing the diversity of demands placed upon the consumable supply chain.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 1.85 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Barton International, GMA Garnet, H.G. Schaaf, OMAX Corporation (Hypertherm), Kennametal, Flow International, WAZER, TECHNI Waterjet, KMT Waterjet Systems, Jet Edge, Opta Minerals, Scientific Material International (SMI), Velella (AWJ), Waterjet Technology, Allfi High Pressure, Aqua-Dynamic, TCI Cutting, CMS Advanced Materials, Hypertherm, Diamond Technology Innovations. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Waterjet Cutting Machine Consumables Market Key Technology Landscape

The technology landscape for waterjet cutting consumables is continuously evolving, primarily focusing on materials science advancements to withstand increasingly extreme operating environments. The primary technology focus is on achieving higher operational pressures, moving beyond the traditional 60,000 PSI standard toward 94,000 PSI and even 100,000 PSI systems. This necessitates the use of advanced component materials. For orifices, synthetic diamond technology is rapidly replacing ruby and sapphire jewels, offering significantly enhanced durability and precision retention under ultra-high pressure, directly translating to longer operational periods and better cut consistency. Similarly, focusing tubes are transitioning from standard tungsten carbide to advanced composite ceramics and specialized carbides engineered for superior wear resistance against high-velocity abrasive slurry, providing operational lifecycles that can be 2 to 3 times longer than conventional tubes.

Another crucial technological development involves the refinement of abrasive media processing. Suppliers are leveraging sophisticated washing, drying, and screening technologies to produce garnet with exceptional purity, low dust content, and highly consistent particle shape and size distribution (SSD). This technological precision in abrasive preparation directly mitigates clogging, reduces wear on mixing tubes, and optimizes cutting speed, which is a major value-add for end-users concerned with maximizing throughput. Furthermore, the integration of advanced sealing materials, often proprietary polymer blends and composite metal designs, is essential for pump components, enabling high duty cycles at extreme pressures while minimizing the frequent failure rates historically associated with high-pressure seals, contributing significantly to system reliability.

The adoption of advanced sensor technologies and real-time monitoring, often coupled with the aforementioned AI analytics, represents a paradigm shift in how consumables are managed. Sensors embedded within the cutting head and pump system continuously track critical parameters such as pressure fluctuations, vibration signatures, and flow degradation, providing data indicative of consumable health. This technological infrastructure allows for proactive intervention, ensuring parts are replaced based on actual wear status rather than arbitrary scheduling, maximizing component utilization. This move toward 'smart' consumables management, underpinned by high-fidelity monitoring equipment, is increasingly becoming a standard offering from leading waterjet system manufacturers, enhancing overall system efficiency and reducing the total cost of ownership (TCO).

Regional Highlights

The global Waterjet Cutting Machine Consumables Market exhibits distinct consumption patterns influenced by industrial maturity, regulatory frameworks, and regional manufacturing output. The Asia Pacific (APAC) region is the engine of volumetric growth, driven by extensive investments in manufacturing infrastructure, particularly in China, India, and Southeast Asian nations like Vietnam and Thailand. This region benefits from large-scale adoption in metal fabrication, automotive component manufacturing, and construction sectors. The high volume of waterjet machine installations necessitates consistent replenishment of abrasive media, making APAC a critical market for garnet suppliers and aftermarket service providers, often characterized by competitive pricing and high demand for cost-efficient solutions.

North America and Europe represent mature markets that prioritize technological sophistication and quality. Demand here is characterized not by sheer volume but by a preference for premium, long-life, high-performance consumables, such as diamond orifices and certified components for aerospace applications. The focus in these regions is heavily on TCO reduction through efficiency gains, high-pressure capabilities, and minimized downtime. Strict environmental regulations, especially in Western Europe, drive innovation in abrasive recycling technologies and the adoption of low-dust, environmentally screened garnet, influencing procurement practices and promoting specialized service models that incorporate waste management solutions.

Latin America (LATAM) and the Middle East & Africa (MEA) are emerging markets showing significant potential. LATAM's growth is tied to resurgent automotive and mining sectors, requiring robust cutting solutions. The MEA region, particularly the Gulf Cooperation Council (GCC) countries, is experiencing growth driven by diversification away from oil and gas, leading to investments in infrastructure, shipbuilding, and defense manufacturing. While the market size is smaller compared to APAC, capital expenditure in these regions often focuses on modern, highly durable waterjet systems, suggesting a growing future demand for corresponding high-quality seals and nozzles, although logistical challenges related to importing bulk abrasive material can sometimes restrain market expansion.

- Asia Pacific (APAC): Highest growth rate, driven by manufacturing expansion in China and India; strong volume consumption of abrasive garnet; focus on automotive and general fabrication.

- North America: Mature market prioritizing high-precision and certified consumables for aerospace and defense; leading adoption of UHP (94k PSI+) systems; strong emphasis on automation and TCO reduction.

- Europe: Focus on premium quality, advanced ceramic/diamond components; driven by stringent environmental regulations necessitating abrasive recycling solutions; strong presence in complex medical and high-value machinery manufacturing.

- Latin America (LATAM): Emerging market growth linked to resurgent automotive and mining industries; demand for durable, robust consumables suitable for heavy industrial use.

- Middle East and Africa (MEA): Growth tied to infrastructure development, shipbuilding, and industrial diversification; increasing adoption of modern waterjet technology leading to demand for technical components.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Waterjet Cutting Machine Consumables Market.- Barton International

- GMA Garnet

- H.G. Schaaf

- OMAX Corporation (Hypertherm)

- Kennametal

- Flow International

- WAZER

- TECHNI Waterjet

- KMT Waterjet Systems

- Jet Edge

- Opta Minerals

- Scientific Material International (SMI)

- Velella (AWJ)

- Waterjet Technology

- Allfi High Pressure

- Aqua-Dynamic

- TCI Cutting

- CMS Advanced Materials

- Hypertherm

- Diamond Technology Innovations

Frequently Asked Questions

Analyze common user questions about the Waterjet Cutting Machine Consumables market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the most critical consumables in a waterjet cutting system?

The most critical consumables are the abrasive garnet (the cutting medium), the focusing nozzle (which shapes the abrasive stream), the orifice (the jewel that forms the high-pressure water stream), and high-pressure seals (essential for pump integrity and preventing leakage at extreme pressures). Failure in any of these components severely degrades cutting performance or halts operation entirely.

How does the quality of abrasive garnet impact operational costs?

High-quality abrasive garnet, characterized by optimal hardness, purity, and angularity, maximizes cutting speed and minimizes the consumption rate. Lower quality or inconsistent abrasive media can lead to slower cutting, increased component wear (especially on focusing tubes), clogging, and significantly higher downtime, ultimately raising the total operational cost and reducing efficiency.

What is the primary factor driving the shift towards ultra-high-pressure (UHP) consumables?

The primary driver is the demand for faster cutting speeds and the ability to process thicker, harder, or more complex composite materials efficiently. UHP systems (above 90,000 PSI) require consumables, such as synthetic diamond orifices and specialized seals, engineered to withstand extreme forces, offering reduced kerf width and superior edge quality, which decreases overall processing time per part.

Are consumables from third-party suppliers compatible with OEM waterjet machines?

Many standard wear parts, such as abrasive media and certain seals, are generally compatible across different machine brands. However, specialized, proprietary components like advanced mixing chambers, unique pump cylinder assemblies, and specific focusing nozzle designs may require OEM-certified consumables to guarantee optimal performance, longevity, and to maintain warranty status.

How is sustainability affecting the waterjet cutting consumables market?

Sustainability is driving innovation in abrasive recycling technologies, allowing end-users to reclaim and reuse garnet, reducing waste volume and disposal costs. Furthermore, there is an increased market demand for domestically sourced, environmentally screened abrasives and longer-lasting component materials to minimize material throughput and environmental impact throughout the supply chain.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager