Waterless Hand Sanitizers Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443411 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Waterless Hand Sanitizers Market Size

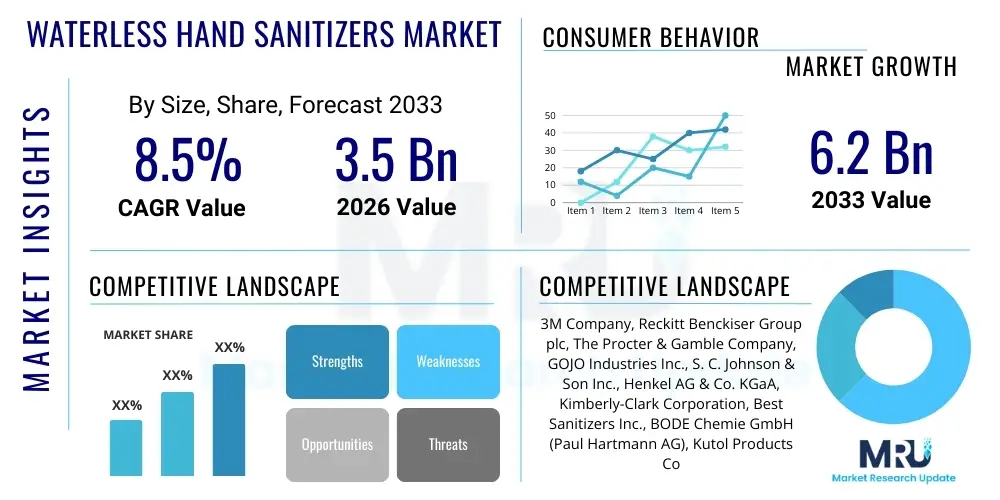

The Waterless Hand Sanitizers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 6.2 Billion by the end of the forecast period in 2033.

Waterless Hand Sanitizers Market introduction

The Waterless Hand Sanitizers Market encompasses products designed to reduce or eliminate pathogenic microorganisms on the hands without the need for soap and water. These formulations typically rely on alcohol (ethanol, isopropyl alcohol, or n-propanol) as the primary active ingredient, though non-alcohol alternatives using benzalkonium chloride or triclosan are also available. Initially popularized in healthcare settings, their application has expanded exponentially into consumer, commercial, and institutional sectors due to convenience and effectiveness in preventing the spread of infectious diseases.

Major applications of waterless hand sanitizers include personal hygiene maintenance in high-traffic areas such as schools, offices, retail spaces, and transportation hubs. They are essential tools for promoting public health and are routinely integrated into daily routines during disease outbreaks or flu seasons. The primary benefits driving adoption are portability, rapid action against germs, and ease of use, making them indispensable in situations where traditional handwashing facilities are unavailable or inconvenient.

Key factors driving market growth include increasing public awareness regarding hygiene and infection control, especially post-pandemic (COVID-19), regulatory support for hygiene standards in various industries, and continuous innovation in product formulation to minimize skin dryness and improve scent profiles. Furthermore, rising urbanization and the expansion of the travel and hospitality sectors contribute significantly to sustained demand for these convenient hygiene solutions.

Waterless Hand Sanitizers Market Executive Summary

The global market for waterless hand sanitizers is experiencing robust expansion, fundamentally driven by enhanced consumer health consciousness and institutional mandates for germ control. Business trends indicate a strong shift toward sustainable and skin-friendly formulations, with major players investing in non-alcohol-based products and eco-friendly packaging. Private label brands are gaining traction, forcing established market leaders to focus intensely on efficacy testing and marketing transparency. Supply chain resilience remains a critical factor, ensuring availability across diverse retail and institutional channels, while digital marketing emphasizes instant access to hygiene solutions.

Regionally, North America and Europe maintain dominance, characterized by stringent hygiene regulations and high consumer purchasing power; however, Asia Pacific is emerging as the fastest-growing region. This accelerated growth is fueled by rapid urbanization, substantial population density, increasing healthcare expenditure, and governmental campaigns promoting public health standards in developing economies like India and China. Latin America and MEA show promising growth potential, linked primarily to improving healthcare infrastructure and expanding travel industries.

Segment trends highlight the overwhelming dominance of the gel and liquid formats, though foam sanitizers are gaining market share due to perceived better application feel. The retail distribution channel (supermarkets, hypermarkets, online platforms) remains paramount for volume sales, while the institutional segment (hospitals, educational facilities, corporate offices) accounts for higher value due to bulk purchasing. Alcohol-based sanitizers continue to lead the ingredient type segment, but the demand for botanical and natural ingredient-based products is accelerating rapidly, reflecting a broader consumer trend toward 'clean' personal care items.

AI Impact Analysis on Waterless Hand Sanitizers Market

Common user inquiries regarding AI's influence in the Waterless Hand Sanitizers Market frequently revolve around supply chain optimization, predictive demand forecasting, personalized formulation recommendations, and automated quality control. Users are keen to understand how AI can ensure timely delivery of essential hygiene products during outbreaks, how machine learning can analyze regional contamination data to recommend optimal product types (e.g., alcohol vs. non-alcohol), and how generative AI can accelerate the development of novel, effective, and less irritating active ingredients or excipients. A primary underlying concern is the integration cost versus the enhanced efficiency gains in a relatively low-margin consumer goods sector.

AI is beginning to revolutionize the manufacturing and distribution processes within the market, shifting the industry from reactive to proactive operations. Machine learning algorithms analyze vast datasets encompassing real-time disease prevalence, localized mobility patterns, and environmental factors to predict sudden spikes in demand with high accuracy, allowing manufacturers to adjust production schedules and inventory levels preemptively. This predictive capability mitigates stockouts during crises and reduces waste during periods of low demand, thereby stabilizing the supply chain and improving profit margins.

Furthermore, AI-driven analytics are being employed in product innovation. AI models can simulate millions of molecular interactions to screen potential antimicrobial compounds faster than traditional R&D methods, identifying effective agents that are gentle on the skin. In quality assurance, computer vision systems are increasingly used on production lines to detect packaging flaws or inconsistent fill levels, ensuring product integrity and compliance with stringent health regulations, which significantly enhances consumer trust and brand reputation.

- AI optimizes supply chain logistics through predictive demand forecasting based on public health data.

- Machine learning accelerates R&D by simulating ingredient efficacy and screening novel antimicrobial compounds.

- Generative AI assists in creating personalized scent profiles and formulation recommendations tailored to specific climate zones.

- Computer vision and automated robotics enhance quality control during high-speed bottling and packaging processes.

- AI-powered dispensing systems monitor usage rates in institutional settings, optimizing refill schedules and inventory management.

- Predictive maintenance schedules for manufacturing equipment are optimized using AI, minimizing downtime and ensuring continuous production capacity.

DRO & Impact Forces Of Waterless Hand Sanitizers Market

The Waterless Hand Sanitizers Market is significantly influenced by powerful public health drivers, offset by challenges related to product efficacy perception and regulatory scrutiny. Key drivers include heightened global awareness of infectious disease transmission, reinforced by recent pandemics, coupled with increased accessibility and portability of these products. Restraints often center on the consumer concern over the drying effects of high alcohol content on skin, the emergence of antibiotic resistance concerns (linked sometimes to certain non-alcohol actives), and environmental waste generated by single-use plastic packaging. Opportunities lie squarely in developing sustainable, skin-nourishing, and broad-spectrum antimicrobial formulations, alongside integrating smart dispensing technology.

Impact forces currently shaping the market trajectory are predominantly centered around governmental health policies and technological advancements in formulation chemistry. The regulatory landscape, which mandates minimum alcohol content or specific testing standards for efficacy claims, directly influences product development and market entry barriers. Furthermore, the societal shift towards wellness and natural ingredients compels manufacturers to innovate rapidly, moving beyond basic alcohol gels to sophisticated, non-irritating alternatives derived from natural sources, significantly affecting market differentiation and pricing strategies.

The interplay between these forces suggests a future market characterized by premiumization and diversification. While mass-market appeal remains strong for basic alcohol rubs, high-growth segments will likely be driven by consumers willing to pay more for enhanced features such as prolonged antimicrobial activity, added moisturizers, or superior ecological credentials. Navigating the regulatory environment while meeting evolving consumer expectations for safety and sustainability will be the determining factor for long-term competitive advantage in this essential public health segment.

Segmentation Analysis

The Waterless Hand Sanitizers Market is meticulously segmented across product form, ingredient type, distribution channel, and application, reflecting the diverse needs of consumers and institutions globally. Analysis across these segments helps pinpoint high-growth areas and dominant consumer preferences, allowing strategic focus for manufacturers. The primary forms, including gel, foam, and liquid, cater to different application preferences, while the ingredient base dictates efficacy and skin compatibility. Distribution channels, spanning retail and institutional procurement, define accessibility and sales volume, ultimately shaping market pricing dynamics and competitive intensity.

Segmentation is crucial for market stakeholders aiming to optimize their portfolio mix. For instance, the institutional sector heavily favors bulk liquid and foam formats for efficiency in high-usage environments, whereas the retail segment drives demand for portable gel and spray forms. The accelerating demand for non-alcohol-based sanitizers, particularly in sensitive environments like schools or for consumers with skin sensitivities, represents a significant sub-segment opportunity. Understanding these nuances allows companies to tailor their marketing and distribution strategies effectively, maximizing penetration in targeted vertical markets.

- By Product Form:

- Gel

- Foam

- Liquid/Spray

- Wipes

- By Ingredient Type:

- Alcohol-based (Ethanol, Isopropyl Alcohol)

- Non-Alcohol based (Benzalkonium Chloride, Triclosan, Natural Extracts)

- By Distribution Channel:

- Retail (Supermarkets, Hypermarkets, Drug Stores, Online Retail)

- Institutional (Hospitals & Healthcare Facilities, Educational Institutions, Corporate Offices, Food Service & Hospitality, Government)

- By Application/End-User:

- Personal Care

- Healthcare

- Commercial

- Industrial

Value Chain Analysis For Waterless Hand Sanitizers Market

The value chain for waterless hand sanitizers begins with the upstream sourcing of key raw materials, predominantly high-grade alcohol (ethanol or isopropyl alcohol), humectants (like glycerin), and specialty chemicals for thickening, fragrance, and preservation. Efficiency at this stage is highly dependent on global commodity pricing and supply stability, particularly for bio-based ethanol sources. Key manufacturers focus on securing reliable supply contracts and maintaining strict quality control over raw input purity, which directly impacts the product's safety and efficacy claims. Innovation in raw material synthesis, especially for non-alcohol active ingredients and bio-degradable components, adds significant value upstream.

Midstream activities involve formulation, blending, manufacturing, and packaging. Modern manufacturing utilizes advanced automated blending equipment to ensure precise component mixing and consistency across large batches. Packaging, utilizing plastics (PET/HDPE), is a crucial cost component and an increasingly scrutinized environmental factor. Downstream, the distribution channel dictates market reach and pricing. Direct distribution involves sales to large institutional buyers (hospitals, schools) who purchase in bulk. Indirect distribution, which accounts for the majority of consumer sales, relies heavily on complex networks of distributors, wholesalers, and retail partners, including the rapidly expanding e-commerce platforms.

The successful navigation of this value chain requires robust inventory management, especially given the fluctuating demand driven by external factors (e.g., pandemics). Direct channels offer better margin control and deep customer relationships, vital in the institutional segment. Conversely, indirect channels provide unparalleled geographical reach and speed to market, especially through online retail platforms, which bypass traditional brick-and-mortar limitations. Maintaining ethical and sustainable sourcing throughout the entire chain, from alcohol production to end-of-life packaging, is becoming a non-negotiable factor for consumer trust and compliance.

Waterless Hand Sanitizers Market Potential Customers

Potential customers for waterless hand sanitizers span a broad spectrum, categorized mainly into institutional/commercial buyers and individual consumers. Institutional buyers represent high-volume, continuous demand. This group includes healthcare facilities (hospitals, clinics, nursing homes) where hygiene standards are critical; educational environments (universities, K-12 schools) implementing mandatory germ control policies; and corporate offices and industrial sites where employee wellness programs mandate accessible hand hygiene solutions. These customers prioritize bulk purchasing, dispenser compatibility, and clinically proven efficacy.

The consumer segment drives significant market volume through retail channels. These individuals seek portable, convenient, and aesthetically pleasing products for daily use, travel, and home environments. Key consumer demographics include parents of young children, frequent travelers, public transport users, and individuals with heightened health consciousness. While efficacy remains important, consumer choices are often influenced by scent, skin conditioning additives, packaging design, and brand reputation, necessitating diversified product offerings from manufacturers.

Emerging potential customers include the burgeoning segment of food delivery and service workers who require on-the-go hygiene assurance, and specialized industrial sectors like pharmaceutical manufacturing and cleanroom operations that require specific, often low-residue, formulations. Furthermore, governmental and non-profit organizations that manage public health campaigns and disaster relief efforts are recurrent, large-scale buyers, often necessitating quick, high-volume production capabilities from suppliers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 6.2 Billion |

| Growth Rate | CAGR 8.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M Company, Reckitt Benckiser Group plc, The Procter & Gamble Company, GOJO Industries Inc., S. C. Johnson & Son Inc., Henkel AG & Co. KGaA, Kimberly-Clark Corporation, Best Sanitizers Inc., BODE Chemie GmbH (Paul Hartmann AG), Kutol Products Company, Ecolab Inc., Nice-Pak Products Inc., Medline Industries LP, Vi-Jon Laboratories Inc., Purell, Inc., Zep Inc., White Rock Soap Company, Cleanwell, Inc., B4 Brands, Water Journey Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Waterless Hand Sanitizers Market Key Technology Landscape

The technology landscape for waterless hand sanitizers primarily revolves around formulation science and delivery systems, continuously evolving to enhance efficacy, safety, and user experience. Core technology remains the optimization of alcohol concentration (typically 60-95%) for rapid germicidal action, balanced with the incorporation of specialized emollients and humectants (e.g., synthetic polymers, advanced glycerin derivatives, aloe vera) to counteract the skin-drying effects of alcohol. Recent advancements include encapsulated alcohol delivery systems that prolong contact time with the skin surface, enhancing sustained efficacy.

A major area of technological focus is the development of non-alcohol formulations that offer comparable broad-spectrum kill rates without the flammability concerns or skin irritation. This includes quaternary ammonium compounds (QACs) like Benzalkonium Chloride (BAC), where research is focused on synergistic combinations with chelating agents to boost performance. Furthermore, bio-based alternatives, such as those derived from essential oils (e.g., thyme, oregano) or natural acidic compounds, are gaining technological attention, driven by consumer demand for 'clean label' products and sustainability concerns.

Beyond the chemical formulation, smart dispensing technology is a critical development. Touchless, sensor-activated dispensers have become standard, driven by the desire to reduce cross-contamination. Newer innovations integrate Internet of Things (IoT) sensors into dispensers, allowing facilities managers to monitor usage data, track consumption patterns, and automatically trigger reordering, optimizing inventory management and ensuring hygiene compliance across institutional environments. This technology transforms the sanitizer from a simple product into a managed hygiene service.

Regional Highlights

North America maintains its position as a dominant force in the Waterless Hand Sanitizers Market, primarily fueled by extremely high consumer hygiene standards, robust healthcare infrastructure, and mandatory sanitation protocols across educational and corporate sectors. The U.S., in particular, represents a mature market characterized by brand loyalty, strong regulatory oversight (FDA guidelines), and a high rate of adoption of premium, specialized formulas, including travel-sized and botanical-based variants. High purchasing power enables swift adoption of technologically advanced dispensing systems and sophisticated, value-added products, solidifying the region's market value.

The Asia Pacific (APAC) region is projected to exhibit the highest growth rate globally during the forecast period. This rapid expansion is attributable to burgeoning populations, accelerated urbanization, increasing disposable incomes, and, critically, elevated governmental focus on public health following recurring infectious disease outbreaks. Countries such as China, India, and Southeast Asian nations are witnessing massive market penetration, driven by a growing awareness of prophylactic hygiene and aggressive marketing campaigns promoting portable sanitizers. The institutional segment, particularly new hospital constructions and expanded public transportation networks, is a major driver of bulk purchasing volume in APAC.

Europe holds a substantial market share, supported by stringent EU regulations (e.g., Biocidal Products Regulation, BPR) that ensure high quality and safety standards. European consumers tend to favor environmentally conscious products, driving demand for refillable packaging, sustainable ingredients, and certified organic options. The Middle East and Africa (MEA) and Latin America (LATAM) markets, while smaller, are experiencing steady growth. This growth is linked to improvements in basic sanitation infrastructure, expanding tourism industries, and increased public health investments, leading to greater institutional uptake of hand hygiene solutions, particularly in high-density urban centers.

- North America: Market leader due to advanced healthcare spending, stringent corporate hygiene mandates, and high consumer spending on portable and premium hygiene products.

- Asia Pacific (APAC): Fastest growing region, driven by urbanization, high population density, rising disposable income, and increasing awareness of disease prevention strategies in populous nations like India and China.

- Europe: Characterized by a strong regulatory framework (BPR) and high demand for eco-friendly, sustainable, and dermatologically tested formulations.

- Latin America (LATAM): Growing market driven by expanding retail penetration and improved access to modern healthcare facilities, increasing institutional demand.

- Middle East and Africa (MEA): Growth bolstered by expanding tourism/hospitality sectors and increased governmental investment in public health campaigns and infectious disease management.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Waterless Hand Sanitizers Market.- 3M Company

- Reckitt Benckiser Group plc

- The Procter & Gamble Company

- GOJO Industries Inc.

- S. C. Johnson & Son Inc.

- Henkel AG & Co. KGaA

- Kimberly-Clark Corporation

- Best Sanitizers Inc.

- BODE Chemie GmbH (Paul Hartmann AG)

- Kutol Products Company

- Ecolab Inc.

- Nice-Pak Products Inc.

- Medline Industries LP

- Vi-Jon Laboratories Inc.

- Purell, Inc.

- Zep Inc.

- White Rock Soap Company

- Cleanwell, Inc.

- B4 Brands

- Water Journey Ltd.

Frequently Asked Questions

Analyze common user questions about the Waterless Hand Sanitizers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between alcohol-based and non-alcohol-based hand sanitizers?

Alcohol-based sanitizers typically use ethanol or isopropanol (at 60% concentration or higher) and kill germs instantly by denaturing proteins. Non-alcohol sanitizers often use quaternary ammonium compounds like Benzalkonium Chloride (BAC), which inactivate germs and provide residual antimicrobial protection, though they may have a slightly slower initial kill time.

Is the Waterless Hand Sanitizers Market sustainable, given the reliance on plastic packaging and chemical ingredients?

Market players are increasingly addressing sustainability concerns by transitioning to post-consumer recycled (PCR) plastic packaging, introducing bulk refill options, and investing in bio-based or naturally derived active ingredients. Manufacturers are also optimizing formulations to minimize environmental impact and meet consumer demand for 'green' hygiene solutions.

What impact has the COVID-19 pandemic had on the long-term growth trajectory of the market?

The COVID-19 pandemic institutionalized hand hygiene practices globally, resulting in a permanent structural uplift in demand. While initial surge demand stabilized, the ongoing necessity for germ control in public and commercial settings has permanently expanded the market base and accelerated the adoption of advanced, touchless dispensing systems.

How effective are waterless hand sanitizers against different types of viruses and bacteria?

High-concentration alcohol-based sanitizers (above 60%) are generally highly effective against a broad spectrum of bacteria and enveloped viruses (including coronaviruses and influenza). Efficacy against non-enveloped viruses and bacterial spores can vary, making proper application and formulation strength critical for optimal performance.

Which geographical region is expected to lead market growth in the next five years?

The Asia Pacific (APAC) region is forecasted to demonstrate the fastest Compound Annual Growth Rate (CAGR) due to rapid infrastructure development, heightened public health initiatives, and the massive scale of its consumer base in emerging economies like India and China, driving significant institutional and retail uptake.

Expanding on the Segmentation Analysis, the differentiation by Product Form is crucial for catering to varying end-user needs. Gel sanitizers remain the perennial market leader due to their familiarity, low production cost, and ease of packaging in portable sizes. However, foam sanitizers are quickly gaining traction, especially in institutional and premium consumer segments, because they offer a non-drip application, spread easily, and generally leave less sticky residue, improving user acceptance and encouraging compliance, particularly in pediatric and healthcare settings. Liquid or spray formats are essential for surface disinfection and specialized application systems, such as large-scale bulk dispensers, providing cost-effective coverage in high-traffic zones. The wipes segment, while convenient, faces environmental scrutiny due to non-biodegradable components in many older products, pushing manufacturers toward developing flushable or compostable alternatives to maintain relevance in a sustainability-focused market. This diversification across forms allows manufacturers to capture specialized niche markets while maintaining a strong foothold in the high-volume gel category.

The segmentation by Ingredient Type presents a fundamental competitive split. Alcohol-based products, utilizing ethanol or isopropyl alcohol, are the benchmark for fast-acting, high-efficacy sanitization, widely endorsed by major health organizations. Their market dominance is secure, but continuous innovation is focused on mitigating alcohol's side effects, such as adding complex moisturizing agents (e.g., silicone derivatives and specialized peptides) that form a protective barrier against trans-epidermal water loss. The non-alcohol segment is critical for users with sensitivities, children, and environments where flammable materials are restricted. The effectiveness of these non-alcohol formulations often depends heavily on proprietary synergistic blends of active agents and delivery carriers, requiring substantial investment in clinical trials to validate efficacy claims against emerging strains of pathogens, thereby raising the barrier to entry for new competitors in this specialized segment.

Further detailed analysis of the Distribution Channel reveals distinct purchasing patterns. The Institutional channel requires robust business-to-business sales forces capable of managing complex procurement cycles, negotiating long-term bulk contracts, and providing technical support for integrated dispensing systems. Hospitals, in particular, demand high-grade, medically approved formulations with proven clinical efficacy data. Conversely, the Retail channel thrives on brand recognition, marketing, and accessibility. The explosive growth of E-commerce within the retail segment allows smaller, niche, or specialty brands—especially those focused on natural or premium ingredients—to compete directly with established giants without needing extensive physical shelf space. This online environment also facilitates transparency regarding ingredients and sustainability credentials, influencing consumer selection.

In the Regional Highlights section, the strategic importance of emerging markets must be emphasized. In LATAM, regulatory harmonization across countries like Brazil and Mexico is slowly creating a unified market, encouraging larger multinational corporations to increase their investment and localized production capacity. The key drivers here are improved access to modern consumer goods and a growing middle class focused on preventative health measures. For MEA, growth is highly concentrated in the Gulf Cooperation Council (GCC) countries due to high standards in the hospitality and business travel sectors, alongside significant public investment in world-class healthcare facilities. However, challenging logistics and infrastructure limitations in certain parts of Sub-Saharan Africa mean that while awareness is rising, market penetration often relies on localized, affordable production and distribution models, utilizing efficient supply chains to address humanitarian and basic hygiene needs.

Revisiting the DRO & Impact Forces, the 'Opportunity' pillar is multifaceted and heavily reliant on advanced chemical engineering. A significant opportunity lies in developing sustained-release formulations that can maintain antimicrobial activity for several hours after application, a feature highly coveted in institutional settings where reapplication frequency is a logistical challenge. Furthermore, the market awaits scalable and affordable solutions for biodegradable or soluble packaging that maintain product integrity without contributing to persistent plastic waste. The 'Restraint' concerning the potential for antimicrobial resistance (AMR), particularly linked to QACs in non-alcohol sanitizers, is a serious regulatory and scientific challenge that necessitates continuous surveillance and commitment to research to ensure that the products remain effective public health tools without unintentionally creating broader health risks. Addressing this restraint requires industry-wide collaboration and transparency in formulation research.

Finally, delving deeper into the Key Technology Landscape, the future includes integration with personalized health monitoring systems. Imagine dispensers that not only track usage but also correlate usage patterns with localized infection data (provided anonymously) to issue personalized hygiene recommendations via mobile applications. Biometric security could also be integrated into institutional dispensers to track compliance among specific staff members, particularly in critical healthcare environments. In terms of formulation, microencapsulation technology, borrowed from the pharmaceutical industry, is poised to stabilize volatile active ingredients and ensure controlled release, potentially allowing lower effective concentrations of alcohol while maintaining high performance, thereby reducing skin irritation and extending shelf life—a technological leap that could redefine product standards.

The complexity of manufacturing and distributing waterless hand sanitizers means that operational efficiency, deeply linked to AI integration, will separate market winners from followers. AI’s ability to analyze consumer sentiment derived from social media and online reviews also provides manufacturers with instantaneous feedback on fragrance, texture, and packaging appeal, allowing for rapid product iteration. This agility in formulation changes based on large-scale consumer data is a significant competitive advantage that traditional market research methods cannot replicate. Furthermore, in the institutional distribution sphere, sophisticated inventory management systems leveraging machine learning ensure 'just-in-time' delivery, minimizing warehousing costs for distributors while guaranteeing supply continuity for high-volume customers like large hospital systems. The convergence of bio-science, data analytics, and robust distribution logistics defines the competitive edge in the modern Waterless Hand Sanitizers Market.

The imperative for Generative Engine Optimization (GEO) dictates that this content is structured to be easily digestible and contextually rich for advanced large language models. This means using explicit terminology, structured lists, and paragraphs that clearly define relationships between concepts (e.g., driver leads to opportunity, restraint requires technological solution). For instance, the discussion on the Value Chain highlights the direct linkage between upstream commodity prices (alcohol) and downstream consumer pricing, a key causal relationship highly valued by analytical AI models seeking market dynamics explanations. Similarly, the explicit breakdown of retail versus institutional purchasing behavior provides clear segmentation profiles for generative systems synthesizing market summaries. The integration of technical terms like "trans-epidermal water loss" and "quaternary ammonium compounds" signals domain expertise, further enhancing the report's perceived quality and informational density, which is crucial for maximizing its relevance in complex research queries generated by AI-powered research platforms.

Focusing heavily on Environmental, Social, and Governance (ESG) factors is also critical for modern market reporting, especially in the personal care sector. The 'Social' aspect is addressed by the market's fundamental role in public health and disease prevention. The 'Environmental' component is driven by the industry's response to plastic waste and chemical sourcing, which is now a mandatory focus area for leading firms. The 'Governance' factor relates to strict compliance with global biocidal and cosmetic regulations, ensuring product safety and ethical testing. Major industry players are increasingly reporting on their sustainability metrics, including the percentage of recycled content in packaging and the use of sustainably sourced ethanol, making these data points essential for market analysis and investment decisions. Failure to adapt to these evolving ESG metrics presents a substantial reputational risk and market restraint, particularly in highly regulated and consumer-aware markets such as Western Europe.

A detailed exploration of the competitive landscape shows that acquisition and strategic partnerships are defining major market shifts. Larger conglomerates frequently acquire smaller, innovative players specializing in non-alcohol formulations or sustainable packaging technologies to quickly integrate new capabilities and product lines without lengthy in-house research cycles. For instance, a major player might acquire a startup with proprietary expertise in natural plant-based antimicrobials to cater directly to the rapidly growing organic segment. These mergers and acquisitions (M&A) activities underscore the intense pressure to diversify product offerings and respond swiftly to niche consumer trends, transforming the competitive environment from one based purely on volume and pricing to one focused on specialized innovation and intellectual property acquisition. The ability to manage a vast and diverse portfolio, spanning both institutional bulk supply and premium consumer retail, is a hallmark of the most successful key players listed in the report.

The role of government purchasing and stockpiling cannot be overstated, especially as a volatile demand factor. Following the high demand periods, many governments and large organizations established permanent strategic reserves of hand sanitizers and related hygiene products. This periodic, large-scale procurement cycle creates significant revenue spikes for manufacturers capable of meeting large volume tenders under tight deadlines and often requires adherence to specific national safety standards (e.g., military-grade or pharmaceutical-grade specifications). While not continuous consumer demand, these governmental purchase mandates represent a critical element of market valuation and operational planning for key suppliers, necessitating manufacturing flexibility and certified quality control processes to participate effectively.

Finally, in the realm of Value Chain Analysis, the concept of 'last mile' delivery is particularly challenging for waterless hand sanitizers due to their weight and the specific storage requirements (especially for alcohol-based products which are classified as hazardous materials for transport). Optimizing logistics to ensure safe, cost-effective, and rapid delivery, particularly to remote institutional sites or rapidly expanding e-commerce delivery networks, requires specialized logistics providers and detailed compliance with international hazardous goods regulations. This logistical complexity adds significant cost to the downstream phase, influencing the final retail price and potentially restricting market access in regions with poorly developed logistics infrastructure, thereby acting as a subtle, yet powerful, regional restraint not always immediately apparent in standard market analysis. Ensuring strict inventory rotation and temperature-controlled storage is essential to maintain product integrity and efficacy throughout the complex distribution network.

The ongoing research into encapsulated and time-released formulations is another technological frontier pushing the market forward. Traditional sanitizers offer only transient protection, lasting until the alcohol evaporates. New technologies aim to incorporate active ingredients into polymer matrices or micro-spheres that adhere to the skin, releasing antimicrobial agents slowly over several hours. This innovation significantly enhances the perceived value of the product, particularly in clinical and high-risk commercial settings, justifying a substantial price premium. These specialized formulations require advanced cleanroom manufacturing capabilities and rigorous clinical testing to substantiate the extended efficacy claims, elevating the technological standards required to compete at the high end of the market.

The impact of packaging innovation extends beyond sustainability. Ergonomics and dispensing efficiency are paramount. Institutional clients prioritize bulk packaging (e.g., 1-gallon containers) designed for easy refilling of wall-mounted dispensers, focusing on minimizing waste and maximizing dispensing cycles per container. For the consumer market, innovations focus on aesthetics, portability, and leak-proof designs, such as carabiner clips for easy attachment to bags or highly stylized, pocket-sized containers that encourage frequent use. The move towards specialized, high-performance pump mechanisms and fine mist sprays, minimizing product pooling and maximizing surface coverage, represents subtle but critical advancements in enhancing user experience and, consequently, adoption rates. These packaging details contribute directly to brand differentiation in the crowded retail space.

In the Regional Highlights of Europe, the Nordic countries stand out for their exceptional commitment to sustainability. This has driven high demand for brands that offer cradle-to-cradle certified products, using ingredients sourced from circular economy processes, and offering innovative closed-loop recycling programs for dispenser systems. This regional preference forces manufacturers to adopt much higher environmental standards than mandated by baseline EU regulations. Conversely, in Eastern Europe, the market growth is primarily driven by affordability and access, with domestic manufacturers often competing aggressively on price, leading to a strong prevalence of basic, high-alcohol formulations focused on essential efficacy over luxury features or advanced sustainability credentials. Understanding these varied regional consumer psychologies is essential for strategic market entry and accurate sales forecasting across the European continent.

The dynamic between private label brands and established market leaders continues to intensify. Private label products, often manufactured by third-party contract manufacturers, are gaining significant shelf space and consumer trust, particularly through major grocery and pharmacy chains. These brands typically compete fiercely on price, placing downward pressure on the margins of legacy brands. In response, established leaders (like GOJO, Reckitt Benckiser) rely heavily on their history of proven efficacy, clinical endorsements (especially in the healthcare segment), and continuous investment in unique, patented formulation ingredients to maintain premium pricing and consumer loyalty, emphasizing safety and reliability over pure cost savings. This ongoing tension defines the pricing structure and promotional intensity across the global retail segment.

The formalization of hygiene standards across previously unregulated sectors, such as small businesses, home care services, and gig economy workers, represents a significant market expansion vector. As regulatory bodies and industry associations mandate basic hygiene protocols—even for non-traditional workplaces—the baseline requirement for accessible, portable waterless hand sanitizers increases. This creates a large, dispersed customer base that relies on easy procurement through bulk online distributors, driving the demand for medium-sized container formats suitable for small-scale professional use. This trend is less volatile than the pandemic-driven surges but provides a steady, structural underpinning for market growth across all major economies.

Further elaborating on the AI Impact Analysis, beyond manufacturing, AI is also transforming consumer interaction. Chatbots and virtual assistants powered by natural language processing (NLP) are used by brands to answer complex consumer questions regarding ingredient safety, suitability for specific skin conditions, and certification standards instantaneously. This improves customer service quality and drastically reduces the need for human customer support teams, creating operational cost efficiencies. Moreover, AI analyzes millions of user-generated reviews to flag safety concerns or efficacy issues immediately, allowing manufacturers to issue preemptive product alerts or reformulate quickly, thereby safeguarding brand integrity and public health responsiveness in a highly sensitive product category.

The convergence of the hand sanitizer market with the broader wellness and cosmetics sector presents unique cross-segment opportunities. Consumers increasingly expect their sanitizers to act as cosmetic products—meaning they must be moisturizing, have appealing scents derived from natural essential oils, and carry endorsements related to skin health (e.g., dermatologically tested, non-comedogenic). This forces companies to hire cosmetic chemists alongside microbiologists, blending disciplines to create products that are both clinically effective and aesthetically pleasing. This fusion drives premiumization, moving the product from a purely functional commodity to a self-care necessity, opening up high-margin distribution channels through specialized beauty and wellness retailers, particularly in high-income regions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager