Waterproof Light Strip Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443462 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Waterproof Light Strip Market Size

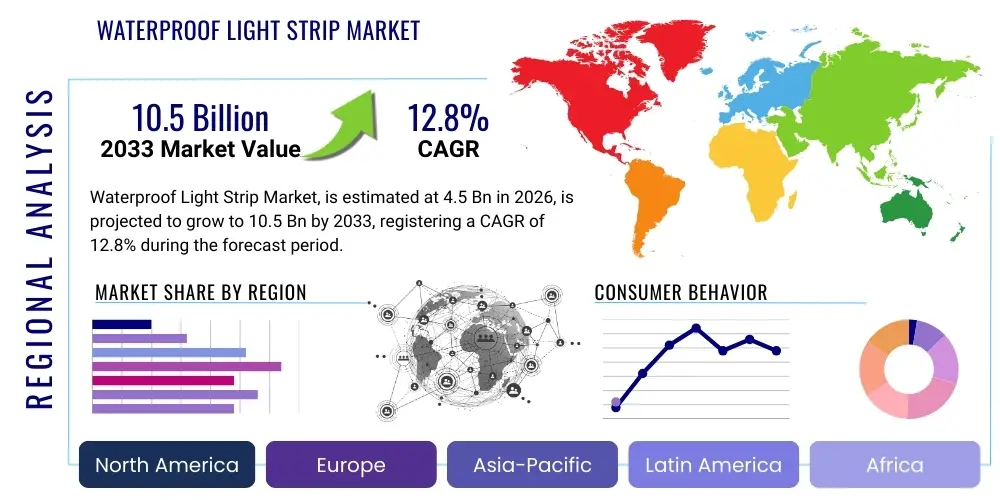

The Waterproof Light Strip Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.8% between 2026 and 2033. The market is estimated at USD 4.5 billion in 2026 and is projected to reach USD 10.5 billion by the end of the forecast period in 2033. This significant growth trajectory is underpinned by increasing global construction activity, rising consumer preference for aesthetic and functional outdoor lighting solutions, and continuous technological advancements enhancing product durability and energy efficiency. Furthermore, the expanding adoption of smart home technologies and the critical need for robust, reliable lighting solutions in harsh or moist environments, such as bathrooms, kitchens, marine applications, and exterior architectural accents, contribute substantially to market expansion. The shift towards low-voltage, highly flexible lighting systems further solidifies the market's upward trend, positioning waterproof light strips as a versatile component in modern lighting design.

Waterproof Light Strip Market introduction

The Waterproof Light Strip Market encompasses flexible lighting solutions, typically utilizing Light Emitting Diode (LED) technology, encapsulated in protective materials such as silicone, epoxy resin, or polyurethane (PU) to achieve high Ingress Protection (IP) ratings, commonly ranging from IP65 to IP68. These products are fundamentally designed to operate reliably in environments exposed to moisture, dust, and direct water spray or submersion. The core product, a flexible printed circuit board (PCB) populated with SMD or COB LEDs, is crucial for both aesthetic and functional illumination, offering advantages such as low power consumption, exceptional longevity, and ease of installation due to their adhesive backing and cuttable nature. Major applications span residential settings (kitchen under-cabinet lighting, bathroom ambient light), commercial spaces (hospitality backlighting, retail display), industrial uses (machine visual inspection, cold storage facilities), and specialized fields like marine and automotive exterior lighting.

The principal benefits driving the adoption of waterproof light strips include their superior durability against environmental stressors, ensuring extended operational life compared to conventional lighting. Their flexibility allows for seamless integration into complex architectural designs and curved surfaces, offering unparalleled design freedom. Furthermore, the inherent energy efficiency of LED technology aligns perfectly with global sustainability initiatives and offers substantial long-term cost savings for end-users. The driving factors fueling market growth are multifaceted: the proliferation of smart lighting systems requiring low-profile, weather-resistant fixtures; the rapid urbanization and associated increase in high-end construction projects emphasizing sophisticated facade and landscape lighting; and the standardization of high IP-rated lighting across various regulatory bodies globally. These elements collectively establish a robust foundation for sustained market expansion, pushing manufacturers toward innovation in material science and electronic integration.

Waterproof Light Strip Market Executive Summary

The Waterproof Light Strip Market exhibits dynamic business trends characterized by intense competition focused on product differentiation through material quality, smart connectivity features, and high IP ratings (especially IP67 and IP68). Key business activities revolve around integrating control systems, such as Wi-Fi and Bluetooth modules, into the strips to facilitate remote operation and customization of color temperature and brightness, catering strongly to the burgeoning smart home segment. Regionally, the Asia Pacific (APAC) dominates in terms of manufacturing capacity and consumption, fueled by rapid infrastructural development and a strong presence of major LED component suppliers. North America and Europe, however, lead in the adoption of high-end, IoT-enabled strips, driven by high consumer purchasing power and stringent energy efficiency standards. Segment trends indicate a rising preference for Chip-on-Board (COB) technology due to its uniform light output and minimized spotting, offering superior aesthetic quality over traditional Surface-Mount Device (SMD) technology. Application-wise, the commercial and architectural lighting segments are showing the fastest growth, requiring customized lengths and color rendering indices (CRI) for high-impact visual design. Regulatory harmonization concerning electromagnetic compatibility (EMC) and product safety certifications remains a critical underlying trend influencing global market access and product standardization.

AI Impact Analysis on Waterproof Light Strip Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Waterproof Light Strip Market primarily center on how AI can enhance the functionality, efficiency, and user experience of these specialized lighting products. Common questions relate to predictive maintenance of exterior installations, dynamic environmental responsiveness, and optimization of manufacturing processes. Specifically, users are keen to understand if AI can enable lighting systems to autonomously adjust intensity and color based on real-time weather conditions, occupancy patterns, or even external factors like ambient light levels, thereby maximizing energy savings and extending product life. Furthermore, there is significant interest in how machine learning algorithms can be employed during manufacturing quality control to instantly detect microscopic material flaws in the waterproof encapsulation layers, ensuring consistent IP ratings and reducing warranty claims associated with premature failure in harsh environments. The key themes summarized from user concern include intelligent automation of lighting scenes, enhanced durability assurance via AI-driven quality inspection, and the integration of predictive analytics for maintenance scheduling in large-scale commercial or municipal installations.

AI's influence is transforming waterproof lighting from static fixtures into adaptive, context-aware systems, profoundly impacting both the supply chain and end-user engagement. In terms of product functionality, AI algorithms facilitate complex, non-linear control over light output, allowing waterproof strips used in architectural lighting to create dynamic, responsive displays that change based on pre-programmed behavioral triggers or learned environmental data, far surpassing traditional timer or basic sensor controls. This capability elevates the value proposition of these strips in high-end projects where aesthetic customization and real-time responsiveness are paramount. On the operational side, AI-powered computer vision systems are being deployed on production lines to analyze the consistency and integrity of silicone or epoxy coatings applied during the waterproofing process, ensuring uniform thickness and bubble-free encapsulation. This stringent, automated quality control minimizes human error, dramatically improving the overall reliability and longevity of the light strips, which is critical for their specified use in challenging outdoor and wet indoor locations.

The economic impact of AI integration manifests through improved energy efficiency and reduced operational costs for large-scale deployments. By continuously analyzing environmental data and usage patterns, AI-driven smart controllers can precisely regulate power delivery to the strips, preventing overheating and optimizing performance curves, thus conserving energy beyond standard LED savings. This predictive optimization extends the service interval of the strips, particularly those installed in hard-to-reach exterior locations, reducing the frequency and expense associated with maintenance and replacement. Consequently, as the sophistication of integrated AI features increases, manufacturers can position their products at a premium, justifying the higher initial cost through demonstrated long-term savings and superior functional performance, thereby shifting the market dynamics towards intelligent, durable lighting solutions.

- AI enables real-time environmental responsiveness, adjusting brightness and color based on ambient light and weather conditions.

- Predictive maintenance algorithms analyze performance data to flag potential failures in harsh environments, reducing downtime.

- Machine learning enhances manufacturing quality control by performing high-speed visual inspection of encapsulation for IP integrity.

- AI-driven controllers optimize energy consumption by learning and automating complex illumination patterns based on occupancy and historical data.

- Intelligent systems facilitate personalized user experiences and dynamic artistic lighting effects in commercial architectural applications.

DRO & Impact Forces Of Waterproof Light Strip Market

The Waterproof Light Strip Market is significantly shaped by a confluence of accelerating drivers, structural restraints, and emerging opportunities, collectively defining the competitive landscape and growth potential. Primary market drivers include the rapid expansion of the global construction and infrastructure sector, particularly in emerging economies, where demand for durable and energy-efficient lighting solutions for new buildings and public spaces is surging. Coupled with this is the increasing consumer interest in DIY and smart home renovations, where easy-to-install, flexible waterproof strips are highly valued for accent lighting and functional illumination in wet zones. Restraints, conversely, pose challenges, notably the susceptibility of low-cost, low-quality imports to premature failure due to poor encapsulation materials or inadequate thermal management, which erodes consumer trust and necessitates stricter regulatory standards. Furthermore, the reliance on petroleum-derived components for encapsulation materials exposes the market to volatility in raw material pricing, challenging stable cost structures for manufacturers.

Opportunities for market players are vast, stemming primarily from the continuous advancement in material science, particularly the development of superior, non-yellowing, UV-resistant silicones and polyurethanes that can withstand extreme temperature variations and prolonged outdoor exposure without degrading the light output. Another critical opportunity lies in the specialization of products for high-demand, niche sectors such as marine lighting, agriculture (grow lights with specific IP ratings), and medical facilities, requiring ultra-hygienic and robust solutions. The transition towards sustainable manufacturing practices and the development of truly circular LED products also represent a long-term growth avenue, appealing to environmentally conscious consumers and corporations. The interplay of these factors—high-growth drivers countered by cost and quality restraints, alongside transformative technological opportunities—creates a highly dynamic market environment where strategic innovation in product design and supply chain resilience are crucial for success.

The impact forces within this market are predominantly concentrated on technological disruption and regulatory pressure. The steady increase in the lumens-per-watt efficacy of LEDs and the transition from traditional SMD to COB technology exert constant upward pressure on performance expectations. Concurrently, global impact forces related to climate change mitigation and energy security are necessitating stricter governmental mandates for energy-efficient lighting (e.g., phase-out of traditional high-intensity discharge lamps), thereby favoring the adoption of advanced LED solutions like waterproof strips. These technological and regulatory forces compel manufacturers to invest heavily in R&D not just for luminescence but specifically for ensuring the longevity and consistent performance of the protective waterproofing layer under real-world stress, making robust IP certification and validated reliability a key competitive differentiator and an essential market entry barrier for substandard products.

Segmentation Analysis

The Waterproof Light Strip Market is extensively segmented based on criteria such as the type of LED technology utilized, the ingress protection (IP) rating, the material used for encapsulation, and the end-use application. Understanding these segmentations is vital for manufacturers to tailor product development and market strategies effectively, targeting specific functional requirements—from low-level humidity resistance (IP65) needed in indoor kitchens to complete submersion resistance (IP68) required for pool or marine applications. Key segmentation reveals distinct purchasing behaviors and performance priorities across different user bases, such as commercial entities valuing high color rendering index (CRI) and longevity, versus residential consumers prioritizing ease of installation and smart control integration. The technological segmentation, particularly between SMD and COB, dictates the aesthetic output, with COB rapidly gaining traction in high-end decorative and architectural projects where seamless, uniform light diffusion is desired.

Further breakdown by encapsulation material highlights a critical technical differentiation point in the market. Silicone is often favored for its superior flexibility, high-temperature resistance, and excellent UV stability, making it ideal for outdoor, exposed environments where plasticized materials would quickly degrade. Epoxy resin, while offering good waterproofing at a lower cost, may be less resistant to yellowing over time, restricting its use primarily to indoor or covered outdoor applications. Polyurethane (PU), representing a middle ground, offers a balance of durability and flexibility, often used in professional-grade, medium-to-high IP rated strips. This material variance directly impacts product lifespan and application suitability, driving material innovation as companies strive for environmentally friendlier and more robust encapsulation methods that enhance light transparency and thermal management properties simultaneously.

Application-based segmentation provides the clearest view of demand drivers. The residential segment remains robust, capitalizing on renovations and DIY trends. However, the commercial segment, encompassing retail, hospitality, and corporate offices, is experiencing the fastest growth due to the demand for sophisticated, energy-efficient lighting that enhances ambiance and brand visibility. Architectural lighting, which requires highly durable, customizable, and precisely controlled waterproof strips for building facades and landscape features, represents a lucrative, high-margin niche. Analyzing these distinct segments allows market participants to refine their sales channels and value propositions, focusing on tailored product features—such as specific color temperatures for retail food displays or marine-grade anticorrosion properties—to capture specialized market share and maximize return on investment.

- By Technology:

- Surface Mounted Device (SMD) LED Strips

- Chip-on-Board (COB) LED Strips

- Diode LED Strips

- By Encapsulation Material:

- Silicone Encapsulation

- Epoxy Resin Encapsulation

- Polyurethane (PU) Encapsulation

- PVC/Rubber Encapsulation

- By IP Rating:

- IP65 (Water Jet Resistant)

- IP67 (Temporary Submersion Resistant)

- IP68 (Continuous Submersion Resistant)

- By Application:

- Residential Lighting (Kitchen, Bathroom, Patio)

- Commercial Lighting (Retail, Hospitality, Office)

- Architectural Lighting (Facade, Landscape, Bridges)

- Industrial Lighting (Cold Storage, Machine Vision)

- Automotive and Marine Lighting (Exterior and Specialty Uses)

- By Voltage Type:

- Low Voltage (12V/24V)

- High Voltage (110V/220V)

Value Chain Analysis For Waterproof Light Strip Market

The value chain for the Waterproof Light Strip Market initiates with upstream activities, dominated by the sourcing and manufacturing of critical raw components. This includes the production of high-efficiency LED chips (typically sourced from major semiconductor firms), flexible Printed Circuit Boards (PCBs), and, critically, the specialized encapsulation materials such as industrial-grade silicone, epoxy, or PU. Pricing and availability of these upstream components—particularly the LED chips and high-quality chemical sealants—significantly dictate the final product cost and performance, emphasizing the importance of securing reliable supply agreements with component manufacturers in regions like East Asia. Furthermore, the design phase, involving thermal management solutions and specific driver circuitry tailored for moisture resistance, is a critical value-add activity performed by specialized lighting engineers, ensuring product longevity and consistent color quality under strenuous operational conditions.

Midstream activities involve the core manufacturing and assembly process. This stage is highly complex for waterproof strips, requiring specialized automated machinery for precision component placement (SMD/COB mounting) and, most importantly, the precise injection, potting, or extrusion of the waterproofing material. Achieving a consistent, hermetic seal that meets high IP standards (IP67/IP68) is the primary value-adding process here, distinguishing premium products from mass-market alternatives. Rigorous quality control testing, including water pressure and temperature cycling tests, is mandatory before products move to the downstream distribution phase. The scale of manufacturing in regions like China and Taiwan provides cost efficiencies, but high-end manufacturers often retain key encapsulation processes in-house or in high-tech facilities to ensure proprietary quality standards and material curing protocols are met.

Downstream analysis focuses on channels of distribution and market penetration. Distribution channels are bifurcated into direct sales, primarily targeting large commercial, architectural, and government projects through specialized lighting contractors, and indirect sales, which utilize wholesalers, electrical distributors, e-commerce platforms (crucial for the DIY and smaller residential markets), and specialty retailers. The rise of e-commerce has dramatically influenced this market, lowering entry barriers for smaller brands and increasing price transparency, especially for standard IP65 residential strips. However, high-specification products (e.g., custom marine or industrial lighting) continue to rely on indirect distribution through expert integrators who provide installation, technical support, and warranty services, effectively bridging the gap between sophisticated technology and complex end-user requirements. This hybrid distribution strategy maximizes market reach while maintaining quality control and technical assurance for specialized applications.

Waterproof Light Strip Market Potential Customers

Potential customers for the Waterproof Light Strip Market span a wide array of industrial, commercial, and residential end-users whose operational environments necessitate reliable, water-resistant lighting solutions. The primary buyers include large architectural firms and lighting design consultants who specify high-end, custom IP67/IP68 strips for building facades, public fountains, swimming pool areas, and high-humidity interior spaces like spa and fitness centers. These customers prioritize color accuracy (high CRI), robust material composition, and long-term warranties, often purchasing directly from specialized manufacturers or authorized distributors capable of handling large, bespoke orders and providing technical integration support. The demand in this sector is driven by the desire for dynamic visual branding and increased property valuation through sophisticated illumination.

A second significant customer base comprises the Hospitality and Retail sectors. Hotels, restaurants, and luxury retail stores utilize waterproof strips extensively for accent lighting in restrooms, exterior signage, patio areas, and display cases, requiring flexibility and aesthetic appeal alongside water resistance. These buyers seek solutions that are easy to maintain, energy-efficient, and capable of integrating seamlessly with central building management systems for dynamic ambiance control. Furthermore, specialty industry end-users, such as boat manufacturers (marine lighting requiring saltwater resistance), automotive customizers (underglow and interior ambient lighting), and agricultural technology firms (controlled environment agriculture lighting systems), form high-value, niche customer segments that demand products meeting extreme durability and specific spectral requirements beyond general lighting specifications.

Finally, the vast residential segment, encompassing both professional installers and individual DIY consumers, constitutes a major volume driver. Homeowners and contractors frequently purchase IP65 rated strips for functional and decorative lighting in kitchens (under-cabinet), bathrooms (behind mirrors, shower niches), and outdoor entertainment areas (decks, pergolas). Price sensitivity and ease of installation are key factors influencing purchasing decisions in this segment, often leading to purchases via large home improvement retailers and online marketplaces. The rapid adoption of smart home ecosystems means these customers are increasingly seeking Wi-Fi or Bluetooth enabled waterproof strips, integrating lighting control directly into their home automation platforms for enhanced convenience and customization capabilities.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 billion |

| Market Forecast in 2033 | USD 10.5 billion |

| Growth Rate | CAGR 12.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Signify (Philips Lighting), OSRAM, 3M, LEDVANCE, WAC Lighting, American Lighting, Govee, Xiamen Opple Lighting, Eaton, Seoul Semiconductor, Lite-On Technology, Cree Lighting, Hubbell, Sylvania Lighting Solutions, Jesco Lighting, General Electric (GE) Lighting, Kichler Lighting, Lixada, AspectLED, Environmental Lights |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Waterproof Light Strip Market Key Technology Landscape

The technology landscape of the Waterproof Light Strip Market is characterized by continuous refinement in LED component architecture, flexible circuit design, and chemical material science focused on improved hermetic sealing and thermal dissipation. A central technological focus remains the shift from traditional SMD LEDs to Chip-on-Board (COB) technology. COB strips feature multiple small LED chips directly mounted onto the PCB, which is then covered by a uniform phosphor layer. This configuration significantly eliminates visible spotting or "dots" that are common in SMD strips, producing a continuous, linear light effect highly favored in high-end architectural applications. Furthermore, COB technology inherently offers better thermal management due to the concentrated placement and larger contact surface with the board, which is crucial for maintaining LED longevity when encapsulated in non-air-breathing, waterproof materials.

Another crucial element is the evolution of encapsulation materials and processes, which directly determines the Ingress Protection (IP) rating and overall durability. Advanced polymer chemistry has introduced specialized, highly translucent silicone and polyurethane compounds that resist yellowing under prolonged UV exposure and maintain flexibility across extreme temperatures. Manufacturers are investing heavily in automated potting and extrusion machinery that ensures uniform, void-free application of these materials, preventing microscopic pathways for water ingress. Innovative techniques, such as nano-coating technologies applied to the PCB before encapsulation, are also emerging to add an extra layer of defense against humidity and corrosive elements, targeting applications in demanding environments like coastal regions or industrial facilities.

The integration of IoT and smart control capabilities represents the third pillar of technological advancement. Modern waterproof light strips are increasingly being designed as part of integrated smart lighting ecosystems, necessitating compatibility with common protocols like Zigbee, Bluetooth Mesh, and Wi-Fi. This integration requires miniature, low-power control modules to be housed within the strip or its associated wiring, often demanding specialized waterproof connectors and highly efficient power supplies (drivers) capable of handling dynamic dimming and color changes (RGB, RGBW, Tunable White). The focus is on ensuring that the smart components maintain their integrity under the same harsh conditions as the LEDs themselves, driving innovation in miniaturization and ruggedized component design to facilitate seamless digital control in exterior and wet environments.

Regional Highlights

Regional dynamics play a vital role in shaping the demand and supply characteristics of the Waterproof Light Strip Market, with significant variances in consumer preferences, regulatory frameworks, and manufacturing capabilities observed across global territories.

- Asia Pacific (APAC): APAC is the dominant market in terms of both manufacturing base and consumption volume, driven by countries like China, South Korea, and Japan. China serves as the global hub for LED chip production and light strip assembly, offering unparalleled scale and cost competitiveness. The rapid urbanization, coupled with significant governmental investments in smart city infrastructure and high-profile architectural projects across emerging economies like India and Southeast Asia, fuels massive domestic demand for robust outdoor and facade lighting solutions. Furthermore, the region’s strong presence in the marine and automotive manufacturing sectors creates consistent specialized demand.

- North America: This region exhibits high adoption rates for premium, high-specification waterproof light strips, particularly those integrated with smart home technology (e.g., compatibility with Amazon Alexa or Google Home). The market is characterized by high consumer spending power, strong emphasis on energy efficiency (driven by codes like California Title 24), and a robust residential renovation market. Demand is strong in outdoor landscaping, pool areas, and high-end commercial hospitality applications, with a preference for high CRI and long warranty periods, often necessitating IP67 or IP68 rated products.

- Europe: Europe is characterized by stringent regulatory environments concerning energy performance (ErP Directive) and material safety, pushing demand towards highly certified, durable, and sustainable products. Countries like Germany and the UK lead in architectural and urban infrastructure lighting upgrades, where waterproof strips are used extensively for accentuating historical buildings and public spaces. The focus here is on product longevity, recyclability, and compliance with EU standards for electromagnetic compatibility (EMC) and ingress protection. The marine industry in countries bordering the Mediterranean and North Sea also contributes a steady demand for specialized, anticorrosive waterproof lighting.

- Latin America (LATAM): The LATAM market is growing steadily, propelled by increasing residential and commercial construction, particularly in major economies like Brazil and Mexico. Demand is generally more price-sensitive than in North America or Europe, leading to a strong presence of mid-range, IP65-rated products. Market growth is closely tied to economic stability and investment in tourism infrastructure, where waterproof lighting is crucial for hotel exteriors, resorts, and coastal property developments.

- Middle East and Africa (MEA): The MEA region, particularly the Gulf Cooperation Council (GCC) countries, represents a high-potential market driven by mega-construction projects and rapid urban development in cities like Dubai, Riyadh, and Doha. The extreme heat and high UV exposure necessitate ultra-durable, UV-resistant encapsulation materials. Large-scale architectural lighting, often using customized, high-brightness waterproof strips for iconic structures and luxury developments, is a primary driver, alongside demand for industrial lighting in oil, gas, and petrochemical facilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Waterproof Light Strip Market.- Signify (Philips Lighting)

- OSRAM

- 3M

- LEDVANCE

- WAC Lighting

- American Lighting

- Govee

- Xiamen Opple Lighting

- Eaton

- Seoul Semiconductor

- Lite-On Technology

- Cree Lighting

- Hubbell

- Sylvania Lighting Solutions

- Jesco Lighting

- General Electric (GE) Lighting

- Kichler Lighting

- Lixada

- AspectLED

- Environmental Lights

Frequently Asked Questions

Analyze common user questions about the Waterproof Light Strip market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the difference between IP65, IP67, and IP68 rated waterproof light strips?

The IP rating specifies the degree of protection against solids and liquids. IP65 protects against dust and low-pressure water jets; IP67 is protected against dust and temporary immersion (up to 1 meter for 30 minutes); and IP68 offers protection against dust and continuous, indefinite submersion under specified pressure, making it ideal for underwater use.

Which encapsulation material is best for UV resistance and longevity in outdoor applications?

Silicone encapsulation is generally considered superior for outdoor use. It offers excellent resistance to UV radiation, maintains flexibility across wide temperature ranges, and is less prone to yellowing or cracking compared to standard epoxy resins, ensuring stable light transmission over the product's lifespan.

Are waterproof light strips compatible with smart home ecosystems like Zigbee or Wi-Fi?

Yes, modern waterproof light strips are increasingly designed to be compatible with smart home platforms. Integration usually occurs via a dedicated waterproof controller module utilizing protocols such as Wi-Fi, Bluetooth Mesh, or Zigbee, enabling remote control, dynamic scene setting, and automation via voice assistants.

What is Chip-on-Board (COB) technology, and why is it replacing traditional SMD in premium waterproof strips?

COB technology mounts multiple tiny LED chips directly onto the PCB, resulting in a continuous, dot-free illumination line. This technology is favored in premium waterproof strips because it offers superior light uniformity, better heat dissipation, and a higher aesthetic quality essential for high-end architectural and decorative lighting projects.

What voltage is safer or more efficient for large outdoor installations of waterproof light strips?

Low voltage (12V or 24V) is significantly safer, particularly in wet environments, minimizing electrical risk. While low voltage requires more frequent power injection points to prevent voltage drop over long runs, it is the standard for robust, safe, and energy-efficient outdoor and specialty installations.

The Waterproof Light Strip Market is witnessing profound technological shifts, driving demand for solutions that offer not only resilience against environmental factors but also sophisticated control capabilities. The shift towards higher IP ratings, primarily IP67 and IP68, is mandatory for expansion into high-growth sectors such as marine, pool, and demanding architectural facade lighting. Manufacturers are continually refining proprietary silicone and polyurethane compounds to ensure superior light transmission, anti-yellowing properties, and resistance to chemical degradation, addressing one of the core restraints related to long-term reliability. Furthermore, the integration of advanced thermal management solutions directly into the flexible PCB is crucial, particularly for high-density COB strips, to maintain the operational efficiency and rated lifespan of the LEDs under the restrictive, non-ventilated conditions imposed by the waterproofing encapsulation. The global competition remains fierce, focusing on balancing cost-effective manufacturing, particularly in APAC, with the premium quality, customization, and warranty support demanded by North American and European commercial clients. Future market success is predicated on delivering fully integrated smart lighting solutions that are robustly engineered to withstand diverse and challenging outdoor environments while providing seamless digital control and optimizing energy utilization through advanced AI-driven systems.

Innovation in connectivity also forms a critical part of the market’s evolution, moving beyond simple on/off functionality to comprehensive networked lighting systems. This necessitates the development of miniature, ruggedized drivers and connectors that can survive the same environmental stresses as the strip itself. The adoption of localized mesh networks, such as Bluetooth Mesh, is gaining prominence, allowing vast arrays of waterproof strips to communicate dynamically over large installations—such as complex building facades or expansive public parks—without relying on extensive, vulnerable wired infrastructure. Regulatory alignment, especially concerning electromagnetic interference (EMI) and product safety, continues to mature, forcing compliance standards that favor reputable manufacturers capable of meeting global certification requirements, thereby acting as a filter against low-quality entrants. This interplay of enhanced material science, sophisticated electronic integration, and adherence to rising regulatory benchmarks defines the market’s strategic trajectory towards providing high-performance, resilient, and intelligent illumination systems across all major application sectors, solidifying the light strip’s position as a foundational element of modern lighting design.

The demand from specialized industrial customers, often overlooked in mainstream analysis, presents a sustained growth opportunity. For instance, in controlled environment agriculture (CEA), waterproof and chemical-resistant light strips are essential for delivering precise photosynthetic active radiation (PAR) spectra in high-humidity settings where traditional fixtures fail. Similarly, in hygienic environments, such as commercial kitchens or certain medical areas, the easy-to-clean, sealed nature of the light strip provides an advantage over traditional exposed fixtures. Addressing these niche needs requires highly customized R&D in both material formulation—to resist specific chemicals or cleaning agents—and spectral output. Strategic partnerships between lighting manufacturers and system integrators specializing in these vertical markets will be key to unlocking this high-value, low-volume segment. Ultimately, the market narrative is centered on transitioning from merely waterproof lighting to functionally intelligent, hyper-durable lighting systems that offer comprehensive reliability and advanced control irrespective of environmental adversity.

Market segmentation by voltage type further elucidates application differences. Low voltage (12V/24V) strips dominate the consumer, automotive, and fine architectural lighting sectors due to their inherent safety, smaller size, and ease of cutting/installation. However, high voltage (110V/220V) strips, which can run significantly longer distances without suffering voltage drop and thus requiring fewer external power supplies, maintain relevance in large commercial or industrial runs where minimizing component count and installation complexity outweighs the need for extra-low voltage safety, provided they are professionally installed and terminated with utmost attention to waterproofing and electrical safety standards. The trend, however, is leaning towards highly efficient low-voltage systems, often augmented by sophisticated power management electronics to minimize voltage drop over extended lengths, combining safety with functional reach. This technological refinement enhances the overall applicability of low-voltage waterproof strips across increasingly larger and more demanding projects, directly competing with and often outperforming high-voltage alternatives through superior control and safer operation.

The impact of sustainability and circular economy principles is also beginning to penetrate the waterproof light strip value chain. Traditionally, the inseparable bonding of the LED chips, PCB, and encapsulation materials has made these products difficult to recycle effectively. Growing consumer and corporate demand for eco-friendly products is pressuring manufacturers to research and implement modular designs or develop encapsulation materials that are either bio-degradable or easily separable from the electronic components at the end of the product life. While full circularity remains a challenge given the requirement for hermetic sealing, incremental innovations in material sourcing, such as using recycled polymers for protective casing or reducing hazardous substances, are becoming competitive differentiators. Companies prioritizing environmental certifications and transparency in their supply chain are expected to capture the attention of high-value governmental and corporate buyers with strong internal sustainability mandates, driving a strategic realignment in product design towards "green" waterproofing solutions.

Competition in the global waterproof light strip market is not just defined by product features but increasingly by distribution efficiency and service delivery. The logistical challenge of maintaining high quality standards for custom-length orders, coupled with the necessity for specialized, waterproof connectors and installation accessories, means that a manufacturer's ability to offer comprehensive, project-specific support is a key competitive edge, particularly in the architectural segment. This includes providing detailed photometric data, thermal simulations, and rigorous in-field technical support. The successful players are those who leverage both global manufacturing scale for cost efficiency and strong regional distribution networks managed by expert technical teams to ensure perfect installation and long-term performance validation, effectively mitigating the risks associated with installing complex, sensitive electronics in harsh environments.

Furthermore, the legal and intellectual property landscape is becoming increasingly complex. As the market matures, patent litigation related to LED chip efficiency, thermal management systems, and proprietary encapsulation formulas is on the rise. Manufacturers must allocate significant resources to R&D and securing intellectual property rights, not only to protect their innovative designs but also to navigate the complex web of existing patents, especially in the US and Europe. This legal environment favors established market leaders who possess extensive patent portfolios and the financial capacity to defend or acquire licenses for critical technologies, potentially increasing the entry barriers for new players relying solely on low-cost generic products. This strategic focus on IP ensures that market dominance is secured not just through aggressive pricing but through proprietary technological superiority and guaranteed product authenticity, a critical factor for professional buyers who rely on certified and traceable components for their complex projects.

Finally, emerging markets within the MEA and LATAM regions continue to present unique growth opportunities, requiring manufacturers to adapt their product specifications to local conditions. For instance, in the Gulf region, the extremely high ambient temperatures necessitate superior heat-resistant materials and thermal design to prevent premature failure. Conversely, regions prone to high humidity and salt spray, particularly coastal areas in Latin America, require specific anticorrosion treatments for external casings and connectors, often driving demand for specialty marine-grade materials. Successful market penetration in these geographically diverse areas requires a modular manufacturing approach that allows for rapid customization of protective elements and power supply units to align with local electrical standards and specific environmental demands, proving that product localization is a necessary strategy for maximizing global market share beyond the core established regions.