Waterproof Pillow Protector Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442727 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Waterproof Pillow Protector Market Size

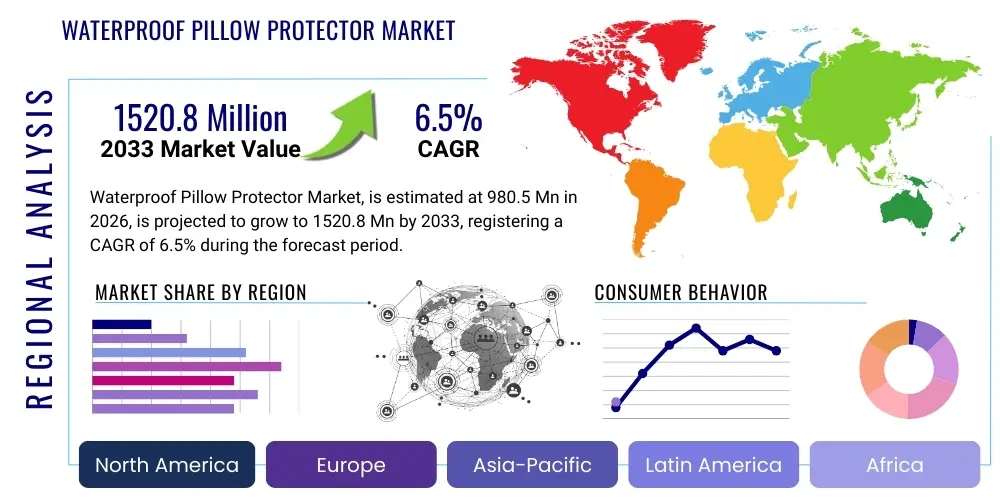

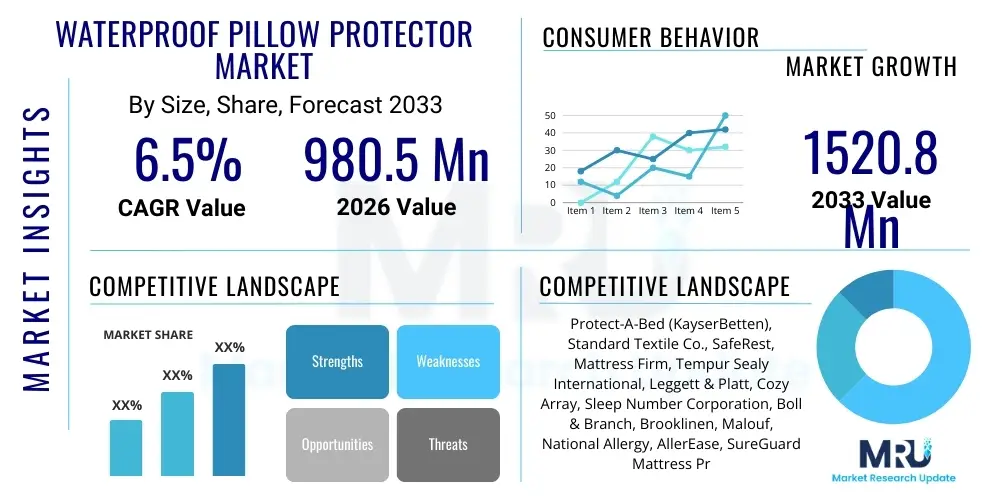

The Waterproof Pillow Protector Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 980.5 Million in 2026 and is projected to reach USD 1520.8 Million by the end of the forecast period in 2033.

Waterproof Pillow Protector Market introduction

The Waterproof Pillow Protector Market encompasses the sales and distribution of protective coverings designed to safeguard pillows against moisture, spills, allergens, dust mites, and bacteria, thereby extending the pillow's lifespan and maintaining hygiene. These products are manufactured using materials such as polyurethane laminates (PUL), vinyl, or specialized treated fabrics like Tencel and polyester blends, which offer impermeable barriers while retaining breathability and comfort. The core function is crucial in settings prioritizing sanitation, notably residential bedrooms, healthcare facilities, and the expansive hospitality sector.

Major applications of waterproof pillow protectors span both the B2C (Residential) and B2B (Commercial) segments. In residential settings, they are increasingly viewed as essential bedding items, driven by greater awareness regarding dust mite allergies and the necessity of preventing liquid damage, especially in households with children or pets. Commercially, hospitals, clinics, hotels, and long-term care facilities rely heavily on these protectors to comply with stringent hygiene standards, reduce operational costs associated with frequent pillow replacement, and enhance guest/patient experience by ensuring a clean sleeping environment. The rise in health consciousness post-pandemic has further amplified the perceived value and adoption rate of these protective accessories globally.

The market growth is primarily fueled by several key factors, including the global expansion of the travel and tourism industry which necessitates high-quality, easily maintainable bedding solutions in hotels. Furthermore, rising incidents of asthma and allergy cases are driving consumers to seek effective barriers against common allergens like dust mites and pet dander encapsulated within pillows. Technological advancements in textile manufacturing, leading to thinner, quieter, and more comfortable waterproof membranes, are successfully overcoming previous consumer resistance related to discomfort or noise, significantly boosting market uptake across various demographic groups.

Waterproof Pillow Protector Market Executive Summary

The Waterproof Pillow Protector Market is poised for substantial expansion, driven by converging trends in consumer health awareness, the stringent hygiene requirements of commercial sectors, and material innovation. Business trends indicate a shift towards eco-friendly and sustainable materials, such as bamboo-derived fabrics and recycled polyester, appealing to environmentally conscious consumers. E-commerce platforms are dominating distribution, offering convenience and a wide range of product comparisons, enabling smaller, specialized brands to compete effectively with established bedding manufacturers. Strategic mergers and acquisitions aimed at supply chain consolidation and intellectual property acquisition regarding breathable waterproofing technologies are characterizing the competitive landscape, ensuring rapid deployment of next-generation products.

Regionally, North America and Europe currently represent the most mature markets due to high disposable incomes, established hygiene standards, and robust healthcare and hospitality sectors. However, the Asia Pacific (APAC) region is projected to register the fastest growth rate. This rapid expansion is attributed to fast urbanization, the burgeoning middle class in countries like China and India, increased spending on home furnishings, and the rapid development of large-scale hotel chains to accommodate growing tourism. Governments in APAC are also increasingly implementing public health campaigns that inadvertently boost the demand for hygienic bedding solutions.

Segment-wise, the commercial application segment, particularly encompassing healthcare and hospitality, holds a dominant market share due to bulk purchasing and mandatory replacement cycles. Nevertheless, the residential segment is showing accelerated growth, largely attributed to specialized sub-segments such as 'premium' or 'luxury' protectors utilizing advanced materials like Tencel, which command higher price points. By material, polyester blends with polyurethane laminates (PUL) remain highly popular due to their cost-effectiveness and proven performance, although the cotton material segment is growing steadily as consumers seek natural, breathable fabric options for superior comfort.

AI Impact Analysis on Waterproof Pillow Protector Market

Common user questions regarding AI's impact on the Waterproof Pillow Protector Market primarily revolve around personalized product recommendations, optimizing manufacturing efficiency, and predicting supply chain disruptions. Users are keen to know if AI can design protectors based on individual sleep patterns (e.g., side sleeper vs. back sleeper sweat profiles) or if it can enhance the anti-microbial properties through data-driven material selection. Key themes emerging from these inquiries include the potential for AI-driven automated quality control systems to ensure flawless waterproofing membranes, the utilization of machine learning algorithms to forecast seasonal demand spikes accurately for raw materials (like polyurethane or specialized fibers), and the development of intelligent, sensor-equipped bedding systems that might integrate passive environmental monitoring, thereby elevating the pillow protector from a simple barrier to a data-generating health accessory.

- AI optimizes supply chain logistics, predicting raw material cost fluctuations (e.g., polymers, cotton) and mitigating procurement risks.

- Generative AI models assist in designing functional textiles, simulating breathability and waterproofing performance before physical prototyping, reducing R&D costs.

- Machine learning algorithms enhance quality control during lamination and stitching processes, identifying microscopic flaws in the waterproof membrane in real-time.

- Predictive maintenance schedules for manufacturing machinery are optimized by AI, minimizing downtime and increasing overall production throughput.

- AI-driven e-commerce personalization engines recommend specific pillow protector types (e.g., cooling, anti-allergy, heavy-duty commercial) based on detailed consumer purchasing history and demographic data.

- Chatbots and AI customer support systems provide instant troubleshooting for common issues like care instructions, boosting customer satisfaction and reducing return rates.

DRO & Impact Forces Of Waterproof Pillow Protector Market

The Waterproof Pillow Protector Market is significantly influenced by a blend of health-driven consumer preferences (Drivers), cost sensitivity and sustainability challenges (Restraints), and burgeoning market opportunities in specialized applications (Opportunities). The primary driver remains the increased global awareness of health, hygiene, and allergen management, directly translating into higher demand for protective bedding. Restraints primarily involve the presence of low-quality, inexpensive imports that compromise consumer trust regarding long-term waterproofing performance, alongside the consumer perception that premium waterproof materials are often noisy or uncomfortable. However, substantial opportunities exist in developing highly sustainable, bio-based waterproof membranes and targeting niche markets such as geriatric care and high-end luxury hospitality where specialized performance characteristics are valued over basic cost savings. These dynamics shape the competitive environment, pushing manufacturers toward innovation in material science and enhanced retail strategies.

Impact forces within the market are predominantly centered on regulatory mandates, technological advancements, and shifts in consumer purchasing behavior. Regulatory bodies, particularly in healthcare and institutional settings, exert significant force by demanding products that meet strict flammability and hygiene standards. Technologically, the ongoing effort to create silent, ultra-thin, yet highly effective waterproof barriers is crucial; companies that master this balance gain a competitive edge. Economically, inflation and raw material price volatility affect manufacturing costs, which are partially absorbed or passed onto consumers, influencing the accessibility of different product tiers. Socially, the increasing trend of professional home cleaning and organization services implicitly recommends and utilizes protective bedding, further embedding waterproof protectors into standard household practices.

The market’s direction is heavily weighted towards meeting the dual consumer demand for hygiene and environmental responsibility. Manufacturers investing in circular economy practices—using recycled materials or developing fully biodegradable polymers for the membrane—are positioned to capitalize on future growth. The competitive force from large bedding retailers entering the private-label protector market also pressures existing specialized brands to continuously innovate in performance features rather than competing solely on price. Ultimately, the success of market participants hinges on their ability to overcome the traditional constraints associated with waterproof materials while effectively communicating the significant health benefits of their products.

Segmentation Analysis

The Waterproof Pillow Protector Market is comprehensively segmented based on material, application, type, and distribution channel, providing a granular view of consumer preferences and industry adoption patterns. Segmentation by material is vital as it directly influences product cost, comfort, and efficacy, differentiating between cost-effective synthetic solutions and premium natural blends. Application segmentation highlights the divergence between high-volume, durability-focused commercial needs and comfort-driven residential demands. Analyzing these segments is crucial for strategic market positioning and product portfolio management, allowing companies to tailor manufacturing processes and marketing campaigns to specific end-user requirements and procurement cycles.

- By Material:

- Cotton (Terry, Jersey Knit)

- Polyester (Microfiber, Knit)

- Polyurethane Laminate (PUL)

- Vinyl

- Tencel/Bamboo Blends

- Others (e.g., Nylon)

- By Application:

- Residential

- Commercial/Institutional (Hospitality, Healthcare, Dormitories, Long-Term Care)

- By Type:

- Zippered Encasement (Six-sided protection)

- Fitted (Cap Style, five-sided protection)

- Pillowcase Style

- By Distribution Channel:

- Online (E-commerce platforms, Direct-to-Consumer Websites)

- Offline (Retail Stores, Department Stores, Specialty Bedding Stores, Wholesalers)

Value Chain Analysis For Waterproof Pillow Protector Market

The value chain for the Waterproof Pillow Protector Market begins with upstream activities involving raw material procurement, focusing primarily on textile fibers (cotton, polyester, Tencel) and chemical components necessary for the waterproof membranes (PUL, vinyl). Key upstream suppliers include chemical manufacturers specializing in polymer technology and textile mills providing specialized knitting or weaving services. Efficiency in this stage is critical, as the quality, breathability, and waterproofing standards of the final product are determined here. Strategic partnerships with suppliers capable of providing certified eco-friendly or hypoallergenic materials offer a competitive advantage and ensure consistency in membrane lamination quality.

Midstream processes involve manufacturing, encompassing fiber preparation, membrane lamination (adhering the waterproof layer to the fabric), cutting, and stitching into the final pillow protector forms (zippered encasements or fitted styles). This stage is capital-intensive, requiring specialized machinery for seamless heat-sealing and high-speed sewing, particularly for fully encasing zippered products that demand precision fit and robust seams to prevent liquid ingress. Companies often locate these manufacturing hubs near raw material sources or close to major distribution ports to minimize logistical costs and lead times. Quality assurance protocols, especially non-destructive testing of the waterproof barrier, are rigorously applied at this stage to maintain brand integrity and meet industry certifications.

Downstream activities center on distribution and sales. The distribution channel is bifurcated into direct and indirect routes. Direct distribution involves sales through proprietary brand websites (D2C) or directly to large commercial clients (e.g., hotel chains, hospital purchasing groups), offering higher margins and greater control over branding. Indirect distribution relies heavily on mass retailers, specialized bedding stores, and increasingly, major e-commerce marketplaces like Amazon and specialized home goods websites. E-commerce platforms, in particular, serve as the primary conduit for residential sales, demanding optimized logistics, efficient fulfillment, and high-quality digital content to drive conversion. Wholesalers and distributors play a critical role in bridging the gap between manufacturers and smaller independent retailers and institutions.

Waterproof Pillow Protector Market Potential Customers

Potential customers, or end-users and buyers, of waterproof pillow protectors span a wide spectrum, categorized primarily into residential and commercial buyers, each with distinct purchase motivations and volume requirements. Residential buyers are highly sensitive to comfort, breathability, noise, and ease of care, purchasing typically in lower volumes (2-4 units per transaction). Key segments within residential buyers include individuals suffering from allergies (seeking dust mite and dander protection), parents of young children (concerned with spills and bedwetting), and consumers investing in high-end pillows who wish to maximize product longevity and maintain warranties. They predominantly utilize online research and e-commerce channels for procurement, prioritizing detailed product reviews and health certifications.

The commercial segment represents high-volume buyers whose purchasing decisions are driven by durability, compliance with hygiene standards, bulk pricing, and ease of institutional laundering. This segment includes the vast network of hotels, motels, and cruise lines globally, where minimizing pillow replacement costs and ensuring superior guest hygiene are operational priorities. Furthermore, healthcare facilities—hospitals, nursing homes, and assisted living centers—constitute a critical customer base, relying on zippered, fully encased protectors to manage bodily fluids, ensure infection control, and facilitate rapid, effective cleaning protocols mandated by health regulations. University dormitories and military housing also represent significant, periodic institutional buyers focusing on resilient and cost-effective solutions capable of withstanding industrial laundering cycles.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 980.5 Million |

| Market Forecast in 2033 | USD 1520.8 Million |

| Growth Rate | CAGR 6.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Protect-A-Bed (KayserBetten), Standard Textile Co., SafeRest, Mattress Firm, Tempur Sealy International, Leggett & Platt, Cozy Array, Sleep Number Corporation, Boll & Branch, Brooklinen, Malouf, National Allergy, AllerEase, SureGuard Mattress Protectors, Lucid, Linenspa, BedCare, Slumber Cloud, Bamboo Protector, Nest Bedding |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Waterproof Pillow Protector Market Key Technology Landscape

The technology landscape for the Waterproof Pillow Protector Market is dominated by advancements in polyurethane lamination (PUL) and microfiber textile engineering, focusing on maximizing the trade-off between impermeability and breathability. Modern waterproofing techniques increasingly employ micro-porous membrane technology, where the laminate features microscopic pores small enough to block liquid droplets and dust mites, yet large enough to allow air molecules and vapor (perspiration) to pass through. This development directly addresses the historical consumer complaint regarding overheating and the crinkling sound associated with older vinyl protectors, significantly enhancing user comfort and boosting premium market adoption. Furthermore, seamless bonding techniques and ultrasonic welding are being adopted to replace traditional stitching, which often creates weak points where water and allergens can potentially penetrate, thereby ensuring superior, long-term integrity of the protection barrier.

A second critical technological focus involves integrating enhanced hygienic features into the fabric itself. This includes the use of silver ion technology and other encapsulated anti-microbial treatments applied directly to the textile surface. These treatments inhibit the growth of bacteria and mold, offering an additional layer of hygiene protection, which is particularly valued in clinical and high-humidity environments. Furthermore, companies are exploring textile blends incorporating natural fibers like Tencel (lyocell), derived from wood pulp, which inherently offer superior moisture-wicking and thermal regulation properties. Blending these materials with synthetic fibers allows manufacturers to create hybrid products that provide high performance alongside a soft, natural hand feel, commanding premium pricing and positioning them as sustainable, high-value alternatives to standard polyester offerings.

Innovation also extends into the fit and closure mechanisms of the protectors. Developments include the use of auto-locking, rust-proof zippers for encasement styles and patented elastic systems for fitted protectors that ensure a secure, tight fit without slipping, regardless of pillow density or size variance. Given the robust requirements of institutional laundering, material technology must also incorporate durability enhancers, ensuring the waterproof membrane withstands repeated exposure to high temperatures and aggressive cleaning chemicals without delamination or performance degradation. Ongoing R&D is heavily focused on developing bio-based or fully compostable polymers for the waterproof layer, aligning with the global push for reduced plastic waste and addressing sustainability concerns among core consumer groups.

Regional Highlights

The global Waterproof Pillow Protector Market exhibits varied growth trajectories across key geographical regions, reflecting differences in hygiene standards, consumer spending power, and the maturity of commercial sectors like hospitality and healthcare. North America, encompassing the United States and Canada, currently holds the largest market share. This dominance is attributed to high consumer awareness regarding health and allergy issues, high discretionary spending on premium bedding products, and the presence of stringent regulatory standards for bedding used in institutional and clinical environments. The region is characterized by a mature retail infrastructure, strong e-commerce penetration, and widespread adoption of specialized anti-allergy products, driving continuous demand for high-performance, comfortable pillow protectors.

Europe represents the second-largest market, exhibiting steady growth propelled by a similar focus on health and sustainability. Countries such as Germany, the UK, and France show high adoption rates, particularly for organic and natural fiber-based protectors (like Tencel and cotton), reflecting strong consumer preference for environmentally responsible products. The robust European hospitality sector, coupled with aging populations requiring enhanced care and hygiene solutions in long-term care facilities, consistently supports the commercial segment. Market fragmentation exists, however, with varying consumer preferences regarding price sensitivity and material selection across Southern, Western, and Nordic European nations.

Asia Pacific (APAC) is forecast to be the fastest-growing region during the forecast period. This rapid expansion is fueled by unprecedented growth in urbanization, rising disposable incomes, and the massive expansion of the hotel industry, particularly in fast-developing economies such as China, India, and Southeast Asian nations. While price sensitivity remains a factor in certain mass markets, the burgeoning middle and affluent classes are increasingly prioritizing western standards of hygiene and comfort, driving demand for both basic and premium waterproof products. Local manufacturing bases are scaling up to meet this internal demand, often introducing innovative, regionally specific designs that optimize for tropical climates.

Latin America (LATAM) and the Middle East & Africa (MEA) currently hold smaller market shares but offer significant future growth potential. In LATAM, economic stability improvements and increased foreign investment are gradually boosting consumer spending on home goods, driving residential demand. In the MEA region, particularly the Gulf Cooperation Council (GCC) countries, significant government investment in high-end tourism infrastructure and healthcare facilities is driving substantial growth in the commercial application segment. Local manufacturers in these regions often focus on robust, highly durable protectors suitable for high temperatures and specific humidity levels.

- North America (Dominant Market): High consumer awareness of allergen control; robust institutional demand from healthcare and hospitality; leading adoption of premium, breathable waterproof technologies.

- Europe (Mature & Sustainability Focused): Strong preference for natural and eco-friendly materials (e.g., Tencel); stringent healthcare hygiene regulations; strong presence of aging care facilities driving commercial bulk purchasing.

- Asia Pacific (Fastest Growth): Rapid growth in urbanization and middle-class income; massive expansion of the tourism and hotel industry; increasing penetration of e-commerce platforms facilitating widespread distribution.

- Latin America (Emerging Market): Improving economic conditions increasing consumer spending on bedding accessories; growing awareness of home hygiene practices.

- Middle East & Africa (Strategic Commercial Growth): Driven by substantial government investment in luxury hospitality and specialized medical infrastructure, especially in the GCC states.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Waterproof Pillow Protector Market.- Protect-A-Bed (KayserBetten)

- Standard Textile Co.

- SafeRest

- Mattress Firm

- Tempur Sealy International

- Leggett & Platt

- Cozy Array

- Sleep Number Corporation

- Boll & Branch

- Brooklinen

- Malouf

- National Allergy

- AllerEase

- SureGuard Mattress Protectors

- Lucid

- Linenspa

- BedCare

- Slumber Cloud

- Bamboo Protector

- Nest Bedding

Frequently Asked Questions

Analyze common user questions about the Waterproof Pillow Protector market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between zippered and fitted waterproof pillow protectors?

Zippered encasements offer six-sided, total protection, sealing the pillow completely against allergens, bed bugs, and moisture. Fitted (cap-style) protectors only cover five sides, functioning more like a standard pillowcase with an added waterproof membrane on the top and sides, primarily guarding against top surface spills.

Which materials offer the best combination of waterproofing and breathability?

The best combination is typically found in products using a thin layer of Polyurethane Laminate (PUL) bonded to a breathable fabric like cotton terry or Tencel/bamboo blends. These materials utilize micro-porous technology to block liquids while allowing heat and vapor to escape, minimizing discomfort and noise.

How frequently should waterproof pillow protectors be washed and replaced?

Pillow protectors should generally be washed monthly, or more often in commercial/healthcare settings, following the manufacturer’s instructions to preserve the waterproof membrane. Replacement frequency varies but is typically recommended every 1–2 years for residential use, or sooner if the laminate barrier shows signs of cracking, peeling, or leakage.

Is the market shifting toward eco-friendly or sustainable waterproof materials?

Yes, sustainability is a major trend. Consumers are increasingly favoring protectors made from recycled polyester, organic cotton, and bio-based Tencel, especially when the waterproof membrane itself utilizes bio-based or certified non-toxic polymers, driving innovation away from traditional vinyl and standard plastic films.

What is the Compound Annual Growth Rate (CAGR) projected for the Waterproof Pillow Protector Market?

The Waterproof Pillow Protector Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033, driven largely by increased health consciousness and expansion in the global hospitality and healthcare sectors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager