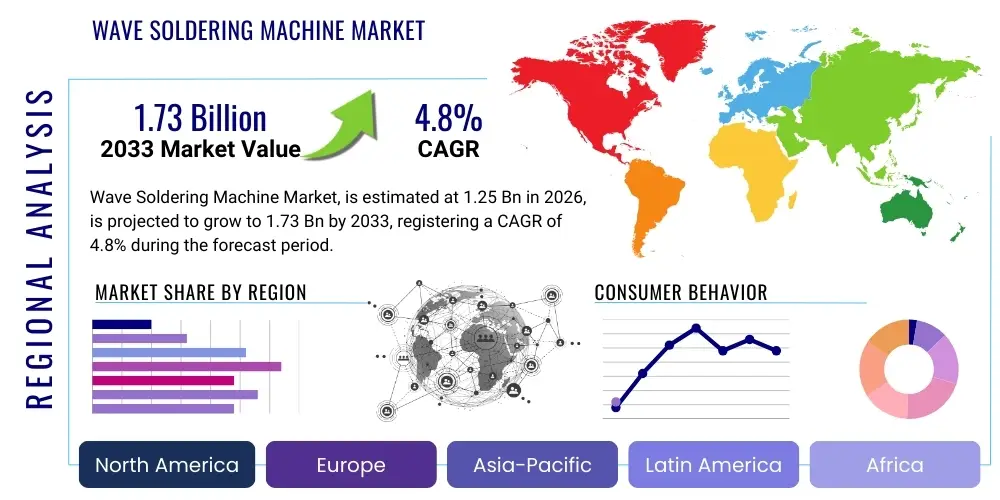

Wave Soldering Machine Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442893 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Wave Soldering Machine Market Size

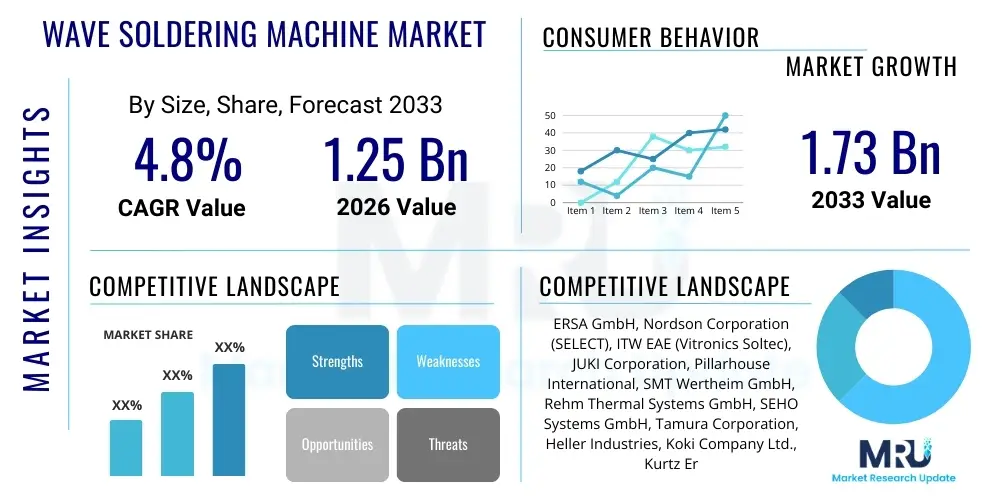

The Wave Soldering Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at $1.25 Billion in 2026 and is projected to reach $1.73 Billion by the end of the forecast period in 2033.

Wave Soldering Machine Market introduction

The Wave Soldering Machine Market encompasses automated equipment essential for soldering components onto Printed Circuit Boards (PCBs), primarily utilizing through-hole technology (THT). This machinery creates reliable electrical and mechanical connections by passing the PCB over a wave of molten solder, ensuring consistent, high-volume production crucial for heavy-duty and specific electronic assemblies. Modern wave soldering systems incorporate complex mechanisms for flux application, preheating, and precise temperature control, adapting to stringent lead-free standards and minimizing defects.

These sophisticated machines find major applications across diverse industries, most notably in automotive electronics, industrial control systems, telecommunications infrastructure, and specific sectors within consumer electronics that still rely heavily on THT components for robust mechanical stability. Key benefits derived from the adoption of wave soldering include exceptional throughput capacity, superior process repeatability, and the ability to handle complex, double-sided board designs where high mechanical strength of component mounting is mandatory. The shift towards higher functional density in electronic devices necessitates reliable interconnect solutions, thereby sustaining the demand for advanced wave soldering equipment.

Driving factors supporting market expansion include the global proliferation of 5G infrastructure, which requires high-reliability telecom equipment, and the continuous growth of the automotive sector, particularly the transition toward electric vehicles (EVs) and advanced driver-assistance systems (ADAS). These applications utilize power electronics and robust connectivity modules often assembled using wave soldering. Furthermore, stringent quality demands across high-reliability industries mandate the use of automated, consistent soldering processes, propelling investment in next-generation, energy-efficient wave soldering machines that incorporate nitrogen inerting capabilities to reduce dross formation and improve solder joint quality.

Wave Soldering Machine Market Executive Summary

The Wave Soldering Machine Market is characterized by robust growth driven primarily by increasing global electronic manufacturing activity, particularly within the Asia Pacific region, which serves as the central hub for mass production of consumer devices and automotive components. Current business trends indicate a significant technological pivot toward lead-free soldering processes, necessitating upgrades to existing machinery to handle higher temperatures and different flux chemistries. Manufacturers are focusing heavily on developing systems that offer enhanced energy efficiency, reduced maintenance downtime, and superior process control, often through integrating advanced monitoring sensors and closed-loop feedback systems to comply with Industry 4.0 standards.

Regional trends highlight the dominance of Asia Pacific, propelled by countries like China, Taiwan, South Korea, and Vietnam, where extensive investments in Electronics Manufacturing Services (EMS) facilities and Original Equipment Manufacturers (OEMs) create sustained demand for high-throughput soldering solutions. While mature markets in North America and Europe show slower unit growth, demand is concentrated in specialized, high-mix, low-volume applications requiring precision and advanced process traceability, particularly in aerospace, defense, and high-end industrial machinery sectors. These regions prioritize sophisticated dual-wave and nitrogen-inerted systems to meet stringent reliability requirements, often leading in the adoption of fully automated lines integrated with MES (Manufacturing Execution Systems).

Segment trends reveal that the dual-wave soldering segment remains dominant due to its versatility in handling a wide array of component types and board complexities. The application segment sees the strongest growth in the automotive electronics sector, driven by increasing electrification and the deployment of complex sensors and control units that require the mechanical stability offered by THT components. Furthermore, there is a distinct trend toward minimizing the environmental footprint of soldering operations, leading to higher adoption rates of selective soldering for smaller batches or highly complex boards, though wave soldering remains indispensable for high-volume THT applications. The market structure remains moderately consolidated, with major global players investing heavily in R&D to optimize flux management and reduce overall nitrogen consumption.

AI Impact Analysis on Wave Soldering Machine Market

Common user questions regarding AI's impact on the Wave Soldering Machine Market center on themes such as predictive maintenance capabilities, real-time quality assurance using machine vision, and autonomous process optimization to maximize yield and minimize energy consumption. Users are highly concerned with how AI can address the inherent variability in soldering processes, particularly managing the effects of aging flux, fluctuating environmental conditions, and varying PCB thermal profiles. Key expectations revolve around using deep learning models to correlate machine parameters (like wave height, preheat temperatures, conveyor speed) with resulting solder joint quality data, enabling automated adjustments far faster and more precisely than traditional statistical process control (SPC) methods.

The core concerns often relate to the cost and complexity of integrating sophisticated AI hardware and software into existing legacy wave soldering lines, alongside the necessity for high-quality, labeled training data derived from complex manufacturing environments. There is a strong anticipation that AI will transition wave soldering from a reactive maintenance model to a proactive, predictive environment, allowing manufacturers to schedule maintenance before critical component failure or quality drift occurs. Furthermore, manufacturers are exploring AI’s role in optimizing lead-free alloy usage and minimizing solder waste (dross), which represents a significant operational cost.

Ultimately, the influence of Artificial Intelligence is expected to profoundly enhance the precision, efficiency, and reliability of wave soldering processes, pushing the boundaries of manufacturing robustness. By moving beyond simple threshold monitoring to complex pattern recognition, AI enables the system to learn optimal operating envelopes for specific board types, guaranteeing consistently high quality in environments facing fluctuating input material quality or high-mix production demands. This integration supports the broader Industry 4.0 mandate for autonomous, zero-defect manufacturing.

- AI enables predictive maintenance, forecasting component failure (e.g., pump wear, heater degradation) based on sensor data analysis.

- Machine Vision systems powered by AI significantly enhance solder joint inspection, identifying micro-defects and insufficient wetting in real-time.

- AI algorithms optimize process parameters (temperature profiles, conveyor speed, flux density) autonomously to maintain peak yield under variable conditions.

- Deep Learning models facilitate root cause analysis by correlating process anomalies with final product quality data, reducing troubleshooting time.

- AI improves energy efficiency by dynamically adjusting preheat zones and power consumption based on real-time board loading and thermal requirements.

DRO & Impact Forces Of Wave Soldering Machine Market

The dynamics of the Wave Soldering Machine Market are shaped by a confluence of powerful drivers related to electronic complexity, significant restraints concerning capital investment and technological alternatives, and compelling opportunities derived from modern manufacturing paradigms. The primary driver is the pervasive demand for reliable, high-power electronics across critical sectors such as automotive and industrial machinery, where through-hole components are still favored for their superior mechanical robustness and power handling capabilities. Conversely, a major restraint is the high initial capital expenditure required for advanced, nitrogen-inerted wave soldering systems, coupled with the increasing trend towards miniaturization and the consequent preference for Surface Mount Technology (SMT), which often substitutes wave soldering with reflow soldering or specialized selective soldering.

Market opportunities largely center around integrating wave soldering technology into the broader smart factory ecosystem (Industry 4.0). This includes developing highly networked machines capable of precise, real-time data communication and remote diagnostics, enabling higher utilization rates and streamlined production flow. The transition to lead-free soldering continues to impact the market, acting as both a driver—by necessitating equipment upgrades—and a restraint—due to the higher operating costs associated with lead-free alloys and flux systems. Furthermore, regulatory mandates concerning environmental safety and power consumption are strong impact forces, compelling manufacturers to invest in highly efficient machines that reduce volatile organic compound (VOC) emissions from flux materials.

Impact forces currently shaping the market include aggressive competitive pricing, particularly from Asian manufacturers, which pressures profit margins for established global vendors. Technological advancements in flux chemistry and inerting techniques are critical impact forces improving overall quality and reducing operational expenses. The ongoing global supply chain volatility, affecting component availability and logistics costs, also acts as a significant external force. Overall, the market remains resilient, driven by the specialized needs of THT assembly in high-reliability segments, although it faces constant pressure to prove its economic viability against highly flexible selective soldering alternatives.

Segmentation Analysis

The Wave Soldering Machine Market is segmented based on critical operational and application parameters, providing a detailed view of market demand across different end-user needs. Key segmentation variables include the machine type, the process technology employed (such as lead-free versus leaded soldering), and the end-use application, which ranges from high-volume consumer electronics to demanding aerospace and defense applications. This structural segmentation helps industry participants tailor product offerings to address specific requirements, such as throughput demands for EMS providers or stringent quality control needs for medical device manufacturers.

The segmentation by Type primarily differentiates between standard single-wave systems, highly versatile dual-wave systems, and specialized wide-body machines designed for large industrial boards. Process technology segmentation highlights the dominance of lead-free systems driven by regulatory compliance (e.g., RoHS, WEEE), contrasting with niche demand for traditional leaded processes retained for specific military or medical devices exempt from such regulations. Geographically, the market is analyzed across major regions including North America, Europe, and the dominant Asia Pacific, reflecting variances in manufacturing sophistication, regulatory strictness, and production volumes across these areas.

- By Type:

- Single Wave Soldering Machine

- Dual Wave Soldering Machine

- Wide Body/High-Volume Wave Soldering Machine

- By Process Technology:

- Leaded Soldering

- Lead-Free Soldering (RoHS Compliant)

- Nitrogen Inerting Systems

- By Application/End-User Industry:

- Automotive Electronics (ECUs, power management)

- Consumer Electronics (LED lighting, appliance control boards)

- Industrial Electronics (Automation, power supplies, IoT gateways)

- Telecommunications (Network infrastructure, base stations)

- Aerospace & Defense

- Medical Devices

- By Geographical Region:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Wave Soldering Machine Market

The value chain for the Wave Soldering Machine Market commences with upstream analysis, involving the sourcing of highly specialized raw materials and subcomponents critical for machine manufacturing. This includes high-grade stainless steel for the solder pot and conveyor systems, precision machined components for the pump mechanism (impellers and nozzles), and advanced electronic controls such as PLCs, sensors, and thermal management components. Suppliers of these core inputs often operate under strict quality parameters, as the longevity and performance of the soldering machine heavily rely on the robustness of these initial materials, particularly those exposed to high thermal stress and corrosive flux residues.

Further down the chain, the core manufacturing stage involves sophisticated assembly and integration of mechanical, electrical, and software systems. Wave soldering machine manufacturers differentiate themselves through proprietary designs for flux sprayers, preheater configurations (e.g., forced air, IR, convection), and wave shaping technologies (laminar vs. turbulent waves). This stage demands high precision engineering and rigorous testing to ensure compliance with international safety and performance standards (e.g., CE, UL), especially concerning thermal uniformity and process repeatability required for lead-free applications, which operate at elevated temperatures.

The downstream analysis focuses on distribution and the end-user interaction. Distribution channels are typically a mix of direct sales teams catering to large Electronics Manufacturing Services (EMS) providers and specialized third-party distributors or agents who provide local installation, training, and ongoing maintenance support, particularly in emerging markets. Direct sales channels are preferred for high-value customized systems, while indirect channels offer broader reach for standard, lower-cost models. Potential customers—the end-users—require comprehensive pre-sales consultation regarding integration into existing production lines and continuous post-sales support, emphasizing the importance of specialized service providers in maintaining machine uptime and process optimization.

Wave Soldering Machine Market Potential Customers

The primary potential customers in the Wave Soldering Machine Market are large-scale Electronics Manufacturing Services (EMS) providers globally. These companies, such as Foxconn, Flex, and Jabil, operate high-volume assembly lines and require fast, reliable equipment to handle mass production contracts across various sectors, including computing, networking, and high-end consumer devices. EMS firms frequently upgrade their soldering infrastructure to maintain competitive edge, requiring machines capable of rapid changeovers, robust lead-free performance, and seamless integration with automated material handling systems (SMEMA compliance).

A second major segment comprises Automotive Tier 1 suppliers and OEMs. The rapid proliferation of Electronic Control Units (ECUs), high-power inverters, battery management systems (BMS), and lighting modules demands components with exceptional mechanical stability and thermal cycling resistance. Wave soldering is the preferred method for many THT power components and connectors essential for automotive longevity and safety. These customers prioritize machines offering extreme process repeatability, strict traceability features, and compliance with automotive standards (e.g., IATF 16949), often necessitating the use of advanced nitrogen inerting to ensure zero-defect output for critical assemblies.

Finally, manufacturers in the Industrial Control and Telecommunications sectors represent significant end-users. Industrial electronics often feature ruggedized PCBs with large, heavy THT components (e.g., relays, capacitors, transformers) requiring the deep penetration and reliable filleting characteristic of wave soldering. Telecom equipment manufacturers, particularly those supplying 5G infrastructure (base stations, routing hardware), rely on robust connectivity components soldered via wave technology to ensure long-term reliability in harsh environmental conditions. Their demand profile focuses on machine durability, long MTBF (Mean Time Between Failures), and the ability to process large, multi-layer boards efficiently.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.25 Billion |

| Market Forecast in 2033 | $1.73 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ERSA GmbH, Nordson Corporation (SELECT), ITW EAE (Vitronics Soltec), JUKI Corporation, Pillarhouse International, SMT Wertheim GmbH, Rehm Thermal Systems GmbH, SEHO Systems GmbH, Tamura Corporation, Heller Industries, Koki Company Ltd., Kurtz Ersa Corporation, Folungwin Industrial Co., Ltd., Shenzhen Jinting Automation Equipment Co., Ltd., ACE Production Technologies, Blundell Production Equipment, BTU International, GKG Precision Machine Co., Ltd., Manncorp, TWS Automation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wave Soldering Machine Market Key Technology Landscape

The Wave Soldering Machine Market is undergoing continuous technological evolution driven by the necessity for cleaner processes, higher quality, and lead-free compatibility. A fundamental technology advancement involves sophisticated flux application systems, moving from basic foaming methods to precision spray fluxers that minimize waste, ensure uniform coverage, and reduce the emission of volatile organic compounds (VOCs). Modern flux systems often include integrated sensors and automatic density controllers to maintain optimal flux activity, which is crucial for achieving high yields with challenging lead-free alloys, requiring more active flux chemistries and tighter process control.

Another crucial technological development is the implementation of nitrogen inerting systems, particularly prevalent in high-reliability and high-volume operations. Introducing an inert nitrogen atmosphere within the preheat and wave zone significantly reduces the oxidation of molten solder, minimizing dross formation and dramatically improving wetting characteristics and solder joint aesthetics. While increasing operational costs (due to nitrogen consumption), this technology is highly valued as it extends the life of the solder bath, reduces maintenance associated with dross removal, and enhances the overall reliability required for demanding applications like server boards and medical devices. Manufacturers are continually working on optimizing nitrogen consumption rates to improve the cost-effectiveness of these systems.

Furthermore, integration technologies related to Industry 4.0—specifically IoT sensors, machine-to-machine communication, and cloud-based analytics—are becoming standard features. These technologies enable remote monitoring of critical parameters (temperature curves, conveyor speed, solder pot level, wave stability) and facilitate full traceability of every soldered board. Automated feedback loops, often enhanced by AI analysis, allow the machine to dynamically adjust preheat settings or wave pressures in response to real-time thermal measurements. Dual-wave technology remains the standard architecture, featuring a primary turbulent wave for component side penetration followed by a secondary laminar wave for finishing and eliminating solder bridges, adapted specifically for the viscosity challenges presented by SAC (Sn-Ag-Cu) lead-free alloys.

Regional Highlights

- Asia Pacific (APAC): Dominance in Volume Manufacturing and Fastest Growth

The APAC region holds the largest market share and exhibits the highest growth rate, predominantly driven by established manufacturing powerhouses like China, Japan, South Korea, and emerging centers such as Vietnam and India. China remains the global epicenter for electronics manufacturing, necessitating vast quantities of high-throughput wave soldering equipment for EMS providers producing consumer electronics, networking gear, and automotive components. The demand here is largely volume-driven, focusing on cost-effective, reliable, and energy-efficient lead-free machines. Regulatory support for domestic manufacturing and large-scale government investments in semiconductor and electronics ecosystems further solidify APAC's dominance.

Japan and South Korea, while focusing on high-value, sophisticated electronics and specialized industrial machinery, drive demand for high-end, fully automated wave soldering systems that incorporate advanced features such as ultra-low oxygen nitrogen inerting and comprehensive AI-driven quality assurance. The regional emphasis on quick time-to-market for new technologies, coupled with the vast scale of production, ensures that APAC continues to be the primary engine of demand, necessitating continuous capacity expansion and technological upgrades across its manufacturing base.

- North America: Focus on High-Reliability and Low-Volume Production

The North American market is characterized by mature demand focused primarily on high-mix, low-volume production for sectors requiring stringent quality and longevity, such as aerospace, defense, and specialized medical instrumentation. While overall unit growth is moderate compared to APAC, the average selling price (ASP) of machines tends to be higher due to the preference for custom-engineered solutions and advanced feature sets, including precision selective wave nozzles and highly sophisticated process monitoring systems compliant with military and defense standards. Regulatory frameworks governing environmental compliance accelerate the adoption of advanced flux management and lead-free systems.

Investments in the region are often linked to reshoring initiatives or building resilient domestic supply chains, particularly in critical infrastructure sectors. Manufacturers in North America prioritize long-term reliability and traceability, often seeking partnerships with vendors that offer comprehensive service contracts and local technical support. The demand for systems capable of handling large, complex, multi-layer PCBs used in industrial controls and specialized computing clusters remains robust.

- Europe: Strict Environmental Compliance and Automation Leadership

The European market is defined by stringent environmental regulations (RoHS, REACH) and a strong push toward automation (Industry 4.0). Demand is concentrated in Western and Central European countries (Germany, France, UK) that specialize in high-precision automotive electronics, sophisticated industrial automation equipment, and specialized telecom gear. European manufacturers are early adopters of closed-loop process control systems and high-efficiency machines designed to minimize energy consumption and flux emissions.

The regulatory environment dictates a near-universal requirement for lead-free capabilities, often pushing for the adoption of nitrogen-inerted systems to manage the technical challenges associated with higher-temperature lead-free soldering. Europe maintains strong niche markets for customized wave soldering solutions tailored for small to medium-sized enterprises (SMEs) that focus on specialized, high-quality products rather than sheer volume. Investment decisions prioritize reliability, long operational life, and integration with complex manufacturing execution systems (MES).

- Latin America, Middle East, and Africa (LAMEA): Emerging Markets and Infrastructure Build-out

The LAMEA region represents an emerging market segment with accelerating demand, driven by local electronics assembly initiatives and infrastructure development, particularly in telecommunications and energy sectors. Brazil and Mexico in Latin America are key manufacturing hubs, attracting foreign direct investment (FDI) and establishing local EMS operations. Demand here is often for standard, robust, and cost-effective wave soldering solutions that offer reliability and ease of maintenance.

The Middle East and Africa are witnessing growth primarily linked to investments in smart city projects, utility infrastructure, and localized defense manufacturing. As manufacturing capabilities mature in these regions, there is a gradual shift from importing finished goods to local assembly, creating initial demand for standardized wave soldering equipment to handle basic PCB assemblies. Growth remains highly dependent on macro-economic stability and successful technology transfer initiatives.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wave Soldering Machine Market.- ERSA GmbH

- Nordson Corporation (SELECT)

- ITW EAE (Vitronics Soltec)

- JUKI Corporation

- Pillarhouse International

- SMT Wertheim GmbH

- Rehm Thermal Systems GmbH

- SEHO Systems GmbH

- Tamura Corporation

- Heller Industries

- Koki Company Ltd.

- Kurtz Ersa Corporation

- Folungwin Industrial Co., Ltd.

- Shenzhen Jinting Automation Equipment Co., Ltd.

- ACE Production Technologies

- Blundell Production Equipment

- BTU International

- GKG Precision Machine Co., Ltd.

- Manncorp

- TWS Automation

Frequently Asked Questions

Analyze common user questions about the Wave Soldering Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between wave soldering and selective soldering?

Wave soldering is a high-volume process ideal for soldering all through-hole components on a PCB simultaneously, offering high throughput and mechanical strength. Selective soldering targets specific areas on the board, crucial when SMT components are adjacent to THT components, providing greater flexibility and minimizing thermal impact on sensitive parts.

How does the shift to lead-free soldering alloys impact machine requirements?

Lead-free soldering requires significantly higher operating temperatures (typically 30-40°C higher than leaded solder). This necessitates wave soldering machines with robust heating elements, enhanced insulation, stronger corrosion resistance in the solder pot, and advanced flux chemistries optimized for lead-free wetting characteristics to prevent bridging and ensure void-free joints.

Which end-user segment drives the highest demand for advanced wave soldering equipment?

The Automotive Electronics sector currently drives the highest demand for advanced, high-reliability wave soldering equipment. This is due to the mandatory requirement for robust mechanical joints in Electronic Control Units (ECUs) and power electronics, coupled with stringent quality standards requiring nitrogen inerting and full process traceability.

What role does Nitrogen Inerting play in the wave soldering process?

Nitrogen inerting replaces the oxygen in the soldering environment, significantly reducing the oxidation of the molten solder (dross formation). This results in cleaner solder baths, improved wetting, reduced maintenance, and ultimately, higher quality solder joints, particularly critical when working with lead-free alloys.

What technological advancements are optimizing wave soldering efficiency?

Key optimizations include AI-driven process control for predictive maintenance and real-time parameter adjustment, precision spray fluxers that reduce waste, dual-wave systems optimized for modern lead-free alloys, and full integration with Manufacturing Execution Systems (MES) for end-to-end production monitoring and traceability in Industry 4.0 environments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager