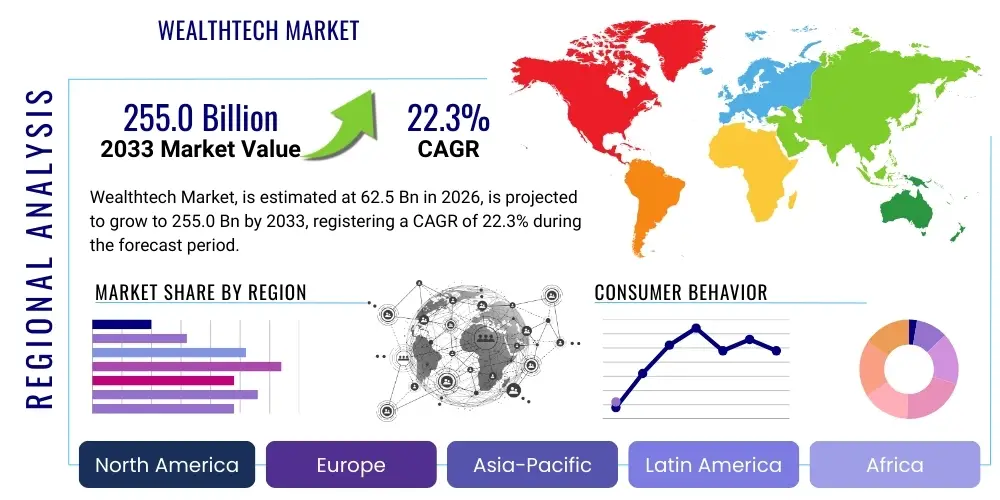

Wealthtech Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443336 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Wealthtech Market Size

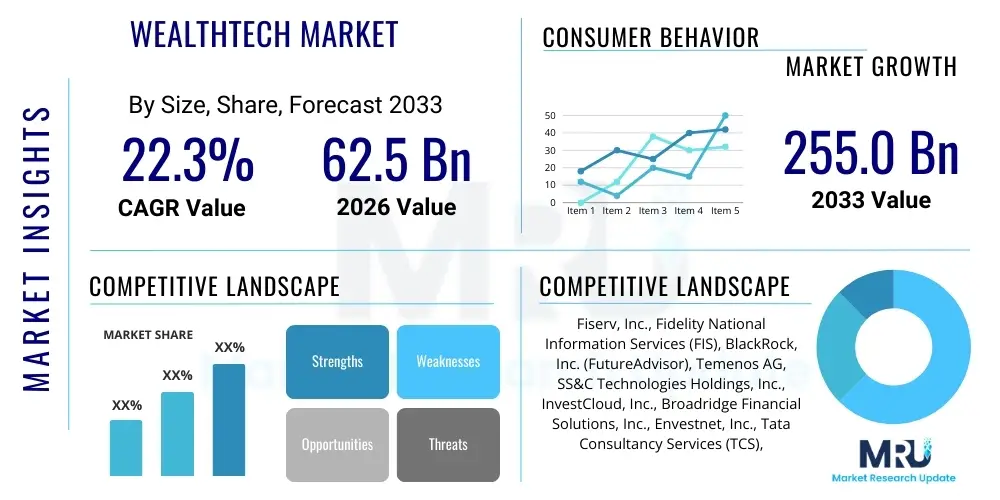

The Wealthtech Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 22.3% between 2026 and 2033. The market is estimated at $62.5 Billion in 2026 and is projected to reach $255.0 Billion by the end of the forecast period in 2033. This significant expansion is primarily driven by the increasing demand for personalized and automated financial advisory services, coupled with the widespread adoption of digital platforms by both established financial institutions and new market entrants. The core value proposition of Wealthtech lies in its ability to enhance operational efficiency, reduce costs, and improve the client experience through advanced technological integration, making it a pivotal area of investment for the global financial sector aiming for modernization.

Market expansion is particularly pronounced in regions with high disposable incomes and a tech-savvy population, such as North America and Europe, although the Asia Pacific region is rapidly accelerating its adoption rates due to massive underserved high-net-worth individual (HNWI) populations and increasing regulatory support for digital financial services. The shift from traditional, human-centric wealth management models to hybrid or fully automated solutions is accelerating, catalyzed by lower transaction costs and greater accessibility provided by Wealthtech platforms. Furthermore, the COVID-19 pandemic acted as a major inflection point, forcing accelerated digitalization and proving the resilience and scalability of digital wealth management solutions across various economic cycles.

Wealthtech Market introduction

The Wealthtech market encompasses the technological solutions and software applications utilized by financial advisors, wealth managers, and investment firms to streamline operations, enhance client engagement, and automate complex processes like portfolio management, risk assessment, and regulatory compliance. These solutions range from sophisticated robo-advisory services that offer automated, algorithm-driven investment management to holistic platform technologies that integrate diverse components of the wealth management lifecycle, including financial planning, tax optimization, and customer relationship management (CRM). Major applications span across banking, brokerage firms, insurance companies, and independent financial advisory practices, facilitating efficiency gains that were previously unattainable through manual processes.

Key benefits driving the market include enhanced personalization of financial products, significant reduction in operational expenses, increased regulatory transparency, and expanded access to financial services for segments previously deemed uneconomical to serve. Driving factors involve the rising demand from younger, digitally native generations for seamless mobile integration, increasing competitive pressure on traditional wealth managers to lower fees, and advancements in data analytics and cloud computing infrastructure which provide the necessary backbone for scalable technological deployments. The core objective of Wealthtech is to democratize wealth management, making sophisticated financial advice accessible, affordable, and highly customized to individual investor needs and long-term financial goals.

Wealthtech Market Executive Summary

The Wealthtech market is characterized by robust business trends centered on convergence, specialization, and regulatory adaptation. Key business trends include the consolidation of platforms, where smaller, niche technology providers are being acquired by larger financial institutions seeking to internalize digital capabilities quickly. There is also a strong emphasis on hyper-personalization, driven by AI and machine learning, moving beyond generic portfolio allocation to tailored financial plans that dynamically adjust to life events and macroeconomic changes. Furthermore, the focus on Environmental, Social, and Governance (ESG) investing is integrating specialized Wealthtech tools capable of screening, tracking, and reporting on sustainable investment mandates, becoming a standard feature rather than a niche offering.

Regionally, North America maintains its dominance due to high investment in proprietary technology development and a well-established regulatory framework supportive of Fintech innovation. However, the Asia Pacific region, particularly China and India, represents the fastest-growing market segment, fueled by rapid growth in the HNWI population and the widespread adoption of mobile-first financial solutions. European markets are driven by the implementation of directives like MiFID II, which necessitate greater transparency and fee disclosure, thereby accelerating the adoption of automated compliance and reporting Wealthtech tools. Segments trends highlight the rapid growth of robo-advisors within the Deployment Type segment, while the increasing adoption of blockchain technology for security and fractional ownership is driving innovation within the Technology segment, positioning decentralized ledger technology as a major disruptive force in custodian services.

AI Impact Analysis on Wealthtech Market

Common user questions regarding AI's impact on the Wealthtech market frequently revolve around themes of performance enhancement, job displacement, and data security. Users seek clarification on whether AI-driven portfolios consistently outperform human advisors, the extent to which automation will redefine the role of traditional financial planners, and how AI algorithms manage inherent biases and ensure robust cybersecurity against sophisticated threats. The consensus expectation is that AI will move beyond basic automation into cognitive advisory roles, providing predictive analytics and proactive risk management that significantly exceed current capabilities. Concerns center on the 'black box' nature of complex algorithms and the need for clear regulatory guidelines on algorithmic accountability and investor protection.

The integration of Artificial Intelligence and Machine Learning (AI/ML) is fundamentally transforming the value proposition of Wealthtech platforms, shifting them from mere digital interfaces to intelligent advisory ecosystems. AI algorithms are proving instrumental in tasks requiring vast data processing and pattern recognition, such as advanced client profiling, determining optimal asset allocation strategies based on real-time market microstructure, and automating compliance checks for suitability and anti-money laundering (AML). This capability allows wealth managers to service a significantly larger client base with fewer resources, thereby increasing profitability margins and addressing the scalability challenge inherent in traditional one-on-one advisory models.

Moreover, AI facilitates highly accurate predictive modeling, enabling firms to anticipate client attrition risk and offer timely, tailored interventions, thus enhancing client retention rates. For investors, AI-driven tools translate into more personalized investment experiences, including automated tax-loss harvesting and dynamic rebalancing strategies that maximize post-tax returns. While AI is automating routine tasks, it is concurrently elevating the human advisor's role, repositioning them from transaction executors to high-level relationship managers focusing on complex emotional and behavioral guidance—areas where technological intervention is less effective. This hybrid approach, combining AI efficiency with human empathy, is defining the competitive landscape.

- AI enables hyper-personalized investment strategies through sophisticated behavioral finance analysis.

- Predictive analytics powered by ML significantly enhances portfolio risk management and forecasting accuracy.

- Natural Language Processing (NLP) is used for automating client communication, query resolution, and sentiment analysis of market news.

- Robo-advisors leverage AI for automated rebalancing, tax-loss harvesting, and fiduciary compliance monitoring.

- AI algorithms accelerate regulatory reporting and audit trails, drastically reducing compliance overhead.

- Machine learning identifies and mitigates fraudulent activities and cyber threats in real time.

- AI drives operational efficiencies by automating back-office tasks, including onboarding and data reconciliation.

DRO & Impact Forces Of Wealthtech Market

The Wealthtech market growth is driven by a confluence of accelerating factors, mitigated by distinct operational and regulatory restraints, while presenting significant avenues for future expansion. The primary driver is the burgeoning technological proficiency and preference among younger investors who demand transparent, mobile-first, and low-cost financial services. This digital native clientele is compelling traditional firms to rapidly modernize their infrastructure. Simultaneously, restraints manifest predominantly through stringent global regulatory requirements concerning data privacy (such as GDPR and CCPA) and the complexities associated with cross-border operations and licensing, which often slow down the deployment of new technologies. However, the overarching opportunity lies in penetrating the vast, underserved middle-market segment and leveraging blockchain for immutable record-keeping and enhanced security.

Key impact forces shaping this dynamic landscape include demographic shifts, specifically the great wealth transfer from baby boomers to millennials, who prioritize digital interaction and ESG principles in their investment decisions. Technological acceleration, particularly the widespread availability of cloud computing and API integration capabilities, allows Wealthtech firms to rapidly develop and scale specialized services without massive upfront capital expenditure. Competitive pressures from both established technology giants (Big Tech) entering financial services and nimble Fintech startups are forcing incumbents to innovate or collaborate, thereby sustaining a high pace of change and adoption across the industry.

Furthermore, global macroeconomic volatility acts as both a driver and a restraint. While volatility increases the demand for sophisticated, algorithm-driven risk management tools (a driver), it simultaneously pressures firms’ profit margins and potentially reduces assets under management (AUM) in the short term (a restraint). The long-term trajectory, however, points towards robust growth, predicated on the Wealthtech industry's capacity to offer resilient, cost-effective solutions that enhance financial literacy and inclusivity across diverse investor demographics, securing its position as a transformative force in the global financial ecosystem.

Segmentation Analysis

The Wealthtech market is extensively segmented across several dimensions, including the type of service offered, the deployment model adopted, the end-user utilizing the solution, and the core technology employed. This segmentation allows market players to specialize and target specific pain points within the wealth management value chain. Key segments include B2B solutions tailored for institutional use, B2C solutions directly aimed at retail investors, and hybrid models combining both automated advice and human consultation. Analyzing these segments provides crucial insights into market maturity and the fastest-growing areas of investment within the technology stack.

- By Component:

- Solutions (Robo-advisory, Portfolio Management, Risk & Compliance Management, Performance Reporting, Financial Planning, CRM)

- Services (Consulting, Integration & Deployment, Support & Maintenance)

- By Deployment Type:

- Cloud-based

- On-premise

- By Enterprise Size:

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

- By End User:

- Banks

- Wealth Management Firms

- Brokerage Firms

- Asset Management Firms

- Others (Fintech startups, Insurance companies)

- By Technology:

- Artificial Intelligence (AI) and Machine Learning (ML)

- Blockchain

- Cloud Computing

- Big Data Analytics

- Robotics Process Automation (RPA)

Value Chain Analysis For Wealthtech Market

The Wealthtech value chain begins with the Upstream Analysis, which focuses primarily on core technology providers. This segment includes foundational infrastructure suppliers such as cloud service providers (AWS, Azure, Google Cloud), data vendors supplying market and proprietary consumer data, and specialized software developers creating sophisticated algorithms for AI/ML and risk modeling. The stability, scalability, and security offered by these upstream players are critical, as they dictate the ultimate performance and regulatory compliance capabilities of the downstream Wealthtech platforms. Strategic alliances in this phase, particularly with leaders in cybersecurity and distributed ledger technology, are essential for maintaining a competitive edge and ensuring data integrity across the ecosystem.

Moving through the midstream, the focus shifts to Wealthtech solution developers and integrators—the core builders of the platforms. These firms transform raw technology into deployable products like robo-advisors, portfolio management systems, and client engagement tools. Distribution channels are varied, encompassing both Direct and Indirect methodologies. Direct distribution involves platforms selling Software-as-a-Service (SaaS) solutions directly to End-Users, such as independent financial advisors or retail investors (B2C). Indirect distribution often involves partnerships with large system integrators or traditional financial institutions (Banks and Brokerage firms) that white-label or integrate the Wealthtech solutions into their proprietary systems, significantly widening market reach through established institutional networks.

The Downstream Analysis involves the interaction with the end-users and the final delivery of the services. End-users (e.g., banks, wealth managers, and individual investors) receive the value proposition through improved efficiency, lower costs, and enhanced client experience. This stage emphasizes post-sales support, continuous software updates, and regulatory maintenance, ensuring the platform remains compliant with evolving global financial laws. The efficiency of the distribution channel—whether direct digital interface or through institutional partnerships—is crucial for determining the speed of adoption and the total addressable market penetration achieved by Wealthtech solution providers.

Wealthtech Market Potential Customers

The primary potential customers and end-users of the Wealthtech market solutions span the entire spectrum of financial services, ranging from large, multinational asset managers to individual, digitally engaged retail investors. Institutional buyers include major global banks seeking comprehensive digital transformation of their private wealth divisions, focusing on solutions that enhance advisor productivity and integrate front-to-back office operations. Further institutional demand comes from independent wealth management firms and multi-family offices that leverage Wealthtech for specialized services such as sophisticated alternative investment tracking and complex trust and estate planning. These institutional clients prioritize compliance, integration capabilities with legacy systems, and robust data security protocols.

Beyond the institutional sector, the fastest-growing segment of potential customers is the affluent mass market and mass retail investors, often served directly by B2C robo-advisors or hybrid platforms. These customers are highly sensitive to fee structures and seek accessibility, transparency, and ease of use, often via mobile applications. The demographic appeal extends particularly to younger generations (Millennials and Gen Z) who prefer self-directed investment and demand ESG-compliant portfolio options. Wealthtech effectively democratizes access to sophisticated tools previously reserved for ultra-high-net-worth clients, making financial advice and portfolio management feasible for individuals with smaller investable assets, representing a significant and largely untapped market opportunity.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $62.5 Billion |

| Market Forecast in 2033 | $255.0 Billion |

| Growth Rate | 22.3% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Fiserv, Inc., Fidelity National Information Services (FIS), BlackRock, Inc. (FutureAdvisor), Temenos AG, SS&C Technologies Holdings, Inc., InvestCloud, Inc., Broadridge Financial Solutions, Inc., Envestnet, Inc., Tata Consultancy Services (TCS), Addepar, Inc., Apex Clearing, Wealthfront Corporation, Betterment LLC, Empower Retirement, Interactive Brokers Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wealthtech Market Key Technology Landscape

The technological underpinnings of the Wealthtech market are rapidly evolving, characterized by the convergence of several advanced digital capabilities aimed at delivering speed, security, and superior decision support. Central to this landscape is Artificial Intelligence (AI) and Machine Learning (ML), which move beyond simple process automation to enable cognitive functions such as personalized risk scoring, predictive financial modeling, and natural language processing for enhanced client interaction. Cloud computing serves as the foundational infrastructure, providing the necessary scalability, elastic capacity, and cost-efficiency required for rapidly onboarding new clients and processing massive volumes of market data in real time, shifting the operational burden from capital expenditure to operating expense models for financial institutions.

A second critical layer involves Big Data Analytics and Business Intelligence (BI) tools. Wealthtech relies heavily on analyzing unstructured and structured data sources—from market feeds and regulatory filings to client communication logs and social media sentiment—to derive actionable insights. These insights inform algorithmic trading, optimize portfolio construction, and ensure regulatory reporting accuracy, providing a competitive edge through deeper understanding of market dynamics and client behavior. The sophisticated use of data analytics allows firms to move from reactive compliance measures to proactive risk management strategies, anticipating and mitigating potential regulatory breaches before they occur.

Furthermore, Distributed Ledger Technology (DLT), particularly blockchain, is gaining traction for its potential to revolutionize back-office functions. Blockchain offers an immutable, transparent, and decentralized record-keeping system, which significantly reduces settlement times, lowers counterparty risk, and streamlines complex cross-border transactions inherent in wealth management, especially for alternative assets and fractional ownership. Alongside these core technologies, Robotics Process Automation (RPA) is deployed to automate highly repetitive, rule-based administrative tasks, further freeing up human advisors to focus exclusively on client relationship management and sophisticated strategic planning.

Regional Highlights

- North America: North America, particularly the United States, represents the most mature and dominant market for Wealthtech solutions globally. This leadership position is underpinned by substantial venture capital funding directed towards Fintech, a highly competitive financial services landscape, and early, widespread adoption of advanced technologies like AI and robo-advisory platforms. Key drivers include a high concentration of sophisticated HNWI and institutional investors demanding digital transparency, coupled with a supportive regulatory sandbox environment that encourages innovation. The US market emphasizes highly integrated platforms that manage complex regulatory requirements across multiple jurisdictions, focusing heavily on tax optimization and comprehensive financial planning tools. Canada also shows strong adoption, though regulatory oversight is slightly more conservative, fostering stable, incrementally advanced digital offerings focused on consumer protection and financial literacy enhancement. The regional trend is moving towards consolidation, with major financial institutions acquiring specialized tech providers to achieve full vertical integration of their digital offerings.

- Europe: The European Wealthtech market is characterized by fragmentation across national boundaries but unified by stringent pan-European regulations such as GDPR and MiFID II. These regulations, specifically demanding greater cost transparency and enhanced suitability assessments, have significantly driven the adoption of automated compliance and reporting tools. The UK remains a major hub, demonstrating high rates of digital adoption, particularly in the realm of direct-to-consumer investment apps and innovative sustainable (ESG) investing platforms. Germany and Switzerland, leveraging their strong existing wealth management heritage, focus on secure, high-end digital solutions for private banking. The regulatory complexity, while initially a barrier, has catalyzed the development of specialized RegTech solutions integrated within Wealthtech platforms, turning compliance into a competitive advantage focused on delivering demonstrable fiduciary duty through digital means.

- Asia Pacific (APAC): APAC is projected to exhibit the highest growth rate during the forecast period, driven by the rapidly expanding middle class, burgeoning HNWI population, and relatively low penetration of traditional financial services in several key markets. Countries like China and India are leading the charge, characterized by mobile-first adoption strategies due to limited legacy infrastructure, enabling rapid scalability of B2C investment apps. Singapore and Hong Kong serve as critical regional financial hubs, focusing on cross-border wealth management and leveraging technology for complex currency and international asset trading. The regulatory environment in APAC is diverse, ranging from highly controlled markets to those actively promoting Fintech innovation zones. The primary focus for Wealthtech in this region is on accessibility and establishing trust through robust, localized digital platforms tailored to unique cultural and linguistic needs.

- Latin America (LATAM): The LATAM region presents significant growth potential, fueled by improving economic stability in countries like Brazil and Mexico, and a high rate of mobile internet penetration. Wealthtech adoption here is largely focused on addressing underbanked and underserved segments, providing basic digital investment and savings tools that overcome geographic and socioeconomic barriers. Challenges include high levels of financial illiteracy and macroeconomic volatility, which require platforms to incorporate strong educational components and robust hedging strategies. Partnerships between domestic banks and global Wealthtech providers are common, focusing on leveraging cloud infrastructure to deliver secure and localized digital financial services, enhancing overall financial inclusion efforts across the continent.

- Middle East and Africa (MEA): The MEA market is seeing specialized growth, particularly in the Gulf Cooperation Council (GCC) nations, driven by government mandates for economic diversification away from oil and high levels of liquid wealth concentrated among HNWIs. Wealthtech solutions in this region often cater to Sharia-compliant investment mandates, requiring specialized algorithmic customization. Africa’s burgeoning startup ecosystem, especially in South Africa and Nigeria, is adopting mobile payment and digital wallet technologies that are forming the foundation for future Wealthtech expansion, focusing initially on micro-investing and savings solutions to reach the massive unbanked population and capitalize on digital remittance flows.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wealthtech Market.- Fiserv, Inc.

- Fidelity National Information Services (FIS)

- BlackRock, Inc. (FutureAdvisor)

- Temenos AG

- SS&C Technologies Holdings, Inc.

- InvestCloud, Inc.

- Broadridge Financial Solutions, Inc.

- Envestnet, Inc.

- Tata Consultancy Services (TCS)

- Addepar, Inc.

- Apex Clearing

- Wealthfront Corporation

- Betterment LLC

- Empower Retirement

- Interactive Brokers Group

- Murex

- Yodlee (Acquired by Envestnet)

- Edelweiss Financial Services

- SEI Investments Co.

- Jemstep (Acquired by Invesco)

- Personal Capital

Frequently Asked Questions

Analyze common user questions about the Wealthtech market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Wealthtech and how does it differ from traditional wealth management?

Wealthtech refers to technology solutions designed to automate and enhance wealth management processes, encompassing everything from robo-advisory to compliance software. It differs from traditional management by offering lower costs, higher scalability, greater transparency, and hyper-personalized digital experiences, often targeting broader market segments.

How is Artificial Intelligence (AI) being utilized to drive growth in the Wealthtech sector?

AI/ML algorithms are used in Wealthtech for advanced client profiling, predictive market analytics, automated portfolio rebalancing, and personalized risk assessment. This utilization enhances decision-making accuracy, lowers operational expenditure, and facilitates the creation of dynamic, individualized financial plans.

What are the primary regulatory challenges facing the global Wealthtech market?

Primary challenges include navigating varied international data privacy regulations (like GDPR), ensuring algorithmic transparency and accountability (MiFID II), maintaining robust cybersecurity standards against evolving threats, and managing complex licensing requirements for cross-border advisory services.

Which geographical region is anticipated to experience the fastest growth in the Wealthtech market?

The Asia Pacific (APAC) region is projected to register the fastest growth due to the rapid increase in its affluent population, high mobile penetration rates, and government initiatives promoting Fintech adoption to address the needs of vast, underserved investment communities.

Are robo-advisors replacing human financial advisors, or are hybrid models becoming dominant?

While robo-advisors automate basic investment tasks, the prevailing trend favors hybrid models. These models combine the cost efficiency and scalability of automated algorithms for routine processes with the complex strategic planning, emotional intelligence, and complex client relationship management skills provided by human advisors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager