Wear Plate Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443416 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Wear Plate Market Size

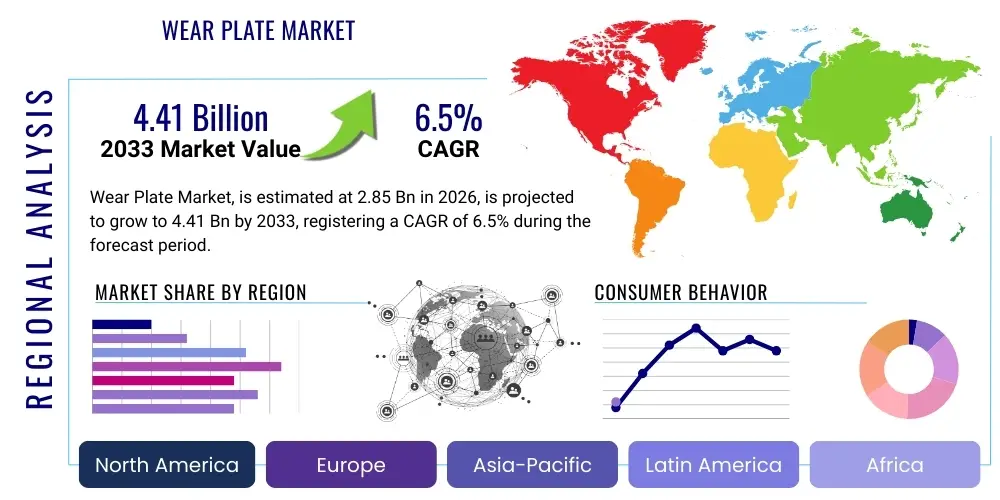

The Wear Plate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 2.85 Billion in 2026 and is projected to reach USD 4.41 Billion by the end of the forecast period in 2033.

Wear Plate Market introduction

The Wear Plate Market encompasses the global manufacturing and distribution of specialized metallic and non-metallic sheets designed to protect industrial machinery and structural surfaces from severe abrasive wear, impact damage, and erosion. These protective linings are crucial in industries where equipment integrity is constantly challenged by harsh operating conditions, such as mining, construction, cement manufacturing, power generation, and steel production. Wear plates are typically fabricated from materials offering high hardness and resilience, including various grades of chromium carbide overlay (CCO) steel, quenched and tempered (Q&T) high-manganese steel, specialized ceramics, and advanced composite materials. The primary function of these components is to significantly extend the service life of expensive capital equipment, such as chutes, hoppers, bucket liners, crushers, and material handling systems, thereby minimizing costly operational downtime and drastically reducing overall maintenance expenditures. The increasing global focus on maximizing asset utilization and reducing the total cost of ownership (TCO) serves as a fundamental driving factor for the adoption of high-performance wear solutions, ensuring continuous demand for robust protective materials across heavy industry verticals.

Product descriptions vary significantly based on material composition and application requirements. Chromium carbide overlay (CCO) plates, formed through sophisticated flux-cored arc welding onto mild steel backing plates, represent a high-performance segment due to their exceptional resistance to severe sliding abrasion and erosion, often performing optimally at elevated temperatures. Conversely, quenched and tempered high-strength steel plates, such as AR 500 grades, are specifically engineered and preferred for applications that involve high impact forces combined with moderate abrasion, commonly utilized in earthmoving and quarrying machinery components. The selection process for an appropriate wear plate involves a meticulous engineering assessment of the specific operational environment, rigorously considering factors such as particle size distribution, dominant impact energy, thermal gradient, and the presence of any corrosive chemical agents. Advanced wear plate solutions increasingly leverage layered structures and optimized microstructural engineering to offer substantially superior performance metrics compared to traditional hardened steels, highlighting the industry's commitment to materials science innovation.

Major applications of wear plates span critical heavy industrial processes globally. In the mining sector, they are indispensable for protecting haul truck bodies, massive excavator buckets, critical conveyor transfer points, and complex ore processing equipment from catastrophic failure due to relentless rock abrasion. Within the construction and aggregate industries, wear plates serve as integral components in asphalt mixing plants, concrete batching equipment, and aggregate screening machinery, where they must withstand constant, high-volume friction from sand, gravel, and cement. The quantifiable benefits derived from implementing high-quality wear plates are substantial, encompassing significantly extended mean time between failures (MTBF), lower capital expenditure on cyclical replacement parts over the equipment lifecycle, and improved operational safety standards. Furthermore, key driving factors for sustained market growth include rapid infrastructure modernization and development in key emerging economies, the sustained global demand for processed raw materials, and increasingly stringent international regulations emphasizing operational reliability and comprehensive asset protection across all heavy industries.

Wear Plate Market Executive Summary

The Wear Plate Market is characterized by resilient business trends driven largely by persistent global infrastructure investment, particularly concentrated in the Asia Pacific region, and a robust commodities cycle that sustains high-volume mining and resource extraction activities. Key business strategies observed among leading manufacturers include proactive vertical integration to ensure control over the quality of specialized raw materials and overlay compounds, alongside significant strategic investment in advanced automated welding and overlay deposition systems aimed at improving production throughput, consistency, and material efficiency. There is a clear market shift towards offering highly customized, engineered wear solutions tailored precisely to specific, often unique operational challenges, moving strategically away from a reliance on generalized, standardized product offerings. This transition often includes the provision of sophisticated engineering consulting services that analyze complex equipment duty cycles and recommend optimal material compositions (e.g., advanced bi-metal overlays, high-content tungsten carbide integration). Simultaneously, global sustainability mandates are increasingly influencing the market, prompting intensive development of wear plates with substantially longer service lives, thereby minimizing overall material consumption and reducing waste generation throughout the entire industrial operational lifecycle. However, competitive pricing pressures remain intensely high, particularly within commodity-grade segments, compelling sustained technological innovation within the premium, high-performance wear plate sectors.

Regional trends unequivocally indicate that the Asia Pacific (APAC) region constitutes the largest and fastest-growing consumer market for wear plates globally. This dominance is fundamentally fueled by enormous government expenditure on public and private infrastructure, rapidly expanding construction sectors, and extensive, high-volume mining operations across key nations like China, India, and Australia. North America and Europe, while possessing mature industrial bases, exhibit robust and stable demand, specifically concentrating on high-end, digitally integrated wear monitoring solutions and the highest grades of Chromium Carbide Overlay (CCO) plates. This is frequently dictated by exceptionally strict regional environmental and operational efficiency standards that mandate the maximization of component lifespan and reliability. The Middle East and Africa (MEA) region is rapidly emerging as a critical future growth area, significantly driven by large-scale, ongoing oil and gas infrastructure projects and sharply increasing local demands from cement and aggregate production facilities necessary to support accelerating urbanization across the region. A notable developing trend in these growth regions is the increasing expansion of localized manufacturing capabilities to mitigate complex international supply chain logistics and reduce the impact of variable import duties, often favoring responsive regional specialized vendors.

Segmentation trends reveal the accelerating prominence of Chromium Carbide Overlay (CCO) plates, which capture the largest market share by value among material types, owing to their superior performance profile in the most severe high-abrasion environments. Nevertheless, Quenched and Tempered (Q&T) steel plates continue to account for substantial volume due to their proven cost-effectiveness, versatile application range, and excellent resilience in scenarios requiring high impact resistance. By application, the global mining sector remains the principal and most demanding consumer, necessitating continuous replacement and systematic upgrading of protective liners in heavy excavation and ore processing machinery. The construction and aggregate segment is experiencing accelerated growth, a trajectory directly tied to the pace of global urbanization and infrastructural modernization. Key technological trends across the market are primarily centered on improving the critical bonding strength between the wear overlay and the base metal, significantly enhancing resistance to thermal cycling and fatigue cracking in extreme environments, and developing sophisticated predictive maintenance services utilizing miniaturized, embedded sensors within the wear components themselves to monitor deterioration rates in real-time and provide actionable data to operators.

AI Impact Analysis on Wear Plate Market

User inquiries regarding the practical application and influence of Artificial Intelligence (AI) on the Wear Plate Market predominantly focus on its capacity to revolutionize predictive maintenance protocols, optimize the complex composition of wear-resistant materials, and enhance the overall automation levels of manufacturing processes. Users consistently ask if AI algorithms can achieve the necessary accuracy to reliably forecast the precise time remaining until a component requires replacement, thereby facilitating truly just-in-time inventory and maintenance strategies that effectively eliminate unplanned production stoppages. There is substantial, growing interest in how advanced machine learning algorithms can rapidly analyze vast streams of operational performance data gathered from diverse field applications to quickly iterate and optimize new wear plate designs, particularly focusing on tailoring complex microstructures and enhancing precision in overlay deposition methods. Key user concerns often center on the substantial upfront investment required for implementing the requisite sensor technology (IoT integration) and developing the specialized internal expertise needed to effectively manage, process, and interpret the large, high-velocity datasets derived from harsh, high-stress industrial operating environments. The overarching expectation is that AI will strategically transform wear management practices from fundamentally reactive or rigid time-based maintenance schedules into highly precise, data-driven, and condition-based strategies, fundamentally increasing asset utilization rates, enhancing operational safety, and achieving measurable reductions in the TCO associated with extreme industrial wear phenomena.

- AI-driven Predictive Maintenance: Utilizing sophisticated machine learning algorithms to analyze continuous data streams (acoustic, vibration, thermal, and thickness data) collected via advanced IoT sensors embedded within or adjacent to wear plates, allowing for accurate forecasting of replacement time, minimizing downtime, and optimizing spare parts inventory levels.

- Material Composition Optimization: AI models perform rapid simulations of complex high-stress wear environments, enabling precise fine-tuning of the chemical composition and specific microstructure of specialized overlay materials (e.g., controlling carbide size in chromium carbide or complex alloys) for achieving maximum abrasion resistance and enhanced fracture toughness.

- Automated Quality Control and Inspection: Implementing advanced computer vision systems and AI-powered image processing within manufacturing lines to ensure superior consistency in overlay thickness, instantly detect microscopic micro-cracks or porosity defects, and verify the metallurgical integrity of the critical welded bonds, thereby dramatically improving overall batch quality and consistency.

- Enhanced Supply Chain Resilience: AI significantly enhances complex logistics and planning for crucial raw materials (including specialized ferroalloys and base steel), accurately predicting demand fluctuations based on global commodity cycles, major infrastructure project timelines, and localized maintenance forecasts, ensuring timely and optimized delivery of customized wear solutions globally.

- Rapid Design Optimization and Simulation: Machine learning techniques accelerate the complex simulation of various distinct wear mechanisms (sliding abrasion, severe impact, slurry erosion) under hundreds of variable operational parameters, allowing for the rapid testing of numerous potential design iterations without the need for time-consuming and expensive physical prototyping cycles, significantly shortening the development timeline.

DRO & Impact Forces Of Wear Plate Market

The Wear Plate Market is dynamically influenced by a critical combination of compelling driving factors, inherent operational restraints, and substantial market opportunities, which collectively define its competitive structure and future trajectory. Key drivers include the relentless and necessary global expansion of mining activities, significantly propelled by the critical energy transition and the burgeoning demand for strategic minerals such as lithium, copper, and nickel, all of which require extremely robust material handling and processing equipment that must be thoroughly protected by high-performance wear plates. Furthermore, intensified global infrastructure development, particularly pronounced in developing nations, necessitates continuous, high-volume construction and aggregate production, ensuring a strong and sustained underlying demand for reliable abrasion-resistant components. These powerful macroscopic trends are effectively amplified by continuous technological advancements that deliver superior wear resistance, which markedly enhances their long-term economic attractiveness when compared to conventional hardened steel liners, thereby solidifying overall market growth momentum. The pervasive industrial necessity of drastically reducing costly, unplanned operational downtime across virtually all heavy industries further amplifies the critical need for advanced, high-performance protective materials.

However, the market must navigate several notable restraints that inevitably temper overall growth rates and introduce operational risks. The most significant restraint is the severe and continuous volatility in the global pricing of key raw materials, specifically including base steel, chromium, and essential ferroalloys, which directly and critically affects manufacturing costs, introduces financial risk, and compresses immediate profitability, necessitating extremely strategic inventory management and proactive hedging practices. Furthermore, the inherent initial high capital cost of deploying advanced wear plates, such as sophisticated ceramic matrix composites or complex bi-metallic overlays, can act as a significant deterrent, especially for smaller-to-medium enterprises (SMEs) who may opt for cheaper, lower-performance alternatives, particularly prevalent in highly price-sensitive regional markets. Substitution risk, although currently assessed as moderate, remains a continuous challenge, as ongoing innovation in alternative protection technologies, such as specialty engineered protective coatings or highly advanced laser hardfacing techniques, continues to evolve rapidly. Moreover, the characteristic long replacement cycles inherent in some massive, high-reliability heavy machinery can occasionally limit new replacement sales volume, strategically shifting the market focus toward long-term maintenance service contracts and value-added aftermarket support.

Opportunities within the market center decisively on capitalizing on the rapid and increasing adoption of highly specialized materials in demanding niche applications, such as the high-temperature, erosion-resistant wear plates required in biomass energy plants and specialized waste-to-energy recovery facilities. A significant and potentially transformative opportunity exists in developing digitally integrated solutions, seamlessly pairing advanced wear materials with embedded IoT sensors for real-time condition monitoring, thereby creating a high-value-added service model that transcends simple material supply and focuses on data provision. Furthermore, targeted geographic expansion into currently untapped or rapidly industrializing markets in Africa and specific developing regions of Southeast Asia, where industrialization is accelerating dramatically, offers substantial potential for market penetration and long-term revenue growth. Establishing strategic, exclusive partnerships with major Original Equipment Manufacturers (OEMs) to supply pre-installed, highly engineered proprietary wear solutions presents another critical avenue for sustained, high-margin revenue growth. The primary impact forces driving and sustaining the Wear Plate Market are compelling economic necessity (the mandate for Total Cost of Ownership reduction), rigorous regulatory pressure (focusing on enhanced safety and operational continuity), and relentless technological push (driven by continuous material science innovation and digitalization).

Segmentation Analysis

The Wear Plate Market is comprehensively segmented across multiple critical dimensions, including material type, plate thickness specifications, specific application industry, and major geographical region. This detailed segmentation framework provides a granular, actionable view of underlying market dynamics, revealing varying demand elasticities, competitive intensities, and distinct growth potential across different end-use sectors. The foundational segmentation by material type is crucial as it directly reflects the required performance profile of the application, ranging widely from cost-effective standard hardened steels suitable for general protection to ultra-high-performance, specialized materials like ceramic composites utilized in extreme erosion environments. Analyzing the plate thickness segmentation is equally vital, as it directly correlates with the expected operational life expectancy and the inherent intensity of the wear environment; thicker plates are primarily utilized in the most extreme impact and highest-abrasion applications, such as massive mining shovels and primary rock crushers. Understanding the precise nuances of these segments is imperative for manufacturers to effectively tailor their production capabilities, optimize inventory management, and align their marketing strategies to ensure that product specifications perfectly match specific industrial needs and budgetary constraints.

- By Material Type:

- Chromium Carbide Overlay (CCO) Plate: Dominated by superior abrasion resistance.

- Quenched and Tempered (Q&T) Steel Plate (e.g., AR 400, AR 500, AR 600): Valued for high impact resistance and toughness.

- Ceramic Wear Plate: Used for extreme fine particle abrasion and erosion.

- Complex Carbide Wear Plate: Offering enhanced performance in specialized high-temperature applications.

- Others (Manganese Steel, Rubber, Polyurethane Liners): Utilized for noise reduction and lightweight applications.

- By Thickness:

- Up to 10 mm: Suitable for moderate wear applications and light liners.

- 10 mm to 30 mm: Standard thickness for most general construction and material handling.

- Above 30 mm: Reserved for high-impact mining and primary crushing machinery components.

- By Application/End-Use Industry:

- Mining and Quarrying: Largest consumer, driven by continuous material processing.

- Construction and Aggregate: Tied to infrastructure spending and urbanization rates.

- Cement and Steel Manufacturing: Requires high-temperature and chemical resistance.

- Power Generation (Coal/Biomass Handling): Needs specialized components for pulverizers and ash handling.

- Material Handling and Logistics: Used in ports, conveyors, and transfer points.

- Others (Dredging, Forestry, Recycling): Niche applications requiring unique wear solutions.

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Wear Plate Market

The intricate Value Chain of the Wear Plate Market initiates robustly in the upstream segment, encompassing the critical sourcing and preparatory processing of necessary raw materials. These materials fundamentally include high-quality base steel plates and diverse ferroalloys, such as chromium, manganese, and molybdenum, essential for either creating the wear-resistant overlay or alloying the base steel for enhanced properties. Key suppliers in this foundational phase are large, integrated steel mills and specialized alloy processing producers. Maintaining efficient sourcing logistics, securing stable long-term supply contracts, and implementing rigorous quality control over these raw materials are absolutely paramount, as minute variations in metallurgical properties directly dictate the final performance characteristics and overall cost structure of the finished wear plate product. Manufacturers typically enter into meticulous, long-term agreements with global material suppliers to strategically mitigate potential price volatility and ensure full material traceability, a prerequisite for meeting demanding industrial and safety standards. Preliminary processing at this stage involves comprehensive inspection, surface cleaning, and precise preparation of the base plates before the specialized overlay application or proprietary heat treatment procedures commence.

The midstream segment constitutes the core manufacturing process, representing the stage of maximum value addition and complexity. Here, the base plate undergoes essential surface preparation, followed by highly specialized welding techniques (critical for CCO plates), rigorous heat treatment (for Q&T plates), or sophisticated bonding processes (for ceramic composites). This segment demands substantial investment in specialized, state-of-the-art machinery, deep metallurgical expertise, and strictly controlled process parameters. Leading manufacturers invest heavily in automated submerged arc welding (SAW) or flux-cored arc welding (FCAW) systems to ensure the consistent and high-integrity deposition of hard carbide layers. Post-fabrication, comprehensive quality assurance checks, including advanced ultrasonic testing and precise hardness measurements across the entire surface, are routinely performed. Distribution channels then efficiently facilitate the complex movement of these heavy, finished products, utilizing a dual approach: direct sales channels targeting large, global mining conglomerates and Original Equipment Manufacturers (OEMs), and indirect sales leveraging a vast network of specialized industrial distributors, stockists, and local fabrication shops that provide essential value-added services like cutting, bending, and specialized installation support to smaller end-users.

The downstream analysis is focused critically on the final application point and the provision of essential aftermarket services. Direct sales channels are the preferred method when engaging with major global OEMs or the largest, vertically integrated mining companies that require standardized products in extremely high volumes, often accompanied by dedicated technical consulting and long-term support contracts. Indirect channels leverage the strategic advantages of regional distributors who maintain vital local inventory, offer immediate product availability for urgent replacements, and provide crucial localized support, particularly vital for replacement parts and small-scale custom installations within the construction and aggregate sectors. Aftermarket services—including professional installation support, ongoing wear monitoring programs, and detailed replacement planning—represent an increasingly significant revenue stream and a major competitive differentiator. The effectiveness and efficiency of the overall distribution channel are crucial factors in ensuring that heavy, specialized products successfully reach remote and demanding industrial sites globally in a highly timely manner, minimizing expensive waiting times and maximizing operational continuity for maintenance crews.

Wear Plate Market Potential Customers

Potential customers for the Wear Plate Market are predominantly large-scale industrial enterprises that operate massive, capital-intensive machinery within environments characterized by severe friction, continuous sliding abrasion, high-energy impact, or excessively elevated temperatures. The global mining sector represents the single most significant and demanding customer base, encompassing companies involved in the large-scale extraction and processing of coal, iron ore, copper, gold, and diverse industrial minerals. These customers require the most robust and reliable wear solutions for critical, non-redundant assets such as primary crushers, massive haul truck bodies, mill liners, and complex material transfer chutes, where component failure instantly leads to substantial and costly production losses. Their complex purchasing decisions are heavily influenced by a combination of factors: proven longevity, comprehensive material performance guarantees, and the supplier's verified capacity to provide expert technical support and highly customized fabrication services specifically designed to maximize throughput and ensure high reliability under extreme operational loads. Trust in the product's lifespan and the supplier's engineering competence is absolutely paramount for these high-stakes operational environments.

The construction and aggregate industry forms the second largest and most diverse customer segment, strongly driven by producers of essential materials such as cement, asphalt, sand, and gravel. These customers require reliable wear plates for concrete batching plants, sophisticated screening equipment, asphalt mixers, and specialized road construction machinery. Although often operating on tighter profit margins compared to large-scale mining operations, these buyers prioritize achieving an optimal balance between cost-effectiveness and performance, frequently opting for materials like standard Q&T steel grades and mid-range CCO plates. The energy sector, encompassing both conventional coal-fired power plants and modern biomass energy facilities, constitutes another vital customer group, requiring highly specific abrasion and erosion resistance for coal pulverizers, complex ash handling systems, and internal boiler components operating under high heat and corrosive conditions. These specialized users necessitate bespoke, highly heat-resistant wear solutions that can effectively withstand severe thermal cycling and chemical corrosion, driving demand for high-specification alloy materials and ceramics.

Furthermore, major steel mills, high-volume recycling centers, and bulk material handling ports are substantial potential customers contributing significantly to demand. Steel mills utilize wear plates in demanding conveyor systems and hot charging buckets, enduring both extremely high temperatures and large-scale impact forces. Recycling and waste management facilities require plates that can successfully withstand the processing of highly contaminated, diverse, and abrasive scrap materials handled by massive shredders and sorting equipment. These diverse and specialized customer profiles emphatically underline the necessity for manufacturers to maintain an exceptionally broad and technologically diverse portfolio of material solutions, spanning from standard abrasion-resistant grades to highly customized ceramic and composite engineered solutions. Successful market participation often requires bundling these specialized products with comprehensive maintenance contracts and the deployment of digital monitoring services, all tailored precisely to the unique, demanding specifications of each distinct industry vertical served.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.85 Billion |

| Market Forecast in 2033 | USD 4.41 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SSAB AB, Outokumpu, Thyssenkrupp AG, Hardox, Voestalpine AG, ArcelorMittal, JFE Steel Corporation, Nippon Steel Corporation, Metso Outotec, Kloeckner Metals, Bradken (Hitachi Construction Machinery), Sandvik AB, Sumitomo Metal Mining Co. Ltd., King Cobra Wear Plates, Welding Alloys Ltd., Kennametal Inc., Essar Steels, Future Materials Group, Tuff Grade Wear Plates, Wuxi Xinji Wear Resistant Alloy Co. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wear Plate Market Key Technology Landscape

The technological landscape of the Wear Plate Market is fundamentally defined by continuous, aggressive innovation primarily focused on enhancing material hardness, increasing impact resistance, and improving the ease of fabrication, simultaneously striving to achieve a significant reduction in overall product weight. A core technological area involves the refinement of advanced flux-cored arc welding (FCAW) and submerged arc welding (SAW) processes utilized for the precise deposition of thick, high-integrity chromium carbide overlays. Current advancements focus intently on optimizing the precise chemistry of both the flux and the filler wire to rigorously control the size, shape, and distribution of primary carbide precipitates within the resultant metal matrix. This meticulous control is essential for maximizing abrasion resistance without introducing undue brittleness or susceptibility to premature cracking. Sophisticated multi-layer deposition techniques are being actively developed to create functional gradient compositions, engineered to offer superior toughness immediately adjacent to the base metal while providing extreme hardness on the exposed working surface. Furthermore, specialized laser cladding technology is emerging as a niche, high-precision manufacturing method for applying exceptionally thin, ultra-high-performance wear layers, particularly crucial in complex or intricate components where traditional bulk welding methods are technically infeasible.

Another crucial and rapidly evolving technological frontier is the continuous refinement and production of Quenched and Tempered (Q&T) steels. Leading manufacturers are now utilizing proprietary, advanced alloying elements (such as strategic additions of boron, nickel, and molybdenum) combined with highly controlled thermomechanical processing routes to reliably achieve both very high yield strength and exceptional toughness concurrently. This technological capability allows Q&T plates, notably those in the premium AR 500 and AR 600 grades, to successfully handle the most extreme impact loads encountered in severe applications like large excavator buckets and hydraulic hammers while simultaneously retaining excellent field weldability and formability required by fabrication shops. The ongoing development of new ultra-high-strength steel alloys possessing inherent, superior wear resistance is strategically reducing the industry's reliance on secondary external overlay processes for specific applications, thereby simplifying overall component design and significantly shortening manufacturing lead times. Concurrently, exploratory research into nanostructured materials is underway, aiming to produce advanced metal matrix composites with dramatically reduced friction coefficients and ultimately superior service life under aggressive wear conditions.

The digitalization and connectivity of wear management represent a transformative technological trend reshaping the entire market. This involves the seamless integration of miniaturized Internet of Things (IoT) sensors, such as precise ultrasonic thickness monitors or strain gauges, directly into the wear plate structure or adjacent mounting points. These sensors autonomously transmit real-time data on material loss progression, temperature excursions, and operational stress profiles to centralized, cloud-based analytical platforms. This integrated technological capability enables highly precise predictive maintenance scheduling, allowing industrial users to transition effectively from generalized reactive maintenance to proactive, condition-based replacement strategies. Advanced data analysis, often powered by sophisticated AI algorithms, plays a critical role in refining subsequent product designs and optimizing installation methods based on observed field performance. This integrated, digital approach not only maximizes crucial asset utilization but also establishes a significantly higher barrier to entry for conventional, technology-laggard suppliers, strategically positioning technologically advanced manufacturers as indispensable long-term partners rather than simply transactional material providers. Establishing standardized protocols for data transmission, ensuring robust data integrity, and implementing stringent cybersecurity measures around these critical industrial IoT systems remain central areas of ongoing technological development.

Regional Highlights

Regional dynamics significantly shape the demand levels, product preferences, and consumption patterns within the Wear Plate Market, driven primarily by localized industrial activity, varying regulatory environments, and regional capital investment cycles.

- Asia Pacific (APAC): APAC is undeniably the global epicenter for wear plate demand, fundamentally underpinned by extensive, rapid construction projects, massive, ongoing urbanization efforts, and the dominance of major global mining economies (Australia, China, India, Indonesia). The region’s characterized growth is marked by extremely high volume consumption across both standardized commodity grades and necessary high-performance segments. Significant, sustained investment in expanding steel and cement manufacturing capacity further solidifies APAC's undisputed leading position in consumption.

- North America: This mature market segment is defined by exceptionally high demand for premium, technologically advanced wear solutions, particularly prevalent in large-scale strategic mining (iron ore, copper) and demanding oil sands operations. North American users place paramount importance on maximum lifespan extension and TCO reduction, favoring established global brands and proprietary CCO products. Automation in local manufacturing and the enthusiastic early adoption of smart, sensor-integrated wear monitoring solutions are defining technological trends here.

- Europe: The European market demonstrates steady, predictable, yet innovation-driven growth, specifically driven by stringent environmental and operational efficiency regulations that legally necessitate the exclusive use of high-quality, ultra-durable materials to minimize waste generation and reduce maintenance downtime. Key demand originates from specialized construction, sophisticated recycling facilities, and advanced steel production. European manufacturers often lead global innovation in both environmental compliance and complex advanced metallurgical processes.

- Latin America (LATAM): Growth in LATAM is tightly correlated with the volatile global commodities market, exhibiting consistently high consumption rates driven by extensive copper and iron ore mining operations located in key countries like Chile, Brazil, and Peru. The market is often highly price-sensitive but simultaneously requires materials capable of extremely high performance due to the harsh operating environments and high abrasion levels found in bulk material transport systems. Effective logistics and localized technical service support are critical competitive factors in achieving market success in this region.

- Middle East and Africa (MEA): MEA is rapidly emerging as a high-potential growth region, fueled substantially by large-scale ongoing infrastructure developments (such as in Saudi Arabia and the UAE) and the strategic expansion of mineral extraction projects throughout Sub-Saharan Africa. Demand is sharply increasing for durable wear plates required in cement production, large port handling equipment, and construction aggregate operations, necessitating localized fabrication capabilities to overcome logistical hurdles.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wear Plate Market.- SSAB AB

- Outokumpu

- Thyssenkrupp AG

- Hardox (A division of SSAB)

- Voestalpine AG

- ArcelorMittal

- JFE Steel Corporation

- Nippon Steel Corporation

- Metso Outotec

- Kloeckner Metals

- Bradken (Hitachi Construction Machinery)

- Sandvik AB

- Sumitomo Metal Mining Co. Ltd.

- King Cobra Wear Plates

- Welding Alloys Ltd.

- Kennametal Inc.

- Essar Steels

- Future Materials Group

- Tuff Grade Wear Plates

- Wuxi Xinji Wear Resistant Alloy Co. Ltd.

- Nucor Corporation

- G. E. W. Technologies GmbH

- Postle Industries

- Triten Corporation

- Element Materials Technology

- Castolin Eutectic

- Corrosion Engineering

- Wear-Tek, Inc.

- XINHUA Wear-Resistant Material Co., Ltd.

- Dillinger Hütte

- TATA Steel

- Ceramix Wear Products

- Hensley Industries

Frequently Asked Questions

Analyze common user questions about the Wear Plate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of Chromium Carbide Overlay (CCO) plates over standard Q&T steel wear plates?

CCO plates offer significantly superior abrasion resistance, especially in sliding wear applications and at elevated temperatures, due to the high volume of extremely hard primary carbides embedded in the metal matrix. While Q&T steel offers better toughness for high-impact environments, CCO extends component service life dramatically under abrasive conditions, reducing replacement frequency and maintenance costs, lowering TCO.

Which application segment drives the highest demand in the global Wear Plate Market?

The Mining and Quarrying segment generates the highest continuous demand for wear plates globally. This is driven by the extreme and constant abrasion and impact experienced by large-scale material handling equipment (chutes, liners, buckets, crushers) used in the high-volume extraction and processing of hard minerals and ores worldwide.

How is digital technology impacting wear plate performance and maintenance strategies?

Digital technology, primarily through integrated IoT sensors and predictive AI analysis, enables real-time monitoring of wear rates and material health. This shifts maintenance from scheduled downtime to proactive condition-based replacement, maximizing operational uptime, optimizing spare parts inventory, and significantly reducing the total cost of ownership (TCO) for critical industrial assets.

What is the projected Compound Annual Growth Rate (CAGR) for the Wear Plate Market?

The Wear Plate Market is projected to experience a robust growth rate, estimated at 6.5% CAGR between the years 2026 and 2033, fueled predominantly by global infrastructure development, rapid urbanization, and sustained investment in core resource extraction industries, particularly across the dynamic Asia Pacific region.

What are the main regional consumption trends for wear plates?

Asia Pacific (APAC) currently dominates global consumption due to unparalleled rapid industrialization and infrastructure development. North America and Europe prioritize high-performance and specialty wear solutions based on TCO, while Latin America and MEA show high growth potential driven by major commodity extraction and large-scale construction projects demanding reliable components.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Wear Plate Market Size Report By Type (Under HBW 400, HBW 400-500, Above HBW 500), By Application (Mining, Construction, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Wear Plate Market Statistics 2025 Analysis By Application (Mining, Construction), By Type (Under HBW 400, HBW 400-500, Above HBW 500), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Wear Plate Sample For Dillinger Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Wear-Resistant Plate, Structural and Cold Forming Plate, Piles and Infrastructure Products, Other), By Application (Construction and Automobile Industry, Mining and Chemical Industry, Machinery Manufacturing Industry, Chemical Industry, Iron Making, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager