Wedding Dress Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442746 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Wedding Dress Market Size

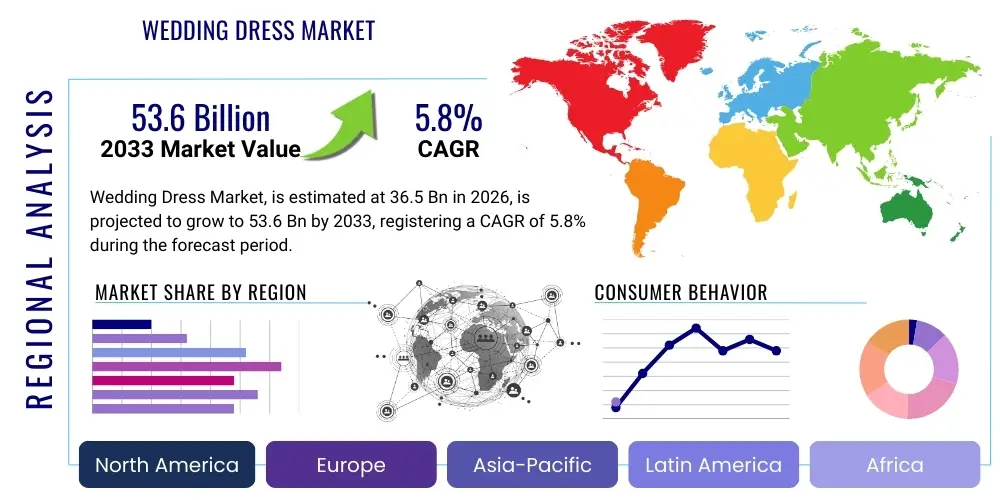

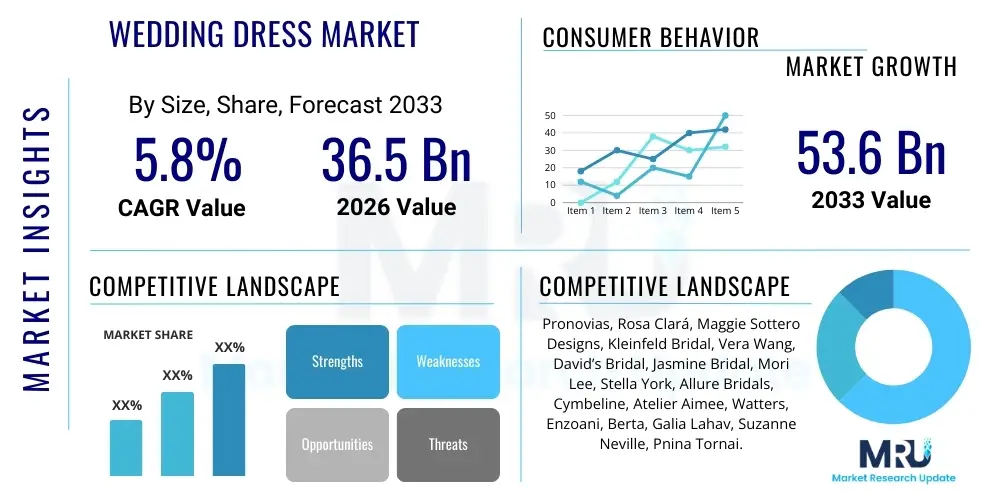

The Wedding Dress Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 36.5 Billion in 2026 and is projected to reach USD 53.6 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the stable global birth rates coupled with a robust recovery in marriage ceremonies post-pandemic restrictions, stimulating demand across all key demographic segments, particularly in emerging economies where traditional ceremonies hold significant cultural and economic value.

The market valuation reflects complex consumer shifts, including a bifurcation between luxury bespoke creations and affordable, ready-to-wear options. While high-end brands continue to capitalize on personalization and exclusivity, mass-market players are leveraging efficient supply chains and fast fashion principles adapted to bridal wear, catering to budget-conscious consumers and destination weddings requiring more practical attire. The rising disposable income, especially across Asian markets, further fuels the premium segment, where consumers prioritize quality fabrics, unique designs, and designer labels, thereby significantly contributing to the overall market valuation trajectory.

Furthermore, globalization of bridal fashion trends, facilitated by digital marketing and social media platforms, is rapidly influencing purchasing decisions worldwide. Manufacturers are investing heavily in omnichannel retail strategies, integrating virtual try-on technologies and personalized digital consultations to enhance the customer experience. This digital transformation, coupled with sustainable and ethical sourcing movements gaining traction among Millennial and Gen Z brides, introduces dynamic pricing and product innovations, reinforcing the projected CAGR and the attainment of the forecasted market size by 2033.

Wedding Dress Market introduction

The Wedding Dress Market encompasses the design, manufacturing, and retail of ceremonial garments specifically tailored for brides. This sector is characterized by its high emotional value and cyclical demand, intrinsically linked to global marriage rates and seasonal wedding trends. Products range from traditional floor-length gowns and contemporary separates to cultural attire specific to various global regions. Major applications include formal wedding ceremonies, elopements, vow renewals, and themed photoshoots, requiring specialized design considerations concerning fabric weight, embellishments, and structural integrity.

The primary benefit of the modern wedding dress market lies in its ability to offer extensive personalization and fulfill complex consumer emotional needs surrounding a significant life event. Technological advancements in fabric manufacturing, such as the development of sustainable silk alternatives and lightweight, structured synthetic materials, have expanded design possibilities, offering enhanced comfort and durability. Key driving factors include increasing urbanization leading to greater exposure to Western bridal styles, rising consumer expenditure on discretionary luxury items, and the pervasive influence of social media platforms like Instagram and Pinterest, which continuously set and accelerate global fashion trends, making bridal wear highly aspirational.

However, the industry faces structural complexity due to long lead times required for bespoke manufacturing and a heavily fragmented distribution network, balancing specialty boutique exclusivity against the mass appeal of online retailers. The market's resilience is underpinned by its cultural significance, ensuring steady, albeit fluctuating, demand. Recent innovations focus heavily on customization through digital design tools and implementing circular economy principles, such as dress rentals and resale programs, appealing to environmentally conscious consumers while maintaining revenue streams.

Wedding Dress Market Executive Summary

The global Wedding Dress Market is experiencing significant upward momentum, underpinned by steady recovery in wedding volumes and strong consumer appetite for highly customized and experiential purchases. Key business trends indicate a definitive shift toward direct-to-consumer (D2C) models, driven by established designers seeking greater control over pricing and customer data, bypassing traditional multi-brand retailers. Additionally, consolidation activities are prevalent, with larger bridal groups acquiring niche, digitally native brands to broaden their aesthetic portfolio and capture diverse consumer segments quickly. Supply chain resilience, particularly post-2020 disruptions, is now a crucial competitive differentiator, focusing on near-shoring strategies for faster turnaround and better inventory management, mitigating risks associated with geopolitical instabilities and transportation costs.

Regionally, Asia Pacific is poised to register the fastest growth, largely attributable to burgeoning middle classes in India and China, who are increasingly adopting Western-style white weddings alongside traditional cultural ceremonies, resulting in multiple dress purchases per event. North America and Europe maintain dominance in terms of market value, driven by high average spending per wedding and mature markets prioritizing designer collaborations and sustainable luxury. Emerging markets in Latin America and the Middle East show potential, driven by young populations and high cultural importance placed on elaborate, high-value bridal events, though market penetration requires specialized offerings catering to distinct religious and aesthetic requirements.

Segment trends reveal that the A-Line and Ball Gown silhouettes remain foundational, but demand for minimalist and customizable separates (e.g., trousers and modern jackets) is growing, appealing to second-time brides or those seeking non-traditional elegance. The distribution landscape is tilting toward online sales, leveraging advanced 3D sizing and augmented reality try-ons, although physical specialty boutiques retain their importance for the critical, personalized fitting experience. Fabric segmentation highlights sustained preference for lace and silk due to perceived luxury, while Tulle and Organza see strong demand in voluminous styles, emphasizing lightweight structure and affordability in the mass market segment.

AI Impact Analysis on Wedding Dress Market

Common user questions regarding AI's impact on the Wedding Dress Market center primarily around four themes: personalization accuracy, supply chain efficiency, design innovation, and job displacement. Users frequently inquire if AI can truly replace the intuition of a human designer or tailor, and how AI-driven styling tools ensure cultural and personal taste accuracy. There are significant concerns about data privacy when using body scanning technology and an expectation that AI should revolutionize the typically lengthy custom dress procurement process. The consensus expectation is that AI will act as a powerful augmentation tool, significantly streamlining design iterations and logistical functions rather than completely replacing the artistic and emotional aspects of bridal consultation and fitting.

The integration of Artificial Intelligence is fundamentally transforming the design-to-delivery lifecycle within the bridal industry. AI-powered trend analysis models analyze millions of social media images, runway data, and historical sales metrics to predict future aesthetic preferences, informing designers about emerging popular necklines, sleeve types, and fabric combinations months in advance. This predictive capability allows manufacturers to optimize inventory, reducing overstock risks associated with the long lead times inherent in high-fashion garment production. Furthermore, consumer-facing AI tools are enabling unprecedented levels of personalization. Machine learning algorithms process customer body measurements, preferred styles, budget constraints, and even venue type to recommend highly optimized dress options, significantly shortening the decision-making cycle for brides.

In the back-end, AI is driving efficiencies in complex supply chain management. Algorithms optimize raw material sourcing (like specific types of silk or lace) by monitoring global inventories and predicting demand fluctuations, ensuring timely material availability and minimizing production delays. Robotics and automated cutting technologies, managed by AI systems, are improving precision and reducing material waste, especially crucial for expensive fabrics and intricate lace placements. While the emotional consultation remains largely human, AI chatbot integration provides 24/7 customer service for routine inquiries regarding order tracking, sizing guides, and policy clarifications, improving overall operational scalability and customer satisfaction.

- AI-driven trend forecasting optimizes material procurement and minimizes inventory obsolescence risk.

- Generative design AI assists designers in rapidly prototyping new silhouettes and embellishment patterns based on consumer data.

- Virtual Try-On (VTO) and Augmented Reality (AR) tools, powered by computer vision, enhance the online shopping experience and reduce return rates due to sizing issues.

- AI-powered chatbots and customer service automation provide instantaneous support and manage pre-sale inquiries efficiently.

- Machine learning algorithms optimize manufacturing floor scheduling, improving efficiency in cutting, stitching, and quality control processes.

- Predictive maintenance analytics minimize downtime for high-precision embroidery and sewing machinery.

DRO & Impact Forces Of Wedding Dress Market

The dynamics of the Wedding Dress Market are governed by a complex interplay of Drivers, Restraints, and Opportunities, collectively forming the Impact Forces that shape its growth trajectory. Key drivers include the consistent global marriage rate, increasing consumer willingness to invest heavily in personalized experiences, and the overwhelming influence of digital media in shaping aesthetic preferences and aspirational spending. Conversely, significant restraints involve the inherent cyclical nature of demand (non-repeat purchase), the high cost of raw materials (especially natural fibers and luxury lace), and persistent intellectual property issues related to design copying and fast-fashion replications. Opportunities lie strongly within sustainable bridal wear, the expansion of the rental and pre-owned market segments, and leveraging advanced digital tools (like 3D printing and digital fitting) to enhance customization and reduce production timelines. These forces create a highly competitive environment where speed to market and unique brand positioning are paramount.

A primary driver is the psychological and cultural significance attributed to the wedding day, ensuring that regardless of economic conditions, the bridal attire remains a priority purchase, often leading to substantial average transaction values compared to general apparel. Furthermore, technological innovation in textile manufacturing allows for better fit, comfort, and intricate detailing at varying price points, broadening market accessibility. However, this growth is constantly hampered by economic volatility, which affects disposable income and, consequently, the willingness of consumers to opt for bespoke or high-end designer gowns, sometimes forcing a pivot toward more affordable, mass-produced options or rental services.

The market's long-term sustainability is heavily reliant on embracing circular economy models—specifically, the normalization of high-quality dress rentals and consignment sales. This meets the demand from environmentally conscious consumers while simultaneously addressing budget limitations. Furthermore, market participants focusing on niche segments, such as plus-size bridal wear, multicultural designs, or destination wedding attire (lightweight and packable), capitalize on underserved areas. The impact forces indicate a trend toward increased specialization and digitalization; brands that successfully integrate sustainable practices with seamless online-to-offline customer journeys are best positioned for long-term resilience and market share growth, effectively leveraging opportunities to mitigate traditional restraints.

Segmentation Analysis

The Wedding Dress Market is highly fragmented and segmented based on product characteristics, material composition, distribution methods, and pricing tiers, reflecting the diverse global consumer base. Segmentation analysis is critical for manufacturers to tailor their production volumes and marketing strategies precisely. The market is primarily defined by Silhouette (Ball Gowns, A-Line, Sheath, Mermaid), which dictates manufacturing complexity and material volume. Fabric type (Lace, Silk, Satin, Tulle) determines the overall aesthetic, price point, and tactile quality. Distribution channels remain a key differentiator, dividing the market between personalized specialty boutiques and large-scale, high-volume online platforms, each catering to distinct consumer expectations regarding service level and convenience.

Understanding these segments allows market players to optimize their inventory and geographic presence. For instance, the premium pricing segment, largely driven by bespoke services and designer collaborations, relies heavily on exclusive specialty boutiques in high-income urban centers. Conversely, the mass-market segment leverages department stores and online platforms, focusing on standardized sizing and efficient logistics. Shifts in marriage demographics, such as older first-time brides or increased second marriages, also influence segment demand, driving interest in more contemporary or simpler silhouettes (Sheath and Separates) over traditional voluminous gowns.

The sustained growth in the online segment is fundamentally reshaping traditional distribution dynamics. Manufacturers must now invest significantly in high-quality digital imagery, virtual reality tools, and standardized sizing charts to overcome the physical limitations of online shopping for an item as critical as a wedding gown. The focus on product customization, accessible through digital platforms, bridges the gap between mass production and personalized demand, ensuring the market remains responsive to individualized consumer preferences across all segmented categories.

- By Product Type/Silhouette:

- Ball Gown

- A-Line

- Sheath/Column

- Mermaid/Trumpet

- Separates (Skirts, Bodices, Trousers)

- By Fabric:

- Lace (Chantilly, Alençon, Venice)

- Silk (Satin, Crepe, Dupioni)

- Tulle and Organza

- Chiffon and Georgette

- Synthetic Blends

- By Distribution Channel:

- Offline Stores (Specialty Boutiques, Bridal Chains, Department Stores)

- Online Stores (E-commerce Platforms, Brand Websites)

- By Pricing:

- Mass Market/Budget ($500 - $2,500)

- Premium/Mid-Range ($2,501 - $8,000)

- Luxury/Bespoke (Above $8,000)

Value Chain Analysis For Wedding Dress Market

The Wedding Dress Market value chain is characterized by multiple intricate steps, beginning with upstream raw material sourcing and culminating in the final retail transaction and post-sale services. Upstream analysis focuses heavily on textile procurement, particularly high-grade silks, imported laces, intricate embellishments (beads, crystals), and specialized thread. Since quality heavily dictates the final product's value, strong, ethical relationships with fabric mills, particularly those producing specialized lace in Europe or high-quality silk in Asia, are critical. Cost fluctuations in these raw materials significantly impact overall profitability, necessitating robust supply chain risk management and strategic purchasing agreements to ensure continuity and quality consistency.

Midstream activities involve design, pattern making, cutting, and complex assembly, often involving highly skilled artisan labor, especially for hand-beading or complex drapery found in luxury gowns. Manufacturing can occur in internal production facilities or outsourced to specialized factories, predominantly located in Asia Pacific (for mass production) and Europe/North America (for high-end or quick-turnaround custom orders). The efficiency of this stage is crucial, as production lead times typically span four to nine months, directly affecting customer satisfaction and inventory turnover rates. Quality control checkpoints are rigorous due to the high emotional and monetary value of the final product, focusing on stitching integrity, fit precision, and embellishment security.

Downstream analysis covers distribution channels, primarily categorized as Direct and Indirect. Direct distribution involves proprietary brand boutiques or brand e-commerce sites, offering maximum control over pricing, brand messaging, and customer experience. Indirect distribution relies on multi-brand specialty bridal retailers, department stores, and independent boutiques, which provide broader geographical reach and personalized fitting services. The shift toward omnichannel retail necessitates seamless integration between physical showrooms (where brides experience the fit and fabric) and digital platforms (used for initial research, style selection, and order tracking), optimizing the customer journey and minimizing friction in the purchasing process.

Wedding Dress Market Potential Customers

The primary end-users and buyers of products within the Wedding Dress Market are engaged individuals planning a formal marriage ceremony, often referred to as "brides" but increasingly encompassing diverse clientele due to changing societal norms and inclusive marketing efforts. This core demographic is segmented not only by age (Millennials and Gen Z) but critically by disposable income, cultural expectations, and wedding scale. Millennials (ages 27-42) currently represent the largest segment of purchasers, heavily influenced by personalized experiences, digital aesthetics, and sustainability credentials, driving demand for unique and ethically sourced gowns.

Secondary customer segments include destination wedding planners and rental service companies. Destination wedding clientele often require lighter, less voluminous gowns suitable for travel and tropical climates. Rental services target budget-conscious or sustainability-focused consumers who prioritize environmental impact over ownership, demanding high-quality, durable gowns built to withstand multiple uses and professional cleaning cycles. Furthermore, fashion stylists and consultants often act as influential intermediaries, guiding the purchasing decisions of high-net-worth individuals and celebrity clientele, ensuring demand for ultra-luxury, bespoke creations remains robust.

A growing niche segment comprises second-time brides or those renewing vows, who typically seek less traditional, often simpler or colored gowns, focusing on sophistication and practicality over maximalist glamour. Effective targeting requires brands to employ sophisticated psychographic segmentation, understanding not just where a customer buys, but why—whether the motivation is tradition, aesthetic aspiration, environmental consciousness, or budget adherence—allowing for highly personalized product offerings and marketing campaigns across all digital touchpoints.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 36.5 Billion |

| Market Forecast in 2033 | USD 53.6 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Pronovias, Rosa Clará, Maggie Sottero Designs, Kleinfeld Bridal, Vera Wang, David’s Bridal, Jasmine Bridal, Mori Lee, Stella York, Allure Bridals, Cymbeline, Atelier Aimee, Watters, Enzoani, Berta, Galia Lahav, Suzanne Neville, Pnina Tornai. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wedding Dress Market Key Technology Landscape

The technology landscape of the Wedding Dress Market is rapidly evolving, driven by the need for enhanced customization, efficiency, and a seamless customer experience, often bridging the physical and digital shopping realms. Key technologies center around advanced textile manufacturing and digital visualization tools. Computer-Aided Design (CAD) and 3D modeling software are now standard practice, allowing designers to create highly detailed virtual prototypes, visualize fabric drape and movement, and rapidly adjust patterns based on client specifications, significantly reducing the time and material waste associated with physical samples. This digital workflow is integrated with high-precision automated cutting machinery, ensuring accuracy even with delicate and expensive fabrics like lace and silk, optimizing yield and reducing labor time.

Consumer-facing technology is primarily focused on overcoming the limitations of online purchasing. Augmented Reality (AR) and Virtual Try-On (VTO) applications utilize sophisticated spatial computing to allow brides to visualize gowns on their own bodies using mobile devices, offering a realistic preview of fit and style before committing to a purchase. Furthermore, 3D body scanning technology, increasingly deployed in specialty boutiques, captures thousands of precise measurements, generating highly accurate virtual avatars. This data is then used for precise pattern adjustments, leading to fewer alterations required post-production, a critical factor in customer satisfaction and cost reduction.

On the logistical and production side, the adoption of specialized Enterprise Resource Planning (ERP) systems tailored for high-fashion, low-volume production ensures robust management of complex order pipelines, multi-stage production schedules, and material tracking across global supply chains. Furthermore, the burgeoning field of sustainable textile technology, including biodegradable materials and efficient water-saving dyeing processes, is gaining prominence. Smart manufacturing processes leverage Internet of Things (IoT) sensors to monitor equipment performance and environmental conditions, ensuring optimal quality control throughout the intricate production of high-value bridal garments.

Regional Highlights

The global Wedding Dress Market exhibits distinct regional dynamics reflecting cultural traditions, economic maturity, and prevailing fashion trends. North America, particularly the United States, represents a highly mature market characterized by high average spending per bride and a strong demand for designer labels and luxury custom gowns. The region is a pioneer in digital adoption, with high consumer comfort levels regarding online purchasing and the use of technologies like virtual try-on, driving strong growth in the D2C segment. Furthermore, the robust infrastructure supporting rental and pre-owned markets contributes significantly to the circular economy within this region, maintaining market vitality.

Europe holds a commanding position, especially in design and manufacturing expertise. Countries like Italy, Spain, and France are home to globally recognized luxury bridal houses (e.g., Pronovias, Rosa Clará), emphasizing high-quality craftsmanship, intricate lace work, and traditional aesthetics. While growth rates are steady, the European market is undergoing a structural shift toward sustainable and ethically produced fashion, pressuring manufacturers to revise their sourcing and production methods. Eastern Europe presents emerging growth opportunities as disposable incomes rise, leading to a greater preference for Western bridal styles and increased market openness for established international brands.

Asia Pacific (APAC) is projected to be the fastest-growing region, driven primarily by demographic dividend and rising discretionary spending in metropolitan areas of China and India. The cultural phenomenon of multi-day, elaborate weddings often requires multiple attire changes, boosting the volume of sales per event. While Western white gowns are popular, there is also high demand for hybrid and culturally specific attire, requiring international brands to localize their collections. Latin America and the Middle East and Africa (MEA) present strong potential, particularly countries with high birth rates and strong cultural importance placed on elaborate weddings (e.g., Brazil, UAE, Saudi Arabia). These regions are characterized by a preference for highly embellished, modest, and high-volume silhouettes, driving demand in the luxury and premium segments, though penetration is often challenged by complex import regulations and regional distribution hurdles.

- North America: Market maturity, highest average spending, early adopter of digital customization, strong rental market infrastructure. Dominant demand for modern and minimalist silhouettes alongside luxury bespoke gowns.

- Europe: Hub for luxury design and artisan craftsmanship (Spain, Italy), increasing focus on sustainable and ethical sourcing, steady market volume with premium pricing stability.

- Asia Pacific (APAC): Highest expected growth rate, driven by India and China, demand for multiple outfits per wedding event (hybrid traditional/Western styles), large consumer base driving mass-market volume.

- Middle East & Africa (MEA): Preference for heavily embellished, luxurious, and modest designs; high investment in premium fabrics and customization, market growth linked strongly to oil wealth and local fashion houses.

- Latin America: Emerging market characterized by strong cultural emphasis on large celebrations, increasing adoption of modern bridal trends influenced by US and European media, steady growth in the mid-range segment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wedding Dress Market, analyzing their product portfolios, geographic footprint, strategic initiatives, and recent merger and acquisition activities.- Pronovias

- Rosa Clará

- Maggie Sottero Designs

- Kleinfeld Bridal

- Vera Wang

- David’s Bridal

- Jasmine Bridal

- Mori Lee

- Stella York

- Allure Bridals

- Cymbeline

- Atelier Aimee

- Watters

- Enzoani

- Berta

- Galia Lahav

- Suzanne Neville

- Pnina Tornai

- Justin Alexander

- The White One

Frequently Asked Questions

Analyze common user questions about the Wedding Dress market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the market growth for sustainable wedding dresses?

Market growth for sustainable wedding dresses is driven by increasing consumer awareness regarding environmental and ethical sourcing issues, particularly among Millennial and Gen Z brides. Key factors include preference for recycled fabrics, natural organic materials, fair labor practices, and the growing popularity of rental and pre-owned bridal options.

How is the rise of online retail affecting traditional bridal boutiques?

Online retail is forcing traditional bridal boutiques to adopt omnichannel strategies, integrating personalized virtual consultations and digital try-on tools with the essential in-person fitting experience. While online sales capture the budget-conscious segment, specialty boutiques maintain their value by offering high-touch service, expert tailoring, and exclusive designer collections.

Which geographic region demonstrates the strongest potential for future market expansion?

Asia Pacific (APAC) shows the strongest potential for future market expansion due to high population density, rising disposable incomes in economies like India and China, and the continued trend of adopting Western bridal styles alongside traditional ceremonies, leading to higher average spending per event.

What is the current primary consumer trend regarding wedding dress customization?

The primary consumer trend is demand for hyper-personalization, moving beyond standard alterations to bespoke elements. This involves mixing and matching separates (skirts and tops), customizing neckline or sleeve designs, and utilizing 3D body scanning and AI-driven platforms to ensure a perfect, unique fit tailored specifically to the bride’s measurements and aesthetic vision.

What impact are rental services having on the luxury segment of the market?

Rental services, especially for luxury designer gowns, are democratizing access to high-end fashion, primarily appealing to consumers who prioritize sustainability or budget optimization. While ownership remains crucial for the bespoke luxury segment, rental services offer a profitable secondary revenue stream for luxury brands and extend the lifecycle value of premium garments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Wedding Dress Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Ball Gown, Trumpet Dresses, A-line dresses, Mermaid-style Dresses, Sheath Wedding Dresses, Tea-length Wedding Dresses, Other), By Application (Wedding Dress Renting service, Wedding Consultant, Photographic Studio, Personal Purchase, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Wedding Dress Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Mermaid-style Dresses, Trumpet Dresses, A-line dresses, Sheath Wedding Dresses, Others), By Application (Modern Trade, Franchise Outlets, Women's Clothing, E-commerce, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Bridal Wear Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (The A-line dress, Trumpet dresses, Sheath wedding dresses, Tea-length wedding dresses, Others), By Application (Wedding Dress Renting Service, Wedding Consultant, Photographic Studio, Personal Purchase, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager