Wheel Flange Lubrication System Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442307 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Wheel Flange Lubrication System Market Size

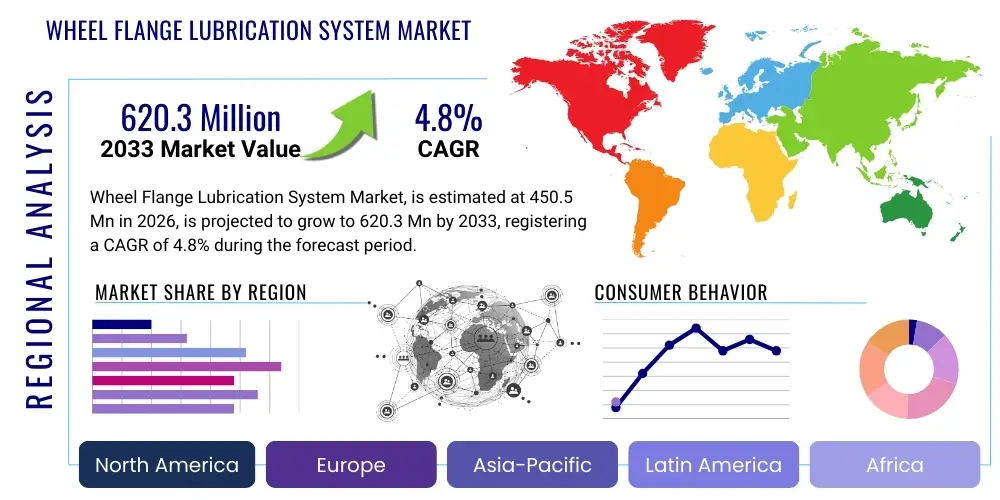

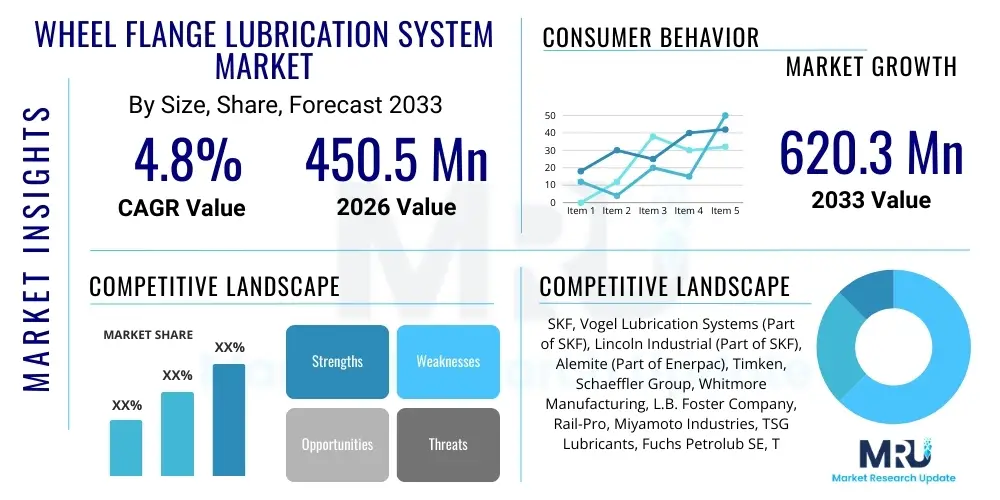

The Wheel Flange Lubrication System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 620.3 Million by the end of the forecast period in 2033.

Wheel Flange Lubrication System Market introduction

The Wheel Flange Lubrication System Market encompasses technologies and equipment designed to reduce friction and wear between railway wheel flanges and the side of the rail head. These systems are crucial components in modern rail infrastructure, serving to extend the lifespan of both wheels and rails, significantly decreasing maintenance costs, and enhancing energy efficiency by minimizing rolling resistance. The primary function involves the precise application of lubricants, typically grease, oil, or solid friction modifiers, directly to the wheel flange or the gauge face of the rail. Effective lubrication is paramount in curves and complex track geometries where contact stresses are highest, mitigating noise pollution, especially in urban transit environments, and preventing costly derailments or operational interruptions caused by excessive wear.

Major applications of these lubrication systems span the entire railway industry, including heavy haul freight lines, high-speed passenger railways, urban metro systems, and specialized industrial railways such utilized in mining and port operations. The increasing global investment in rail network expansion and modernization, particularly in developing economies, is driving the adoption of sophisticated automated lubrication solutions. Furthermore, regulatory pressures emphasizing safety, reduced carbon footprint, and optimized operational expenditure compel rail operators to integrate highly reliable lubrication systems that can withstand extreme environmental conditions and heavy-duty usage cycles, ensuring uninterrupted service delivery across diverse geographies.

Key benefits derived from implementing effective wheel flange lubrication include a reduction in lateral forces exerted on the rail, which translates directly into less rail grinding and replacement frequency. It also addresses the critical issue of rolling stock maintenance by protecting wheel profiles from rapid degradation, thereby reducing wheel turning frequency. Driving factors for market growth involve technological advancements, such as the integration of IoT sensors for real-time monitoring of lubricant usage and rail conditions, coupled with a persistent global focus on improving railway infrastructure longevity and maximizing the return on massive capital investments in rolling stock and track assets.

Wheel Flange Lubrication System Market Executive Summary

The Wheel Flange Lubrication System Market is undergoing robust transformation, driven primarily by globalization of railway networks and the imperative for sustainable operation. Business trends indicate a strong pivot towards smart lubrication solutions, where suppliers are integrating digital interfaces, telematics, and predictive maintenance algorithms into their offerings. This shift allows rail operators to move away from scheduled maintenance to condition-based monitoring, optimizing lubricant expenditure and minimizing asset downtime. Furthermore, consolidation among key market players is driving innovation in solid lubricant technology and biodegradable grease formulations, responding to stringent environmental regulations and the operational demands of high-traffic corridors, ensuring market growth across both OEM installations and aftermarket segments.

Regionally, the Asia Pacific (APAC) stands out as the fastest-growing market, fuelled by massive governmental investments in expanding high-speed and metropolitan rail networks, notably in China and India. North America and Europe, characterized by established heavy-haul and passenger rail systems, exhibit high demand for advanced, trackside systems capable of handling extreme temperature variances and heavy load capacities. Segment trends highlight that the On-Board lubrication system segment, particularly those utilizing automated and GPS-triggered dispensing, is gaining traction due to superior accuracy and reduced trackside maintenance requirements. Concurrently, the demand for non-petroleum-based, environmentally friendly lubricants is rising significantly, influencing product development cycles for major manufacturers seeking compliance and ecological responsibility.

The market structure is highly competitive, dominated by specialized industrial lubrication firms and large railway component suppliers. Strategic partnerships focusing on joint research for advanced friction management materials and sensor integration are becoming prevalent. The market trajectory is heavily influenced by the replacement cycle of aging rail infrastructure components and the regulatory push for noise reduction in densely populated urban areas, positioning efficient wheel flange lubrication as a critical infrastructure requirement rather than a supplementary maintenance activity. The overall outlook remains positive, underpinned by continuous global reliance on rail transport for freight and passenger mobility.

AI Impact Analysis on Wheel Flange Lubrication System Market

Common user questions regarding AI's impact on Wheel Flange Lubrication Systems frequently revolve around how AI can optimize application rates, predict wear patterns, and automate diagnostic processes, thus reducing manual oversight and lubricant waste. Users are particularly concerned about the feasibility of integrating AI with legacy railway infrastructure and the associated cybersecurity risks of connecting mission-critical systems. Key themes emerging from these inquiries include the expectation that AI-driven predictive maintenance will revolutionize the cost-efficiency of lubrication schedules and a need for standardized protocols for data exchange between lubrication hardware and centralized management platforms. There is significant interest in using Machine Learning (ML) models to correlate operational data (speed, load, curve radius, temperature) with optimal lubrication parameters, moving beyond simple distance or time-based application.

The application of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally changing the operational paradigm of Wheel Flange Lubrication Systems, transitioning them from reactive maintenance components to proactive, intelligent friction management tools. AI algorithms process vast amounts of telemetry data collected from on-board sensors, trackside monitoring stations, and historical wear patterns to determine the precise optimal volume and frequency of lubricant application required for specific track segments under varying conditions. This advanced calculation capability ensures that lubricant is applied exactly where and when it is needed, drastically reducing over-lubrication (which can lead to adhesion issues) and under-lubrication (which results in excessive wear and noise). The outcome is significant extension of wheel and rail life, which is a major cost driver for rail operators globally.

Furthermore, AI-powered diagnostic tools are enhancing the reliability of the lubrication systems themselves. By analyzing operational parameters such as pump pressure, nozzle blockage indicators, and reservoir levels, ML models can predict potential system failures before they occur. This capability supports truly condition-based maintenance, minimizing system downtime and ensuring continuous optimal friction management. The next phase of AI integration involves deep reinforcement learning to adjust lubrication strategies in real-time based on immediate feedback loops concerning noise levels or detected vibrations, providing an unprecedented level of dynamic responsiveness in complex railway environments.

- AI enables Predictive Lubrication Scheduling, minimizing waste and optimizing stock levels.

- Machine Learning algorithms correlate operational data (speed, temperature, curvature) for highly precise, dynamic lubricant dispensing.

- Real-time Fault Detection and Diagnosis (FDD) of lubrication hardware using sensor data.

- Enhanced integration with existing Rail Traffic Management Systems (RTMS) for coordinated maintenance activities.

- Use of Computer Vision and AI to inspect wheel flange wear profiles remotely, validating lubrication effectiveness.

- Optimization of energy consumption by maintaining ideal low-friction conditions across the track network.

DRO & Impact Forces Of Wheel Flange Lubrication System Market

The market dynamics are defined by powerful Drivers related to operational efficiency and increasing Restraints concerning environmental impact and infrastructure complexity, while significant Opportunities exist in emerging markets and smart technology adoption. The central impact forces revolve around the shift toward minimizing life cycle costs for rail assets, making efficient lubrication a critical economic necessity rather than an accessory. Operational expenditure reductions achieved through lower rail and wheel replacement rates serve as a compelling driver, directly influencing procurement decisions globally. Conversely, the high initial capital investment required for implementing sophisticated trackside and on-board monitoring systems acts as a substantial restraint, particularly for smaller rail operators or those managing aging infrastructure lacking digital compatibility.

Drivers (D): The primary drivers include the escalating global volume of rail traffic, demanding more resilient and long-lasting track infrastructure, especially in heavy-haul sectors like mining and coal transport where axle loads are maximized. Furthermore, strict environmental noise regulations in urban centers necessitate highly effective friction management systems to suppress squeal noise generated on tight curves, making advanced lubrication systems mandatory for urban metro and light rail transit systems. The desire to enhance overall energy efficiency in rail operations, where reduced friction translates directly into lower fuel or electricity consumption, also significantly propels market growth.

Restraints (R): Key restraints involve the high complexity and cost associated with maintaining both trackside and on-board systems, especially concerning regular replenishment and calibration in remote areas. The variability in lubricant performance across extreme climates (freezing winters and scorching summers) poses significant technological hurdles that require specialized, high-performance formulations, increasing procurement costs. Moreover, the integration challenges inherent in retrofitting advanced lubrication systems onto legacy rolling stock and disparate rail gauge standards across different countries can slow market penetration.

Opportunities (O): Substantial opportunities lie in the rapid expansion of rail networks across Asia Pacific and Latin America, where new construction offers greenfield installation opportunities for state-of-the-art, fully integrated systems. The development of solid lubricant sticks and friction modifiers offers an environmentally cleaner and less maintenance-intensive alternative to traditional wet grease applications, opening new segments. Additionally, the integration of 5G and IoT technologies for real-time remote diagnostics and control offers vendors a chance to create value-added service contracts based on performance and predictive maintenance.

- Drivers: Increasing freight volumes and axle loads; Demand for reduced noise pollution in urban rail; Focus on minimizing rail and wheel wear lifecycle costs; Energy efficiency mandates in rail operations.

- Restraints: High initial capital expenditure and complexity of implementation; Challenges related to maintenance and lubricant supply logistics in remote locations; Performance limitations of conventional lubricants in extreme temperatures.

- Opportunities: Expansion of new high-speed and heavy-haul rail projects in emerging economies; Development and commercialization of solid stick and biodegradable lubrication technologies; Integration of IoT and AI for precision lubrication control.

- Impact Forces: Intense pressure to reduce total cost of ownership (TCO) for rolling stock; Regulatory emphasis on safety and environmental compliance (e.g., non-toxic lubricants); Technological disruption favoring smart, sensor-based application systems.

Segmentation Analysis

The Wheel Flange Lubrication System Market is comprehensively segmented based on three critical parameters: the location of the system (Type), the material used for friction reduction (Mechanism), and the specific railway application (End-User). Analyzing these segments provides a nuanced understanding of market maturity, technological adoption rates, and regional demand dynamics. The segmentation by type, encompassing On-Board and Trackside systems, often reflects the operational strategy of the rail operator, with On-Board preferred for flexibility and precision, and Trackside favored for high-volume, fixed-route applications, requiring robust hardware capable of enduring harsh outdoor environments while lubricating thousands of wheels daily, leading to distinct investment patterns in infrastructure components.

The segmentation by mechanism is vital as it dictates performance, maintenance frequency, and environmental compliance. Traditional grease-based systems remain dominant due to their established track record and cost-effectiveness, particularly in heavy haul environments where high friction reduction is necessary under extreme loads. However, solid-stick lubricants are gaining significant traction, especially in sensitive urban areas, because they eliminate the risk of lubricant washout, run-off, and track contamination, offering a cleaner, more controlled release of friction modifier materials. The emerging use of non-petroleum-based oils and biodegradable greases further defines this segment, catering directly to environmentally conscious transit authorities in Western Europe and North America.

Segmentation by application clarifies end-user-specific requirements. Heavy Haul Railways prioritize durability, high capacity reservoirs, and lubricants engineered for high contact pressure, where the main objective is preventing catastrophic rail head failure and managing extreme wheel wear. Conversely, Metro/Transit Systems prioritize noise suppression and precise, low-volume application in tight curves, often opting for automated, real-time dispensing linked to vehicle speed and curvature data. The diversity in required performance metrics across these segments ensures a highly differentiated product offering from market participants, emphasizing customization and specialized engineering to meet strict safety and operational standards dictated by various railway governing bodies worldwide.

- By Type:

- On-Board Lubrication Systems

- Trackside Lubrication Systems

- By Mechanism/Lubricant Type:

- Grease-Based Systems (Conventional and Synthetic)

- Oil-Based Systems

- Solid Stick/Friction Modifier Systems

- By Application:

- Heavy Haul Freight Railways

- Metro/Transit and Passenger Railways

- Industrial and Mining Railways

Value Chain Analysis For Wheel Flange Lubrication System Market

The value chain for the Wheel Flange Lubrication System Market begins with upstream activities focused on the raw material procurement, encompassing specialized lubricant base stocks (petroleum, synthetic, or bio-based) and the precision manufacturing of hardware components such as pumps, reservoirs, dispensing nozzles, and electronic control units (ECUs). Key suppliers in the upstream segment include specialized chemical manufacturers and precision engineering firms providing highly durable components designed to withstand vibration, extreme temperatures, and dirt ingress typical of railway operations. The quality of these inputs directly impacts the performance and lifespan of the final system, necessitating stringent quality control and robust material certifications, often governed by international railway standards, ensuring reliable product delivery.

The core midstream segment involves the system assembly and integration, where original equipment manufacturers (OEMs) and specialized lubrication solution providers design and test integrated units. This stage includes complex software development for control and monitoring systems, integrating GPS, telemetry, and diagnostic software, which adds significant value. Distribution channels are typically dual: direct sales to large railway operators (national railways, major freight companies) for both new rolling stock (OEM supply) and infrastructure projects (trackside installation), leveraging dedicated engineering consultation teams. Indirect channels involve authorized distributors and specialized railway maintenance service providers, particularly prominent in the aftermarket sector for lubricant supply and system repair.

Downstream activities center on installation, commissioning, maintenance, and long-term service contracts. For on-board systems, installation often occurs during rolling stock manufacturing or major overhaul cycles. Trackside systems require complex civil engineering and electronic commissioning alongside the rail line. The ongoing profitability in the downstream sector is heavily reliant on recurring revenue from lubricant sales and specialized maintenance contracts, where suppliers offer performance-based guarantees tied to reduced wear metrics. End-users (railway operators) are the ultimate beneficiaries, realizing cost savings through extended asset life and enhanced operational safety and efficiency, thereby completing the value cycle through continuous system utilization and service renewals.

Wheel Flange Lubrication System Market Potential Customers

Potential customers for Wheel Flange Lubrication Systems are primarily major entities involved in operating and maintaining railway infrastructure and rolling stock globally. The most significant segment comprises national railway corporations and large private freight operators, especially those managing extensive networks characterized by high axle loads and numerous curves, such as heavy-haul networks utilized for iron ore, coal, and bulk commodity transport. These customers prioritize system robustness, long service intervals, and proven friction reduction capabilities to minimize severe track degradation and wheel replacement schedules, making TCO reduction the main purchasing criterion. Their purchasing decisions are often centralized and involve large, multi-year contracts for both trackside and on-board units and associated consumables, prioritizing established, certified suppliers with global service footprints.

A second crucial customer segment consists of urban transit authorities, metropolitan rail systems (metros, subways), and light rail operators. For this group, the primary motivation for adopting lubrication systems is not solely wear reduction but critically, noise abatement (wheel squeal). Operating in densely populated areas, these customers face stringent noise control regulations, making precise, quiet, and environmentally friendly lubrication systems essential. They often prefer solid-stick friction modifiers or clean grease formulations to avoid track contamination in high-visibility urban areas, typically purchasing through public tenders emphasizing noise performance and regulatory compliance, ensuring long-term contracts for lubricant supply.

Finally, specialized industrial railway operators, including major mining companies, port operators, and large manufacturing facilities that utilize internal rail networks for material handling, form the third customer base. These internal networks often feature exceptionally tight curves, steep gradients, and severe operating conditions, demanding highly reliable, custom-engineered lubrication solutions. While their networks are smaller, the intensity of use is extremely high, necessitating systems designed for maximum durability and minimal manual intervention. Purchasing decisions here are often integrated into broader equipment procurement for infrastructure upgrades or fleet replacement, focusing on systems that simplify internal maintenance logistics and reduce site-specific operational hazards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 620.3 Million |

| Growth Rate | CAGR 4.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SKF, Vogel Lubrication Systems (Part of SKF), Lincoln Industrial (Part of SKF), Alemite (Part of Enerpac), Timken, Schaeffler Group, Whitmore Manufacturing, L.B. Foster Company, Rail-Pro, Miyamoto Industries, TSG Lubricants, Fuchs Petrolub SE, TotalEnergies, Shell, Vossloh Group, Nordic Flanges, Plymouth Locomotive Works, Interflon, Lubrite Industries, Graco Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wheel Flange Lubrication System Market Key Technology Landscape

The key technology landscape of the Wheel Flange Lubrication System Market is rapidly evolving beyond simple mechanical dispensing toward sophisticated mechatronic and digital systems. A core technological trend is the pervasive adoption of smart lubrication controls, utilizing GPS and odometer readings to trigger lubricant dispensing only at pre-defined track locations (typically curves), maximizing efficiency and minimizing environmental run-off. Modern systems incorporate ruggedized microprocessors and specialized solenoid valves that ensure consistent, atomized dispensing volumes, even under high-speed operation or severe vibration. Furthermore, materials science innovation is critical, focusing on developing extreme pressure (EP) additives for grease and oil formulations that maintain viscosity and lubricity across a wide range of operational temperatures and humidity levels, critical for global railway environments, alongside the necessary non-toxic, biodegradable base fluids.

Another significant technological advancement is the rise of solid-stick friction management technology. These sticks, composed of highly durable polymer matrices infused with graphite or other friction modifiers, are applied via controlled spring mechanisms or automated actuator arms. This passive-active application method eliminates the complex hydraulic infrastructure associated with wet lubrication systems and significantly reduces the maintenance burden and environmental risk. This technology is particularly appealing for high-density commuter lines where environmental cleanliness is paramount and rapid lubricant replacement is necessary. Furthermore, telemetry and IoT integration constitute the cutting edge, enabling lubrication system controllers to transmit real-time data on reservoir levels, pressure integrity, and operational status back to centralized maintenance depots via cellular networks, facilitating predictive failure analysis and remote adjustments of dispensing parameters for maximizing efficiency.

The convergence of sensor technology and diagnostic software is vital for maintaining high performance. Advanced acoustic monitoring systems are being deployed, often integrated with the lubrication hardware, to detect wheel squeal—a direct indicator of insufficient lubrication—and dynamically adjust dispensing rates instantaneously. Coupled with this is the use of non-contact sensors, such as LiDAR or specialized cameras, that monitor actual wheel flange and rail gauge face wear profiles over time, providing quantitative feedback on the effectiveness of the lubrication strategy. This closed-loop feedback mechanism, increasingly powered by AI and machine learning models, ensures that the system is self-optimizing, moving the industry towards true prescriptive maintenance, significantly enhancing the longevity and reliability of rail assets globally.

Regional Highlights

- North America: The North American market, dominated by extensive heavy-haul freight operations (Class I railroads), shows high demand for robust, high-capacity trackside and on-board grease-based systems engineered for extreme temperature variances and heavy axle loads.

The U.S. and Canada prioritize systems that contribute to improved fuel efficiency and decreased maintenance frequency for vast track mileages. Investment is heavily focused on retrofitting existing rolling stock and high-volume curves with sophisticated telemetry-equipped systems. The regulatory environment encourages technological adoption that reduces operational bottlenecks and improves safety across long-distance, high-throughput corridors. The emphasis here is on durability and maximizing lubrication interval rather than solely noise reduction, a characteristic distinct from European counterparts.

The aftermarket segment, particularly for specialized lubricants and replacement parts, constitutes a significant portion of regional revenue due to the large installed base of legacy systems. Furthermore, ongoing research into advanced friction modifiers that withstand high shear forces typical of North American heavy freight conditions is driving collaborative efforts between lubricant suppliers and rail operators, ensuring the market remains a core testing ground for high-performance friction management solutions tailored for extreme operational stress environments.

- Europe: The European market is characterized by a mature, integrated, and diverse rail network encompassing high-speed passenger lines and dense urban transit systems. Environmental mandates, particularly concerning track cleanliness and noise pollution (wheel squeal), are the primary drivers of technology adoption.

There is a strong preference for highly accurate, low-volume dispensing systems, including solid stick and environmentally benign (biodegradable) lubricant formulations, especially in densely populated areas like Germany, the UK, and France. Governments and transit authorities are heavily invested in modernizing signaling and control systems, which facilitates the seamless integration of GPS-triggered on-board lubrication systems for precise curve-specific application. This regional market is highly sensitive to technological innovation that minimizes environmental footprint and complies with stringent noise standards (TSI Noise). Demand is split between retrofitting urban metro fleets and implementing advanced trackside systems along high-speed corridors.

The European rail industry's focus on interoperability and standardization across national borders also influences the market, requiring lubrication systems and components to meet rigorous CEN standards. Key growth areas include the expansion of cross-border freight corridors and the renewal of older urban tram and light rail infrastructure, necessitating compact, aesthetically discreet, and low-maintenance trackside lubrication units capable of precise operation under varying track conditions and demanding schedules.

- Asia Pacific (APAC): APAC is the fastest-growing region, fueled by unprecedented investment in new rail infrastructure, particularly in China, India, and Southeast Asian nations. The region is seeing mass deployment of high-speed rail and expansion of metro systems to support rapid urbanization.

China's extensive high-speed rail network and India's ambitious railway modernization projects are generating substantial demand for both OEM integration into new rolling stock and massive installations of trackside units on newly constructed lines. In contrast to North America, the focus is often on initial build-out and scaling capacity rapidly, favoring robust, reliable systems that can be quickly deployed and managed efficiently across vast distances. Competition among system suppliers in APAC is intense, focusing on pricing, reliability under high temperatures and monsoon conditions, and local service support capabilities.

The diversity of rail gauges and operating environments, from arid deserts to humid tropics, necessitates versatile product offerings. Emerging economies in Southeast Asia are gradually transitioning from older manual systems to automated lubrication, representing a significant untapped market segment. The market growth here is projected to remain strong, driven by governmental policy prioritizing infrastructure development as a cornerstone of national economic strategies, directly supporting large-scale procurement of lubrication systems for new construction and significant maintenance overhauls.

- Latin America (LATAM): The LATAM market is characterized by significant heavy-haul mining operations, particularly in Brazil, Chile, and Peru, which are crucial consumers of high-performance lubrication systems. Investment is highly concentrated in systems designed for high axle load capacity and operations in challenging geographical terrains (mountains, remote areas).

Market demand is generally project-specific, linked directly to major commodity transport investments, such as iron ore and copper extraction. While urban transit in major cities like São Paulo and Mexico City provides steady demand for light rail lubrication, the backbone of the market remains the industrial railway segment. The challenge in LATAM often lies in infrastructure maturity and logistics; therefore, systems that are reliable, easy to maintain in remote locations, and offer long service intervals are highly valued by operators seeking to minimize downtime and logistical complexities.

- Middle East and Africa (MEA): The MEA region is an emerging market for rail infrastructure, with substantial projects underway in the Gulf Cooperation Council (GCC) states (e.g., Saudi Railway System) and strategic developments in North and South Africa.

The key challenge and technological requirement in MEA are resistance to extremely high temperatures, sand ingress, and corrosion. Lubrication systems must be hardened and utilize specialized, stable lubricant formulations. The market is primarily driven by greenfield projects, offering opportunities for suppliers to integrate the latest smart, connected technologies from the outset. Investment priorities center on reliable systems that ensure operational continuity despite severe environmental conditions, linking lubrication directly to the successful operation of these newly developed, high-profile national rail networks.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wheel Flange Lubrication System Market.- SKF

- Vogel Lubrication Systems (Part of SKF)

- Lincoln Industrial (Part of SKF)

- Alemite (Part of Enerpac)

- Timken

- Schaeffler Group

- Whitmore Manufacturing

- L.B. Foster Company

- Rail-Pro

- Miyamoto Industries

- TSG Lubricants

- Fuchs Petrolub SE

- TotalEnergies

- Shell

- Vossloh Group

- Nordic Flanges

- Plymouth Locomotive Works

- Interflon

- Lubrite Industries

- Graco Inc.

Frequently Asked Questions

Analyze common user questions about the Wheel Flange Lubrication System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary benefit of implementing an automated Wheel Flange Lubrication System?

The primary benefit is the substantial reduction in the total cost of ownership (TCO) for railway assets, achieved by significantly extending the lifespan of both wheels and rails, minimizing maintenance frequency, and improving overall energy efficiency through optimized friction management.

How do On-Board and Trackside Lubrication Systems differ in application and maintenance?

On-Board systems are mounted directly on rolling stock, offering highly precise, dynamic lubrication tied to the vehicle's telemetry (GPS, odometer), suitable for targeted application. Trackside systems are fixed infrastructure, ideal for high-traffic, curved segments, and require less individual vehicle maintenance but higher civil engineering investment and centralized track access.

Which technology is driving innovation in reducing environmental impact in this market?

The key technologies driving environmental innovation are solid stick friction modifiers and the development of biodegradable, non-petroleum-based grease and oil formulations, which eliminate concerns regarding lubricant run-off and track contamination in ecologically sensitive or urban areas.

How does AI impact the efficiency and accuracy of modern lubrication systems?

AI significantly enhances system efficiency by using Machine Learning (ML) to analyze real-time operational data (load, speed, curve geometry) to predict wear rates and dynamically adjust the lubricant dispensing volume and frequency, ensuring optimal precision and minimizing waste for condition-based maintenance.

What are the main growth constraints facing the Wheel Flange Lubrication System Market?

The major constraints include the high initial capital investment required for implementing advanced, connected systems and the logistical complexities associated with maintaining consistent lubricant supply and technical servicing across vast and remote railway networks globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager