Wheelbarrows Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440995 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Wheelbarrows Market Size

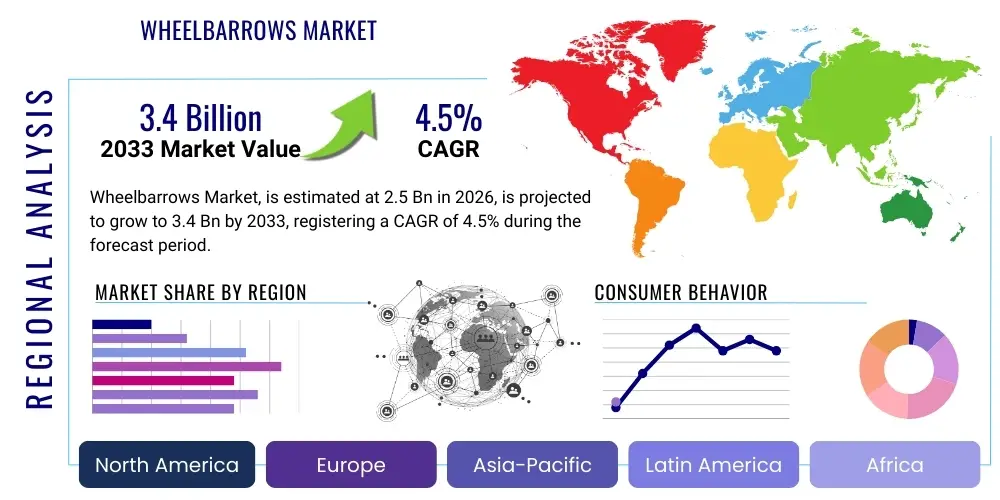

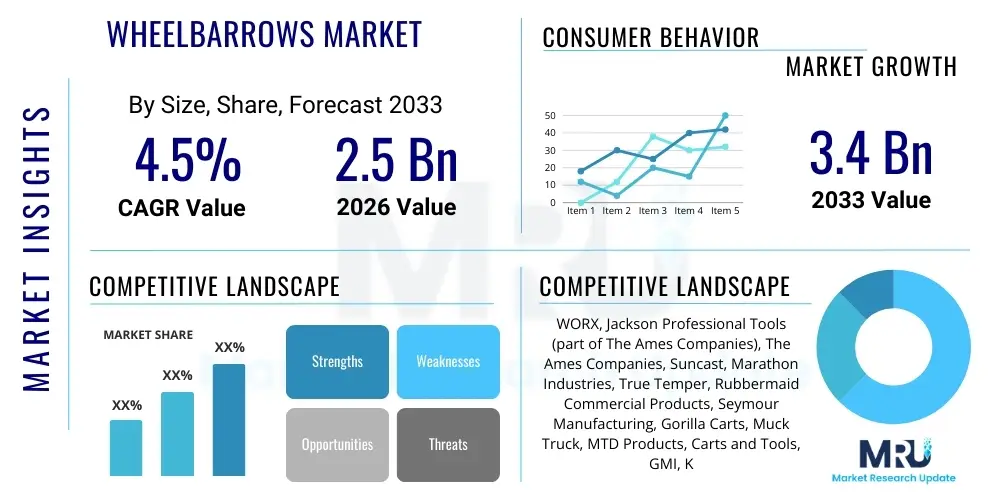

The Wheelbarrows Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at $2.5 Billion in 2026 and is projected to reach $3.4 Billion by the end of the forecast period in 2033. This growth trajectory is primarily driven by sustained global investment in residential and commercial construction projects, coupled with the increasing adoption of professional landscaping and agricultural practices worldwide. The market resilience, even amidst fluctuating raw material costs, underscores the essential nature of wheelbarrows as indispensable tools in material handling across various heavy-duty and light-duty applications.

Wheelbarrows Market introduction

The Wheelbarrows Market encompasses the global production, distribution, and sale of single-wheeled or dual-wheeled hand-propelled vehicles used for hauling loads, predominantly composed of a tray or hopper supported by a frame and handles. These tools are fundamental for efficiently moving materials such as soil, gravel, cement, fertilizers, debris, and refuse over short distances, particularly across uneven terrain where motorized transport is impractical. Modern wheelbarrows are categorized by material composition, capacity, and power source (manual or electric), catering to a broad spectrum of end-users ranging from individual homeowners engaged in gardening to large-scale construction contractors executing major infrastructure projects. The product description emphasizes durability, ergonomic design to minimize user strain, and load capacity tailored to specific industrial requirements.

Major applications for wheelbarrows span diverse economic sectors. In the construction industry, they are vital for mixing and transporting concrete and moving building materials on job sites. The gardening and landscaping sector relies heavily on wheelbarrows for moving mulch, plants, tools, and earth, facilitating efficient maintenance and design projects. Furthermore, in agriculture, they are utilized for hauling feed, manure, crops, and equipment across farms. Key benefits driving market growth include their simplicity of operation, low maintenance requirements, high maneuverability in confined spaces, and cost-effectiveness compared to powered alternatives like skid steers or mini dumpers. The versatility and robustness of the tool ensure its sustained relevance despite advancements in material handling technology.

Driving factors propelling the Wheelbarrows Market include rapid urbanization, which fuels residential and commercial infrastructure development globally, necessitating continuous material transport. The robust growth in the Do-It-Yourself (DIY) movement, particularly in developed economies, increases demand for smaller, ergonomic wheelbarrows suitable for home gardening and renovation tasks. Additionally, the emergence of battery-powered and motorized wheelbarrows addresses labor shortages and improves operational efficiency in heavy-duty commercial applications, overcoming the traditional physical limitations associated with manual models. These factors, combined with technological advancements focusing on lightweight yet highly durable materials, solidify the market's positive outlook.

Wheelbarrows Market Executive Summary

The Wheelbarrows Market Executive Summary highlights a stable yet innovation-focused industry characterized by significant penetration in traditional sectors such as construction and agriculture, increasingly driven by electric and specialized models. Business trends indicate a strong move toward ergonomic designs and superior material construction, primarily focusing on polypropylene tubs for corrosion resistance and reduced overall weight, alongside high-strength steel for heavy-duty applications. Manufacturers are focusing on differentiating their offerings through feature sets like puncture-proof tires, improved balancing systems (dual-wheel configurations), and integrated dumping mechanisms. The competitive landscape is fragmented, with local manufacturers dominating region-specific markets while a few global brands focus on standardized, high-quality offerings to leverage international supply chains and brand recognition.

Regionally, Asia Pacific (APAC) stands out as the primary growth engine, largely due to unprecedented infrastructure development and robust residential construction activity in countries like China, India, and Southeast Asia. North America and Europe maintain mature, steady markets characterized by high adoption rates of premium, specialized, and electric models catering to stringent safety and efficiency standards in professional landscaping and contracting. Segment trends reveal that while steel wheelbarrows remain the baseline due to cost and durability, the fastest growth is observed in the plastic/polypropylene segment, driven by residential users and applications where corrosion resistance is critical. Furthermore, the motorized segment, though small in volume, commands the highest average selling price and demonstrates significant growth potential in large commercial environments seeking labor savings and efficiency gains.

In summary, the market's trajectory is positive, underpinned by essential end-use applications and fueled by product evolution focused on user comfort and operational specialization. Key market participants are concentrating on optimizing global supply chains, managing the volatility of input materials (steel prices), and investing in battery technology for power-assisted solutions. The overarching theme is the balancing act between traditional low-cost utility and modern, high-efficiency ergonomics, ensuring the wheelbarrow remains a perennial fixture in material handling toolkits worldwide, adapting to the needs of both the DIY enthusiast and the industrial contractor.

AI Impact Analysis on Wheelbarrows Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Wheelbarrows Market often revolve around perceived obsolescence, automation potential, and supply chain efficiency improvements. Common questions include: "Will robots or autonomous dumpers replace manual wheelbarrows?" "How can AI optimize the manufacturing process for steel or plastic tubs?" and "Can AI improve logistics and demand forecasting for seasonal tools like wheelbarrows?" Analysis indicates that users are less concerned about AI being directly integrated into the tool itself (given its mechanical simplicity) and more focused on AI's ability to automate surrounding processes. The key themes emerging are the optimization of production lines using predictive maintenance, enhanced inventory management based on real-time construction data, and the potential for AI-driven design iteration, such as topology optimization for lightweighting the frame without compromising structural integrity.

While AI will not immediately replace the physical utility of a wheelbarrow, its influence is profound in supporting operational aspects. AI is crucial in predictive analytics for raw material procurement, allowing manufacturers to hedge against price volatility for steel and plastic resins, ensuring cost stability. Furthermore, in the distribution phase, machine learning algorithms can analyze complex logistical networks, optimizing routes and warehousing locations to minimize delivery times and costs, particularly critical for bulky products like wheelbarrows. This back-end support ensures that traditional, low-tech products are manufactured and delivered using high-tech efficiency, maintaining competitive pricing and timely market availability.

The primary expectation users have is that AI should lead to smarter, stronger, yet lighter wheelbarrows manufactured more affordably. For instance, generative design powered by AI can help engineers simulate stress points and material fatigue under various load conditions, leading to optimal material usage and minimal waste. This application of AI to material science and mechanical design is the most significant anticipated impact, ensuring that the wheelbarrow, even in its simplest form, evolves to be maximally efficient and environmentally conscious in its production cycle. This integration of sophisticated analytics into a rudimentary product highlights the pervasive nature of AI across all industrial sectors.

- AI-driven Predictive Maintenance: Optimizing assembly line operations and tool longevity during manufacturing, reducing downtime and operational costs.

- Supply Chain Optimization: Utilizing machine learning for forecasting seasonal demand fluctuations and managing volatile raw material inventory (steel, polypropylene).

- Generative Design Integration: Applying AI to topology optimization for frame and tray design, ensuring maximal strength with minimal material usage (lightweighting).

- Automated Quality Control: Employing computer vision systems on assembly lines to detect minor defects in welding or plastic molding that affect long-term durability.

- Logistics Efficiency: AI algorithms streamlining distribution routes and inventory placement, significantly lowering shipping costs for bulky items.

DRO & Impact Forces Of Wheelbarrows Market

The dynamics of the Wheelbarrows Market are influenced by a complex interplay of Drivers (D), Restraints (R), Opportunities (O), and external Impact Forces. The primary drivers include the consistent growth in global construction and infrastructure spending, which ensures a steady demand baseline. This is further amplified by the persistent trend toward residential refurbishment and landscaping projects, particularly in developed nations where consumer disposable income supports DIY activities. These factors establish the wheelbarrow as an indispensable tool, impervious to short-term economic fluctuations in core end-user markets. Furthermore, the introduction of ergonomic and motorized models significantly mitigates the restraint associated with manual labor intensity, thereby expanding the potential user base and application scope.

Key restraints largely revolve around cost management and competitive pressure. Volatility in commodity prices, especially for steel and crude oil derivatives used in plastic manufacturing, directly impacts production costs and profit margins, forcing manufacturers to frequently adjust pricing strategies or absorb costs. Another significant restraint is the competition posed by alternative, albeit higher-cost, material handling equipment such as skid steers, compact track loaders, and automated guided vehicles (AGVs) in industrial settings, which handle significantly larger volumes. This competition necessitates continuous innovation in the wheelbarrow segment to justify its usage based on cost-efficiency and maneuverability in niche environments.

Opportunities for market expansion are centered on technological advancements and geographical market penetration. The major opportunity lies in the widespread adoption of battery-powered wheelbarrows, which combine the maneuverability of a traditional unit with powered assistance, addressing labor concerns and enhancing productivity in large commercial sites and challenging terrains. Geographically, untapped potential exists in developing economies in Africa and parts of Latin America, where infrastructure build-out is accelerating but sophisticated material handling equipment is cost-prohibitive. Impact forces, which include stringent worker safety regulations (pushing for ergonomic designs) and fluctuating interest rates affecting residential construction financing, mandate adaptive strategies in product development and market positioning. These combined forces drive a necessity for durable, cost-effective, and user-friendly products that align with contemporary labor and environmental standards.

Segmentation Analysis

The Wheelbarrows Market is strategically segmented based on product type, material composition, capacity metrics, and ultimate end-use applications, providing a detailed framework for market penetration and strategic planning. This segmentation is crucial for manufacturers to tailor product features, pricing, and distribution channels to specific user requirements. For instance, the distinction between single-wheel and dual-wheel configurations directly addresses stability and load-bearing needs, while the segmentation by material (steel versus poly) separates the heavy-duty commercial market from the lighter residential and gardening sectors. Understanding these granular segments allows for precise market targeting and optimizes the return on investment for product development efforts, ensuring market offerings align perfectly with demand profiles across diverse geographies and user profiles.

Segmentation allows for the identification of high-growth niches, such as the increasing demand for heavy-duty, battery-powered wheelbarrows in commercial construction, a segment characterized by higher average selling prices (ASPs) and a lower price sensitivity among professional buyers focused on operational efficiency. Conversely, the high-volume consumer market is dominated by small to medium-capacity poly wheelbarrows, emphasizing affordability and ease of storage. The global market research must analyze the intersection of these segments, recognizing that regional preferences (e.g., preference for deep steel trays in agricultural regions) often dictate local market leadership and optimal product mixes. Effective segmentation is the cornerstone of a competitive market strategy in this foundational tool category.

- By Product Type:

- Single Wheel Wheelbarrows (Standard, High maneuverability)

- Dual Wheel Wheelbarrows (Enhanced stability, Higher load distribution)

- Electric/Motorized Wheelbarrows (Battery-powered assistance, High efficiency)

- By Material:

- Steel Wheelbarrows (Heavy-duty construction, Industrial use)

- Polypropylene/Plastic Wheelbarrows (Corrosion resistance, Residential/Gardening use)

- Hybrid/Fiberglass Wheelbarrows (Weight reduction, Specialized applications)

- By Capacity:

- Small Duty (Up to 4 cu ft, Residential/DIY)

- Medium Duty (4 to 6 cu ft, General gardening, Light construction)

- Heavy Duty (Above 6 cu ft, Commercial construction, Agriculture)

- By End-Use:

- Construction Industry (Cement, gravel, scaffolding)

- Gardening and Landscaping (Mulch, soil, plants)

- Agriculture and Farming (Feed, manure, harvest)

- Industrial and Utility (Waste management, Warehouse movement)

Value Chain Analysis For Wheelbarrows Market

The value chain for the Wheelbarrows Market begins with upstream activities focused on raw material sourcing and primary manufacturing. Upstream analysis involves the procurement of key materials: high-grade sheet steel (for trays and frames), plastic resins (polypropylene and HDPE) for poly models, rubber or pneumatic materials for tires, and specialized components like axles, bearings, and electric motors for powered units. Managing the volatility of steel and plastic resin markets is paramount at this stage, as it dictates the final manufacturing cost. Key upstream partnerships often involve long-term contracts with steel mills and petrochemical suppliers to ensure consistent material quality and supply. The manufacturing process itself involves stamping, welding (for steel frames), injection molding (for poly trays), assembly, and surface treatment (painting or powder coating for corrosion resistance). Efficiency in these stages, particularly through automated welding and assembly, is critical for maintaining high throughput and competitive pricing.

Downstream analysis focuses on logistics, distribution, and point-of-sale activities. Given the bulky nature of wheelbarrows, transportation costs represent a significant component of the final price, necessitating sophisticated logistics strategies, often involving partially disassembled units to optimize container space. The market employs a multi-tiered distribution channel. Direct distribution is common for high-volume commercial contracts, where manufacturers supply large construction firms or national agricultural cooperatives directly. Conversely, indirect distribution utilizes a dense network of wholesalers, regional distributors, and, most importantly, large retail chains (home improvement centers like Home Depot, Lowe's, B&Q) which serve the bulk of the residential and small contractor market. E-commerce platforms are increasingly relevant, particularly for specialized or niche (e.g., electric) models, allowing direct-to-consumer sales, though shipping costs remain a substantial challenge for standard manual units.

The distribution channel landscape is defined by the dichotomy between high-volume retail and specialized industrial supply. Large big-box retailers exert significant pricing pressure on manufacturers, demanding favorable terms and high inventory turnover. Specialized distributors, however, focus on quality, durability, and brand reputation, catering to professional contractors who prioritize tool longevity over initial purchase price. The overall value chain is highly sensitive to external factors like international trade tariffs affecting steel prices and logistical bottlenecks impacting shipping times. Successful players manage these complexities by localizing assembly operations closer to key markets and maintaining robust inventory management systems that predict retail seasonality accurately.

Wheelbarrows Market Potential Customers

The potential customer base for the Wheelbarrows Market is highly diverse, spanning individual consumers to massive multinational corporations, categorized primarily by their end-use application and required load capacity. The largest and most economically significant customer group is the construction sector. This includes large general contractors involved in major infrastructure projects (highways, bridges), residential developers building subdivisions, and specialized subcontractors (masons, landscapers, roofers). These buyers typically require heavy-duty, steel-based, high-capacity wheelbarrows, often transitioning towards electric models to comply with site safety regulations and enhance labor efficiency. Their purchasing decisions are driven by durability, warranty, and proven performance under harsh conditions, leading to large-volume procurement contracts and high expenditure on replacement units over time.

The second major group consists of the vast community of gardening and landscaping professionals, including commercial landscapers, municipal park maintenance crews, and independent garden centers. These customers often prefer medium-duty, corrosion-resistant polypropylene wheelbarrows that are lighter and easier to maneuver, crucial for moving mulch, compost, and small stones without damaging residential lawns or pathways. The purchasing cycle for this group tends to be seasonal, peaking in spring and summer, and is heavily influenced by ergonomic features, weight, and storage convenience. Furthermore, the retail market for DIY enthusiasts represents a critical customer segment, characterized by high volume and price sensitivity, seeking standard poly or light steel models sold primarily through major home improvement stores and online retailers for general home maintenance and gardening tasks.

Finally, the agricultural and industrial sectors constitute specialized customer segments. Farmers require robust, large-capacity wheelbarrows for moving feed, crops, or manure, prioritizing stability (dual-wheel often preferred) and resistance to chemical corrosion. The industrial and utility segment includes customers in waste management, mining, and warehouse operations who use specialized utility carts or heavy-duty wheelbarrows for moving waste or intermediate goods. These customers value specialized features like integrated brakes, extra-deep tubs, and highly robust tire systems. Understanding the specific constraints—whether capacity, material compatibility, or maneuverability—for each customer group is essential for successful product specialization and market penetration.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.5 Billion |

| Market Forecast in 2033 | $3.4 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | WORX, Jackson Professional Tools (part of The Ames Companies), The Ames Companies, Suncast, Marathon Industries, True Temper, Rubbermaid Commercial Products, Seymour Manufacturing, Gorilla Carts, Muck Truck, MTD Products, Carts and Tools, GMI, King Industry, Haian Jiade, Jinhua Fuding, Zhejiang Hongsheng, Ningbo Sanyuan, Qingdao Huada, Qingdao Rida. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wheelbarrows Market Key Technology Landscape

Despite the inherent mechanical simplicity of the wheelbarrow, the market's technology landscape is evolving, driven primarily by material science innovation and electrification. Traditional manufacturing technologies, such as deep-draw metal stamping and robotic welding for steel trays, remain fundamental, focused on maximizing structural integrity and minimizing weight. However, the use of advanced polymer injection molding techniques is expanding rapidly. These techniques allow for the production of lightweight, rust-proof polypropylene trays with complex, ergonomic shapes that optimize load balancing and dumping ease. Material innovation also includes the use of composite materials and high-density plastics that offer durability comparable to steel but with significant weight reduction, critical for consumer appeal and adherence to labor safety standards.

The most transformative technology in the wheelbarrows market is the integration of electric power and advanced battery management systems. Electric or motorized wheelbarrows utilize lithium-ion battery technology to power a drive system (often a brushless motor in the wheel hub), significantly reducing the manual effort required to move heavy loads up slopes or across rough terrain. This technology targets professional users in construction and agriculture, where maximizing productivity and reducing repetitive strain injuries (RSIs) are top priorities. Advances in battery technology, including longer run times and faster charging cycles, are making these powered models increasingly viable and cost-effective, positioning them as an efficient middle ground between manual labor and full-scale mechanized equipment.

Furthermore, technology related to tire development is crucial. The shift toward flat-free or puncture-proof tires, often made from solid polyurethane foam, addresses a primary user frustration: downtime due to deflation. While these tires may offer less cushioning than traditional pneumatic tires, continuous advancements are improving their shock absorption capabilities. Digital technology also influences product design through Computational Fluid Dynamics (CFD) and Finite Element Analysis (FEA), optimizing the structural geometry of frames and handles for maximum load capacity and ergonomic comfort. These digital tools ensure modern wheelbarrows are engineered for peak performance and user safety, pushing the boundaries of what is possible within this classic tool design.

Regional Highlights

- Asia Pacific (APAC): APAC represents the fastest-growing market globally, characterized by massive investments in infrastructure development, rapid urbanization, and a booming residential construction sector, particularly in economies like China, India, and Southeast Asia. The region exhibits high demand for basic, cost-effective steel wheelbarrows for construction sites, alongside a rising need for medium-duty poly models driven by increasing personal disposable income and the emergence of modern gardening culture. The scale of development projects ensures high volume sales, making this region critical for global manufacturers seeking growth.

- North America: North America is a mature market known for high consumer standards, a strong DIY culture, and significant professional landscaping activity. Demand is heavily concentrated on premium products, including high-end ergonomic poly models, specialized dual-wheel units for stability, and the highest adoption rate of electric and battery-powered wheelbarrows, driven by high labor costs and efficiency mandates in commercial environments. US and Canadian regulations prioritizing worker safety also drive innovation in ergonomic design.

- Europe: The European market displays steady growth, focusing on durability, environmental compliance, and ergonomic standards. Western European countries exhibit strong demand for high-quality, long-lasting wheelbarrows in the professional construction and agricultural sectors. Regulations concerning material safety and recycling capabilities influence product design, favoring highly durable, repairable, and sustainably sourced components. Eastern Europe provides growth opportunities as infrastructure modernization continues across the region, boosting demand for medium to heavy-duty equipment.

- Latin America: This region is characterized by fragmented growth, with demand tied closely to localized economic cycles and infrastructure spending, particularly in Brazil and Mexico. The market is highly price-sensitive, with a preference for durable, simple-to-maintain steel wheelbarrows. The increasing professionalization of agriculture is, however, driving niche demand for specialized farming models. Logistical challenges and varying quality standards across countries influence distribution and market entry strategies.

- Middle East and Africa (MEA): The MEA market is projected to see moderate to high growth, fueled by mega-project construction in the GCC countries (Saudi Arabia, UAE) and expanding mining and infrastructure efforts in South Africa and parts of Sub-Saharan Africa. The demand environment is harsh, necessitating extremely robust, heavy-duty steel models capable of withstanding extreme temperatures and rough terrain. The adoption of advanced, high-efficiency equipment, including motorized units, is accelerating in high-spending Gulf nations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wheelbarrows Market.- WORX

- Jackson Professional Tools (a brand under The Ames Companies)

- The Ames Companies Inc.

- Suncast

- Marathon Industries

- True Temper

- Rubbermaid Commercial Products

- Seymour Manufacturing International

- Gorilla Carts

- Muck Truck (Specializing in motorized carriers)

- MTD Products (Often through subsidiary brands)

- Carts and Tools

- GMI (Global Material Handling)

- King Industry

- Haian Jiade Machinery Co., Ltd.

- Jinhua Fuding Machinery Co., Ltd.

- Zhejiang Hongsheng Industry and Trade Co., Ltd.

- Ningbo Sanyuan Tools Co., Ltd.

- Qingdao Huada Metal Product Co., Ltd.

- Qingdao Rida Technology Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Wheelbarrows market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the electric wheelbarrows segment?

The primary factor driving the growth of electric wheelbarrows is the imperative for increased operational efficiency and the reduction of labor intensity in commercial construction and large-scale landscaping. Battery-powered models mitigate manual strain, enhance productivity across challenging terrains, and adhere to ergonomic safety standards.

Which material type is preferred by the residential gardening segment?

The residential gardening segment primarily prefers polypropylene or plastic wheelbarrows. These models are favored due to their significant weight advantage, high resistance to rust and corrosion from fertilizers or wet soil, and general lower price point compared to heavy-duty steel variants.

How does the volatility of raw material prices affect the wheelbarrows market?

Raw material price volatility, particularly concerning steel and plastic resins, directly impacts manufacturing costs and profit margins. Manufacturers often absorb short-term increases or pass them onto consumers, necessitating advanced supply chain management and hedging strategies to maintain competitive pricing.

Which geographical region exhibits the highest market growth rate for wheelbarrows?

The Asia Pacific (APAC) region currently exhibits the highest market growth rate. This is attributed to massive governmental and private sector investments in infrastructure, accelerating urbanization trends, and sustained residential construction booms across key economies like India and China.

What is the difference in application between single-wheel and dual-wheel wheelbarrows?

Single-wheel wheelbarrows offer superior maneuverability in tight spaces and allow for easier tipping and dumping of materials. Dual-wheel models prioritize stability and load distribution, making them ideal for heavier, more balanced loads over flat or less restrictive terrains, reducing user effort for carrying capacity.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Wheelbarrows Market Statistics 2025 Analysis By Application (Construction Applications, Industrial Applications, Home Applications, Agriculture & Livestock), By Type (Traditional Wheelbarrows, Hand Trucks), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Landscape Garden Wheelbarrows Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Manual Wheelbarrows, Electric Wheelbarrows), By Application (Municipal, Park, Family), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager