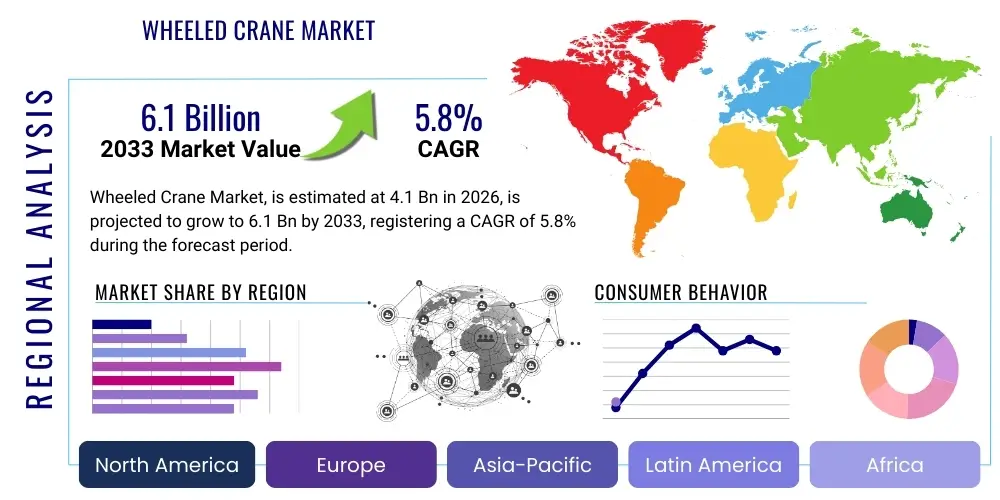

Wheeled Crane Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440959 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Wheeled Crane Market Size

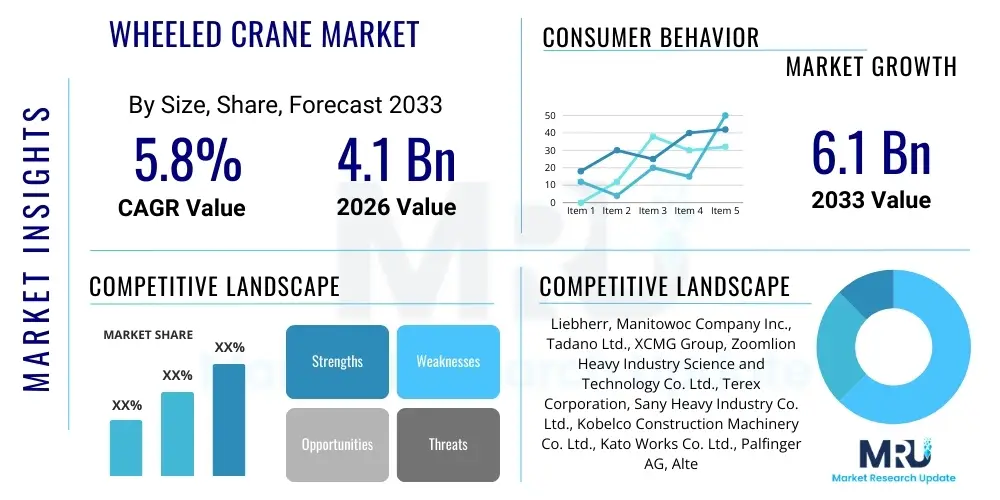

The Wheeled Crane Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.1 Billion in 2026 and is projected to reach USD 6.1 Billion by the end of the forecast period in 2033.

Wheeled Crane Market introduction

The Wheeled Crane Market encompasses mobile lifting equipment characterized by their capability to operate on rubber tires, offering superior mobility and flexibility compared to fixed or crawler-based systems. These cranes, primarily categorized into All-Terrain, Rough Terrain, and Truck-Mounted variants, are crucial for modern construction, infrastructure development, and industrial maintenance activities globally. Their core functionality involves lifting and precisely placing heavy materials across diverse and often challenging operational environments, making them indispensable assets in large-scale projects and tight urban spaces where rapid deployment and relocation are essential requirements.

Major applications of wheeled cranes span across several high-growth sectors, including residential and commercial construction, extensive public infrastructure projects such as bridges and highways, and specialized industrial sectors like oil and gas processing plants and utilities maintenance. The intrinsic benefit of these machines lies in their operational versatility; Truck-Mounted cranes, for instance, offer high-speed road travel, minimizing transit time between sites, while Rough Terrain cranes provide stability and mobility on uneven ground typical of energy or remote construction sites. This dual capability—high lifting capacity combined with exceptional maneuverability—drives consistent demand.

Driving factors for sustained market expansion include the global push for urbanization, necessitating extensive building construction, and significant governmental investment in upgrading aging civil infrastructure across developed and emerging economies. Furthermore, technological advancements centered on enhanced safety features, higher load charts, and improved fuel efficiency are making newer wheeled crane models more economically viable and environmentally compliant, encouraging fleet modernization among rental companies and end-users. The rising adoption of advanced telematics and remote monitoring systems also optimizes operational uptime and maintenance scheduling, contributing significantly to the overall market attractiveness.

Wheeled Crane Market Executive Summary

The Wheeled Crane Market is currently undergoing significant transformation driven by stringent global safety regulations and a pronounced shift towards digitalization in construction machinery management. Business trends indicate a robust demand for high-capacity, all-terrain cranes that can handle complex lifts in constrained urban environments while maintaining operational efficiency. Key industry players are focusing heavily on integrating hybrid and electric powertrain technologies to meet stricter emissions standards, particularly in European and North American markets. Furthermore, the rental sector dominates the procurement landscape, driven by the cost-efficiency of leasing advanced machinery rather than outright purchase, especially for project-based usage.

Regional trends highlight the Asia Pacific (APAC) as the primary growth engine, fueled by massive public and private investments in infrastructure, particularly in China, India, and Southeast Asian nations undergoing rapid industrialization and urbanization. North America and Europe demonstrate mature market characteristics, emphasizing replacement cycles and demand for specialized, highly maneuverable cranes (e.g., smaller city cranes) compliant with Tier 4 Final/Stage V emission standards. The Middle East and Africa (MEA) region presents significant opportunities linked to large-scale energy projects and ongoing construction associated with future cities and tourism infrastructure development.

Segment trends underscore the rising popularity of All-Terrain (AT) cranes due to their adaptability across highway travel and off-road applications, offering the best balance of speed and power. In terms of capacity, the medium-to-high lifting range (100 to 250 metric tons) is experiencing accelerating adoption, reflecting the increasing scale and complexity of modern construction elements such as precast components and larger wind turbine parts. Technological integration, particularly in load monitoring systems and operator assist functions, is becoming a decisive factor in purchasing decisions, signaling a market preference for smart, safer, and highly efficient lifting solutions.

AI Impact Analysis on Wheeled Crane Market

Common user questions regarding AI's impact on the Wheeled Crane Market primarily revolve around operator safety enhancement, the feasibility of autonomous operation in construction zones, and the efficacy of predictive maintenance systems in reducing downtime. Users frequently inquire about how AI can analyze complex site conditions and loads in real-time to prevent tipping or overloading incidents, thus minimizing human error. Another major concern focuses on the deployment timeline and cost-effectiveness of AI-powered telematics for fleet management, specifically analyzing whether the investment in advanced algorithms for condition monitoring truly translates into significant savings on maintenance and fuel consumption. The consensus suggests high expectation for AI to transform operational efficiency and safety, moving away from purely mechanical systems toward cognitive machinery.

The integration of Artificial Intelligence and Machine Learning (ML) is fundamentally altering the operational dynamics of wheeled cranes by optimizing lift planning and execution. AI algorithms can process vast amounts of data regarding ground pressure, wind speed, boom deflection, and load characteristics simultaneously, providing instantaneous feedback or even preemptive intervention to ensure lifts remain within safe operating parameters. This level of computational assistance significantly lowers the risk associated with complex or non-standard lifts, which traditionally depend solely on operator experience. Furthermore, AI contributes to more efficient project management by automating the assessment of necessary crane resources based on construction project requirements and timelines.

Beyond immediate operational safety, AI applications are crucial for the long-term asset management of large crane fleets. ML models analyze historical operational data—including hours worked, duty cycles, fault codes, and environmental exposure—to accurately predict potential equipment failures before they occur. This transition from reactive or time-based maintenance to true condition-based predictive maintenance maximizes equipment uptime, drastically reduces unexpected breakdowns, and optimizes the scheduling of technicians and spare parts. Consequently, this leads to lower total cost of ownership (TCO) for fleet owners and ensures greater reliability for demanding construction schedules.

- AI-driven real-time load management systems enhance stability and prevent exceeding load limits.

- Predictive maintenance utilizing machine learning models forecasts component failures, maximizing operational uptime.

- Autonomous positioning and route planning systems optimize crane movement across large, dynamic construction sites.

- Advanced vision systems and AI object recognition improve situational awareness and collision avoidance in crowded environments.

- AI facilitates automated diagnostic reports, streamlining field service and reducing repair times.

- Optimization of fuel consumption and hydraulic performance through continuous operational data analysis.

DRO & Impact Forces Of Wheeled Crane Market

The Wheeled Crane Market is primarily driven by global infrastructure investment and urbanization trends, while facing restraints related to high initial capital outlay and skilled operator shortages. Significant opportunities exist in embracing electrification and digital twin technologies for enhanced operational planning. These market dynamics are heavily influenced by the interplay of economic cycles, regulatory compliance, and technological advancements focusing on safety and efficiency across all operational parameters.

Drivers: Global government expenditure on critical infrastructure projects, particularly in transport networks, renewable energy installations (e.g., wind farms where specialized mobile cranes are essential), and utility upgrades, forms the strongest impetus for market growth. Rapid urbanization in emerging markets necessitates continuous high-rise construction and maintenance activities, demanding versatile and highly mobile lifting solutions. Furthermore, increasing emphasis on worker safety and stringent regulatory standards mandates the adoption of modern cranes equipped with sophisticated safety technologies (e.g., load moment indicators, anti-two block systems), driving the replacement cycle of older machinery.

Restraints: A significant constraint is the high purchase price and considerable lifecycle operating costs associated with modern, high-capacity wheeled cranes, which can be prohibitive for smaller construction firms or rental companies without strong financing. The cyclical nature of the construction and mining industries directly impacts crane demand, making the market vulnerable to economic downturns and fluctuations in commodity prices. Additionally, a critical global shortage of highly trained and certified crane operators poses a long-term operational constraint, influencing both safety records and the overall utilization efficiency of sophisticated modern equipment.

Opportunities: Opportunities abound in the development and commercialization of hybrid and fully electric wheeled cranes, addressing the growing need for low-emission machinery in urban and regulated zones. The burgeoning field of IoT and telematics offers substantial opportunities for market players to develop subscription-based, value-added services focused on predictive maintenance, remote diagnostics, and fleet utilization optimization. Furthermore, expanding into high-growth specialized applications, such as modular construction and maintenance of ultra-large industrial facilities, presents lucrative avenues for manufacturers to innovate lifting solutions tailored to unique logistical challenges.

Impact Forces: The cumulative effect of these forces suggests a moderately high positive impact on the market trajectory over the forecast period, contingent upon stable global economic conditions. While restraints like high costs and operator scarcity dampen growth marginally, the powerful drivers from infrastructure spending and technological adoption, particularly concerning safety and emissions compliance, are expected to significantly accelerate market adoption rates, favoring manufacturers who invest in electrification and advanced digital features. Regulatory pressure acts as a critical force, mandating modernization and indirectly stimulating the replacement market.

Segmentation Analysis

The Wheeled Crane Market is comprehensively segmented based on Type, Lifting Capacity, and End-User Application, reflecting the diverse operational requirements across various industries. Analysis across these segments is vital for understanding market dynamics, identifying high-growth niches, and tailoring product development to specific end-user needs. The Type segmentation distinguishes between cranes optimized for high mobility on public roads versus those designed exclusively for challenging, off-road terrains. Lifting Capacity segmentation correlates directly with the complexity and scale of construction projects, while End-User segmentation reveals the primary industries driving current and future demand for wheeled lifting solutions.

The dominance of specific segments often varies regionally; for example, Truck-Mounted cranes are particularly popular in densely populated regions requiring frequent and rapid relocation between sites, while Rough Terrain cranes maintain a stronghold in energy and mining sectors situated in remote areas. Strategic manufacturers focus on developing flexible platforms, such as All-Terrain cranes, that bridge the gap between these applications, offering robust performance capabilities combined with excellent roadability. Future segment growth is expected to be highest in segments integrating green technologies and enhanced digital safety features, driven by regulatory compliance and customer demand for efficiency.

- By Type:

- All-Terrain (AT) Cranes

- Rough Terrain (RT) Cranes

- Truck-Mounted Cranes (TMC)

- Mobile Harbor Cranes (MHC)

- By Lifting Capacity:

- Below 50 Metric Tons

- 50 - 150 Metric Tons

- 150 - 300 Metric Tons

- Above 300 Metric Tons

- By End-User Application:

- Construction (Residential, Commercial)

- Infrastructure (Bridges, Highways, Rail)

- Utilities and Power Generation (Wind, Thermal, Nuclear)

- Oil & Gas and Mining

- Industrial and Heavy Maintenance

- By Propulsion:

- Diesel

- Hybrid

- Electric (Emerging)

Value Chain Analysis For Wheeled Crane Market

The value chain for the Wheeled Crane Market is complex, involving multiple stages from raw material sourcing to final deployment and maintenance. Upstream activities involve the procurement of specialized components, including high-strength steel for booms, advanced hydraulic systems, engines (diesel and electric), and sophisticated electronic control units. Key players in this stage are specialized metal processors and global component manufacturers who supply OEMs with highly durable and reliable materials conforming to strict engineering standards. Quality control and supply chain efficiency at the upstream level directly influence the final performance and safety profile of the cranes.

Midstream activities are dominated by original equipment manufacturers (OEMs) responsible for design, assembly, rigorous testing, and integration of the specialized components. This stage involves significant R&D investment, particularly in areas like lightweighting materials, developing advanced control software, and incorporating telematics technology. Distribution channels represent a critical downstream component, typically involving a mix of direct sales to large construction or rental corporations and reliance on a global network of authorized dealers and distributors. These dealers provide essential localized services, including financing, operator training, maintenance, and spare parts supply, ensuring widespread market reach and customer support.

The downstream market is characterized by end-users, primarily large rental companies (which often account for the majority of sales volume), major construction firms, and specialized industrial maintenance providers. The service segment, encompassing periodic maintenance, component repair, and digital service subscriptions (e.g., predictive maintenance packages), contributes significantly to the overall lifecycle value of the crane. Direct distribution is favored for large, strategic customers requiring highly customized solutions, while indirect channels leverage dealer expertise to penetrate regional and SME markets efficiently, providing necessary after-sales support that enhances brand loyalty and repeat business.

Wheeled Crane Market Potential Customers

Potential customers in the Wheeled Crane Market primarily comprise entities requiring temporary or permanent heavy lifting capabilities across various project scales. The most significant customer base consists of global and regional equipment rental and leasing companies. These firms procure vast fleets of cranes to rent out to smaller construction companies, infrastructure developers, and industrial clients who prefer operational flexibility and reduced capital expenditure over direct ownership. Rental companies are highly sensitive to utilization rates, demanding high reliability, robust maintenance support, and excellent residual value from the equipment they purchase.

The second major category includes large-scale civil engineering and construction contractors specializing in major public works, such as building high-rise commercial towers, bridges, and extensive road networks. These companies often own a core fleet of specialized cranes critical to their operations, preferring machinery that offers high capacity and compliance with the most stringent international safety standards. Furthermore, energy sector participants, including oil and gas exploration firms and renewable energy developers (e.g., wind and solar farm constructors), represent high-value specialized customers requiring Rough Terrain and large All-Terrain cranes capable of handling immense loads in isolated or harsh environmental conditions.

Other crucial end-users include utility companies for power line and infrastructure maintenance, port and terminal operators utilizing mobile harbor cranes for cargo handling, and heavy industrial maintenance service providers who require versatile lifting equipment for plant shutdowns and equipment installation. The buying criteria across these segments are distinct: rental companies prioritize versatility and TCO, construction firms focus on capacity and speed, and industrial users emphasize precision and safety compliance for intricate tasks within operating facilities.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.1 Billion |

| Market Forecast in 2033 | USD 6.1 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Liebherr, Manitowoc Company Inc., Tadano Ltd., XCMG Group, Zoomlion Heavy Industry Science and Technology Co. Ltd., Terex Corporation, Sany Heavy Industry Co. Ltd., Kobelco Construction Machinery Co. Ltd., Kato Works Co. Ltd., Palfinger AG, Altec Industries, Fassi Group, Effer SpA, HIAB (Cargotec), Elliott Equipment Company, National Crane (Manitowoc), Grove (Manitowoc), Link-Belt Cranes, Fuwa Heavy Industry, Sennebogen Maschinenfabrik GmbH |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wheeled Crane Market Key Technology Landscape

The Wheeled Crane Market's technological landscape is rapidly evolving, moving away from purely mechanical systems toward sophisticated digital, connected, and power-efficient machines. Core innovations are concentrated in hydraulic system optimization, material science for boom construction (using lighter, stronger steel alloys), and, most significantly, the integration of advanced electronics. Key technology drivers include Load Moment Indicators (LMIs) and enhanced stability control systems that utilize highly sensitive sensors and real-time computation to ensure operation within certified safe boundaries, significantly reducing the risk of catastrophic failure and improving overall site safety compliance.

Telematics and the Internet of Things (IoT) represent the crucial connectivity infrastructure for modern wheeled cranes. These systems allow for remote monitoring of critical parameters, including engine health, fuel consumption, GPS location, and operational hours. This data is leveraged to provide actionable insights for fleet managers, enabling predictive maintenance scheduling and optimizing crane utilization across multiple projects. The increasing prevalence of digital interfaces and automated set-up procedures, such as automated outrigger leveling and boom sequencing, minimizes human setup time and complexity, enhancing operational speed and consistency, particularly important for quick deployment scenarios like Truck-Mounted Cranes.

A burgeoning technological segment involves the development of alternative powertrain solutions, primarily hybrid and fully electric systems. Driven by global mandates for reduced carbon emissions, electric wheeled cranes are gaining traction, especially in urban construction sites where noise pollution and air quality restrictions are strict. While battery capacity and charging infrastructure remain challenges, manufacturers are investing heavily in improving energy density and utilizing energy recuperation systems during hoisting and lowering operations. Furthermore, the integration of AI for lift planning and operational guidance represents the frontier of technological development, promising safer and more precise material handling than ever before.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market for wheeled cranes globally, driven by massive urbanization, industrialization, and unprecedented government spending on infrastructure, particularly in China, India, and Southeast Asian countries (Indonesia, Vietnam). The demand here is diverse, ranging from small Truck-Mounted cranes for residential construction in rapidly expanding urban centers to high-capacity All-Terrain cranes needed for major highway projects and the construction of new ports and industrial zones. Price competitiveness remains a critical factor, leading to strong local manufacturing presence and intense competition, although demand for high-end safety features is steadily increasing due to regulatory harmonization.

- North America: This region is characterized by a mature market focused on replacement cycles and technology upgrades, rather than sheer volume expansion. Demand is heavily concentrated on high-capacity All-Terrain cranes and specialized Rough Terrain cranes for energy projects (oil and gas, and renewables, especially wind turbine installation). North American buyers prioritize compliance with strict safety standards (e.g., OSHA) and seek cranes integrated with advanced telematics for robust fleet management. The shift toward Tier 4 Final compliant engines has necessitated significant fleet modernization, ensuring continuous demand for technologically advanced models.

- Europe: The European market is highly regulated and strongly focused on environmental sustainability, driving the adoption of low-emission, hybrid, and electric wheeled cranes, especially in Western European countries (Germany, UK, France). The fragmented nature of construction sites and strict limitations on size and weight in many historical cities favor smaller, highly maneuverable city cranes and Truck-Mounted cranes capable of navigating dense urban environments. Infrastructure renewal projects, combined with expansion in offshore and onshore wind energy, ensure stable demand for specialized heavy lift equipment.

- Middle East and Africa (MEA): Growth in the MEA region is episodic but high, largely dependent on large-scale government-backed infrastructure and energy projects (Saudi Arabia's Vision 2030, UAE development). The market demands heavy-duty Rough Terrain and All-Terrain cranes suitable for handling extreme temperatures and remote desert operations typical of large oil and gas facilities and vast construction sites. While capital expenditure can be volatile, high-profile projects ensure consistent demand for the largest class of wheeled cranes, often purchased or leased directly by global EPC contractors.

- Latin America (LATAM): The LATAM market, while facing economic volatility in key countries like Brazil and Argentina, shows promising long-term growth driven by mining expansion, public infrastructure backlog, and continued residential construction. The region exhibits strong demand for versatile and robust equipment that can handle challenging, varied topography. Affordability and ease of maintenance are often prioritized alongside fundamental lifting capacity, leading to a strong presence of both global OEMs and regionally focused manufacturers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wheeled Crane Market.- Liebherr

- Manitowoc Company Inc.

- Tadano Ltd.

- XCMG Group

- Zoomlion Heavy Industry Science and Technology Co. Ltd.

- Terex Corporation

- Sany Heavy Industry Co. Ltd.

- Kobelco Construction Machinery Co. Ltd.

- Kato Works Co. Ltd.

- Palfinger AG

- Altec Industries

- Fassi Group

- Effer SpA

- HIAB (Cargotec)

- Elliott Equipment Company

- National Crane (Manitowoc)

- Grove (Manitowoc)

- Link-Belt Cranes

- Fuwa Heavy Industry

- Sennebogen Maschinenfabrik GmbH

Frequently Asked Questions

Analyze common user questions about the Wheeled Crane market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand in the Wheeled Crane Market?

The central driver is increasing global government and private sector investment in large-scale infrastructure projects, including transportation networks, energy facilities, and rapid urban residential and commercial development worldwide.

How do All-Terrain Cranes differ fundamentally from Rough Terrain Cranes?

All-Terrain (AT) cranes are designed for high-speed travel on public roads combined with strong lifting performance on varied construction sites. Rough Terrain (RT) cranes are optimized exclusively for demanding off-road conditions, focusing on stability and mobility over uneven ground, typically found in mining or remote energy sites.

What impact is sustainability having on the design of new wheeled cranes?

Sustainability is driving manufacturers to innovate in hybrid and fully electric powertrain technologies, focusing on reducing diesel emissions and operational noise, making newer models suitable for highly regulated urban and eco-sensitive construction zones.

Which geographic region currently dominates the global Wheeled Crane Market?

The Asia Pacific (APAC) region currently dominates the market, primarily due to unprecedented investment in infrastructure, rapid urbanization, and massive industrial expansion across countries like China and India.

What is the significance of telematics and IoT in wheeled crane fleet management?

Telematics and IoT enable real-time remote monitoring of equipment performance, utilization, and health, facilitating predictive maintenance strategies, maximizing operational uptime, and reducing the total cost of ownership (TCO) for fleet operators.

The Wheeled Crane Market analysis indicates a strong reliance on global capital expenditure cycles, with technology integration being the defining factor for competitive advantage. Manufacturers prioritizing safety, efficiency, and compliance with environmental regulations are best positioned for long-term growth and market share expansion throughout the forecast period. Continued focus on digitalization, particularly in autonomous operation features and advanced asset management tools, will reshape procurement decisions in the coming years, ensuring that the market remains dynamic and technologically focused. The replacement demand in mature markets combined with unprecedented infrastructure construction in emerging economies forms a solid foundation for the projected CAGR of 5.8%.

Further market acceleration is anticipated from advancements in lifting materials and structural components, allowing for higher capacity lifting without a commensurate increase in vehicle weight. The challenge of integrating robust cybersecurity measures into highly connected crane systems is also becoming a key consideration for both manufacturers and end-users, ensuring that digitalized assets are protected from operational interference. The shift towards large-scale prefabricated construction methods is also boosting demand for extremely high-capacity wheeled cranes capable of handling and positioning massive, modular components quickly and precisely on site.

In summary, the Wheeled Crane Market is evolving into a sector where technological differentiation is paramount. Success is increasingly tied to the ability of OEMs to offer smart, highly mobile, and sustainable lifting solutions that address the dual pressures of maximizing productivity while adhering to increasingly strict global safety and environmental mandates. This specialized equipment segment remains crucial to global infrastructure growth, underpinning construction, energy, and heavy industrial activities worldwide. Market strategies must be highly attuned to regional infrastructure pipelines and specific end-user capacity requirements.

The convergence of advanced robotics, sophisticated sensor technology, and AI-driven load management is paving the way for semi-autonomous wheeled crane operation. While fully autonomous cranes are still emerging, the current focus is on operator assistance and fatigue reduction systems, significantly improving safety metrics. Investment in operator training facilities that utilize virtual reality (VR) and simulation is also a crucial element of the market ecosystem, addressing the skilled labor shortage by rapidly producing certified operators capable of managing modern, complex crane controls. This integrated approach to technology and human factors will define the market landscape from 2026 to 2033.

Moreover, financing and leasing solutions are playing an increasingly crucial role, especially for smaller market participants. Manufacturers and dealerships often partner with financial institutions to offer attractive lease structures, ensuring that advanced, high-cost machinery remains accessible across the entire spectrum of potential customers. The secondary market for used wheeled cranes also influences the primary market, particularly regarding residual value, which acts as a key variable in the Total Cost of Ownership calculation for rental companies and large contractors. Strong residual values incentivize earlier replacement cycles, indirectly driving primary market sales and maintaining high equipment quality standards across the industry.

Finally, global supply chain resilience remains a critical underlying factor. Disruptions in the supply of high-grade steel, specialized hydraulic components, or electronic controllers can significantly delay manufacturing and delivery schedules, impacting the market's ability to capitalize on immediate demand spikes. Manufacturers are actively pursuing regional diversification of their supplier base and utilizing modular design principles to mitigate these risks. This focus on supply chain robustness is essential to maintaining the competitive edge and meeting the rigorous demands of global construction timelines, especially those pertaining to nationally critical infrastructure and energy transition projects.

The Wheeled Crane Market is projected to experience notable growth in the hydraulic systems segment, driven by the requirement for precise and efficient control over heavy loads. Modern hydraulic systems incorporate advanced proportional valves and pressure-compensated pumps, which allow for smoother, faster, and more energy-efficient crane movements. This efficiency is critical not only for operational speed but also for optimizing fuel consumption, a key operating expense for diesel-powered cranes. Furthermore, the development of synthetic hydraulic fluids with extended life and improved performance characteristics contributes to reduced maintenance requirements and lower environmental impact.

Another area of concentrated technological investment is the cabin and operator interface design. Ergonomics, visibility, and control intuitiveness are paramount for operator safety and productivity. Modern crane cabins feature integrated digital displays that consolidate all critical information, from engine diagnostics to real-time load charts and camera feeds. Joysticks and control systems are increasingly customizable, allowing operators to tailor controls to their preferences, thus reducing fatigue during long shifts. Climate control and noise reduction also contribute significantly to the appeal of newer models, serving as crucial non-lifting performance differentiators in competitive tenders.

In the context of material science, the adoption of lightweight, high-tensile steel is vital for achieving longer boom lengths and higher lifting capacities without compromising stability or exceeding road weight limits. Manufacturers continually research materials that provide a better strength-to-weight ratio, allowing cranes to transport more counterweight or boom sections on the road, thereby minimizing the need for multiple transport vehicles and reducing logistical costs. This material innovation directly translates into enhanced efficiency, particularly for high-capacity All-Terrain models used in remote or time-sensitive projects.

The specialized segment of Mobile Harbor Cranes (MHCs) is seeing robust growth driven by the expansion and modernization of global container ports. These cranes, often truck-mounted but specialized for dockside use, benefit significantly from automated positioning and anti-sway technology, ensuring faster and safer cargo handling. The adoption of electric drives in MHCs is particularly strong in ports aiming to achieve zero-emission operations, aligning with global maritime industry sustainability initiatives. Their mobility allows ports to quickly reconfigure lifting assets based on vessel sizes and peak traffic demands, offering flexibility unmatched by fixed gantry cranes.

Market consolidation, particularly through mergers and acquisitions, is a continuing trend among global OEMs seeking to expand their geographical footprint and acquire specialized technological capabilities, particularly in the telematics and software domains. Vertical integration within the value chain, where manufacturers also provide financing or specialized maintenance contracts, is becoming a common strategy to capture greater lifetime value from the equipment sold. These strategic maneuvers are essential for maintaining competitiveness against low-cost entrants, particularly those originating from Asian markets who are rapidly closing the technology gap.

In conclusion, the competitive landscape of the Wheeled Crane Market is defined by technological rivalry, operational efficiency demands, and strict adherence to global safety and environmental standards. The future success of key players hinges on their ability to deliver integrated solutions—combining robust hardware with intelligent software and flexible aftermarket support—to meet the sophisticated needs of global construction and infrastructure clients facing increasingly complex logistical and regulatory hurdles.

The push for standardization across international regulations, while sometimes slow, offers long-term benefits to global manufacturers by reducing the complexity of designing machinery for multiple different markets. Initiatives aimed at harmonizing safety certification and emissions standards, particularly between European and North American regulators, streamline the R&D process and accelerate the deployment of new models. Conversely, the lack of unified standards in certain emerging markets can create barriers and necessitate customized product offerings, adding cost and complexity to regional expansion efforts, thus influencing strategic investment decisions regarding local manufacturing and assembly plants.

The importance of specialized attachments and accessories cannot be overstated in the Wheeled Crane Market. Manufacturers are increasingly offering specialized lifting tools, jibs, and custom rigging solutions designed to maximize the versatility of their base crane models for niche applications, such as tunnel boring machine assembly or specialized maintenance within confined industrial plants. This focus on modularity and accessory compatibility allows end-users to maximize the return on investment (ROI) of a single crane platform by adapting it to a wider range of jobs, thereby expanding the crane’s effective market utility and attractiveness to rental fleets.

The labor market dynamics, specifically the aging workforce of experienced crane operators, necessitates the development of intuitive and automated crane controls. Advanced Human-Machine Interface (HMI) systems are designed to lower the cognitive load on operators, allowing newer, less experienced staff to safely manage complex lifts with greater confidence. These systems incorporate features such as joystick feedback, visual guides, and automated sequence checks, effectively democratizing the operation of high-capacity cranes and directly mitigating the restraint posed by the global operator shortage, acting as a crucial enabling factor for market growth in the long term.

Furthermore, the shift towards digitalization extends to the entire sales and after-sales process. Manufacturers are utilizing digital twin technology to simulate crane performance under specific site conditions before the equipment is even deployed, offering customers greater confidence in the feasibility and safety of planned lifts. This pre-sale service, powered by advanced modeling and simulation tools, provides a significant competitive advantage and reduces risk exposure for both the manufacturer and the customer, enhancing the value proposition of modern wheeled cranes beyond just their lifting capacity specifications.

The market for Rough Terrain Cranes, while smaller in volume than All-Terrain or Truck-Mounted segments, is particularly resilient due to its strong ties to the energy and mining sectors, which operate independently of general economic construction cycles. These cranes are built for extreme durability and stability, often featuring specialized axle configurations and heavy-duty components to withstand continuous operation in harsh, remote environments. Manufacturers serving this niche are focused on extended service intervals and robust component protection, catering to end-users whose primary concern is avoiding costly breakdowns in locations far removed from repair facilities.

In conclusion of the segmentation and technology review, the Wheeled Crane Market is defined by a clear trend towards intelligent, connected, and environmentally responsible lifting solutions. The convergence of hardware innovation (materials, hydraulics) and software integration (AI, telematics) is creating highly efficient machines that address the core market demands for safety, productivity, and reduced environmental impact, positioning the market favorably for sustained growth throughout the 2026–2033 forecast horizon.

The ongoing development of smart construction sites, where all machinery is interconnected and communicates real-time data, further integrates wheeled cranes into the digital ecosystem. This integration allows for dynamic scheduling and resource allocation, where the crane's availability and optimal positioning are instantly communicated to site managers and other equipment operators. This level of coordination minimizes bottlenecks, reduces idle time, and significantly improves the overall efficiency of large construction projects, cementing the role of advanced telematics as a non-negotiable feature in future wheeled crane procurement decisions.

The financial viability of adopting electric and hybrid wheeled cranes is steadily improving, moving beyond mere regulatory compliance into becoming an economic advantage. Reduced fuel consumption, lower maintenance costs (due to fewer moving parts compared to diesel engines), and access to incentives or preferred tendering in urban projects collectively lower the operational expenses over the crane’s lifespan, compensating for the higher initial capital cost. This shift supports the projected growth in the "Propulsion" segmentation toward greener alternatives, especially in densely populated markets like Western Europe and North America.

In summary, the detailed market analysis confirms that while traditional drivers like infrastructure spending remain foundational, the future of the Wheeled Crane Market is inextricably linked to technological sophistication. Manufacturers must maintain high standards in safety and performance while aggressively pursuing innovation in digitalization and sustainable power sources to capture leadership in this competitive and essential heavy equipment segment.

The demand for cranes in the 150-300 Metric Ton capacity range is particularly buoyant, acting as a sweet spot for large-scale commercial and infrastructure projects. Cranes in this class offer a compelling balance between necessary lifting capacity for large components (such as modular building sections or heavy beams) and still retaining sufficient road mobility to operate effectively across varied sites. This mid-to-high capacity segment is seeing the most aggressive technological updates, including advanced variable outrigger systems and longer telescopic booms designed to maximize reach and versatility, thereby increasing their utilization rates for fleet owners.

Furthermore, the long-term maintenance and servicing contracts represent a stable and high-margin revenue stream for OEMs. Comprehensive service packages that include digital monitoring, guaranteed uptime SLAs (Service Level Agreements), and certified spare parts supply are increasingly bundled with new crane sales. This strategy shifts the relationship between manufacturer and customer from a one-time transaction to a long-term partnership, guaranteeing equipment reliability and ensuring the manufacturer retains control over the quality and integrity of repairs and maintenance throughout the equipment lifecycle.

The geopolitical landscape also influences market dynamics. Trade tariffs, currency fluctuations, and varying import/export regulations can impact the cost of components and the final price of the machinery, particularly affecting cross-border distribution. OEMs with diversified manufacturing and assembly facilities spanning multiple continents are better positioned to navigate these macroeconomic pressures, providing a crucial operational advantage over regionally concentrated competitors. This global footprint strategy is essential for mitigating risk and ensuring stable supply to key regional markets, especially APAC and MEA, where project timelines are often highly sensitive.

The growth of the specialized industrial and heavy maintenance application segment is underpinned by the increasing complexity of manufacturing facilities, refineries, and chemical plants requiring precise, often hazardous, lifts during planned shutdowns. This niche demands cranes with exceptionally high safety ratings and specialized certifications. Manufacturers who can customize their wheeled crane models with specific corrosion protection packages or spark-arresting features gain a competitive edge in serving these high-security and high-requirement industrial clients, underscoring the importance of tailored product development within the broader market framework.

The Wheeled Crane Market is positioned for robust evolution, driven by mandatory safety upgrades and the economic necessity of improved efficiency. The integration of advanced telematics provides fleet managers with unprecedented transparency into equipment performance, transforming how assets are utilized and maintained. As global construction standards continue to tighten, demanding faster, safer, and cleaner operations, the adoption curve for high-tech wheeled cranes, particularly those incorporating AI-enhanced load control and sustainable powertrains, is expected to accelerate significantly, cementing the projected market value growth.

The shift towards renewable energy sources, specifically large-scale wind farm projects both onshore and offshore, is generating intense demand for the largest class of wheeled cranes (Above 300 Metric Tons). These specialized applications require enormous lifting height and capacity to handle modern, multi-megawatt turbine components. Manufacturers are continuously pushing the boundaries of telescopic boom technology and counterweight systems to meet these extreme requirements, ensuring that the heavy-lift segment remains a core area of innovation and high revenue generation for the leading global OEMs.

Finally, governmental infrastructure stimulus packages, often enacted to boost post-pandemic economic recovery, have provided a substantial near-term boost to the demand for wheeled cranes. This synchronized global investment, particularly focused on upgrading critical national assets such as aging bridges, highways, and utility networks, provides a reliable demand floor for the market, mitigating risks associated with cyclical private commercial construction activity and ensuring market stability into the middle of the forecast period.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Wheeled Crane Market Statistics 2025 Analysis By Application (Petroleum Chemical Industry, Power Infrastructure Construction, Nuclear Power Plant, Bridges and Subway, Other), By Type (Cross-Country Crane, All Road Crane), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Wheeled Crane Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Cross-country crane, All road crane), By Application (Petroleum chemical industry, Power infrastructure construction, Nuclear power plant, Bridges and subway, Other), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager