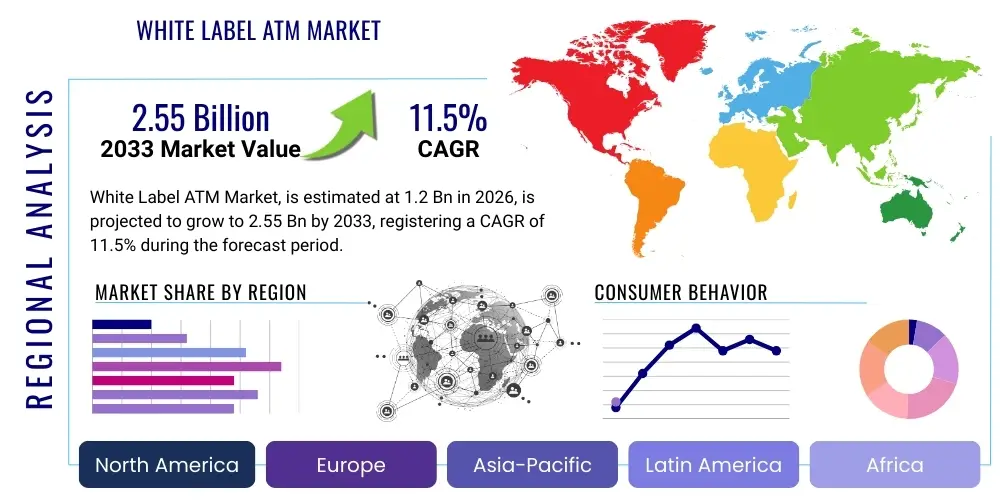

White Label ATM Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442297 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

White Label ATM Market Size

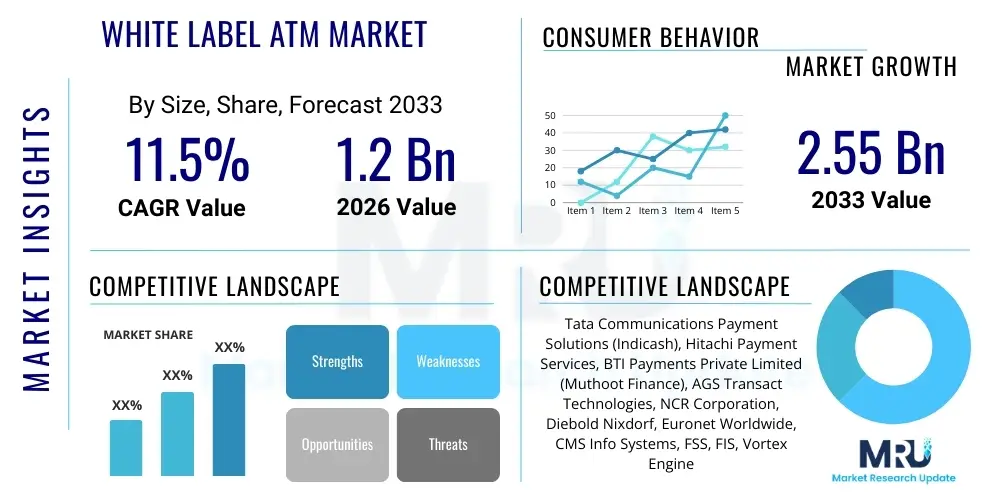

The White Label ATM Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at $1.2 Billion in 2026 and is projected to reach $2.55 Billion by the end of the forecast period in 2033.

White Label ATM Market introduction

The White Label ATM (WLA) Market encompasses the deployment and operation of Automated Teller Machines (ATMs) by non-banking financial entities, licensed to offer basic banking services to customers across geographical locations, especially in rural and semi-urban areas where traditional bank branch penetration is low. WLAs are deployed by certified Non-Bank ATM Operators (NBAOs), providing essential functions such as cash withdrawal, balance inquiry, and mini statements. These machines operate without the branding of any specific bank, instead carrying the brand of the WLA operator. The primary objective is to expand financial inclusion and bridge the accessibility gap left by conventional banking infrastructure, thereby enhancing the reach of digital and cash-based services to underserved populations. The regulatory environment, particularly in developing economies like India and parts of Southeast Asia, actively supports the WLA model as a scalable and cost-effective mechanism for delivering ubiquitous banking services.

The product, fundamentally an ATM machine coupled with specialized software and secure network connectivity, differs from traditional brown-label or bank-owned ATMs primarily in ownership and branding, while maintaining high standards of security and interoperability with the broader banking network. Major applications include enabling seamless cash access for rural residents, facilitating government direct benefit transfers (DBT) withdrawals, and offering basic utility bill payment services. The market's growth is fundamentally driven by the ongoing governmental pushes for financial inclusion, the rising consumer preference for immediate cash access, and the high capital expenditure required for banks to establish their own physical branch networks in remote locations. WLAs offer a commercially viable model for service providers to meet regulatory requirements and capture untapped consumer segments.

Significant benefits derived from WLAs include reduced operational costs for banks, increased convenience for consumers through localized access points, and stimulation of local economies by ensuring consistent cash flow. Driving factors also involve technological advancements such as biometric authentication, contactless withdrawal options, and enhanced security features that improve user trust and operational efficiency. Furthermore, the supportive regulatory framework, which provides subsidies or incentives for deployment in unbanked regions, acts as a crucial catalyst for market expansion. The integration of non-traditional services, such as assisted e-commerce and micro-loans accessed via the ATM interface, is further expanding the market's total addressable audience and service scope, solidifying the WLA model as a critical component of the modern financial ecosystem.

White Label ATM Market Executive Summary

The White Label ATM market is exhibiting robust expansion driven primarily by strategic business trends focusing on optimizing operational costs, achieving deeper geographical penetration, and diversifying service offerings beyond mere cash dispensing. Business trends indicate a strong shift towards managed services agreements and outsourcing models, where banks leverage third-party expertise to handle the complexities of network management, cash logistics, and regulatory compliance, thereby concentrating capital on core banking functions. There is also a notable trend toward integrating WLAs with digital payment ecosystems, enabling hybrid transaction models that accept both card and QR-code initiated withdrawals. Non-banking financial corporations (NBFCs) and technology providers are strategically forming alliances to deploy high-security, low-maintenance terminals, prioritizing long-term service contracts and profitability derived from transaction fees rather than asset ownership.

Regionally, the Asia Pacific (APAC) region dominates the WLA landscape, specifically due to mandated financial inclusion policies in India and rapid urbanization in Southeast Asian countries like Indonesia and the Philippines, necessitating widespread cash access points. These emerging economies present high demand coupled with regulatory incentives for WLA deployment in underserved locales. North America and Europe, while having mature banking infrastructure, show steady, albeit slower, growth focused on advanced technological integration, such as sophisticated remote monitoring systems and enhanced biometric security, primarily addressing niche areas like specialized retail environments or isolated communities. Latin America is also emerging as a high-potential market, driven by increasing population access to formal banking systems and the necessity for secure cash disbursement channels.

Segment trends highlight the increasing prominence of advanced Service offerings beyond traditional cash withdrawal, including Aadhaar Enabled Payment System (AEPS) functionality, utility bill payments, and inter-bank fund transfers through the WLA network. By Deployment Type, rural and semi-urban areas are projected to witness the fastest Compound Annual Growth Rate (CAGR), as market players focus their investment strategies on fulfilling governmental mandates for serving unbanked populations. Technology trends emphasize the replacement of legacy systems with modular, cloud-connected WLAs capable of real-time data reporting and predictive maintenance, enhancing uptime and reducing overall service delivery costs. Security features, particularly anti-skimming devices and robust encryption protocols, remain a critical investment area across all geographical and operational segments to ensure consumer trust and regulatory adherence.

AI Impact Analysis on White Label ATM Market

User inquiries regarding AI's impact on the White Label ATM Market primarily revolve around operational efficiency, security enhancements, and predictive maintenance capabilities. Common questions include: "How can AI reduce ATM downtime?", "Will AI-driven fraud detection replace traditional security methods?", and "What role does machine learning play in optimizing cash management for WLAs?" Users are keen to understand if AI can significantly lower the high operational costs associated with cash logistics, security patrols, and reactive maintenance common in remote WLA deployments. There is a clear expectation that AI will automate routine tasks, provide deeper transactional insights to better tailor services, and fundamentally transform the economics of WLA operations by improving utilization rates and mitigating financial losses due to complex fraud schemes. Users anticipate a shift from reactive problem-solving to proactive, intelligent network management across expansive WLA networks.

The core theme summarized from user analysis is the integration of Artificial Intelligence and Machine Learning (ML) primarily to optimize the complex logistics associated with operating a geographically dispersed network of cash-intensive devices. AI algorithms are being deployed to predict cash demand fluctuations with greater accuracy based on localized demographic, socio-economic, and seasonal data, drastically reducing instances of cash outages (known as ‘out-of-cash’ events) or unnecessary cash replenishment trips. This predictive analytics capability directly translates into substantial cost savings on fuel, manpower, and insurance associated with cash-in-transit (CIT) operations. Furthermore, AI systems monitor machine health in real-time, predicting component failures before they occur, scheduling proactive maintenance, and thereby maximizing ATM uptime, a critical metric for profitability and consumer satisfaction in the WLA sector.

Beyond logistics, AI is fundamentally redefining security and user experience within the WLA ecosystem. Machine learning models analyze behavioral patterns and transaction histories instantaneously to detect anomalies indicative of fraud attempts, such as 'skimming' or unauthorized access, offering a level of protection far exceeding static rule-based systems. AI-powered surveillance systems monitor the physical environment, alerting operators to unusual activity or tampering attempts with high precision. Looking forward, AI is expected to personalize the WLA user interface, offering tailored services (like personalized quick cash options or relevant product promotions) based on user history and inferred needs, potentially transforming the WLA from a pure cash point into a localized, intelligent financial service hub, thereby generating new revenue streams for operators.

- AI-driven Predictive Maintenance: Minimizes machine downtime by anticipating hardware failures and optimizing technician dispatch schedules, improving Service Level Agreements (SLAs).

- Enhanced Cash Demand Forecasting: Utilizes machine learning on granular transaction data, socio-economic factors, and event calendars to accurately predict cash requirements, significantly reducing cash-in-transit (CIT) costs.

- Real-time Fraud Detection: ML algorithms analyze behavioral and transactional data patterns to instantaneously identify and flag suspicious activities, mitigating risks associated with skimming and transaction reversal fraud.

- Optimized Operational Efficiency: Automated monitoring and self-diagnosis capabilities reduce the reliance on human oversight for routine checks across geographically scattered ATM networks.

- Personalized User Experience: Future AI applications will customize the ATM interface based on individual customer preferences and history, potentially promoting non-cash services and increasing overall transaction volume.

- Computer Vision for Physical Security: AI-powered cameras monitor the area around the WLA for unauthorized device attachments, tampering attempts, and suspicious loitering, enhancing physical security protocols.

DRO & Impact Forces Of White Label ATM Market

The White Label ATM Market is shaped by a powerful combination of Driving factors, significant Restraints, and compelling Opportunities, which together constitute the primary Impact Forces determining market trajectory and investment appeal. Drivers largely stem from governmental policy initiatives promoting financial inclusion, particularly in developing economies, which incentivize non-bank entities to deploy terminals in previously unserved areas. The rising cost-consciousness of traditional banks regarding branch expansion, coupled with the high consumer reliance on cash transactions, especially in retail and informal sectors, further propel the demand for third-party ATM services. The increasing acceptance and standardization of interoperable payment interfaces, such as national switching networks, also provide a foundation for WLA operators to offer seamless services to customers of any bank, enhancing the value proposition. These drivers create a sustained and expanding demand base for WLA services, ensuring continued network build-out.

However, the market faces significant Restraints that challenge profitability and scalability. High operational costs associated with cash management, security, and maintenance in remote locations remain a primary hurdle. Ensuring physical security against theft and vandalism, particularly in areas lacking robust law enforcement infrastructure, adds considerable risk and expense. Furthermore, the rising proliferation of digital payment methods, including mobile wallets, UPI (Unified Payments Interface), and QR code transactions, poses a long-term competitive threat to the cash-based nature of ATM services, potentially leading to a gradual decline in the average transaction volume per machine over time. Regulatory uncertainty, including frequent changes in interchange fees and compliance mandates related to technology upgrades (e.g., migration to EMV standards or implementation of stricter security protocols), can also strain the financial viability of WLA operators, requiring significant capital investment.

Opportunities for growth are predominantly found in technological innovation and diversification of service offerings. The deployment of advanced WLAs equipped with biometric authentication, cardless cash withdrawal, and value-added services like micro-insurance sales, ticketing, and government service access (G2C services) can unlock new revenue streams and improve utilization rates. Market penetration opportunities are vast in Tier 3, Tier 4 cities, and rural belts across Asia and Africa, where the population remains heavily dependent on cash and bank infrastructure is scarce. Strategic partnerships between WLA operators, FinTech companies, and telecom providers to integrate financial services—creating hybrid digital-cash access points—present a significant avenue for long-term profitable expansion. Leveraging AI and IoT for proactive monitoring and cash management optimization offers a pathway to overcome cost restraints and realize the full potential of the WLA business model, positioning operators as critical components of the national financial access infrastructure.

Segmentation Analysis

The White Label ATM Market is meticulously segmented based on the critical dimensions of Deployment Type, Service Offered, Location, and Technology utilized, allowing for precise market sizing and strategic targeting. This segmentation reflects the varied operational environments and customer needs across different demographics. Deployment Type, distinguishing between rural, semi-urban, and urban settings, dictates the operational costs, maintenance strategies, and utilization rates, with rural segments representing the highest growth potential due to ongoing financial inclusion mandates. The segmentation by Service Offered is crucial for understanding revenue generation, differentiating between core cash services and emerging value-added services that improve profitability per transaction.

The categorization by Location, separating On-site (within a major facility like a mall or large office) and Off-site (standalone or roadside) ATMs, helps in analyzing footprint optimization and security investment levels, with Off-site locations typically presenting higher operational challenges but greater accessibility. Finally, segmentation by Technology covers crucial aspects such as the type of authentication (biometric versus PIN-based) and connectivity methods, reflecting the modernization efforts and security investments required to keep pace with evolving banking standards and customer expectations. Analyzing these segments is essential for WLA operators to align their investment strategies with regional consumer behavior and regulatory incentives, particularly focusing on hybrid deployment models that combine the accessibility of cash with the utility of digital services.

Understanding the interplay between these segments allows for strategic market entry and service specialization. For instance, in rural deployments, emphasis is placed heavily on basic cash services and technology robust enough to handle connectivity challenges (e.g., satellite links or 4G backup), often incorporating biometric authentication for unbanked populations lacking traditional documentation. Conversely, urban deployments focus more on high transaction volume, advanced features like contactless withdrawal, and integration with complex value-added services like credit card payment facilitation. This granular segmentation provides a framework for analyzing competitive intensity and identifying underserved niches where profitability can be maximized through specialized WLA models that cater precisely to the economic activities and infrastructural limitations of the target geography.

- Deployment Type:

- Rural

- Semi-urban

- Urban

- Service Offered:

- Cash Withdrawal

- Cash Deposit (Limited Deployment)

- Mini Statements & Balance Inquiry

- Bill Payments & Utility Services

- Card-to-Card Transfer

- Aadhaar Enabled Payment System (AEPS)

- Location:

- On-site (e.g., railway stations, shopping centers)

- Off-site (Standalone kiosks)

- Technology:

- Traditional PIN-based

- Biometric Authentication

- Contactless/NFC Enabled

- IoT & Cloud-Connected WLAs

Value Chain Analysis For White Label ATM Market

The White Label ATM market value chain is intricate, involving multiple specialized entities from hardware manufacturing to end-user transaction processing, highlighting the dependence on upstream technology providers and downstream service logistics. Upstream analysis focuses on the manufacturing and assembly of ATM hardware components, including secure encryption modules, cash dispensing mechanisms, and specialized software development for operating systems and anti-fraud tools. Key upstream players include international hardware manufacturers and secure software vendors who provide the core technological framework, emphasizing robustness, regulatory compliance (such as PCI DSS and local banking standards), and modular design for ease of maintenance and upgrades. The efficiency and security embedded at this stage directly influence the long-term operational costs and reliability of the deployed WLA units. Pricing pressure in the upstream segment is moderate, driven by large-volume contracts from major WLA operators and the need for continuous R&D investment in security technologies.

Downstream analysis primarily involves deployment, operations, and service management, encompassing cash logistics, first-line maintenance (FLM) and second-line maintenance (SLM), network connectivity, and transaction processing services. WLA operators act as the central hub, contracting specialized agencies for physical security and cash replenishment (CIT services) and partnering with national payment switch providers or banking networks for transaction authorization and settlement. Distribution channels are predominantly direct, where WLA operators purchase hardware and deploy terminals through their proprietary or contracted network of installation partners. However, indirect channels involve strategic partnerships with retail chains, fuel stations, and large corporate houses (franchise model) where the WLA is installed and maintained by the operator but hosted by the third party, benefiting from existing foot traffic and shared infrastructure costs. Efficiency in this downstream segment is paramount, as downtime due to poor logistics or maintenance significantly erodes profitability.

The distinct nature of WLA operations—being non-bank owned—necessitates a highly formalized contractual relationship with sponsoring banks for regulatory oversight and network access. Direct operations involve the WLA company managing all aspects from capital expenditure to daily operations and maintenance, bearing the full risk and reward. Indirect operations, particularly the managed services model popular among traditional banks, involve the bank retaining the ATM brand (brown or white label) but outsourcing the entire operational chain (hardware procurement, installation, cash management, maintenance) to the WLA provider for a fixed or variable fee. The optimization of the distribution channel, particularly focusing on maximizing the density of high-performing locations and minimizing the cost of cash replenishment through intelligent forecasting, is the key differentiator in competitive advantage within the value chain.

White Label ATM Market Potential Customers

The primary customers and end-users of the White Label ATM Market are diverse, encompassing both financial institutions seeking outsourced solutions and the general public, particularly those residing in areas with limited traditional banking access. Financial institutions, including public and private sector banks, constitute a significant customer base, not because they use the WLAs directly, but because they sponsor the WLAs, enabling their customers to transact on these networks and meet regulatory mandates for financial inclusion without incurring the substantial capital expenditure required for proprietary branch expansion. For these sponsoring banks, the WLA operator acts as an essential service extender, focusing on efficiency and compliance, thereby reducing the bank’s operational footprint while maintaining widespread service availability. These B2B customers prioritize network reliability, security protocols, and competitive interchange fee structures provided by the WLA operator.

The ultimate end-users, however, are the vast population of banked and unbanked consumers, primarily those situated in Tier 2, Tier 3 cities, and rural geographies. These consumers utilize WLAs for essential services such as cash withdrawals, balance inquiries, and increasingly, accessing government benefits (DBT) or engaging in micro-financial transactions via AEPS (Aadhaar Enabled Payment System). Potential customers in this segment value proximity, machine uptime, and the security of the transaction environment. In regions where access to banking is heavily reliant on cash for daily transactions, the WLA provides a critical infrastructural link, ensuring liquidity and facilitating commerce. Furthermore, small businesses and merchants located near WLA points benefit indirectly from increased cash circulation, highlighting the socio-economic importance of these deployments.

A growing segment of potential customers also includes FinTech companies and retail chains looking to integrate banking access points into their existing ecosystems. FinTech platforms may partner with WLA operators to provide cardless cash withdrawal options or utilize the ATM network as a touchpoint for customer onboarding or service fulfillment. Large retail chains and fuel pump operators act as important hosts, providing secure, high-traffic locations for WLA deployment. They benefit from enhanced customer footfall and potentially revenue sharing arrangements. Therefore, potential customers span traditional banking partners, technology-driven financial disruptors, local businesses, and millions of cash-reliant individual consumers, all seeking convenient, secure, and accessible financial transaction points outside the traditional bank branch model.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.2 Billion |

| Market Forecast in 2033 | $2.55 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Tata Communications Payment Solutions (Indicash), Hitachi Payment Services, BTI Payments Private Limited (Muthoot Finance), AGS Transact Technologies, NCR Corporation, Diebold Nixdorf, Euronet Worldwide, CMS Info Systems, FSS, FIS, Vortex Engineering, Prizm Payment Services, Financial Software & Systems (FSS), Transaction Solutions International (TSI), Vakrangee Limited, Fidelity National Information Services (FIS), ACI Worldwide, Hyosung TNS. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

White Label ATM Market Key Technology Landscape

The technology landscape governing the White Label ATM market is defined by continuous evolution focusing on enhancing security, improving transactional efficiency, and expanding service accessibility, especially in remote environments. Core technological components include robust hardware platforms compliant with global banking standards, secure cryptographic processors for PIN management and data encryption, and specialized software stacks that manage the ATM lifecycle. Crucially, modern WLAs are transitioning away from proprietary operating systems towards more standardized, yet highly secure, Linux or Windows 10 IoT platforms, allowing for easier integration of third-party applications and services. The foundational technology relies heavily on secure network connectivity (VPNs and dedicated leased lines or 4G/5G connections for remote areas) to ensure real-time communication with the national payment switch and the sponsoring bank, maintaining high data integrity and reliability across every transaction cycle.

The most significant recent technological advancements center around security and biometric integration. EMV (Europay, Mastercard, and Visa) compliance remains mandatory globally, but market leaders are now deploying advanced anti-skimming solutions, secure physical cash cassettes with geo-fencing capabilities, and sophisticated terminal security monitoring systems that leverage artificial intelligence. Biometric technology, including fingerprint and iris recognition, is being increasingly adopted, especially in developing economies (like India’s implementation of AEPS), to serve the vast population without traditional bank accounts or identification cards, transforming the security paradigm from "what you have" (card) and "what you know" (PIN) to "who you are." This shift not only improves security but is a fundamental driver of financial inclusion by making WLAs accessible to marginalized demographics.

Furthermore, the incorporation of Internet of Things (IoT) sensors and cloud-based management platforms is rapidly optimizing WLA operations. IoT devices monitor parameters such as temperature, power supply status, vault door status, and currency levels in real time, feeding data into cloud dashboards for predictive maintenance and cash management analytics. Contactless technology (NFC-enabled readers) allows for quicker, more secure cash withdrawals via mobile phones or contactless cards, catering to tech-savvy urban consumers and reducing physical wear and tear on card readers. The push towards modular, standardized hardware design facilitates easier field upgrades and repairs, crucial for maintaining high uptime across dispersed WLA networks, lowering the Total Cost of Ownership (TCO) for operators and making the WLA model financially sustainable in challenging locations.

Regional Highlights

- Asia Pacific (APAC): Dominance and Rapid Growth Engine. APAC represents the largest and fastest-growing market for White Label ATMs globally, primarily driven by massive populations and government initiatives focused on financial inclusion, particularly in India, Indonesia, and the Philippines. India, with its regulatory framework supporting WLA deployment in unbanked rural areas and initiatives like AEPS, is a key market, stimulating demand for low-cost, high-volume transaction points. The region is characterized by high cash usage despite rapid digitization, necessitating a hybrid infrastructure approach. Market players in APAC focus on scaling networks rapidly and deploying robust, anti-fraud technologies tailored for high-volume, potentially low-connectivity environments. Strategic investment is concentrated on semi-urban and rural areas to capture the high subsidies and untapped consumer base.

- North America: Maturity and Service Optimization. The North American market (dominated by the US) is mature, characterized by high penetration of traditional banking services. WLA growth here is slower but focused on niche segments, such as specialized retail environments, isolated recreational areas, and private businesses seeking custom branding or proprietary transaction processing. Technological investment emphasizes advanced compliance, sophisticated anti-money laundering (AML) controls, and the integration of highly secure, real-time remote monitoring systems. The market is driven less by inclusion and more by convenience and cost-effective outsourcing for smaller financial institutions and Independent Sales Organizations (ISOs).

- Europe: Regulatory Complexity and Consolidation. The European WLA market shows moderate growth, heavily influenced by strict regulations such as PSD2 and GDPR, impacting data handling and transaction processing. WLAs often target areas where traditional banks are reducing their branch footprints. Consolidation among WLA operators and a focus on premium, integrated financial services (not just cash) characterize this region. Adoption of advanced features like multi-currency support and integration with digital bank accounts is high. Investment priority is placed on cyber security and seamless cross-border interoperability.

- Latin America (LATAM): Emerging Market Potential. LATAM is an emerging market with significant growth potential, fueled by expanding banking populations and high reliance on cash for daily life in countries like Brazil, Mexico, and Argentina. The market faces infrastructural challenges but offers high rewards for operators capable of navigating regulatory complexities and managing high-security risks. WLAs are crucial for distributing remittances and enabling social security payments, making them an important social and financial tool. Deployment strategies often focus on secured, high-traffic commercial centers and urban fringes.

- Middle East and Africa (MEA): Untapped Rural Frontiers. The MEA region is highly diverse. The Middle Eastern segment focuses on high-tech, secure deployments often linked to large retail and tourist sectors. Africa, however, presents the most significant long-term growth opportunity, driven by massive unbanked populations and infrastructural deficits. WLA deployment in Sub-Saharan Africa is crucial for micro-finance, mobile money integration, and government aid disbursement. Challenges include inconsistent power supply and connectivity, driving demand for solar-powered and highly ruggedized ATM units.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the White Label ATM Market.- Tata Communications Payment Solutions (Indicash)

- Hitachi Payment Services

- BTI Payments Private Limited (Muthoot Finance)

- AGS Transact Technologies

- NCR Corporation

- Diebold Nixdorf

- Euronet Worldwide

- CMS Info Systems

- FSS (Financial Software & Systems)

- FIS (Fidelity National Information Services)

- Wincor Nixdorf (now part of Diebold Nixdorf)

- Vortex Engineering

- Prizm Payment Services

- Transaction Solutions International (TSI)

- Vakrangee Limited

- ACI Worldwide

- Hyosung TNS

- Omnicard Payments

- Brink's Incorporated

- CashConnect

Frequently Asked Questions

Analyze common user questions about the White Label ATM market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the difference between a White Label ATM and a bank-owned ATM?

A White Label ATM (WLA) is owned, operated, and maintained by a non-banking entity (like a corporation or NBFC) but functions similarly to a bank ATM, offering services to customers of any bank. It does not carry the branding of a specific bank, unlike a traditional brown-label or bank-owned ATM, which is managed by the bank itself.

Who regulates the White Label ATM market and transaction fees?

WLAs are regulated by the central monetary authority or central bank of the respective country (e.g., the Reserve Bank of India in India). This authority establishes the licensing requirements, security standards, and determines the interchange fees (the fees paid by the customer's bank to the WLA operator's sponsor bank for facilitating the transaction).

What are the primary challenges faced by White Label ATM operators?

The key challenges include maintaining high network uptime in remote areas due to connectivity and power issues, managing the high costs associated with secure cash logistics and replenishment, and mitigating increasing threats from digital payment methods that potentially reduce cash transaction volumes over time.

How does the deployment of WLAs contribute to financial inclusion?

WLAs significantly boost financial inclusion by extending accessible, secure cash withdrawal points to rural and semi-urban populations where traditional bank branches are economically unviable. They facilitate access to formal banking channels and governmental Direct Benefit Transfer (DBT) schemes for previously unbanked citizens.

Is the White Label ATM market expected to survive the rise of digital payments?

Yes, while digital payments are growing, the WLA market is expected to remain robust. It is adapting by integrating new services (like cardless cash and micro-finance access) and focusing on markets globally, particularly in Asia and Africa, where cash dependency remains high, ensuring WLAs serve as essential physical endpoints for financial access.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager