White Marble Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440929 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

White Marble Market Size

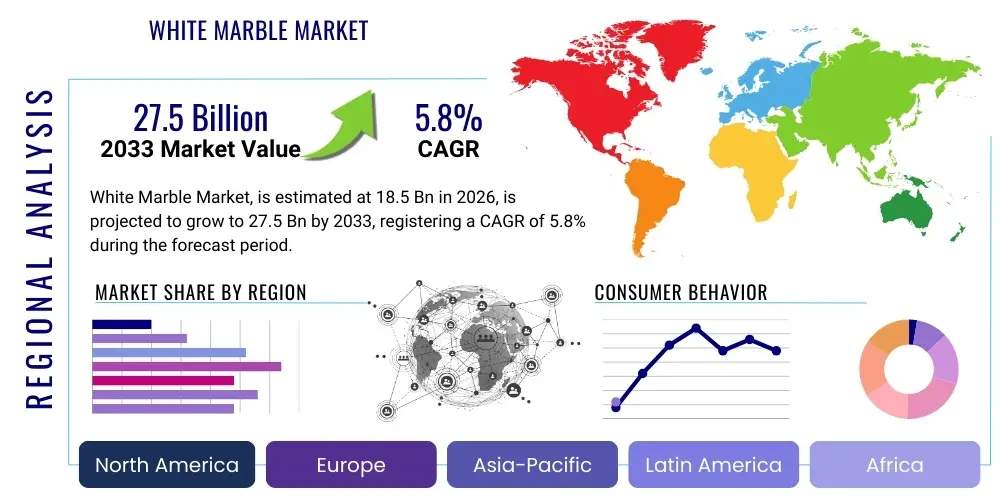

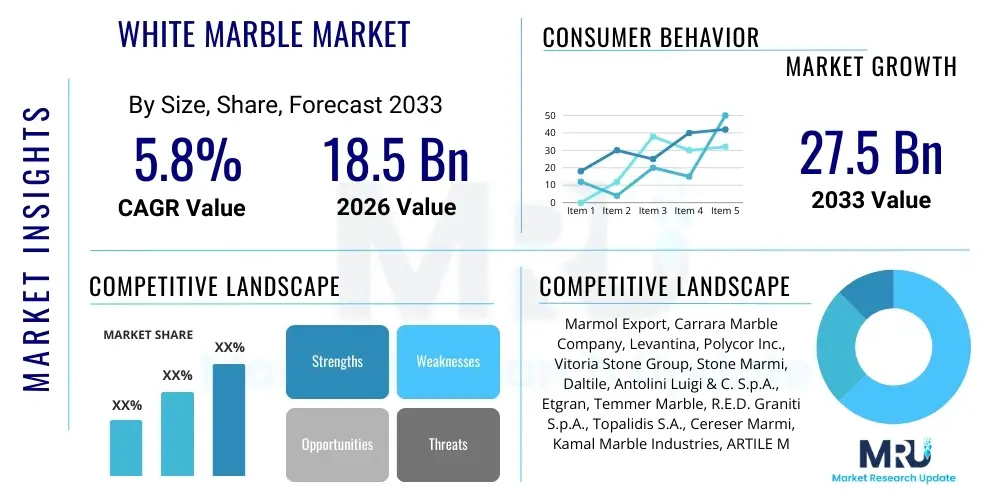

The White Marble Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $18.5 Billion in 2026 and is projected to reach $27.5 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally supported by the increasing global demand for high-end aesthetic materials in both commercial and luxury residential construction sectors, particularly across rapidly urbanizing economies in Asia Pacific and the Middle East. The inherent elegance and timeless appeal of white marble, coupled with advancements in quarrying and processing technologies that improve accessibility and reduce waste, are key determinants driving this substantial valuation increase.

White Marble Market introduction

The White Marble Market encompasses the global trade, quarrying, processing, and distribution of natural calcareous rock characterized by high purity, crystalline structure, and a predominantly white coloration, often including subtle veining or patterning. These materials are highly prized for their aesthetic versatility, durability, and historical association with luxury and monumental architecture. Key product classifications range from highly homogeneous types like Thassos and Carrara to richly veined varieties such as Calacatta and Statuario, each commanding different price points and serving specific design requirements. Major applications span interior design elements such as flooring, wall cladding, kitchen countertops, vanity tops, and exterior architectural applications, including facades and monuments. The primary benefits include superior thermal resistance, unique aesthetic value that appreciates over time, and a perceived quality marker in construction projects. Driving factors influencing market expansion include rising disposable incomes globally, significant investment in high-density urban infrastructure projects, the trend toward natural and sustainable building materials, and effective marketing positioning white marble as a symbol of sophistication and opulence in high-value properties.

White marble is derived from metamorphic rocks resulting from the recrystallization of carbonate minerals, most commonly calcite or dolomite, under intense heat and pressure. The pure white color is indicative of very low levels of impurities, primarily silica, iron oxides, or clay minerals. The quality assessment within the market relies heavily on factors such as porosity, abrasion resistance, consistency of color, and veining pattern density. Standardized grading systems, although varying slightly by region, help suppliers and purchasers categorize the suitability of specific marble types for applications ranging from high-traffic commercial flooring to sensitive decorative installations. The geological scarcity of premium grades, especially those originating from historically significant quarries in Italy, Greece, and Turkey, contributes significantly to the market's premium pricing structure and overall value proposition.

Historically, white marble served as the cornerstone of classical architecture, yet modern technological advancements have broadened its application scope considerably. These innovations include specialized sealing agents that improve stain resistance, lightweight backing processes for installation in high-rise buildings, and sophisticated computer numerical control (CNC) machinery that allows for precise customization of complex shapes and designs. Furthermore, the increasing consumer focus on creating unique and personalized living and working spaces strongly favors white marble due’s intrinsic ability to offer distinct, non-replicable aesthetic outcomes. The market ecosystem is highly complex, involving numerous small-scale quarry operators, large multinational mining corporations, specialized fabricators, and global distributors, all contributing to the final supply chain dynamics and competitive landscape of this global commodity. The environmental footprint associated with quarrying remains a significant consideration, pushing major industry players towards implementing more sustainable extraction methods and resource management strategies to ensure long-term market viability.

White Marble Market Executive Summary

The global White Marble Market is poised for consistent expansion, driven primarily by robust business trends centered on global urbanization, increased luxury infrastructure development, and an accelerating preference for natural stone over synthetic alternatives in high-value projects. Key business trends include the consolidation of mid-sized quarrying operations to achieve economies of scale, standardization of quality control metrics across international supply chains, and substantial investments in automation technologies to improve yield and efficiency in the processing stages. Regionally, the Asia Pacific (APAC) region is projected to exhibit the highest growth rates, fueled by massive residential construction programs in China and India and ambitious commercial and hospitality projects across Southeast Asia. The Middle East and Africa (MEA) region also presents critical demand centers, particularly in the Gulf Cooperation Council (GCC) nations, where large-scale monumental and private residential developments extensively utilize premium white marble. Europe and North America, while mature markets, maintain stable demand driven by renovation and restoration activities, and the unwavering demand for exclusive, internationally recognized varieties like Carrara and Calacatta for prestige projects.

Segment trends indicate strong performance in the dimensional stone segment, which includes slabs and tiles for flooring and wall cladding, as these materials offer the greatest coverage area and visual impact in architectural designs. Countertops and vanity applications also show high growth, reflecting the increased consumer focus on luxury kitchen and bathroom aesthetics. By end-use, the residential sector remains the largest consumer, benefiting from growing homeowner affluence and design sophistication. However, the commercial sector, encompassing hotels, corporate offices, and retail spaces, is rapidly catching up, utilizing white marble to convey corporate image and luxury branding. Furthermore, the specialized segment involving sculptures and monuments, though smaller in volume, maintains high-value transactions due to the artistic expertise required. Competitive dynamics are characterized by a strong interplay between legacy European suppliers, who offer brand equity and historical certification, and large-volume producers in emerging markets like Turkey, Brazil, and Greece, who compete aggressively on price and capacity, leading to a bifurcated market structure.

Overall market stability is contingent on managing supply chain logistics, particularly the secure and efficient transport of large, heavy, and fragile slabs across continents. Geopolitical stability in key quarrying regions and adherence to international trade tariffs also significantly influence material flow and pricing. The shift towards incorporating environmentally responsible practices, such as minimizing water consumption in processing and maximizing material utilization to reduce quarrying waste, is becoming a mandatory requirement rather than a competitive advantage. Success in this market is increasingly defined by the ability of companies to integrate vertical operations—from quarrying to fabrication—and leverage digital tools for inventory management and customer visualization, thereby offering seamless project solutions to architects and interior designers globally.

AI Impact Analysis on White Marble Market

User queries regarding the impact of Artificial Intelligence (AI) on the White Marble Market frequently revolve around three core themes: efficiency improvements in extraction, supply chain optimization, and enhanced quality control mechanisms. Users seek to understand how AI-driven analytics can minimize resource wastage during quarrying, predict optimal cutting patterns to maximize high-grade slab yield, and ensure uniformity of batches through automated visual inspection. Concerns often center on the initial investment required for sophisticated AI deployment and the required upskilling of labor to manage these advanced systems. Expectations are high regarding AI’s potential to revolutionize inventory management, allowing distributors to forecast demand more accurately based on global construction indices and design trends, thereby reducing warehousing costs and mitigating the risks associated with carrying vast, high-value physical stock. The integration of AI tools is anticipated to transform traditional, labor-intensive operations into precision-engineered processes, directly impacting profitability and material scarcity management.

AI’s influence is profound in the upstream sector of the market, particularly in geological surveying and quarry management. Machine learning algorithms analyze seismic, satellite, and drilling data far more quickly and accurately than traditional methods, identifying optimal drilling locations and predicting potential structural defects within the marble deposit before extraction begins. This predictive capability minimizes unproductive excavation and significantly improves the recovery rate of valuable, intact blocks. Furthermore, in the cutting and processing stages, Computer Vision systems paired with AI models can analyze the veining, color, and microscopic structure of raw blocks in real-time. This allows high-precision gang saws and diamond wire machines to automatically adjust cutting paths to bypass faults and highlight aesthetic features, maximizing the yield of premium-grade material suitable for highly profitable applications like book-matched wall panels.

Downstream, AI is enhancing the customer experience and personalization. AI-powered design software utilizes generative adversarial networks (GANs) to allow architects and clients to visualize how specific marble slabs will look in a finished space, accounting for lighting, scale, and adjacent materials. This reduces the uncertainty inherent in natural stone selection, speeding up the decision-making process. Moreover, AI aids logistics through predictive maintenance scheduling for heavy machinery, minimizing costly downtime at quarries and processing plants. It also optimizes global shipping routes and packaging based on real-time factors like weather and port congestion, ensuring timely and safe delivery of fragile, heavy goods, thereby addressing critical supply chain vulnerabilities.

- AI-driven geological surveying enhances quarry recovery rates and minimizes non-productive excavation efforts.

- Computer Vision systems perform rapid, objective quality grading and defect detection on processed slabs.

- Machine learning optimizes cutting patterns (nesting) to maximize the yield of high-value slabs from raw blocks.

- Predictive analytics supports supply chain management, forecasting demand, and optimizing global inventory levels.

- AI tools assist in personalized design visualization, allowing clients to virtually integrate marble products into projects before purchase.

- Automated maintenance scheduling (Predictive Maintenance) reduces operational downtime for heavy quarrying equipment.

- AI improves logistical efficiency by optimizing container loading and selecting cost-effective, secure transport routes globally.

DRO & Impact Forces Of White Marble Market

The White Marble Market is shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming the Impact Forces that dictate market direction and growth velocity. The primary driver is the enduring and amplified aesthetic appeal of white marble, which is strongly associated with luxury, longevity, and high status in architectural design, making it a preferred material for high-net-worth individuals and prestige commercial projects. This driver is augmented by global macroeconomic factors, specifically the increasing disposable incomes in emerging economies and the resulting surge in premium residential construction and interior decoration expenditure. However, the market faces significant restraints, chiefly the high material cost relative to engineered stones or ceramics, which limits its adoption in budget-sensitive projects. Furthermore, white marble’s inherent maintenance requirements—including susceptibility to staining and etching, necessitating specialized sealing and cleaning—pose a functional constraint for many end-users, alongside increasingly stringent environmental regulations regarding quarry waste and water usage. Opportunities for expansion lie in technological innovation, such as the development of advanced sealants and surface treatments that minimize maintenance issues, coupled with leveraging digital platforms for global sourcing transparency and implementing sustainable quarrying practices (Green Marble initiatives) to appeal to environmentally conscious consumers and meet regulatory compliance.

The key Impact Forces driving transformation include technological substitution threats from high-quality porcelain and quartz surfaces that mimic natural marble aesthetics while offering superior durability and zero-maintenance properties. This competitive pressure forces natural marble suppliers to consistently innovate in processing and finishing. Simultaneously, the force of buyer power is considerable, especially from large construction conglomerates and architectural firms that purchase vast quantities, enabling them to negotiate pricing and demand stringent quality standards, necessitating higher capital investment in certification and quality assurance from suppliers. Supplier power is also significant, particularly for specific, globally recognized varieties (e.g., Carrara Statuario), where supply is geologically constrained and controlled by a few established quarry operators, allowing them to dictate premium pricing and supply volume, which often leads to price volatility in the international market. Regulatory forces are tightening globally, focusing on worker safety, dust control, and site remediation after quarry closure, substantially increasing operational costs and forming a barrier to entry for smaller, non-compliant firms, thus favoring larger, integrated enterprises capable of meeting these extensive compliance burdens.

The combination of these forces suggests a future market characterized by premiumization, where technological enhancement dictates competitive advantage. Companies that can successfully mitigate the natural vulnerabilities of the stone through applied nanotechnology or advanced sealing techniques, while simultaneously ensuring environmentally sound quarrying, will capture the high-margin segment. Conversely, high transportation costs and complex logistics will continue to be perpetual restraining forces, challenging the economic viability of supplying highly specialized grades to remote construction sites. The enduring cultural value and aesthetic superiority of white marble ensure long-term demand stability, particularly in the high-end luxury segment, provided the industry successfully navigates these operational and competitive challenges by focusing on value-added services and sustainability certifications to differentiate the natural product from increasingly realistic engineered alternatives.

Segmentation Analysis

The White Marble Market is comprehensively segmented based on three key dimensions: Type, Application, and End-User. This granular segmentation allows market participants to precisely identify niche opportunities and tailor their operational strategies, ranging from quarrying efforts focused on specific geological characteristics to targeted marketing campaigns aimed at defined customer groups such-as luxury interior designers or large-scale commercial developers. Segmentation by Type is crucial due to the vast qualitative differences and varying price points associated with specific regional origins, such as the distinction between high-purity, homogeneous types and those characterized by distinctive, rare veining patterns. Segmentation by Application highlights the varying technical requirements—a slab used for a high-traffic floor must meet different mechanical resistance standards than one used for decorative wall cladding or a static sculpture. Lastly, End-User segmentation provides insight into consumption patterns, contrasting the project timelines and procurement needs of the residential sector versus the large-volume, standardized demands of the commercial sector, underpinning the required logistical and pricing strategies necessary for market penetration across diverse construction project scales.

- By Type:

- Carrara Marble (Standard, Gioia, Venatino)

- Calacatta Marble (Oro, Gold, Borghini)

- Statuario Marble

- Thassos Marble

- Makrana Marble

- Other Regional Varieties (e.g., Bianco Rhino, Volakas)

- By Application:

- Flooring and Paving

- Wall Cladding and Facades

- Countertops and Vanity Tops

- Monuments and Sculptures

- Furniture and Decorative Items

- By End-User:

- Residential Sector (New Construction and Renovation)

- Commercial Sector (Hotels, Offices, Retail, Healthcare)

- Industrial Sector

Value Chain Analysis For White Marble Market

The value chain for the White Marble Market is linear, highly capital-intensive, and critical for determining the final product cost and quality, beginning with geological exploration and culminating in final installation. Upstream analysis focuses on the quarrying and extraction process, which involves high-risk activities such as geological surveying, large-scale drilling, and the specialized use of diamond wire cutting machines to extract massive, intact blocks from the bedrock. Efficiency at this stage—measured by the block-to-waste ratio and the consistency of block size—is vital for profitability. Key upstream stakeholders include specialized geological surveying firms and quarry operators, whose proprietary knowledge of specific deposits provides a significant competitive advantage and dictates the scarcity premium of the raw material. Transportation of these raw blocks from remote quarry sites to processing centers is another high-cost, critical step due to the weight and fragility of the material.

The midstream stage involves processing and fabrication. Raw blocks are transported to processing centers where they are cut into slabs using multi-blade gang saws or advanced CNC equipment, followed by surface treatment processes such as polishing, honing, or brushing. This stage adds significant value through precision engineering and quality control, ensuring the slab meets aesthetic and structural standards. Processing facilities often require substantial investments in water treatment systems, dust mitigation technology, and specialized polishing lines. Downstream activities involve distribution, marketing, and installation. Distribution channels are bifurcated: direct channels often involve large integrated companies selling directly to major commercial contractors and luxury residential developers, offering customized cutting and installation services as part of the package. Indirect channels rely on a network of importers, wholesalers, and specialized stone retailers who purchase standardized slabs and tiles for onward sale to smaller contractors and DIY renovators, providing wider geographical market access but with added layers of cost and margin.

The distribution channel complexity directly impacts market reach and pricing. Direct sales channels, preferred for high-value, bespoke projects requiring specific sourcing or large volumes (such as entire hotel projects), maximize margins for the primary supplier but demand sophisticated logistical management and dedicated installation teams. Indirect channels, conversely, simplify inventory management for quarry operators by offloading sales risk to distributors but compress the supplier’s margin. Furthermore, the role of specialized architects and interior designers acts as a powerful influence in the downstream chain, as they often specify particular white marble types, effectively driving demand and product requirements back up the chain to the quarry source. The efficiency of the entire chain hinges on minimizing breakage and maximizing yield during the extraction and processing phases, making technological adoption in both upstream and midstream operations paramount for sustainable success and competitive pricing in the global market.

White Marble Market Potential Customers

Potential customers for the White Marble Market are predominantly high-value End-Users operating within the luxury construction and premium interior design sectors, requiring materials that convey prestige, durability, and unique aesthetic value. The primary target groups include high-net-worth individuals engaged in custom home building or extensive renovation projects, for whom white marble serves as a defining element of luxury residential architecture, particularly in kitchens, master bathrooms, and grand entryways. Residential consumption is characterized by a demand for premium, highly veined, and rare varieties such as Calacatta Gold or Statuario, often necessitating bespoke fabrication and specialized installation, focusing heavily on aesthetic perfection and veining matching for book-matched installations, reflecting sophisticated design preferences and significant purchasing power.

The commercial sector represents another massive segment, where key buyers are international luxury hotel chains, high-end corporate headquarters, exclusive retail boutiques, and major healthcare facility developers. In these environments, white marble is utilized extensively for grand lobbies, high-traffic flooring, elevators, and restroom vanity areas, chosen for its durability in commercial settings and its contribution to the brand image of opulence and permanence. Commercial buyers often prioritize standardized sizes, certified quality (e.g., minimal porosity), and reliable volume supply over aesthetic rarity, typically engaging in large-volume, contractual purchases that demand consistent batch quality and logistical precision. Additionally, public sector organizations and monumental restoration agencies represent specialized, high-value customers, requiring historically accurate materials for government buildings, museums, monuments, and culturally significant sites, often subject to stringent conservation standards and specialized procurement processes.

Beyond traditional construction, emerging customer groups include specialized luxury furniture designers and manufacturers who incorporate white marble into high-end tables, cabinets, and decorative objects, leveraging its cool temperature and smooth finish. Landscaping architects and garden designers also form a niche market, utilizing marble components for custom water features, sophisticated paving, and outdoor sculptures where the material's weathering properties and white luminosity are prized. Catering to this diverse customer base requires suppliers to offer not only raw slabs but also value-added services such as advanced cutting, pre-installation sealing, and robust warranties guaranteeing material integrity, positioning the supplier as a holistic solutions provider rather than a mere material vendor in the highly competitive global construction supply chain.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $18.5 Billion |

| Market Forecast in 2033 | $27.5 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Marmol Export, Carrara Marble Company, Levantina, Polycor Inc., Vitoria Stone Group, Stone Marmi, Daltile, Antolini Luigi & C. S.p.A., Etgran, Temmer Marble, R.E.D. Graniti S.p.A., Topalidis S.A., Cereser Marmi, Kamal Marble Industries, ARTILE Marble, Finstone, Vetter Stone, Tekmar Stone, Amso International, and Marmi Rossi S.p.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

White Marble Market Key Technology Landscape

The White Marble Market relies heavily on specialized technologies to enhance extraction efficiency, improve product quality, and manage inventory seamlessly across global supply chains. A primary technological focus in the quarrying phase is the extensive deployment of Diamond Wire Cutting systems, which have replaced traditional methods of block extraction. These systems utilize diamond-coated beads strung along high-speed cables, offering significantly cleaner cuts, reducing material wastage (kerf loss), improving extraction speed, and enhancing operator safety compared to traditional blasting or jet flaming. Furthermore, advancements in robotic drilling and computerized scanning are allowing quarry operators to pre-map internal rock structures, enabling precision extraction that maximizes the yield of flawless, large blocks, thereby commanding higher market prices due to size and structural integrity.

In the processing and fabrication stage, the key technological advancements center on surface enhancement and precision customization. Computer Numerical Control (CNC) machinery has become standard, enabling the highly accurate cutting, shaping, and edging of slabs for complex architectural designs, reducing human error and allowing for rapid turnaround times on custom orders like spiral staircases or intricately carved fireplace mantels. Crucially, the application of Nanotechnology is revolutionizing the material's vulnerability to stains and corrosion. Nanoparticle sealants penetrate the micro-pores of the marble surface, creating a protective barrier that repels liquids and etching agents without altering the stone's natural luster or breathability, significantly broadening the marble's suitability for high-use areas such as commercial kitchens and outdoor applications, which were previously impractical due to maintenance concerns.

Additionally, Information Technology (IT) plays a critical role in market competitiveness. Sophisticated Enterprise Resource Planning (ERP) systems, often integrated with AI modules, manage inventory by tracking individual slabs—often using embedded Radio-Frequency Identification (RFID) tags—from the quarry face through processing, distribution, and final sale. This digital tracking allows buyers globally to view high-resolution digital images of the exact slab they are purchasing, ensuring transparency and meeting the bespoke requirements of high-end projects. Furthermore, advanced water recirculation and filtration technologies are now mandatory at processing plants, allowing companies to meet rigorous environmental standards by minimizing water consumption and safely managing the slurry byproduct generated during the cutting and polishing operations, aligning operational efficiency with sustainable manufacturing practices.

Regional Highlights

- Asia Pacific (APAC): APAC is the fastest-growing region, driven by explosive urbanization and massive infrastructure investment, particularly in China, India, and Southeast Asian nations (Vietnam, Indonesia). Demand is high across both high-volume residential projects and luxury commercial real estate. While the region is a major consumer, countries like India also possess significant domestic marble reserves (e.g., Makrana marble), creating a unique dynamic where both imports and domestic production compete vigorously on price and quality. The hospitality sector is a major consumer, utilizing white marble as a primary design element to attract luxury tourism.

- North America: A mature and high-value market characterized by robust demand for imported, premium European white marbles, particularly Carrara and Calacatta, for high-end residential renovation and new luxury home construction. The market is defined by quality specification and brand recognition, with consumers demanding certified materials and professional installation services. Commercial demand is stable, primarily driven by corporate headquarters and high-end retail fit-outs in major metropolitan areas, maintaining a premium pricing environment.

- Europe: The historical core of the white marble industry, encompassing both the largest producers (Italy, Greece) and significant consumers. Demand is driven by restoration projects of historical buildings, consistent high-end residential demand, and a strong export market, capitalizing on centuries of quarrying expertise and brand heritage. The focus here is increasingly on sustainability, ethical sourcing certifications, and maintaining the prestige associated with classic European marble varieties against global competitors.

- Middle East and Africa (MEA): This region, notably the GCC countries (UAE, Saudi Arabia, Qatar), represents a significant demand center characterized by mega-projects in luxury residential, commercial, and monumental construction. The extreme heat and harsh climate necessitate materials with excellent thermal and weathering properties. Demand favors pristine white, low-porosity marbles for expansive flooring and external cladding in highly visible, large-scale developments, supported by governmental investment in diversification projects and tourism infrastructure.

- Latin America (LATAM): A growing market with mixed dynamics. While Brazil is a major global producer of natural stone (though often colored varieties), the consumer market for white marble is expanding, driven by increasing affluence in urban centers and rising adoption of modern, high-end design aesthetics in private residences and boutique hotels, primarily supplied through imports due to geographical limitations of premium white marble deposits in the region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the White Marble Market.- Marmol Export

- Carrara Marble Company

- Levantina

- Polycor Inc.

- Vitoria Stone Group

- Stone Marmi

- Daltile

- Antolini Luigi & C. S.p.A.

- Etgran

- Temmer Marble

- R.E.D. Graniti S.p.A.

- Topalidis S.A.

- Cereser Marmi

- Kamal Marble Industries

- ARTILE Marble

- Finstone

- Vetter Stone

- Tekmar Stone

- Amso International

- Marmi Rossi S.p.A.

Frequently Asked Questions

Analyze common user questions about the White Marble market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the White Marble Market between 2026 and 2033?

The White Marble Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% during the forecast period from 2026 to 2033, driven by increasing demand in luxury construction and renovation projects globally, particularly within the Asia Pacific and Middle East regions.

Which geographical region is expected to lead the market growth in terms of consumption?

The Asia Pacific (APAC) region is expected to lead market growth in consumption volume and fastest expansion rate, primarily due to rapid urbanization, massive residential development, and significant governmental investment in high-end infrastructure projects across major economies like China and India.

What are the primary challenges or restraints affecting the White Marble Market?

Primary restraints include the high initial cost of white marble compared to substitute materials, high maintenance requirements (susceptibility to staining and etching), and increasingly stringent environmental regulations regarding quarry operations and waste management, which necessitate higher operational expenditures.

How is AI technology impacting the operational efficiency of marble quarrying?

AI technology significantly enhances operational efficiency by optimizing cutting patterns using Computer Vision to maximize the yield of high-grade slabs from raw blocks, and by utilizing predictive analytics for geological surveying to identify the most valuable and structurally sound extraction points, minimizing waste.

What are the key differences between Carrara and Calacatta white marbles?

Carrara marble is typically characterized by a soft grey background and fine, feathered veining, making it more common and affordable. Calacatta marble features a whiter background with more dramatic, thick, and bold veining patterns, often in gold or brown tones, positioning it as a rarer and higher-priced luxury variety in the market.

In which application segment is white marble most commonly used globally?

White marble is most commonly used in the Flooring and Paving application segment, particularly in both high-end residential projects and large-scale commercial facilities (hotels, offices) due to its aesthetic impact and capacity to cover large surface areas, establishing an immediate sense of luxury and sophistication.

How do technological advancements like nanotechnology affect the use of white marble?

Nanotechnology significantly improves white marble's utility by providing advanced sealants that penetrate the stone's pores, dramatically increasing resistance to staining, etching, and moisture absorption without altering the natural appearance, thereby making the material viable for previously challenging areas like commercial kitchen countertops and outdoor facades.

Which end-user segment represents the largest source of demand for white marble?

The Residential Sector remains the largest source of demand, fueled by increasing global affluence and the prioritization of high-quality natural stone in luxury home construction and bespoke renovation projects, emphasizing premium grades for key interior features like kitchen islands and bathroom vanities.

What role does the Value Chain Analysis highlight regarding distribution channels?

The Value Chain Analysis highlights a bifurcation in distribution: large integrated companies often use direct channels for major commercial projects, ensuring custom service and maximizing margins, while indirect channels (wholesalers, retailers) are utilized for wider market reach and standardized product sales to smaller contractors and general consumers.

What is the significance of the shift towards Green Marble initiatives?

The shift towards Green Marble initiatives signifies the industry's response to escalating environmental regulatory pressure and growing consumer demand for sustainable materials. These initiatives focus on minimizing quarry waste, reducing water consumption during processing, and ensuring responsible land remediation after extraction, which is critical for long-term market viability and achieving corporate social responsibility goals.

Why are large commercial buyers considered a strong impact force in the market?

Large commercial buyers, such as international hotel groups or major construction firms, exert significant buyer power. They purchase large volumes under long-term contracts, enabling them to negotiate highly competitive pricing and impose stringent demands regarding quality certification, batch consistency, and logistical precision, thereby influencing supplier standards and profitability.

How do ERP systems benefit the global trade of white marble?

ERP systems, especially when integrated with RFID tracking, streamline the global trade of white marble by providing end-to-end visibility of inventory. This allows buyers worldwide to track specific slabs from the quarry to the installation site, ensuring transparency, minimizing logistical errors, and facilitating bespoke order fulfillment crucial for high-value international projects.

What distinction separates dimensional stone from other white marble applications?

Dimensional stone refers to specific cut marble (slabs and tiles) measured and cut to specific dimensions for flooring, wall cladding, and countertops, distinguished from uses like monuments or sculptures, which often involve bespoke carving or unique artistic fabrication processes tailored to non-standard dimensions.

Which factors contribute to the scarcity premium associated with specific white marble types?

The scarcity premium for types like Statuario or Calacatta is driven by their limited geographical availability (often sourced from small, specific European quarries), low extraction yield of flawless blocks, and highly desirable aesthetic characteristics, leading to controlled supply volumes and subsequent high international pricing.

How do geopolitical factors affect the White Marble Market?

Geopolitical stability in key quarrying and trade regions, particularly Europe and the Middle East, is crucial. Instability or the imposition of new tariffs can disrupt supply chains, increase transportation costs, introduce sourcing delays, and cause volatility in the international pricing of imported white marble products.

What is the estimated market valuation of the White Marble Market in 2033?

The White Marble Market is estimated to reach a valuation of $27.5 Billion by the end of the forecast period in 2033, reflecting consistent capital investment and sustained global demand for high-end natural architectural materials.

Beyond aesthetics, what functional benefit drives the commercial use of white marble?

A key functional benefit driving commercial use is the high thermal resistance of white marble, which contributes to maintaining cooler internal temperatures in large commercial spaces, particularly beneficial in warm climates like the Middle East, alongside its inherent durability in high-traffic environments.

What is the role of architects and interior designers in the white marble value chain?

Architects and interior designers act as significant market influencers in the downstream value chain; their product specifications dictate material choice, often favoring certified or specific quarry sources, thereby generating demand and setting quality standards that suppliers must meet to secure high-value project tenders.

How does the segmentation by Type affect product pricing?

Segmentation by Type directly impacts pricing because rare, visually striking varieties (e.g., Calacatta Gold) command significantly higher prices due to their scarcity and aesthetic appeal, while common varieties (e.g., standard Carrara) are priced lower and utilized in high-volume, cost-sensitive projects.

What technological advancement is crucial for minimizing material wastage during extraction?

The implementation of modern Diamond Wire Cutting (DWC) systems is crucial for minimizing material wastage during extraction, as they provide precise, clean cuts with minimal kerf loss and reduce the risk of cracking large blocks, which ensures a higher recovery rate of premium, sellable material.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- White Marble Market Size Report By Type (Natural Marble, Artificial Marble), By Application (Construction & Decoration, Statuary & Monuments, Furniture, Other), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Architectural White Marble Market Statistics 2025 Analysis By Application (Residential Buildings, Public Buildings), By Type (Natural Marble, Artificial Marble), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- White Marble Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Natural Marble, Artificial Marble), By Application (Construction & Decoration, Statuary & Monuments, Furniture, Other), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager