Whitening Toothpastes Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441944 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Whitening Toothpastes Market Size

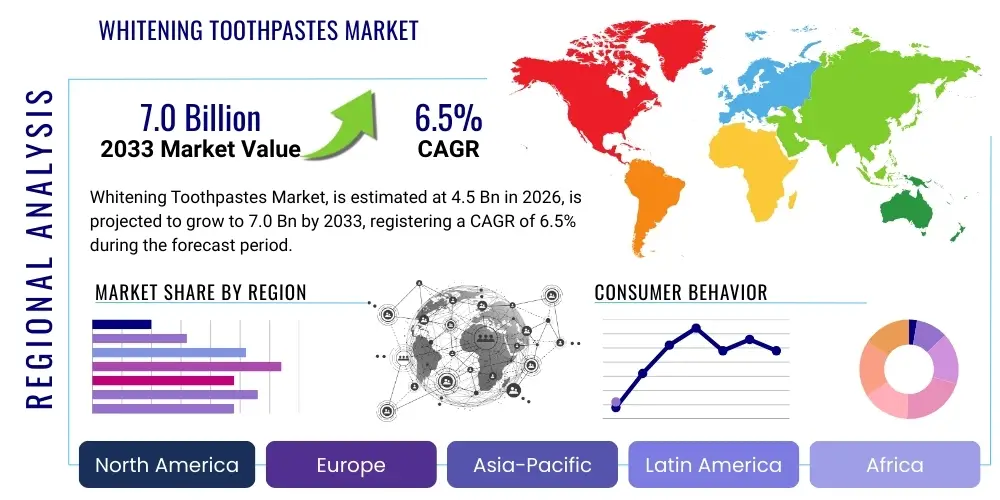

The Whitening Toothpastes Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.0 Billion by the end of the forecast period in 2033. This robust growth trajectory is primarily driven by escalating consumer focus on cosmetic dentistry and oral aesthetics, coupled with increasing disposable income in emerging economies. The convenience and lower cost of OTC whitening toothpastes compared to professional dental procedures make them a highly accessible consumer product globally.

The market expansion is further underpinned by continuous product innovation, particularly the integration of advanced chemical formulations like Phthalimidoperoxycaproic acid (PAP) and stabilized hydrogen peroxide delivery systems, which aim to minimize tooth sensitivity—a long-standing restraint in this category. Manufacturers are also heavily investing in marketing campaigns that link a whiter smile to personal confidence and social success, thereby shifting the product from a niche cosmetic item to a daily essential in developed markets. Furthermore, the rising incidence of extrinsic tooth staining due to changing dietary habits, increased consumption of coffee, tea, and tobacco products, necessitates effective home-care solutions, fueling demand for high-efficacy whitening formulations.

Whitening Toothpastes Market introduction

Whitening toothpastes are specialized oral hygiene products formulated to remove extrinsic surface stains from teeth, thereby enhancing the overall brightness and aesthetic appeal of the user's smile. These products typically rely on a combination of physical abrasives, such as high-cleaning silica or dicalcium phosphate, and mild chemical agents, often including low concentrations of carbamide peroxide, hydrogen peroxide, or emerging compounds like PAP, to achieve their stain-lifting effect. They serve as an affordable, non-invasive alternative or supplement to professional in-office bleaching procedures, fitting seamlessly into the daily oral care routine of the global consumer base. The primary market application is cosmetic enhancement, targeting individuals concerned with discoloration caused by diet, aging, or lifestyle factors.

The benefits associated with the adoption of whitening toothpastes extend beyond mere cosmetic improvement, contributing significantly to consumer psychological well-being. A perceived improvement in smile aesthetics often correlates with increased self-confidence and improved social interaction quality. Key driving factors propelling this market include the pervasive influence of social media platforms, where aesthetic standards are highly emphasized, and the rising global awareness regarding oral hygiene coupled with an increasing preference for preventative and aesthetic self-care products. Technological advancements in formulation science, focused on balancing efficacy with reduced abrasive damage to enamel and dentin, further solidify market growth and consumer trust.

However, the market introduction phase is continuously evolving, characterized by a rapid diversification of ingredients. Traditional ingredients are being supplemented or replaced by 'natural' alternatives such as activated charcoal, baking soda, and enzymes, responding to the clean beauty movement and consumer demand for perceived gentler solutions. This continuous innovation cycle ensures that whitening toothpastes remain a dynamic and highly competitive segment within the broader oral care industry, effectively catering to diverse consumer needs concerning stain removal, sensitivity management, and ingredient preference.

Whitening Toothpastes Market Executive Summary

The Whitening Toothpastes Market exhibits dynamic growth, fundamentally driven by shifts in consumer priorities towards cosmetic enhancement and self-care, positioning it as a high-value segment within the fast-moving consumer goods (FMCG) sector. Business trends indicate a strong move toward premiumization, where consumers are willing to pay higher prices for products offering clinically proven efficacy, advanced anti-sensitivity benefits (e.g., potassium nitrate integration), and aesthetically pleasing packaging. A major trend involves the intersection of whitening efficacy with holistic oral health, necessitating formulations that also provide cavity protection (fluoride or hydroxyapatite) and gum health support. Furthermore, sustainability is becoming a non-negotiable factor, pushing manufacturers to explore recyclable packaging and responsibly sourced natural ingredients, which impacts both supply chain complexity and marketing narratives.

Regionally, North America and Europe maintain dominance, characterized by high consumer awareness, established distribution networks, and strong regulatory frameworks that ensure product safety, fostering high consumer trust. However, the Asia Pacific (APAC) region is forecasted to demonstrate the highest Compound Annual Growth Rate (CAGR). This surge in APAC is fueled by rapid urbanization, the expansion of the middle class, which now has greater disposable income allocated to cosmetic items, and the pervasive adoption of Western beauty standards disseminated via digital media. Countries like China and India are transitioning from basic oral care to specialized, aesthetic-focused products, representing massive untapped potential, although market entry requires navigating diverse cultural preferences and localized regulatory requirements.

Segment trends reveal a bifurcation in consumer preference. The chemical segment, led by peroxide-based formulas, continues to attract consumers seeking maximum, rapid results, driving innovation in delivery systems to reduce side effects. Concurrently, the 'natural/botanical' segment, encompassing charcoal, herbal extracts, and enzyme-based formulas, is experiencing significant growth, appealing to a segment prioritizing gentle, clean-label ingredients, despite potentially longer timelines for visible results. Distribution channel trends highlight the growing dominance of e-commerce platforms, offering consumers transparency, price comparison, and access to niche, direct-to-consumer (D2C) brands, thereby challenging the traditional supremacy of supermarkets and pharmacies.

AI Impact Analysis on Whitening Toothpastes Market

User queries regarding AI's influence in the Whitening Toothpastes market frequently revolve around personalized product recommendations, the use of predictive analytics for inventory and trend forecasting, and the application of AI-driven tools for virtual dental consultations or color-matching. Consumers are increasingly asking: "Can AI tell me which toothpaste is best for my unique staining type?" and "How is AI optimizing the ingredient discovery process?" The central themes emerging from this analysis include expectations for hyper-personalization, improved supply chain efficiency, and enhanced diagnostic precision in identifying oral care needs. Key concerns often focus on data privacy related to uploading photos for virtual assessments and the clinical validation of AI-recommended products, suggesting a need for transparent data governance and robust scientific backing for AI tools used in oral health diagnostics.

AI's primary influence is seen in refining the consumer journey, transforming generic marketing into highly targeted micro-segmentation based on individualized staining profiles, dietary habits, and genetic predispositions collected through digital means. Machine learning algorithms analyze vast datasets of consumer reviews, clinical trial results, and ingredient interactions to rapidly identify optimal formulations and predict efficacy rates under varying conditions. This predictive capability significantly reduces R&D cycles, allowing manufacturers to bring highly customized and efficacious products to market faster. Furthermore, AI-powered chatbots and virtual assistants are being deployed on brand websites to provide immediate, context-aware advice on product usage, expected results, and potential sensitivity management, vastly improving the post-purchase consumer experience.

Beyond consumer interaction, AI is revolutionizing manufacturing and supply chain resilience. Predictive maintenance algorithms monitor production equipment to prevent downtime, while AI-driven demand forecasting utilizes sophisticated models that incorporate real-time retail data, seasonal effects, and social media sentiment to optimize stock levels. This minimizes wastage, reduces holding costs, and ensures shelves are stocked precisely where and when demand peaks. In terms of formulation, AI is assisting material scientists by simulating the interaction of novel ingredients like advanced silica particles or chelation agents, speeding up the process of discovering next-generation whitening compounds that offer superior efficacy with minimal enamel abrasion, ultimately raising the performance ceiling for the entire product category.

- Personalized Formulation Recommendations: AI analyzes individual staining causes (e.g., coffee, tobacco) and sensitivity levels to suggest optimal product mixes.

- Predictive Trend Analysis: Machine learning models forecast shifts in ingredient popularity (e.g., rise of PAP vs. peroxide) and packaging demands.

- Supply Chain Optimization: AI ensures real-time inventory management and dynamic routing, reducing logistics costs and product expiry risk.

- Virtual Diagnostic Tools: AI-powered applications allow users to upload teeth photos for preliminary stain assessment and color-matching to product efficacy expectations.

- Enhanced R&D Efficiency: Algorithms simulate complex ingredient interactions to accelerate the discovery of non-abrasive, highly effective whitening agents.

- Automated Customer Service: AI chatbots provide instant, detailed product usage instructions and troubleshoot common issues like mild sensitivity.

DRO & Impact Forces Of Whitening Toothpastes Market

The dynamics of the Whitening Toothpastes Market are fundamentally shaped by interconnected forces of demand, regulatory compliance, and technological innovation. The key drivers center on the pervasive societal pressure for enhanced aesthetic appearance, coupled with increasing consumer expenditure on personal grooming products, positioning the aesthetic outcome as a primary purchase motivation. Restraints primarily involve the side effect of tooth sensitivity associated with certain chemical whitening agents and the increasing scrutiny from regulatory bodies regarding the long-term safety of high-abrasivity formulations. Opportunities lie in developing advanced formulations that merge maximum whitening efficacy with enamel restoration and anti-sensitivity features (e.g., using nano-hydroxyapatite alongside whitening agents). These market forces create a high-stakes environment where innovation that balances aggressive efficacy with established safety protocols dictates competitive success.

Impact forces dictate that market participants must continuously invest in clinical validation to overcome consumer skepticism regarding the efficacy claims often perceived as exaggerated. The rise of direct-to-consumer models and the transparency demanded by digital consumers mean that brands cannot rely solely on traditional marketing; product performance must be verifiable. Furthermore, the global push toward sustainability is an irreversible impact force, compelling manufacturers to re-engineer product packaging (moving away from non-recyclable plastic tubes) and to source ingredients ethically, directly influencing procurement strategies and manufacturing costs. The convergence of oral health with overall wellness trends presents a significant transformative impact, pushing whitening toothpastes to evolve into comprehensive "oral cosmetic wellness" solutions rather than standalone stain removers.

The competitive landscape is intensely impacted by the swift pace of ingredient innovation. The introduction and rapid adoption of novel, non-peroxide-based chemical agents like PAP demonstrates how technological opportunities can rapidly disrupt established market leadership. Companies that successfully navigate the complex intellectual property landscape associated with these advanced formulations and secure swift regulatory approval gain a substantial first-mover advantage. Conversely, failure to adapt to emerging regulatory restraints—such as potential future limitations on certain microplastics or specific abrasive particle sizes—could lead to product recalls or competitive disadvantage. Therefore, strategic market participation requires a nuanced understanding of these driving, restraining, and opportunity-creating forces, ensuring long-term product relevance and compliance.

Segmentation Analysis

The Whitening Toothpastes Market is extensively segmented to accurately reflect the diversity of consumer needs, ingredient preferences, distribution modalities, and regional specificities. Comprehensive segmentation allows manufacturers to target specific demographics, such as highly sensitive consumers requiring low-abrasion formulas, or specific geographical regions where natural ingredients hold greater cultural significance. The key axes of segmentation include the active whitening mechanism employed (chemical vs. physical/natural), the primary target end-user (adults versus adolescents), the price point (premium versus economic), and the critical distribution channels utilized for sales, reflecting differing consumer access points and shopping habits. Understanding these segments is crucial for effective product portfolio management and targeted marketing campaigns.

- Ingredient Type:

- Peroxide-based (Hydrogen Peroxide, Carbamide Peroxide)

- Non-Peroxide/Chemical (PAP, Enzymes, PVP)

- Natural/Herbal (Activated Charcoal, Baking Soda, Silica, Botanical Extracts)

- End-User:

- Adults

- Adolescents/Children (with lower abrasive formulas)

- Distribution Channel:

- Supermarkets/Hypermarkets

- Pharmacies/Drug Stores

- Online Retail (E-commerce Platforms and D2C)

- Dental Clinics (Professional Grade)

- Price Range:

- Premium

- Mass/Economic

Value Chain Analysis For Whitening Toothpastes Market

The value chain for the Whitening Toothpastes Market commences with the Upstream segment, dominated by the sourcing and refinement of specialized raw materials. This includes high-grade abrasive silicas (often synthetic hydrated silica), chemical whitening agents such as stabilized hydrogen peroxide or PAP, and auxiliary ingredients like humectants, flavorants, and fluoride compounds. Supply reliability, ingredient purity, and adherence to global cosmetic and pharmaceutical grade standards are critical at this stage. Manufacturers often rely on a few specialized chemical suppliers, leading to potential supply concentration risk. Innovation upstream focuses on developing bio-available ingredients like nano-hydroxyapatite to promote enamel remineralization while whitening.

The Midstream segment involves manufacturing and formulation science, where specialized blending and packaging facilities convert raw materials into finished toothpaste tubes. This stage is complex due to the need for maintaining the stability and efficacy of sensitive active ingredients (e.g., peroxide breakdown upon exposure to light or heat) and ensuring precise dosing. Quality control is paramount to guarantee product safety and consistency across large production batches. Direct manufacturers invest heavily in R&D to optimize abrasive particle size and shape, ensuring maximum stain removal with minimum damage to tooth structure, which is a major point of differentiation in a crowded market.

The Downstream segment, encompassing distribution and retail, is critical for market access. Distribution channels are bifurcated into indirect and direct routes. Indirect channels, such as traditional supermarkets, hypermarkets, and drug stores, rely on extensive shelf space and established logistics chains, making them vital for mass-market penetration. Direct channels, primarily e-commerce and brand-specific direct-to-consumer (D2C) websites, offer greater pricing flexibility, deeper consumer data insights, and the ability to rapidly launch and test niche, premium products. Dental clinics represent a specialized distribution channel for professional-grade whitening toothpastes, often positioned as follow-up care to in-office treatments, driving higher average transaction values and reinforcing professional endorsement.

Whitening Toothpastes Market Potential Customers

The potential customer base for the Whitening Toothpastes Market is broad, extending across various demographic and psychographic segments, but is primarily focused on consumers driven by aesthetic concerns and preventative oral care. The core target market consists of aesthetically-conscious adults, predominantly millennials and Gen Z, who utilize social media heavily and view a bright smile as integral to personal branding and professional success. These buyers are generally willing to invest in premium products, often seeking immediate, visible results and favoring brands that align with their ethical values (e.g., cruelty-free, sustainable packaging). Their purchasing behavior is often influenced by digital reviews and influencer endorsements rather than traditional media.

Another significant segment comprises users with specific extrinsic staining issues, such as heavy coffee drinkers, tea aficionados, and tobacco users. For these consumers, the product serves a functional, restorative purpose, mitigating daily discoloration caused by lifestyle habits. This segment prioritizes high-efficacy formulations, often tolerating slightly higher costs or even mild sensitivity in exchange for superior stain-lifting power. Additionally, consumers who have previously undergone professional whitening treatments form a crucial customer base, as they require continuous maintenance products to prolong the results and protect their investment, often preferring professional-recommended or clinically-proven formulations available via pharmacy or dental clinic channels.

Furthermore, the market includes individuals suffering from mild tooth sensitivity who still desire whitening benefits. This segment demands specialized, low-abrasive formulas often fortified with desensitizing agents like potassium nitrate or strontium chloride. The expansion of oral wellness consciousness has also brought in older demographics who seek to counteract natural age-related tooth darkening without undergoing expensive or intrusive dental procedures. Manufacturers must effectively tailor product messaging—emphasizing safety and gentleness for the sensitive segment, and speed and power for the lifestyle-stain segment—to convert these diverse groups into loyal, repeat purchasers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.0 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | The Procter & Gamble Company (P&G), Colgate-Palmolive Company, Unilever PLC, GlaxoSmithKline PLC (GSK), Johnson & Johnson, Church & Dwight Co., Inc., Henkel AG & Co. KGaA, Lion Corporation, Sunstar Suisse S.A., Dentaid SL, Dr. Fresh LLC, Hello Products LLC, Tom's of Maine, Sensodyne, Crest, Aquafresh, Arm & Hammer, Beverly Hills Formula. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Whitening Toothpastes Market Key Technology Landscape

The technology landscape in the Whitening Toothpastes Market is characterized by continuous refinement of existing abrasive and chemical systems, alongside the introduction of novel, proprietary delivery mechanisms designed to enhance efficacy while minimizing adverse effects. A core technological focus is the engineering of advanced abrasives, particularly specialized synthetic silicas. These engineered silica particles are designed to possess high cleaning power but with a lower Relative Dentin Abrasivity (RDA) value, ensuring effective stain removal without excessive wear on the enamel and dentin structure. Precision control over particle morphology and concentration allows manufacturers to fine-tune the balance between polishing and stain eradication, a critical factor for premium product positioning.

Chemical technology innovation is centered on stabilizing active agents and introducing non-peroxide alternatives. Stabilizing hydrogen peroxide, the gold standard for chemical whitening, within the toothpaste matrix remains a complex technological challenge, requiring specialized encapsulation techniques to maintain potency over the product lifespan. The rise of Phthalimidoperoxycaproic acid (PAP) marks a significant technological shift, as it offers peroxide-like results without the associated free radical release or high sensitivity, driving significant R&D investment. Furthermore, enzyme technologies, utilizing agents like papain or bromelain, are gaining traction, leveraging biological mechanisms to break down protein films on the tooth surface to which stains adhere, offering a gentle yet effective whitening method appealing to the natural segment.

Beyond the active ingredients, the technology landscape is being shaped by integration with broader oral care devices and smart packaging solutions. Some premium products are designed for optimal interaction with sonic and electric toothbrushes, optimizing foaming action and abrasive contact. Packaging innovation includes airless pumps and specialized tube materials that protect sensitive ingredients from degradation by atmospheric oxygen or UV light. Future technological advancements are expected to heavily involve nano-scale chemistry, such as the use of nano-hydroxyapatite to fill micro-fissures in the enamel surface, simultaneously reducing sensitivity, repairing structure, and enhancing the perception of whiteness by altering light reflection properties.

Regional Highlights

Regional dynamics in the Whitening Toothpastes Market are highly diversified, reflecting varying levels of economic maturity, aesthetic standards, and regulatory stringency, collectively influencing market penetration and growth rates across different geographical areas. North America, particularly the United States, represents the largest and most mature market segment, characterized by high consumer awareness regarding aesthetic dental care and significant market penetration of premium, clinically proven brands. The strong presence of specialized dental chains and pervasive media influence linking white teeth to personal success ensures sustained high demand. Innovation here focuses on combining advanced chemical whitening with maximum sensitivity protection and rapid results.

Europe constitutes the second major market, driven by consumer demand for high-quality, scientifically validated products, although stringent EU regulations concerning ingredient concentrations, particularly for hydrogen peroxide, dictate product formulation strategies. This regulatory environment favors the adoption of non-peroxide technologies and natural alternatives, leading to strong growth in the 'clean label' and natural segments in countries like Germany and the UK. Pricing in Europe tends towards premiumization, reflecting the costs associated with stringent compliance and the consumer preference for well-established, pharmacy-backed brands. The market structure is complex due to localized packaging and labeling requirements across the continent.

Asia Pacific (APAC) is the engine of future market growth, expected to record the highest CAGR during the forecast period. This rapid expansion is driven by burgeoning disposable incomes, fast-paced urbanization, and the adoption of Western cosmetic standards, especially among the youth in China, India, and Southeast Asia. The region exhibits high price sensitivity in mass segments but significant demand for premium imported brands in major metropolitan areas. Manufacturers are prioritizing market entry strategies that include localized flavor profiles and formulations tailored to region-specific dietary staining habits. Conversely, Latin America and the Middle East & Africa (MEA) remain emerging markets, with growth primarily concentrated in urban centers, fueled by increasing access to modern retail channels and a rising middle class seeking affordable cosmetic enhancements.

- North America: Dominant market share; driven by high aesthetic standards, robust e-commerce channels, and significant adoption of both peroxide and advanced non-peroxide formulas.

- Europe: High demand for natural and sensitive formulations; growth constrained but steered by strict regulations on peroxide levels, leading to a focus on premium, certified products.

- Asia Pacific (APAC): Fastest-growing region; powered by rapid urbanization, rising disposable incomes, and increasing social media influence driving cosmetic dental interest in countries like China, India, and Japan.

- Latin America: Emerging market with growth focused on mass-market affordable whitening options and rising consumer awareness.

- Middle East & Africa (MEA): Growth driven by expanding modern retail infrastructure and increasing health and wellness expenditure in key oil-rich nations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Whitening Toothpastes Market.- The Procter & Gamble Company (P&G) (Crest)

- Colgate-Palmolive Company (Colgate Optic White)

- Unilever PLC (Signal, Pepsodent)

- GlaxoSmithKline PLC (GSK) (Sensodyne True White, Aquafresh)

- Johnson & Johnson (Listerine)

- Church & Dwight Co., Inc. (Arm & Hammer)

- Henkel AG & Co. KGaA

- Lion Corporation

- Sunstar Suisse S.A.

- Dentaid SL

- Dr. Fresh LLC

- Hello Products LLC (Acquired by Colgate-Palmolive)

- Tom's of Maine (Acquired by Colgate-Palmolive)

- Coswell SpA (BlanX)

- Dr. Bronner's Magic Soaps

- Supersmile

- Beverly Hills Formula

- Philips Oral Healthcare

- GC Corporation

- Davids Natural Toothpaste

Frequently Asked Questions

Analyze common user questions about the Whitening Toothpastes market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the most effective ingredient used in modern whitening toothpastes?

The most effective traditional chemical agent is stabilized hydrogen peroxide, though newer formulations utilizing Phthalimidoperoxycaproic acid (PAP) are gaining traction due to superior results with reduced sensitivity risks. Efficacy is also highly dependent on the toothpaste's abrasive system (e.g., engineered silica) and consistency of use.

How quickly can I expect to see noticeable results from using whitening toothpaste?

Visible results typically appear within two to four weeks of consistent, twice-daily use. Initial results focus on removing extrinsic surface stains; deeper internal stains are generally unaffected and require professional dental treatment. Results can vary widely based on the severity of initial staining.

Do whitening toothpastes increase tooth sensitivity, and how can this be managed?

Some whitening toothpastes, particularly those with higher concentrations of chemical agents or high abrasive levels, can temporarily increase sensitivity. This is often managed by using formulations containing desensitizing agents like potassium nitrate or strontium chloride, or by alternating usage with a sensitivity-specific toothpaste.

Are natural whitening agents like activated charcoal safe and effective?

Activated charcoal is effective at adsorbing surface stains but often lacks necessary clinical data proving long-term safety regarding enamel abrasion. While popular due to their natural perception, consumers should look for low-Relative Dentin Abrasivity (RDA) formulations to minimize the risk of enamel wear over time.

Is professional advice required before starting a regimen with a new whitening toothpaste?

While over-the-counter whitening toothpastes are generally safe for daily use, consulting a dentist is highly recommended, especially for individuals with pre-existing conditions like severe tooth sensitivity, gum recession, or restorations, to ensure the chosen product will not cause adverse effects or damage existing dental work.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager