Wind Power Bearing Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441092 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Wind Power Bearing Market Size

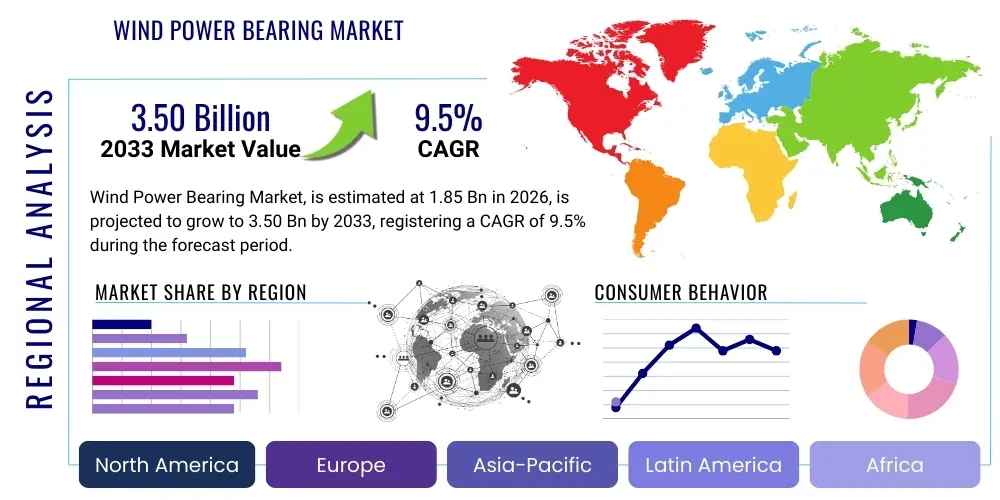

The Wind Power Bearing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 3.50 Billion by the end of the forecast period in 2033. This substantial expansion is primarily driven by global commitments to renewable energy, large-scale wind farm development, and critical technological advancements focused on increasing the reliability and lifespan of wind turbine components, particularly in harsh offshore environments where bearing failure leads to extremely high maintenance costs. The transition towards higher-capacity turbines necessitates bearings capable of handling significantly increased dynamic and static loads, demanding robust engineering and advanced materials science.

Wind Power Bearing Market introduction

The Wind Power Bearing Market encompasses specialized components crucial for the operational integrity and efficiency of modern wind turbines. These bearings manage immense forces and facilitate the rotation and articulation of various turbine systems, including the main shaft, gearbox, yaw system, and pitch system. They are designed to withstand challenging conditions such as variable speeds, heavy loads, high vibration, and temperature fluctuations. Major applications span utility-scale onshore and rapidly expanding offshore wind farms, where reliability is paramount to maximizing energy output and minimizing downtime. Key benefits derived from high-performance bearings include enhanced turbine lifespan, reduced maintenance intervals, and improved energy generation efficiency, directly contributing to the lower Levelized Cost of Energy (LCOE) for wind power projects globally. The market is propelled by aggressive renewable energy targets set by governments worldwide, supportive regulatory frameworks like feed-in tariffs and tax credits, and continuous innovation in bearing materials, lubrication systems, and monitoring technologies designed specifically for megawatt-class turbines. The global push for decarbonization positions wind energy, and consequently the specialized bearing market, as a cornerstone of future electrical grids.

Wind Power Bearing Market Executive Summary

The global Wind Power Bearing Market is experiencing robust expansion, fundamentally fueled by geopolitical shifts toward energy independence and widespread industrial adoption of green energy standards. Business trends highlight a pronounced shift towards consolidation among bearing manufacturers, enabling integrated R&D efforts focused on developing larger, more durable bearings suitable for 10+ MW offshore turbines. Supply chain resilience, particularly the sourcing of high-grade steel and advanced coatings, remains a key strategic priority for market leaders aiming to mitigate production risks. Regionally, Asia Pacific, specifically China and India, dominates new installations due to massive national renewable energy programs, while Europe continues to lead in offshore technology and retrofitting older fleets. North America, driven by utility-scale projects in the Midwest and robust policy support, represents a high-growth region. Segment-wise, main shaft bearings, which endure the most significant operational stress, hold the largest value share, but demand for pitch and yaw bearings is accelerating due to the increased importance of active load management and precise blade control systems required for optimal energy capture across varied wind regimes. Furthermore, the aftermarket service segment, encompassing repair, refurbishment, and replacement, is exhibiting faster growth than the OEM segment, driven by the aging global turbine fleet and the necessity of extending asset lifecycles.

AI Impact Analysis on Wind Power Bearing Market

User inquiries regarding the integration of Artificial Intelligence (AI) in the Wind Power Bearing Market frequently center on predictive maintenance capabilities, optimization of lubrication schedules, and early fault detection systems crucial for minimizing catastrophic failures. The key themes revolve around how AI-driven diagnostics can transform maintenance from reactive or time-based schedules to condition-based strategies, reducing operational expenditure (OPEX) significantly. Users are particularly concerned about the accuracy of models trained on diverse datasets from various turbine types and operational environments, and the necessary infrastructure investment required for high-frequency sensor data collection and processing. Expectations are high concerning AI’s potential to analyze complex vibration patterns, acoustic emissions, and temperature data in real-time to pinpoint nascent bearing degradation, thereby extending Mean Time Between Failures (MTBF) and ensuring maximum uptime, especially in inaccessible offshore settings where human intervention is costly and hazardous. AI is viewed as the primary tool to unlock the next level of operational efficiency and reliability in modern wind farm management.

- AI-driven predictive maintenance (PdM) algorithms enhance bearing lifespan and reduce unscheduled downtime by analyzing real-time sensor data.

- Machine learning models optimize lubrication intervals and types based on actual load profiles and environmental conditions, preventing premature failure.

- AI facilitates advanced anomaly detection in vibration and thermal signatures, identifying early stages of spalling or micro-pitting far before conventional monitoring systems.

- Neural networks are used in the design phase to simulate extreme load scenarios, optimizing bearing geometry and material selection for maximum durability.

- Digital twins of critical turbine components, supported by AI, provide precise insights into component wear and tear, improving fleet management strategies.

DRO & Impact Forces Of Wind Power Bearing Market

The dynamics of the Wind Power Bearing Market are shaped by a complex interplay of accelerating renewable energy adoption (Driver) countered by stringent operational requirements and high capital costs (Restraints), opening avenues for technological advancements (Opportunity), which collectively exert substantial influence (Impact Forces) on market trajectory. Global government mandates supporting wind energy, coupled with significant reductions in the cost of generating wind power, serve as the primary drivers, sustaining continuous demand for new installations and replacement parts. However, the operational environment is harsh; bearings must operate under extreme, cyclical loads, and maintenance failures, especially offshore, lead to significant downtime and expenditure, acting as a major restraint. The opportunity lies in developing next-generation condition monitoring systems and integrated bearing designs that utilize advanced materials and smart sensors to drastically improve durability and predictability. These market forces collectively dictate innovation cycles, pricing structures, and competitive intensity, compelling manufacturers to invest heavily in durability and advanced manufacturing processes to meet the escalating performance demands of high-megawatt turbines and secure long-term contracts with major turbine OEMs.

Segmentation Analysis

The Wind Power Bearing Market is systematically segmented across critical dimensions, including bearing type, application within the turbine, and the specific turbine location (onshore or offshore). This classification allows for a detailed assessment of specific technological demands and market penetration rates across different operational needs. The type segmentation, encompassing various roller and ball bearing configurations, reflects the diversity of stress management strategies employed across different turbine mechanisms. Application segmentation highlights the specialized functions of pitch, yaw, main shaft, and gearbox bearings, each facing unique load characteristics and failure modes, driving specialized R&D. Furthermore, the distinction between onshore and offshore applications is vital, as the harsh, saline, and demanding environment of offshore installations requires significantly higher material specifications and protective coatings, commanding premium pricing and demanding unparalleled reliability standards from bearing suppliers globally. Understanding these segments is paramount for strategic planning and resource allocation within the value chain.

- By Type:

- Ball Bearings (Deep Groove, Angular Contact)

- Roller Bearings (Cylindrical Roller Bearings, Tapered Roller Bearings, Spherical Roller Bearings, Needle Roller Bearings)

- Slewing Bearings (Four-point Contact Ball Bearings, Three-row Roller Bearings)

- By Application:

- Main Shaft Bearings

- Gearbox Bearings

- Pitch Bearings

- Yaw Bearings

- By Installation Location:

- Onshore Wind Turbines

- Offshore Wind Turbines

Value Chain Analysis For Wind Power Bearing Market

The Wind Power Bearing value chain initiates with the upstream analysis, primarily centered on the sourcing and processing of raw materials, predominantly high-purity bearing steel (such as 100Cr6 or similar alloys), advanced lubricants, specialized coatings, and sealing systems. Reliability and quality control at this foundational stage are non-negotiable, given the catastrophic consequences of component failure within a turbine. Key upstream players include specialized steel manufacturers and chemical companies providing high-performance greases and oils designed for extreme pressure and variable temperatures. The middle segment involves the core manufacturing process, where highly sophisticated machining, heat treatment, grinding, and assembly techniques are employed by major bearing producers. This stage is characterized by high capital investment in precision manufacturing equipment and stringent quality assurance protocols to achieve the micron-level tolerances required for high-speed, high-load operations.

Downstream analysis focuses on the final integration and deployment. This includes the direct supply of bearings to Original Equipment Manufacturers (OEMs) such as Vestas, Siemens Gamesa, and GE Renewable Energy, where the bearings are integrated into turbine nacelles and pitch/yaw systems. This OEM channel represents the largest volume for new installations. Post-installation, the downstream focus shifts to the massive aftermarket sector, encompassing maintenance service providers (MSPs) and independent service organizations (ISOs) that handle replacements, refurbishment, and repair operations for aging turbines. The distribution channel is multifaceted, relying heavily on direct sales and engineering collaboration with OEMs due to the highly customized nature of large bearings, while the aftermarket often utilizes authorized distributors and specialized industrial supply houses. Indirect channels, though less prominent for ultra-large bearings, support smaller component replacements and general maintenance supplies, ensuring operational continuity across dispersed wind farm locations globally.

The direct channel involves extensive engineering consultation and long-term contracts between the bearing supplier and the turbine manufacturer, often requiring co-development of bearing specifications specific to the turbine model's architecture and expected load spectrum. This ensures optimal performance and guarantees compliance with stringent industry certifications. Conversely, the indirect channel, particularly important for the aftermarket, relies on efficient logistics and inventory management to quickly supply replacement parts across wide geographical areas. Service quality and the speed of delivery in the aftermarket significantly influence turbine uptime, making robust regional distribution networks essential for sustaining long-term asset profitability for wind farm operators. Therefore, market leaders focus intensely on strengthening both their direct technical engagement and their global service footprint.

Wind Power Bearing Market Potential Customers

Potential customers in the Wind Power Bearing Market are fundamentally segmented into two primary categories: Original Equipment Manufacturers (OEMs) and End-Users/Operators utilizing the aftermarket for maintenance and repairs. OEMs are the largest volume buyers, procuring customized bearing solutions directly from manufacturers for integration into new wind turbine assemblies. These customers, including global giants and regional specialists, prioritize technological partnership, quality consistency, and cost-efficiency in large-scale procurement contracts. They require bearings specifically engineered to meet the dynamic load requirements of their latest turbine designs, often pushing the boundaries of material science and manufacturing precision. These relationships are typically long-term and strategic, often involving proprietary design elements and exclusivity agreements, making the OEM segment a highly competitive but stable revenue stream for bearing suppliers. Customer loyalty is heavily influenced by reliability data and warranty coverage.

The second major customer group consists of Wind Farm Operators and Independent Service Providers (ISPs), who constitute the burgeoning aftermarket. These customers procure bearings for maintenance, repair, and overhaul (MRO) activities required to keep existing fleets operational. Their purchasing decisions are primarily driven by replacement lead times, total cost of ownership (TCO) calculated through extended service life, and the availability of specialized refurbishment services. As the global fleet of installed wind turbines ages, the need for robust, reliable replacement bearings that sometimes exceed the performance of the original components intensifies, creating lucrative opportunities for bearing suppliers offering specialized MRO services and condition monitoring solutions. Utility companies and private investors managing large portfolios of wind assets are also key end-users within this category, focusing on asset integrity management and operational uptime optimization.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 3.50 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SKF, Schaeffler AG, Timken Company, NSK Ltd., NTN Corporation, JTEKT Corporation, TPI Composites, Suzlon Energy Ltd., Goldwind Science & Technology Co., Ltd., Siemens Gamesa Renewable Energy, Vestas Wind Systems A/S, Wärtsilä Corporation, GE Renewable Energy, Dalian Metallurgical Bearing Co., Ltd., Luoyang LYC Bearing Co., Ltd., Wafangdian Bearing Group Corp. (ZWZ), C&U Group, Regal Rexnord, ZYS Bearing, THK Co. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wind Power Bearing Market Key Technology Landscape

The technological landscape of the Wind Power Bearing Market is characterized by intense focus on material innovation, advanced manufacturing precision, and the integration of smart monitoring capabilities. A critical technological trend involves the utilization of specialized heat treatment processes, such as bainitic hardening or carburizing, to significantly enhance the toughness and fatigue resistance of bearing rings and rolling elements, addressing the core challenge of sub-surface fatigue caused by variable wind loads. Furthermore, advanced surface coatings, including diamond-like carbon (DLC) coatings, are increasingly employed to mitigate micropitting and reduce friction, especially in pitch and yaw bearings that experience oscillating movements rather than full rotations. These material science advancements are crucial for extending the life cycle of bearings beyond the standard 20-year turbine design life.

Another significant development is the widespread adoption of integrated sensor technology, transforming traditional bearings into 'smart' components. These smart bearings incorporate embedded sensors for measuring real-time parameters such as temperature, vibration, load distribution, and lubrication integrity. This data is essential for enabling sophisticated Condition Monitoring Systems (CMS), which utilize advanced signal processing and AI algorithms to predict impending failures with high accuracy. This shift from reactive maintenance to true predictive maintenance is essential, particularly for difficult-to-access offshore turbines where maintenance windows are narrow and costs are prohibitively high. The synergy between material robustness and digital intelligence defines the leading edge of bearing technology today, promoting unprecedented levels of reliability.

The engineering complexity is further driven by the move towards larger diameter bearings, particularly slewing bearings for yaw and pitch systems, and main shaft bearings for multi-megawatt direct-drive and geared turbines. Manufacturing these large components requires specialized, high-precision large-scale CNC machinery and rigorous quality control protocols to ensure dimensional accuracy across several meters. Lubrication technology also plays a pivotal role, with a strong focus on synthetic, environmentally friendly greases and oils offering superior thermal stability and load-carrying capacity across wide temperature ranges, minimizing the risk of premature lubricant degradation, which is a common failure root cause in harsh environments. Continuous innovation in sealing technology is also critical to prevent ingress of moisture and contaminants, maintaining the integrity of the lubricating film within the bearing cavity.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to maintain its position as the largest and fastest-growing market, primarily driven by massive installation capacities in China and India. China, in particular, dominates both onshore and emerging offshore development, supported by national Five-Year Plans prioritizing renewable energy expansion and localizing the supply chain. Demand is high for both new installation (OEM) bearings and aftermarket components due to the sheer size of the installed base. South Korea, Japan, and Taiwan are investing heavily in offshore projects, necessitating highly durable, specialized slewing and main shaft bearings.

- Europe: Europe is characterized by technological maturity and leadership in offshore wind technology (especially the UK, Germany, and Denmark). This region drives demand for high-capacity, highly reliable bearings (typically 8MW+ turbines) and represents a significant refurbishment and replacement market, focusing intensely on extending the lifespan of existing infrastructure. Regulatory support and stringent quality standards push innovation in material science and condition monitoring integration.

- North America: North America, led by the United States, demonstrates robust growth fueled by supportive governmental policies like the Inflation Reduction Act (IRA) and large-scale utility procurement. The demand is strong across both main shaft and gearbox segments, with a growing focus on optimizing efficiency and managing the vast, often remote, onshore turbine fleets. Technological adoption, particularly relating to digital monitoring and advanced failure prediction, is high in this region.

- Latin America (LATAM): LATAM, particularly Brazil, Chile, and Mexico, shows potential growth driven by rich wind resources and increasing energy demands. The market here is sensitive to capital costs, driving demand for robust, cost-effective bearing solutions suitable for remote installations and varying grid conditions. Growth is often project-specific and reliant on stable foreign investment policies.

- Middle East and Africa (MEA): The MEA region is in the nascent to moderate growth phase, with significant projects emerging in Saudi Arabia, UAE, and South Africa. These markets are driven by diversification away from fossil fuels and face unique challenges related to extreme heat and sand ingress, requiring specialized sealing and high-temperature lubrication solutions for bearing longevity.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wind Power Bearing Market, analyzing their product portfolios, strategic initiatives, regional presence, and focus on innovation, particularly concerning large-scale turbine applications.- SKF

- Schaeffler AG

- Timken Company

- NSK Ltd.

- NTN Corporation

- JTEKT Corporation

- TPI Composites

- Suzlon Energy Ltd.

- Goldwind Science & Technology Co., Ltd.

- Siemens Gamesa Renewable Energy

- Vestas Wind Systems A/S

- Wärtsilä Corporation

- GE Renewable Energy

- Dalian Metallurgical Bearing Co., Ltd.

- Luoyang LYC Bearing Co., Ltd.

- Wafangdian Bearing Group Corp. (ZWZ)

- C&U Group

- Regal Rexnord

- ZYS Bearing

- THK Co. Ltd.

Frequently Asked Questions

Analyze common user questions about the Wind Power Bearing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand in the Wind Power Bearing Market?

The primary driver is the accelerating global deployment of utility-scale wind energy projects, fueled by stringent governmental renewable energy targets and the continuous reduction in the Levelized Cost of Energy (LCOE) associated with wind power generation.

How does the shift to offshore wind turbines impact bearing requirements?

Offshore environments demand larger bearings (often exceeding 4 meters in diameter) with enhanced corrosion resistance, specialized sealing systems, and superior fatigue life due to the extreme loads, humidity, and high cost associated with maintenance interventions.

Which segment of the wind turbine utilizes the most technically complex bearings?

The main shaft bearing segment often requires the most technically complex bearings, needing to manage enormous non-uniform dynamic loads and high axial forces originating from the rotor blades, necessitating large spherical or cylindrical roller bearing designs.

What role does Condition Monitoring play in the Wind Power Bearing Market?

Condition Monitoring Systems (CMS), increasingly integrated with smart bearings and AI, are critical for predictive maintenance, allowing operators to detect early signs of bearing degradation, optimize lubrication, and drastically reduce unplanned downtime and catastrophic failure rates.

Which geographical region holds the largest market share for wind power bearings?

Asia Pacific (APAC), particularly driven by the massive new installation capacity in China, currently holds the largest market share due to unparalleled regional investment in both onshore and burgeoning offshore wind farm development.

The extensive analysis of the Wind Power Bearing Market reveals a sector critically dependent on precision engineering, advanced material science, and digital integration. As global energy demands pivot towards sustainability, the reliability and lifespan of these specialized components become central to the economic viability of wind power projects worldwide. Manufacturers are continually challenged to develop bearings that can withstand ever-increasing loads corresponding to multi-megawatt turbine designs, ensuring that technological advancements in metallurgy, surface treatment, and lubrication keep pace with the aggressive expansion of the wind energy sector. The aftermarket component of the industry is also rapidly maturing, providing robust opportunities for service providers focused on extending the operational life of legacy assets through meticulous repair, refurbishment, and replacement strategies. Geopolitical factors, combined with supportive regulatory mechanisms across major regions like APAC, Europe, and North America, solidify the market’s positive long-term trajectory.

Furthermore, the competitive landscape is highly concentrated among a few global industry leaders who possess the necessary expertise and manufacturing capabilities to produce large-scale, high-precision bearings. These key players are strategically investing in vertical integration and R&D to maintain their competitive edge, often collaborating directly with Wind Turbine OEMs to co-develop custom solutions that optimize performance for specific turbine models. Supply chain stability, particularly the sourcing of specialized high-grade steel, remains a recurrent concern that influences production timelines and overall cost structures. Addressing these supply challenges through strategic partnerships and diversifying sourcing options is paramount for mitigating market volatility and ensuring consistent product availability for both new construction and critical replacement needs globally.

Looking ahead, the successful deployment of next-generation 15MW+ offshore turbines will rely heavily on breakthroughs in bearing technology, pushing the physical limits of current designs. This necessitates further innovation in areas such as ceramic components, hybrid bearing configurations, and ultra-durable seal designs capable of operating faultlessly under the most strenuous oceanic conditions. The market's future growth will be fundamentally linked to its ability to continuously improve the Mean Time Between Failures (MTBF) and reduce the Levelized Cost of Energy (LCOE), ensuring wind power remains a highly competitive and sustainable energy source in the global energy mix for decades to come. The integration of AI and machine learning for predictive asset management is not merely an optional feature but a critical operational requirement for ensuring the economic viability of wind farm investments in the long term.

In summary, the Wind Power Bearing Market is positioned for sustained high growth, underpinned by foundational global energy policies and continuous technological evolution. The market's segmentation by application, type, and location highlights the diverse engineering challenges faced, with offshore applications representing the pinnacle of performance requirements. Strategic emphasis is placed on minimizing operational risk through robust design and maximizing service life through intelligent monitoring systems. Key market participants must prioritize resilience in their supply chains, invest aggressively in smart bearing technology, and focus on expanding specialized aftermarket services to capture the full scope of opportunities presented by the accelerating global transition to renewable energy sources, ultimately influencing the worldwide energy infrastructure dramatically over the forecast period and beyond, cementing the bearing as a pivotal component in the green energy transition.

The specialized nature of wind power bearings demands rigorous quality control and certification processes. Unlike standard industrial bearings, these components must often meet specific standards set by turbine manufacturers and regulatory bodies to ensure they comply with safety and operational requirements for 20-25 year service life. This necessity for high reliability drives manufacturing complexity and requires extensive testing under simulated real-world conditions, including highly accelerated life testing (HALT) protocols. The capital expenditure required for specialized machinery capable of producing these large-diameter, highly accurate components limits the number of viable manufacturers globally, creating significant entry barriers for new market entrants. The established expertise in advanced metallurgy, heat treatment, and precision grinding forms the core competitive advantage for market leaders like SKF, Schaeffler, and Timken, reinforcing their dominant positions in both the OEM and replacement segments of the industry globally. This focus on engineering excellence permeates every layer of the value chain.

Furthermore, sustainability concerns are increasingly influencing product development. Bearing manufacturers are exploring ways to reduce their environmental footprint, including utilizing recycled content in steel production, minimizing solvent use in manufacturing processes, and developing biodegradable or environmentally benign lubricants suitable for offshore use. This green mandate, driven by turbine operators’ and utilities' ESG (Environmental, Social, and Governance) commitments, is forcing innovation not just in performance but also in product lifecycle management and material choice. The push towards modular and easily maintainable bearing designs is also a key trend, aiming to simplify field repairs and reduce the logistical complexity of replacing massive components, thus improving the efficiency of repair crews and cutting down on maintenance time and costs, particularly relevant for geographically dispersed wind assets across various continents and remote locations.

The dynamics of pricing and market penetration are strongly influenced by regional manufacturing capabilities. While Europe and North America possess significant technological leadership, APAC, particularly China, leverages scale and domestic manufacturing advantages to offer highly competitive pricing, impacting global market equilibrium. This bifurcated market structure means that Western manufacturers often compete on superior technology, durability, and service contracts, especially for premium offshore projects, while APAC manufacturers compete aggressively on price and capacity for large-volume onshore projects. Navigating this pricing disparity requires sophisticated market segmentation strategies and tailored product offerings. Strategic alliances between Western technology providers and Asian manufacturing partners are becoming increasingly common as companies seek to balance cost efficiency with technological superiority and access to high-growth regional markets while mitigating supply chain disruption risks, thereby stabilizing global availability of these critical components.

Investment in R&D remains paramount, focusing not only on bearing design itself but also on surrounding systems like seals, housing, and lubrication delivery. For instance, the development of closed-loop lubrication systems that monitor oil quality and automatically replenish or filter the lubricant in real-time is a key area of focus, directly addressing one of the primary causes of premature bearing failure. Such integrated system approaches maximize reliability and minimize manual intervention, thereby significantly reducing the operational expenditures for wind farm owners. The continuous evolution of wind turbine size—with rotor diameters now exceeding 200 meters and hub heights over 150 meters—ensures that the demand for increasingly resilient, larger, and more technologically advanced bearings will continue to accelerate, driving steady investment and innovation across the entire bearing manufacturing ecosystem.

The global energy transition mandates require market participants to adopt agile manufacturing strategies. The rapid pace of turbine model introductions and decommissioning requires bearing suppliers to quickly adapt production lines and develop replacement solutions for older, sometimes discontinued, turbine models. This necessitates robust engineering support and efficient inventory management to ensure that replacement parts are available on demand, minimizing the economic losses associated with turbine downtime. The ability to rapidly reverse-engineer and manufacture compatible, high-quality replacement bearings for older turbine fleets is becoming a distinct competitive advantage in the aftermarket sector. This operational flexibility is essential for sustaining relationships with major utility companies and independent power producers who manage diverse and aging fleets, demanding responsiveness and reliability from their component suppliers.

Furthermore, regulatory changes, particularly those related to environmental protection and noise pollution, also subtly influence bearing design. For instance, the demand for quieter turbines necessitates bearing designs that minimize vibration and acoustic emissions, pushing innovation in precision manufacturing and the use of low-noise materials and optimized internal geometries. While not the primary driver, compliance with increasingly strict environmental and noise standards adds another layer of complexity to the already demanding specification list for next-generation wind power bearings. Successful market players are those that proactively integrate these sustainability and compliance requirements into their initial design phases, thereby securing long-term contracts based on holistic performance metrics rather than just load capacity and initial cost, demonstrating comprehensive commitment to both operational and environmental excellence in the highly competitive renewable energy landscape.

The adoption of advanced materials science extends beyond standard steel alloys. Manufacturers are actively researching and implementing specialized materials, including high-nitrogen stainless steels and ceramics, particularly for rolling elements in hybrid bearings. Hybrid bearings, which combine steel rings with ceramic rolling elements, offer superior electrical insulation, crucial for preventing damage caused by stray electrical currents generated in the turbine generator or static discharge during operation. They also exhibit lower friction, higher stiffness, and exceptional wear resistance, contributing significantly to improved energy efficiency and prolonged operational life, particularly in gearbox applications where high speeds and contaminated lubrication can accelerate wear. The economic viability of scaling up hybrid bearing production for massive main shaft applications remains a key research frontier, promising further breakthroughs in component durability and long-term asset value enhancement for the operators.

The complexity of yaw and pitch bearings, which control the orientation of the rotor and the angle of the blades respectively, should not be understated. These bearings typically operate under oscillating, non-rotating conditions, making them susceptible to fretting corrosion and false brinelling—wear phenomena that are difficult to predict and prevent using conventional monitoring techniques. Technological efforts in this area focus on specialized surface treatments, innovative sealing arrangements, and using synthetic greases with solid additives to maintain a robust lubricating film even under micro-movements. The trend towards larger rotor diameters increases the moment loads exerted on the pitch and yaw systems exponentially, necessitating extremely large slewing bearings with enhanced structural rigidity and precise gear teeth for reliable articulation and active load management across the entire spectrum of wind speed and direction, directly impacting energy capture efficiency.

Finally, digitalization across the manufacturing process, utilizing Industry 4.0 principles, is transforming production efficiency and quality assurance. Smart factories employ robotic systems for precise assembly, automated inspection using high-resolution cameras and lasers, and real-time data analysis to maintain stringent quality tolerances. This digitalization minimizes human error and allows manufacturers to achieve the micron-level accuracy required for multi-meter bearings consistently. Furthermore, the integration of supply chain data with production planning enables a highly responsive manufacturing environment, allowing faster scaling of production to meet the sudden spikes in demand often seen in the OEM market following major wind farm contract awards. This level of operational sophistication is mandatory for companies aiming to be primary suppliers in this highly demanding industrial sector.

The intersection of materials engineering and digital technologies is setting the stage for the next generation of wind power bearings. The long service life requirements necessitate a holistic approach where the bearing is treated as a highly engineered system rather than a simple component. This system includes the bearing itself, its lubrication, its housing, and its integrated monitoring infrastructure. Failure analysis is crucial, and sophisticated analytical tools, often powered by AI, are employed to determine the precise root cause of failures, feeding critical insights back into the design and manufacturing loops. This continuous improvement cycle, driven by real-world operational data gathered from deployed turbines across diverse climates, is fundamental to achieving the necessary reliability targets. The commitment to failure reduction translates directly into significant cost savings for wind farm operators, making these technological advancements highly valued across the entire wind energy ecosystem.

The economic contribution of the aftermarket segment is rapidly growing, not just in volume but also in technical sophistication. Refurbishment programs offered by major bearing manufacturers provide an economically and environmentally sustainable alternative to full replacement. These programs involve detailed inspection, non-destructive testing, precision grinding of raceways, and replacement of rolling elements, restoring the bearing to near-original specifications at a fraction of the cost of a new unit. The increasing acceptance of certified refurbished bearings, particularly for aging onshore turbines, underscores the market’s focus on extending asset lifecycles and maximizing return on investment. This trend solidifies the role of bearing manufacturers not just as component suppliers, but as essential partners in the long-term asset management and operational strategy of wind farm owners globally.

Looking at the regional growth disparities, while APAC leads in volume, Europe and North America often lead in value due to the higher specifications required for offshore installations and the higher complexity of replacement contracts involving specialized crane and logistics operations. Market penetration strategies must therefore be highly localized, addressing the specific regulatory environment, turbine size class, and maintenance culture of each region. For instance, in developing markets, accessibility and initial cost might outweigh absolute durability, driving demand for locally sourced or standard high-quality roller bearings. Conversely, in mature markets, the emphasis is almost exclusively on proprietary designs offering maximum resistance to known failure modes like White Etching Areas (WEA) and ensuring compliance with insurance provider risk assessments, demonstrating the necessity of a globally flexible yet locally focused operational model for leading market participants.

Finally, the competitive environment is characterized by intense intellectual property battles surrounding patented designs, advanced heat treatments, and proprietary coating technologies. Manufacturers continuously file patents related to bearing geometry optimization, integrated sensor packages, and specialized lubrication delivery systems to protect their technological investments and secure exclusivity with major OEMs. This emphasis on IP reflects the high engineering barrier to entry and the specialized nature of wind power bearing manufacturing, ensuring that innovation remains the key differentiator between market leaders and smaller niche players. The consolidation trend is likely to continue as companies seek to acquire complementary technologies and secure larger manufacturing footprints to serve the rapidly expanding global wind energy market efficiently and reliably.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager