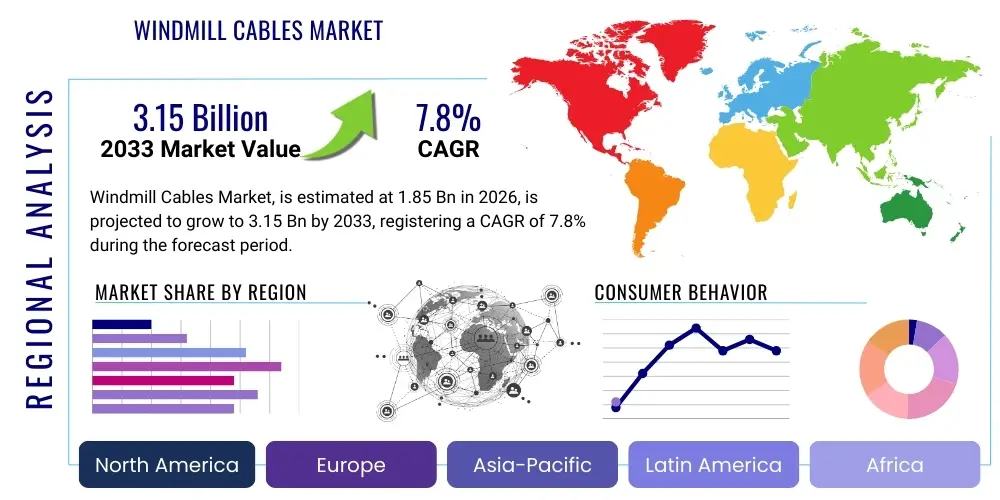

Windmill Cables Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443132 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Windmill Cables Market Size

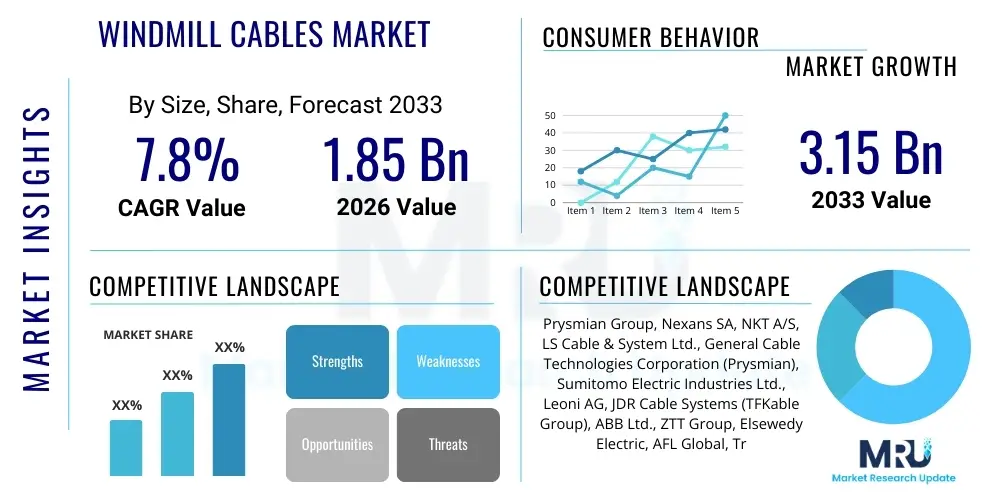

The Windmill Cables Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 3.15 Billion by the end of the forecast period in 2033. This substantial growth trajectory is primarily driven by global commitments to decarbonization, increasing investments in offshore wind energy infrastructure, and continuous technological advancements in cable design optimizing efficiency and durability under harsh operational conditions.

Windmill Cables Market introduction

The Windmill Cables Market encompasses specialized electrical and data transmission cables designed specifically for the rigorous environment and operational demands of wind turbines and associated infrastructure. These cables, which include medium and high-voltage transmission lines, umbilical cables for offshore applications, and robust internal wiring within the nacelle and tower, are critical components ensuring efficient power evacuation and control system integrity. Product requirements are stringent, demanding resistance to high mechanical stress, vibration, temperature extremes, UV exposure, and moisture ingress, particularly in marine and harsh terrestrial settings. The major applications span utility-scale onshore wind farms, complex floating and fixed-bottom offshore installations, and localized distributed energy projects.

The core benefits derived from high-performance windmill cables include minimized power loss during transmission, enhanced operational safety, and reduced downtime due to component failure. Modern cables often incorporate advanced materials, such as specialized polymers and high-strand conductors, which extend service life and improve reliability, directly impacting the levelized cost of energy (LCOE) generated by wind power assets. They are essential links connecting generators to substations and enabling crucial communication between various turbine sensors and control units for pitch and yaw adjustments.

Driving factors sustaining market growth include unprecedented regulatory support for renewable energy globally, ambitious national targets for wind capacity expansion (especially in European and Asian markets), and the falling cost of wind energy technology, making it increasingly competitive with traditional fossil fuels. Furthermore, the trend toward larger, higher-capacity turbines (8 MW and above) necessitates corresponding upgrades in cable specifications, driving demand for higher-voltage, more resilient cable solutions capable of handling increased power throughput efficiently.

Windmill Cables Market Executive Summary

The global Windmill Cables Market exhibits robust expansion characterized by significant business model shifts towards vertically integrated solutions and a strong focus on high-voltage direct current (HVDC) cable systems for long-distance offshore power transmission. Key business trends involve strategic collaborations between cable manufacturers, utility companies, and major turbine OEMs to co-develop custom cable solutions optimized for specific project needs, particularly in deep-water wind development zones. Manufacturers are investing heavily in automation and digitalization across their production facilities to enhance quality control, manage complex material requirements, and shorten lead times in a rapidly expanding industry.

Regionally, Asia Pacific, led by China and India, dominates the market in terms of new installed capacity and demand volume for onshore cables, while Europe remains the pioneer and primary driver for high-specification offshore cable technology, particularly HVDC export cables. North America is experiencing accelerated growth due to federal and state incentives promoting large-scale offshore wind projects, such as those planned along the US East Coast. These regional dynamics reflect a duality in demand: volume-driven low-to-medium voltage cables in emerging markets and value-driven, high-specification submarine cables in established, high-investment regions.

Segment-wise, the Offshore application category is projected to witness the fastest growth rate, fueled by the development of massive wind farms located far from shore, necessitating complex inter-array and export cable systems. Material segmentation shows a growing preference for specialty polymer insulations, such as cross-linked polyethylene (XLPE) and ethylene propylene rubber (EPR), over traditional materials, due to their superior thermal and dielectric properties, essential for handling fluctuating loads and high temperatures within the confined spaces of turbine towers and nacelles. The trend towards higher voltage ratings (e.g., 66 kV inter-array cables replacing 33 kV) is fundamentally reshaping the product mix supplied by industry leaders.

AI Impact Analysis on Windmill Cables Market

User queries regarding AI's influence in the Windmill Cables sector primarily revolve around how machine learning can improve predictive maintenance, enhance cable integrity monitoring, and optimize installation logistics. Users are concerned about reducing unscheduled maintenance costs, particularly for costly offshore cable repairs, and seek clarity on how sensor data, combined with AI algorithms, can reliably predict insulation degradation or potential failure points before they manifest. There is also significant interest in using AI for optimizing cable routing during the design phase of large wind farms, minimizing material usage and maximizing transmission efficiency, thereby reducing initial capital expenditure and maximizing long-term operational performance.

AI’s critical role lies in transitioning the industry from reactive maintenance to proactive, condition-based monitoring, which is particularly vital for subsea infrastructure where inspection and repair are extremely expensive and time-consuming. By integrating data feeds from Distributed Temperature Sensing (DTS), Partial Discharge (PD) monitoring systems, and acoustic sensors embedded within or near the cable infrastructure, AI models can identify subtle anomalies and correlate them with environmental data (e.g., seabed movement, tidal currents, and temperature fluctuations) to generate precise risk assessments. This advanced diagnostic capability extends the effective lifespan of the installed cable base and dramatically improves asset utilization.

Furthermore, AI-driven solutions are enhancing manufacturing processes by optimizing cable compounding and extrusion parameters, ensuring higher material consistency and lower defect rates, particularly for specialized high-voltage materials. In logistics, AI models are used to simulate optimal winding patterns, manage complex spooling operations, and determine precise vessel movements during offshore cable laying, minimizing strain and ensuring adherence to stringent installation tolerances. This holistic application of AI across the lifecycle—from material formulation and manufacturing quality control to operational monitoring and predictive asset management—is central to future resilience in the windmill power transmission network.

- AI-driven Predictive Maintenance: Utilizing real-time sensor data (DTS, PD monitoring) to anticipate cable failures and scheduling maintenance proactively.

- Optimized Cable Routing: Machine learning algorithms determining the most efficient and least stress-prone cable layout for both onshore and offshore projects.

- Manufacturing Quality Control: AI vision systems and data analytics monitoring extrusion processes to ensure material consistency and reduce defects in high-voltage insulation.

- Enhanced Asset Management: AI correlation of performance data with environmental factors (e.g., water temperature, vibrations) to calculate Remaining Useful Life (RUL) of installed cables.

- Digital Twin Simulation: Creating virtual replicas of wind farm cable networks for stress testing and scenario planning prior to deployment.

DRO & Impact Forces Of Windmill Cables Market

The market is predominantly driven by aggressive renewable energy targets and technological advancements in wind turbine size and capacity. Key restraints include the high initial capital expenditure associated with specialized submarine cables, the volatility of raw material prices (copper and polymers), and significant supply chain challenges related to securing specialized cable-laying vessels and skilled installation labor. Opportunities emerge from the rapid expansion of floating offshore wind technology, the need for robust grid interconnections, and the development of next-generation superconductor cables to reduce transmission losses. These forces collectively shape the market's growth trajectory and influence strategic investment decisions among major industry players.

The primary driver is the accelerating global transition towards renewable energy sources, codified by government policies such as the European Green Deal and commitments from nations like the US and China to achieve carbon neutrality. This regulatory push guarantees a sustained pipeline of large-scale wind projects, ensuring continuous demand for complex cable systems. However, a significant constraint is the increasing complexity of offshore installations, which requires extremely long, high-voltage submarine cables that are expensive to manufacture, transport, and install. Failure rates, though low, result in massive financial losses due to specialized repair logistics, making cable resilience a paramount, often cost-prohibitive, requirement.

Opportunities are substantial, particularly in developing 66 kV and 132 kV inter-array cable systems to efficiently connect the new generation of large, powerful turbines, replacing the conventional 33 kV standard. Furthermore, the development of robust cable infrastructure capable of operating reliably in extreme deep-water environments is a niche opportunity driven by the emerging floating offshore wind sector. The impact forces indicate strong external pressure from energy policy and technological innovation (high positive impact), balanced by internal market forces relating to cost management and supply chain capacity limitations (moderate negative impact), resulting in an overall positive market momentum tempered by execution risk.

Segmentation Analysis

The Windmill Cables Market is segmented based on critical technical and application parameters, providing a detailed understanding of demand patterns across different end-use environments and operational requirements. Key segmentation categories include the Application Type (Onshore vs. Offshore), Voltage Rating (Low, Medium, High Voltage), Product Type (Inter-Array, Export, Internal), and Material Type (Copper vs. Aluminum conductors, XLPE vs. EPR insulation). Understanding these segments is vital for manufacturers to tailor product specifications, ranging from standard armored cables used in land-based farms to highly specialized dynamic cables essential for floating offshore installations. The rapid technological shift towards higher voltage systems (e.g., 66 kV inter-array cables) and increased reliance on high-performance polymeric insulation materials define current market dynamics.

The distinction between Onshore and Offshore applications is fundamental, as it dictates material resilience, sheathing requirements (e.g., extensive armoring for subsea cables), and installation methods. Offshore cables, encompassing both inter-array lines connecting turbines within the farm and export cables transmitting power back to the mainland grid, represent the highest value segment due to their complexity, length, and the demanding marine environment. Conversely, the high volume of onshore installations, especially in emerging economies, drives substantial demand for medium-voltage buried or trench-laid cables, focusing more on cost efficiency and ease of installation.

Voltage rating segmentation tracks the evolution of turbine technology; as turbine capacity increases, the required voltage levels for efficient power evacuation rise to minimize transmission losses. The move from 33 kV to 66 kV for inter-array links and the increased adoption of HVDC for export links exceeding 100 km highlight the technological progression. Material selection, particularly insulation and sheathing, is critical for achieving the required durability and performance standards. XLPE remains the standard for power cables due to its excellent dielectric strength, while specialized elastomer-based materials (like EPR) are often preferred for dynamic cables in floating applications due to their superior flexibility and resistance to continuous movement stress.

- By Voltage Rating:

- Low Voltage (Below 1 kV)

- Medium Voltage (1 kV to 35 kV)

- High Voltage (36 kV to 220 kV)

- Extra High Voltage (Above 220 kV, typically HVDC for export)

- By Application:

- Onshore Wind Farms

- Offshore Wind Farms (Fixed-Bottom)

- Offshore Wind Farms (Floating)

- By Product Type:

- Internal Tower Cables (Uplift, Down-loop)

- Nacelle and Pitch System Cables

- Inter-Array Cables (IAC)

- Export Cables (Submarine/Underground)

- By Conductor Material:

- Copper

- Aluminum

- By Insulation Material:

- Cross-Linked Polyethylene (XLPE)

- Ethylene Propylene Rubber (EPR)

- Other Polymers (e.g., PVC, LSZH)

Value Chain Analysis For Windmill Cables Market

The value chain for the Windmill Cables Market is complex, stretching from upstream raw material procurement through specialized manufacturing processes, complex logistics, and highly technical downstream installation and maintenance services. Upstream analysis involves sourcing critical materials like high-purity copper and aluminum conductors, and specialized polymer compounds (XLPE, EPR, HFFR) for insulation and jacketing, which are susceptible to commodity price fluctuations. Key players in this stage are large mining and chemical processing firms. Manufacturers must maintain strong supplier relationships to ensure material consistency and manage supply chain resilience, especially for high-specification polymers used in offshore cables.

The midstream process is dominated by specialized cable manufacturing firms. These companies employ advanced extrusion, stranding, and armoring technologies, often requiring bespoke manufacturing facilities, particularly for extremely long, continuous lengths of high-voltage subsea cables. Quality control and adherence to international standards (e.g., IEC, IEEE) are paramount. Logistics for these large, heavy, and often fragile products are highly specialized, involving dedicated shipping vessels and storage facilities capable of handling massive cable spools and managing precise delivery schedules to remote installation sites, which significantly impacts overall project timelines and costs.

Downstream analysis focuses on installation and end-use. Direct distribution typically involves large, long-term contracts signed directly between cable manufacturers and major wind farm developers (e.g., Ørsted, Iberdrola) or EPC contractors. Indirect channels are less common but may involve specialized distributors for low-to-medium voltage internal turbine cables and repair parts. Installation involves highly skilled marine contractors for subsea cable laying (trenching and protection) or civil engineering firms for onshore burial. Maintenance and repair form the final critical step, often involving specialized subsea ROVs and highly technical splicing operations, emphasizing the enduring nature of the relationship between the cable supplier and the asset owner throughout the turbine's operational life.

Windmill Cables Market Potential Customers

The primary customers and end-users of windmill cables are entities responsible for the design, construction, ownership, and operation of wind energy generation facilities globally. This includes major utility companies, independent power producers (IPPs), dedicated wind farm developers, and large Engineering, Procurement, and Construction (EPC) contractors specializing in renewable energy infrastructure. These entities require a range of cable solutions, from robust low-voltage control cables inside the nacelle to high-capacity medium-voltage inter-array cables and critical high-voltage export cables that connect the farm to the transmission grid.

Utility companies and IPPs, such as major European and North American energy firms, represent the largest buyers, driving demand for massive quantities of high-specification cables, especially in the growing offshore sector where cable reliability is paramount. Their buying decisions are heavily influenced by factors like total cost of ownership, proven cable performance history, and manufacturer capacity to deliver continuous, long lengths of submarine cable with guaranteed quality. They seek long-term partners capable of providing integrated solutions, including monitoring and maintenance support.

Furthermore, specialized construction and marine logistics firms often act as intermediaries, procuring cables based on project specifications defined by the asset owners. Government bodies and public-private partnerships supporting state-funded grid modernization or research projects also constitute a niche customer segment, particularly when testing new cable technologies such as high-temperature superconductors (HTS) or advanced dynamic cables for deep-water floating platforms. Ultimately, the demand is fueled by the need for efficient, durable, and reliable infrastructure capable of evacuating large amounts of renewable power with minimal environmental impact.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 3.15 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Prysmian Group, Nexans SA, NKT A/S, LS Cable & System Ltd., General Cable Technologies Corporation (Prysmian), Sumitomo Electric Industries Ltd., Leoni AG, JDR Cable Systems (TFKable Group), ABB Ltd., ZTT Group, Elsewedy Electric, AFL Global, Trelleborg AB, KEI Industries Limited, Tele-Fonika Kable S.A. (TFKable), Orient Cable (ORIC), Hellenic Cables S.A., Deka Cables (E&E Group), Belden Inc., Southwire Company LLC. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Windmill Cables Market Key Technology Landscape

The Windmill Cables market is defined by several converging technological advancements aimed at enhancing power efficiency, durability, and operational flexibility, particularly within the challenging offshore environment. A major technological shift involves the transition to higher voltage ratings, specifically the widespread adoption of 66 kV Alternating Current (AC) inter-array cables, which significantly reduce transmission losses within large offshore wind farms compared to the legacy 33 kV systems. This requires manufacturers to refine extrusion and splicing techniques for high-performance XLPE insulation, ensuring void-free and highly reliable connections under high thermal and electrical stress. Furthermore, the development of specialized materials, such as robust anti-kinking sheathing and integrated fiber optic elements for real-time monitoring, is crucial for improving system intelligence and longevity.

The emergence of floating offshore wind power necessitates the rapid development and deployment of dynamic cables. Unlike static cables used for fixed-bottom installations, dynamic cables must withstand continuous, high-cycle mechanical stresses due to platform movement (heave, pitch, roll) in deep water. Key technological innovations here include the use of advanced elastomer insulations like EPR, combined with sophisticated stress mitigation systems such and buoyancy modules and tether tension controls, ensuring structural integrity over a 25-year lifespan. Research into High-Temperature Superconductor (HTS) cables represents a significant, long-term technological pursuit, promising near-zero transmission losses and potentially revolutionizing long-distance power evacuation, although commercial viability remains challenging.

Digitalization is rapidly becoming an integral technology component, extending the value proposition beyond the physical cable itself. Integrated Distributed Temperature Sensing (DTS) and acoustic monitoring systems are embedded into cable designs to provide continuous operational data. This technology, combined with advanced data analytics and AI platforms, allows for precise thermal mapping and fault localization, dramatically reducing diagnostic time and improving asset utilization. Standardization efforts across the industry, particularly for connector interfaces and installation procedures, also play a vital technological role in minimizing project risk and ensuring interchangeability across diverse wind power projects.

Regional Highlights

The global Windmill Cables market exhibits distinct regional dynamics driven by varying levels of wind energy maturity, regulatory support, and geographic resource availability. Europe is a technological leader, particularly in offshore and HVDC cable systems, benefiting from early and sustained government commitment to offshore wind energy in the North Sea and Baltic Sea. Countries such as the UK, Germany, and the Netherlands represent mature markets demanding high-specification export and inter-array cables, fostering innovation in installation techniques and material science. The region's focus is currently on expanding transmission capacity and developing resilient grid connections for large-scale multi-gigawatt wind parks.

Asia Pacific (APAC) stands as the dominant region in terms of sheer volume and future capacity growth, largely propelled by ambitious targets in China, India, and emerging markets like Vietnam and South Korea. China leads global manufacturing and deployment, driving massive demand for both onshore and rapidly expanding offshore projects. This region is characterized by competitive pricing and rapid adoption of new technologies, although onshore demand for medium-voltage cables still accounts for a significant market share. The need for long-distance subsea export cables to connect remote coastal wind farms in APAC is a critical growth driver.

North America is experiencing accelerated market expansion, primarily fueled by supportive federal policies, such as tax credits and state-level renewable portfolio standards, particularly in the US. The initial focus is on developing large offshore wind lease areas along the Atlantic Coast, requiring massive investment in specialized high-voltage submarine cables and associated infrastructure. The region presents a high-value opportunity due to the necessity for robust, specialized cables compliant with stringent local standards and capable of handling significant power loads over medium-to-long distances. Latin America and the Middle East and Africa (MEA) represent emerging high-potential markets, driven by favorable wind resources and increasing government emphasis on energy diversification, primarily focusing on large-scale onshore projects requiring reliable medium-voltage cable systems.

- Europe: Hub for offshore wind technology; high demand for complex HVDC and 66 kV AC submarine cables; focus on grid interconnection and long-distance power evacuation.

- Asia Pacific (APAC): Highest volume market; dominated by China and India; rapid growth in both onshore and offshore capacity; focus on manufacturing scale and competitive cost structures.

- North America: Accelerating offshore market development (US East Coast); driven by state mandates and federal incentives; high-specification requirements for new infrastructure.

- Latin America (LATAM): Strong potential in onshore projects (e.g., Brazil, Chile); increasing demand for medium-voltage cables tailored to variable climatic conditions.

- Middle East & Africa (MEA): Emerging market for renewable diversification; focus on solar-wind hybrid projects and foundational onshore cable infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Windmill Cables Market.- Prysmian Group

- Nexans SA

- NKT A/S

- LS Cable & System Ltd.

- General Cable Technologies Corporation (Prysmian)

- Sumitomo Electric Industries Ltd.

- Leoni AG

- JDR Cable Systems (TFKable Group)

- ABB Ltd.

- ZTT Group

- Elsewedy Electric

- AFL Global

- Trelleborg AB

- KEI Industries Limited

- Tele-Fonika Kable S.A. (TFKable)

- Orient Cable (ORIC)

- Hellenic Cables S.A.

- Deka Cables (E&E Group)

- Belden Inc.

- Southwire Company LLC

Frequently Asked Questions

Analyze common user questions about the Windmill Cables market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between onshore and offshore windmill cables?

Offshore cables, particularly submarine export and inter-array types, require far greater mechanical protection, specialized armoring against abrasion and marine environments, and often incorporate integrated fiber optics for communication. Onshore cables are typically buried and focus on optimized cost and ease of installation for medium-voltage transmission.

Which voltage rating is emerging as the new standard for inter-array cables in offshore wind farms?

The industry is transitioning from 33 kV Alternating Current (AC) inter-array cables to 66 kV AC systems. This shift accommodates the increasing power output of modern, larger wind turbines, significantly enhancing power evacuation efficiency and reducing overall transmission losses within the wind farm boundary.

What are dynamic cables and why are they important for market growth?

Dynamic cables are specialized, highly flexible cables designed to connect floating offshore wind platforms to the seabed infrastructure. They are crucial for market growth as they enable the development of deep-water floating wind technology, a massive untapped resource previously inaccessible with fixed-bottom turbine designs.

What raw material price fluctuations pose the biggest threat to cable manufacturers?

Fluctuations in the price of high-purity copper and aluminum, used as conductors, and petroleum-derived polymers, utilized for high-performance insulation materials like XLPE and EPR, represent the most significant cost volatility challenges for windmill cable manufacturers.

How is AI being utilized to enhance the performance and longevity of windmill cables?

AI is primarily used for Predictive Maintenance (PdM) by analyzing sensor data (e.g., Distributed Temperature Sensing, Partial Discharge monitoring) to detect early signs of degradation or stress, thus enabling proactive intervention and extending the functional lifespan of the cable assets, minimizing costly unscheduled downtime.

The Windmill Cables Market continues to expand globally, driven by fundamental shifts in energy policy favoring large-scale renewable integration. The technological frontier is being pushed by offshore demands, necessitating robust materials science and complex system integration, particularly in high-voltage alternating current and direct current submarine cable systems. Manufacturers are strategically positioning themselves through vertical integration, capacity expansion, and strategic partnerships to meet the accelerating demand, ensuring the foundational reliability of the global wind energy infrastructure. This market environment promises sustained investment and innovation throughout the forecast period, positioning cable manufacturers as critical enablers of the energy transition.

Continued investment in R&D focusing on material durability and advanced monitoring systems, coupled with efforts to streamline complex offshore installation logistics, will be key differentiators among market participants. As wind turbines continue to increase in capacity and wind farms move further offshore into deeper waters, the necessity for high-performance, resilient, and intelligent cable solutions will only intensify, solidifying the market's trajectory toward higher value and technological sophistication. The regulatory environment remains a pivotal supportive pillar, guaranteeing long-term visibility for major infrastructure projects.

The convergence of digitalization trends, particularly the integration of Internet of Things (IoT) sensors and Artificial Intelligence (AI) for asset management, is fundamentally transforming the lifecycle support offered by cable providers. This shift from simply supplying a product to providing an integrated, monitored solution ensures higher asset reliability and operational efficiency for wind farm operators. Therefore, companies investing heavily in smart cable technology and advanced manufacturing techniques are best positioned to capture the dominant market share in the rapidly evolving global wind energy landscape, particularly across the technologically demanding European and North American offshore markets.

The geopolitical landscape also influences the market, particularly regarding trade agreements and local content requirements in key regions like Europe and North America, which can impact the supply chain structure and manufacturing footprints of major international players. Furthermore, the specialized nature of cable-laying vessels and limited port infrastructure capable of handling massive cable drums present enduring bottlenecks that market leaders must address through logistical innovation and strategic alliances with specialized marine contractors. Successfully navigating these logistical and technological hurdles is central to realizing the projected market growth through 2033 and beyond.

In summary, the Windmill Cables Market is characterized by high barriers to entry due to stringent quality standards and capital-intensive manufacturing processes, yet offers significant rewards due to the guaranteed long-term demand generated by global climate goals. The focus is shifting from simply meeting demand volume to delivering high-performance, customized solutions that minimize lifetime operational risks and maximize energy transmission efficiency across diverse and challenging environments. This necessitates continuous material innovation and close collaboration between cable suppliers, turbine manufacturers, and project developers to ensure optimal system performance. The market outlook remains exceptionally strong, predicated on the sustained, unprecedented expansion of both fixed-bottom and floating offshore wind capacity worldwide.

The ongoing refinement of cable testing procedures and certification standards, often driven by international bodies and insurance underwriters, further shapes product development. Manufacturers are compelled to exceed baseline requirements to offer greater assurances of cable integrity, especially given the catastrophic cost of failures in subsea environments. Future success in this specialized domain will depend heavily on technological leadership in HVDC systems, advanced material compounding for insulation, and the capability to execute complex, high-precision offshore installation projects efficiently and safely.

Specific attention is being paid to fire safety and environmental impact, driving the adoption of halogen-free, flame-retardant (HFFR) materials for internal turbine wiring and focusing on sustainable sourcing practices for copper and polymer inputs. Regulatory pushes in Europe demanding higher environmental stewardship are propagating globally, influencing material choices and manufacturing energy consumption standards. Consequently, green manufacturing processes and circular economy principles are becoming competitive advantages for established cable manufacturers aiming to serve the leading wind energy developers.

The interplay between global commodity markets and currency fluctuations adds another layer of complexity to market profitability, requiring sophisticated risk management strategies from key players. Given the long lead times for major projects, locking in raw material costs and negotiating flexible contracts are essential business practices. Ultimately, the stability of the Windmill Cables Market is intrinsically linked to political and financial backing for renewable energy infrastructure, which, despite occasional short-term volatility, is secured by strong, long-term global commitments.

The market’s competitive landscape is defined by a few dominant global players possessing the necessary manufacturing scale and specialized vessel access required for offshore projects, contrasting with a broader base of regional players supplying the more standardized onshore segment. Consolidation and strategic acquisitions remain a viable strategy for companies seeking to gain expertise in niche areas, such as dynamic cables or specific high-voltage technology patents. This structured competition ensures continuous innovation and quality enhancement across all product segments, further reinforcing the market's underlying strength.

Technological advancement is not limited to power cables; the integration of reliable and high-speed data transmission capabilities via fiber optic elements within the power cable sheathing is crucial. These integrated solutions allow wind farm operators to manage complex turbine operations, including pitch control and fault diagnostics, in real time, maximizing energy capture and minimizing wear. The market for these specialized integrated cables is growing faster than that for power-only cable solutions, reflecting the increasing digitalization of wind farm asset management and control systems globally.

Looking ahead, emerging markets in Latin America and MEA, while currently small contributors, offer exponential growth potential as they begin to modernize their grids and tap into vast, untapped wind resources. These regions will provide substantial opportunities for manufacturers of robust, medium-voltage onshore cables designed for challenging terrain and intermittent grid connectivity, diversifying the global demand structure beyond the current concentration in European and APAC offshore markets.

The successful deployment of future large-scale offshore wind hubs, particularly those relying on multi-terminal HVDC grids, will depend entirely on the capacity and technological readiness of the cable industry. This high-stakes environment demands flawless execution in manufacturing and installation, reinforcing the dominance of established players with proven track records in high-reliability transmission systems. The continuous drive toward higher capacity and longer distances places the Windmill Cables Market at the very heart of the global clean energy transition, guaranteeing its vital role in the infrastructure sector.

The sustained efforts to reduce the Levelized Cost of Energy (LCOE) from wind power assets indirectly drives demand for better cables. Every incremental improvement in cable efficiency—whether through reduced transmission losses, extended lifespan, or lower maintenance requirements—translates directly into a more competitive energy price. Therefore, product innovation in terms of lighter, stronger, and more thermally efficient cable designs is highly valued by wind farm developers seeking long-term operational cost optimization.

In conclusion, the market is navigating complex technological demands, significant logistical constraints, and volatile raw material pricing, yet it is buoyed by unwavering political and economic support for clean energy expansion. The dual focus on high-specification offshore solutions and cost-optimized onshore infrastructure defines the market's current segmentation, positioning it for resilient and substantial growth throughout the forecast horizon toward 2033. The continuous innovation in materials and monitoring technology will be critical enablers for sustaining this growth trajectory.

Addressing the constraints related to specialized installation vessels and skilled labor for cable laying, particularly in offshore environments, requires significant coordinated industry investment. Solutions like advanced trenching technology, automated splicing techniques, and standardized cable handling procedures are critical for reducing installation costs and timelines, which are major components of overall project expenditure. Manufacturers are increasingly offering turnkey solutions that bundle cable supply with installation and monitoring services to mitigate these execution risks for wind farm developers.

Furthermore, the long-term integrity of cable insulation materials under dynamic and thermal loading conditions is a central research focus. Developing advanced polymers with enhanced thermal resilience and superior dielectric properties, capable of handling higher continuous operating temperatures, will be essential for maximizing the energy throughput without compromising safety or lifespan. This continuous material science innovation ensures the cable infrastructure keeps pace with the exponential growth in turbine capacity and electrical demand.

Finally, the growing environmental scrutiny extends to the decommissioning and recycling of wind farm components, including cables. Future cable designs are increasingly considering end-of-life circularity, focusing on materials that are easier to separate and recycle. While still an emerging trend, the requirement for sustainable product lifecycles will become a major regulatory and market factor, influencing procurement decisions in mature European markets and progressively spreading globally, further driving material innovation beyond pure performance metrics.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager