Wire and Cable Black Masterbatch Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442191 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Wire and Cable Black Masterbatch Market Size

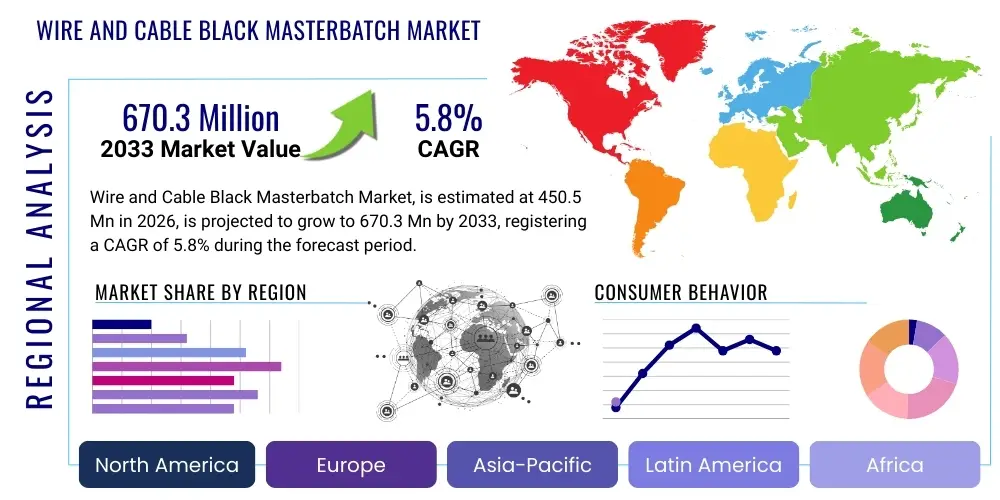

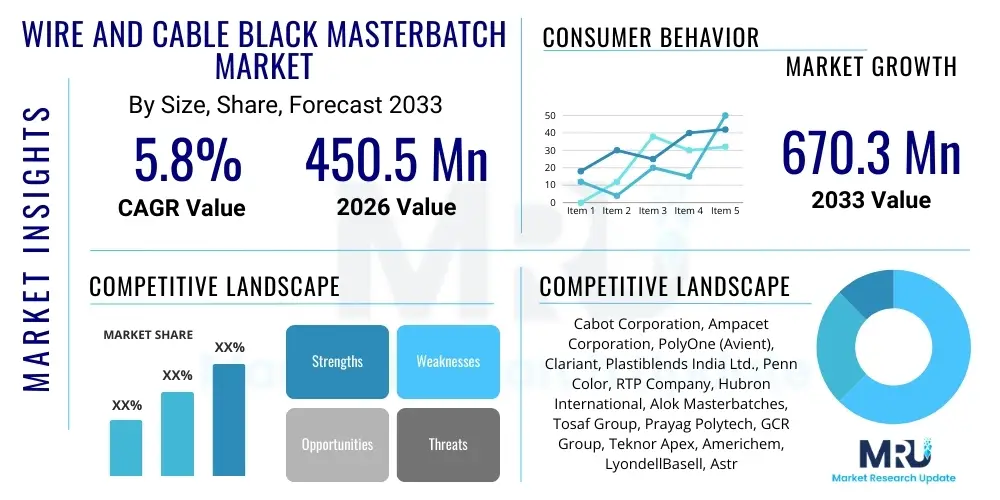

The Wire and Cable Black Masterbatch Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 670.3 Million by the end of the forecast period in 2033.

Wire and Cable Black Masterbatch Market introduction

The Wire and Cable Black Masterbatch Market encompasses the specialized segment of masterbatches—highly concentrated mixtures of pigments and/or additives encapsulated during a heat process into a carrier resin—specifically designed for the insulation, sheathing, and jacketing of electrical wires and cables. These masterbatches primarily utilize high-grade carbon black as the core pigment, conferring essential attributes such as excellent UV resistance, thermal stability, opacity, and electrical conductivity or semi-conductivity, depending on the application requirement. The robust demand for power transmission infrastructure upgrades, expansion of high-speed data networks, and stringent safety standards in automotive and construction sectors globally are fundamental drivers underpinning market growth. Black masterbatches are crucial not only for coloration but, more importantly, for protecting polymer compounds, extending the service life of external cables exposed to harsh environmental conditions, and ensuring compliance with industry performance specifications.

The product, often delivered in pellet form, simplifies the processing phase for wire and cable manufacturers, ensuring consistent dispersion, minimizing dust, and achieving precise additive loading compared to using raw carbon black powder. Key applications span across high-voltage power cables, telecommunication fiber optic cables, specialized automotive wiring, and building wiring systems. Benefits derived from utilizing these masterbatches include superior weather resistance, critical for external deployment; improved mechanical properties, which aids in handling and installation; and crucial stabilization against thermal degradation during extrusion and operational service life. These performance enhancements directly translate into reduced maintenance costs and enhanced system reliability across diverse industries. Furthermore, the market is characterized by increasing innovation aimed at developing halogen-free flame-retardant (HFFR) black masterbatches, aligning with growing regulatory pressure for safer cabling materials in enclosed public spaces.

Driving factors for sustained market expansion include accelerated urbanization in emerging economies, necessitating massive infrastructure investment in smart grids and residential electrification projects. The global transition toward renewable energy sources, such as large-scale solar farms and offshore wind installations, requires vast quantities of high-performance, durable, UV-resistant power cables, boosting demand for specialty black masterbatches. Lastly, the proliferation of data centers and the 5G network rollout globally mandate sophisticated, high-quality communication cables, ensuring sustained high-performance requirements for polymer compounds that black masterbatches effectively address.

Wire and Cable Black Masterbatch Market Executive Summary

The Wire and Cable Black Masterbatch Market is experiencing significant momentum driven by robust infrastructural spending and regulatory mandates emphasizing cable longevity and safety. Business trends highlight a pronounced shift towards high-performance specialty formulations, specifically those offering enhanced conductivity or superior UV stabilization for demanding outdoor applications like photovoltaic (PV) and power transmission lines. Manufacturers are increasingly focusing on customization, offering masterbatches optimized for specific polymer carriers (e.g., polyethylene, polypropylene, PVC, and cross-linked polyethylene (XLPE)) to meet precise regulatory standards and processing requirements of cable extruders. The competitive landscape is marked by strategic mergers and acquisitions aimed at expanding geographical reach and integrating specialized additive technologies, enabling key players to offer comprehensive material solutions rather than standalone colorants. Sustainability is emerging as a critical trend, pushing R&D towards developing black masterbatches incorporating recycled resins or those designed for use in recyclable cable sheathing, although performance standards remain paramount.

Regionally, the Asia Pacific (APAC) dominates the market, primarily fueled by massive government investments in smart city projects, rural electrification, and the build-out of extensive 5G telecommunication networks in countries like China, India, and Southeast Asian nations. North America and Europe demonstrate mature market characteristics, focusing intensely on retrofitting existing power grids, upgrading aging infrastructure, and complying with stringent environmental and safety regulations, such as REACH and RoHS directives, which favor halogen-free and low-smoke zero-halogen (LSZH) formulations. Latin America and the Middle East & Africa (MEA) present high-growth opportunities, spurred by rapid construction activity, oil and gas infrastructure expansion, and nascent renewable energy projects, creating consistent demand for durable, weather-resistant wire and cable products.

Segment trends reveal that the Power Cables application segment maintains the largest market share due to continuous global energy infrastructure expansion and high-voltage direct current (HVDC) line development. However, the Automotive Wires segment is anticipated to witness the highest growth rate, propelled by the accelerated global production and adoption of Electric Vehicles (EVs), which require complex, high-reliability wiring harnesses utilizing specialized conductive black masterbatches for battery cable insulation and shielding. In terms of carrier resin, Polyethylene (PE) masterbatches remain dominant owing to their excellent insulation properties and widespread use in outdoor and high-voltage cable applications, though Ethylene-Vinyl Acetate (EVA) masterbatches are gaining traction in applications requiring greater flexibility and improved flame retardancy characteristics for specific end-uses.

AI Impact Analysis on Wire and Cable Black Masterbatch Market

User queries regarding AI's impact on the Wire and Cable Black Masterbatch Market generally revolve around how Artificial Intelligence (AI) and Machine Learning (ML) can optimize complex manufacturing processes, enhance material quality control, and predict performance characteristics under various stress conditions. Key themes include the potential for AI-driven formulation development, aiming to reduce the trial-and-error cycle inherent in creating highly specialized masterbatch compounds; optimizing carbon black dispersion to ensure consistent electrical and UV performance; and implementing predictive maintenance in extrusion lines, minimizing material waste and downtime. Users are particularly concerned about AI's role in verifying compliance with increasingly complex global material specifications (e.g., fire safety, toxicology profiles) and automating supply chain logistics to stabilize raw material costs, particularly for carbon black and specialized polymer carriers. The overarching expectation is that AI will introduce unprecedented levels of precision and efficiency, lowering production costs while elevating the consistency and reliability of the final cable product.

- AI-Enhanced Material Design: Utilizing generative algorithms to model optimal carbon black loading and dispersion profiles, minimizing material wastage during formulation.

- Predictive Quality Control: Implementing ML algorithms on extrusion lines to monitor melt flow index, dispersion homogeneity, and color consistency in real-time, drastically reducing off-spec batches.

- Supply Chain Optimization: AI-driven forecasting models used to predict fluctuations in volatile carbon black pricing and optimize procurement strategies, stabilizing input costs for masterbatch producers.

- Performance Simulation: Applying digital twin technology and AI modeling to predict the long-term UV resistance and electrical longevity of masterbatch-infused cable jackets before physical testing.

- Automated Compliance Verification: Deploying natural language processing (NLP) and ML tools to rapidly cross-reference masterbatch material composition against evolving global standards (e.g., RoHS, REACH, UL ratings).

- Process Optimization: Using reinforcement learning to fine-tune extruder temperature profiles and screw speeds for maximum throughput and energy efficiency during masterbatch compounding.

- Data-Driven Maintenance: Utilizing sensor data and ML to implement predictive maintenance schedules for compounding equipment, enhancing operational uptime and equipment lifespan.

DRO & Impact Forces Of Wire and Cable Black Masterbatch Market

The Wire and Cable Black Masterbatch Market is driven by extensive infrastructural demands, particularly the mandatory requirements for high-performance materials in outdoor and critical applications. However, it faces significant restraints related to raw material cost volatility and stringent regulatory hurdles concerning material safety. Opportunities are primarily centered around the global green energy transition and the burgeoning EV market, demanding specialized conductive materials. These forces collectively shape the market's trajectory, compelling manufacturers to balance innovation for performance and cost management while strictly adhering to increasingly complex environmental and safety standards imposed globally.

Key drivers include the global expansion and modernization of power transmission grids, especially in developing economies, necessitating high volumes of UV-stabilized cable insulation and sheathing. The rapid rollout of 5G infrastructure, requiring millions of kilometers of specialized data and power cables, further boosts demand. Additionally, the automotive industry's electrification trend (EVs) creates a robust market for conductive masterbatches essential for high-voltage battery cables, requiring exceptional thermal stability and shielding performance. The imperative for cable longevity and reliability, reducing the frequency of replacement in inaccessible or critical infrastructure, significantly favors high-quality black masterbatches over cheaper, less effective alternatives.

Restraints primarily stem from the fluctuating prices of raw materials, particularly carbon black, which is highly dependent on crude oil derivatives. This price volatility complicates long-term procurement and pricing strategies for masterbatch manufacturers. Furthermore, the stringent regulatory environment—including the shift towards Low Smoke Zero Halogen (LSZH) and Halogen-Free Flame Retardant (HFFR) materials in many regions—can slow down the adoption of standard polyethylene-based black masterbatches, requiring significant R&D investment for new compliant formulations. The market also faces the technical challenge of ensuring perfect dispersion of carbon black at high concentrations to maintain consistent electrical properties without compromising mechanical integrity, a crucial hurdle for specialized applications.

Opportunities lie in capitalizing on the massive shift toward renewable energy infrastructure, including photovoltaic (PV) solar parks and wind farms, which require highly durable, extreme-weather-resistant cable protection. The integration of smart grid technologies globally demands advanced sensor and control cables, driving the need for niche, high-specification masterbatches. Furthermore, developing nations' push for smart city development and rural electrification projects provides substantial untapped market potential. The ongoing innovation cycle focused on conductive and semi-conductive masterbatches for voltage shielding in medium- and high-voltage cables represents a high-value opportunity, moving beyond simple coloration and UV protection into complex engineering functionality.

Segmentation Analysis

The Wire and Cable Black Masterbatch Market is systematically segmented based on the carrier polymer type, the primary application area of the final wire or cable product, and the end-use industry utilizing the infrastructure. This segmentation is crucial as performance requirements vary dramatically across categories; for instance, telecommunication cables require different properties than high-voltage power transmission cables, necessitating distinct masterbatch formulations. The dominant segments are characterized by the underlying global infrastructure trends: PE masterbatches are favored for external robustness, while PVC remains prevalent in basic construction wiring. Application analysis highlights power infrastructure as the largest consumer, but automotive wiring is the fastest evolving sector due to EV technology.

Analyzing the market through the lens of material type reveals the technical demands placed on masterbatch manufacturers. Polyethylene (PE) carrier-based black masterbatches hold a substantial share, primarily due to their compatibility with popular cable jacket materials (HDPE, LDPE, LLDPE) used in communication, distribution, and high-voltage underground cables, offering excellent moisture and chemical resistance alongside crucial UV protection. However, the requirement for superior flame retardancy and flexibility in confined spaces boosts demand for PVC and EVA carriers, particularly in residential and marine applications. This intricate interplay between regulatory requirements and material science dictates the specific black masterbatch type required for compliance and optimal performance in diverse operating environments, making precise segmentation critical for strategic targeting.

Further granularity in segmentation provides insights into the commercial viability of various market niches. For example, within the application segments, specialized areas like mining cables or subsea cables command higher pricing and require masterbatches with extreme resistance to abrasion, pressure, and specific chemical degradation agents, differentiating them significantly from standard building wire masterbatches. Geographically, segmentation helps identify areas of concentrated infrastructure investment; for instance, the intense focus on renewable energy in Europe and North America drives demand for high-end XLPE-compatible masterbatches, whereas large-scale power distribution projects in APAC fuel the volume demand for standard PE-based formulations, highlighting distinct growth patterns based on regional maturity and infrastructural priorities.

- By Carrier Polymer Type:

- Polyethylene (PE) Black Masterbatch (HDPE, LDPE, LLDPE)

- Polyvinyl Chloride (PVC) Black Masterbatch

- Ethylene-Vinyl Acetate (EVA) Black Masterbatch

- Cross-Linked Polyethylene (XLPE) Black Masterbatch

- Others (e.g., Rubber, Nylon)

- By Application:

- Power Cables (Low, Medium, High Voltage)

- Communication Cables (Fiber Optic, Copper)

- Automotive Wires & Harnesses

- Construction Wires (Building and Residential)

- Industrial Wires (Machinery, Robotics)

- Specialty Wires (Marine, Mining, Aerospace)

- By End-Use Industry:

- Energy & Power Generation

- Telecommunications & Data Centers

- Automotive & Transportation

- Construction & Infrastructure

- Industrial Manufacturing

Value Chain Analysis For Wire and Cable Black Masterbatch Market

The value chain for the Wire and Cable Black Masterbatch Market begins with the upstream procurement of essential raw materials, primarily carbon black and various polymer carrier resins such as PE, PVC, and EVA. Carbon black suppliers are central, as the quality and grade of carbon black (e.g., furnace black, channel black) directly determine the masterbatch's final properties, including UV resistance and conductivity. The masterbatch manufacturer constitutes the core processing stage, converting these raw inputs through intensive mixing, dispersion, and extrusion processes into highly concentrated pellets. Efficiency and technological capability at this stage, particularly in achieving uniform carbon black dispersion, are critical differentiators, as poor dispersion can lead to reduced mechanical integrity and inconsistent electrical performance in the final cable product.

The midstream involves the distribution and direct sales of the finished black masterbatches. Distribution channels are typically a combination of specialized chemical distributors who service multiple smaller cable manufacturers and direct sales teams targeting large, integrated wire and cable producers who require highly customized formulations and bulk quantities. Due to the technical nature and high-performance demands of cable applications, direct collaboration between the masterbatch producer and the cable manufacturer is common, allowing for rapid co-development and testing of specific compounds tailored to meet rigorous industry standards (e.g., IEC, UL, ASTM). This direct engagement ensures the masterbatch performs optimally within the cable manufacturer’s unique extrusion process parameters, forming a vital feedback loop for quality control and technical service.

Downstream, the finished masterbatches are used by cable manufacturers to coat or sheath the conductor material (copper or aluminum). The final consumers (end-users) are large infrastructure developers, utilities, telecommunication companies, construction firms, and automotive OEMs. The market is primarily driven by indirect consumption through large-scale infrastructure projects. Utility companies, for example, specify the required cable characteristics (including UV resistance and lifespan) to their procurement partners, indirectly dictating the demand for high-quality black masterbatches. Direct sales often characterize the specialized segments like automotive, where OEMs have stringent material specifications. The efficiency of the distribution channel is crucial for maintaining supply continuity, especially in high-volume construction and energy projects where project timelines are critical, emphasizing the importance of robust logistics and inventory management across the value chain.

Wire and Cable Black Masterbatch Market Potential Customers

The potential customers for Wire and Cable Black Masterbatch are predominantly industrial processors specializing in electrical and electronic products, specifically those focused on conductor insulation and sheathing. The primary immediate buyers are Wire and Cable Manufacturers, ranging from large, multinational conglomerates that produce everything from power transmission lines to specialized micro-cables, down to smaller, regional companies focused exclusively on residential wiring or automotive harnesses. These manufacturers use the masterbatch as a key additive in their compounding process to achieve the required color, UV protection, thermal stability, and, critically, the necessary electrical conductivity or semi-conductivity profile for high-voltage applications, making them the direct end-user of the product.

Beyond the direct cable producers, secondary, highly influential customers include major utilities and telecommunication infrastructure developers. Although they do not purchase the masterbatch directly, their material specifications and procurement standards for finished cables dictate the quality and type of masterbatches demanded from the manufacturers. For example, a national grid operator specifying a 40-year lifespan for new underground power cables indirectly creates demand for premium, highly stabilized black masterbatches. Furthermore, Original Equipment Manufacturers (OEMs) in sectors like Automotive (for EV battery cabling) and specialized Industrial Machinery (for robotic and heavy-duty wiring) represent high-value customer segments requiring customized, high-reliability black masterbatches tailored to proprietary polymer systems and extreme operating conditions.

The fastest-growing segment of potential customers currently includes companies involved in renewable energy project development, such as solar photovoltaic (PV) installers and wind farm operators. The massive scale of these projects, combined with the extreme environmental exposure of the cables (intense UV radiation, temperature fluctuations), mandates the use of highly specialized black masterbatches that ensure long-term integrity and energy output stability. Lastly, construction and infrastructure companies represent a foundational, volume-driven customer base, continuously consuming standard PVC and PE black masterbatches for commercial, residential, and institutional building wiring applications globally, maintaining steady, although less specialized, demand.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 670.3 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cabot Corporation, Ampacet Corporation, PolyOne (Avient), Clariant, Plastiblends India Ltd., Penn Color, RTP Company, Hubron International, Alok Masterbatches, Tosaf Group, Prayag Polytech, GCR Group, Teknor Apex, Americhem, LyondellBasell, Astra Polymers, Polyplast Muller, Hebei Dingsheng Color Masterbatch. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wire and Cable Black Masterbatch Market Key Technology Landscape

The technological landscape in the Wire and Cable Black Masterbatch Market is defined by the necessity for highly specialized compounding equipment capable of achieving exceptional carbon black dispersion, which is fundamental to the performance of the final cable. The dominant technologies employed center around high-shear mixing systems, primarily twin-screw extruders. Modern twin-screw extrusion technology allows for precise temperature control and tailored screw element configurations, enabling optimal dispersion of high-structure carbon black without thermal degradation of the carrier polymer. This meticulous control is particularly vital when producing semi-conductive masterbatches for medium and high- voltage cables, where consistent resistivity across the polymer matrix is paramount for preventing electrical treeing and ensuring long-term insulation integrity.

A crucial technological area involves additive engineering, focusing on incorporating high-performance stabilizers and anti-oxidants alongside the carbon black. Manufacturers employ sophisticated chemical grafting and surface modification techniques to enhance the compatibility between the carbon black particles and the specific carrier resin (e.g., cross-linked polyethylene - XLPE), which improves UV resistance and thermal aging characteristics. Furthermore, the push for eco-friendly solutions has spurred innovation in halogen-free fire retardant (HFFR) technology, where specialized black masterbatches must be developed that are compatible with inorganic fire retardant systems (like aluminum trihydrate or magnesium hydroxide) while maintaining coloration and UV stability, requiring complex proprietary coupling agents and processing aids.

Digitalization and process control represent another key technology trend. Advanced monitoring systems, often incorporating spectrophotometers and rheometers inline, are used during compounding to measure melt viscosity, color consistency, and carbon black particle size distribution in real-time. This level of automation significantly reduces process variability and ensures compliance with tight material specifications mandated by utility and telecom sectors. Finally, nanoscale dispersion technology is emerging, aiming to utilize ultra-fine carbon black or potentially carbon nanotubes in small percentages to achieve enhanced electrical conductivity for static dissipation or specialized shielding, pushing the boundaries of traditional masterbatch compounding methods for niche, high-value applications.

Regional Highlights

The geographical distribution of the Wire and Cable Black Masterbatch Market reflects underlying disparities in infrastructural maturity and ongoing investment cycles across the globe. Asia Pacific (APAC) currently holds the dominant market share and exhibits the highest growth trajectory, largely driven by the monumental scale of urbanization, aggressive power generation capacity expansion (including nuclear and coal in some regions, alongside vast solar projects), and the comprehensive rollout of 5G telecom infrastructure across China, India, and ASEAN countries. These regions require immense volumes of both high-voltage power cables and communication cables, fueling volume demand for both standard and high-performance masterbatches. Government initiatives supporting smart grid implementation and rural electrification further solidify APAC's leading position, with a continuous focus on locally sourced, cost-effective solutions.

Europe and North America represent highly mature markets characterized by replacement and upgrade cycles rather than greenfield expansion, focusing intensely on regulatory compliance and high-specification materials. In Europe, the stringent implementation of the Construction Products Regulation (CPR) and the preference for Low Smoke Zero Halogen (LSZH) materials significantly impact demand, favoring specialized, complex black masterbatch formulations that ensure minimal smoke toxicity and optimized flame retardancy. North America is driven primarily by the modernization of aging electrical grids, the massive integration of distributed renewable energy (solar, wind), and the rapid expansion of data center infrastructure, leading to strong demand for UV-stabilized and fire-resistant masterbatches tailored for overhead and underground residential distribution (URD) applications. Manufacturers in these regions prioritize technical service, traceability, and material certifications.

Latin America (LATAM) and the Middle East & Africa (MEA) are emerging as significant growth markets, though often characterized by greater volatility. LATAM's growth is tied to internal infrastructure development, particularly in Brazil and Mexico, focusing on improving national power grids and residential construction. MEA, particularly the GCC countries, sees substantial demand linked to megaprojects, oil and gas infrastructure expansion, and large-scale solar power initiatives (e.g., Saudi Arabia, UAE). These regions require masterbatches capable of withstanding extreme heat and intense UV radiation, making the stabilization performance of the product a critical purchasing criterion. Infrastructure financing and geopolitical stability are key factors influencing the pace of market penetration and growth in these emerging areas, requiring masterbatch suppliers to offer robust, climate-adapted solutions.

- Asia Pacific (APAC): Dominant market, driven by rapid urbanization, massive 5G deployment, and government-led electrification projects, especially in China, India, and Southeast Asia.

- North America: Focus on grid modernization, renewable energy integration (solar/wind), and strict compliance with URD cable specifications and fire safety codes.

- Europe: High-value, specialized market dictated by rigorous safety regulations (CPR, REACH), driving demand for LSZH and high-performance, long-lifetime masterbatches.

- Latin America (LATAM): Growth fueled by regional infrastructure projects, especially in power transmission and residential construction, emphasizing cost-effectiveness and durability.

- Middle East & Africa (MEA): High demand linked to oil and gas operations, utility-scale solar projects, and construction megaprojects requiring materials with extreme thermal and UV resistance.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wire and Cable Black Masterbatch Market.- Cabot Corporation

- Ampacet Corporation

- PolyOne (Avient)

- Clariant

- Plastiblends India Ltd.

- Penn Color

- RTP Company

- Hubron International

- Alok Masterbatches

- Tosaf Group

- Prayag Polytech

- GCR Group

- Teknor Apex

- Americhem

- LyondellBasell

- Astra Polymers

- Polyplast Muller

- Hebei Dingsheng Color Masterbatch

- Shenzhen Ciba Masterbatch Co., Ltd.

- Gabriel-Chemie Group

Frequently Asked Questions

Analyze common user questions about the Wire and Cable Black Masterbatch market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of black masterbatch in wire and cable manufacturing?

The primary function is to provide essential UV stabilization and weather resistance, significantly extending the service life of cables exposed outdoors (like power and telecom lines). It also provides opacity, pigmentation, and in specialized grades, essential electrical conductivity or semi-conductivity for shielding layers in high-voltage cables.

How does the choice of carrier resin (PE, PVC, EVA) impact masterbatch performance?

The carrier resin must be compatible with the final polymer compound used for the cable jacket or insulation. PE carriers are standard for external, high-performance cables requiring UV stability and moisture resistance, while PVC and EVA are preferred for flexibility, flame retardancy (especially in HFFR formulations), and indoor construction applications.

What is driving the demand for specialized conductive black masterbatches?

Demand is driven by the need for high-voltage power transmission cables (HVDC and HVAC) and Electric Vehicle (EV) battery cables. Conductive masterbatches create semi-conducting layers that equalize electrical stress across the insulation, preventing partial discharge and ensuring cable reliability at higher voltages, which is critical for grid modernization.

Which geographical region exhibits the fastest growth in the Wire and Cable Black Masterbatch Market?

Asia Pacific (APAC) is currently the fastest-growing region, fueled by massive infrastructure investment, urbanization trends, rapid 5G network build-out, and extensive government programs focused on power generation and transmission expansion across major economies like China and India.

What is the main challenge facing black masterbatch manufacturers in the current market?

The main challenge is managing the volatility of raw material prices, particularly crude oil-derived carbon black, while simultaneously meeting increasingly stringent global regulatory standards (like LSZH and environmental certifications) which often require complex, higher-cost specialized formulations and extensive testing.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager