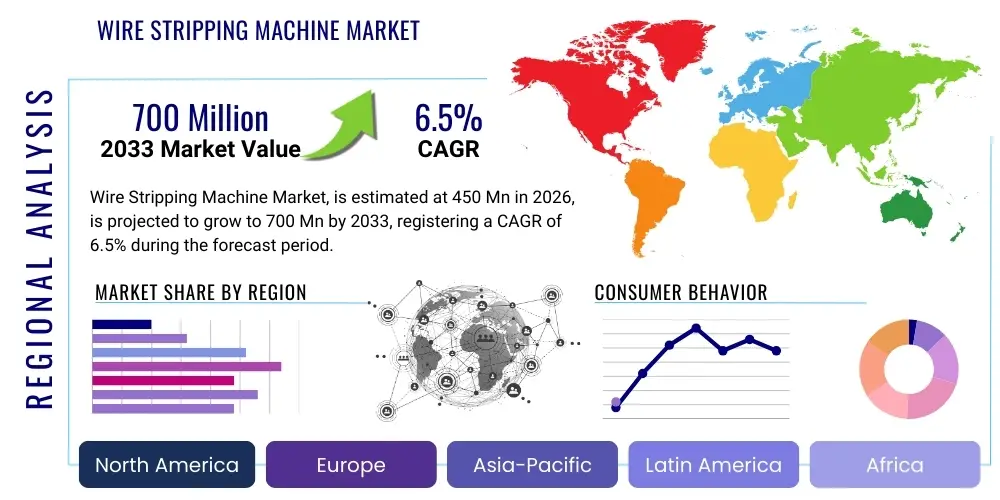

Wire Stripping Machine Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442663 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Wire Stripping Machine Market Size

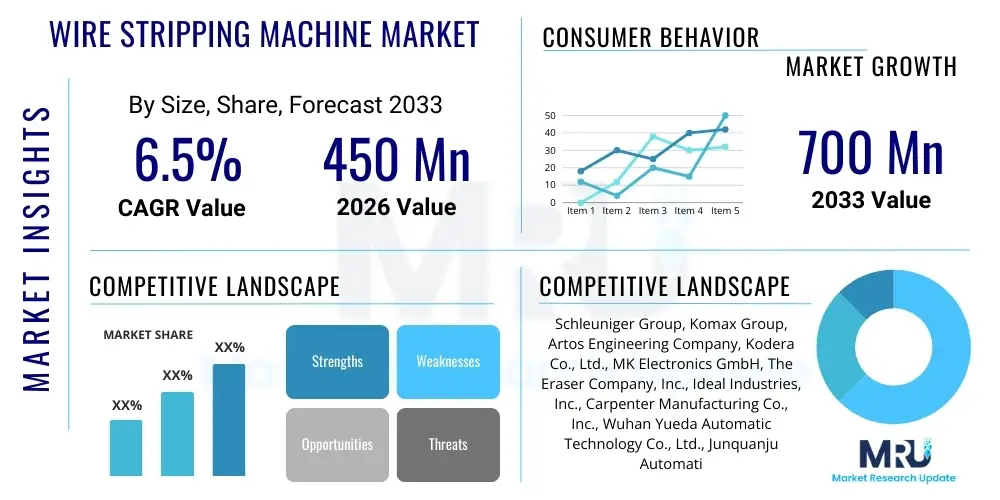

The Wire Stripping Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $450 Million in 2026 and is projected to reach $700 Million by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the escalating demand for high-precision wire processing solutions across critical manufacturing sectors globally, including the rapidly expanding electric vehicle (EV) industry, sophisticated consumer electronics manufacturing, and large-scale renewable energy infrastructure projects.

Wire Stripping Machine Market introduction

The Wire Stripping Machine Market encompasses highly specialized equipment designed to remove the insulating jacket or sheath from the electrical wire or cable, enabling the conductor beneath to be exposed for connection purposes, such as crimping or soldering. These machines range from simple manual tools used for low-volume applications to complex, fully automatic, computerized systems capable of processing thousands of wires per hour with sub-millimeter precision. The core functionality centers on ensuring clean, damage-free removal of insulation regardless of the material type—be it PVC, Teflon, Fiberglass, or specialized high-temperature polymers—which is crucial for maintaining electrical integrity and safety standards in the final assembly.

Major applications of wire stripping technology span nearly every sector utilizing electrical components, notably the automotive industry for vehicle harness manufacturing, telecommunications for network cabling and device interconnects, aerospace for lightweight and high-reliability systems, and general appliance manufacturing. The escalating complexity of modern wiring harnesses, particularly in electric and hybrid vehicles requiring precise handling of high-voltage cables and intricate data transmission lines, is significantly bolstering demand for highly advanced automatic stripping machines. These systems offer unparalleled repeatability and reduced material waste compared to manual or semi-automatic methods, justifying the higher capital investment for high-volume producers.

The primary benefits delivered by modern wire stripping equipment include vastly improved production efficiency, enhanced processing speed, superior accuracy in strip length and quality, and drastically improved operator safety through automation. Key driving factors for market expansion include the global shift towards sophisticated automation across manufacturing plants (Industry 4.0 adoption), the massive surge in consumer electronics production requiring miniaturized component wiring, and substantial government investments in smart grids and electric vehicle infrastructure, all of which necessitate efficient and precise cable preparation at massive scales. Furthermore, stringent regulatory requirements concerning electrical connection reliability and safety mandate the use of precision machinery for wire processing, eliminating defects common in manual handling.

Wire Stripping Machine Market Executive Summary

The global Wire Stripping Machine Market is characterized by a strong shift toward digitalization and integration, positioning fully automatic and robotic stripping systems as the dominant business trend. Manufacturers are increasingly prioritizing machines that can handle multiple wire types and gauges concurrently, featuring quick-change tooling capabilities and integrated quality assurance systems, often involving vision inspection, to minimize downtime and maximize throughput in flexible manufacturing environments. Strategic partnerships focused on software development for machine monitoring and predictive maintenance are becoming common, allowing suppliers to offer comprehensive, end-to-end cable processing solutions rather than just standalone hardware. The primary competitive differentiator lies in processing speed for ultra-fine wires and the ability to handle tough, modern insulation materials like cross-linked polyethylene (XLPE) and specialized fluorine polymers used in high-performance applications.

Regionally, Asia Pacific (APAC) maintains its position as the largest and fastest-growing market, largely fueled by its established status as the global manufacturing hub for electronics, automotive components, and telecommunications equipment, particularly in China, Japan, and South Korea. However, North America and Europe are exhibiting strong growth in the high-end segment, driven by the reshoring of specialized manufacturing operations and intensive investment in electric vehicle production facilities, which demand high-specification, fully automated wire processing lines for complex battery management systems and power distribution units. Latin America and the Middle East & Africa (MEA) are emerging regions, where initial market adoption is centered around semi-automatic and robust manual machinery supporting infrastructure projects and localized appliance assembly, gradually transitioning toward automation as industrialization deepens.

Segment trends highlight the undeniable dominance of automatic wire stripping machines, which are projected to capture the highest market share due to their essential role in high-volume, precision-dependent industries such as automotive harness manufacturing and complex medical device assembly. Within applications, the automotive sector remains the largest consumer, driven by the exponentially increasing wire content in modern vehicles (especially EV architecture), while the electronics and telecommunications segments show the highest growth rate, necessitated by the miniaturization of components and the rollout of 5G networks requiring vast amounts of new cabling infrastructure. End-user demand is heavily skewed towards Original Equipment Manufacturers (OEMs) who require integrated, customized solutions that fit seamlessly into their assembly lines, though the aftermarket segment remains vital for supplying specialized spare parts and maintenance services globally.

AI Impact Analysis on Wire Stripping Machine Market

Common user questions regarding AI's impact on wire stripping machines often revolve around capabilities such such as real-time defect detection, self-calibration mechanisms, and optimization of machine parameters based on fluctuating material input quality (e.g., variations in cable diameter or insulation stiffness). Users are keenly interested in whether AI can facilitate predictive maintenance to reduce costly unplanned downtime, optimize production scheduling across diverse product mixes, and improve yield rates by automatically adjusting stripping parameters (blade pressure, speed, grip force) on the fly without human intervention. There is also significant interest in using machine learning algorithms to process large datasets of historical operational parameters to define optimal recipes for new or unusual wire types, thereby drastically reducing setup and testing time. The key thematic concerns center on the investment cost required to upgrade existing machinery versus purchasing new AI-integrated systems, and the need for specialized training for maintenance and operational staff to effectively manage these sophisticated technologies. The overarching expectation is that AI will transform wire stripping from a purely mechanical process into an adaptive, data-driven manufacturing cell.

The implementation of Artificial Intelligence and Machine Learning (ML) algorithms is poised to revolutionize the precision and operational efficiency of wire stripping machines. AI-driven vision systems are achieving unprecedented accuracy in inspecting strip quality, identifying minute insulation tears, conductor damage, or incorrect strip lengths instantly, far surpassing the capabilities of human operators or traditional sensor systems. This enhances overall quality control and compliance with strict industry standards, such as those mandated in aerospace or medical device manufacturing. Furthermore, ML models are utilized to analyze vibration, temperature, and current consumption data from machine components (like blades, bushings, and servo motors) to accurately predict potential failures, triggering maintenance alerts precisely when needed, thereby shifting operations from reactive to proactive servicing and maximizing uptime.

Beyond quality assurance and maintenance, AI is also fundamentally changing the operational aspects of modern stripping equipment. Sophisticated algorithms are used for dynamic process optimization, where the machine learns the optimal settings required for a specific batch of wire and automatically fine-tunes parameters like cutting depth and pull-off speed throughout the production run to compensate for environmental variables (e.g., temperature changes affecting insulation elasticity) or minor inconsistencies in raw material batches. This level of autonomous adjustment leads to higher first-pass yield, minimizing scrap rates, which is especially critical when handling expensive, specialized wires. The integration of these AI capabilities transforms the stripping machine into a smart asset that communicates seamlessly with wider Manufacturing Execution Systems (MES), contributing significantly to the goals of fully automated, lights-out factories.

- AI-driven predictive maintenance reducing unplanned machine downtime by analyzing operational data patterns.

- Integration of advanced AI vision systems for real-time, high-speed inspection of strip quality and conductor integrity.

- Machine Learning algorithms optimizing dynamic stripping parameters (blade pressure, feed speed) based on real-time material feedback.

- Automated recipe generation for complex or newly introduced wire types, significantly cutting down setup and calibration time.

- Enhanced energy efficiency achieved through AI optimization of motor cycling and idle phases.

DRO & Impact Forces Of Wire Stripping Machine Market

The market dynamics are governed by a complex interplay of rapid technological adoption (Drivers), stringent cost pressures and technical hurdles (Restraints), and expansive new application areas (Opportunities). The primary driving forces include the global proliferation of electronic devices, requiring intricate, miniature wiring harnesses, and the monumental capital investments being made in the electric vehicle (EV) sector, where specialized high-voltage cable processing necessitates automated, highly reliable stripping solutions. Technological advancements in machine design, particularly in laser stripping techniques offering non-contact processing, are further accelerating market growth by enabling the handling of extremely delicate and thin-walled insulation materials without mechanical stress. These factors collectively push manufacturers toward high-efficiency, fully automatic equipment, thereby elevating the average selling price and overall market valuation.

However, the market faces significant restraints. The initial high capital investment required for purchasing advanced, fully automatic wire stripping machines, particularly those integrating vision systems and robotics, acts as a barrier to entry for smaller-scale manufacturers and those in developing economies. Furthermore, the specialized training and skilled labor required to operate, program, and maintain these sophisticated computer numerical control (CNC) systems present an ongoing operational cost challenge. A perpetual technical challenge remains the handling of extremely high-temperature and chemically resistant insulation materials, which require highly specialized and expensive tooling that must be frequently replaced. Additionally, the cyclical nature of end-user industries, such as consumer electronics and automotive, can introduce volatility into machine procurement cycles.

Opportunities for market growth are abundant, primarily stemming from the increasing global focus on renewable energy infrastructure—solar and wind farms—which require vast quantities of robust, weather-resistant cabling and subsequent precision stripping for interconnection. The global expansion of 5G and fiber-optic networks necessitates continuous investment in specialized equipment capable of stripping fine, delicate optical fibers and associated power cables. Moreover, the growing emphasis on miniaturization in medical devices and wearable technology opens up a niche market for micro-precision stripping solutions. Companies focusing on developing flexible machinery that can rapidly switch between processing electrical wires and fiber optic cables, alongside offering subscription models for machine maintenance and software updates, are strategically positioned to capitalize on these diverse opportunities and mitigate the impact of market restraints.

Segmentation Analysis

The Wire Stripping Machine Market is segmented comprehensively based on the degree of automation (Type), the industrial context of their use (Application), and the primary purchasing entity (End-User). This multi-dimensional segmentation provides a nuanced understanding of market dynamics, revealing that the transition from manual and semi-automatic systems to fully automatic solutions is the most defining trend. The automatic segment is further differentiated by high-speed, multi-core, and precision handling capabilities, reflecting the current industry requirement for integrated cable processing centers rather than simple standalone stripping units. Analyzing these segments is crucial for manufacturers developing targeted product strategies and for investors seeking to identify high-growth niches within specialized applications.

Segmentation by application clearly illustrates the market's dependence on capital-intensive sectors, with automotive manufacturing driving the highest volume demand due to complex wiring harnesses required for safety, infotainment, and powertrain systems. However, the electronics segment demands the highest precision for handling extremely small gauge wires used in micro-components. Geographic segmentation confirms regional specialization, where established markets focus on acquiring advanced automation technologies, while emerging markets show greater demand for robust, cost-effective semi-automatic models. Understanding this segmentation structure is paramount for accurately forecasting regional demand patterns and technological adoption rates across varied industrial landscapes globally.

- By Type:

- Automatic Wire Stripping Machines

- Semi-Automatic Wire Stripping Machines

- Manual Wire Stripping Tools/Machines

- Laser Wire Stripping Systems

- By Application:

- Automotive & Transportation

- Electronics & Consumer Appliances

- Telecommunications & Data Networks

- Aerospace & Defense

- Construction & Infrastructure

- Medical Devices

- By End-User:

- Original Equipment Manufacturers (OEMs)

- Cable Assembly Houses (Contract Manufacturers)

- Aftermarket/Maintenance, Repair, and Operations (MRO)

Value Chain Analysis For Wire Stripping Machine Market

The value chain for the Wire Stripping Machine Market commences with upstream analysis, involving the sourcing and processing of core raw materials such as high-grade tool steel and carbide for precision cutting blades, sophisticated electronic components (sensors, servo motors, control units), and structural materials (aluminum and specialized alloys) for machine bodies. Suppliers in this phase are critical for maintaining the high standards of durability and precision required, especially for tooling components which dictate the machine's lifespan and processing quality. Any volatility in global metal prices or supply chain disruptions concerning specialized electronic controllers (PLCs/CNC units) can significantly impact the final manufacturing cost and lead times of the equipment. Furthermore, specialized software developers for machine control interfaces and connectivity platforms constitute a vital part of the upstream intellectual property segment.

Moving downstream, the value chain involves the crucial stages of manufacturing, assembly, software integration, rigorous testing, and quality certification before the product enters the distribution phase. The distribution channel is multifaceted, comprising both direct sales—especially for large, customized, or fully integrated automatic systems sold directly to major OEMs in the automotive and aerospace sectors—and indirect sales through a network of specialized industrial distributors, agents, and local representatives. These intermediaries play a vital role in providing local installation support, training, and essential post-sales services, particularly for semi-automatic and mid-range machines where regional presence and quick service response are critical competitive factors. The efficiency of this distribution network is directly tied to the ability of manufacturers to penetrate diverse geographic markets rapidly.

The final stage involves reaching the potential customers (End-Users), which completes the value chain loop. Direct channels afford manufacturers greater control over branding, pricing, and gathering direct feedback on customization requirements, essential for maintaining a technological edge. Conversely, indirect channels allow for broader market penetration and lower sales overheads in geographically fragmented regions. The robustness of the aftermarket support, including the supply of replacement blades, maintenance kits, and software updates provided through both direct service centers and authorized distributors, is essential for ensuring long-term customer satisfaction and generating recurring revenue streams, thereby cementing the overall value proposition delivered to the end-users.

Wire Stripping Machine Market Potential Customers

The primary consumers of wire stripping machines are diverse industrial entities that require precise and high-throughput preparation of electrical cables for final assembly. Foremost among these are Original Equipment Manufacturers (OEMs) within the automotive sector, including Tier 1 and Tier 2 suppliers who specialize in fabricating intricate wire harnesses for vehicle platforms ranging from combustion engines to complex electric powertrains. These buyers demand machines with exceptionally high speeds, modular design, and integrated quality control features to meet strict safety and quality standards (e.g., ISO/TS 16949). Similarly, OEMs in the aerospace and defense industries are key customers, specifically seeking laser stripping systems that guarantee non-contact removal of insulation from sensitive, often costly, lightweight wires where mechanical damage is unacceptable.

Another major segment comprises Cable Assembly Houses (CAHs) or Electronic Manufacturing Services (EMS) providers, which act as contract manufacturers serving multiple industries including consumer electronics, telecommunications, and industrial automation. These customers require flexibility, needing machines capable of rapid changeovers between various wire gauges and insulation types to accommodate short runs of diverse products. The rapid expansion of server farms and data centers also positions telecommunications infrastructure builders as significant buyers, seeking robust machines for stripping heavy-gauge network power cables and highly precise equipment for handling fiber optic components. Finally, the Aftermarket and MRO (Maintenance, Repair, and Overhaul) segments purchase primarily smaller, durable semi-automatic or manual machines for on-site repairs, facility maintenance, and low-volume customization work.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $450 Million |

| Market Forecast in 2033 | $700 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Schleuniger Group, Komax Group, Artos Engineering Company, Kodera Co., Ltd., MK Electronics GmbH, The Eraser Company, Inc., Ideal Industries, Inc., Carpenter Manufacturing Co., Inc., Wuhan Yueda Automatic Technology Co., Ltd., Junquanju Automation Equipment Co., Ltd., V-TEK International, Metzner Maschinenbau GmbH, Kingsing Machinery Co., Ltd., Hozan Tool Industrial Co., Ltd., JBC Technologies, TE Connectivity (Selected products). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wire Stripping Machine Market Key Technology Landscape

The technological landscape of the Wire Stripping Machine Market is dominated by advancements aimed at increasing precision, speed, and versatility, driven primarily by the demands of complex, modern wiring applications. The most significant advancement is the integration of servo-driven axis control systems, replacing older pneumatic and hydraulic mechanisms. Servo systems allow for precise, repeatable control over cutting depth and pull-off force, minimizing the risk of nicking or damaging the delicate conductor strands, which is paramount for safety-critical components. Coupled with high-resolution sensors and integrated measuring systems, these machines can automatically detect and compensate for minor variations in wire diameter or insulation thickness, ensuring zero-defect output even at extremely high production rates. Furthermore, modular tooling systems featuring quick-change interfaces are becoming standard, drastically cutting down the time required for product changeovers and enhancing operational flexibility in job shops handling varied batches.

A burgeoning technological segment is the deployment of Laser Wire Stripping (LWS) systems, which offer a non-contact, thermal-based stripping methodology. LWS technology utilizes focused laser energy to ablate the insulation material without ever touching the underlying conductor. This is particularly crucial for ultra-fine gauge wires, specialized high-temperature insulations (e.g., PTFE/Teflon), or coaxial cables where maintaining concentricity and preventing deformation is vital. While the capital cost for LWS is higher, the superior quality and ability to process materials that are challenging for traditional mechanical blades are driving adoption in highly regulated sectors like medical device manufacturing, aerospace, and high-frequency data transmission applications. Continuous research is focused on developing faster, more energy-efficient laser sources (e.g., CO2 and UV lasers) and optimizing beam delivery systems to ensure rapid, clean ablation across a wider array of insulation compounds.

In alignment with the Industry 4.0 paradigm, connectivity and data integration represent another major technological thrust. Modern wire stripping machines are equipped with integrated software platforms (often proprietary HMI systems) that allow seamless communication with factory MES (Manufacturing Execution Systems) and ERP (Enterprise Resource Planning) systems. This enables centralized remote monitoring, real-time diagnostics, and detailed data logging regarding production volume, cycle times, and quality metrics. Enhanced features include automated material tracking using RFID or barcode scanners, ensuring the correct wire recipe is selected for the material being loaded. This level of digitalization not only facilitates better resource management and traceability but also supports the implementation of Artificial Intelligence models for continuous process improvement and predictive maintenance strategies, solidifying the machine’s role as an interconnected component within the smart factory ecosystem.

Regional Highlights

- Asia Pacific (APAC): APAC is the global powerhouse for the Wire Stripping Machine Market, dominating both in terms of market size and growth rate. This leadership position is directly attributable to the region's expansive manufacturing base for consumer electronics (e.g., smartphones, laptops, smart home devices), automotive components (particularly in China, Japan, and South Korea), and massive investments in telecommunications infrastructure and renewable energy projects. China, in particular, drives high-volume demand for both entry-level semi-automatic machines and high-end, high-speed automated systems catering to the export market. The rapid development of indigenous Electric Vehicle (EV) supply chains across the region necessitates the procurement of advanced, specialized cable processing machinery capable of handling high-voltage battery cables and intricate sensor wiring with extremely high precision and reliability. Local manufacturing competitiveness fuels constant investment in cutting-edge automation technologies to maintain high throughput and low operational costs.

- North America: The North American market is characterized by a high demand for premium, precision-focused, and highly automated wire stripping equipment, largely driven by the aerospace & defense sectors and the rapidly scaling domestic EV manufacturing initiatives. These industries prioritize quality compliance, traceability, and robust machine reliability over initial cost, favoring highly integrated systems that meet stringent international standards (e.g., AS9100). The recent trend toward manufacturing reshoring and the strong emphasis on automated factory floor operations (Smart Manufacturing initiatives) are accelerating the replacement cycle of older machinery with modern, networked, and AI-enabled stripping solutions. US and Canadian manufacturers specializing in medical devices also constitute a key niche, requiring laser stripping technology for handling ultra-fine and biomaterial-compatible wires.

- Europe: The European market demonstrates mature demand, with a strong focus on sustainability, energy efficiency, and high engineering standards, primarily led by Germany, Switzerland, and Italy. The automotive sector, undergoing a fundamental transformation toward electric mobility, is the largest consumer, seeking customized, flexible production lines capable of switching between low-volume, high-complexity harness variants and high-volume standard cabling. European manufacturers exhibit a preference for machines built with longevity, modularity, and easy integration into existing PLC-controlled production lines. Strict regulatory frameworks regarding workplace safety and environmental impact also propel the demand for fully enclosed, low-noise, and highly efficient automatic systems. The region is a key innovation hub for laser stripping and software-driven process control technologies.

- Latin America (LATAM): The LATAM market, while smaller, presents significant growth potential, centered primarily around Brazil and Mexico, which serve as regional hubs for appliance manufacturing and automotive assembly (Mexico). Market procurement is often cost-sensitive, resulting in a dual demand structure: high-end automatic machines for international OEM operations, and robust, cost-effective semi-automatic models for local assembly and repair shops supporting infrastructure development. Infrastructure projects related to power distribution and telecommunications network expansion are steady drivers of machine acquisition, focusing on durability and ease of maintenance in varied operational environments.

- Middle East & Africa (MEA): The MEA market is an emerging region, closely tied to investments in large-scale infrastructure projects, oil & gas industry cabling, and utility expansions. Demand for wire stripping equipment is largely driven by construction and power distribution sectors, requiring reliable, heavy-duty machines for processing large-gauge cables. Adoption rates for fully automatic systems are growing, particularly in technologically advanced hubs like the UAE and Saudi Arabia, coinciding with diversification initiatives aimed at building local manufacturing capabilities in electronics and specialized automotive assembly. Market growth is heavily dependent on sustained governmental capital expenditure on smart city and energy transition projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wire Stripping Machine Market.- Schleuniger Group

- Komax Group

- Artos Engineering Company

- Kodera Co., Ltd.

- MK Electronics GmbH

- The Eraser Company, Inc.

- Ideal Industries, Inc.

- Carpenter Manufacturing Co., Inc.

- Wuhan Yueda Automatic Technology Co., Ltd.

- Junquanju Automation Equipment Co., Ltd.

- V-TEK International

- Metzner Maschinenbau GmbH

- Kingsing Machinery Co., Ltd.

- Hozan Tool Industrial Co., Ltd.

- JBC Technologies

- TE Connectivity (Selected products)

- Tewatt Machinery Co., Ltd.

- Mechatronic Systemtechnik GmbH

- JAM Corporation

- Lapp Group (Selected equipment)

Frequently Asked Questions

Analyze common user questions about the Wire Stripping Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of automatic wire stripping machines?

The primary driver is the explosive growth and complexity of the automotive sector, particularly the rapid transition to Electric Vehicles (EVs). EVs necessitate extensive, highly reliable wiring harnesses for battery management and power distribution units, demanding the speed, precision, and repeatability only fully automatic machines can provide to ensure safety and quality at high volume production rates.

How does laser stripping technology compare to mechanical stripping, and where is it predominantly used?

Laser stripping offers non-contact material removal, eliminating the risk of nicks or scratches on delicate conductors, which is a major advantage over mechanical methods. It is predominantly used in high-precision, low-tolerance industries such as aerospace, defense, and medical device manufacturing, especially for wires insulated with specialized, high-temperature polymers like Teflon or polyimide that are difficult to cut cleanly with blades.

Which geographical region represents the largest market share for wire stripping equipment?

Asia Pacific (APAC) currently holds the largest market share, fueled by its status as the global manufacturing center for consumer electronics, major telecommunication equipment, and automotive components. Robust industrial policies and continuous capital investment in automation across countries like China and South Korea sustain this dominant market position.

What key challenges restrain the growth of the high-end wire stripping machine segment?

The main restraints include the significant initial capital expenditure required for advanced, fully automatic, and AI-integrated systems, which can be prohibitive for small and medium enterprises. Additionally, the increasing technical complexity requires specialized maintenance and programming skills, contributing to higher operational labor costs and training requirements.

In what ways is Industry 4.0 influencing the design and functionality of new wire stripping machines?

Industry 4.0 demands are leading to the incorporation of integrated sensors, advanced connectivity (IoT), and proprietary software interfaces that allow machines to communicate seamlessly with factory management systems (MES/ERP). This integration supports real-time performance monitoring, remote diagnostics, data-driven optimization of processes, and implementation of predictive maintenance routines, enhancing overall factory efficiency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager