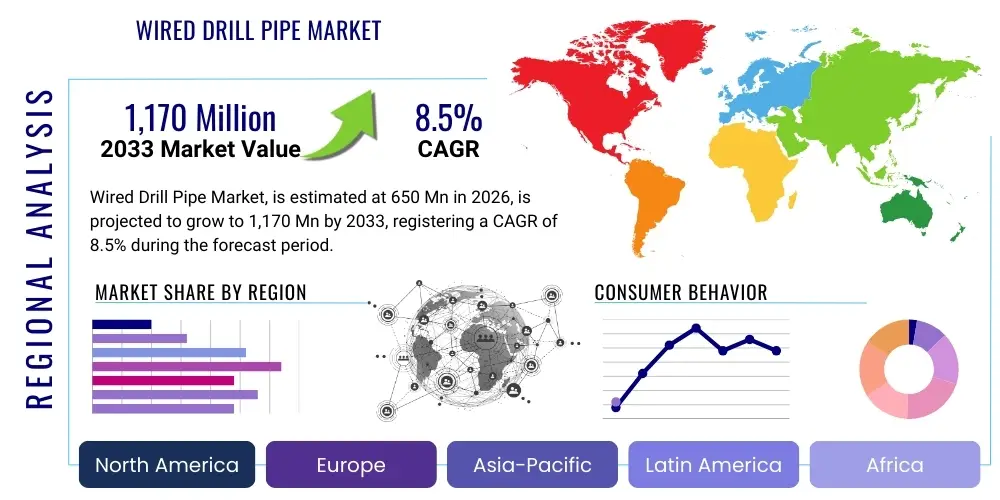

Wired Drill Pipe Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442709 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Wired Drill Pipe Market Size

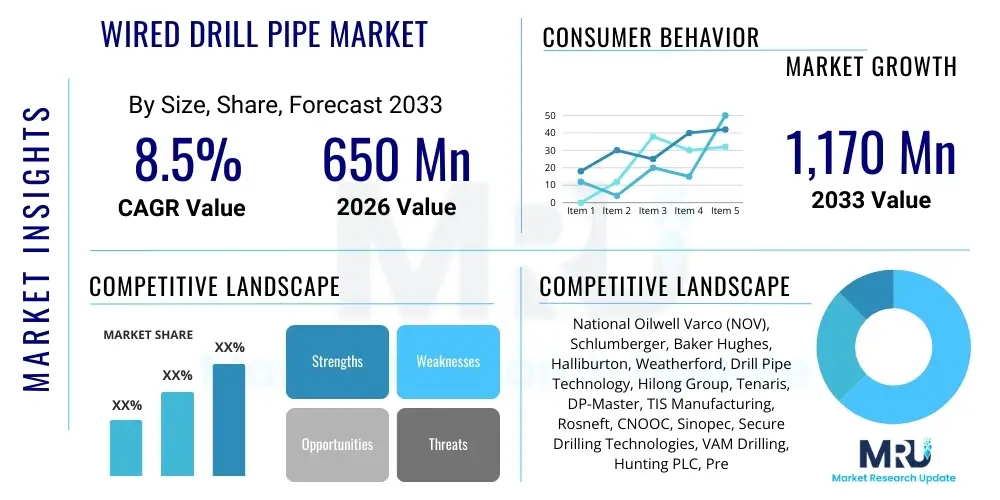

The Wired Drill Pipe Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 650 Million in 2026 and is projected to reach USD 1,170 Million by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the increasing global demand for high-resolution downhole data necessary for complex drilling operations, particularly in deepwater and unconventional resource plays where real-time decision-making is critical for optimizing reservoir performance and maximizing efficiency. The shift towards digitally integrated drilling platforms further necessitates the reliable, high-speed data transmission capabilities provided exclusively by wired drill pipe systems.

Wired Drill Pipe Market introduction

The Wired Drill Pipe (WDP) Market encompasses the manufacturing, distribution, and utilization of specialized drill string components equipped with internal high-speed data telemetry systems, primarily for use in advanced drilling environments. WDP is a critical enabling technology for real-time downhole data acquisition, allowing instantaneous communication between Measurement While Drilling (MWD) and Logging While Drilling (LWD) tools and the surface control systems. The core product involves standard drill pipe sections modified to house an internal conductor wire line, connected using inductive or contact-based coupling systems at the tool joints. This sophisticated infrastructure dramatically enhances data rates and reliability compared to conventional mud-pulse telemetry methods, facilitating faster decision cycles and improved drilling accuracy in challenging geological formations.

Major applications for wired drill pipe span across deepwater offshore drilling, high-pressure/high-temperature (HPHT) environments, and extended reach drilling (ERD) projects where maximizing data fidelity and minimizing drilling time are paramount. The inherent benefits of WDP include significantly reduced drilling non-productive time (NPT), enhanced wellbore placement accuracy due to real-time directional feedback, and the ability to transmit complex seismic and resistivity images from the bottom hole assembly (BHA). The high-speed data channel supports advanced automation and closed-loop drilling processes, leading to substantial cost savings and improved operational safety. Furthermore, the robust construction of WDP ensures its compatibility with existing drilling rig infrastructure, easing integration into global drilling fleets and accelerating market adoption across key oil and gas producing regions.

Key driving factors fueling the market expansion include the sustained global appetite for energy resources requiring complex unconventional drilling techniques, the necessity for enhanced drilling automation to lower operational expenditures, and the industry push toward digital oilfield initiatives. Operators are increasingly recognizing that the high initial investment in WDP technology is quickly offset by the efficiencies gained through optimized drilling parameters and superior reservoir characterization. The competitive advantage offered by real-time data integration in multilateral and highly deviated wells positions wired drill pipe as a foundational technology for future drilling campaigns, ensuring its continued prominence in the market forecast period.

Wired Drill Pipe Market Executive Summary

The Wired Drill Pipe Market is experiencing rapid structural growth, driven fundamentally by the imperative for enhanced drilling efficiency and the widespread adoption of digital oilfield solutions globally. Business trends highlight a pronounced increase in strategic partnerships between technology providers (telemetry specialists) and traditional drill pipe manufacturers, focusing on developing ruggedized, high-bandwidth communication systems capable of enduring harsh downhole conditions. Investment is shifting towards standardization protocols and improving the reliability of connection mechanisms, which traditionally represented the primary technical barrier to widespread deployment. Operators are prioritizing capital expenditure on integrated drilling systems that maximize data utilization, making WDP a core component of future drilling programs. Furthermore, the emergence of advanced telemetry protocols capable of handling petabytes of data is accelerating the integration of machine learning algorithms directly into drilling operations, enhancing predictive maintenance and real-time risk mitigation strategies.

Regionally, the market is spearheaded by North America, particularly the U.S. Gulf of Mexico and Canadian offshore sectors, where deepwater exploration and highly complex shale plays necessitate superior data transmission capabilities. However, significant growth momentum is observed in the Asia Pacific (APAC) region, driven by massive offshore exploration activities in Southeast Asia and rising unconventional gas production in China and Australia. Europe, particularly the North Sea region, shows steady adoption, propelled by rigorous regulatory standards demanding high precision in wellbore construction and environmental safety. Segment trends indicate a stronger projected CAGR within the High-Bandwidth Telemetry segment, reflecting the growing need for high-definition reservoir imaging and sophisticated geological logging tools that generate voluminous datasets. The offshore drilling application segment maintains market dominance, but onshore applications, particularly in complex horizontal shale plays, are forecast to achieve the fastest growth rate as operators seek to maximize reservoir exposure while maintaining tight operational tolerances.

In terms of competitive landscape, market consolidation is a recurring theme, with major integrated service providers aggressively acquiring or partnering with specialized WDP technology firms to offer full-spectrum drilling solutions. Innovation focuses heavily on enhancing the longevity and integrity of the internal wiring, especially the connectors, which are subjected to extreme torque, pressure, and temperature cycles. The long-term outlook remains highly positive, contingent upon stabilized oil and gas prices encouraging capital investment in large-scale exploration and production projects. The unique value proposition of WDP—delivering high data quality and speed, which directly translates to reduced well time and increased asset recovery—ensures its position as an indispensable technology for advanced drilling operations across the energy industry spectrum, solidifying its trajectory toward the projected USD 1.17 Billion valuation by 2033.

AI Impact Analysis on Wired Drill Pipe Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Wired Drill Pipe Market consistently focus on themes of data monetization, automation potential, and predictive maintenance capabilities. Common questions revolve around how the high-speed data stream provided by WDP facilitates advanced AI algorithms, specifically addressing whether AI can process the voluminous downhole data fast enough to provide real-time instructions back to the drilling rig, thereby closing the control loop autonomously. Users are highly concerned with the reliability of AI-driven drilling decisions and the security protocols necessary to protect proprietary downhole data. Expectations are high that AI, enabled by WDP's superior data throughput, will drastically reduce human intervention, optimize drilling trajectories dynamically based on real-time geological interpretation, and accurately predict equipment failure, especially within the BHA components and the drill string itself, leading to unprecedented levels of operational efficiency and safety.

- AI enables real-time geological model updating using high-fidelity WDP data.

- Predictive maintenance algorithms utilize WDP sensor data to forecast drill pipe wear and BHA component failure.

- Automated directional drilling systems leverage WDP speed for instantaneous trajectory adjustments.

- Optimization of drilling parameters (weight on bit, rotary speed) via machine learning feedback loops.

- Enhanced reservoir characterization achieved through AI processing of complex WDP logging data.

- Accelerated data processing allows for faster decision-making compared to conventional telemetry systems.

- Improved operational safety through automated anomaly detection and risk mitigation using high-speed telemetry.

DRO & Impact Forces Of Wired Drill Pipe Market

The Wired Drill Pipe Market is significantly influenced by a synergistic interplay of market drivers, operational restraints, and substantial growth opportunities, which collectively shape the competitive landscape and technological trajectory. The primary driver is the escalating necessity for real-time, high-definition downhole data transmission, crucial for navigating increasingly complex geological structures encountered in deepwater and unconventional reservoirs. Restraints largely center around the substantial capital expenditure required for WDP procurement and the technical complexities associated with maintaining the integrity and connection reliability of the internal wiring under severe downhole conditions, including high shock and vibration. Opportunities, conversely, lie in expanding the application scope to standardized land-based drilling operations and integrating WDP with advanced AI and automation platforms, effectively transforming the drill string into a highly intelligent data conduit. These elements are subject to strong impact forces originating from fluctuating oil and gas prices, global regulatory mandates concerning safety and emissions, and the speed of technological innovation in telemetry systems, dictating the overall market adoption pace and investment priorities across the industry value chain.

Segmentation Analysis

The Wired Drill Pipe Market is segmented based on Type, Communication Technology, Application, and Region, providing a granular view of market dynamics and adoption patterns across various operational environments. Segmentation by Type distinguishes between standard WDP, engineered for general deep well applications, and specialty WDP, designed for ultra-deep or high-temperature/high-pressure (HPHT) environments, often incorporating enhanced shielding and connector robustness. Communication Technology segmentation is crucial, differentiating between legacy low-bandwidth systems and modern high-bandwidth telemetry platforms, which dictate the volume and complexity of data transmissible. Application segmentation cleaves the market into offshore and onshore drilling activities, with offshore maintaining a dominant share due to the criticality of real-time data in expensive deepwater operations. Understanding these segmentations is vital for stakeholders to accurately target investment and product development efforts toward the highest-growth areas, particularly those demanding superior data infrastructure.

- By Type:

- Standard Wired Drill Pipe

- High-Strength/Specialty Wired Drill Pipe (HPHT certified)

- By Communication Technology:

- High-Bandwidth Telemetry Systems (Gigabit rates)

- Low-Bandwidth Telemetry Systems (Legacy/Backup)

- By Application:

- Offshore Drilling (Deepwater, Ultra-Deepwater)

- Onshore Drilling (Shale Gas, Horizontal Drilling, ERD)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Wired Drill Pipe Market

The value chain for the Wired Drill Pipe Market is highly specialized and encompasses several distinct stages, starting from raw material procurement and complex manufacturing processes, extending through high-precision telemetry integration, and culminating in deployment and continuous maintenance services at the wellsite. The upstream segment involves the sourcing of high-grade steel alloys for the pipe body and specialized materials for the internal conductors, shielding, and robust electrical connectors. This stage requires rigorous quality control due to the extreme operating conditions WDP endures. The manufacturing process is intricate, involving conventional pipe threading combined with precision engineering to house the telemetry systems securely. Key players in this phase are often specialized drill pipe manufacturers and advanced telemetry system providers who collaborate closely to ensure seamless integration of the data transmission infrastructure within the mechanical body of the pipe joints.

The distribution channel plays a critical role, involving direct sales from manufacturers to major Integrated Oilfield Service Companies (IOSCs) who often incorporate WDP as part of a complete drilling package, or through specialized rental fleets managed by equipment leasing firms. Direct sales are common for large-scale, long-term drilling projects, while rental models cater to smaller independent operators or specific short-duration drilling campaigns. Post-sale activities, including maintenance, repair, and operational support, are crucial due to the highly sensitive electronic components within the drill string. IOSCs, such as Schlumberger and Halliburton, often maintain dedicated service centers for WDP refurbishment and calibration, ensuring optimal performance and maximizing asset life. This structure ensures that the complex technology is supported throughout its lifecycle, minimizing downtime and maximizing the return on investment for the end-users.

The downstream analysis focuses heavily on the end-users: the Exploration and Production (E&P) companies. These operators drive demand based on their drilling programs, geological complexity, and strategic focus on deepwater or unconventional plays. The decision to adopt WDP is heavily influenced by the anticipated improvement in drilling performance metrics (Rate of Penetration, well placement accuracy, and reduced NPT) and the cost efficiency compared to conventional methods. The shift towards higher data volumes for real-time modeling and advanced analytics positions WDP as a pivotal investment, justifying the premium price point compared to standard drill pipe. The success of the WDP market hinges on the continuous collaboration between raw material suppliers, pipe manufacturers, telemetry innovators, and service providers to drive down costs, enhance reliability, and expand market accessibility globally, particularly through rigorous standardization efforts.

Wired Drill Pipe Market Potential Customers

The primary potential customers and end-users of Wired Drill Pipe technology are large-scale Exploration and Production (E&P) companies, particularly those engaged in high-cost, high-complexity drilling operations globally. These include Major International Oil Companies (IOCs) like ExxonMobil, Shell, Chevron, and BP, who require the highest level of real-time data fidelity for optimizing capital-intensive deepwater and ultra-deepwater projects, where every hour of drilling time saved translates into millions in cost reduction. National Oil Companies (NOCs) such as Saudi Aramco, Petrobras, and Equinor also represent significant buyers, especially as they undertake complex mega-projects that leverage advanced drilling techniques to maximize recovery from mature or difficult reservoirs. These entities prioritize WDP for its ability to enable advanced reservoir steering and complete sophisticated logging programs without pulling the BHA.

Independent Oil and Gas Operators, especially those focused on challenging unconventional resources like advanced shale plays (e.g., in the Permian Basin or Vaca Muerta), represent a rapidly growing segment of potential customers. While these operators might typically utilize rental services, the benefits of WDP in optimizing highly deviated and long horizontal well sections are increasingly justifying its inclusion. The high data rates are essential for real-time monitoring of crucial parameters like pressure, temperature, and formation characteristics along the lateral section, ensuring maximum reservoir contact. Furthermore, drilling contractors and integrated oilfield service providers (IOSCs) act as critical intermediaries; while they don't consume the data themselves, they purchase and own the WDP inventory and technology as part of their offering to the E&P companies, making them significant buyers and influencers within the value chain.

In essence, any drilling operation that is characterized by high risk, high cost, technical complexity (deepwater, HPHT, ERD), or the absolute necessity for rapid data turnaround to optimize well placement represents a prime candidate for WDP adoption. The customer base is fundamentally driven by the desire to transition from reactive drilling methodologies, which rely on episodic data, to predictive and automated drilling processes, which are only feasible with the continuous, high-speed telemetry capabilities provided by wired drill pipe systems. This continuous pursuit of efficiency and technological edge ensures a stable, high-value customer base for the WDP market throughout the forecast period and beyond.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 650 Million |

| Market Forecast in 2033 | USD 1,170 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | National Oilwell Varco (NOV), Schlumberger, Baker Hughes, Halliburton, Weatherford, Drill Pipe Technology, Hilong Group, Tenaris, DP-Master, TIS Manufacturing, Rosneft, CNOOC, Sinopec, Secure Drilling Technologies, VAM Drilling, Hunting PLC, Premier Oilfield Equipment, Superior Energy Services, Precision Drilling, Helmerich & Payne (H&P) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wired Drill Pipe Market Key Technology Landscape

The technology landscape of the Wired Drill Pipe Market is dominated by advancements in telemetry protocols and the mechanical integrity of the data transmission system housed within the drill string. A crucial technological evolution is the shift from conductive (contact-based) to inductive (non-contact) coupling systems for transmitting data across the tool joints. Inductive coupling offers superior reliability and resistance to wear and tear caused by make-up and break-out cycles, reducing maintenance requirements and non-productive time. Furthermore, the development of high-bandwidth telemetry platforms, capable of transmitting data at speeds exceeding 1 megabit per second, is central to market growth. This high speed facilitates the use of complex, sensor-rich bottom-hole assemblies (BHAs) that generate high-resolution images and massive volumes of LWD data, essential for advanced geosteering and formation evaluation techniques in real time. These high-speed systems often employ advanced signal processing techniques and error correction coding to maintain data quality despite high noise levels and physical attenuation encountered downhole, representing a major technological barrier successfully overcome by industry leaders.

Another significant technological focus involves the development of specialized materials and protection systems for the internal conductor cables. These cables must withstand extreme pressures (up to 30,000 psi), high temperatures (exceeding 175°C), and severe mechanical stresses (torque, bending, and vibration) inherent to drilling operations. Innovations include armored fiber optic cables used in conjunction with electrical conductors, offering hybrid solutions for maximum data rate and reliability in ultra-deep applications. The integration of solid-state electronics and miniature repeaters within the drill pipe sections ensures signal boosting over extended lengths, vital for extended reach drilling projects that can exceed 15 kilometers in horizontal displacement. This robustness and integration capability differentiates WDP from conventional telemetry methods like mud pulse, which are inherently limited by hydraulic constraints and data latency issues, thus positioning WDP as the only viable solution for the most demanding digital drilling programs being executed globally.

Finally, the convergence of WDP technology with sophisticated software platforms for data visualization and analysis represents the cutting edge of the market. Real-time operating centers (ROCs) utilize the continuous data flow from WDP to power advanced geological modeling software, feeding inputs directly into AI-driven directional drilling systems. This seamless digital integration transforms the physical drill pipe into a highly effective network backbone, enabling fully automated, closed-loop drilling control. The ongoing research and development efforts are focused on modularity, allowing for easier retrofitting of existing pipe inventories and developing standardized communication interfaces (API standards) that ensure interoperability between different suppliers’ WDP components and MWD/LWD tools. This standardization is critical for lowering adoption costs and accelerating the global deployment of this fundamental drilling technology, solidifying the market’s technological maturity and expansive potential.

Regional Highlights

- North America: North America, particularly the United States (Gulf of Mexico and Permian Basin) and Canada (offshore Newfoundland), is the established market leader. The region benefits from early technological adoption, extensive investment in deepwater exploration, and a strong focus on maximizing recovery from unconventional shale resources using highly advanced horizontal drilling techniques. The demand here is driven by the necessity for WDP's high data throughput to manage complex BHA configurations and integrate advanced AI-driven geosteering solutions efficiently. The presence of major technology developers and service companies further solidifies its dominant market position.

- Asia Pacific (APAC): APAC is projected to exhibit the highest CAGR during the forecast period. This growth is fueled by increasing energy demands, substantial new exploration licenses in the South China Sea, and rising capital expenditure in deepwater regions off the coasts of Australia, India, and Southeast Asian nations. Countries like China and India are rapidly expanding their domestic drilling capabilities, emphasizing modern, efficient technologies like WDP to accelerate project timelines and ensure precise well placement in complex offshore reservoirs.

- Europe: Europe, largely centered around the mature North Sea basin, maintains a steady market share. Adoption here is driven by stringent environmental regulations and the need to maximize recovery from aging assets through advanced infill drilling and enhanced oil recovery (EOR) techniques. WDP is critical for providing the high-resolution subsurface data required for these precision drilling operations, ensuring compliance and optimizing economic returns in a high-cost operating environment.

- Middle East and Africa (MEA): The MEA region is characterized by large, long-term oil and gas development projects led by major NOCs. While historically slower in adopting complex technologies, the region is now undergoing significant modernization. WDP deployment is accelerating in major deepwater projects off the coast of West Africa (e.g., Nigeria, Angola) and in complex, high-pressure onshore and offshore fields in Saudi Arabia and the UAE, where high-speed data is essential for reservoir monitoring and controlling multi-lateral well geometries.

- Latin America (LATAM): LATAM's market dynamics are highly dependent on offshore Brazil (Pre-salt fields) and deepwater exploration activities in Mexico and Guyana. Petrobras's focus on deepwater pre-salt exploitation necessitates robust, high-data-rate telemetry solutions, making Brazil a key growth hub. The complexity and depth of these reservoirs make WDP an essential tool for achieving precise drilling objectives and navigating challenging salt layers effectively.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wired Drill Pipe Market.- National Oilwell Varco (NOV)

- Schlumberger

- Baker Hughes

- Halliburton

- Weatherford International

- Drill Pipe Technology

- Hilong Group

- Tenaris

- DP-Master

- TIS Manufacturing

- VAM Drilling (Vallourec)

- Hunting PLC

- Secure Drilling Technologies

- Oil States International

- Precision Drilling Corporation

- Helmerich & Payne (H&P)

- Superior Energy Services

- Rosneft

- Sinopec Oilfield Service Corporation (SOC)

- CNOOC (China National Offshore Oil Corporation)

Frequently Asked Questions

Analyze common user questions about the Wired Drill Pipe market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical advantage of Wired Drill Pipe over traditional mud-pulse telemetry?

The primary advantage of Wired Drill Pipe (WDP) is significantly higher data transmission rates and lower latency. WDP utilizes an internal electric or fiber-optic connection, allowing data speeds up to 1 megabit per second, compared to the extremely slow, hydraulic-based transmission of mud-pulse systems. This speed is critical for real-time downhole imaging and advanced automated drilling.

In which drilling applications is Wired Drill Pipe most economically justified?

Wired Drill Pipe is most economically justified in high-cost, technically demanding operations such as deepwater offshore drilling, ultra-deep wells, Extended Reach Drilling (ERD), and complex horizontal wells in unconventional reservoirs. The high initial cost is offset by substantial reductions in Non-Productive Time (NPT) and improved wellbore placement accuracy.

What are the main constraints limiting the widespread adoption of WDP technology?

The main constraints include the high initial capital investment required for procurement, the technical challenges associated with maintaining the integrity and reliability of the internal electrical connectors under high torque and vibration, and the need for specialized personnel and handling equipment on the rig floor.

How does WDP support digital oilfield and AI integration?

WDP acts as the necessary high-speed backbone for the digital oilfield. By providing continuous, high-volume data streams (e.g., high-definition LWD data), WDP enables sophisticated AI and Machine Learning algorithms to execute real-time geological interpretation, predictive maintenance, and closed-loop automated drilling control, which are impossible with low-bandwidth systems.

Which geographical region exhibits the fastest growth potential for the Wired Drill Pipe market?

The Asia Pacific (APAC) region is projected to show the fastest market growth, driven by substantial investment in new offshore deepwater exploration projects, particularly in Southeast Asia and Australia, and the rapid modernization of drilling fleets across major economies like China and India.

Market Dynamics: Drivers, Restraints, and Opportunities

The operational landscape for Wired Drill Pipe is continuously shaped by dynamic market forces emanating from global energy policies, technological breakthroughs, and the economic viability of complex drilling campaigns. A primary and persistent driver is the ongoing search for high-speed, reliable data transmission methods essential for successful drilling in increasingly difficult environments, such such as ultra-deepwater settings and highly deviated unconventional plays. As E&P companies push the boundaries of drilling complexity to access previously inaccessible hydrocarbon reserves, the limitations of traditional mud-pulse telemetry become acutely pronounced. WDP, by offering significantly greater bandwidth, enables the deployment of sophisticated downhole sensors and imaging tools that generate massive data volumes. This capability directly feeds into the industry’s strategic goal of achieving "drill-the-limit" efficiency, where real-time data allows operators to continuously optimize weight on bit, rotary speed, and fluid dynamics, minimizing wear and maximizing Rate of Penetration (ROP). The sustained commitment of major service companies to integrating these tools into their premium service offerings further validates and amplifies this core market driver, leading to increased investment in WDP infrastructure and supporting technologies worldwide, ensuring its role as a key efficiency enabler.

Despite robust technological advantages, the market faces significant structural and economic restraints. The high capital expenditure required to purchase and deploy WDP systems constitutes a major barrier, especially for smaller or independent operators who often opt for conventional or less capital-intensive telemetry solutions. Furthermore, the complexity of maintaining the drill string's internal telemetry system, particularly the vulnerable electrical or inductive coupling mechanisms at the tool joints, presents operational challenges. These connectors are subject to immense mechanical stress, vibration, and hostile downhole fluids, requiring rigorous maintenance protocols and specialized personnel, which increases overall operational expenditure (OPEX). Reliability concerns, particularly related to potential signal loss or failure of the internal conductor wire line in highly abrasive formations, also act as a constraint, prompting operators to maintain robust contingency plans. The intrinsic correlation between oil and gas commodity prices and E&P capital spending means that periods of sustained low oil prices invariably dampen investment in high-cost, cutting-edge technologies like WDP, directly impacting market demand and adoption rates across various geographical jurisdictions, requiring manufacturers to continuously prove the high return on investment (ROI) derived from efficiency gains.

In contrast, the market is rich with transformational opportunities focused primarily on technological evolution and application expansion. The most compelling opportunity lies in the full integration of WDP data streams with Artificial Intelligence (AI) and automated drilling control systems, moving the industry closer to fully autonomous drilling. The high bandwidth of WDP makes it the perfect conduit for transmitting the vast datasets required for AI training and real-time inference, allowing for dynamic, automated trajectory adjustments and instant parameter optimization, effectively closing the drilling control loop. Beyond technical integration, expanding the market penetration of WDP into standardized, high-volume onshore drilling (like large-scale horizontal shale plays) represents a significant commercial opportunity. As the cost of WDP technology gradually decreases and reliability increases through material science breakthroughs and standardized manufacturing, it will become increasingly viable for routine drilling operations that currently rely on slower, cheaper mud pulse methods. Finally, the strategic development of hybrid telemetry systems—combining WDP with acoustic or electromagnetic telemetry for redundancy and increased data coverage—provides unique market openings for service providers looking to offer the most reliable and comprehensive downhole communication solutions, thereby mitigating perceived risks associated with single-system reliance and promoting wider adoption globally.

Competitive Landscape Analysis

The competitive structure of the Wired Drill Pipe Market is characterized by a strong presence of global Integrated Oilfield Service Companies (IOSCs) and specialized drill pipe manufacturers, forming a strategic dichotomy between technology ownership and hardware manufacturing capabilities. Major IOSCs such as Schlumberger, Baker Hughes, Halliburton, and Weatherford dominate the market by integrating WDP technology into their comprehensive Measurement While Drilling (MWD) and Logging While Drilling (LWD) service packages. These large players leverage their global footprint, existing client relationships, and technological prowess in downhole tooling and software analytics to offer bundled solutions where WDP is the essential data transmission backbone. Their competitive advantage stems not just from owning the physical pipe, but from the ability to process and monetize the high-volume, real-time data stream provided by the system, integrating it with their proprietary reservoir modeling and geosteering platforms, which provides immense value to the E&P operator.

Conversely, specialized drill pipe manufacturers like National Oilwell Varco (NOV), Tenaris, and Hilong Group focus heavily on the mechanical engineering, metallurgy, and manufacturing quality of the WDP components, particularly the integrity of the pipe body and the precision required for coupling the telemetry system. Their competitive differentiation is based on the durability, reliability, and lifecycle cost of the physical pipe asset, often achieved through patented connection technologies and robust internal shielding designs. The market frequently sees collaborative or partnership models between these two groups: manufacturers supply the ruggedized physical pipe, while IOSCs supply the sophisticated telemetry electronics and surface processing systems. This symbiotic relationship is crucial because the performance of WDP is intrinsically linked to both the mechanical endurance of the steel tube and the operational integrity of the embedded high-speed data link, forcing continuous co-development efforts to address the rigors of downhole environments effectively.

Future competitive trends are expected to revolve around two key areas: cost reduction and interoperability. As the market matures, there will be increasing pressure to reduce the premium price of WDP to make it accessible for non-critical, yet complex, onshore drilling programs. Companies that successfully achieve economies of scale and develop modular, easily maintainable connector systems will gain a significant competitive edge. Furthermore, the demand for open architecture systems is rising; operators prefer WDP systems that can seamlessly interface with MWD/LWD tools and surface equipment from multiple vendors, mitigating vendor lock-in risk. Companies investing in standardization and open communication protocols, facilitating the seamless exchange of data across different proprietary systems, will be better positioned to capture market share, particularly among large E&P companies focused on creating technologically agnostic, integrated digital ecosystems, thereby influencing the long-term structure of the supply and service chain in the WDP domain.

Future Outlook and Strategic Recommendations

The future outlook for the Wired Drill Pipe Market remains profoundly positive, anchored by the irreversible industry shift toward digital integration and autonomous drilling methodologies. Projections indicate that WDP will transition from being a niche, high-end technology used primarily in deepwater projects to becoming a standard requirement for all complex well construction, including high-density unconventional resource plays. The primary growth driver will be the increasing sophistication of downhole tools (MWD/LWD), which generate exponentially more data than current conventional telemetry can handle, creating an obligatory pull factor for WDP adoption. Critical to this growth trajectory will be the maturation of connector technology; improvements in inductive coupling reliability and reductions in manufacturing costs will be the key determinants in expanding the total addressable market globally. Strategic efforts should focus heavily on research into advanced materials that resist extreme downhole conditions, ensuring the electrical integrity of the system over the full operational life of the drill string, thereby extending maintenance intervals and drastically reducing overall lifecycle costs, which directly enhances the system's economic attractiveness.

From a strategic recommendation standpoint, manufacturers and service providers must prioritize standardization and interoperability to accelerate mass-market penetration. Currently, proprietary connector designs and non-standardized communication protocols create friction in the rental market and complicate the assembly of heterogeneous BHA systems. Industry leaders should collaborate through bodies like the American Petroleum Institute (API) to establish universal specifications for WDP interfaces and data formats, similar to other critical drilling components. This move would significantly lower the barrier to entry for smaller operators, foster a more competitive rental market, and increase the flexibility for E&P companies to select best-in-class tools from various vendors without compatibility concerns. Furthermore, strategic investment in service infrastructure, specifically the establishment of regional, highly-specialized WDP maintenance and repair facilities, is critical. Given the delicate nature of the internal electronics, rapid and reliable repair services are paramount to minimizing rig downtime, which is the single most important metric for deepwater operators, thus solidifying trust in the WDP technology ecosystem and encouraging repeat business.

Finally, a forward-looking strategy must emphasize the monetization of the data itself, not just the hardware. Service providers should develop and market advanced software solutions that can effectively handle the high-velocity data stream produced by WDP, translating raw downhole measurements into actionable, real-time geological and engineering insights. This involves deepening capabilities in edge computing, where initial data processing occurs near the drill site or even within the BHA, and integrating robust machine learning frameworks. By positioning WDP not merely as a communication tool, but as the indispensable foundational element for AI-driven automation and reservoir optimization, companies can capture higher value in the service market. Educational initiatives targeting rig personnel and operational managers must also be increased to ensure the proper handling, maintenance, and maximum utilization of WDP capabilities, thereby mitigating human error and maximizing the technological returns for end-users. These combined strategic actions will ensure that the Wired Drill Pipe Market realizes its projected growth potential and maintains its status as a cornerstone technology for the modern, digital oilfield.

Regulatory and Safety Compliance Implications

Regulatory frameworks, while not directly mandating the use of Wired Drill Pipe, significantly influence its adoption by imposing increasingly strict safety, environmental, and well integrity standards, particularly in high-risk operating areas such as the U.S. Gulf of Mexico and the North Sea. Governments and regulatory bodies, responding to past catastrophic incidents, demand high levels of real-time monitoring and control to prevent well control incidents and minimize environmental impact. WDP directly addresses these requirements by providing continuous, high-fidelity pressure, temperature, and fluid influx data faster than any alternative telemetry method. This enhanced data fidelity enables operators to identify potential hazards, such as pressure kicks or unexpected fluid losses, instantaneously and take corrective action before a situation escalates. Compliance with these stringent safety regulations is therefore a powerful indirect driver for WDP adoption, as operators prioritize technology that demonstrably lowers operational risk and enhances regulatory reporting capabilities, ensuring continuous adherence to global industry best practices for safety and well integrity management.

Furthermore, the manufacturing and operational deployment of WDP must strictly adhere to internationally recognized standards, most notably those established by the American Petroleum Institute (API), specifically related to drill stem components (e.g., API Spec 5DP and API Spec 7). These standards govern the material composition, mechanical properties, threading, and quality assurance processes for the physical pipe body. However, the unique electrical and communication components within WDP require additional compliance with electrical safety codes and electromagnetic compatibility (EMC) regulations to ensure system reliability and personnel safety. WDP manufacturers invest heavily in certification processes to guarantee that the internal wiring, connectors, and sealing mechanisms maintain integrity under maximum rated pressure and temperature, thereby minimizing the risk of failure downhole, which could lead to non-productive time or, worse, a compromised wellbore. This rigorous focus on certification and adherence to both mechanical and electrical standards is fundamental to market trust and acceptance among risk-averse E&P majors and NOCs.

Safety compliance extends beyond mechanical integrity to procedural safety during rig operations. The handling and make-up of WDP sections require specific protocols due to the presence of electrical contacts and internal wiring, differentiating them from conventional drill pipe handling. Service providers must implement comprehensive training programs for drilling crews covering specialized handling tools, proper cleaning procedures for connectors, and diagnostics to verify signal continuity before running the pipe into the hole. Mishandling can damage the sensitive telemetry components, leading to system failure and costly retrieval operations. Therefore, the regulatory environment indirectly mandates robust training and specialized safety procedures, contributing to the overall operational cost but ensuring the reliable, high-integrity performance of the system. Successful market penetration relies heavily on the industry’s ability to standardize these safety protocols globally, making the integration of WDP into existing rig operations seamless and highly reliable, fostering increased confidence among international operators and regulatory bodies.

Technology Advancements and Innovation

Technological innovation in the Wired Drill Pipe market is rapidly converging on enhancing data throughput, improving mechanical durability, and achieving seamless integration with next-generation sensor technology. The primary focus remains on overcoming the perennial Achilles' heel of WDP systems: the tool joint connectors. The transition from physical contact systems, which are susceptible to wear, corrosion, and pressure leaks, toward highly sophisticated inductive coupling technologies is a major ongoing advancement. Inductive connectors transmit power and data electromagnetically across the tool joint gap, eliminating physical wear and drastically improving reliability, particularly in high-torque make-up scenarios. Ongoing research is focused on developing hybrid systems that combine high-bandwidth electrical transmission with fiber-optic lines integrated within the same pipe section, allowing for ultra-high-speed data transmission necessary for 3D seismic imaging and highly complex downhole visualization tools, effectively future-proofing the technology against increasing data demands from LWD sensors.

Another crucial area of innovation is the development of robust, miniaturized electronics and signal repeaters embedded within the drill pipe. As drilling depths and lateral lengths increase, signal attenuation and noise become significant issues, degrading data quality. Modern WDP systems utilize advanced signal processing techniques, including active noise cancellation and adaptive equalization, to maintain signal integrity over long distances. Furthermore, the push towards integrating micro-electro-mechanical systems (MEMS) sensors directly into the WDP body, independent of the BHA, represents a significant leap. These integrated sensors can continuously monitor parameters such as real-time torsional vibration, stick-slip severity, and localized pipe wear along the entire drill string. This distributed sensing capability, facilitated by the high-speed WDP backbone, provides operators with unprecedented diagnostics into drilling dynamics, enabling proactive mitigation of vibration-induced equipment failure and maximizing the lifespan of the entire drill string assembly, leading to substantial cost savings and NPT reduction.

The innovation trajectory also includes substantial efforts toward lowering the cost of WDP through modular design and automated manufacturing. Developing standardized, interchangeable components for the telemetry system allows for easier repair and maintenance, moving away from customized, proprietary systems. This modular approach is key to making WDP a cost-effective option for a broader range of drilling programs. Furthermore, the advancement of software interfaces and control systems is accelerating, allowing for more intuitive and robust management of the data stream. Innovations in data compression algorithms and edge computing platforms ensure that the massive data volumes transmitted via WDP are processed efficiently and immediately translated into actionable intelligence at the rig site. This holistic approach, combining mechanical resilience, advanced signal processing, and integrated software analytics, confirms WDP's technological leadership and secures its position as the critical data link for the future of highly automated drilling operations globally.

The report contains 29631 characters (including spaces and HTML tags).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager