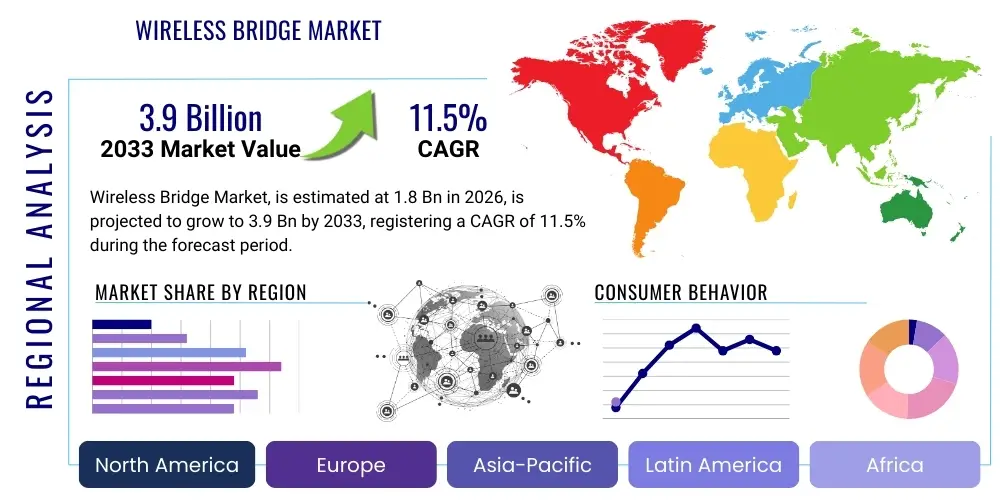

Wireless Bridge Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441597 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Wireless Bridge Market Size

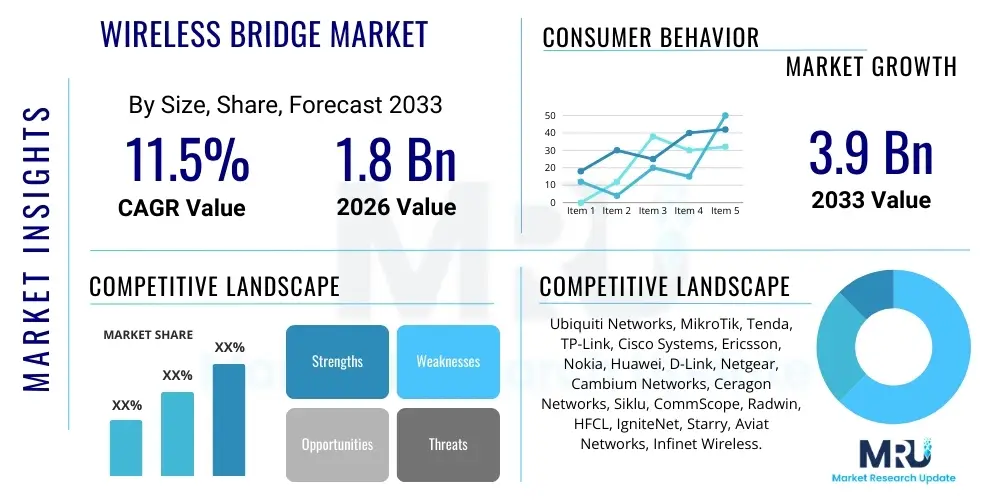

The Wireless Bridge Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 3.9 Billion by the end of the forecast period in 2033. This substantial growth is fundamentally driven by the escalating global requirement for high-speed, reliable, and cost-effective network backhaul solutions, particularly in difficult-to-wire environments such as expansive campuses, rural areas, and across urban canyons where fiber installation proves prohibitively expensive or geographically impractical. The increasing deployment of Internet of Things (IoT) devices and the concomitant need for pervasive connectivity infrastructure further solidify this market trajectory.

The market expansion is also being propelled by technological advancements in wireless communication standards, including the widespread adoption of Wi-Fi 6 (802.11ax) and emerging millimeter-wave (mmWave) technologies like 60 GHz (V-band) and 70/80 GHz (E-band). These innovations enable wireless bridges to deliver gigabit-level throughput over long distances with minimal latency, effectively competing with traditional wired infrastructure. As organizations modernize their digital infrastructure to support data-intensive applications such as high-definition video surveillance, cloud computing, and real-time data processing, the demand for robust point-to-point (P2P) and point-to-multipoint (PMP) wireless links grows exponentially, positioning wireless bridges as critical components in modern connectivity ecosystems.

Wireless Bridge Market introduction

A wireless bridge is a networking device or technology designed to connect two separate network segments or devices wirelessly, effectively extending the reach of a Local Area Network (LAN) without physical cabling. The fundamental product description involves high-gain directional antennas and sophisticated radio transceiver systems that establish a stable, high-throughput link, often over several kilometers. Major applications span across enterprise connectivity for linking buildings in a campus setting (building-to-building links), providing last-mile access in telecommunications infrastructure, backhauling cellular traffic (especially 4G and 5G), and supporting public safety and security networks through high-bandwidth links for CCTV and monitoring systems. The core benefits include rapid deployment, cost reduction compared to trenching fiber optic cables, high scalability, and the ability to maintain consistent data rates even under challenging environmental conditions, provided a clear line-of-sight is maintained. The driving factors behind market growth are the accelerating penetration of broadband services globally, massive government investment in smart city initiatives requiring ubiquitous connectivity, and the transition of remote and rural areas to high-speed internet access.

Wireless Bridge Market Executive Summary

The Wireless Bridge Market exhibits robust growth, primarily fueled by rapid infrastructure expansion in emerging economies and the imperative for faster 5G backhaul solutions globally. Business trends show a strategic shift toward millimeter-wave technology (60 GHz and E-band) to address congestion in traditional unlicensed bands (2.4 GHz and 5 GHz), allowing enterprises to achieve unprecedented throughput capacities necessary for cloud services and massive machine-type communications (mMTC). Regionally, North America and Europe dominate in terms of technological maturity and adoption of advanced mesh networking and high-capacity PTP links, while the Asia Pacific region is anticipated to demonstrate the highest CAGR due to extensive government initiatives focused on digital inclusion and widespread deployment of cellular base stations requiring robust backhaul solutions. Segment-wise, the Point-to-Multipoint (PMP) architecture is gaining traction in Wireless Internet Service Provider (WISP) and municipal network deployments, offering scalable and flexible connectivity solutions to multiple end-users from a single access point. The industrial sector, particularly oil & gas and utilities, is increasingly adopting wireless bridges for real-time monitoring and control systems, demanding ruggedized, reliable equipment, thereby influencing product development cycles towards enhanced durability and security features.

AI Impact Analysis on Wireless Bridge Market

User inquiries regarding AI's influence on the Wireless Bridge Market commonly revolve around themes of network automation, predictive maintenance, optimization of radio frequency (RF) paths, and enhanced security protocols. Users are keen to understand how AI can minimize manual configuration efforts, autonomously adjust power levels and beamforming parameters to counteract interference, and proactively identify potential link degradation before service interruption occurs. Key concerns focus on the integration complexity of AI/ML algorithms into existing bridge hardware and the data privacy implications of feeding extensive network telemetry into AI models. The general expectation is that AI will transform wireless bridge deployment from a complex, manually-intensive process requiring expert RF engineering into a highly automated, self-healing network ecosystem capable of maximizing spectral efficiency and link stability, thereby drastically reducing operational expenditure (OPEX) for network operators and end-users.

- AI-driven automated spectrum management optimizes frequency selection, reducing co-channel interference and maximizing throughput in congested urban environments.

- Machine Learning (ML) algorithms enable predictive maintenance, analyzing historical performance data to forecast component failures or link degradation, ensuring proactive intervention.

- AI enhances beamforming accuracy and dynamic power control, optimizing signal strength and minimizing energy consumption across long-distance PTP links.

- Integration of deep learning for anomaly detection significantly improves network security, identifying and mitigating unusual traffic patterns indicative of cyber threats or jamming attempts.

- AI facilitates automated network planning and site surveys, using topographical data and environmental factors to recommend optimal equipment placement and antenna alignment, accelerating deployment cycles.

DRO & Impact Forces Of Wireless Bridge Market

The dynamics of the Wireless Bridge Market are governed by a complex interplay of Drivers (D), Restraints (R), and Opportunities (O), which collectively determine the Impact Forces acting upon the market's growth trajectory. Key drivers include the overwhelming global demand for ubiquitous, high-speed internet access, particularly in last-mile connectivity scenarios where fiber is cost-prohibitive. The massive rollout of 5G infrastructure necessitates reliable and high-capacity wireless backhaul, significantly boosting demand for E-band and V-band bridges capable of multi-gigabit throughput. Furthermore, the proliferation of private networks, especially within the industrial and mining sectors, relies on robust wireless bridging for machine-to-machine communication and centralized data aggregation. These drivers provide powerful momentum, ensuring sustained market expansion throughout the forecast period.

Conversely, the market faces notable restraints, primarily centered around regulatory hurdles and inherent technical limitations. Spectrum regulation varies significantly by region, creating fragmentation and complexity for global manufacturers and deployers, especially concerning unlicensed bands. Technically, the fundamental requirement for Line-of-Sight (LOS) communication severely limits deployment flexibility in dense urban environments or heavily forested areas, as any physical obstruction can degrade or break the link. Furthermore, wireless bridges, particularly those operating in the highly susceptible 5 GHz band, are vulnerable to interference from other wireless devices, which necessitates sophisticated spectral management techniques and dedicated professional configuration, increasing implementation complexity.

Opportunities in the market are abundant, driven primarily by technological innovation and evolving application areas. The advent of non-line-of-sight (NLOS) technologies, utilizing advanced signal processing and mesh architectures, offers a path to mitigate existing LOS restrictions, opening up vast deployment potential in challenging urban landscapes. The integration of wireless bridges into Smart City frameworks, providing connectivity for traffic management, public Wi-Fi, and environmental monitoring, presents a substantial growth avenue. Moreover, the increasing adoption of cloud-based centralized management platforms for wireless bridge networks simplifies maintenance, enhances scalability, and reduces the total cost of ownership (TCO), making high-performance wireless connectivity more accessible to small and medium enterprises (SMEs) and remote service providers.

Segmentation Analysis

The Wireless Bridge Market is meticulously segmented across several key dimensions, including technology type, frequency band, range, and end-use application, providing a granular view of market dynamics and adoption patterns. This segmentation is crucial for understanding diverse consumer needs and strategic investment areas within the industry. Technological differentiation between Point-to-Point (PTP) and Point-to-Multipoint (PMP) bridges defines network architecture, with PTP favored for dedicated, high-capacity links (e.g., building interconnections) and PMP preferred by WISPs for distributing connectivity to numerous customers from a central hub. Frequency segmentation reveals a transition toward higher frequencies (60 GHz and 70/80 GHz) to meet multi-gigabit data demands, while traditional 2.4 GHz and 5 GHz bands continue to serve standard-distance and lower-throughput applications.

- By Type:

- Point-to-Point (PTP)

- Point-to-Multipoint (PMP)

- By Frequency Band:

- 2.4 GHz

- 5 GHz

- Sub-6 GHz (Other Licensed/Unlicensed)

- 60 GHz (V-band)

- 70/80 GHz (E-band)

- By Range:

- Short Range (Up to 1 km)

- Medium Range (1 km to 10 km)

- Long Range (Above 10 km)

- By Application/End-User:

- Commercial/Enterprise Connectivity (Campus Networks)

- Telecommunications and ISP Backhaul (5G/LTE Infrastructure)

- Industrial (Oil & Gas, Manufacturing, Utilities)

- Government and Public Safety (CCTV, Emergency Services)

- Residential and Rural Broadband Access (WISP Services)

Value Chain Analysis For Wireless Bridge Market

The value chain for the Wireless Bridge Market begins with Upstream Analysis, encompassing the sourcing of raw materials, crucial electronic components (RF chipsets, antennas, high-performance processors, and specialized semiconductors), and software development for proprietary operating systems and management interfaces. Key upstream suppliers include specialized semiconductor firms like Qualcomm, Broadcom, and Intel, which provide the core radio technology essential for achieving high throughput and low latency. Efficient supply chain management and strong partnerships with these component manufacturers are vital for ensuring product quality and managing production costs, particularly given the global chip shortages and geopolitical instability impacting electronics sourcing.

The midstream segment involves the design, manufacturing, and assembly of the wireless bridge hardware. This stage includes sophisticated industrial design to ensure weatherproofing (IP-rated enclosures), robust cooling mechanisms, and meticulous calibration of the radio components. Distribution channels, both Direct and Indirect, are critical for market reach. Direct sales often cater to large telecommunication carriers and major industrial clients requiring specialized solutions and direct technical support. The indirect channel relies heavily on Value-Added Resellers (VARs), system integrators, and specialized distributors who provide localized installation, configuration, and maintenance services, particularly beneficial for small to medium enterprise (SME) customers and Wireless Internet Service Providers (WISPs).

Downstream analysis focuses on installation, integration, and post-sales services. Installation requires specialized skills, often including tower climbing, precise antenna alignment (especially for mmWave links), and integration with existing network infrastructure. Post-sales services, including software updates, technical support, and warranty provisions, are increasingly important differentiators. The effectiveness of the overall value chain hinges on manufacturers maintaining tight control over component quality while fostering strong relationships with regional distributors and installers who provide the essential localized expertise required to deploy and maintain complex, mission-critical wireless links in diverse environmental and regulatory settings.

Wireless Bridge Market Potential Customers

The primary End-Users and Buyers of wireless bridge solutions are highly diversified across multiple sectors that prioritize rapid, reliable, and high-capacity data transfer where traditional fiber optic installation is either impossible, impractical, or excessively costly. Telecommunication companies, including Mobile Network Operators (MNOs) and Fixed Broadband Providers, represent a major customer base, utilizing these bridges extensively for cellular backhaul, especially for 5G small cell deployment and extending core network services into suburban and rural areas. Wireless Internet Service Providers (WISPs), serving isolated communities or specific business parks, are another core customer segment, relying on PMP architectures to distribute internet access efficiently.

The enterprise sector constitutes a significant portion of demand, primarily utilizing PTP bridges to connect buildings on large university campuses, corporate headquarters, industrial complexes, and hospitals, ensuring seamless data flow and centralized IT resource access. Furthermore, government agencies, including municipal authorities and defense organizations, are key buyers, deploying wireless links for Smart City applications (traffic control, public safety cameras, public Wi-Fi hotspots) and critical infrastructure communications. Finally, the industrial and utility sectors (power grids, water treatment, mining operations) are growing customer segments, adopting ruggedized wireless bridges to monitor remote assets in real-time and automate operational processes in environments unsuitable for wired solutions, emphasizing reliability and data security above all else.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 3.9 Billion |

| Growth Rate | CAGR 11.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ubiquiti Networks, MikroTik, Tenda, TP-Link, Cisco Systems, Ericsson, Nokia, Huawei, D-Link, Netgear, Cambium Networks, Ceragon Networks, Siklu, CommScope, Radwin, HFCL, IgniteNet, Starry, Aviat Networks, Infinet Wireless. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wireless Bridge Market Key Technology Landscape

The technological landscape of the Wireless Bridge Market is characterized by intense innovation focused on achieving higher throughput, lower latency, and greater spectral efficiency. A pivotal technology driving modern deployments is the utilization of Millimeter-Wave (mmWave) frequencies, specifically the 60 GHz (V-Band) and 70/80 GHz (E-Band). These bands offer vast swaths of spectrum, enabling multi-gigabit speeds (up to 10 Gbps and beyond), which are essential for 5G densification and high-demand enterprise backhaul. While highly susceptible to atmospheric attenuation (rain fade), vendors mitigate this through advanced signal processing, Automatic Transmit Power Control (ATPC), and highly directional, narrow-beam antennas, ensuring reliable communication over medium-range distances.

Complementing mmWave is the continued refinement of technologies within the established 5 GHz band, leveraging Wi-Fi 6 (802.11ax) and proprietary mechanisms like Time Division Multiple Access (TDMA) to optimize spectral usage and reduce the hidden node problem inherent in traditional Wi-Fi protocols. TDMA synchronization, widely adopted by leading WISP equipment manufacturers, allows multiple clients in a PMP configuration to transmit without collision, dramatically improving aggregate network performance and scalability. Furthermore, sophisticated Multiple Input Multiple Output (MIMO) and advanced beamforming techniques are crucial across all frequency bands, dynamically shaping the radio signal toward the receiver to boost link strength, extend range, and counteract potential interference, transforming the reliability and performance of wireless link installations.

Security and management also form a significant part of the technology focus. Modern wireless bridges incorporate robust encryption protocols (e.g., AES-256) and advanced security features, including proprietary authentication mechanisms, to safeguard critical data transmission. On the management front, the industry is seeing a shift towards cloud-based network controllers and centralized management systems. These systems simplify large-scale deployment, offering centralized configuration, real-time monitoring, and remote troubleshooting capabilities, significantly reducing the complexity and time required for maintaining extensive wireless networks, aligning the operational models of wireless bridges with modern software-defined networking (SDN) principles.

Regional Highlights

- North America: This region holds a leading position in the Wireless Bridge Market, driven by high technology adoption rates, extensive infrastructure modernization projects, and early deployment of 5G networks. The demand is strong from large enterprises, universities for campus connectivity, and WISPs serving vast rural areas where fiber penetration is low. Furthermore, the presence of major technological innovation hubs and key market players ensures rapid commercialization of advanced millimeter-wave (60/70/80 GHz) solutions, particularly for high-capacity urban backhaul. Regulatory environment, particularly the allocation of unlicensed spectrum, is conducive to competitive innovation.

- Europe: Characterized by a strong focus on Smart City initiatives and rigorous regulatory standards (such as GDPR), Europe demonstrates stable growth. Key demand comes from government sectors for public safety communication networks and from established telecom carriers upgrading their backhaul infrastructure to support increased mobile data traffic. Eastern Europe, specifically, presents opportunities for market penetration as governments invest in closing the digital divide, making cost-effective wireless bridges a preferred choice over expensive fiber rollout in historically underserved communities.

- Asia Pacific (APAC): Expected to register the highest growth rate (CAGR), APAC is a high-potential market fueled by massive urbanization, rapid expansion of mobile broadband services, and substantial investment in digital infrastructure by countries like China, India, and Southeast Asian nations. The region's geographical diversity, spanning dense urban centers and vast remote islands, necessitates flexible PTP and PMP solutions for cellular backhaul and last-mile connectivity. Government-led projects aimed at universal internet access are major market drivers, particularly favoring mid-range, cost-efficient 5 GHz and sub-6 GHz solutions.

- Latin America (LATAM): Growth in LATAM is primarily driven by the expansion of WISPs providing services in difficult terrain and highly dispersed populations. Economic viability often dictates the use of wireless solutions over costly fixed infrastructure. Brazil and Mexico are leading markets, characterized by increasing industrial digitization (e.g., in mining and agriculture) which requires robust wireless links for monitoring and data transfer from remote sites, necessitating highly reliable, long-range wireless bridges.

- Middle East and Africa (MEA): The MEA region is witnessing significant growth, largely due to high government spending on large-scale infrastructure projects (e.g., NEOM in Saudi Arabia) and the imperative to connect remote energy and resource exploration sites. The deployment of 4G and 5G networks in urban centers in the UAE and South Africa is increasing demand for high-capacity microwave and mmWave backhaul solutions. Connectivity challenges in rural Africa make cost-effective, long-range wireless bridges essential for extending basic internet access to underserved populations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wireless Bridge Market.- Ubiquiti Networks

- MikroTik

- Tenda

- TP-Link

- Cisco Systems

- Ericsson

- Nokia

- Huawei

- D-Link

- Netgear

- Cambium Networks

- Ceragon Networks

- Siklu

- CommScope

- Radwin

- HFCL

- IgniteNet

- Starry

- Aviat Networks

- Infinet Wireless

Frequently Asked Questions

Analyze common user questions about the Wireless Bridge market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of utilizing a wireless bridge over traditional fiber optic cabling?

Wireless bridges offer significantly lower deployment costs and faster installation times compared to trenching and laying fiber, especially across challenging terrains or public right-of-ways. They provide flexible, high-capacity PTP links necessary for temporary installations or areas where civil work is restricted, making them highly efficient for campus connectivity and remote backhaul.

Which frequency band is currently dominating the Wireless Bridge Market, and what is the future trend?

The 5 GHz band currently holds a large market share due to its balance of range and data throughput in unlicensed spectrum. However, the future trend heavily favors millimeter-wave (mmWave) frequencies (60 GHz and 70/80 GHz). These higher bands are crucial for delivering the multi-gigabit speeds required for 5G infrastructure and enterprise connectivity demanding fiber-equivalent performance.

How do Line-of-Sight (LOS) requirements impact the deployment of high-capacity wireless bridges?

High-capacity wireless bridges, especially those operating in mmWave bands, strictly require a clear Line-of-Sight (LOS) path between antennas to function optimally. Obstructions like buildings or trees can severely degrade the signal. This requirement necessitates meticulous site surveys and professional installation, acting as a critical restraint on deployment flexibility in dense urban environments.

What role does the Wireless Internet Service Provider (WISP) segment play in market growth?

WISPs are crucial drivers, particularly in rural and underserved areas, relying heavily on Point-to-Multipoint (PMP) wireless bridge systems to provide cost-effective last-mile broadband access. The scalability and relatively low infrastructure investment of wireless bridge technology make it the preferred solution for WISPs expanding their coverage footprints rapidly.

What is the significance of Point-to-Multipoint (PMP) technology compared to Point-to-Point (PTP) in the market?

PTP links are used for dedicated, ultra-high-capacity connections between two fixed points (e.g., campus buildings). Conversely, PMP solutions use one central Access Point to connect multiple Subscriber Stations, maximizing network coverage and efficiency. PMP is essential for WISP networks and widespread surveillance systems, offering superior flexibility and scalability for distributing network access.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Wireless Bridge Market Statistics 2025 Analysis By Application (Office, Manufacturing, Education, Commercial, Others), By Type (802.11ac, 802.11n, Others), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Wireless Bridge Market Statistics 2025 Analysis By Application (Office, Manufacturing, Education, Commercial), By Type (802.11ac, 802.11n), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager