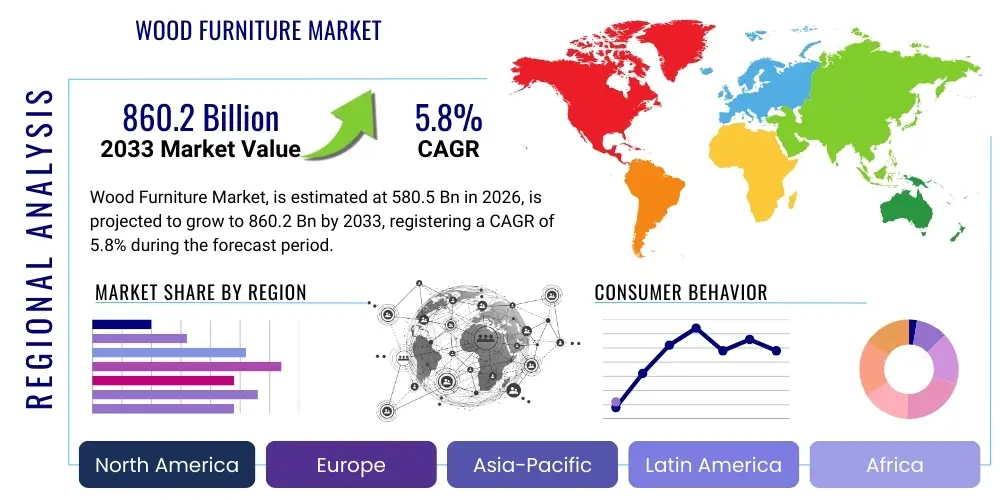

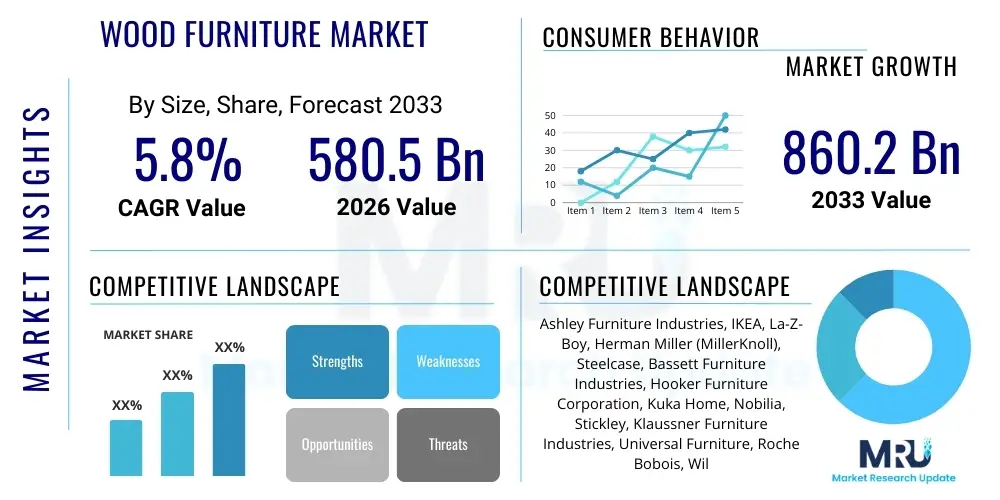

Wood Furniture Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442298 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Wood Furniture Market Size

The Wood Furniture Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $580.5 Billion in 2026 and is projected to reach $860.2 Billion by the end of the forecast period in 2033.

Wood Furniture Market introduction

The Wood Furniture Market encompasses the manufacturing, distribution, and sale of furniture products primarily constructed from wood materials, including solid wood, engineered wood (such as MDF, particleboard, and plywood), and recycled wood derivatives. These products cater to a vast array of end-users across residential, commercial, and institutional sectors, ranging from intricate handcrafted pieces to mass-produced modular units. The enduring appeal of wood furniture is rooted in its aesthetic versatility, durability, natural warmth, and perceived value, making it a foundational element in interior design globally. Product descriptions span diverse categories, including seating, tables, storage units, bedroom sets, and custom architectural millwork, reflecting sophisticated design trends and evolving consumer preferences for multifunctional and sustainable options.

Major applications of wood furniture are broadly segmented into residential use, covering living room, dining room, and bedroom furnishings, and contract or commercial use, involving office spaces, hospitality sectors (hotels, resorts), healthcare facilities, educational institutions, and public areas. The demand is heavily influenced by construction spending, urbanization rates, and the frequency of renovation activities. A significant benefit derived from wood furniture, particularly solid wood, is its longevity and the capacity for repair and refinishing, contributing to a circular economy model. Furthermore, certified sustainable wood sources (like FSC or PEFC) are increasingly favored by environmentally conscious consumers, aligning the industry with global sustainability mandates.

Key driving factors propelling the growth of this market include the rise in disposable incomes in developing economies, leading to increased consumer spending on home aesthetics and interior improvements. The proliferation of e-commerce platforms has revolutionized furniture retail, providing consumers with greater choice, price transparency, and convenient direct-to-consumer delivery options, thereby expanding market accessibility. Moreover, technological advancements in woodworking machinery, material optimization (e.g., lightweighting and strength enhancements in engineered wood), and innovative finishes that enhance durability and aesthetic appeal are consistently stimulating market expansion and competitive differentiation among manufacturers.

Wood Furniture Market Executive Summary

The Wood Furniture Market is characterized by robust resilience and significant transformation, driven primarily by evolving consumer lifestyles and the imperative for sustainable sourcing. Current business trends indicate a strong shift toward digitalization of the supply chain, encompassing everything from computer-aided design (CAD) and automated manufacturing to advanced inventory management and online retail logistics. Manufacturers are heavily investing in Industry 4.0 technologies, such as robotics and CNC machining, to enhance precision, reduce waste, and improve operational efficiency. Design trends emphasize customization, modularity, and the fusion of traditional craftsmanship with contemporary minimalist aesthetics. Furthermore, geopolitical shifts and trade dynamics are influencing sourcing strategies, prompting diversification away from single-region supply dependencies toward more resilient, localized, or regionalized manufacturing hubs.

Regional trends highlight dynamic growth acceleration in the Asia Pacific (APAC) region, particularly driven by rapid urbanization, massive real estate development, and the expansion of the middle class in countries like China and India, making APAC the primary engine of global demand. North America and Europe, while mature markets, exhibit steady demand, focusing on premium, high-quality, and sustainably certified products, often prioritizing repairability and heirloom quality over disposable furniture. In these regions, strict regulatory frameworks regarding volatile organic compounds (VOCs) and material traceability mandate higher production standards, creating market opportunities for eco-friendly manufacturers. Latin America and the Middle East & Africa (MEA) are emerging as high-potential markets, fueled by infrastructure investments, demographic expansion, and growing retail furniture distribution networks.

Segment trends reveal that the residential sector maintains market dominance, but the contract sector is experiencing rapid growth, largely due to sustained demand from the hospitality and commercial real estate renovation cycles post-pandemic. In terms of material type, engineered wood segments, offering cost-effectiveness and flexibility in design, are growing faster than solid wood in mass-market applications, though solid wood retains premium pricing and high demand in luxury and custom segments. Within the product categories, functional and space-saving furniture, such as transformable sofas and multipurpose tables, are seeing heightened demand, reflecting the increasing prevalence of smaller living spaces in urban centers. This focus on utility and optimized footprint is a critical trend influencing product development across all furniture segments.

AI Impact Analysis on Wood Furniture Market

User inquiries regarding AI's impact on the Wood Furniture Market primarily revolve around four key themes: how AI enhances design and customization (e.g., generative design tools), optimization of complex supply chain logistics (demand forecasting and inventory management), automation potential in factory operations (quality control and predictive maintenance), and the role of AI in improving the online customer experience (virtual try-on and personalized recommendations). Consumers and industry stakeholders are keen to understand how AI can maintain the artisanal quality and individuality associated with wood furniture while introducing efficiencies typical of mass production. Key concerns include the initial investment cost for small- to medium-sized enterprises (SMEs) and the potential disruption of traditional craftsmanship roles versus the value proposition of faster time-to-market and reduced material waste.

The implementation of Artificial Intelligence and Machine Learning (ML) in the wood furniture value chain is set to revolutionize operational capabilities, transforming the industry from traditional, labor-intensive manufacturing to an optimized, data-driven ecosystem. In the design phase, generative AI tools can rapidly iterate thousands of designs based on material constraints, structural integrity requirements, and aesthetic preferences, significantly accelerating the product development cycle. Furthermore, AI-powered computer vision systems are being deployed on factory floors for real-time quality inspection, accurately identifying defects in wood grain, joinery, and finish that may be missed by human inspection, thereby guaranteeing higher product consistency and minimizing waste attributable to flaws.

Crucially, AI’s strongest impact is observed in inventory optimization and demand forecasting, especially in an industry characterized by high SKU variability and long lead times. ML algorithms analyze vast datasets of historical sales, seasonal trends, macroeconomic indicators, and even social media sentiment to predict demand with greater accuracy than traditional statistical models. This capability allows manufacturers to adjust production schedules dynamically, reducing costly overstocking or understocking, thus optimizing working capital and improving overall supply chain responsiveness. For end-consumers, AI-driven personalization engines enhance e-commerce platforms by offering tailored product suggestions and enabling sophisticated augmented reality (AR) tools for visualizing furniture placement in their homes, bridging the gap between online browsing and purchase confidence.

- AI-driven Generative Design: Rapid prototyping and creation of optimal, structurally sound furniture designs tailored to specific aesthetic parameters and material availability.

- Predictive Maintenance: Use of ML to analyze machinery sensor data, forecasting equipment failures, and scheduling maintenance proactively, minimizing downtime in CNC and finishing lines.

- Optimized Supply Chain Logistics: Advanced algorithms for demand forecasting, dynamic inventory management, and route optimization for complex furniture delivery networks.

- Automated Quality Control: AI-powered computer vision systems for real-time inspection of wood surfaces, joint integrity, and finish consistency, ensuring superior product quality.

- Personalized Customer Experience: AI chatbots and recommendation engines offering tailored product suggestions and design advice on e-commerce platforms.

- Material Yield Optimization: ML models analyzing wood panel layouts to maximize cutting efficiency and minimize raw material waste, addressing sustainability concerns.

DRO & Impact Forces Of Wood Furniture Market

The Wood Furniture Market dynamics are shaped by a complex interplay of internal growth drivers, external constraints, latent opportunities, and powerful impact forces that dictate the industry's trajectory. Key drivers include global increases in residential construction activity and commercial renovation projects, sustained consumer demand for high-quality, durable home furnishings, and the growing prominence of sustainable and certified wood products. Conversely, the market faces significant restraints, notably the volatility and increasing cost of raw timber resources, stringent environmental regulations impacting logging practices and chemical finishes, and intense competition from substitutes like metal, plastic, and composite materials, which often offer lower price points and easier maintenance. These competitive pressures demand continuous innovation in design and material science to maintain wood furniture's market share.

Opportunities for market expansion are abundant, particularly in the realm of customizable and smart furniture integration. The increasing adoption of modular and multipurpose furniture catering to compact urban living offers significant growth avenues. Furthermore, manufacturers focusing on digitalization—through advanced e-commerce strategies, virtual reality showroom experiences, and efficient digital supply chain management—are positioned to capture larger market shares. The shift towards circular economy models presents opportunities for companies specializing in furniture rental, repair, and refurbishment services, extending the lifecycle of wood products and appealing to sustainability-focused clientele. Investing in advanced manufacturing techniques, such as additive manufacturing for complex components or enhanced wood treatment processes, also represents a critical opportunity for technological differentiation.

Impact forces acting on the market are multifaceted, encompassing macroeconomic instability, geopolitical trade tariffs, and rapid technological disruption. Economic downturns significantly impact consumer discretionary spending on large-ticket items like furniture, creating cyclical demand fluctuations. The increasing awareness and regulatory pressure concerning deforestation and sustainable forestry constitute a potent environmental impact force, compelling companies to achieve verified certifications and transparent sourcing practices. Technologically, the rapid maturation of e-commerce necessitates continuous investment in logistical capabilities (e.g., handling bulky items) and digital marketing to remain visible. Ultimately, the successful navigation of the Wood Furniture Market depends on balancing traditional craftsmanship and material integrity with modern demands for efficiency, customization, and environmental accountability.

Segmentation Analysis

The Wood Furniture Market is comprehensively segmented based on material type, product type, end-user application, and distribution channel, providing a detailed view of market demand patterns and competitive dynamics. Understanding these segments is crucial for strategic planning, allowing businesses to tailor their product offerings and marketing efforts to specific demographic and functional requirements. Segmentation by material helps identify shifts between high-value solid wood and cost-efficient engineered wood, reflecting consumer decisions concerning budget versus longevity. Product segmentation further details demand across essential furniture categories such as chairs, tables, storage, and beds, revealing where the largest volume and value growth lies. The functional needs of residential users versus the high durability and specification needs of contract users define the end-user segments, while distribution channel analysis tracks the ongoing migration of sales from traditional brick-and-mortar stores to robust online retail platforms.

Analysis of product type segmentation shows that seating and tables (including dining and coffee tables) consistently account for the largest revenue share due to their necessity and high replacement frequency in both residential and commercial settings. However, the storage segment, encompassing wardrobes, cabinets, and shelving units, is experiencing accelerated growth driven by the need for organizational solutions in increasingly smaller urban living spaces. Material-wise, while solid wood furniture commands premium prices and caters to the luxury segment, engineered wood, particularly Medium-Density Fiberboard (MDF) and particleboard, dominates the volume segments, favored for flat-pack, ready-to-assemble (RTA) furniture due to its lower cost, consistency, and ease of manufacturing. The strategic focus for manufacturers is increasingly leaning towards optimizing engineered wood quality to mimic the aesthetics of solid wood while maintaining cost advantages.

End-user segmentation clearly delineates the demand profiles. The residential segment remains the largest purchaser, driven by new home purchases, remodeling projects, and routine furniture replacement. The contract segment, comprising businesses such as hotels, corporate offices, and educational institutions, demands large-volume orders with strict specifications on fire safety, durability, and commercial-grade longevity, often requiring custom design solutions. The shift toward hybrid work models, for instance, is driving unique demand for high-quality, ergonomic home office wood furniture, blurring the traditional lines between residential and commercial product specifications. Distribution channels continue their evolutionary trend, with dedicated brand stores and large format furniture retailers maintaining a strong presence for high-touch, consultative sales, while e-commerce gains traction globally, capitalizing on convenience, extensive product catalogs, and competitive pricing for standardized items.

- By Material Type:

- Solid Wood Furniture

- Engineered Wood Furniture (MDF, Plywood, Particleboard)

- Others (Reclaimed Wood, Wood Composites)

- By Product Type:

- Seating (Sofas, Chairs, Stools)

- Tables (Dining Tables, Coffee Tables, End Tables)

- Storage Units (Cabinets, Wardrobes, Shelving)

- Beds and Accessories

- Other Furniture (Office Desks, Outdoor Furniture)

- By End-User:

- Residential

- Commercial/Contract (Office, Hospitality, Retail, Healthcare)

- By Distribution Channel:

- Offline (Specialty Stores, Furniture Chains, Hypermarkets)

- Online (E-commerce Portals, Direct-to-Consumer Websites)

- By Design:

- Modern/Contemporary

- Traditional/Classic

- Transitional

Value Chain Analysis For Wood Furniture Market

The Value Chain Analysis for the Wood Furniture Market begins with upstream activities centered on raw material procurement, encompassing sustainable forestry, timber harvesting, and primary processing into lumber or veneers. This stage is critical, as the quality and sustainability certifications of the raw wood directly influence the final product’s integrity and marketability. Key upstream participants include logging companies and certified timber suppliers. Following primary processing, intermediate activities involve secondary manufacturing, where wood is dried, treated, cut, shaped, and assembled. This phase includes the production of specialized components, such as hardware, finishes, and foam materials, where efficiency, automation (e.g., CNC machinery), and waste reduction are paramount for cost control.

Downstream activities focus on marketing, sales, and distribution to the end-consumer. Distribution channels are bifurcated into direct and indirect methods. Direct channels involve manufacturers selling directly to consumers through their own showrooms or dedicated e-commerce platforms, offering greater control over branding and customer experience, and allowing for mass customization strategies. Indirect channels involve wholesalers, large-format furniture retailers (IKEA, Ashley Furniture), specialty interior design stores, and third-party e-commerce marketplaces (Amazon, Wayfair). The growing dominance of the online distribution channel necessitates sophisticated logistical infrastructure capable of handling large, delicate shipments, often involving last-mile assembly services, which adds complexity but also value to the downstream operations.

The efficiency of the overall value chain is highly dependent on streamlined logistics and inventory management across all stages, especially given the bulkiness and variety of furniture products. Effective supply chain management minimizes lead times and reduces transportation costs, which constitute a significant portion of the final product price. Investment in digital platforms that connect raw material suppliers, component manufacturers, and distributors in real-time is crucial for improving responsiveness. The ability of companies to manage both high-volume standardized production (via indirect channels) and high-margin custom orders (often via direct channels) dictates their competitive position in the market.

Wood Furniture Market Potential Customers

Potential customers for the Wood Furniture Market are segmented primarily across the residential consumer base and various segments of the commercial (contract) sector, each exhibiting distinct purchasing behaviors and product specifications. Residential buyers represent the largest volume segment, encompassing homeowners, tenants, and renovators across diverse demographic and income levels. These consumers typically prioritize aesthetics, comfort, functionality (especially modularity and space-saving features), and durability, often making purchasing decisions based on personal style, brand reputation, and online reviews. The high-net-worth segment within the residential market seeks premium, bespoke, and solid wood heirloom pieces, driven by exclusivity and material quality.

The commercial sector, or contract buyers, constitutes a crucial, high-volume segment that includes procurement managers for hospitality (hotels, resorts, restaurants), corporate offices (desks, conference tables, seating), healthcare institutions (clinics, hospitals), and educational facilities (universities, libraries). These buyers prioritize commercial-grade durability, fire safety compliance, adherence to ergonomic standards, and the ability to handle high-traffic usage. Orders in the contract segment are typically large, often requiring customized specifications, tight delivery timelines, and long-term warranties. Architects, interior designers, and facility management companies frequently act as intermediaries or key decision-makers for commercial procurement, making B2B relationship management vital for manufacturers targeting this segment.

Furthermore, emerging customer segments include organizations involved in the rental and staging market, catering to short-term needs for events, temporary housing, or real estate display purposes. These customers demand flexibility, rapid deployment, and furniture that can withstand multiple assemblies and relocations. Additionally, institutions and government bodies purchasing furniture for public spaces, military facilities, and municipal offices form a specialized segment focused heavily on strict compliance, longevity, and often mandated sustainability standards. Successful market players must maintain product lines that satisfy the aesthetic demands of the residential consumer while meeting the rigorous performance and regulatory requirements of the commercial and institutional sectors.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $580.5 Billion |

| Market Forecast in 2033 | $860.2 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ashley Furniture Industries, IKEA, La-Z-Boy, Herman Miller (MillerKnoll), Steelcase, Bassett Furniture Industries, Hooker Furniture Corporation, Kuka Home, Nobilia, Stickley, Klaussner Furniture Industries, Universal Furniture, Roche Bobois, Williams-Sonoma, Pulaski Furniture. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wood Furniture Market Key Technology Landscape

The technology landscape in the Wood Furniture Market is rapidly advancing, focusing on enhancing precision, maximizing material yield, and enabling design complexity through automation. Computer Numerical Control (CNC) woodworking machinery remains the foundational technology, allowing for intricate cutting, routing, and drilling operations with high repeatability and minimal human error. Advanced multi-axis CNC machines are crucial for producing curved or complex geometric furniture components that were previously expensive or impossible to create manually. Alongside CNC, automated panel processing and edge banding systems have significantly increased throughput in engineered wood manufacturing, enabling efficient production of flat-pack furniture at scale while maintaining rigorous quality standards in joints and finishes.

Beyond physical manufacturing, digitalization and software technologies are transforming the front end of the value chain. Computer-Aided Design (CAD) and Computer-Aided Manufacturing (CAM) software are now seamlessly integrated, allowing designers to move directly from virtual models to machine instructions, dramatically reducing time-to-market. Furthermore, the integration of Augmented Reality (AR) and Virtual Reality (VR) technologies provides consumers with immersive visualization tools, allowing them to preview furniture in their own environments or walk through virtual showrooms. This adoption of spatial computing enhances the online shopping experience and significantly reduces the probability of returns due to size or fit discrepancies, a costly issue in the furniture industry.

The future technology landscape is heavily influenced by smart factory concepts and sustainability. Robotics and collaborative robots (cobots) are increasingly performing repetitive or heavy tasks, such as material handling and assembly line assistance, improving workplace safety and efficiency. Simultaneously, technologies focused on sustainability, such as advanced wood drying kilns optimized by sensors and analytics to reduce energy consumption, and innovative finishing systems that utilize low-VOC (Volatile Organic Compound) or water-based coatings, are becoming industry standard. Traceability technologies, including blockchain or specialized tagging, are also gaining traction to verify the sustainable and ethical sourcing of raw wood materials throughout the entire supply chain, appealing to environmentally conscious consumers and meeting regulatory demands.

Regional Highlights

Regional dynamics are critical to understanding the global Wood Furniture Market, reflecting diverse economic growth patterns, material availability, and cultural design preferences. Each major region contributes uniquely to the market's overall size and growth trajectory, often specializing in particular segments or quality levels. Strategic expansion efforts are frequently tailored to capitalize on the distinct characteristics and maturity levels of these regional markets.

- Asia Pacific (APAC): This region dominates the global market in terms of production volume and is the fastest-growing consumption hub. Driven by massive population size, rapid urbanization, substantial investment in infrastructure, and the expansion of the middle class in countries like China, India, and Vietnam, APAC exhibits immense demand for functional, mass-produced, and semi-custom wood furniture. Vietnam and China, in particular, serve as global manufacturing bases, benefiting from competitive labor costs and robust supply chains, though regulatory pressures related to timber sourcing are increasing.

- North America: Characterized by high consumer spending power and a strong focus on quality and brand recognition. The US and Canada are mature markets where demand is driven by housing market health and home renovation cycles. There is a strong preference for durable, larger-scale furniture, and a growing emphasis on sustainably sourced and domestically manufactured products, often commanding premium prices. E-commerce penetration is extremely high, necessitating sophisticated logistical solutions for bulky goods.

- Europe: This market is highly segmented, driven by strong aesthetic traditions (e.g., Scandinavian minimalism, Italian luxury design) and rigorous environmental standards (e.g., EU Timber Regulation). Countries like Germany, Italy, and France are leaders in high-end design, custom cabinetry, and innovative engineered wood applications. Sustainability, ethical sourcing (FSC/PEFC certification), and adherence to strict low-VOC limits are non-negotiable consumer and regulatory expectations, forcing manufacturers to adopt advanced, eco-friendly production methods.

- Latin America (LATAM): Represents an emerging market with significant long-term growth potential, fueled by improving economic conditions, demographic growth, and rising urbanization, especially in Brazil and Mexico. The demand spectrum ranges from highly cost-sensitive products to rapidly growing segments seeking modern, accessible design. Infrastructure investment and the formalization of retail distribution networks are key factors influencing market accessibility and growth.

- Middle East and Africa (MEA): Growth is primarily concentrated in the Gulf Cooperation Council (GCC) states due to substantial investments in hospitality, luxury residential real estate, and large-scale commercial projects (e.g., NEOM in Saudi Arabia, mega-projects in UAE). This region is characterized by high demand for imported, high-quality, often opulent furniture styles, positioning it as a key market for luxury European and North American exporters. African markets, while nascent, are showing increasing demand driven by rising construction and housing needs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wood Furniture Market.- Ashley Furniture Industries

- IKEA (Inter IKEA Systems B.V.)

- La-Z-Boy Incorporated

- Herman Miller (MillerKnoll)

- Steelcase Inc.

- Bassett Furniture Industries, Inc.

- Hooker Furniture Corporation

- Kuka Home

- Nobilia

- Stickley Furniture

- Klaussner Furniture Industries

- Universal Furniture

- Roche Bobois

- Williams-Sonoma, Inc.

- Pulaski Furniture

- Ethan Allen Global, Inc.

- Hülsta

- Natuzzi S.p.A.

- Manwah Holdings

- Flexsteel Industries, Inc.

Frequently Asked Questions

Analyze common user questions about the Wood Furniture market and generate a concise list of summarized FAQs reflecting key topics and concerns.What key factors are driving the growth of the Wood Furniture Market globally?

Market growth is primarily driven by accelerating global urbanization, increased consumer spending on home aesthetics due to rising disposable incomes, and the robust expansion of the e-commerce sector, which makes furniture more accessible and easier to purchase across international borders.

How is sustainability impacting material sourcing in the wood furniture industry?

Sustainability is a critical factor, compelling manufacturers to seek certified wood sources (FSC, PEFC) and adopt circular economy practices like refurbishment. This shift responds to stringent environmental regulations and strong consumer preference for eco-friendly, ethically sourced products.

Which regional market holds the largest share and which is expected to grow fastest?

The Asia Pacific (APAC) region currently holds the largest market share in terms of volume and is projected to exhibit the fastest Compound Annual Growth Rate (CAGR) through 2033, fueled by massive real estate development and consumer market expansion in countries like China and India.

What is the role of Artificial Intelligence (AI) in modern wood furniture manufacturing?

AI is increasingly used for advanced applications such as generative design, optimizing material cutting to minimize waste, enhancing demand forecasting accuracy, and powering automated quality control systems on the factory floor, thereby boosting efficiency and product consistency.

Are engineered wood or solid wood segments showing higher growth rates?

While solid wood maintains dominance in the high-value and luxury segments, the engineered wood segment (MDF, particleboard) is experiencing faster volume growth. This is due to its cost-effectiveness, consistency in manufacturing, and suitability for popular Ready-to-Assemble (RTA) and flat-pack furniture designs targeted at the mass market.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Solid Wood Furniture Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Pine Wood Furniture Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Hardwood Furniture Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager