Wood Pallets Boxes Packaging Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442882 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Wood Pallets Boxes Packaging Market Size

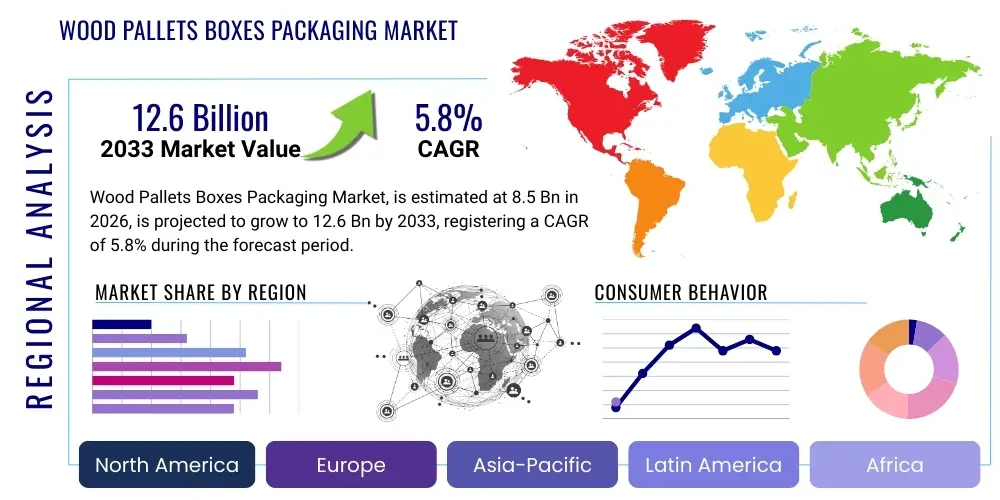

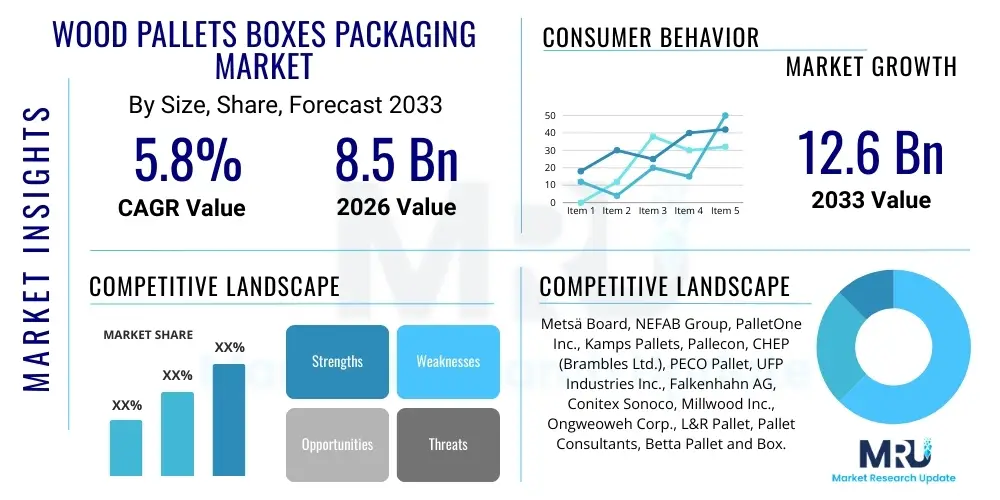

The Wood Pallets Boxes Packaging Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 8.5 Billion in 2026 and is projected to reach USD 12.6 Billion by the end of the forecast period in 2033.

This steady expansion is primarily attributed to the robust growth of international trade and the increasing demand for durable, customizable, and sustainable packaging solutions across diverse industrial sectors. Wood pallets and boxes remain the backbone of global logistics, offering unmatched strength and load-bearing capacity necessary for the transport of heavy and high-value goods. The structural integrity and reparability of wooden packaging provide a significant competitive advantage over alternatives like plastic or metal in high-cycle distribution environments.

Furthermore, evolving sustainability mandates are bolstering the market position of wood packaging. Wood, as a renewable resource, aligns well with corporate environmental responsibility goals, especially when sourced from certified sustainable forests (e.g., FSC or PEFC). Innovations in pallet pooling services and the optimization of lumber processing techniques are further driving down operational costs and extending the lifecycle of these essential logistical assets, thereby ensuring continued market relevance through the forecast period.

Wood Pallets Boxes Packaging Market introduction

The Wood Pallets Boxes Packaging Market encompasses the manufacturing, repair, and distribution of wooden platforms (pallets) and rigid containers (boxes/crates) utilized primarily for the storage, protection, and transportation of goods within the global supply chain. These packaging solutions are fundamental components of unit load handling, facilitating mechanical lifting and stacking, which is crucial for efficient warehousing and freight logistics. The market is highly influenced by macroeconomic indicators such as GDP growth, industrial output, and the expansion of the e-commerce sector, which necessitate reliable and cost-effective bulk packaging.

Wood pallets and boxes offer inherent benefits including high strength-to-weight ratio, excellent shock absorption properties, ease of repair, and superior interlocking capabilities when stacked. Major applications span almost every industry, notably encompassing fast-moving consumer goods (FMCG), food and beverages, chemicals, pharmaceuticals, heavy machinery, and construction materials. The core products include standard stringer pallets (e.g., GMA pallets), block pallets (e.g., European Euro pallets), custom-designed wooden crates, and industrial lumber packaging used for specialized or oversized items.

Key driving factors supporting market momentum include the continuous globalization of supply chains, necessitating standardized and robust shipping platforms; stringent safety regulations requiring stable load securement; and the rising adoption of automated material handling systems in warehouses, which require uniformly constructed pallets. The demand for heat-treated (HT) wooden packaging, compliant with ISPM 15 standards, also continues to grow, supporting cross-border trade and minimizing the risk of pest proliferation, thereby solidifying wood packaging's essential role in international logistics.

Wood Pallets Boxes Packaging Market Executive Summary

The global Wood Pallets Boxes Packaging Market is positioned for stable expansion, underpinned by renewed focus on supply chain resilience and accelerating automation in warehousing. Business trends indicate a shift towards pallet rental and pooling services, which optimize utilization and reduce capital expenditure for end-users, alongside increased investment in digital tracking technologies embedded within wooden assets. Manufacturers are also focusing on optimizing lumber sourcing and treatment processes to meet international phytosanitary standards (ISPM 15), essential for seamless global transit. Consolidation among pallet manufacturers and distributors is a notable trend, aiming for scale and efficiency in servicing large multinational logistics operations.

Regionally, Asia Pacific (APAC) continues to lead market growth due to rapid industrialization, massive infrastructure development, and the burgeoning e-commerce sectors in countries like China and India, driving substantial demand for new packaging units. North America and Europe, while being mature markets, exhibit strong demand driven by continuous innovation in automated warehouses and the preference for sustainable, locally sourced lumber products. These regions are prioritizing closed-loop recycling and pallet refurbishment programs to maximize asset longevity and minimize waste, adhering to circular economy principles.

Segmentation trends reveal that block pallets, favored for their four-way entry and suitability for automated systems, are gaining prominence over traditional stringer pallets. Furthermore, the market for custom-sized industrial crates and boxes is seeing significant growth, catering to specialized logistics needs in the automotive, aerospace, and renewable energy sectors, where precise handling and protection of non-standard components are paramount. Heat-treated wood remains the dominant material segment, mandated by regulatory compliance for nearly all international shipments, securing its long-term viability against alternative materials.

AI Impact Analysis on Wood Pallets Boxes Packaging Market

User queries regarding the impact of Artificial Intelligence (AI) on the wood packaging sector predominantly center on how technology can optimize supply chain efficiency, predict wood demand and pricing, and enhance inventory management. Common concerns involve the integration cost of AI-driven tracking solutions, the potential for AI to influence wood waste reduction strategies, and its role in quality assurance during manufacturing. Users expect AI to move beyond simple automation, providing predictive maintenance insights for pallet pooling assets and optimizing complex logistical routes. The consensus suggests AI's primary influence will be indirect, driving efficiency in the utilization and management of the packaging assets rather than in the raw production process itself.

AI and machine learning algorithms are being increasingly deployed within pallet pooling systems to forecast future demand accurately, minimize idle inventory, and optimize repair and refurbishment schedules. By analyzing historical usage data, seasonal trends, and geopolitical factors, AI can predict regional shortages or surpluses, enabling proactive relocation and reducing transportation costs. Furthermore, AI-powered computer vision systems are being utilized in manufacturing plants for quality control, instantly identifying defects, material inconsistencies, and deviations from specifications, ensuring that manufactured pallets meet the stringent requirements of automated handling systems.

The implementation of predictive logistics platforms, often incorporating AI, fundamentally changes how wood packaging assets are managed downstream. These systems optimize container loading and route planning, reducing the incidence of packaging damage (which often occurs during suboptimal loading), thereby extending the service life of wooden pallets and boxes. This efficiency gain, driven by sophisticated data analysis, translates directly into reduced replacement cycles and lower overall ownership costs for logistics providers and end-users, thus sustaining the wood packaging market against lightweight alternatives.

- AI optimizes lumber yield in manufacturing by minimizing cutting waste.

- Predictive analytics enhances pallet pooling efficiency and asset utilization rates.

- Machine vision systems automate quality control and defect detection in production.

- AI-driven logistics platforms minimize in-transit damage through optimized load planning.

- Forecasting models improve inventory management and reduce storage costs for rental services.

DRO & Impact Forces Of Wood Pallets Boxes Packaging Market

The Wood Pallets Boxes Packaging Market is shaped by a confluence of accelerating drivers related to global trade, persistent restraints concerning supply chain volatility, and substantial opportunities driven by sustainability and technological integration. The primary driver remains the fundamental reliance of standardized global shipping on robust wood packaging. However, market growth is often constrained by the volatile prices and limited availability of lumber, particularly during unexpected macroeconomic shifts or environmental events. The opportunity lies significantly in developing closed-loop circular economy models for wood packaging and leveraging digitalization to optimize asset tracking.

Key impact forces include the increasing global adoption of automated storage and retrieval systems (AS/RS), which impose exacting standards on pallet quality and dimensional stability, forcing manufacturers to enhance precision. Furthermore, environmental regulations promoting sustainable sourcing and mandates, such as the ISPM 15 treatment requirement, act as both a driver for compliance and a barrier for non-certified producers. The competitive threat from plastic pallets, while persistent, is often mitigated by wood’s superior repairability, lower initial cost, and higher friction coefficient, which is often favored in specific material handling environments.

The market faces external pressure from evolving international tariffs and trade agreements, which can alter logistical pathways and subsequently impact packaging demand flows. Internally, the industry is increasingly focused on mechanization within the manufacturing process to counter rising labor costs and improve consistency. This balance of internal technological enhancement and external regulatory adaptation defines the competitive landscape and long-term trajectory of the wood packaging sector through the forecast period.

Segmentation Analysis

The Wood Pallets Boxes Packaging Market is systematically segmented based on product type, material grade, structural design, and end-use application, providing granular insights into demand patterns and competitive dynamics. Product segmentation typically differentiates between pallets (platforms for handling) and boxes/crates (enclosed containers for protection). Further differentiation occurs based on the type of wood treatment applied, with heat-treated (HT) wood dominating international trade segments due to phytosanitary regulations. The design segmentation is critical, distinguishing between block and stringer pallets based on entry points and material handling compatibility, which dictates usage in automated versus conventional warehouses. Analyzing these segments helps stakeholders tailor production capacity and sales strategies to align with specific industrial requirements globally.

Within end-use applications, the FMCG and Food & Beverages sectors represent a significant volume driver due to high-frequency shipment cycles and relatively standardized product sizes, requiring vast quantities of reusable and recyclable pallets. Conversely, the heavy machinery and automotive sectors demand high-load-bearing, custom-designed wooden crates for specialized components and engine blocks, focusing more on protection and structural integrity rather than cycle speed. The pharmaceutical segment, though smaller in volume, mandates stringent quality control and specialized temperature-sensitive packaging solutions, occasionally utilizing hybrid wood-plastic composites.

The primary material segments include softwood (often pine or spruce) due to its cost-effectiveness and ready availability, and hardwood (such as oak or birch) prized for its exceptional durability and load capacity, often reserved for high-cycle pooling systems or extremely heavy loads. Market trends show growing demand for optimized designs that use fewer materials while maintaining load integrity, driven by sustainability goals and cost-reduction initiatives across all segments. This requires continuous innovation in nail patterns, board thickness, and structural reinforcement techniques tailored to modern automated systems.

- By Product Type:

- Wood Pallets (Stringer Pallets, Block Pallets)

- Wood Boxes and Crates

- Wood Skids

- Reels and Spools

- By Material Grade:

- Softwood

- Hardwood

- Composite Wood

- By Application:

- Food and Beverages

- Chemicals and Pharmaceuticals

- FMCG (Fast-Moving Consumer Goods)

- Manufacturing and Industrial (Automotive, Heavy Machinery)

- Building and Construction

- E-commerce and Retail

- By Treatment Type:

- Heat Treated (HT)

- Non-Treated/Chemical Treated (Minimal use, regulatory constraints)

Value Chain Analysis For Wood Pallets Boxes Packaging Market

The value chain for the Wood Pallets Boxes Packaging Market is complex, beginning with upstream raw material sourcing and extending through manufacturing, distribution, and end-of-life management (recycling/repair). Upstream analysis focuses heavily on sustainable forestry management and lumber mills, which process timber into standardized pallet stock lumber (e.g., cants and deck boards). Price volatility in the timber market directly impacts the final cost of wooden packaging, making strategic long-term sourcing agreements crucial for manufacturers. Key challenges upstream include regulatory pressures regarding logging practices, ensuring ISPM 15 compliance through heat treatment facilities, and managing seasonal fluctuations in timber harvesting.

The manufacturing stage involves highly automated assembly lines that convert lumber into finished pallets or customized boxes using specialized nailing and cutting equipment. Manufacturers must focus on precision engineering to meet the exacting dimensional tolerances required by modern automated warehouses. Downstream, the distribution channel is bifurcated: direct sales typically serve large industrial clients or pallet pooling operators, while indirect distribution utilizes packaging distributors or 3PLs (Third-Party Logistics providers) to reach smaller or geographically dispersed end-users. The prominence of pallet pooling services, such as CHEP or PECO, represents a unique downstream segment, acting as both a distributor and a vital asset manager.

Final consumption involves the integration of these assets into complex supply chains. Efficient material handling and asset recovery systems are critical in the downstream phase to maximize the lifespan of the packaging. Direct buyers benefit from customization and dedicated supply, while indirect channels provide flexibility and local inventory access. The growth of the refurbishment and repair segment underscores the market's commitment to circularity, effectively extending the value chain past initial product use and maximizing resource efficiency, which is a major factor in maintaining the cost-competitiveness of wood packaging.

Wood Pallets Boxes Packaging Market Potential Customers

The primary consumers and end-users of wood pallets, boxes, and crates span virtually every sector engaged in the physical movement and storage of goods, driven by the universal need for unit load formation. The most significant potential customer base resides within the logistics-intensive industries where bulk transportation and rigorous handling are routine. This includes multinational corporations operating extensive supply chains, logistics service providers (3PLs and 4PLs), and major retailers managing massive distribution centers. Specific focus is placed on sectors requiring high load capacity, frequent cycling, and adherence to international shipping standards.

Core buyers are concentrated in manufacturing (e.g., automotive assembly plants, electronic component manufacturers), where precision crates protect sensitive equipment, and in the food and beverage industry, which requires high volumes of hygienic, standardized pallets for rapid movement of perishable and non-perishable goods. E-commerce fulfillment centers also represent a burgeoning customer segment, relying on robust pallets to support high-density storage and rapid throughput associated with automated sorting systems. Furthermore, construction and infrastructure projects frequently purchase heavy-duty wooden boxes for the transportation of materials like oversized pipe, specialized tools, and aggregate components.

The market also targets specialized niches, such as the pharmaceutical industry, which demands ISPM 15 certified and often custom-sized skids for temperature-controlled logistics, prioritizing cleanliness and compliance. In addition, large agricultural operations utilize wooden crates for bulk harvesting and storage. The overarching characteristic of all potential customers is the criticality of minimizing product damage during transit and optimizing warehouse efficiency, making the durability and standardized dimensions of wood packaging indispensable for modern operational success.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.5 Billion |

| Market Forecast in 2033 | USD 12.6 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Metsä Board, NEFAB Group, PalletOne Inc., Kamps Pallets, Pallecon, CHEP (Brambles Ltd.), PECO Pallet, UFP Industries Inc., Falkenhahn AG, Conitex Sonoco, Millwood Inc., Ongweoweh Corp., L&R Pallet, Pallet Consultants, Betta Pallet and Box. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wood Pallets Boxes Packaging Market Key Technology Landscape

The technology landscape in the Wood Pallets Boxes Packaging Market is evolving rapidly, moving beyond basic lumber processing to incorporate high-level automation, digitization, and material optimization. Modern manufacturing relies heavily on automated nailing machines and robotic assembly systems, which ensure high throughput and meet the rigorous dimensional tolerances required by automated storage and retrieval systems (AS/RS). These systems use advanced sensors and programmable logic controllers (PLCs) to minimize human error and ensure product consistency, which is paramount for smooth operation in high-speed, contemporary warehouses. Furthermore, sophisticated software is used for design optimization, such as FEA (Finite Element Analysis), to determine the optimal wood species and structure for specific load requirements, reducing material usage without compromising safety.

A major technological advancement is the integration of Internet of Things (IoT) devices and tracking technologies within pallets. Smart pallets, embedded with RFID tags, GPS trackers, or NFC chips, allow for real-time visibility into the supply chain, enabling accurate asset tracking, monitoring of environmental conditions (temperature, shock), and optimizing pooling logistics. This technological layer transforms the wooden pallet from a disposable commodity into a traceable, managed asset, significantly improving efficiency for rental companies and large-scale logistics operators. Data generated by these smart assets feeds into AI and machine learning systems for predictive maintenance and enhanced route optimization.

In terms of material processing, the heat treatment (HT) technology mandated by ISPM 15 continues to be refined for energy efficiency. Modern kilns and treatment chambers offer better temperature control and shorter cycle times, reducing production costs while guaranteeing compliance. Moreover, advancements in wood preservation techniques, including specialized coatings and non-toxic treatments, are being explored to enhance water resistance, fire safety, and overall durability, particularly for pallets exposed to harsh environmental conditions or long-term outdoor storage, thereby extending the utility and service life of the wood packaging assets significantly.

Regional Highlights

Regional dynamics play a crucial role in shaping the Wood Pallets Boxes Packaging Market, influenced by local trade volumes, regulatory environments, availability of timber resources, and the level of adoption of automated logistics infrastructure. North America (NA) and Europe represent mature markets characterized by high labor costs, leading to a strong impetus for automation and highly standardized pallet sizes (e.g., GMA in the US, Euro Pallets in Europe). Demand in these regions is stable, driven heavily by pallet pooling systems and a strong focus on circularity, ensuring high rates of repair and recycling, prioritizing hardwood for durability in pooling operations.

Asia Pacific (APAC) is the fastest-growing region, fueled by massive manufacturing output, infrastructural investment, and explosive growth in cross-border e-commerce and retail logistics, particularly in developing economies like India, Vietnam, and Indonesia. This region demands high volumes of new pallets and crates, often utilizing softwood due to cost considerations, alongside a growing need for compliant ISPM 15 certified packaging for export purposes, driving significant investment in regional treatment facilities. The fragmented nature of the logistics sector in parts of APAC, however, presents challenges regarding standardization and asset recovery.

Latin America (LATAM) and Middle East & Africa (MEA) exhibit varied growth profiles. LATAM's market expansion is tied closely to commodity exports (e.g., agricultural and mining products), requiring heavy-duty wood packaging. MEA, particularly the GCC countries, is witnessing substantial growth driven by diversification strategies and large construction projects, creating high demand for durable wood boxes and specialty crating for equipment. Both regions are increasingly adopting international standards, boosting the necessity for certified wood packaging and structured supply chains.

- North America: Market maturity, strong emphasis on pallet pooling (GMA standard), high automation adoption, focus on robust repair and recycling infrastructure.

- Europe: High regulatory compliance (Euro Pallet standard, ISPM 15), strong influence of circular economy models, significant reliance on both pooled and proprietary wood assets.

- Asia Pacific (APAC): Highest volume demand, rapid e-commerce growth, significant expansion in manufacturing and export logistics, increasing investment in local timber processing capabilities.

- Latin America (LATAM): Demand driven by resource extraction and agricultural exports, fragmented local markets, slow but steady adoption of standardized logistics practices.

- Middle East and Africa (MEA): Growth centered around infrastructure projects and oil & gas industry requirements, rising need for specialized, protective crating solutions, increasing reliance on international supply chains.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wood Pallets Boxes Packaging Market.- CHEP (Brambles Ltd.)

- PalletOne Inc.

- UFP Industries Inc.

- NEFAB Group

- Kamps Pallets

- PECO Pallet

- Millwood Inc.

- Metsä Board

- Conitex Sonoco

- L&R Pallet

- Ongweoweh Corp.

- Universal Forest Products

- Betta Pallet and Box

- Falkenhahn AG

- Pallet Consultants

- Denton Pallet and Skid Company

- Rehrig Pacific Company (Wood Division)

- Litco International Inc.

- Prime Wood Inc.

- Packnet Ltd.

Frequently Asked Questions

Analyze common user questions about the Wood Pallets Boxes Packaging market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand in the Wood Pallets Boxes Packaging Market?

The central driver is the persistent expansion of global trade, particularly the surge in e-commerce and retail logistics, which necessitates high volumes of standardized, robust, and cost-effective unit load platforms for mechanized handling and international shipment compliance (ISPM 15 standards).

How do heat-treated (HT) pallets impact international trade?

Heat-treated (HT) pallets are mandatory for virtually all cross-border shipping under the ISPM 15 regulation. This treatment, involving heating wood to a specific core temperature to eliminate pests, ensures phytosanitary compliance, minimizes the risk of biological contamination, and enables seamless global logistics operations.

What role does technology play in optimizing wood pallet usage?

Technology, specifically IoT integration (RFID, GPS tracking) and AI-driven analytics, transforms pallets into smart assets. This enables real-time asset visibility, minimizes loss rates in pooling systems, optimizes repair cycles through predictive maintenance, and improves efficiency in automated warehousing systems.

What are the key advantages of wood pallets over plastic alternatives?

Wood pallets typically offer lower initial purchase costs, superior strength-to-weight ratios for extremely heavy loads, higher repairability, better friction for stacked stability, and are sourced from a renewable resource, aligning strongly with modern circular economy objectives.

Which geographical region exhibits the fastest growth rate for wood packaging?

The Asia Pacific (APAC) region is projected to register the fastest growth rate, propelled by rapid industrialization, massive infrastructure projects, and the accelerating establishment of sophisticated logistics networks to support enormous domestic and international e-commerce volumes.

The Wood Pallets Boxes Packaging Market serves as a foundational element of the global supply chain, demonstrating remarkable resilience and adaptability despite the ongoing challenges of lumber price volatility and environmental mandates. The demand forecast remains robust, fueled by non-negotiable requirements for unit load standardization, particularly in automated environments and international shipping corridors. Continuous innovations in automation within the manufacturing sector, coupled with the integration of digital tracking technologies, are enhancing the overall efficiency and competitive standing of wood packaging against synthetic alternatives.

A deep dive into segmentation highlights the critical role of the Food & Beverages and FMCG sectors as primary volume drivers, relying on the predictable performance and structural integrity of wood. Simultaneously, niche requirements in specialized industries like pharmaceuticals and heavy machinery drive demand for custom-engineered wooden crates, emphasizing protection and compliance. The future market trajectory is inextricably linked to the success of closed-loop supply chain models, specifically pallet pooling, which maximizes asset utilization and inherently supports sustainability goals by extending the lifecycle of wood assets.

Regional analysis underscores the diverse market maturity levels, with North America and Europe leading in asset management sophistication and sustainability integration, while APAC leads in raw volume growth driven by industrial expansion. Strategic market players are increasingly focusing on vertical integration, securing long-term lumber supply contracts, and investing heavily in ISPM 15 compliant heat treatment capabilities to maintain market access across all major trading blocks. Success in this evolving landscape hinges on the ability to balance cost-effective production with adherence to stringent global quality and environmental standards, utilizing technology as a force multiplier for operational efficiency and compliance assurance across the expansive and complex wood packaging ecosystem.

The long-term outlook for the Wood Pallets Boxes Packaging Market is one of stable modernization, where traditional material superiority is augmented by digital intelligence. Market participants who proactively adopt AI for predictive logistics and invest in durable, digitally traceable assets will capture significant market share. Furthermore, legislative pressure towards sustainable forestry and reduced packaging waste will favor certified wood producers offering transparent, repairable, and highly recyclable products. The strategic importance of wood packaging in global security and efficient resource movement ensures its continued dominance in the logistical framework for the foreseeable future, making targeted investments in sustainability and automation critical determinants of competitive success.

Focusing on the segmentation of the market by wood type, Softwood continues to dominate in volume due to lower cost and widespread availability, making it ideal for one-way shipping and low-cycle use. However, Hardwood is increasingly valued for pooling services and high-cycle applications where longevity and high load capacity are essential, justifying the higher material investment. The integration of composite wood elements, often in specific areas like stringers or runners, aims to mitigate common failure points and extend service life, presenting a minor but growing segment focusing on hybrid solutions that combine the best properties of wood with enhanced structural reinforcement materials. Understanding these material trade-offs is crucial for optimizing packaging selection based on the specific end-use logistics environment.

Market consolidation remains a notable trend, particularly in highly regulated markets like North America and Europe. Major players are expanding their geographical footprint and service offerings, moving towards a comprehensive 'pallet solutions' model that includes rental, repair, inventory management, and specialized packaging consultation. This shift indicates a movement away from simple commodity trading toward high-value service provision. The competitive edge is increasingly found in supply chain flexibility, rapid fulfillment capabilities, and the integration of sophisticated IT systems that provide clients with actionable data regarding asset location and condition, driving efficiency gains across client operations.

The impact of regulatory measures extends beyond ISPM 15, increasingly encompassing carbon footprint reporting and mandated material recycling targets. Companies operating in the Wood Pallets Boxes Packaging Market are responding by investing in third-party environmental certifications (like FSC and PEFC) to demonstrate sustainable sourcing practices. This emphasis on verifiable sustainability not only mitigates regulatory risk but also serves as a strong differentiating factor for corporate clients committed to reducing their Scope 3 emissions. The ability to provide transparent documentation on the entire product lifecycle—from forest to end-of-life—is becoming a non-negotiable requirement for engaging with large, environmentally conscious customers.

Looking ahead, emerging markets in Southeast Asia and parts of Africa present significant untapped potential. While logistical challenges exist (including infrastructure deficits and less mature regulatory frameworks), the sheer projected growth in industrial output and consumer markets in these regions promises substantial long-term demand. Companies entering these markets must navigate local sourcing complexities and establish robust, compliant manufacturing operations, often requiring partnerships with regional timber suppliers. The long-term success of the wood packaging market globally is thus intricately tied to both technological advancement in established economies and foundational infrastructure build-out in rapidly developing regions, ensuring resilient supply and distribution worldwide.

The adoption of standardized pallet sizes globally, while generally beneficial, still faces challenges due to regional historical preferences. The co-existence of standards such as the 48x40 inch GMA pallet (North America) and the 1200x800mm Euro Pallet (Europe) necessitates dual production capabilities for manufacturers serving international clients. This complexity drives demand for specialized pallet management software that can track and optimize mixed fleets across different operational environments, minimizing errors in automated systems designed for specific dimensions. The trend toward truly global standardization, although slow, would unlock immense cross-regional efficiencies for wood packaging producers and users.

Finally, labor dynamics significantly influence the market structure. The manufacturing of wood pallets remains a labor-intensive activity, particularly for custom crates and repair services. The rising cost of labor in developed economies drives manufacturers towards increased automation, using robotic systems for assembly and inspection. In contrast, emerging markets leverage lower labor costs but often face challenges in maintaining the consistent quality and dimensional precision required for automated client operations. The market is thus continuously seeking a technological balance between human precision for customization and robotic efficiency for high-volume, standardized production.

The strategic deployment of manufacturing facilities close to key timber sources (upstream proximity) and major consumption hubs (downstream proximity) is paramount for maintaining cost competitiveness and reducing transportation emissions. This decentralized yet coordinated manufacturing strategy allows major players to mitigate regional lumber price shocks and provide rapid fulfillment to localized logistics centers. The wood packaging market's future health is dependent on sustained investment in supply chain optimization, ensuring that the inherent advantages of wood—its strength, renewability, and cost profile—continue to outweigh the operational complexities of material sourcing and regulatory compliance in a globalized economy.

Advancements in wood preservation techniques are increasingly focusing on non-toxic, environmentally friendly treatments that enhance the lifespan and performance characteristics of the packaging without introducing problematic chemicals. While standard heat treatment addresses phytosanitary concerns, innovations such as modified wood technologies or specialized polymer coatings offer better resistance to moisture, mold, and fire. These advanced treatments increase the initial cost of the pallet but significantly decrease the Total Cost of Ownership (TCO) by reducing the frequency of replacement and repair in challenging operational environments, thus providing a high-value proposition for pooling operators and pharmaceutical logistics providers.

The emergence of "collaborative robotics" (cobots) in the repair sector is a relatively new technological frontier. Repairing damaged pallets—a historically manual and often dangerous task—is being partially automated through cobots that assist human workers with heavy lifting, complex nailing patterns, and inspection tasks. This blending of human dexterity for defect identification and robotic strength for structural repair improves both labor safety and the consistency of the refurbished product, ensuring that recycled pallets meet high-quality standards suitable for re-entry into automated logistics systems.

The financial structuring of the wood packaging market is also seeing evolution. Traditionally dominated by outright purchase, the shift toward rental and pooling models fundamentally alters capital expenditure for end-users, converting it into an operational expenditure (OpEx). This model, spearheaded by major asset managers like CHEP, provides logistics resilience and minimizes the headache of asset tracking and disposal for the user. Consequently, the value chain is increasingly weighted towards service provision and asset management expertise rather than solely manufacturing capability, driving M&A activities focused on acquiring logistics and IT competencies.

In conclusion, the Wood Pallets Boxes Packaging Market is defined by its maturity, resilience, and necessity within global trade. It is a market that efficiently synthesizes renewable material resources with increasingly sophisticated technology. The ability to reliably deliver strong, globally compliant, and environmentally responsible packaging solutions, backed by advanced asset tracking and service management, will dictate leadership in this essential industrial sector through the 2033 forecast horizon. The emphasis on circularity and digital integration ensures that wood packaging remains not just competitive, but foundational to the efficient functioning of modern global supply chains.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager