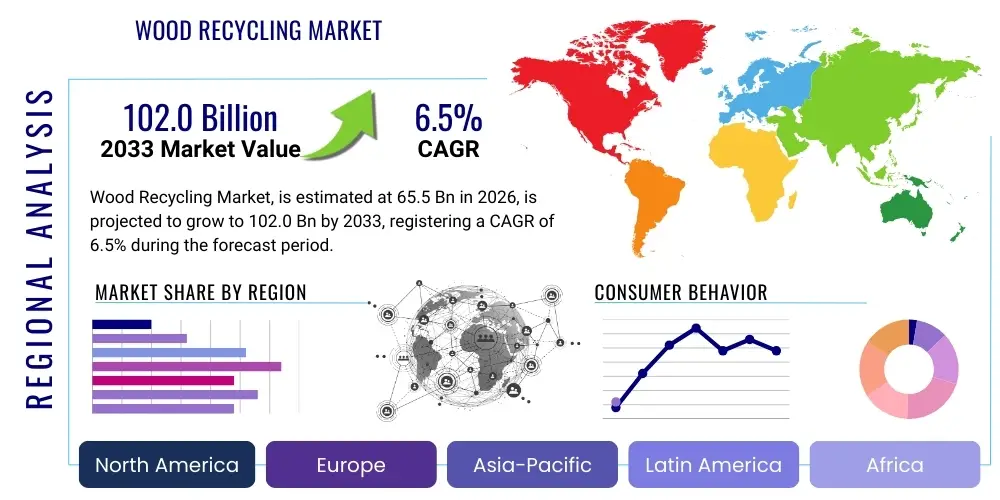

Wood Recycling Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441074 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Wood Recycling Market Size

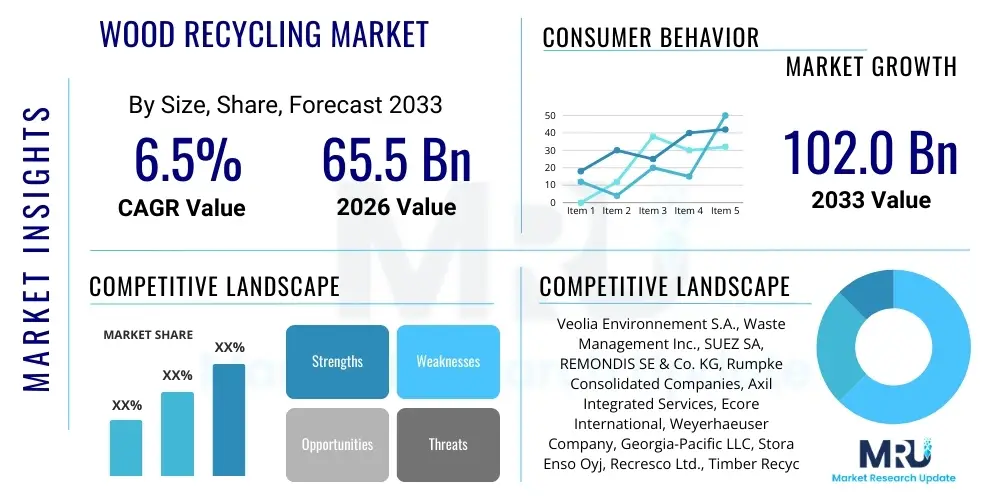

The Wood Recycling Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 65.5 Billion in 2026 and is projected to reach USD 102.0 Billion by the end of the forecast period in 2033.

Wood Recycling Market introduction

The Wood Recycling Market encompasses the collection, processing, and reuse of waste wood materials that would otherwise be destined for landfills. This critical industrial sector addresses global sustainability mandates by transforming wood debris originating from construction and demolition (C&D) activities, industrial manufacturing, packaging, and municipal sources into valuable secondary raw materials or energy feedstock. The primary objective is circularity, minimizing deforestation pressures, and reducing greenhouse gas emissions associated with waste decomposition. Product output ranges from engineered wood products and particleboard to biomass fuel and landscaping mulch, demonstrating high versatility in end-user applications. Heightened regulatory enforcement regarding landfill bans for specific waste streams, particularly in developed economies, is structurally driving market expansion, alongside increasing corporate commitments to environmentally sound procurement practices and closed-loop systems. This transformation is pivotal in shifting the global economy towards resource efficiency and material optimization.

Key products within this market include recycled wood chips used in particleboard and medium-density fiberboard (MDF) manufacturing, shredded wood fiber utilized for animal bedding, playground surfaces, and composting agents, and high-quality wood fuel pellets/chips for energy generation in industrial boilers and combined heat and power (CHP) plants. The technological sophistication involved spans advanced sorting systems, including optical sorters and magnetic separation equipment to remove contaminants, high-throughput shredders, and specialized grinders capable of processing diverse wood types, including treated or painted wood. Furthermore, the market benefits significantly from its direct positive environmental impact, offering a demonstrably lower carbon footprint alternative compared to harvesting virgin timber or energy production from fossil fuels, appealing strongly to environmentally conscious businesses and governmental procurement agencies seeking to meet ambitious climate targets.

Major applications fundamentally span biomass energy production, constituting a substantial percentage of recycled wood usage, especially lower-grade materials; the manufacturing of composite wood products such as oriented strand board (OSB) and fiberboard, utilizing higher-grade sorted materials; and the agricultural/landscaping sector, which uses ground wood for mulch, compost bulking agents, and animal bedding. The intrinsic benefits include cost savings for manufacturers accessing cheaper recycled feedstock compared to virgin timber, enhanced resource security, and compliance with stringent waste diversion mandates. Driving factors include escalating wood waste generation globally due to rapid urbanization and infrastructure projects, supportive government policies promoting bioenergy and circular economy models, and growing consumer demand for sustainable, recycled content products, which collectively create a robust framework for sustained market growth across all geographical regions.

Wood Recycling Market Executive Summary

The Wood Recycling Market is characterized by vigorous business trends driven by the imperative of waste reduction and the transition toward a circular economy model. Key trends include the integration of advanced sorting technologies, such as AI-powered robotics, to increase the purity of recycled wood streams, making them suitable for higher-value applications like furniture and building materials. Furthermore, there is a substantial business shift towards specializing in processing complex or contaminated waste wood (e.g., pressure-treated timber), previously deemed non-recyclable, through innovative chemical and thermal treatment processes. Investment in decentralized micro-recycling facilities closer to waste generation points is optimizing logistics and reducing transportation costs, enhancing overall operational efficiency for major market players and enabling smaller local enterprises to participate effectively in the supply chain.

Regional trends indicate significant divergence based on regulatory maturity and industrial concentration. Europe maintains dominance, primarily due to the European Union’s ambitious waste management directives, high landfill taxes, and strong established markets for biomass energy and composite panel manufacturing, compelling high diversion rates. Asia Pacific, particularly China and India, is emerging as the fastest-growing region, fueled by massive construction booms, increasing wood consumption, and nascent but rapidly evolving government policies supporting waste-to-energy projects and sustainable forestry practices, necessitating rapid expansion of recycling infrastructure. North America is characterized by robust markets for C&D wood recycling and significant uptake in using recycled wood in landscaping and specialized industrial applications, though regional variation exists in regulatory strictness.

Segment trends reveal that the Biomass Fuel application segment continues to capture the largest share of recycled wood volume, especially lower-grade fractions, underpinned by ongoing governmental subsidies and renewable energy targets globally. However, the Composite Wood segment is exhibiting the highest growth rate, reflecting increasing technical capacity to process recycled fibers into high-performance, aesthetically acceptable structural and decorative products, thus achieving maximum material value. Within the Source segmentation, Construction & Demolition (C&D) waste remains the primary feedstock source globally due to the predictable high volume and relative homogeneity of the waste stream compared to mixed municipal sources, leading to specialized processing facilities dedicated solely to C&D debris management and processing.

AI Impact Analysis on Wood Recycling Market

Analysis of common user questions reveals significant interest concerning AI's role in overcoming historical bottlenecks in wood recycling, primarily focused on contamination detection, sorting efficiency, and quality assurance. Users frequently inquire about how AI can accurately differentiate between various wood species and identify hidden contaminants (metals, plastics, hazardous treatments) in high-speed processing environments, which is crucial for maximizing end-product quality, especially for composite wood manufacturing. Concerns also revolve around the capital expenditure required to integrate these complex AI systems and their scalability across diverse facility sizes, ranging from large centralized processing hubs to smaller regional yards. Expectations are high that AI will lead to predictive maintenance of heavy machinery, optimizing uptime and reducing operational costs, thereby transforming the economics of wood waste processing from a high-labor, low-precision operation to a technologically sophisticated, highly reliable industry. Key themes indicate that AI is seen not just as an efficiency tool but as a necessary innovation to meet stricter global quality standards for secondary raw materials.

- AI-powered optical sorting systems significantly increase the purity and separation rate of mixed wood streams by identifying different wood grades and contaminants in real-time.

- Predictive analytics driven by machine learning algorithms optimize equipment maintenance schedules, reducing unplanned downtime for grinders and shredders, leading to higher operational reliability.

- Computer vision enhances quality control processes by automatically scanning wood chips or fibers, ensuring they meet precise specifications for particle size and moisture content, particularly vital for high-grade applications like furniture boards.

- AI enables optimized inventory management and logistics by forecasting waste input volumes from C&D sites and industrial partners, leading to more efficient collection routes and storage capacity utilization.

- Advanced data analysis supports complex market pricing strategies by correlating input material quality and final product demand, thereby maximizing revenue generation from differentiated recycled wood products.

- Robotic picking arms, guided by AI, safely and rapidly remove difficult or dangerous contaminants (e.g., large metal pieces) before primary processing, protecting valuable machinery from damage.

DRO & Impact Forces Of Wood Recycling Market

The Wood Recycling Market operates under substantial structural influences, where regulatory mandates act as the primary Drivers, demanding high waste diversion rates and imposing significant landfill levies, thereby making recycling economically superior to disposal. Restraints primarily involve the variability and contamination levels of feedstock, particularly treated and mixed construction wood, which complicates processing and limits the material’s suitability for high-value uses, necessitating costly sorting and purification steps. Opportunities are concentrated in developing sophisticated technologies for upcycling lower-grade recycled wood into specialty chemicals or advanced biofuels (biorefining), expanding the total addressable market beyond traditional composite panels and biomass. These forces converge to create a dynamic environment where the Impact Forces of stringent environmental policies and fluctuating virgin timber prices strongly dictate investment in advanced recycling infrastructure, pushing the market towards greater technical complexity and higher material recovery rates globally.

Specifically, market Drivers include the expanding global focus on embodied carbon reduction in construction materials, which favors recycled wood over virgin timber; significant growth in the biomass energy sector, which relies heavily on residual wood feedstock; and increasing consumer and institutional preferences for sustainable products documented through certifications like the Forest Stewardship Council (FSC) Recycled label. Conversely, key Restraints also encompass the cyclical nature of the construction industry, which affects feedstock supply consistency, and the high energy consumption required for comminution (grinding and chipping) processes, which impacts operational profitability, especially when energy costs spike. Furthermore, inconsistent regulatory enforcement across different regions creates disparity in the competitive landscape, challenging global standardization efforts.

The Opportunities emerging from these dynamics center on the chemical recycling of wood polymers, which allows for the recovery of lignin and cellulose for bio-based materials, creating entirely new, high-margin product lines. Additionally, there is a burgeoning market opportunity in utilizing recycled wood in 3D printing applications for construction, offering precision and customization while adhering to material sustainability goals. The Impact Forces emphasize that societal pressure for zero-waste initiatives combined with technological advancements in contamination removal are forcing recyclers to invest in modernization, transforming them from simple waste handlers into sophisticated material processors. This shift is crucial for market participants seeking long-term resilience and profitability by navigating the complex interplay between material quality requirements, energy inputs, and regulatory compliance obligations across major global economies.

Segmentation Analysis

The Wood Recycling Market is primarily segmented based on the Source of the waste material, the Application or end-use of the recycled product, and the Type of Wood being processed. This segmentation is crucial as the quality, processing required, and eventual market value are highly dependent on the source material characteristics, such as moisture content, degree of contamination, and type of protective treatment applied. The application segment, particularly the distinction between lower-value biomass and higher-value composite materials, determines the profitability trajectory of recycling facilities, influencing technological investment decisions. Analyzing these segments helps stakeholders understand specific demand drivers and supply dynamics within various sub-sectors of the wood waste management value chain across different operational landscapes.

- Source:

- Construction & Demolition (C&D) Waste

- Industrial Waste (Pallets, Crates, Manufacturing Scraps)

- Municipal Waste (Yard Waste, Furniture)

- Application:

- Biomass Fuel (Energy Generation, Heat Production)

- Composite Wood (Particleboard, MDF, OSB)

- Animal Bedding and Mulch (Landscaping, Agriculture)

- Others (Compost Bulking Agents, Specialty Fillers)

- Product Type:

- Virgin/Clean Wood

- Treated/Contaminated Wood (Painted, Pressure Treated)

Value Chain Analysis For Wood Recycling Market

The Value Chain for the Wood Recycling Market begins with the Upstream activities centered on wood waste generation and collection, predominantly from construction sites, industrial facilities, and municipal transfer stations. This initial stage involves intricate logistics, including specialized fleet management and contract negotiation with waste producers, where efficiency in collection density is paramount to cost control. Following collection, the material enters the primary processing stage involving sorting, metal removal, and initial grinding (comminution). This stage is capital-intensive, requiring specialized, heavy-duty machinery capable of processing variable and often contaminated feedstocks, with output quality directly influencing downstream usability and market value. Optimized upstream management drastically reduces processing costs and maximizes material integrity, establishing a competitive edge.

The Downstream phase focuses on the refinement and transformation of processed wood fibers into marketable end-products. This includes drying, screening, and further size reduction (milling) to meet precise specifications required by manufacturers of composite panels (e.g., specific particle geometry for MDF) or energy producers (e.g., moisture content thresholds for biomass pellets). The distribution channel varies significantly based on the end-product: high-volume, lower-value products like biomass chips often move through bulk commodity channels directly to power plants or large industrial facilities (Direct Distribution), whereas higher-value products like specialized mulch or composite wood feedstock might be sold via specialized distributors or brokers who service smaller manufacturing clients or retail landscaping suppliers (Indirect Distribution). Direct sales channels are often employed by large vertically integrated recyclers who own or contract power generation facilities.

The market relies heavily on a robust network connecting waste generators to processors and end-users. Direct channels offer greater control over quality assurance and faster feedback loops, beneficial for specialized, high-specification materials. Indirect channels, leveraging brokers and intermediaries, are essential for penetrating fragmented end-markets like residential landscaping or small-scale animal husbandry. The overall efficiency of the value chain is increasingly being enhanced by digitalization, using IoT and telemetry to track material flow, monitor contamination rates in real-time, and optimize material blending strategies to meet precise customer technical requirements, thereby bridging the gap between waste generation and high-value material utilization.

Wood Recycling Market Potential Customers

Potential customers for recycled wood materials are highly diverse, spanning major industrial sectors driven by their material input needs, cost efficiency, and corporate sustainability mandates. The primary end-users or buyers fall into three main categories: manufacturers of composite wood products (e.g., particleboard, fiberboard), entities engaged in energy production (power plants, industrial boilers, CHP facilities), and agricultural/landscaping organizations. These customers rely on recycled wood as a cost-effective, environmentally preferred alternative to virgin timber or fossil fuels. For composite panel manufacturers, the consistent supply of clean, appropriately sized wood fiber is paramount, driving demand for high-purity streams derived mainly from C&D or industrial off-cuts. These manufacturers often purchase material under long-term supply contracts to ensure stability.

Energy producers, encompassing both large-scale utilities and smaller institutional heating plants, represent the largest volume consumers, prioritizing caloric value, moisture consistency, and low ash content in the biomass fuel they procure. Their purchasing decisions are heavily influenced by prevailing natural gas prices and governmental support mechanisms (e.g., renewable energy credits or subsidies) that favor bioenergy generation. Furthermore, the agricultural sector, including commercial farms and large-scale nurseries, represents a steady market for lower-grade processed wood utilized as animal bedding (e.g., poultry or equestrian facilities), ground cover, or as a carbonaceous additive in composting processes, where material contamination tolerance is generally higher but specifications regarding material texture and absence of specific chemicals are strict.

A growing segment of buyers includes infrastructure contractors and civil engineering firms that utilize recycled wood in erosion control applications, road construction stabilization, and specialized land reclamation projects, demanding bulk quantities of material meeting specific environmental and engineering standards. The modern potential customer base is increasingly sophisticated, demanding transparency regarding the source, processing methods, and environmental certifications (e.g., verification of non-hazardous treatment), driving recyclers toward better documentation and traceability. Essentially, any sector seeking resource efficiency, cost reduction in raw materials, and documented sustainability improvements is a prime target for recycled wood products, reinforcing the broad commercial relevance of the recycling industry.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 65.5 Billion |

| Market Forecast in 2033 | USD 102.0 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Veolia Environnement S.A., Waste Management Inc., SUEZ SA, REMONDIS SE & Co. KG, Rumpke Consolidated Companies, Axil Integrated Services, Ecore International, Weyerhaeuser Company, Georgia-Pacific LLC, Stora Enso Oyj, Recresco Ltd., Timber Recycling Systems, Evergreen Recycling, Viridor, WestRock Company, Renewable Fiber Inc., Biffa plc, GreenWaste Recovery Inc., DS Smith plc, Unison Recycling. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wood Recycling Market Key Technology Landscape

The technological landscape of the Wood Recycling Market is characterized by a drive toward higher efficiency, increased material purity, and the ability to process previously challenging waste streams. Central to this evolution are advanced comminution technologies, including specialized slow-speed shredders and high-speed grinders equipped with robust sensor systems to detect and prevent damage from contaminants like metal or rock, maximizing uptime and reducing maintenance costs. Furthermore, automated sorting systems, utilizing a combination of magnetic separators for ferrous metals, eddy current separators for non-ferrous metals, and increasingly sophisticated optical sorting or near-infrared (NIR) spectrometry, are crucial for achieving the high levels of cleanliness required for composite wood manufacturing. These sorting advancements allow recyclers to move beyond simple bulk chipping toward producing distinct, high-specification raw materials, commanding premium pricing and expanding market applicability.

A significant area of technological investment is in the processing of treated or contaminated wood. This includes innovative thermal treatment processes, such as pyrolysis or gasification, which safely decompose hazardous chemical treatments (like chromated copper arsenate, or CCA) while recovering energy or valuable char residues, thus unlocking a massive potential supply stream that is otherwise restricted from conventional recycling routes or landfill disposal. Moisture management technology, including sophisticated drying and dewatering systems, is also vital, particularly for biomass applications where energy value is inversely proportional to moisture content. Modern recycling facilities are increasingly integrating IoT and centralized control systems, allowing operators to monitor material flow, energy consumption, and equipment performance remotely, leading to highly optimized resource utilization.

The industry is also witnessing the emergence of biological and chemical recycling methodologies. Biological processes, such as specialized enzymatic or fungal treatments, are being researched to selectively degrade specific contaminants or chemically modify wood fibers to improve compatibility for composite materials. Chemical recycling involves breaking down the lignocellulosic structure of wood into fundamental biochemical components (lignin, cellulose, hemicellulose), which can then be utilized in the production of high-value bio-plastics, specialty chemicals, and advanced liquid biofuels, representing the highest potential value uplift in the recycling chain. These technologies, while currently high in capital expenditure, promise to fundamentally shift the industry from a low-value commodity market towards a specialized bio-resource sector, driven by advanced material science and sustainable chemistry principles.

Regional Highlights

Regional dynamics play a crucial role in shaping the Wood Recycling Market, driven by distinct regulatory landscapes, economic development stages, and reliance on virgin timber resources.

- Europe: Dominated by rigorous EU directives targeting high resource efficiency and aggressive landfill reduction targets. Germany, the UK, and France are leaders, exhibiting mature markets for biomass fuel and particleboard production from recycled sources. High landfill taxes make recycling economically mandatory, sustaining high investment in advanced sorting infrastructure.

- North America (NA): Characterized by strong activity in Construction & Demolition (C&D) wood recycling, especially in urban centers of the US and Canada. The market is driven by large-scale timber industries and a substantial demand for landscaping materials and animal bedding. Regional variations in regulation mean certain states/provinces lead in material diversion (e.g., California), while others lag.

- Asia Pacific (APAC): The fastest-growing region, fueled by massive infrastructure investment and urbanization, leading to unprecedented volumes of C&D waste. China and India are key growth drivers, focusing heavily on waste-to-energy projects utilizing wood biomass and rapidly developing composite wood manufacturing capabilities. Policy enforcement related to waste sorting is rapidly increasing, creating massive future opportunities.

- Latin America (LATAM): Market development is uneven, with countries like Brazil showing greater maturity due to large agricultural and timber industries providing significant residue, especially for self-consumption biomass use. Infrastructure remains a challenge, but increasing international investment is fostering modernization in urban waste management systems.

- Middle East and Africa (MEA): A nascent but high-potential market, driven by large-scale construction projects (e.g., Gulf Cooperation Council states). The focus is primarily on basic grinding and chipping for use in site stabilization or temporary construction needs, with formal recycling structures still developing, offering strong future potential for international players.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wood Recycling Market.- Veolia Environnement S.A.

- Waste Management Inc.

- SUEZ SA

- REMONDIS SE & Co. KG

- Rumpke Consolidated Companies

- Axil Integrated Services

- Ecore International

- Weyerhaeuser Company

- Georgia-Pacific LLC

- Stora Enso Oyj

- Recresco Ltd.

- Timber Recycling Systems

- Evergreen Recycling

- Viridor

- WestRock Company

- Renewable Fiber Inc.

- Biffa plc

- GreenWaste Recovery Inc.

- DS Smith plc

- Unison Recycling

- Hadfield Wood Recyclers

- Re-Gen Waste Ltd.

- Metsä Group

- Smurfit Kappa Group

Frequently Asked Questions

Analyze common user questions about the Wood Recycling market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers accelerating the growth of the Wood Recycling Market?

The key drivers are stringent government regulations imposing landfill bans and high disposal fees on wood waste, growing global demand for renewable biomass energy, and increasing corporate sustainability initiatives requiring the use of recycled content in manufacturing and construction sectors.

How does AI technology improve the profitability and efficiency of wood recycling operations?

AI significantly enhances profitability by integrating automated optical sorting systems that drastically increase the purity of recycled wood streams, making them viable for higher-value applications like particleboard, while predictive maintenance algorithms minimize costly operational downtime of high-throughput machinery.

Which application segment holds the highest growth potential in the Wood Recycling Market?

While Biomass Fuel currently consumes the largest volume, the Composite Wood manufacturing segment (producing MDF, particleboard, and OSB) exhibits the highest growth potential due to technological advancements enabling cleaner feedstock and strong market pull for structurally sound, sustainable building materials globally.

What is the main challenge associated with recycling Construction and Demolition (C&D) wood waste?

The primary challenge is the high variability and contamination level of C&D waste, specifically the presence of hazardous treatments (e.g., paint, preservatives) and foreign materials (metals, plastics, dirt), which requires extensive and costly pre-processing, limiting its suitability for premium end-uses.

Which geographical region leads the global Wood Recycling Market in terms of regulatory maturity and market penetration?

Europe leads the global market, primarily driven by the European Union's aggressive circular economy policies, established biomass energy infrastructure, and consistently high recycling rates mandated by regional directives, ensuring high market maturity and technological adoption.

Is recycled wood suitable for structural applications in construction?

Recycled wood, especially highly purified and processed fibers, is widely used in composite wood products (like OSB and specialized particleboards) that serve structural and non-structural applications. However, regulatory standards often mandate specific processing and certification to ensure structural integrity and safety standards are consistently met in load-bearing environments.

How do fluctuating energy prices affect the Wood Recycling Market?

Fluctuating energy prices have a dual effect: high energy costs increase the operational expenses for comminution (grinding) in recycling facilities; simultaneously, high fossil fuel prices increase the competitiveness and demand for recycled wood biomass as a more stable and cost-effective energy alternative, boosting the volume segment of the market.

What is chemical recycling and its role in wood waste management?

Chemical recycling involves breaking down the complex lignocellulosic polymers in wood into fundamental chemical components such as sugars, lignin, and cellulose. This process allows for the creation of high-value bio-based chemicals and advanced materials, representing a key opportunity for utilizing low-grade or contaminated wood that is unsuitable for mechanical recycling.

Are there substitutes for recycled wood biomass in the energy sector?

Yes, key substitutes include traditional fossil fuels (coal, natural gas), agricultural residues, municipal solid waste (MSW) derived fuels, and other dedicated energy crops. However, recycled wood often offers a favorable balance of availability, lower sulfur content, and sustainable sourcing compared to many of these alternatives.

What certifications are important for recycled wood products in the construction industry?

Important certifications include Forest Stewardship Council (FSC) Recycled certification, which verifies the percentage of recycled material used; third-party verification of non-hazardous status; and meeting specific international and national building standards for fire rating and structural performance, crucial for market acceptance.

How is the logistics challenge of collecting dispersed wood waste being addressed?

The logistics challenge is being addressed through optimized route planning utilizing GIS and real-time tracking (IoT), the establishment of decentralized transfer stations or material recovery facilities (MRFs) closer to urban waste generation zones, and collaborative agreements between recyclers and major waste haulers to consolidate collection streams.

Does the recycling process affect the potential toxicity of treated wood waste?

Yes. Simply grinding treated wood only changes its form, not its toxicity. Specialized processes, such as high-temperature thermal treatments (e.g., gasification) or chemical washing/extraction, are required to safely neutralize or separate hazardous chemicals (like CCA or creosote) before the recovered fibers can be utilized, often restricting its use to only energy recovery.

What is the role of the municipal waste stream in the overall wood recycling supply?

Municipal solid waste (MSW) provides a steady, albeit highly mixed, source of wood waste, primarily consisting of yard waste (clean wood for mulch/compost) and discarded household items (furniture, packaging). While generally lower in volume purity compared to C&D waste, it contributes significantly to landscaping and biomass segments and requires extensive pre-processing.

How are advancements in panel technology driving demand for recycled wood?

Advancements in bonding agents and refining processes allow manufacturers to produce composite panels with performance characteristics rivaling those made from virgin wood, even when using higher percentages of recycled fiber. This technological improvement widens the acceptable feedstock pool and stabilizes demand for high-quality recycled input materials.

What investment levels are typical for establishing a high-capacity wood recycling processing plant?

Investment levels vary significantly based on capacity and required output quality. Establishing a high-capacity plant focusing on advanced sorting and composite-grade output can require tens of millions of USD, primarily dedicated to specialized shredders, optical sorting technology, material handling systems, and advanced environmental compliance infrastructure.

How do global trade dynamics influence the market for recycled wood chips?

Global trade dynamics significantly influence pricing, as recycled wood chips and pellets are major internationally traded commodities, particularly for biomass fuel used in European and Asian power markets. Trade restrictions, shipping costs, and international quality standards dictate the economic viability of exporting processed wood materials across continents.

What is the future outlook for the use of recycled wood in 3D printing applications?

The future outlook is promising but nascent. Recycled wood fibers can be incorporated into bio-composite filaments used in large-scale additive manufacturing for construction components and specialized furniture. This application requires extremely fine, highly consistent powder, pushing technological limits on wood particle size reduction and blending.

Why is the purity of recycled wood feedstock so critical for composite material production?

Purity is critical because contaminants like metal, plastic, or chemicals interfere with the bonding process of resins, weakening the final composite panel, potentially damaging milling equipment, and leading to product defects. High purity ensures structural integrity, compliance with formaldehyde emission standards, and manufacturing efficiency.

What role does government policy play in regulating the definition of "waste wood"?

Government policies are fundamental, defining what constitutes "waste," "recyclable material," and "hazardous waste wood." These definitions determine disposal requirements, levy taxes, and mandate handling procedures (e.g., whether painted wood is classified as non-hazardous residual or requires specialized treatment), greatly impacting operational costs and market supply availability.

How is carbon accounting influencing corporate procurement of recycled wood?

Recycled wood often has a significantly lower embodied carbon footprint compared to virgin materials. Corporations pursuing ambitious net-zero or sustainability goals actively seek out documented recycled wood products to reduce their Scope 3 emissions related to raw material extraction and production, making environmental documentation a major procurement criterion.

What are the limitations of current mechanical recycling processes for wood?

Current mechanical processes struggle with highly mixed, chemically treated, or extremely wet wood waste. They are also limited by the need for continuous contaminant removal, which reduces throughput, and the inability to effectively separate wood species, leading to generalized output rather than highly specified input materials for certain high-end manufacturing.

Which industrial sector generates the largest volume of recyclable wood waste?

Globally, the Construction and Demolition (C&D) sector generates the largest predictable volume of recyclable wood waste, encompassing timber framing, decking, formwork, and associated packaging materials, although processing costs are often high due to the presence of nails and fasteners.

How does the Wood Recycling Market contribute to climate change mitigation?

The market mitigates climate change primarily by diverting wood waste from landfills, where decomposition produces methane (a potent greenhouse gas), and by substituting carbon-intensive virgin timber and fossil fuels with recycled wood products and biomass fuel, thus closing the carbon loop and reducing reliance on high-emission alternatives.

What technological advancements are crucial for processing low-grade wood into high-grade biomass pellets?

Crucial advancements include highly efficient drying technologies (like rotary drum dryers) to reduce moisture content below required thresholds, precise screening and sizing equipment, and specialized pelletizing machinery that can compress variable-density wood fiber into uniform, high-density fuel pellets suitable for global commodity markets.

In the Value Chain, where is the highest operating cost incurred in wood recycling?

The highest operating cost is typically incurred in the energy-intensive comminution (shredding and grinding) phase due to the high power demand of heavy machinery, coupled with the ongoing costs of equipment wear-and-tear and replacement parts necessitated by processing abrasive and often contaminated materials.

Are small, localized wood recycling operations economically viable?

Yes, small, localized operations are viable, particularly if they focus on specific niche markets such as high-value mulch, localized animal bedding supply, or acting as initial transfer/pre-processing hubs for larger centralized facilities, thereby minimizing high long-haul transportation costs associated with bulk waste transport.

What is the typical lifespan of equipment like heavy-duty wood grinders?

The lifespan of heavy-duty grinders and shredders varies significantly but typically ranges from 7 to 15 years, highly dependent on the type of feedstock processed, rigorousness of maintenance schedules, and timely replacement of high-wear parts like screens, hammers, and cutting blades.

How do the costs of collecting wood waste compare between urban and rural areas?

Collection costs are generally lower in dense urban areas due to higher waste concentration (density) leading to optimized route efficiencies. Rural collection is more expensive due to longer haul distances and lower material density, often necessitating specialized regional aggregation points to consolidate feedstock volumes economically.

What are the emerging markets for recycled wood fiber outside of energy and construction?

Emerging markets include the production of activated carbon (biochar) for soil amendment and water filtration, utilization in bio-composites for the automotive industry (interior panels), and as feedstock for specialized bio-refineries producing biodegradable plastics and biochemicals, offering high-margin product diversification opportunities.

How does the increasing adoption of engineered wood products impact the feedstock quality for recyclers?

The increased adoption of engineered wood (glulam, laminated veneer lumber) complicates recycling feedstock quality because these materials often contain strong, non-separable adhesives and resins that are difficult to break down mechanically and require specialized thermal or chemical processes, adding complexity to traditional recycling streams.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager