Wooden Ceiling Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442987 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Wooden Ceiling Market Size

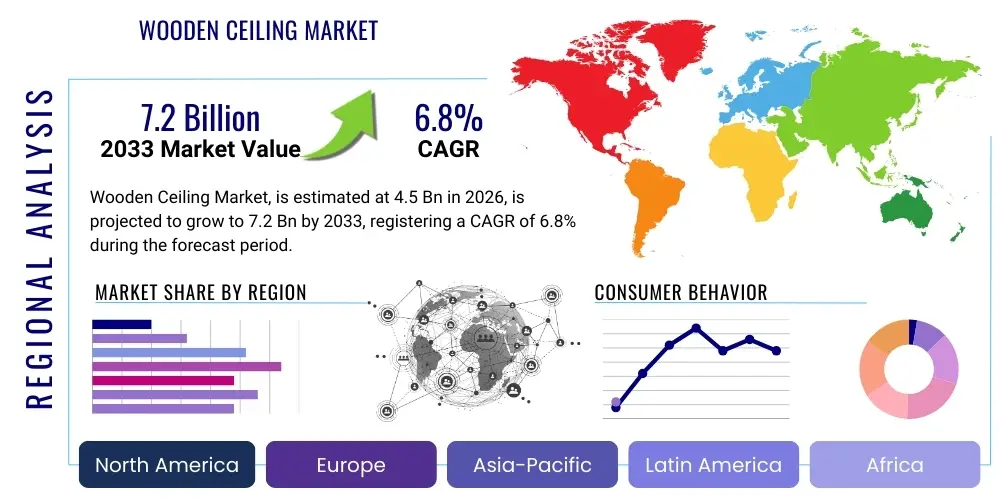

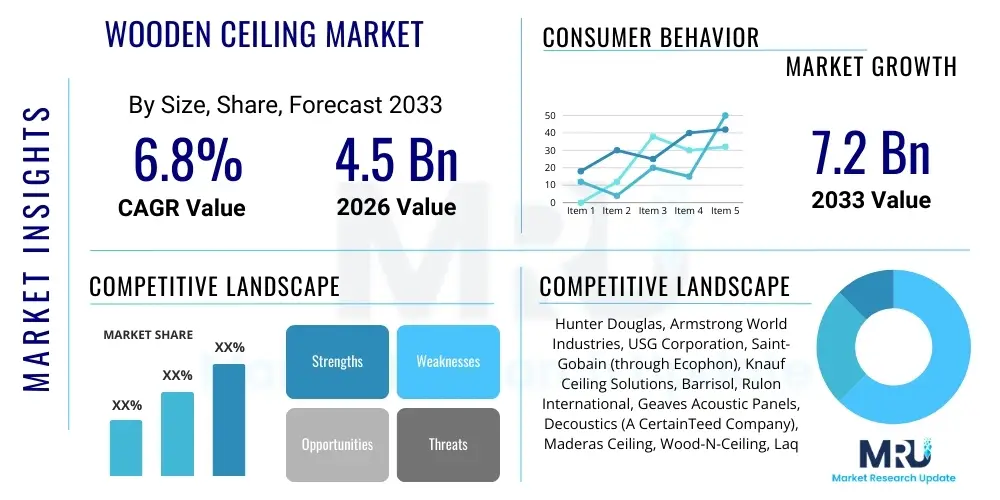

The Wooden Ceiling Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.2 Billion by the end of the forecast period in 2033. This substantial growth is driven primarily by the escalating demand for sustainable building materials and increasing consumer preferences for premium, aesthetically pleasing interior finishes in both residential and commercial infrastructure projects globally. The market expansion is further supported by innovations in wood processing techniques, allowing for enhanced durability and fire resistance in modern wooden ceiling systems.

Wooden Ceiling Market introduction

The Wooden Ceiling Market encompasses the manufacture, distribution, and installation of various ceiling systems utilizing natural or engineered wood materials, ranging from solid wood panels and beams to acoustic perforated panels and veneered tiles. These products serve as critical architectural elements, enhancing both the thermal and acoustic properties of indoor spaces while contributing significantly to interior design aesthetics. Major applications span high-end residential construction, luxury hospitality sectors, corporate offices, and institutional buildings where natural, warm finishes are highly valued. The primary benefits include superior acoustic performance, inherent aesthetic appeal, insulation properties, and the sustainability profile of wood compared to synthetic materials.

Key driving factors accelerating market penetration include the resurgence of biophilic design principles in architecture, which emphasize connecting occupants with nature, thereby boosting the utilization of natural materials like wood. Furthermore, stringent environmental regulations promoting sustainable construction practices are favoring wood products sourced from certified forests. Technological advancements, such as the development of lightweight wood composites and specialized treatments for moisture and fire protection, have broadened the applicability of wooden ceilings in diverse environmental conditions, overcoming traditional limitations associated with moisture susceptibility and flammability. This synthesis of aesthetic value, functional performance, and environmental consciousness positions wooden ceilings as a crucial growth segment within the broader construction materials industry.

Wooden Ceiling Market Executive Summary

The Wooden Ceiling Market is characterized by robust business trends focusing on innovation in modular designs and bespoke solutions catering to architectural specificity. A major trend involves the integration of advanced features such as concealed lighting, integrated ventilation systems, and specialized acoustic backing, transforming the ceiling from a passive component into an active part of the building system. Companies are increasingly investing in sustainable sourcing and traceability to meet the rising demand for certified environmentally friendly products, leveraging certifications like FSC (Forest Stewardship Council) to gain a competitive edge. The market structure remains moderately fragmented, with specialized manufacturers competing on quality, customization capability, and installation efficiency, while mergers and acquisitions among regional players are observed to consolidate expertise and expand geographic reach, particularly into high-growth urban centers.

Regionally, the market exhibits strong growth momentum across Asia Pacific (APAC), driven by rapid urbanization, significant investments in luxury residential complexes, and the proliferation of high-end commercial spaces in countries like China and India. North America and Europe, while being mature markets, continue to demonstrate steady demand, fueled by renovation projects and the strong adoption of energy-efficient and aesthetically conscious interior designs. Segment trends highlight the increasing preference for acoustic wooden ceiling panels, particularly in office environments and educational institutions, to comply with evolving standards for occupant well-being and productivity. Furthermore, the residential segment shows growing adoption of solid wood ceilings, particularly in high-net-worth individual properties, emphasizing classic and timeless design elements. Engineered wood products are gaining traction due to their enhanced stability and cost-effectiveness compared to solid wood alternatives.

AI Impact Analysis on Wooden Ceiling Market

Common user inquiries regarding the influence of Artificial Intelligence (AI) on the Wooden Ceiling Market frequently revolve around optimizing design workflows, predicting material defects, and enhancing construction project management efficiency. Users often question how AI can facilitate faster, customized ceiling designs that integrate complex geometries and acoustic requirements without extensive manual iteration. Concerns also focus on AI’s role in material wastage minimization, supply chain forecasting, and predictive maintenance for installed wooden ceilings, especially concerning moisture content and structural integrity over time. The core expectation is that AI will streamline the entire lifecycle, from forest resource management and material processing to installation planning and quality control on-site. The analysis confirms a growing anticipation that AI algorithms will revolutionize customized product manufacturing and logistics, thereby significantly lowering production costs and lead times for complex, architectural wooden ceiling projects.

- AI-driven parametric design tools accelerate the creation of complex, customized wooden ceiling patterns and systems, integrating acoustic modeling automatically.

- Predictive analytics optimize material yield during lumber processing, minimizing waste and improving cost efficiency for manufacturers.

- Machine learning algorithms enhance quality control by identifying microscopic defects or inconsistencies in wood panels before lamination or installation.

- AI optimizes supply chain logistics, forecasting demand fluctuations for specific wood species and ensuring timely delivery to large-scale construction sites.

- BIM (Building Information Modeling) integrated with AI assists in clash detection and precise installation planning for intricate suspended ceiling systems.

- IoT sensors embedded in smart wooden ceilings, coupled with AI, enable predictive maintenance related to thermal shifts or excess moisture accumulation.

DRO & Impact Forces Of Wooden Ceiling Market

The Wooden Ceiling Market is fundamentally driven by architectural trends favoring natural, sustainable materials and the increasing emphasis on improving indoor air quality and acoustic comfort in commercial and residential spaces. Restraints primarily involve the high initial cost associated with premium wood species and complex custom installations, alongside inherent challenges related to wood’s susceptibility to moisture damage, fire risk, and thermal expansion if not properly treated. Opportunities abound in developing advanced composite wood products, focusing on bio-based treatments that offer superior fire resistance and moisture stability, thereby expanding application scope to high-humidity environments. The impact forces indicate that demand-side dynamics, such as rising consumer disposable incomes and a global shift toward LEED (Leadership in Energy and Environmental Design) certified construction, exert a strong positive influence, compelling manufacturers to innovate rapidly in both aesthetics and functional performance.

The major driver remains the global surge in green building initiatives, where wooden ceilings contribute positively to the embodied carbon reduction goals of construction projects, often qualifying for preferred environmental certifications. The aesthetic superiority and warmth provided by wooden finishes continue to command a premium in luxury markets, ensuring sustained demand despite higher material costs. Conversely, the market faces strong restraint from fluctuating raw material prices, particularly for exotic or certified premium wood species, which introduces volatility into manufacturing costs and pricing strategies. Furthermore, regulatory hurdles concerning fire safety standards in public and high-rise commercial buildings often necessitate extensive and costly fire-retardant treatments, posing a logistical and financial challenge for broader market adoption, especially in densely populated urban centers where steel and concrete alternatives are often preferred for structural integrity and rapid construction.

Opportunities are critically linked to technological innovation, specifically in developing innovative mounting systems that simplify installation and reduce overall project timelines, thus mitigating the high labor costs typically associated with custom wood installations. Geographic expansion into emerging economies with rapidly growing construction sectors, particularly Southeast Asia and parts of the Middle East, represents untapped market potential. The impact forces manifest strongly in competitive rivalry, where differentiation is achieved through design patents, material sourcing transparency, and superior acoustic engineering capabilities. Supplier power is moderate, influenced heavily by forest management practices and timber supply chain resilience, while buyer power remains significant in large commercial projects demanding stringent adherence to budget and highly customized specifications. The threat of substitutes, primarily gypsum, metal, and PVC ceilings, forces constant innovation in wood-based alternatives to maintain a clear value proposition based on aesthetic and ecological superiority.

Segmentation Analysis

The Wooden Ceiling Market is comprehensively segmented based on material type, product type, application (acoustic properties), and end-user vertical. This stratification allows for a nuanced understanding of market dynamics, revealing varying growth rates and preferences across different consumer groups and architectural needs. Material segmentation differentiates between solid wood, engineered wood (plywood, MDF, HDF), and wood composites, each catering to distinct price points and structural requirements. Product type segmentation includes traditional panels, linear slats, grids, and customized beams, reflecting the versatility of wooden ceilings in design implementation. The core drivers for segmentation growth are the evolving acoustic requirements in modern office spaces and the increasing architectural complexity in high-end residential and hospitality projects demanding bespoke, aesthetically integrated solutions that utilize premium materials effectively.

- By Material Type:

- Solid Wood (Oak, Maple, Walnut, Teak)

- Engineered Wood (Plywood, Veneered MDF, HDF)

- Wood Composites and Laminates

- By Product Type:

- Panels and Tiles (Rectangular, Square)

- Linear and Slatted Systems

- Grids and Open Cell Systems

- Custom/Bespoke Ceiling Systems

- By Application (Acoustic Properties):

- Standard/Decorative Ceilings

- Acoustic Absorbing Ceilings (Perforated, Micro-perforated)

- Sound Diffusing Systems

- By End-User:

- Residential (Single-family, Multi-family)

- Commercial (Offices, Retail, Hospitality)

- Institutional (Education, Healthcare, Government Buildings)

- By Installation Method:

- Suspended/Lay-in Systems

- Direct Mount Systems

- Torsion Spring Systems

Value Chain Analysis For Wooden Ceiling Market

The value chain for the Wooden Ceiling Market commences with the upstream activities of raw material procurement, involving certified forest logging and timber processing. This stage is crucial, focusing heavily on sustainability certifications (e.g., FSC, PEFC) which dictate the premium price and market acceptance of the final product. Midstream activities involve the specialized manufacturing and processing of timber into ceiling-specific components, including veneering, lamination, cutting, acoustic perforation, and application of fire-retardant and moisture-resistant treatments. This manufacturing phase requires significant capital investment in precision machinery and quality control systems to ensure dimensional stability and finish consistency for architectural grade products. Efficiency in this stage, particularly in minimizing material waste and optimizing resource utilization, is a key determinant of competitive advantage.

Downstream analysis highlights the critical role of distribution channels, which are typically bifurcated into direct and indirect routes. Direct sales often involve large-scale commercial projects where manufacturers engage directly with architects, interior designers, and major construction contractors to provide highly customized solutions and technical support throughout the design and installation phases. Indirect channels, which serve the smaller residential and renovation markets, rely on a network of specialized distributors, authorized dealers, and large-format home improvement retailers. Effective channel management, including logistics for bulky and sometimes fragile wood components, is essential for ensuring product integrity and timely project completion. The installation phase, often requiring specialized carpentry and alignment expertise, represents the final and highly value-adding step in the chain.

The channel structure is increasingly optimized for technical specification and customization. Architectural firms and specifiers act as key influencers, demanding high technical data regarding acoustic performance, fire rating, and environmental provenance. Manufacturers who invest in strong digital presence, offering BIM-ready models and extensive technical documentation, secure a greater share of the project market. Profit margins tend to be highest at the specialized manufacturing and direct installation phases, reflecting the complexity and bespoke nature of the products. Controlling the upstream sourcing costs while maintaining high quality in the midstream production defines the profitability, making long-term partnerships with sustainable timber suppliers a strategic necessity for market leaders in the wood ceiling industry.

Wooden Ceiling Market Potential Customers

The primary end-users and buyers of wooden ceiling systems span a diverse spectrum, categorized largely into three major sectors: commercial, residential, and institutional. Within the commercial sector, the hospitality industry, including luxury hotels and high-end resorts, represents a significant customer base, valuing the warm aesthetics and premium feel of wood to create distinctive guest experiences. Corporate offices and co-working spaces are rapidly adopting wooden ceilings, particularly acoustic panel systems, driven by the need to enhance employee well-being, focus, and productivity through superior sound management and biophilic design integration. Retail outlets and premium shopping centers utilize wooden ceilings to define sophisticated brand environments and differentiate their interior architecture, establishing an exclusive atmosphere that encourages consumer dwelling time.

The residential market, particularly the high-net-worth segment and bespoke luxury home builders, constitutes a crucial customer group focused on solid wood and customized veneered solutions for living areas, master suites, and dedicated entertainment spaces. These customers prioritize unique design, material authenticity, and long-term durability, often incorporating intricate designs and specialized wood species to achieve a personalized aesthetic that standard materials cannot replicate. Institutional buyers, including universities, theaters, concert halls, and specialized medical facilities, prioritize functional attributes such as superior fire resistance ratings and stringent acoustic performance over pure cost-effectiveness, opting for highly engineered, often perforated or slotted wood panels designed for optimum sound clarity and public safety compliance.

In essence, the potential customer base is unified by a collective prioritization of quality, aesthetics, and sustainability, moving beyond basic functionality offered by substitute materials. Architects and interior designers serve as crucial intermediary customers, influencing the final purchase decision based on product specification, technical reliability, and the manufacturer’s capability to deliver bespoke systems on demanding project schedules. Targeting these design influencers through continuous education, providing advanced technical libraries, and showcasing successful large-scale installations are essential strategies for manufacturers looking to capture higher market share and establish brand preference among the most valuable customer segments across the global construction landscape.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Hunter Douglas, Armstrong World Industries, USG Corporation, Saint-Gobain (through Ecophon), Knauf Ceiling Solutions, Barrisol, Rulon International, Geaves Acoustic Panels, Decoustics (A CertainTeed Company), Maderas Ceiling, Wood-N-Ceiling, Laqfoil, Lindner Group, Ceilings & Interiors, Mosaik Design & Build, Supawood Architectural Lining Systems, Acoustical Solutions, Acoustic Ceilings, Inc., Chicago Metallic (A Rockfon Company), Spigogroup. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wooden Ceiling Market Key Technology Landscape

The Wooden Ceiling Market's technology landscape is defined by innovations aimed at improving wood durability, acoustic performance, and ease of installation. A pivotal technology is the development and application of advanced non-toxic, clear-coat fire-retardant treatments (FRT) that meet stringent global fire safety classifications (e.g., Euroclass, ASTM E84) without compromising the natural aesthetic of the wood. Furthermore, sophisticated Computer Numerical Control (CNC) routing and laser cutting technologies are essential for creating micro-perforated or slotted acoustic panels with extremely precise geometry, maximizing sound absorption coefficients (NRC values) while maintaining visual uniformity. These precision manufacturing processes enable mass customization, allowing architects to specify unique panel shapes and perforation patterns that were previously prohibitively expensive or impossible to produce manually, thereby driving product differentiation.

Another crucial technological area is the advancement in engineered wood product fabrication, particularly in cross-laminated timber (CLT) applications for ceiling systems, and high-pressure veneering techniques. These technologies ensure dimensional stability, mitigating wood's natural tendency to warp or crack due to environmental moisture and temperature fluctuations. The integration of patented, hidden suspension and clip systems represents a significant installation technology advancement. These systems enable quicker, tool-less assembly and disassembly for maintenance access, reducing labor costs on-site and enhancing the overall longevity and accessibility of the ceiling plenum. Such advancements are critical for positioning wooden ceilings as a viable, durable alternative to traditional gypsum board or metal grid systems in large commercial environments where rapid deployment is often a critical contractual requirement.

Furthermore, digital technologies, especially Building Information Modeling (BIM) compatibility, are increasingly non-negotiable for key players. Manufacturers are providing extensive libraries of 3D objects and digital twins of their products, enabling seamless integration into architectural design software, facilitating precise material take-offs, and ensuring accurate coordination with other building services like HVAC and lighting. The focus is shifting towards 'smart ceilings,' where embedded IoT sensors monitor environmental factors (temperature, humidity, air quality) and communicate with building management systems, optimizing HVAC cycles and contributing to overall building efficiency. This technological convergence transforms the wooden ceiling from a static decorative element into an active, intelligent component of the modern sustainable building infrastructure, driving demand in technologically advanced construction projects globally.

Regional Highlights

- Asia Pacific (APAC): APAC is anticipated to be the fastest-growing region, driven by massive investment in commercial real estate, rapid urbanization, and a growing middle class demanding high-quality interior finishes. Countries like China, India, and Southeast Asian nations are witnessing a surge in luxury hospitality projects and corporate office construction, leading to high adoption of both decorative and acoustic wooden ceiling systems. The availability of diverse timber resources and competitive manufacturing capabilities further bolsters regional growth, though regulatory fragmentation across countries remains a minor challenge.

- North America: North America holds a substantial market share, characterized by a strong emphasis on sustainable building certifications (e.g., LEED, WELL standards) and a mature renovation market. Demand is strong for acoustically superior, aesthetically diverse engineered wood products in commercial spaces, particularly in technology hubs and educational institutions. The region benefits from robust construction codes that drive continuous innovation in fire and structural safety, favoring products that integrate seamlessly into complex HVAC and lighting systems.

- Europe: Europe represents a mature but stable market, underpinned by strong regulatory frameworks prioritizing environmental sustainability (e.g., EU Green Deal) and the inherent cultural appreciation for wood in design. Countries like Germany, the UK, and Scandinavia lead the adoption, focusing heavily on locally sourced, certified timber and innovative acoustic solutions for heritage restoration and modern office fit-outs. High labor costs necessitate the adoption of fast-installing, modular wooden ceiling systems, which is a key market differentiator.

- Latin America (LATAM): The LATAM market is emerging, with growth concentrated in urban centers of Brazil and Mexico, driven by foreign investment in tourism infrastructure and high-end residential developments. Market penetration is slower due to economic volatility and reliance on imported specialized products, but local manufacturers are beginning to scale up production of basic veneered and laminate wooden ceiling options to cater to price-sensitive segments.

- Middle East and Africa (MEA): MEA presents high potential, particularly within the Gulf Cooperation Council (GCC) nations, fueled by mega-projects in hospitality, luxury retail, and government infrastructure (e.g., Saudi Vision 2030 projects). The demand is overwhelmingly skewed towards bespoke, high-luxury solid wood and veneered ceilings capable of withstanding extreme arid climates, often requiring specialized, high-specification moisture and fire treatments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wooden Ceiling Market.- Hunter Douglas

- Armstrong World Industries

- USG Corporation

- Saint-Gobain (through Ecophon)

- Knauf Ceiling Solutions

- Barrisol

- Rulon International

- Geaves Acoustic Panels

- Decoustics (A CertainTeed Company)

- Maderas Ceiling

- Wood-N-Ceiling

- Laqfoil

- Lindner Group

- Ceilings & Interiors

- Mosaik Design & Build

- Supawood Architectural Lining Systems

- Acoustical Solutions

- Acoustic Ceilings, Inc.

- Chicago Metallic (A Rockfon Company)

- Spigogroup

Frequently Asked Questions

Analyze common user questions about the Wooden Ceiling market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Wooden Ceiling Market?

The Wooden Ceiling Market is projected to exhibit a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033, driven by increasing preference for sustainable materials and aesthetic demands in high-end construction.

How do wooden ceilings address acoustic performance in commercial spaces?

Wooden ceilings significantly enhance acoustic performance through specialized designs such as micro-perforated panels, slotted systems, and integrated acoustic backing, effectively absorbing sound and reducing reverberation in offices, halls, and classrooms.

What are the primary challenges restraining the adoption of wooden ceilings?

Key challenges include the high initial cost compared to conventional ceilings, the necessity for stringent fire-retardant treatments to meet building codes, and susceptibility to moisture and humidity if not properly engineered and sealed.

Which geographical region is expected to lead market growth?

The Asia Pacific (APAC) region is forecasted to lead market growth due to rapid infrastructure development, increased urbanization, and rising investment in luxury residential and commercial projects across key economies like China and India.

How is AI influencing the manufacturing of wooden ceiling systems?

AI is transforming manufacturing by enabling advanced parametric design for bespoke systems, optimizing material yield using predictive analytics, and enhancing quality control through machine learning to ensure defect-free, precision-cut panels.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager