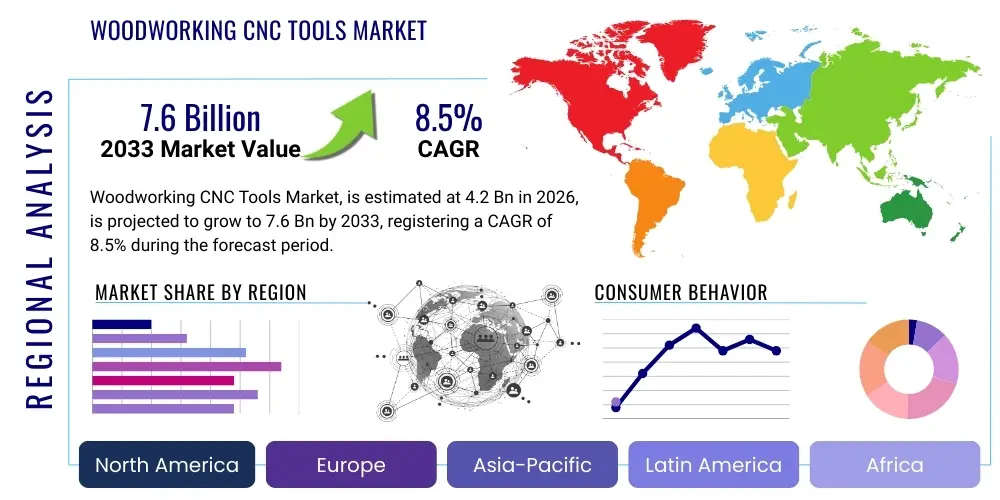

Woodworking CNC Tools Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441847 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Woodworking CNC Tools Market Size

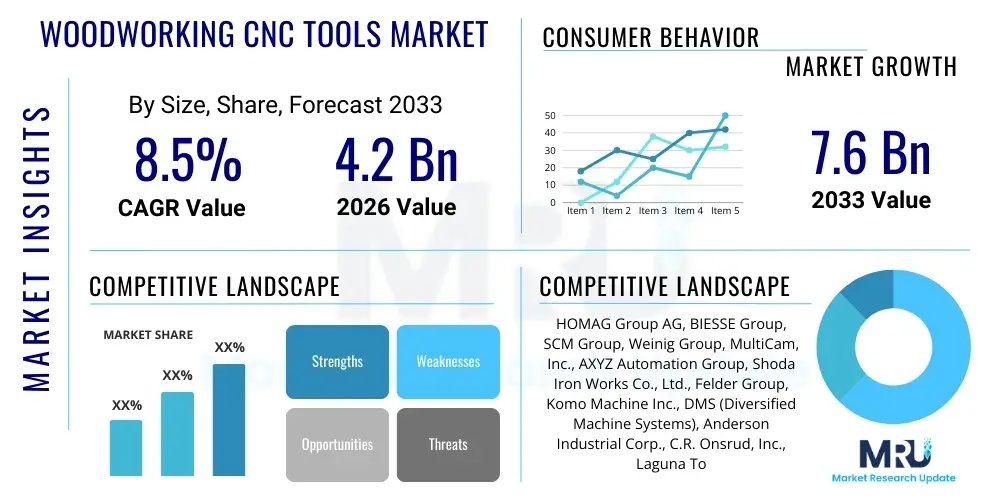

The Woodworking CNC Tools Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 4.2 Billion in 2026 and is projected to reach USD 7.6 Billion by the end of the forecast period in 2033.

Woodworking CNC Tools Market introduction

The Woodworking Computer Numerical Control (CNC) Tools Market encompasses advanced machinery and peripheral cutting instruments used for automated, high-precision processing of wood materials, including solid wood, plywood, MDF, and particleboard. These tools are integral to modern manufacturing, replacing manual labor with digitized, repeatable processes that enhance efficiency, reduce waste, and allow for complex design execution. Key products include CNC routers, machining centers (3-axis, 4-axis, and 5-axis), lathes, and specialized cutting heads and bits made from materials like carbide and diamond, optimized for diverse wood densities and cutting applications.

Major applications of these sophisticated tools span across several high-growth industries, notably high-end furniture production, custom cabinetry, architectural millwork, flooring manufacturing, and specialized wood craft. The adoption is driven by the global shift towards personalized products and mass customization, where traditional manual methods cannot meet the stringent demands for consistency and complex geometric shaping required by modern interior design and construction standards. Furthermore, these machines significantly improve workplace safety and mitigate the reliance on increasingly scarce skilled manual labor, thereby optimizing operational expenditure over the long term.

The core benefits driving market expansion include unparalleled precision and repeatability, crucial for maintaining tight tolerances across large production runs. CNC tools enable rapid prototyping and flexible production schedules, adapting quickly to design changes via integrated CAD/CAM software. The primary driving factors are the rapid adoption of Industry 4.0 standards, increasing automation in manufacturing sectors worldwide, robust growth in the residential and commercial construction industries, and technological advancements leading to more affordable and user-friendly CNC systems, making them accessible even to smaller specialized workshops.

Woodworking CNC Tools Market Executive Summary

The Woodworking CNC Tools Market is experiencing robust acceleration driven by paradigm shifts in manufacturing toward automation and digitalization. Key business trends indicate a strong move toward integrated software solutions that facilitate seamless design-to-production workflows, alongside a rising demand for multi-functional 5-axis machines capable of intricate, one-step processing, thereby significantly reducing setup times and handling costs. The competitive landscape is characterized by innovation focused on developing intelligent tools featuring predictive maintenance capabilities and enhanced energy efficiency, aiming to lower the total cost of ownership for end-users globally. Furthermore, strategic partnerships between software developers and hardware manufacturers are becoming crucial for providing comprehensive, turnkey solutions to large industrial clients.

Regionally, Asia Pacific (APAC) stands out as the primary engine of market growth, fueled by massive industrial expansion, rapid urbanization, and heightened investment in residential and commercial infrastructure, particularly in emerging economies like China, India, and Southeast Asian nations. North America and Europe, while mature markets, emphasize technological superiority, focusing on adopting highly automated, specialized machinery that integrates Artificial Intelligence (AI) for process optimization and defect detection. Regulatory frameworks promoting sustainable forestry and reduced material waste are also indirectly bolstering the demand for precision CNC tools in these regions.

Segment-wise, CNC routers maintain the largest market share due to their versatility and broad applicability in furniture and cabinetry, but the 5-axis machining centers segment is projected to exhibit the highest CAGR, reflecting the industry's need for complex geometries and faster turnaround times. Based on end-use, the custom furniture manufacturing segment is growing rapidly, propelled by consumer preferences for personalized, high-quality bespoke products. Component-wise, the demand for high-performance cutting tools made of advanced materials like polycrystalline diamond (PCD) is surging, driven by their extended lifespan and ability to maintain precision at high processing speeds.

AI Impact Analysis on Woodworking CNC Tools Market

User inquiries regarding the influence of Artificial Intelligence (AI) on the Woodworking CNC Tools Market primarily center on three areas: automation sophistication, predictive capabilities, and operational efficiency gains. Common questions explore how AI can move beyond basic automation to enable self-optimizing tool paths, whether AI-driven sensors can reliably predict tool wear and prevent costly downtime, and the extent to which AI integration might reduce the need for highly specialized human operators, thereby addressing the persistent skilled labor shortage. Users are also concerned about the ease of integrating new AI modules into existing machinery infrastructure and the potential return on investment (ROI) derived from these technologies.

The analysis indicates a strong user expectation that AI will be the foundational technology for the next generation of smart woodworking factories. Key themes revolve around leveraging machine learning algorithms to process vast amounts of operational data—such as material density variations, spindle load, and temperature fluctuations—to dynamically adjust cutting parameters in real-time. This dynamic optimization ensures consistent quality regardless of material anomalies, which is a significant challenge in natural wood processing. Furthermore, users anticipate AI-powered vision systems to enhance quality control by automatically identifying and flagging defects (e.g., knots, cracks) on the wood surface before or during processing, minimizing material loss.

Overall, AI's influence is seen as transformative, moving CNC tools from programmed execution systems to intelligent, adaptive manufacturing platforms. This shift is expected to radically enhance efficiency, reduce operational costs associated with material waste and unplanned maintenance, and standardize production quality across different production batches and facilities. The successful integration of AI, however, depends heavily on developing standardized communication protocols between diverse CNC hardware and software platforms, a key challenge that vendors are actively addressing to fulfill market expectations.

- AI-driven optimization of cutting speeds and feed rates based on real-time material feedback.

- Implementation of predictive maintenance using machine learning to forecast tool replacement needs, minimizing unexpected downtime.

- Enhanced quality control through AI vision systems capable of real-time defect identification and material grading.

- Autonomous tool path generation and collision avoidance, simplifying complex programming tasks.

- Reduced energy consumption through AI algorithms that optimize machine power utilization during idle and operational phases.

DRO & Impact Forces Of Woodworking CNC Tools Market

The dynamics of the Woodworking CNC Tools Market are shaped by powerful Drivers promoting automation, significant Restraints related to investment and skill requirements, and compelling Opportunities centered on technological evolution and geographic expansion. The primary driving forces include the sustained global growth of the furniture and cabinetry industries, especially the custom and ready-to-assemble (RTA) segments, coupled with the critical shortage of skilled manual labor in developed economies, making automation an economic imperative. Furthermore, stringent global standards for precision and surface quality in architectural millwork necessitate the use of highly accurate CNC machinery, reinforcing market growth. These drivers collectively push manufacturers to adopt sophisticated automated solutions to maintain competitiveness and production scale.

However, the market faces notable Restraints that impede widespread adoption, particularly in small and medium enterprises (SMEs). The initial capital outlay required for purchasing high-end CNC machining centers is substantial, creating a significant barrier to entry. Additionally, the complexity associated with operating, programming, and maintaining advanced CNC systems necessitates a workforce with specialized technical skills, which are often expensive or difficult to recruit. Economic volatility and trade uncertainties can also lead to delayed capital expenditure decisions by furniture manufacturers, temporarily slowing market momentum. Addressing these restraints requires manufacturers to develop financing solutions and simplified, intuitive software interfaces.

Opportunities for growth are concentrated in the increasing adoption of 5-axis machining for complex, contoured wood components, which opens new avenues for artistic and functional designs previously difficult to achieve. The market also benefits significantly from the expansion into untapped emerging markets in Africa and Latin America, where rapid industrialization is beginning to create demand for high-capacity woodworking machinery. Furthermore, the integration of Industrial Internet of Things (IIoT) sensors and cloud connectivity presents a vast opportunity for manufacturers to offer enhanced diagnostics, remote support, and performance monitoring services, establishing new revenue streams and increasing customer loyalty. These favorable forces, coupled with sustained industrial automation trends, are projected to exert a net positive impact on the market trajectory over the forecast period.

Segmentation Analysis

The Woodworking CNC Tools Market is comprehensively segmented based on machine type, technology, component, and end-use application, providing a granular view of specific industry demands and technological preferences. The core segmentation by machine type distinguishes between CNC Routers, CNC Machining Centers (vertical and horizontal), CNC Lasers/Plasma Cutters (for specialized inlays and thin wood materials), and CNC Drills/Boring Machines. CNC Routers hold dominance due to their versatility in 2D and 3D carving, cutting, and engraving, serving a vast range of applications from signage to cabinetry. However, high-precision machining centers, which offer tool-changing capabilities and advanced interpolation, are capturing higher value share.

Technology segmentation focuses on the degree of freedom offered by the machine, predominantly 3-axis, 4-axis, and 5-axis systems. While 3-axis machines are standard for flat panel processing, the growth of complex architectural designs and ergonomic furniture is fueling the demand for 5-axis technology, allowing simultaneous movement across multiple dimensions, drastically reducing setup time for complex parts. Component segmentation is vital, covering both hardware (spindles, control systems, linear guides) and software (CAD/CAM systems, simulation software, optimization tools). The integration quality and user interface of the software components are increasingly becoming crucial differentiating factors.

The end-use application segment clarifies the primary consumer industries, including Furniture Manufacturing (residential and commercial), Architectural Millwork and Wood Construction (beams, trusses, molding), Wood Crafts and Artistic Applications, and Others (e.g., musical instruments, aerospace wood composites). Furniture manufacturing, driven by global housing starts and interior design trends, remains the largest consumer segment. The market dynamics show a clear trend towards systems that offer modularity and scalability, allowing manufacturers to tailor their production lines to fluctuating demand and diverse product portfolios, ensuring long-term applicability and maximizing the utility of the significant investment.

- By Machine Type:

- CNC Routers

- CNC Machining Centers (3-axis, 4-axis, 5-axis)

- CNC Lasers/Plasma Cutters

- CNC Drills and Boring Machines

- By Technology:

- 3-Axis CNC

- 4-Axis CNC

- 5-Axis CNC and Above

- By Component:

- Hardware (Spindles, Controls, Drives, Tables)

- Software (CAD/CAM, Simulation, Optimization)

- Cutting Tools (Carbide, HSS, PCD, specialized bits)

- By End-Use Application:

- Furniture and Cabinetry Manufacturing

- Architectural Millwork and Construction

- Wood Crafts and Artistic Applications

- Others (Flooring, Packaging)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Woodworking CNC Tools Market

The value chain of the Woodworking CNC Tools Market begins with the upstream suppliers responsible for raw materials and essential components. This phase involves procuring high-grade steel, specialty alloys, and electronics necessary for producing robust machine frames, high-speed spindles, servo motors, control units, and specialized cutting tools (like PCD inserts and carbide tips). Key upstream activities include R&D for material science to improve tool durability and precision, and the manufacturing of proprietary control systems (e.g., by Siemens, Fanuc) that govern machine functionality. The efficiency and quality of these upstream components directly dictate the performance and longevity of the final CNC machine.

The middle segment of the chain is dominated by Original Equipment Manufacturers (OEMs) who design, assemble, and integrate the components into complete CNC woodworking systems. This phase requires significant engineering expertise in areas such as machine kinematics, thermal stabilization, and software integration (CAD/CAM compatibility). Distribution channels play a critical role, involving a mix of direct sales to large industrial clients and indirect sales through specialized industrial distributors and dealers. Direct channels are preferred for highly customized, expensive machinery where close customer support and tailored integration services are mandatory, while indirect channels serve standardized products and offer localized maintenance and quick spare parts availability.

Downstream analysis focuses on the end-users, primarily large-scale furniture manufacturers, bespoke cabinet makers, and construction companies. Post-sale activities, including installation, technical training, maintenance contracts, and software updates, form a substantial part of the downstream value proposition. The increasing complexity of CNC systems has heightened the demand for reliable after-sales service and ongoing technical consultancy, driving manufacturers and distributors to invest heavily in specialized service teams. Customer retention and perceived value in this market are intrinsically linked to the reliability and continuous operational support provided throughout the machine's lifecycle.

Woodworking CNC Tools Market Potential Customers

The primary consumers, or potential customers, of Woodworking CNC Tools are sophisticated manufacturing entities requiring high throughput, precision, and flexibility in wood processing operations. The largest segment comprises large-scale industrial furniture manufacturers, including those specializing in kitchen cabinetry, office furniture, and ready-to-assemble (RTA) components. These buyers prioritize machinery that can seamlessly integrate into automated production lines, offering rapid tool changing, high processing speeds, and minimal downtime to ensure economies of scale and meet tight delivery schedules for mass-market products.

A rapidly growing segment consists of medium-sized, custom architectural millwork and bespoke cabinet shops. These end-users, while smaller in volume than industrial manufacturers, require advanced 5-axis and nesting CNC solutions capable of handling unique, complex designs for high-value contracts in luxury residential and commercial construction projects. Their purchasing decisions are heavily influenced by machine flexibility, ease of programming for one-off parts, and the ability to produce aesthetically demanding, high-quality finishes crucial for custom interior design projects. Their need for flexibility often outweighs the focus on sheer speed.

Furthermore, specialized segments such as manufacturers of musical instruments (guitars, pianos), wooden toys, and intricate wood crafts also represent key potential customers. These buyers demand extreme precision for delicate carving and shaping operations, often requiring specialized tooling and control systems. The market also sees adoption by educational institutions and vocational training centers, which purchase standardized CNC routers and simulation software to train the next generation of industrial woodworkers, ensuring long-term demand growth driven by labor readiness.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.2 Billion |

| Market Forecast in 2033 | USD 7.6 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | HOMAG Group AG, BIESSE Group, SCM Group, Weinig Group, MultiCam, Inc., AXYZ Automation Group, Shoda Iron Works Co., Ltd., Felder Group, Komo Machine Inc., DMS (Diversified Machine Systems), Anderson Industrial Corp., C.R. Onsrud, Inc., Laguna Tools, Maxicam, Jinan Quick-Full CNC Equipment Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Woodworking CNC Tools Market Key Technology Landscape

The technology landscape in the Woodworking CNC Tools Market is defined by the convergence of precision mechanics and sophisticated digital control systems. Central to this landscape are advanced Computer-Aided Design (CAD) and Computer-Aided Manufacturing (CAM) software suites, such as AlphaCAM and Mastercam, which enable seamless translation of complex 3D models into optimized machine tool paths. These software packages are increasingly featuring simulation capabilities that allow users to virtualize the machining process, identify potential collisions, and accurately estimate cycle times, drastically improving efficiency and reducing material waste prior to physical production. High-speed, liquid-cooled spindles with automatic tool changers are standard features, allowing for greater material versatility and continuous operation at high feed rates.

The adoption of 5-axis simultaneous machining represents a pivotal technological advancement, moving the industry beyond traditional flat panel processing. This technology allows for undercutting, complex contoured surfaces, and precise angled boring in a single setup, which is essential for modern high-end furniture and architectural elements. Furthermore, the integration of Industrial Internet of Things (IIoT) sensors is transforming connectivity, enabling remote diagnostics, real-time machine performance monitoring, and centralized data collection across an entire factory floor. This data is critical for predictive maintenance scheduling and overall equipment effectiveness (OEE) analysis.

Another crucial technological development is the implementation of advanced Human-Machine Interfaces (HMI), featuring large touchscreen displays and intuitive, graphics-based control systems that simplify machine operation and programming, thereby mitigating some of the restraints associated with the need for highly skilled programmers. Robotics are increasingly being integrated, particularly for automated material handling (loading and unloading large panels) and tool changing, further reducing cycle times and minimizing human intervention. Cutting tools themselves are evolving, with polycrystalline diamond (PCD) tools gaining traction over traditional carbide due to their superior longevity and performance when machining abrasive wood-based materials like MDF and particleboard, yielding cleaner cuts and less frequent replacements.

Regional Highlights

The global Woodworking CNC Tools Market exhibits varied growth patterns influenced by regional economic conditions, industrial maturity, and regulatory environments. Asia Pacific (APAC) is projected to be the most dynamic and rapidly expanding region globally. This growth is predominantly fueled by high-volume furniture production in China and Vietnam, coupled with massive infrastructure investments and rising consumer disposable incomes in India and Indonesia. Government initiatives supporting manufacturing modernization and industrial automation are significantly driving the penetration of CNC technology, often displacing older, less efficient manual machines.

North America and Europe represent mature markets characterized by replacement demand and a focus on advanced, specialized machinery. North American manufacturers prioritize automation integration to combat high labor costs and demand for bespoke products, leading to a strong uptake of high-performance 5-axis machining centers and sophisticated software integration. European demand is driven by stringent quality standards, environmental regulations promoting material optimization, and the presence of leading machinery manufacturers (e.g., Germany, Italy), which often act as early adopters and innovation hubs for new CNC technologies.

Latin America and the Middle East & Africa (MEA) are emerging markets showing gradual but steady growth. In Latin America, particularly Brazil and Mexico, the expansion of local construction and furniture industries is fostering demand for reliable, mid-range CNC solutions. The MEA region is focusing investments on establishing local manufacturing capabilities, driven by diversification efforts away from oil economies, notably in Saudi Arabia and the UAE. While currently smaller in market size, these regions offer significant future growth potential as industrialization accelerates and regulatory environments stabilize, encouraging foreign investment in manufacturing infrastructure.

- Asia Pacific (APAC): Dominates the market share and growth rate due to high-volume manufacturing, urbanization, and government promotion of factory automation; China, Vietnam, and India are key revenue contributors.

- North America: High demand for premium, custom millwork and cabinetry; early adoption of 5-axis technology and IIoT for operational efficiency gains and labor cost mitigation.

- Europe: Focus on technological sophistication, precision, and integration of sustainable manufacturing practices; strong presence of market leaders driving innovation in automated wood processing solutions.

- Latin America (LATAM): Steady growth driven by local residential construction boom and increasing capacity of domestic furniture producers; emphasis on mid-range, robust CNC routers.

- Middle East & Africa (MEA): Emerging market opportunities linked to construction megaprojects and government-led industrial diversification programs aimed at establishing local wood processing industries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Woodworking CNC Tools Market.- HOMAG Group AG

- BIESSE Group

- SCM Group

- Weinig Group

- MultiCam, Inc.

- AXYZ Automation Group

- Shoda Iron Works Co., Ltd.

- Felder Group

- Komo Machine Inc.

- DMS (Diversified Machine Systems)

- Anderson Industrial Corp.

- C.R. Onsrud, Inc.

- Laguna Tools

- Maxicam

- Jinan Quick-Full CNC Equipment Co., Ltd.

- Heian Corporation

- Shenzhen Handa Machinery Co., Ltd.

- Excitech CNC Technology Co., Ltd.

- NewCNC, Inc.

- TeknoMac Srl

Frequently Asked Questions

Analyze common user questions about the Woodworking CNC Tools market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of 5-axis CNC machines in woodworking?

The primary factor driving 5-axis CNC adoption is the increasing industry demand for complex, contoured architectural and furniture components that require undercutting and simultaneous multi-angle machining, significantly reducing setup time and enhancing geometric design capabilities beyond what 3-axis systems can achieve.

How does the integration of AI impact tool wear and maintenance schedules in CNC woodworking?

AI integration utilizes machine learning and sensor data (e.g., vibration, load) to analyze operational patterns, accurately predict the remaining useful life of cutting tools, and automate predictive maintenance scheduling. This proactive approach minimizes unplanned machine downtime and reduces high costs associated with tool failure.

Which geographical region holds the highest growth potential for the Woodworking CNC Tools Market?

The Asia Pacific (APAC) region, driven by rapid urbanization, massive investment in residential and commercial infrastructure, and high-volume furniture manufacturing in countries like China and Vietnam, holds the highest growth potential for CNC woodworking tool adoption over the forecast period.

What are the main restraints preventing small and medium enterprises (SMEs) from adopting advanced CNC solutions?

The main restraints for SMEs include the prohibitively high initial capital expenditure required for sophisticated CNC machinery and the difficulty in recruiting and retaining personnel with the necessary specialized technical skills for programming, operation, and advanced machine maintenance.

What role does software integration play in the overall value proposition of modern CNC woodworking tools?

Software integration (CAD/CAM, HMI) is critical, transforming the overall value proposition by enabling seamless design-to-production workflows, optimizing material nesting layouts to reduce waste, and providing intuitive interfaces that simplify complex operational tasks, making the machines more efficient and user-friendly.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager