Worm Gears Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442144 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Worm Gears Market Size

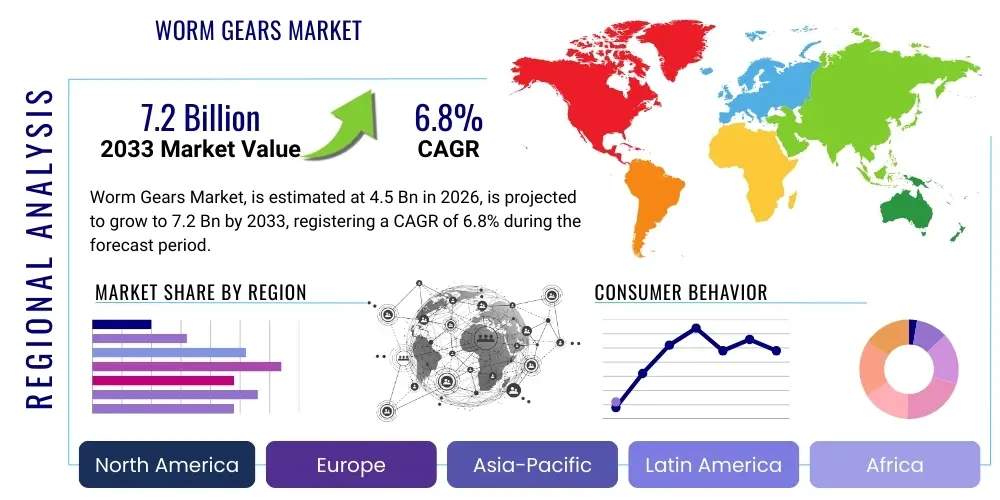

The Worm Gears Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.2 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating demand for high-ratio, compact power transmission solutions across diverse industrial applications, particularly within material handling and robotics where precision and load-bearing capacity in limited space are paramount requirements. The growth trajectory is further reinforced by the ongoing global push toward factory automation and the modernization of aging industrial infrastructure in developed economies, necessitating efficient and reliable gear systems capable of continuous operation under varying load conditions. Furthermore, emerging markets are investing heavily in manufacturing capabilities, providing fertile ground for the adoption of worm gear systems due to their robustness and cost-effectiveness in lower-to-medium power applications compared to other complex gearing solutions.

Worm Gears Market introduction

The Worm Gears Market encompasses the manufacturing, distribution, and utilization of gear arrangements consisting of a worm (a screw-like helical gear) meshing with a worm wheel (a spur gear or helical gear). These mechanical components are pivotal in power transmission systems, primarily utilized for achieving high reduction ratios in a single, compact stage, often exceeding ratios achievable by standard helical or spur gear setups. The primary product description centers around the inherent advantage of worm gears: their ability to provide self-locking characteristics under certain conditions, making them ideal for applications requiring load holding, such as elevators, conveyor systems, and certain lifting mechanisms. This unique feature minimizes the need for external braking systems, simplifying machine design and enhancing operational safety. The materials used in manufacturing typically include hardened steel for the worm and bronze or cast iron for the wheel, selected for optimal friction reduction and durability under high torque loads.

Major applications of worm gear drives span a broad spectrum of industrial sectors. They are indispensable in heavy-duty material handling equipment, including large-scale conveyor belts, hoists, and cranes, due to their robust design and high torque multiplication capability. In the automotive industry, they are employed in steering mechanisms and specific differential systems, particularly in commercial vehicles. Furthermore, the burgeoning fields of industrial machinery, including specialized packaging equipment, textile machinery, and machine tool indexing systems, rely heavily on the precision and high reduction ratios offered by worm drives. The widespread adoption in critical infrastructure and construction equipment further underscores their reliability and efficiency in converting high-speed, low-torque input into low-speed, high-torque output, which is essential for controlling heavy loads smoothly and precisely.

The key benefits driving the market include superior noise reduction compared to spur or helical gears, attributed to the sliding action of the meshing teeth, and the aforementioned compact design which saves valuable space in complex machinery layouts. Driving factors for market growth involve the rapid acceleration of industrial automation globally, specifically the adoption of Industry 4.0 paradigms which demand highly efficient, low-maintenance mechanical components. Furthermore, stringent safety regulations worldwide, particularly concerning load-holding mechanisms, amplify the attractiveness of self-locking worm gear systems. Technological advancements focused on enhancing gear efficiency through improved lubricants and specialized coatings are continuously expanding the performance envelope of these components, making them suitable for higher power density applications than traditionally perceived.

Worm Gears Market Executive Summary

The global Worm Gears Market is experiencing robust expansion fueled by interconnected business trends across key industrial verticals. A dominant business trend is the transition towards modular and customizable gear solutions, allowing manufacturers to quickly adapt to specific end-user requirements regarding torque, speed, and spatial constraints. The market is also witnessing increased consolidation among specialized gear manufacturers aiming to achieve economies of scale and integrate advanced manufacturing techniques, such as precision grinding and hobbing, to improve gear accuracy and lifespan. Furthermore, the emphasis on total cost of ownership (TCO) is shifting procurement decisions toward high-quality, durable worm gear units, even if initial capital expenditure is higher, thereby stimulating innovation in material science and surface treatments to extend operational longevity.

Regionally, the Asia Pacific (APAC) stands out as the primary growth engine, largely driven by the rapid industrialization and massive infrastructure projects ongoing in China, India, and Southeast Asian nations. This region dominates both in terms of consumption and production capacity, benefiting from lower manufacturing costs and substantial domestic demand in sectors like construction, automotive manufacturing, and renewable energy installations. North America and Europe, while representing mature markets, maintain high revenue share dueowed to the consistent replacement cycle of sophisticated industrial machinery, coupled with increasing investments in robotics and aerospace applications where ultra-high precision gearboxes are mandatory. Specific regional trends include Europe's strong focus on energy-efficient drives and North America's emphasis on automation in warehouse and logistics operations, both areas heavily utilizing worm gear drives.

In terms of segmentation, the Material Handling segment continues to hold the largest market share, reflecting its foundational role in almost every industrial process globally. However, the Automotive and Robotics segments are projected to exhibit the highest Compound Annual Growth Rate (CAGR) during the forecast period, reflecting global transitions toward electric vehicles (EVs) and advanced manufacturing automation. Specifically within the Material segment, high-performance alloys and bronze worm wheel materials designed for continuous operation at high loads are seeing increased demand over traditional cast iron, addressing industry needs for enhanced reliability and reduced wear. Trends within the power segment show a clear preference for compact, enclosed gearboxes offering high power density, which necessitates continual improvement in heat dissipation and lubrication management within the worm gear architecture.

AI Impact Analysis on Worm Gears Market

Common user inquiries regarding AI's impact on the Worm Gears Market primarily center on three areas: predictive maintenance implementation, optimization of manufacturing processes, and how AI-driven system design affects gear ratio selection. Users are concerned about whether existing worm gear systems can be retrofitted with IoT sensors and AI-driven monitoring for condition-based maintenance, aiming to minimize costly downtime. They also frequently ask about the role of machine learning in optimizing the hobbing and grinding processes for manufacturing the complex worm profile, ensuring higher geometric accuracy and reduced scrap rates. Furthermore, the expectation is that AI algorithms will eventually optimize entire machine layouts, influencing the selection of optimal gear types, potentially validating or challenging the continued dominance of worm gears in specific high-ratio applications based on real-time operational data and efficiency modeling. The core theme is leveraging AI to enhance the operational reliability, manufacturing efficiency, and lifecycle management of these critical mechanical components, moving from reactive repair to proactive maintenance schedules.

- AI-enabled Predictive Maintenance: Utilizing sensor data (vibration, temperature, lubrication quality) analyzed by machine learning models to anticipate wear and failure in worm drives, thus maximizing uptime and optimizing service intervals.

- Manufacturing Process Optimization: Deployment of AI and computer vision systems to monitor and adjust cutting tool parameters during the hobbing and grinding of worms and wheels, leading to improved precision, surface finish, and reduced manufacturing variability.

- Digital Twin Simulation: Creation of virtual models of industrial systems incorporating worm gearboxes to simulate varying load conditions, environmental stress, and efficiency degradation over time, facilitating better system integration and product validation prior to physical deployment.

- Automated Design and Selection: Implementing AI algorithms that recommend optimal worm gear ratios, materials, and lubrication schemes based on required application parameters (load, duty cycle, speed, space constraints), speeding up the engineering design phase.

- Supply Chain Resilience: Using AI tools to predict demand fluctuations for specific worm gear types and components, optimizing inventory levels, and enhancing the resilience of the complex industrial supply chains involved in gear manufacturing.

DRO & Impact Forces Of Worm Gears Market

The Worm Gears Market is primarily driven by the escalating global focus on industrial automation and the resultant increase in demand for precise and reliable speed reduction units across sectors like robotics, material handling, and processing machinery. Key restraints include the inherent lower efficiency of worm gears compared to helical or planetary gears, especially under high-speed operation, due to the sliding friction between the worm and the wheel, which results in energy loss and greater heat generation, limiting their utility in applications where energy conservation is paramount. Opportunities are substantial, stemming from the development of advanced material pairings and specialized low-friction coatings (e.g., nitride or DLC coatings) which significantly improve efficiency and durability, allowing worm gears to penetrate higher performance markets. The primary impact force accelerating market growth is the undeniable trend toward compact machine design; the high reduction ratio capability of worm gears in a single stage addresses the critical industry need for powerful, yet space-saving, mechanical drives, ensuring their continued relevance despite efficiency drawbacks in certain specialized niches. This persistent push for miniaturization across industrial robotics and precise motion control systems acts as a strong, sustained external force bolstering market revenues.

Segmentation Analysis

The Worm Gears Market is comprehensively segmented based on material type, reduction ratio, application, and end-use industry, providing a granular view of market dynamics and identifying key growth pockets. Segmentation by material is crucial as it dictates the torque capacity, efficiency, and overall lifespan of the gear drive, with materials like bronze being favored for the worm wheel due to its good frictional characteristics against steel worms. Reduction ratio segmentation differentiates between standard ratios (e.g., 5:1 to 60:1) used in general industrial drives and high-ratio systems (above 60:1) essential for highly specific applications like indexing tables and precision instrumentation, reflecting the diverse performance requirements across the industrial landscape. The analysis of these segments reveals that while heavy industry applications drive volume, the precision and robotics segments are driving value and technological advancements related to manufacturing accuracy and material science integration.

The segmentation structure highlights that the Material Handling sector consistently consumes the largest volume of worm gears, largely due to the mandatory requirement for self-locking mechanisms in lifting and conveying equipment where gravity loads must be securely held during power interruptions. Meanwhile, the Application segmentation into areas like hoisting, indexing, and positioning allows manufacturers to tailor product specifications—such as backlash control and angular accuracy—to meet specific operational demands. Furthermore, the End-Use Industry categorization (Automotive, Aerospace, Food & Beverage, etc.) demonstrates varying demands based on regulatory compliance, operational environment (e.g., need for corrosion resistance in Food & Beverage), and required duty cycles. This detailed segmentation strategy assists stakeholders in identifying lucrative market gaps, understanding competitive landscapes within specialized niches, and directing R&D investment towards high-growth areas such as high-precision worm drives for robotics and advanced manufacturing tools that necessitate extremely accurate and repeatable motion control, thereby enhancing overall operational productivity.

- By Material:

- Cast Iron

- Steel (Carbon Steel, Alloy Steel, Stainless Steel)

- Bronze (Phosphor Bronze, Aluminum Bronze)

- Others (Plastics, Composite Materials for low-load applications)

- By Reduction Ratio:

- Low Ratio (Below 20:1)

- Medium Ratio (20:1 to 60:1)

- High Ratio (Above 60:1)

- By Application:

- Material Handling (Cranes, Conveyors, Hoists)

- Indexing and Positioning Systems

- Industrial Machinery (Mixers, Extruders, Presses)

- Automotive and Transportation

- Robotics and Automation

- General Industrial Drives

- By End-Use Industry:

- Construction and Mining

- Automotive Manufacturing

- Aerospace and Defense

- Food and Beverage Processing

- Energy (Oil & Gas, Renewables)

- Machine Tools and Fabrication

Value Chain Analysis For Worm Gears Market

The value chain for the Worm Gears Market begins with the upstream analysis, which involves the sourcing and processing of raw materials, predominantly various grades of steel (for the worm shaft) and bronze or specialized alloys (for the worm wheel). Key activities at this stage include high-precision metal casting, forging, and the procurement of specialized lubricants and coatings necessary for enhancing friction reduction and lifespan. Efficiency and cost optimization at the upstream level are critical, as the quality and metallurgical properties of the raw materials directly dictate the performance characteristics, such as torque capacity and thermal stability, of the final gear set. Suppliers of high-grade, traceable materials and precision machining centers form the critical foundation of this segment, establishing quality benchmarks necessary for industrial reliability and compliance with standards such as ISO and DIN.

Moving downstream, the value chain encompasses the complex manufacturing processes—hobbing, grinding, heat treating, and meticulous assembly—followed by rigorous quality testing of the assembled gearboxes. Gear manufacturers specialize in achieving ultra-low backlash and high contact ratio, which differentiates premium products intended for robotics and aerospace from standard industrial drives. Distribution channels play a vital role in reaching diverse global end-users; this includes both direct sales channels, where manufacturers interact directly with large OEM customers for customized solutions, and indirect distribution through a robust network of industrial distributors, wholesalers, and specialized maintenance, repair, and overhaul (MRO) service providers. Indirect channels are crucial for serving smaller businesses and providing timely spare parts and local technical support globally.

The final stage involves the integration of the worm gear units into end-use equipment and post-sales services. Direct channels are favored when supplying major OEMs like robotics manufacturers or large automotive assembly line constructors, allowing for tailored design input and just-in-time delivery models. Indirect channels, through specialized distributors, focus on offering a wide range of standard products for maintenance and replacement markets, ensuring quick access to components and reducing machine downtime. The increasing trend toward digitalization is seeing distributors integrate e-commerce platforms and inventory management software to streamline the purchasing process, further optimizing the efficiency of the downstream segment and improving overall customer experience regarding product availability and technical specifications retrieval.

Worm Gears Market Potential Customers

The potential customer base for the Worm Gears Market is extremely broad, spanning virtually all heavy and light industrial sectors that rely on mechanical power transmission and speed reduction, specifically where high torque output and a self-locking feature are either advantageous or mandatory. Primary end-users and buyers include large-scale Original Equipment Manufacturers (OEMs) specializing in material handling systems such as cranes, forklifts, and complex conveyor setups used in logistics hubs and mining operations. These customers require high-volume, standardized, yet highly reliable gearboxes. Another significant segment consists of specialized machinery manufacturers in the food and beverage industry, who need corrosion-resistant and hygienically designed stainless steel worm gear drives for mixers, fillers, and packaging equipment, often demanding high precision for controlled operations under washdown conditions.

Furthermore, the automotive and aerospace sectors represent high-value customers, particularly those requiring bespoke, low-backlash worm drives for critical applications such as steering columns in heavy vehicles, flight control surface actuation systems, and precision testing rigs, where failure is not an option and demanding zero-defect tolerance is standard. The rapidly expanding robotics and automation industry constitutes a highly lucrative customer segment, requiring compact, high-precision worm gear reducers for joint actuation and positioning systems in articulated robotic arms and automated guided vehicles (AGVs), placing a premium on power density and angular accuracy. This diverse buyer landscape, from heavy industrial users valuing robustness to precision instrument makers valuing zero backlash, ensures a stable and diversified demand stream for worm gear products across the economic spectrum.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SEW-Eurodrive GmbH & Co KG, Bonfiglioli S.p.A., ABB Ltd., Siemens AG, Rexnord Corporation, Altra Industrial Motion Corp., Mitsubishi Electric Corporation, Nidec Corporation, David Brown Santasalo, Cone Drive Operations Inc., Sumitomo Heavy Industries, Ltd., Premium Transmission, Gear Motions Inc., Boston Gear, Elecon Engineering Company Limited, Rossi Group, Nord Drivesystems, Motovario S.p.A., Tsubakimoto Chain Co., Renold Plc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Worm Gears Market Key Technology Landscape

The technology landscape within the Worm Gears Market is characterized by continuous advancements aimed at mitigating the traditional drawback of low efficiency and improving power density, precision, and longevity. A critical technological focus is on the development and application of advanced machining techniques, particularly high-precision hobbing and grinding methodologies. Modern Computer Numerical Control (CNC) machinery allows for the precise generation of complex worm profiles, such as double-enveloping or duplex gearing, which significantly increases the contact area between the worm and the wheel. This enhanced contact area not only boosts torque transmission capability but also minimizes wear and reduces the localized pressure points, thereby extending the operational life and smoothness of the gear drive. Furthermore, achieving near-perfect surface finishes through techniques like superfinishing is essential for minimizing frictional losses, which is directly linked to improved energy efficiency and reduced heat generation in high-speed applications.

Another pivotal area of innovation revolves around material science and surface engineering. The use of specialized, low-friction coatings, such as Diamond-Like Carbon (DLC) or specific nitride treatments, on the steel worm is becoming increasingly common. These coatings dramatically reduce the coefficient of friction when paired with the bronze worm wheel, addressing the core inefficiency challenge associated with sliding contact. Concurrently, advancements in bronze alloy compositions, particularly those incorporating nickel or tin variants, are leading to worm wheels with superior wear resistance and thermal stability under heavy continuous loads. These material innovations are crucial for enabling worm gears to operate reliably in increasingly demanding environments, especially in high-temperature or corrosive industrial settings where durability and resistance to chemical degradation are paramount for maintaining operational continuity and safety standards.

Finally, the integration of smart technology, often termed condition monitoring (CM), is rapidly becoming a standard expectation in premium worm gear systems. This involves embedding or retrofitting gearboxes with Internet of Things (IoT) sensors to monitor vital operational parameters such as vibration spectrum, temperature, and lubricant contamination in real time. The data collected is analyzed using AI algorithms (as detailed previously) to predict potential component failures, shifting maintenance from reactive to predictive models. This technological shift is fundamental for end-users seeking to maximize asset utilization and minimize unscheduled downtime. Furthermore, advanced lubrication technologies, including synthetic lubricants optimized for high-pressure, sliding-contact conditions, contribute significantly to reducing operating temperatures and prolonging the life of the gear mesh, solidifying the modern worm gear drive as a highly reliable and sophisticated component within advanced industrial automation frameworks.

Regional Highlights

- Asia Pacific (APAC): APAC is the fastest-growing region and the largest market shareholder, driven primarily by extensive infrastructure development, massive investments in automated manufacturing capacity (Industry 4.0 adoption in China, South Korea, and Japan), and the burgeoning automotive sector, especially in India and Southeast Asia. The demand for localized, reliable power transmission solutions for new industrial setups and expanding supply chain logistics centers is immense. Government initiatives supporting domestic manufacturing and foreign direct investment in automation technology further amplify the requirement for robust worm gear systems.

- North America: Characterized by a strong focus on technological sophistication, North America is a significant consumer of high-precision, zero-backlash worm gearboxes, particularly in aerospace, high-end robotics, and advanced material handling for e-commerce fulfillment centers. The market growth is fueled by the modernization of existing industrial plants and a strong emphasis on integrating IoT and predictive maintenance into critical machinery, driving demand for premium, sensor-ready gear units compliant with stringent local safety and efficiency standards.

- Europe: Europe represents a mature but highly innovation-driven market, focusing heavily on energy efficiency and sustainable manufacturing practices, driven by EU directives. Demand is high in specialized machinery, machine tools, and the automotive industry (especially in Germany and Italy). European manufacturers often lead in developing specialized, high-efficiency worm gear geometries and advanced coating technologies to maximize power density while minimizing energy consumption, positioning the region as a leader in technical innovation for the market.

- Latin America (LATAM): Growth in LATAM is more moderate but steady, concentrated mainly in the mining, oil and gas, and construction sectors, particularly in Brazil and Mexico. The demand is often for durable, heavy-duty worm gears capable of operating reliably in harsh environmental conditions. Market expansion is closely tied to commodity price stability and subsequent investment in processing equipment and infrastructure upgrades.

- Middle East and Africa (MEA): The MEA region shows promising growth prospects linked to diversification efforts away from oil economies, particularly investments in logistics hubs, manufacturing bases, and large-scale construction projects in the GCC countries. Demand is focused on robust worm gear systems for infrastructure, water treatment facilities, and power generation (both traditional and renewable energy) applications, requiring products designed for high reliability in extreme heat and dusty environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Worm Gears Market.- SEW-Eurodrive GmbH & Co KG

- Bonfiglioli S.p.A.

- ABB Ltd.

- Siemens AG

- Rexnord Corporation

- Altra Industrial Motion Corp.

- Mitsubishi Electric Corporation

- Nidec Corporation

- David Brown Santasalo

- Cone Drive Operations Inc.

- Sumitomo Heavy Industries, Ltd.

- Premium Transmission

- Gear Motions Inc.

- Boston Gear

- Elecon Engineering Company Limited

- Rossi Group

- Nord Drivesystems

- Motovario S.p.A.

- Tsubakimoto Chain Co.

- Renold Plc.

- Falk Corporation (a brand of Rexnord)

- Winergy AG

- Regal Beloit Corporation (now Regal Rexnord Corporation)

- Hansen Industrial Transmissions (a part of Sumitomo Drive Technologies)

- Emerson Electric Co.

- Flender GmbH

- Santasalo Gears (formerly part of David Brown)

- Slewing Ring Systems Co., Ltd.

- Cleveland Gear Company

- Varvel S.p.A.

Frequently Asked Questions

Analyze common user questions about the Worm Gears market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical advantage of using a worm gear drive over other gear types?

The primary advantage is the ability to achieve a very high speed reduction ratio in a compact, single stage, alongside their unique self-locking capability. This self-locking feature prevents the load from driving the worm wheel back through the worm shaft, which is essential for safety in lifting and hoisting applications, minimizing the need for external braking mechanisms.

How are manufacturers addressing the issue of low efficiency inherent to worm gear systems?

Manufacturers are addressing lower efficiency through several technological advancements, including the adoption of advanced, low-friction surface coatings (like DLC and specific nitrides) on the worm shaft, optimizing worm and wheel geometry (e.g., double-enveloping designs), and utilizing high-performance synthetic lubricants specifically designed for sliding contact conditions to reduce frictional energy loss.

Which industrial sectors are driving the highest demand for high-precision worm gearboxes?

The highest demand for high-precision, low-backlash worm gearboxes is being driven by the Robotics and Automation sector, the Aerospace and Defense industry for critical actuation systems, and the specialized Machine Tool industry for highly accurate indexing and positioning mechanisms essential for modern manufacturing processes.

What role does the Asia Pacific (APAC) region play in the global Worm Gears Market?

The APAC region plays a dominant role, serving as both the largest consumer and a major manufacturing hub globally. This dominance is driven by aggressive industrialization, rapid expansion in material handling infrastructure (logistics), and significant investment in new automotive and construction manufacturing capacity across key economies like China and India.

Is predictive maintenance technology being integrated into standard worm gear units?

Yes, predictive maintenance (PdM) based on AI and IoT sensors is increasingly being integrated into premium and standard worm gear units. This involves using sensors to monitor vibration, temperature, and lubrication status to predict potential failures, allowing for condition-based maintenance schedules that maximize operational lifespan and drastically reduce unplanned machine downtime.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager