Woven Wire Mesh Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441802 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Woven Wire Mesh Market Size

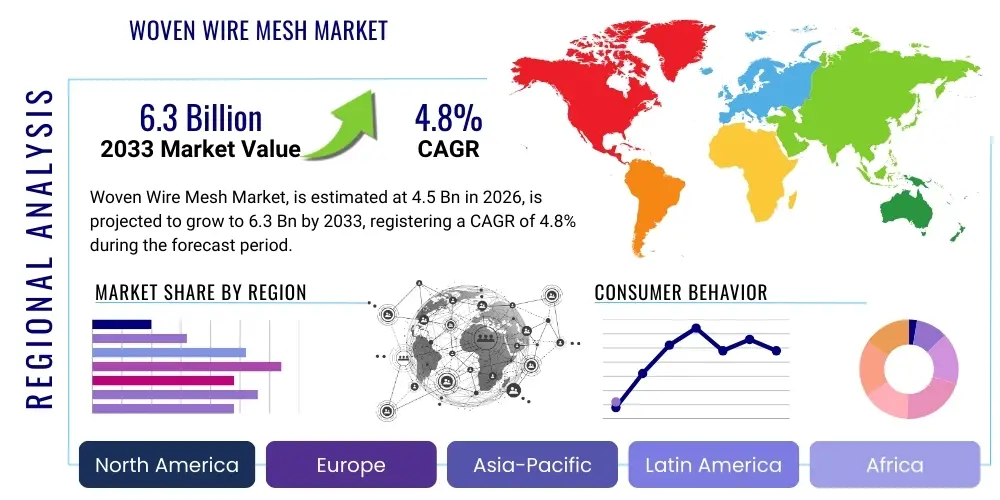

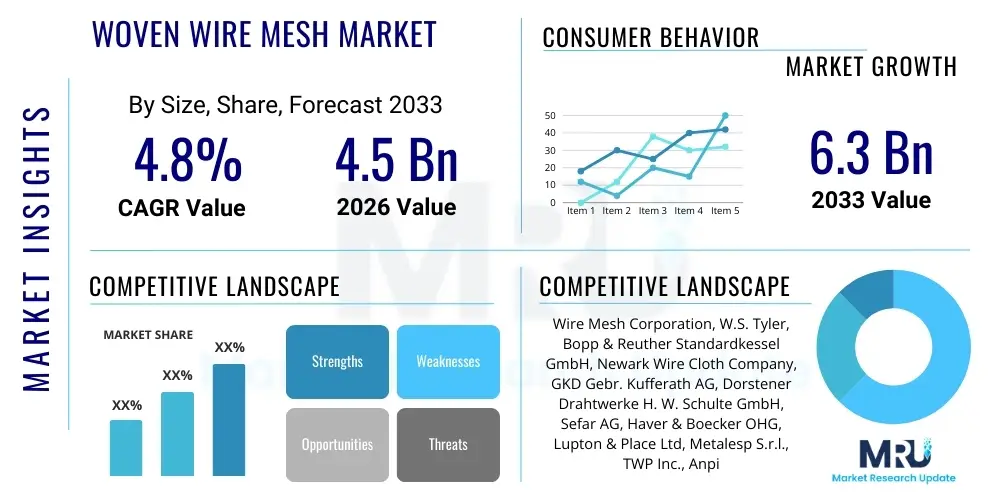

The Woven Wire Mesh Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 6.3 Billion by the end of the forecast period in 2033. This growth trajectory is significantly influenced by the accelerating expansion of infrastructure development projects globally, particularly within emerging economies. The fundamental utility of woven wire mesh across critical industrial processes, ranging from precision filtration in chemical processing to robust security fencing in construction, solidifies its indispensable role in the modern industrial landscape. Economic indicators suggesting sustained growth in manufacturing output, coupled with stringent regulatory standards demanding higher quality filtration and separation mediums, are primary catalysts propelling this forward momentum.

Woven Wire Mesh Market introduction

The Woven Wire Mesh Market encompasses the manufacturing, distribution, and application of metallic wire fabrics created by weaving metal strands into patterns such as plain weave, twilled weave, or Dutch weave. These materials are characterized by exceptional durability, precise aperture sizes, high flow rates, and resistance to corrosion and extreme temperatures, making them foundational components across diverse industries. The primary raw materials typically include stainless steel, carbon steel, galvanized steel, and various specialty alloys like Monel or Hastelloy, chosen specifically to meet the rigorous demands of end-user environments. Technological advancements in weaving machinery and material science continue to enhance the performance characteristics of these meshes, expanding their utility into highly specialized applications.

Major applications for woven wire mesh span a broad spectrum, including complex filtration systems used in petrochemical and pharmaceutical manufacturing, sophisticated screening and grading processes in mining and aggregate industries, and structural reinforcement in aerospace and automotive sectors. Furthermore, its aesthetic and functional properties are heavily utilized in architectural design, where it serves as protective barriers, decorative facades, and solar shading elements. The inherent strength-to-weight ratio and versatility in customization—specifically concerning mesh count, wire diameter, and material composition—underscore its significant market appeal and sustained demand across mature and rapidly developing industrial sectors worldwide. The ability to customize filtration characteristics down to micron levels provides a competitive edge in specialized segments.

The market growth is primarily driven by global infrastructure investment cycles, the imperative for improved industrial safety standards, and the rising demand for high-efficiency filtration media essential for maintaining product quality and environmental compliance. Benefits derived from utilizing woven wire mesh include long service life, minimal maintenance requirements, and reliable performance under severe operational conditions. These factors collectively position woven wire mesh as an irreplaceable material solution, directly contributing to the optimization and reliability of critical manufacturing and processing operations globally, thereby ensuring consistent market expansion throughout the forecast period.

Woven Wire Mesh Market Executive Summary

The Woven Wire Mesh Market is experiencing robust growth driven by favorable business trends centered on technological innovation in production techniques and an increased emphasis on high-performance materials such as stainless steel and exotic alloys. Key business trends indicate a shift toward automated weaving processes, enabling manufacturers to produce highly precise, large-format mesh products with superior consistency, effectively catering to the escalating demands of infrastructure and heavy industry projects. Consolidation among mid-sized players aimed at achieving economies of scale and securing access to proprietary weaving technologies is also a notable market development. Furthermore, the push for sustainable practices is encouraging the development of recyclable mesh products and optimizing material use, appealing particularly to environmentally conscious end-users in the European and North American markets.

Regional trends highlight the Asia Pacific (APAC) as the undisputed leader in market expansion, fueled by massive government investments in urban infrastructure, extensive mining activities, and the rapid establishment of new manufacturing facilities, especially in China, India, and Southeast Asian nations. North America and Europe maintain significant market shares, characterized by demand for highly specialized, premium-grade mesh utilized primarily in sophisticated sectors like aerospace, food and beverage processing, and pharmaceuticals, where regulatory standards necessitate materials with extremely high corrosion resistance and precision filtering capabilities. The Latin America and Middle East & Africa (MEA) regions are emerging growth centers, driven primarily by investments in oil and gas extraction, water treatment infrastructure, and burgeoning construction sectors requiring durable, cost-effective screening solutions.

Segment trends reveal that stainless steel remains the dominant material segment due to its unparalleled combination of strength, chemical resistance, and longevity, making it crucial for filtration and architectural applications. The filtration and screening application segment holds the largest market share, directly benefiting from industrial modernization efforts and stricter environmental regulations requiring advanced particle separation technologies. Within weave types, the Plain Weave segment is foundational, though the Dutch Weave segment is witnessing faster growth, attributed to its superior strength and finer filtration capabilities, making it ideal for high-pressure industrial environments. Strategic market positioning relies heavily on differentiating product offerings based on application-specific certifications and advanced material engineering.

AI Impact Analysis on Woven Wire Mesh Market

User inquiries regarding the integration of Artificial Intelligence (AI) and Machine Learning (ML) in the Woven Wire Mesh Market primarily center on optimizing production efficiency, enhancing quality control, and predicting material performance under stress. Common concerns include the complexity and cost of retrofitting legacy machinery with sensor technology, the effective utilization of vast datasets generated during the weaving process, and the potential for AI-driven automation to impact the skilled labor force. Users are particularly interested in how AI can minimize material wastage by predicting defects in real-time and how predictive maintenance algorithms can drastically reduce costly downtime associated with complex weaving equipment. Furthermore, there is significant anticipation regarding AI's ability to simulate the long-term corrosive or erosive behavior of different wire alloys, thereby accelerating R&D cycles and customizing material selection for niche, high-performance applications. The overall expectation is that AI will transition the manufacturing process from reactive quality checks to proactive, highly efficient, and adaptive production environments.

The influence of AI is projected to revolutionize several facets of woven wire mesh manufacturing, beginning with the initial material inspection phase. AI-powered vision systems are deployed to scrutinize incoming raw wire for metallurgical inconsistencies or diameter variations far exceeding the detection capabilities of human inspectors or conventional sensors. During the weaving process, machine learning models continuously monitor tension, speed, and temperature, automatically adjusting loom parameters to maintain aperture consistency and weave precision, which is critical for demanding filtration and screening applications. This real-time optimization capability ensures that batch variations are minimized, leading to higher product yield and significantly reduced scrap material, directly impacting profitability. Additionally, AI assists in dynamic scheduling and inventory management, predicting demand fluctuations based on complex economic indicators and customer order patterns, optimizing supply chain logistics for raw metals.

For end-users, especially those in highly regulated industries like petrochemicals and aerospace, AI-enhanced quality assurance provides unprecedented confidence in the product's reliability. Manufacturers utilizing AI can provide detailed digital twins or digital quality certificates that trace every aspect of the mesh production, from the original raw material batch to the final weave inspection. This level of transparency and verification becomes a significant market differentiator. Looking ahead, advanced AI algorithms are expected to accelerate the development of entirely new mesh materials, simulating the performance of novel alloys under specific environmental stresses (e.g., high acidity, extreme heat) before costly physical prototypes are created, drastically shortening the innovation pipeline for specialized, high-margin products.

- AI-driven real-time quality control enhancing aperture precision and reducing weave defects.

- Predictive maintenance for complex weaving machinery minimizing unplanned downtime and operational costs.

- Optimization of raw material inventory and supply chain forecasting using advanced ML models.

- Accelerated material science R&D through AI simulation of novel alloy performance under specific stress factors.

- Enhanced energy efficiency in manufacturing by optimizing loom speed and tension based on material feedback loops.

- Automated defect detection using computer vision systems during final product inspection.

DRO & Impact Forces Of Woven Wire Mesh Market

The Woven Wire Mesh Market dynamics are fundamentally shaped by a confluence of driving factors, restrictive pressures, and latent opportunities, all synthesized by powerful impact forces that dictate market entry and profitability. Key drivers include stringent regulatory mandates globally, particularly concerning air and water quality, which necessitate highly efficient separation and filtration media in industrial processes. The continuous expansion of global construction and infrastructure spending, particularly in transportation, utilities, and urban development, ensures steady demand for protective barriers, reinforcement, and aggregate screening equipment. Furthermore, the inherent durability and resistance capabilities of woven wire mesh, especially stainless steel variants, make them preferred materials over less robust alternatives in critical, high-stress environments. These driving forces create a stable foundation for consistent market growth, particularly in specialized, high-tolerance segments.

However, the market faces significant restraints that temper its potential growth rate. Primary among these is the volatility and unpredictability in the pricing of essential raw materials, particularly nickel and chromium, which are critical components of stainless steel alloys. These price fluctuations directly influence manufacturing costs and profitability, often leading to challenges in stable contract pricing. Additionally, the increasing availability and adoption of alternative materials, such as synthetic fabrics (e.g., polymer meshes) and perforated metals, in certain less demanding applications pose competitive threats, potentially eroding market share in lower-value segments. The high capital expenditure required for acquiring and maintaining advanced, high-speed weaving machinery also acts as a barrier to entry for smaller manufacturers, contributing to market concentration among established industry leaders.

Opportunities for expansion lie predominantly in developing specialized, next-generation mesh products, such as ultra-fine nano-mesh for advanced microfiltration applications in biotechnology and electronics manufacturing. The rising focus on sustainable industrial processes presents opportunities for manufacturers to develop and market meshes with extended lifecycles and high recyclability, aligning with circular economy initiatives. Furthermore, geographic expansion into rapidly industrializing regions of Africa and Southeast Asia, where local manufacturing capabilities for high-precision mesh are currently limited, offers significant long-term growth potential. The cumulative impact forces—specifically, the high degree of product differentiation possible based on weave type and material alloy, coupled with the critical role of the product in safety and operational efficiency—ensure that woven wire mesh remains an essential, non-discretionary component in most industrial value chains, providing resilience against minor economic downturns.

Segmentation Analysis

The Woven Wire Mesh Market is meticulously segmented based on material type, weave pattern, application, and end-use industry, providing a granular view of market dynamics and catering to specific industrial requirements. The segmentation reflects the diverse utility and customization inherent in the product, ranging from standard industrial screening to highly specialized laboratory and medical applications. Understanding these segments is crucial for manufacturers to optimize their product portfolios and target specific growth areas where precision and material resistance are paramount. Material composition, particularly the use of stainless steel versus carbon steel, fundamentally dictates performance characteristics such as corrosion resistance and tensile strength, heavily influencing segment value. The dominant application segment, Filtration and Screening, underscores the product's role as a fundamental enabling technology across nearly all major industrial sectors.

- By Material Type:

- Stainless Steel Woven Wire Mesh

- Carbon Steel Woven Wire Mesh

- Galvanized Steel Woven Wire Mesh

- Copper/Brass Woven Wire Mesh

- Nickel & Nickel Alloy Woven Wire Mesh (e.g., Monel, Hastelloy)

- Aluminum Woven Wire Mesh

- By Weave Pattern:

- Plain Weave

- Twilled Weave

- Dutch Weave (Plain Dutch, Twilled Dutch)

- Crimped Weave

- Others (e.g., Intercrimp, Lock Crimp)

- By Application:

- Filtration and Separation

- Screening and Grading

- Reinforcement and Structural

- Protective and Safety Barriers

- Architectural and Decorative

- Conveyor Belts and Trays

- By End-Use Industry:

- Chemical and Petrochemical

- Mining and Quarrying (Aggregate, Cement)

- Food and Beverage Processing

- Water Treatment and Utilities

- Pharmaceutical and Biotechnology

- Aerospace and Automotive

- Construction and Infrastructure

- Pulp and Paper

Value Chain Analysis For Woven Wire Mesh Market

The value chain for the Woven Wire Mesh Market initiates with the upstream analysis, focusing heavily on the procurement and processing of raw metal wires. This stage is dominated by large, integrated steel producers and specialized wire drawing companies that convert primary metal stock (such as billets of stainless steel, copper, or nickel alloys) into fine wires with precise diameter tolerances. The quality and purity of these raw wires are critical, as they directly influence the final mesh integrity and performance. Manufacturers often maintain long-term relationships with a limited number of high-quality wire suppliers to ensure consistent metallurgical specifications and to mitigate the severe impact of commodity price volatility, which is a perennial challenge in this upstream segment. Efficient inventory management and bulk purchasing strategies are essential capabilities at this stage to secure cost advantages.

The midstream involves the core manufacturing process, which includes weaving, calendering, finishing, and fabrication. Weaving is highly capital-intensive, utilizing specialized, high-speed looms. Manufacturers must invest heavily in precision machinery to achieve the micron-level accuracy required for applications like pharmaceutical filtration. Secondary processes, such as heat treating (to enhance material ductility and stress resistance), and calendering (to flatten the mesh for specific uses), add significant value. The fabrication stage, where the finished mesh is cut, framed, or welded into final products (like filter discs, screens, or architectural panels), is where customization becomes paramount, often requiring specialized labor and sophisticated welding techniques, thereby differentiating premium manufacturers from commodity producers.

Downstream analysis covers distribution channels and end-user engagement. Distribution is typically dual-pronged: direct sales to major industrial end-users (e.g., large petrochemical complexes or infrastructure projects) for large-volume, customized orders, and indirect sales through specialized industrial distributors, hardware wholesalers, and fabrication job shops that serve smaller, regional clients needing off-the-shelf products. The role of these distributors is crucial for localized inventory management and providing technical support to diverse customers. End-users’ purchasing decisions are highly influenced by total cost of ownership, regulatory compliance (e.g., FDA approvals for food grade mesh), and the certified performance data provided by the manufacturer, emphasizing the importance of robust quality control and traceable production records throughout the entire value chain.

Woven Wire Mesh Market Potential Customers

The primary end-users and buyers of woven wire mesh are highly diversified industrial entities requiring material separation, fluid control, structural support, or environmental containment. The most significant customer base resides within the heavy industrial sectors, specifically chemical, petrochemical, and oil & gas refining facilities, where woven mesh is indispensable for complex fluid catalytic cracking, impurity filtration, and particulate containment within high-pressure reactors. These customers prioritize mesh alloy composition (e.g., Monel for harsh chemical resistance) and guaranteed aperture size stability, making quality certification the decisive factor in procurement. Capital expenditure cycles in these industries directly impact demand for new filtration assemblies, representing large, cyclical contract opportunities for mesh suppliers.

A rapidly growing segment of potential customers includes environmental engineering firms and municipal water/wastewater treatment plants. These buyers utilize mesh for coarse screening of solids, fine particle removal, and sludge dewatering processes, driven by stricter global regulations on effluent discharge and water conservation. The demand here is consistently high and non-cyclical, focused on meshes made from highly corrosion-resistant materials like stainless steel 316L, offering longevity in aquatic and corrosive environments. Furthermore, infrastructure developers and construction contractors constitute another stable customer group, purchasing large volumes of galvanized or carbon steel mesh for reinforcing concrete structures, security fencing, and screening aggregates (sand, gravel) required for construction materials.

Niche but high-value customer segments include pharmaceutical and biotechnology companies, which require sterile, ultra-fine mesh for tablet screening, surgical tool sterilization trays, and precise laboratory filtration, demanding extremely high material purity and traceability. Similarly, the aerospace and high-performance automotive sectors procure specialty alloys for components used in fuel filtration and sound dampening, where light weight, high strength, and resistance to thermal stress are paramount. Successful engagement with these potential customers necessitates suppliers to not only offer competitive pricing but, more importantly, to provide comprehensive engineering support, customized fabrication capabilities, and adherence to specific industry regulatory standards (e.g., ISO, ASTM, and client-specific certifications).

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.3 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Wire Mesh Corporation, W.S. Tyler, Bopp & Reuther Standardkessel GmbH, Newark Wire Cloth Company, GKD Gebr. Kufferath AG, Dorstener Drahtwerke H. W. Schulte GmbH, Sefar AG, Haver & Boecker OHG, Lupton & Place Ltd, Metalesp S.r.l., TWP Inc., Anping County PFM Screen Co., Ltd., Lawrence Sintered Metals, Ametek Inc., Belt Technologies Inc., Clear Edge Filtration Group, Gerard Daniel Worldwide, Metalco Industries Inc., Axel Johnson Inc., F.P. Smith Wire Cloth Company |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Woven Wire Mesh Market Key Technology Landscape

The Woven Wire Mesh Market relies heavily on sophisticated mechanical engineering and automation to achieve the necessary precision and production volumes. The core technology centers around high-speed, shuttleless weaving looms, which have evolved significantly to handle complex alloy wires and maintain micro-level aperture consistency, especially crucial for advanced Dutch weaves used in high-pressure environments. Modern looms incorporate servo-motor controls and precise tensioning systems, allowing for real-time adjustments based on digital feedback, minimizing the variance in mesh count across large production runs. The transition from manual inspection to automated optical and laser inspection systems represents a paramount technological shift, ensuring that meshes meet stringent quality standards required by end-users in highly regulated sectors like aerospace and pharmaceuticals. Furthermore, specialized heat treatment furnaces are utilized post-weaving to relieve internal stresses within the wire, ensuring the material retains its optimal mechanical properties for enhanced lifespan.

Beyond the primary weaving process, material science and finishing techniques constitute a crucial part of the technological landscape. Innovations in surface treatment, such as plasma etching or specialized polymer coatings, are being developed to enhance resistance to specific chemicals or microbial growth, expanding the mesh's applicability in highly corrosive or sanitary applications. Calendering technology, which involves running the woven mesh through heavy rollers, is continuously refined to produce meshes with extremely smooth and flat surfaces (filter cloths), critical for applications requiring superior cake filtration or precise flow dynamics. The development of advanced welding and sintering techniques is also vital, allowing manufacturers to create complex, multi-layered mesh laminates and customized filter assemblies with exceptional mechanical stability and pore size distribution consistency, overcoming limitations of single-layer mesh performance.

A significant emerging technology area is the integration of Industry 4.0 principles, including the deployment of Internet of Things (IoT) sensors on weaving machines to collect extensive operational data. This data feeds into predictive maintenance models and AI-driven process optimization systems, drastically improving operational efficiency and reducing unexpected maintenance costs. Furthermore, the use of advanced simulation software allows engineers to digitally model the performance of various mesh geometries and alloys under simulated real-world conditions (e.g., pressure drop, flow rate, abrasive wear) before physical prototypes are made. This digital twin technology accelerates product development cycles and allows for hyper-customization of mesh products, serving the niche requirements of advanced manufacturing and scientific research communities, thereby maintaining the market's technological edge against competing filtration media.

Regional Highlights

The regional analysis reveals distinct growth patterns and maturity levels across the global Woven Wire Mesh Market, driven by localized industrial activity and infrastructure investment cycles. Each region presents unique material preference and application focus, demanding tailored market strategies from global suppliers. Geopolitical stability and local regulations regarding manufacturing safety and environmental standards heavily influence the rate of adoption for premium versus standard mesh products.

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market globally, driven primarily by unprecedented infrastructure spending, robust manufacturing growth (especially in electronics and automotive sectors), and large-scale mining activities in countries like Australia, Indonesia, and India. China remains the dominant manufacturing hub and consumer, utilizing vast quantities of mesh for construction reinforcement, water filtration, and industrial screening. The region's growth is characterized by high volume demand, often favoring cost-effective carbon and galvanized steel meshes for general applications, while stainless steel demand escalates alongside rapid urbanization and increased regulatory oversight in food and pharmaceutical industries.

- North America: This region is characterized by high market maturity and a strong demand for specialized, high-margin mesh products. Growth is propelled by stringent regulatory frameworks concerning environmental protection and public safety, driving the need for precision filtration in petrochemicals, aerospace, and advanced manufacturing (e.g., semiconductors). Stainless steel and high-performance nickel alloys dominate material preference. The focus here is less on volume and more on technological innovation, traceability, and adherence to specific industry standards like API and ASTM, making engineering support a key competitive differentiator.

- Europe: Europe exhibits stable, moderate growth, strongly influenced by the pursuit of circular economy goals and industrial automation initiatives. The region is a leader in demanding environmentally friendly production processes and high-quality, long-lasting products. Key sectors driving demand include automotive, high-end architectural design, and pharmaceuticals. There is a strong preference for 316L stainless steel and corrosion-resistant alloys, fueled by rigorous standards (e.g., REACH regulations) requiring certified materials for filtration and separation applications throughout the continent.

- Latin America (LATAM): Market expansion in LATAM is closely tied to commodity cycles, particularly mining (copper, iron ore) and oil & gas extraction, driving demand for heavy-duty screening and separation meshes. Brazil and Mexico are the principal markets, seeing increased infrastructure development. However, price sensitivity is higher here compared to North America and Europe, leading to a balanced demand between high-grade imported stainless steel mesh for specialized processes and locally sourced, more cost-effective galvanized mesh for general construction.

- Middle East and Africa (MEA): Growth in MEA is primarily dictated by massive investments in oil and gas production, desalination projects, and urban development mega-projects (e.g., Saudi Arabia’s Vision 2030). Mesh is essential for water treatment (reverse osmosis pre-filtration), petrochemical processing, and robust sand control in drilling operations. The high-stress environments necessitate the use of premium, corrosion-resistant alloys, making this region a high-value market, though vulnerable to volatility in global energy prices and political stability which can affect investment pace.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Woven Wire Mesh Market.- Wire Mesh Corporation

- W.S. Tyler, Filtration Group Corporation

- Bopp & Reuther Standardkessel GmbH

- Newark Wire Cloth Company

- GKD Gebr. Kufferath AG

- Dorstener Drahtwerke H. W. Schulte GmbH

- Sefar AG

- Haver & Boecker OHG

- Lupton & Place Ltd

- Metalesp S.r.l.

- TWP Inc. (The Wire People)

- Anping County PFM Screen Co., Ltd.

- Lawrence Sintered Metals

- Ametek Inc.

- Belt Technologies Inc.

- Clear Edge Filtration Group

- Gerard Daniel Worldwide

- Metalco Industries Inc.

- Axel Johnson Inc. (Industrial Solutions Division)

- F.P. Smith Wire Cloth Company

Frequently Asked Questions

Analyze common user questions about the Woven Wire Mesh market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand for Woven Wire Mesh in the coming years?

The central market driver is the escalating global requirement for high-efficiency industrial filtration and separation media, fueled by stringent environmental regulations concerning air and water quality, coupled with continuous massive infrastructure development projects worldwide, particularly in the APAC region.

Which material type holds the largest market share and why?

Stainless steel woven wire mesh holds the dominant market share due to its superior durability, excellent corrosion resistance across diverse chemical environments, and ability to meet stringent regulatory requirements in high-value industries like pharmaceuticals, food processing, and petrochemicals.

How does the Dutch Weave pattern differ from Plain Weave and what are its key applications?

Dutch Weave differs by using thicker warp wires and finer shute wires packed tightly together, creating a gradient, wedge-shaped opening rather than square holes. This provides high mechanical strength and superior fine particle filtration capability, making it essential for high-pressure fluid filtration and critical gas-liquid separation.

What are the key technological advancements impacting manufacturing efficiency in this market?

Key technological advancements include the adoption of high-speed, shuttleless looms with servo-motor controls for precision, and the integration of AI-powered machine vision systems for real-time quality control, which collectively minimize defects, reduce material waste, and enhance aperture consistency.

What is the main challenge related to raw material procurement in the Woven Wire Mesh Market?

The primary challenge is the extreme price volatility of raw metal components, specifically nickel and chromium (used in stainless steel), which creates significant cost unpredictability for manufacturers and makes long-term contractual pricing difficult to stabilize for high-volume custom orders.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Woven Wire Mesh Market Statistics 2025 Analysis By Application (Industrial, Agricultural, Architectural & Artistic), By Type (Carbon Steel, Galvanized Steel, Stainless Steel, Aluminum), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Woven Wire Mesh Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Carbon Steel, Galvanized Steel, Stainless Steel, Aluminum, Others), By Application (Industrial, Agricultural, Architectural, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager