Yeast and Yeast Extract Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441501 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Yeast and Yeast Extract Market Size

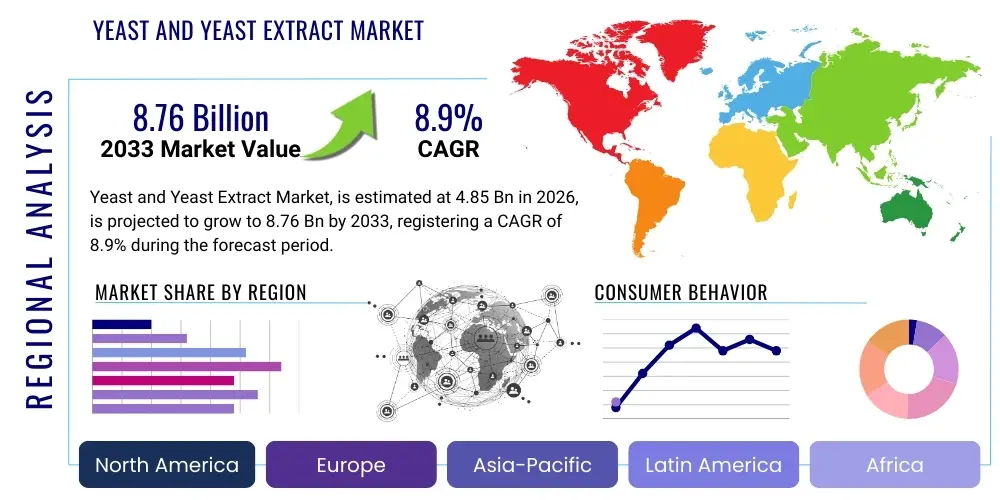

The Yeast and Yeast Extract Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.9% between 2026 and 2033. The market is estimated at USD 4.85 Billion in 2026 and is projected to reach USD 8.76 Billion by the end of the forecast period in 2033.

Yeast and Yeast Extract Market introduction

The Yeast and Yeast Extract Market encompasses the production and commercialization of various yeast species, primarily Saccharomyces cerevisiae, and their derived extracts. Yeast is a crucial bio-ingredient utilized extensively across the food and beverage industry, nutritional supplements, and increasingly in biofuels and pharmaceuticals. Its fundamental role stems from its capacity for fermentation, which is essential in processes such as baking, brewing, and wine production. Yeast extracts, conversely, are concentrated products obtained by breaking down the yeast cells, often used as natural flavoring agents, savory enhancers (due to their high glutamic acid content), and nutritional supplements providing B vitamins and proteins. The distinction lies in their application: whole yeast provides leavening and bio-production capabilities, while yeast extracts serve primarily as functional food ingredients that enhance umami and palatability without the need for artificial additives.

The major applications driving market demand are centered around the surging global preference for clean-label ingredients and natural flavor enhancement. In the food sector, yeast extract acts as a sodium reduction tool while maintaining taste intensity, fulfilling a key public health trend. Furthermore, the rising consumption of functional foods and dietary supplements, especially those targeting gut health and immunity, heavily relies on specific yeast strains and beta-glucan-rich yeast cell wall components. Beyond food, the pharmaceutical and biotechnology sectors utilize yeast for producing recombinant proteins, vaccines, and various biotherapeutics, positioning yeast as an indispensable microorganism in modern biology and industrial fermentation.

Key benefits driving market adoption include the inherent nutritional value of yeast and its extracts, offering a sustainable source of protein and essential micronutrients. Yeast is a versatile, cost-effective bio-factory that supports industrial scalability. Market growth is fundamentally propelled by the increasing global population demanding processed and packaged foods, coupled with the rapid expansion of the bakery and brewing industries in developing economies. Additionally, technological advancements in strain development through genetic engineering are yielding yeasts with enhanced fermentation efficiencies and customized functional properties, further broadening the scope of application and consolidating the market's long-term growth trajectory.

Yeast and Yeast Extract Market Executive Summary

The Yeast and Yeast Extract market is currently experiencing robust growth, primarily fueled by shifting consumer preferences towards natural, savory ingredients and the functional food movement. Business trends indicate significant investment in upstream processing technologies, focusing on optimized fermentation conditions and downstream extraction methods to maximize yield and purity of specialized extracts like high-nucleotide and high-protein varieties. Leading market players are actively pursuing horizontal integration through strategic mergers and acquisitions to consolidate regional market shares and expand their product portfolios, especially targeting specialized segments suchibilities such as animal nutrition and vegetarian food flavoring. The focus remains on sustainable production practices, utilizing molasses and other agro-industrial byproducts as cost-effective and environmentally friendly feedstocks for large-scale yeast cultivation, thereby enhancing operational margins and meeting corporate social responsibility goals.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, largely attributable to the massive and expanding food processing industries in China, India, and Southeast Asian nations. The region’s traditional reliance on savory flavors, coupled with increasing disposable incomes and urbanization, has intensified the demand for processed savory snacks and ready-to-eat meals where yeast extracts are integral flavor components. Europe and North America, while mature, maintain strong market positions due to high consumer awareness regarding natural ingredients, stringent regulatory environments favoring clean labels, and the established dominance of the baking and brewing sectors. These developed regions are driving innovation in specialized functional extracts, particularly those fortified for immunity and digestive health, supporting the trend of preventative healthcare.

Segment trends reveal that the yeast extract segment, categorized by its function as a flavor enhancer, dominates in terms of value, driven by its versatile applications in soups, sauces, ready meals, and meat substitutes. Within the yeast type segmentation, Baker's Yeast remains foundational due to the stable demand from the global bread industry. However, the Nutritional Yeast segment is exhibiting the highest growth rate, propelled by the surge in vegan, vegetarian, and plant-based diets, positioning nutritional yeast as a viable, flavor-rich, and complete protein source. Furthermore, the application segment of feed additives is gaining traction, driven by global mandates to reduce antibiotic use in livestock and the need for natural immune modulators, which yeast cell walls (mannan oligosaccharides and beta-glucans) effectively provide.

AI Impact Analysis on Yeast and Yeast Extract Market

Common user questions regarding AI's impact on the Yeast and Yeast Extract market center around efficiency gains, predictive quality control, and the acceleration of strain development. Users frequently inquire: "How can AI optimize fermentation kinetics?", "Will machine learning replace traditional sensory analysis for flavor profiling?", and "What role does AI play in developing novel yeast strains with enhanced properties?" Based on these queries, the key themes summarize the expectation that AI and ML technologies will revolutionize upstream bioprocessing by enabling hyper-precise monitoring and control, moving away from empirical methods towards data-driven optimization. Concerns often revolve around the high initial investment cost for implementing sophisticated sensor systems and computational models, particularly for smaller market players, and the need for specialized data scientists who can bridge the gap between biological engineering and advanced analytics.

The primary influence of AI is expected to be felt in yield optimization and risk mitigation across large-scale industrial fermentation facilities. AI algorithms are adept at processing multivariate data streams—including temperature, pH, dissolved oxygen, substrate consumption rates, and spectral analysis of broth composition—to predict real-time outcomes and automatically adjust process parameters. This level of predictive maintenance minimizes batch failures, ensures consistency, and significantly lowers operational waste, which is critical in an industry dealing with sensitive biological systems. Moreover, AI aids in complex supply chain management, optimizing logistics for sensitive raw materials like molasses and managing fluctuations in energy costs.

Beyond process control, Generative AI models and machine learning are being deployed in R&D to fast-track strain engineering. By analyzing vast genomic datasets of diverse yeast species, AI can predict the effect of specific gene edits on metabolic pathways, accelerating the development of strains optimized for high productivity (e.g., higher protein yield or increased beta-glucan production) or stress resistance. This capability drastically reduces the time and cost associated with traditional trial-and-error laboratory screening, promising a future where customized yeast strains for niche applications—such as low-alcohol beer fermentation or sustainable aviation fuel production—can be developed rapidly and reliably, thus serving as a major disruptive force in the market's innovation landscape.

- AI-driven optimization of fermentation parameters (temperature, aeration, nutrient dosing) for maximum yield and purity.

- Predictive maintenance schedules for bioprocess equipment, minimizing downtime and increasing plant efficiency.

- Machine Learning (ML) integration for rapid quality control and sensory profiling of yeast extracts, ensuring flavor consistency.

- Accelerated discovery and engineering of novel yeast strains with enhanced tolerance or customized metabolic pathways using genomic data analysis.

- Supply chain risk management and forecasting of raw material prices (e.g., sugar molasses) using advanced statistical models.

- Automated monitoring systems using computer vision and advanced sensors to detect microbial contamination early in the process.

DRO & Impact Forces Of Yeast and Yeast Extract Market

The Yeast and Yeast Extract Market is subjected to a powerful combination of drivers (D) and opportunities (O) that collectively propel its expansion, counterbalanced by inherent restraints (R) and external impact forces. A primary driver is the accelerating trend of clean-label consumerism, where yeast extract is increasingly adopted as a natural replacement for Monosodium Glutamate (MSG) and high-sodium ingredients, simultaneously addressing flavor enhancement needs and nutritional concerns. Coupled with this is the robust growth in the global population embracing vegan and flexitarian diets, which places nutritional yeast and its derivatives at the core of the plant-based food revolution, serving as essential components in meat analogs and dairy substitutes. These drivers are amplified by opportunities arising from technological advancements in genetic modification and synthetic biology, allowing producers to design high-performance, specialized yeast strains tailored for high-value applications in pharmaceuticals and specialized bio-based chemical production, offering significant margin expansion beyond traditional food uses.

Despite the strong tailwinds, the market faces significant restraints. The primary challenge is the volatility and fluctuating costs of raw materials, predominantly molasses (a byproduct of the sugar industry), which is subject to agricultural yields and global sugar market dynamics, creating considerable pressure on production costs. Furthermore, the reliance on high energy consumption processes, particularly during downstream separation and drying (spray drying), poses an environmental and economic constraint, especially amid rising global energy prices and stringent sustainability mandates. Another restraint involves the potential for consumer misconceptions regarding yeast extract’s classification; although natural, some consumers confuse it with MSG, necessitating continuous educational efforts and clear labeling strategies by industry participants to maintain consumer trust and acceptance.

The overarching impact forces shaping the market trajectory are environmental sustainability and regulatory scrutiny. There is enormous pressure from industrial and governmental bodies to reduce waste and optimize water usage in fermentation processes, driving innovation towards circular economy models utilizing agricultural waste streams. Geopolitical stability also acts as a critical force; disruptions in key agricultural producing regions can severely impact the supply chain for raw materials. The interplay between strong demand drivers (natural flavor, plant-based protein) and operational restraints (raw material cost, energy intensity) creates a highly competitive environment where only companies investing heavily in supply chain resilience, advanced fermentation optimization (often AI-assisted), and proprietary strain development will secure dominant positions in the future market landscape.

Segmentation Analysis

The Yeast and Yeast Extract market is comprehensively segmented based on its source, type, application, and form, providing granular insight into end-user requirements and market dynamics across various sectors. The segmentation highlights the intrinsic differences in product functionality—from whole, metabolically active yeast used in leavening (Baker’s Yeast) and brewing (Brewer’s Yeast) to concentrated, hydrolyzed extracts serving as high-impact flavorants and nutritional boosters. Analyzing these segments is crucial for understanding specific growth pockets, such as the explosive demand for nutritional yeast in the prepared vegan meals segment or the steady, high-volume requirement for inactive dry yeast in animal feed formulation, reflecting the market’s diverse and specialized demand structure.

- By Type:

- Baker's Yeast (Fresh, Active Dry, Instant Dry)

- Brewer's Yeast (Traditional, Specialized Strains)

- Wine Yeast

- Feed Yeast

- Nutritional Yeast (Flakes, Powder)

- Probiotic Yeast (e.g., Saccharomyces boulardii)

- By Form:

- Dry (Powder, Granules)

- Liquid (Suspensions, Pastes)

- By Source:

- Molasses (Beet, Cane)

- Agro-Industrial Byproducts (Spent Grain, Whey)

- Others (Glycerol, Starchy Substrates)

- By Application:

- Food and Beverages (Savory Flavors, Baked Goods, Alcoholic Beverages, Functional Foods)

- Animal Feed (Poultry, Swine, Aquaculture, Ruminants)

- Pharmaceutical and Nutraceuticals (Dietary Supplements, Probiotics, Immunomodulators)

- Biotechnology and Biofuel

Value Chain Analysis For Yeast and Yeast Extract Market

The value chain for the Yeast and Yeast Extract market is intricate, beginning with the sourcing of agricultural raw materials and culminating in the highly specialized distribution to diverse end-use industries. The upstream analysis focuses heavily on the procurement of fermentation substrates, primarily high-sugar molasses derived from sugar cane or sugar beet processing. Reliability and cost control at this stage are paramount, as substrate costs represent a significant portion of the total production expenditure. Key upstream activities include securing long-term contracts with large sugar producers and implementing robust quality control measures to ensure the nutrient composition of the feedstock is optimal for consistent yeast cell propagation. The selection and maintenance of proprietary, high-yield yeast mother strains are also critical upstream activities, heavily reliant on advanced biotechnology R&D.

Midstream activities involve the core manufacturing processes: propagation, large-scale industrial fermentation, harvesting (centrifugation), washing, and finally, drying (for yeast) or hydrolysis and concentration (for yeast extract). The efficiency of the fermentation and downstream processing steps is crucial for profitability. For yeast extract production, the precise control of autolysis or enzymatic hydrolysis determines the final flavor profile (umami intensity) and nutritional composition. Energy consumption, especially in the evaporation and spray drying stages, constitutes a major operational factor, pushing manufacturers to adopt energy-recovery systems and continuous processing techniques to enhance throughput and reduce the overall carbon footprint per unit produced.

Downstream analysis involves the complex distribution channels and the ultimate consumption by end-users. Distribution relies on both direct sales, particularly to large industrial food manufacturers (e.g., savory sauce producers or major breweries) and major feed mill operators, and indirect channels through specialized food ingredient distributors and logistics partners. The final products, whether active dry yeast or flavor extracts, require specific storage and handling conditions (temperature, humidity, inert packaging) to maintain viability and quality over shelf life. The direct channel allows for closer collaboration on custom formulations, particularly for high-value nutraceutical or pharmaceutical applications, while the indirect channel ensures wide market penetration across the fragmented bakery and smaller food processing sectors globally.

Yeast and Yeast Extract Market Potential Customers

The potential customers for the Yeast and Yeast Extract market span a broad spectrum of industrial categories, reflecting the ingredient’s versatile functionality as a nutritional supplement, fermenting agent, and natural flavor enhancer. The largest volume buyers are typically within the mass food manufacturing sector, specifically companies specializing in convenience foods, savory seasonings, and ready-to-eat meals, where yeast extracts are essential for delivering rich, meat-like, or umami flavors without artificial enhancers. These manufacturers prioritize consistency, scalability, and certification (e.g., Kosher, Halal, Non-GMO) to meet the diverse demands of their global consumer bases. Furthermore, the brewing and baking industries represent foundational customers, requiring continuous, high-quality supplies of specific yeast strains calibrated for optimal performance in leavening or alcohol production.

Another major customer segment resides in the animal nutrition industry, encompassing large-scale feed producers for livestock (poultry, swine, and aquaculture). These customers utilize inactive yeast and yeast cell wall fractions (MOS, beta-glucans) primarily as functional feed additives to improve animal gut health, boost immunity, and replace prophylactic antibiotics, driven by increasing global regulatory pressure to enhance animal welfare and reduce antibiotic resistance. Their purchasing decisions are heavily influenced by efficacy data, cost-to-benefit ratios, and compliance with stringent feed safety standards, often requiring custom formulations tailored to specific animal physiological requirements and rearing environments.

High-growth potential customers are increasingly found in the burgeoning nutraceutical and plant-based food sectors. Nutraceutical companies purchase yeast (often specialized strains like Saccharomyces boulardii) for formulating probiotics, immune supplements, and B-vitamin complexes, targeting health-conscious consumers seeking natural sources of functional ingredients. Similarly, the rapid proliferation of companies developing plant-based meat and dairy alternatives rely heavily on nutritional yeast and yeast extracts to replicate the savory depth and mouthfeel traditionally associated with animal products, positioning them as high-value customers focused on innovation, flavor complexity, and clean-label messaging. These segments demand premium, highly purified, and often fortified yeast products.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.85 Billion |

| Market Forecast in 2033 | USD 8.76 Billion |

| Growth Rate | CAGR 8.9% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lallemand Inc., Lesaffre, Angel Yeast Co., Ltd., AB Mauri (Associated British Foods plc), DSM Nutritional Products, Kerry Group, Ohly GmbH (Associated British Foods plc), Leiber GmbH, Biospringer (Lesaffre), Nutrex NV, Novozymes (Now part of Novonesis), Synergy Flavors, Sensient Technologies Corporation, Gnosis by Lesaffre, Alltech, Chr. Hansen Holding A/S (Now part of Novonesis), Ajinomoto Co., Inc., Biomin (DSM), Kemin Industries, Red Star Yeast Company. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Yeast and Yeast Extract Market Key Technology Landscape

The technological landscape of the Yeast and Yeast Extract market is rapidly evolving, driven primarily by the need for increased efficiency, better yield, and customization of functional properties. At the core are advancements in large-scale bioprocessing and industrial fermentation. Modern facilities utilize Continuous Fermentation Systems (CFS) rather than traditional batch systems, which allow for sustained production at optimized conditions, significantly increasing volumetric productivity and reducing turnaround time. This shift is supported by sophisticated Process Analytical Technology (PAT), involving real-time sensors (e.g., NIR spectroscopy, mass spectrometry) and integrated software that monitors critical process parameters, ensuring tight control over yeast growth and metabolic activity, which directly translates to consistent product quality and reduced risk of batch variation.

In the downstream processing of yeast extracts, the focus is on maximizing the extraction yield of desirable components, such as nucleotides, peptides, and beta-glucans, while minimizing undesirable off-flavors. Advanced extraction technologies include Ultrafiltration (UF) and Microfiltration (MF) techniques, which separate cell components based on molecular weight, allowing for the isolation of high-purity fractions tailored for specific nutraceutical or savory enhancement applications. Furthermore, Enzyme-Assisted Hydrolysis is becoming highly specialized, where specific exogenous enzymes are introduced to the autolysis stage to predictably cleave cell proteins and nucleic acids, customizing the resulting extract’s flavor profile (umami, kokumi) and solubility, providing manufacturers with highly differentiated product offerings.

Biotechnology and genetic engineering represent the frontier of innovation, particularly in strain development. Techniques such as CRISPR-Cas9 are being utilized to precisely modify the genomes of Saccharomyces cerevisiae and other yeast species. This precision allows researchers to knock out genes responsible for undesirable byproducts or enhance metabolic pathways that increase the production of high-value compounds like specific proteins, carotenoids, or fatty acids. The resulting proprietary strains offer superior performance in niche applications, such as enhanced tolerance to high ethanol concentrations in brewing or resistance to inhibitory compounds in sustainable feedstock usage, ensuring that technological investment in genomics remains a critical competitive differentiator for market leaders seeking premium market positions.

Regional Highlights

Asia Pacific (APAC) dominates the global yeast and yeast extract market in terms of volume and exhibits the highest growth trajectory, largely driven by fundamental demographic and industrial expansion. Countries like China and India represent massive consumption hubs due to their enormous bakery industries and rapidly expanding processed food sectors. The tradition of incorporating savory, fermented ingredients into local cuisine provides a natural affinity for yeast extracts as flavor enhancers in ready-to-eat meals, instant noodles, and savory snacks. Furthermore, the burgeoning animal feed industry in Southeast Asia is adopting yeast-based functional additives at an increasing rate to improve livestock health and productivity, responding to rising regional demand for protein, thereby cementing APAC's pivotal role in shaping future market demand and supply dynamics.

Europe holds a significant market share, characterized by its mature and highly specialized baking and brewing industries, which demand high volumes of specific yeast strains with stringent quality standards. The European market is also a key driver of the high-value nutritional yeast segment, fueled by strong consumer adoption of vegetarian and vegan diets, particularly in Western European nations like Germany, the UK, and the Netherlands. Strict European Union regulations regarding food additives and clean labeling favor the use of natural ingredients like yeast extract over artificial enhancers, compelling food formulators to rely heavily on these natural alternatives. Innovation in this region is focused on sustainable sourcing, zero-waste manufacturing, and developing extracts for immune and gut health applications, catering to the sophisticated and health-conscious consumer base.

North America maintains a strong position, driven primarily by the high per capita consumption of packaged and convenience foods, alongside a significant push toward functional foods and supplements. The United States market is leading the charge in the adoption of nutritional yeast as a staple ingredient in the preparation of vegan and cheese-flavored substitutes. High investment in biotechnology allows North American companies to lead in the development of specialized probiotic yeast strains and genetically engineered yeasts for bio-based chemical production and sustainable energy solutions. Market stability is ensured by the robust infrastructure supporting both industrial-scale production and a highly efficient distribution network capable of meeting the diverse and fast-paced demands of the regional food service and retail sectors.

- Asia Pacific (APAC): Highest growth rate; driven by massive expansion of food processing (China, India) and significant growth in the animal feed sector. Focus on savory enhancement in traditional and convenience foods.

- Europe: High market value; mature baking and brewing industries; strong regulatory support for clean labels; major consumption of nutritional yeast due to high prevalence of vegan diets.

- North America: Stable growth; driven by large functional food and supplement industries; high adoption of yeast extracts in plant-based dairy and meat alternatives; technological leadership in specialized bio-production.

- Latin America (LATAM): Emerging market; driven by expanding brewing industry (Brazil, Mexico) and increasing industrialization of feed production, utilizing local molasses supplies.

- Middle East and Africa (MEA): Growth potential centered around urbanization, increasing demand for packaged bakery products, and necessary implementation of feed additives for climate-resilient livestock farming.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Yeast and Yeast Extract Market.- Lallemand Inc.

- Lesaffre

- Angel Yeast Co., Ltd.

- AB Mauri (Associated British Foods plc)

- DSM Nutritional Products

- Kerry Group

- Ohly GmbH (Associated British Foods plc)

- Leiber GmbH

- Biospringer (Lesaffre)

- Nutrex NV

- Novozymes (Now part of Novonesis)

- Synergy Flavors

- Sensient Technologies Corporation

- Gnosis by Lesaffre

- Alltech

- Chr. Hansen Holding A/S (Now part of Novonesis)

- Ajinomoto Co., Inc.

- Biomin (DSM)

- Kemin Industries

- Red Star Yeast Company

Frequently Asked Questions

Analyze common user questions about the Yeast and Yeast Extract market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the Yeast Extract Market?

The primary factor driving growth is the surging global demand for clean-label, natural flavor enhancers. Yeast extract is widely used as a natural alternative to artificial flavorings and Monosodium Glutamate (MSG), fulfilling consumer preferences for savory, yet healthy, processed foods.

How is the Yeast and Yeast Extract Market affected by the rise of plant-based diets?

The market is positively and significantly affected. Nutritional Yeast and yeast extracts are foundational ingredients in plant-based food manufacturing, providing essential protein, B vitamins, and crucial savory (umami) notes to replicate the flavor profile and nutritional density of traditional meat and dairy substitutes.

What are the main restraints impacting the profitability of yeast production?

The primary restraints include the volatile cost of raw materials, particularly agricultural molasses, which is subject to unpredictable agricultural yields and commodity market fluctuations. Additionally, the energy-intensive nature of downstream processing, such as drying, adds substantial operational cost pressure.

What technological advancements are shaping the future of yeast strain development?

Advanced biotechnology, specifically genomic editing tools like CRISPR-Cas9, is critically shaping the future. These tools allow for the precise and rapid development of custom yeast strains with optimized metabolic pathways, leading to higher yields, enhanced stress tolerance, and the production of specific high-value functional ingredients.

Which geographical region holds the highest growth potential for the Yeast and Yeast Extract market?

The Asia Pacific (APAC) region demonstrates the highest growth potential. This growth is fueled by rapid urbanization, massive expansion in the regional processed food and beverage industries, and increasing adoption of yeast-based feed additives across the large livestock farming sectors in countries like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager