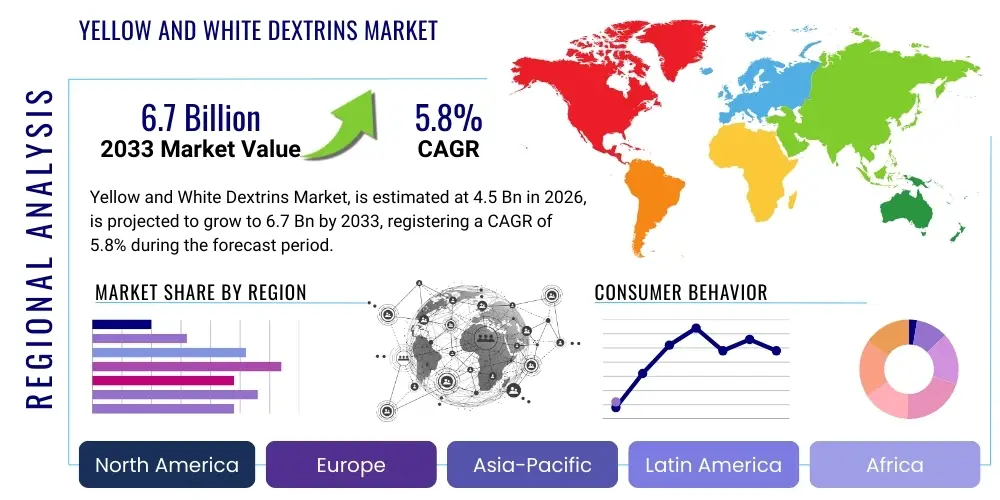

Yellow and White Dextrins Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443486 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Yellow and White Dextrins Market Size

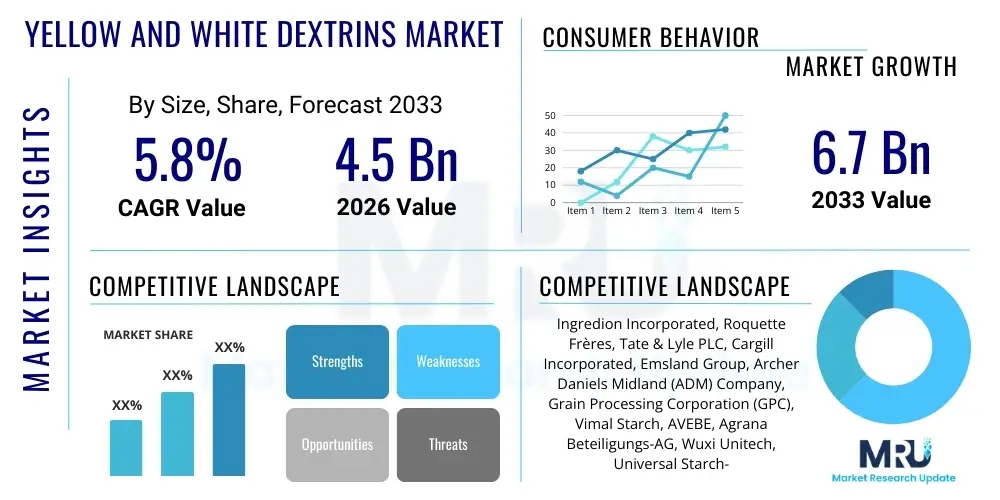

The Yellow and White Dextrins Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 6.7 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the escalating demand for natural, starch-derived ingredients across several key industrial sectors, including packaging, food processing, and pharmaceuticals. The versatility of dextrins, particularly their excellent binding and thickening properties, positions them as indispensable components in formulations requiring high functional performance.

Yellow and White Dextrins Market introduction

The Yellow and White Dextrins Market encompasses the production and consumption of hydrolyzed starch products, which are primarily categorized by their processing method and resulting color and functionality. Dextrins are low-molecular-weight carbohydrates produced by heating dry starch, either alone (pyrodextrins) or in the presence of trace amounts of acid (acid hydrolysis). White dextrins, processed under mild heat and shorter durations, retain a pale color and are largely preferred for applications demanding low viscosity and high solubility, such as in the food and pharmaceutical industries where they serve as binding agents, carriers, and stabilizers. Conversely, Yellow dextrins, often termed canary dextrins, undergo more rigorous heat and acid treatment, resulting in a darker color, lower solubility, and significantly enhanced adhesive properties, making them dominant in industrial applications like paper sizing, textile finishing, and robust adhesive manufacturing.

Major applications of dextrins span a wide array of sectors, underscoring their functional utility. In the food industry, white dextrins act as fat replacers, texture enhancers, and dietary fibers, catering to the rising consumer trend toward healthier, minimally processed ingredients. Pharmaceutical manufacturers utilize them as excipients, binders, and disintegrants in tablet formation. The industrial segment, spearheaded by yellow dextrins, relies on their powerful binding capabilities for manufacturing corrugated boards, envelopes, and abrasive materials. The inherent benefits of dextrins—being bio-based, non-toxic, and economically viable—provide a strong competitive edge over synthetic alternatives, thereby propelling market expansion globally.

Key driving factors for market growth include the robust expansion of the packaging industry, especially in emerging economies, which heavily relies on yellow dextrin adhesives for sustainable and high-strength bonding solutions. Furthermore, increasing regulatory pressure favoring natural and biodegradable materials over synthetic polymers in Europe and North America is creating significant opportunities for white dextrins in specialty food formulations and pharmaceutical excipients. Continuous research aimed at enhancing the functional properties of these starch derivatives, such as optimizing their molecular weight distribution for specific applications, further stimulates demand and broadens the application base.

Yellow and White Dextrins Market Executive Summary

The Yellow and White Dextrins Market is characterized by steady growth, driven primarily by favorable business trends emphasizing sustainability, product quality, and the shift towards bio-based raw materials. Current business trends indicate a strong push for process optimization, with key market players investing heavily in advanced enzymatic and controlled pyrolysis techniques to ensure consistent quality and functional efficacy across different grades of dextrins. Strategic mergers and acquisitions are frequently observed, aimed at securing raw material supply chains, especially starch derived from corn, potato, and tapioca, and expanding geographical reach into high-growth regions like Asia Pacific, which is witnessing rapid industrial and consumer sector expansion.

Regionally, Asia Pacific (APAC) stands out as the primary growth engine for the market, driven by massive consumption in the textile and packaging sectors in countries such as China and India. The rapid pace of urbanization and the subsequent increase in processed food demand in Southeast Asian nations also bolster the demand for white dextrins. North America and Europe, while mature markets, emphasize high-purity, specialized white dextrins for pharmaceutical and high-end food applications, driven by stringent quality standards and a strong focus on functional food ingredients. European regulatory mandates promoting biodegradable packaging solutions further cement the demand for yellow dextrins in industrial applications across the continent.

Segment trends reveal distinct growth patterns within the market. By product type, Yellow Dextrins currently dominate the market volume due to their extensive use in high-volume industrial adhesives and binding applications, correlating directly with the growth of the manufacturing and construction sectors. However, the White Dextrins segment is projected to exhibit a faster Compound Annual Growth Rate (CAGR) over the forecast period, primarily fueled by the burgeoning nutraceutical and pharmaceutical industries seeking premium, clean-label excipients and dietary fiber ingredients. The application segment growth is led by the packaging sector, followed closely by the food and beverage industry, reflecting the global reliance on sustainable bonding agents and natural texture modifiers.

AI Impact Analysis on Yellow and White Dextrins Market

Analysis of common user questions regarding AI's impact on the Yellow and White Dextrins Market reveals significant interest centered on efficiency gains, predictive quality control, and formulation optimization. Users frequently inquire about how AI can mitigate raw material price volatility, enhance the precision of acid hydrolysis or pyrolysis processes, and streamline complex supply chain logistics for bulk starch derivatives. Key concerns revolve around the initial investment required for sophisticated sensor technology and machine learning integration, and whether AI can genuinely accelerate the development of novel dextrin functionalities, such as those with improved water resistance or specific molecular weight profiles tailored for high-speed industrial machinery. The overarching expectation is that AI will standardize production, reduce batch-to-batch variability, and provide real-time insights into energy consumption during the drying and roasting stages.

AI's influence is transforming the production workflow by enabling predictive maintenance and optimizing energy consumption in starch conversion plants. Machine learning algorithms analyze vast datasets comprising temperature, pressure, reaction time, and acid concentration during the dextrinization process. This predictive capability allows manufacturers to anticipate quality deviations before they occur, ensuring that the resulting yellow or white dextrin consistently meets strict end-user specifications regarding solubility, color, and adhesive strength. Furthermore, AI assists in dynamic inventory management, balancing the fluctuating supply of raw starch materials (corn, potato, wheat) with the highly specific, just-in-time demands of industrial adhesive and pharmaceutical buyers, thereby minimizing waste and operational costs.

The incorporation of AI into research and development accelerates the discovery of new applications and product grades. Generative models and neural networks can simulate thousands of possible starch modification processes, rapidly identifying optimal parameters for creating specialized dextrins—for instance, high-purity white dextrins suitable for advanced drug delivery systems or industrial yellow dextrins with superior moisture resistance. This technological integration drastically cuts down the experimental time required for new product launches, providing a competitive edge to companies that leverage advanced analytics to understand market requirements and tailor product functionalities precisely. Ultimately, AI fosters a shift towards personalized and high-precision production in the dextrin market.

- AI-driven optimization of starch conversion temperature and acid concentration for enhanced yield.

- Predictive quality control systems minimizing batch variation in color and viscosity.

- Supply chain optimization using machine learning to forecast raw material volatility.

- Automated energy management leading to reduced utility consumption during drying processes.

- Accelerated formulation development for novel, high-specification dextrin grades.

DRO & Impact Forces Of Yellow and White Dextrins Market

The Yellow and White Dextrins Market is propelled by several strong market drivers, notably the increasing global emphasis on sustainable and bio-based ingredients, which positions starch derivatives favorably against petroleum-based chemical alternatives. Significant growth in the packaging industry, particularly the demand for corrugated boxes and paper sacks which utilize robust yellow dextrin adhesives, serves as a fundamental market stimulus. Concurrently, the rising consumer preference for functional foods, health supplements, and clean-label products boosts the demand for high-purity white dextrins used as functional fibers and excipients. These drivers interact powerfully, creating a positive market environment where natural ingredient sourcing is prioritized across industrial and consumer sectors.

However, the market faces notable restraints, primarily related to the price volatility and seasonality of raw starch sources, particularly corn and tapioca, which directly impacts production costs and profit margins for dextrin manufacturers. Furthermore, intense competition from synthetic polymers and alternative natural thickeners, such as guar gum and modified celluloses, poses a constant challenge, forcing manufacturers to innovate constantly to maintain competitive pricing and functional superiority. Stringent regulatory hurdles in certain regions concerning the classification and allowed applications of modified starches, though generally favorable, can sometimes impede faster product deployment, requiring extensive safety and efficacy testing.

Opportunities for market expansion are substantial, particularly in developing novel applications such as bio-based packaging coatings, biodegradable plastics formulations, and advanced drug encapsulation techniques using specialized white dextrin grades. Manufacturers can capitalize on the growing industrial shift toward greener chemistries by developing high-performance yellow dextrins capable of replacing traditional synthetic resins in construction and textile sizing. The impact forces—ranging from robust industrial growth (pulling yellow dextrins) to heightened consumer health awareness (pulling white dextrins)—exert a combined influence that favors market expansion, provided manufacturers successfully navigate the challenges posed by raw material price fluctuations and technological substitution threats.

Segmentation Analysis

The Yellow and White Dextrins Market is segmented based on critical parameters, including product type, application, and grade. This segmentation provides clarity on the diverse functionality and end-use scenarios of these starch derivatives. Product type differentiation separates the market into Yellow Dextrins (Pyrodextrins) and White Dextrins (Acid-modified pyrodextrins), reflecting their distinct processing conditions and resulting physical properties—Yellow dextrins are highly soluble and adhesive, while White dextrins are characterized by lower viscosity and better stability in food matrices. Understanding these core product differences is crucial for targeting specific industrial and consumer markets.

Application-based segmentation is critical, highlighting the widespread utility of dextrins across major sectors. The Packaging Industry, which relies heavily on yellow dextrins for adhesives, represents the largest revenue share. Following closely are the Food & Beverage sector, where white dextrins function as stabilizers and texture enhancers, and the Pharmaceutical & Nutraceutical sector, utilizing high-purity white dextrins as tableting binders and encapsulating agents. Other significant applications include textiles, foundry operations, and construction materials. Geographic segmentation ensures that market strategies are tailored to the distinct regulatory and demand landscapes of key regions like APAC, North America, and Europe, which prioritize different grades and applications.

Further granularity is provided by segmenting based on the source of the starch, such as maize/corn, potato, tapioca, and wheat. While corn starch remains the dominant source globally due to abundance and cost-effectiveness, regional sourcing preferences (e.g., tapioca in Southeast Asia, potato in Europe) affect the final product characteristics and supply chain dynamics. The versatility inherent in dextrins allows suppliers to meet highly specific requirements, such as food-grade versus industrial-grade specifications, ensuring optimized performance for every end-use application.

- By Type:

- Yellow Dextrins (Canary Dextrins)

- White Dextrins

- By Raw Material Source:

- Corn Starch

- Potato Starch

- Tapioca Starch

- Wheat Starch

- By Application:

- Adhesives and Binders (Packaging, Paper, Envelopes)

- Food & Beverages (Thickening Agents, Stabilizers, Fat Replacers)

- Pharmaceuticals and Nutraceuticals (Excipients, Binders)

- Textiles and Sizing

- Foundry and Casting

- Others (Construction, Ceramics)

- By Grade:

- Food Grade

- Industrial Grade

- Pharmaceutical Grade

Value Chain Analysis For Yellow and White Dextrins Market

The value chain for the Yellow and White Dextrins Market begins with upstream analysis centered on the sourcing and preparation of primary raw materials, predominantly starch derived from corn, potato, tapioca, or wheat. This upstream segment is highly dependent on agricultural commodity market stability and weather patterns, which dictate starch quality and pricing. Key players in this stage include large agricultural cooperatives and major starch producers who invest heavily in efficient harvesting and primary processing infrastructure. The stability of this supply is critical, as any volatility in starch prices directly impacts the cost of dextrin production, necessitating strategic long-term sourcing contracts and risk mitigation strategies to ensure predictable supply for downstream manufacturing.

The core of the value chain involves the manufacturing process—the conversion of native starch into dextrins through controlled dry heating (pyrolysis) and/or acid modification (dextrinization). This middle segment requires specialized equipment, including sophisticated roasters, reactors, and highly controlled drying systems, particularly for producing high-purity white dextrins used in sensitive pharmaceutical applications. Manufacturers differentiate themselves here through process efficiency, energy consumption minimization, and the ability to produce customized dextrin grades with precise molecular weight distribution, solubility, and adhesive strength. Quality control and adherence to strict regulatory standards (e.g., ISO, HACCP, GMP) are paramount at this stage to ensure product suitability for diverse end-use markets.

Downstream analysis focuses on distribution channels and end-user engagement. Distribution is multi-layered, involving direct sales to large industrial customers (e.g., major packaging companies, pharmaceutical giants) and indirect channels through specialized chemical distributors and ingredient suppliers for smaller manufacturers and regional markets. Effective logistics are essential, given that dextrins are high-volume, relatively low-margin commodities. Potential customers are highly diverse, spanning packaging, food, pharma, and textile sectors. Direct communication and technical support are crucial for key accounts, ensuring that the appropriate yellow or white dextrin grade is matched to the specific functional requirements of the buyer, such as high-speed machine compatibility for industrial adhesives or specific binding properties for tableting.

Yellow and White Dextrins Market Potential Customers

The primary potential customers and end-users of Yellow and White Dextrins are highly fragmented yet concentrated within key industrial and consumer sectors, each demanding specific functional properties. Leading the consumption volume are adhesive and binding manufacturers, who constitute the largest buyer segment for high-strength, high-viscosity yellow dextrins, particularly for manufacturing corrugated board, multiwall paper bags, and laminates. These customers prioritize consistency, rapid setting time, and strong mechanical bonding, as their operations often involve high-speed, continuous manufacturing lines. The demand here is directly correlated with global trade activity and the expansion of e-commerce packaging requirements.

The second major consumer cluster comprises Food & Beverage processing companies, particularly those focused on convenience foods, confectionery, and dairy alternatives. These buyers predominantly utilize white dextrins as clean-label thickening agents, low-calorie fillers, texturizers, and dietary fibers (e.g., resistant dextrins). Their purchasing decisions are heavily influenced by regulatory approvals, ingredient transparency, and the ability of the dextrin to mimic the functional properties of fats or other expensive hydrocolloids while maintaining flavor neutrality. The ongoing consumer shift toward lower-sugar and high-fiber products creates a constant need for reliable, high-quality white dextrin suppliers.

A high-value, quality-sensitive customer segment includes Pharmaceutical and Nutraceutical manufacturers. These companies require ultra-pure, pharmacopeia-grade white dextrins to serve as excipients, binders, fillers, and disintegrants in tablet, capsule, and powder formulations. For this segment, compliance with Good Manufacturing Practices (GMP) and detailed documentation regarding source, processing, and purity is non-negotiable. Other niche, yet significant, potential customers include textile sizing specialists, who use yellow dextrins to improve yarn strength, and foundry manufacturers, where dextrins act as binders for sand cores and molds, demonstrating the ingredient's broad utility across foundational industries.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ingredion Incorporated, Roquette Frères, Tate & Lyle PLC, Cargill Incorporated, Emsland Group, Archer Daniels Midland (ADM) Company, Grain Processing Corporation (GPC), Vimal Starch, AVEBE, Agrana Beteiligungs-AG, Wuxi Unitech, Universal Starch-Chem Allied, SPAC Starch Products, Samyang Genex, Everest Starch (India) Pvt Ltd., Sanstar Bio-Polymers, Matsutani Chemical Industry Co., Ltd., J. Rettenmaier & Söhne (JRS), Nippon Starch Chemical Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Yellow and White Dextrins Market Key Technology Landscape

The technological landscape of the Yellow and White Dextrins Market is defined by continuous advancements in starch modification techniques aimed at improving product purity, functional consistency, and production efficiency. The foundational technology remains the pyrodextrinization process, involving controlled heat and acid exposure. However, modern manufacturing employs highly automated, continuous flow reactors integrated with sophisticated sensor technology that precisely monitors moisture content, temperature profiles, and reaction kinetics. This level of control is essential for producing narrow-specification dextrins, ensuring that the resulting molecular weight distribution is optimized for highly specific end-user requirements, such as high-solids adhesive formulations requiring rapid tack development or specialized white dextrins with superior compressibility for high-speed tablet presses.

A key technological innovation driving the high-purity White Dextrins segment is the utilization of enzymatic hydrolysis combined with controlled drying techniques, such as spray drying. Enzymatic methods offer a milder, more selective way to cleave starch chains compared to traditional acid modification, resulting in products with fewer off-flavors, higher purity, and better digestibility—a crucial factor for nutraceutical applications (e.g., resistant starches/dextrins). Spray drying technology is integral for converting the liquid dextrin solution into a fine, highly flowable powder, which significantly enhances the handling and mixing properties, making the product highly sought after by pharmaceutical companies and complex food formulators.

Furthermore, advancements in waste heat recovery and energy optimization technologies are crucial in this energy-intensive industry. Manufacturers are implementing sophisticated heat exchangers and closed-loop systems to reduce the overall energy required for the high-temperature roasting phase of yellow dextrin production. The focus on sustainability also extends to effluent treatment, utilizing filtration and membrane separation technologies to minimize water consumption and ensure that the process byproducts are managed efficiently. The integration of advanced analytics, often leveraging AI, provides real-time adjustments to processing parameters, marking a shift toward 'smart manufacturing' in the dextrin production sector.

Regional Highlights

Regional dynamics play a crucial role in shaping the demand, supply, and technological trajectory of the Yellow and White Dextrins Market, reflecting diverse economic activities and regulatory frameworks across the globe. Asia Pacific (APAC) is the undisputed leader in market size and growth rate. This dominance is attributed to rapid industrialization, particularly in China and India, which fuels massive demand for yellow dextrins in the robust packaging, textile, and construction industries. The expanding middle class and increasing penetration of organized retail also drive the consumption of processed foods, boosting the use of white dextrins as stabilizers and thickeners. Furthermore, the availability of abundant raw materials, such as tapioca and maize starch, contributes to lower production costs and high export volumes from this region.

North America and Europe constitute mature markets characterized by stringent quality regulations and high demand for specialized, pharmaceutical-grade white dextrins. In these regions, growth is less volume-driven and more value-driven, focusing on innovation in clean-label ingredients, dietary fibers, and high-performance industrial adhesives designed for challenging applications. European policies favoring bio-based and biodegradable materials strongly encourage the substitution of synthetic binders with yellow dextrins in industrial applications. Manufacturers in North America prioritize R&D to develop specialty dextrins with enhanced functionalities to secure premium pricing and maintain competitiveness against lower-cost imports.

Latin America (LATAM) and the Middle East & Africa (MEA) represent emerging markets with high growth potential, though currently smaller in overall share. LATAM’s market expansion is tied to the development of its food and beverage sector and increasing infrastructure projects requiring industrial adhesives. The MEA region is witnessing gradual growth fueled by investments in manufacturing and packaging infrastructure, particularly in the Gulf Cooperation Council (GCC) countries. These regions present opportunities for key global players seeking to establish new distribution hubs and capitalize on the early stages of industrial development, often favoring industrial-grade yellow dextrins initially before shifting towards higher-purity white dextrins as the consumer base matures.

- Asia Pacific (APAC): Market leader, driven by mass consumption in packaging and textiles; strong raw material base (corn, tapioca).

- North America: Focus on high-value, pharmaceutical-grade white dextrins and advanced sustainable industrial adhesives.

- Europe: Growth supported by strict environmental regulations favoring bio-based packaging solutions; high adoption of white dextrins in functional foods.

- Latin America (LATAM): Emerging market with growing demand in the food processing and regional construction sectors.

- Middle East & Africa (MEA): Increasing adoption driven by infrastructure development and nascent growth in the regional manufacturing base.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Yellow and White Dextrins Market.- Ingredion Incorporated

- Roquette Frères

- Tate & Lyle PLC

- Cargill Incorporated

- Emsland Group

- Archer Daniels Midland (ADM) Company

- Grain Processing Corporation (GPC)

- Vimal Starch

- AVEBE

- Agrana Beteiligungs-AG

- Wuxi Unitech

- Universal Starch-Chem Allied

- SPAC Starch Products

- Samyang Genex

- Everest Starch (India) Pvt Ltd.

- Sanstar Bio-Polymers

- Matsutani Chemical Industry Co., Ltd.

- J. Rettenmaier & Söhne (JRS)

- Nippon Starch Chemical Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Yellow and White Dextrins market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary distinction between Yellow and White Dextrins?

The distinction lies in their processing and functionality. Yellow dextrins undergo more intense heat and acid treatment, resulting in strong adhesive properties suitable for industrial binders. White dextrins are processed mildly, retaining lower viscosity and higher purity, making them ideal for food and pharmaceutical applications as carriers and stabilizers.

Which application segment drives the highest demand for Dextrins globally?

The Packaging and Adhesives segment currently drives the highest volume demand, primarily consuming industrial-grade Yellow Dextrins for manufacturing corrugated boards, paper sacks, and envelopes due to their reliable, cost-effective binding capabilities.

How does the sustainability trend influence the Dextrins market?

The global push for sustainability significantly benefits the dextrins market, as they are natural, bio-based, and biodegradable starch derivatives. This makes them preferred substitutes for synthetic, petroleum-based polymers in industrial adhesives and food ingredients, aligning with clean-label and eco-friendly consumer preferences.

What are the main raw materials used in Dextrin production, and how does sourcing impact the final product?

The main raw materials are starches derived from corn, potato, tapioca, and wheat. The source impacts the final dextrin’s properties; for instance, potato starch yields high-viscosity products, while corn starch is generally preferred for its abundance and cost-effectiveness in high-volume industrial applications.

Which geographical region exhibits the fastest growth rate for the Dextrins market?

Asia Pacific (APAC) shows the fastest growth, propelled by robust industrial expansion, urbanization, and high consumer demand for packaged goods and processed foods, particularly in rapidly developing economies like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager