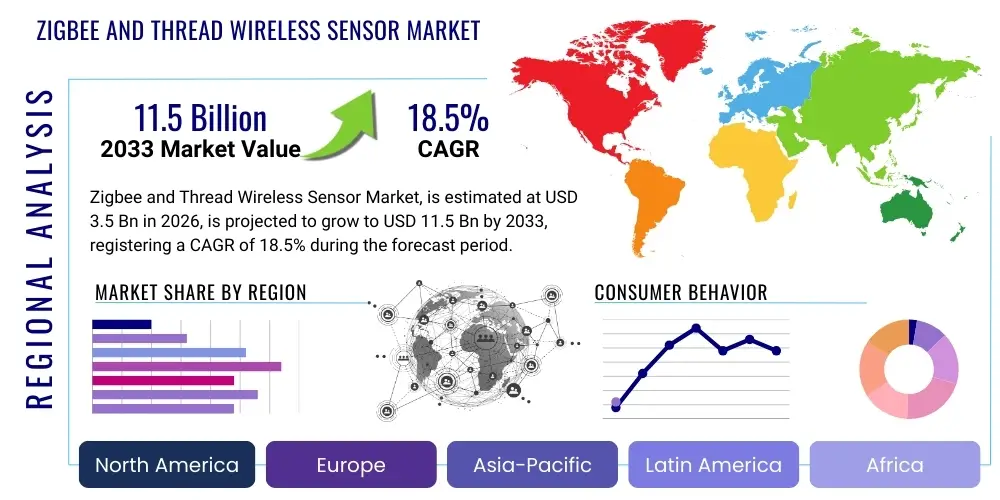

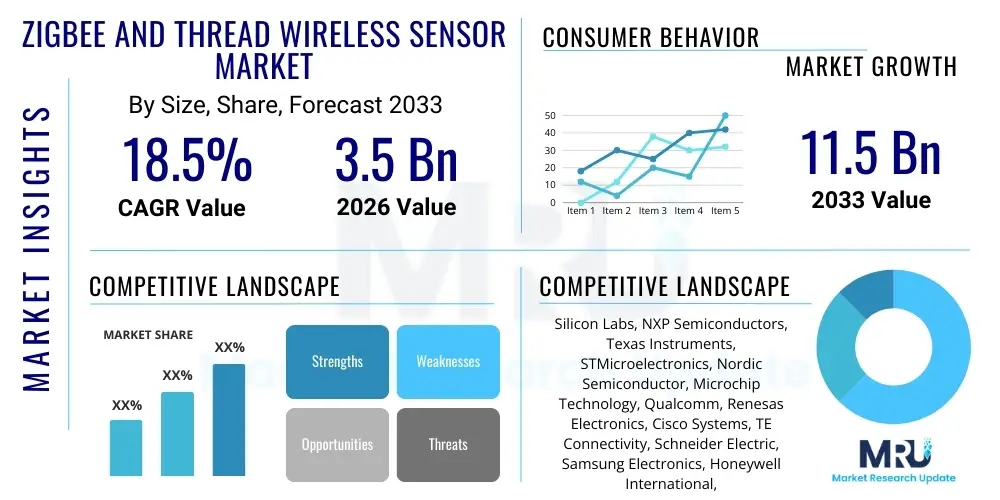

Zigbee and Thread Wireless Sensor Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441427 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Zigbee and Thread Wireless Sensor Market Size

The Zigbee and Thread Wireless Sensor Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at $1.25 Billion in 2026 and is projected to reach $4.01 Billion by the end of the forecast period in 2033.

Zigbee and Thread Wireless Sensor Market introduction

The Zigbee and Thread Wireless Sensor Market encompasses the deployment and integration of low-power, mesh-networking protocols optimized for connecting a vast array of Internet of Things (IoT) devices, particularly within smart environments. Zigbee, a well-established standard based on the IEEE 802.15.4 specification, offers robust connectivity for devices requiring long battery life, commonly used in smart lighting, heating, and security systems. Thread, an emerging IP-based mesh networking protocol, provides secure, scalable, and resilient connectivity, forming the backbone for interoperability initiatives like the Matter standard, which significantly boosts its market potential.

The core products within this market include specialized wireless modules, sensor nodes (such as temperature, humidity, and motion sensors), gateways, and associated networking software stacks. Major applications span smart home automation, where ease of installation and reliability are paramount, and complex industrial environments (IIoT), requiring dependable network coverage for monitoring assets and processes. Benefits derived from utilizing these technologies include substantial energy efficiency, rapid network deployment, and enhanced device interoperability, making them foundational technologies for pervasive computing environments.

Market expansion is primarily driven by the escalating demand for cohesive smart building management systems that prioritize energy savings and centralized control. The widespread adoption of IoT across vertical sectors, coupled with increasing governmental mandates regarding energy efficiency in commercial spaces, further accelerates market growth. Furthermore, the inherent strengths of mesh networking—self-healing and extended range—are overcoming traditional limitations associated with large-scale wireless sensor networks, firmly positioning Zigbee and Thread as critical enablers for next-generation connected devices.

Zigbee and Thread Wireless Sensor Market Executive Summary

The Zigbee and Thread Wireless Sensor Market is experiencing robust growth fueled by converging business trends, specifically the standardization facilitated by the Matter protocol, which bridges the gap between competing IoT ecosystems. This convergence reduces fragmentation, thereby lowering development costs and accelerating consumer adoption rates across residential and commercial sectors. Businesses are increasingly investing in proprietary Thread-enabled chipsets to future-proof their hardware offerings, recognizing the protocol's advantages in security and native IPv6 support. The shift towards edge computing also necessitates the deployment of reliable, low-latency mesh networks, reinforcing the foundational role of these wireless technologies in processing data locally.

Regionally, North America maintains market leadership due to high early adoption rates of smart home devices and significant infrastructure investment in industrial IoT projects. However, the Asia Pacific region is forecast to demonstrate the fastest growth rate, propelled by rapid urbanization, substantial government spending on smart city infrastructure in countries like China and India, and the burgeoning consumer electronics manufacturing base. Europe focuses heavily on sustainability, driving demand for Zigbee and Thread sensors in advanced Heating, Ventilation, and Air Conditioning (HVAC) systems and environmental monitoring within commercial real estate, aligning with strict EU energy efficiency directives.

In terms of segmentation, the Hardware component segment, particularly the intelligent transceiver modules and integrated system-on-chips (SoCs), commands the largest market share. Technologically, the Thread protocol is anticipated to witness faster adoption growth, largely due to its foundational role in the Matter initiative, ensuring long-term interoperability and scalability critical for enterprise deployments. Application-wise, the Smart Homes and Buildings segment remains the dominant revenue generator, while Industrial Automation (IIoT) represents a rapidly growing segment, utilizing the network reliability for mission-critical monitoring and control applications.

AI Impact Analysis on Zigbee and Thread Wireless Sensor Market

Common user questions regarding AI’s influence on the Zigbee and Thread market center primarily on how machine learning can optimize network efficiency, manage large sensor datasets, and improve device autonomy. Users frequently inquire about the integration challenges of deploying AI algorithms directly onto low-power sensor nodes (edge AI) and how predictive maintenance capabilities, enabled by sophisticated data analysis, will transform industrial applications. Key themes highlight the expectation that AI will transition these sensor networks from simple data collectors to intelligent, self-managing ecosystems, reducing human intervention and maximizing battery life through predictive power management techniques. Furthermore, there is significant interest in how AI can enhance the security posture of mesh networks by identifying and neutralizing anomalous communication patterns or potential breaches in real-time.

AI's primary impact involves enhancing the operational intelligence and automation of Zigbee and Thread networks. Machine learning algorithms are crucial for analyzing the massive volumes of data generated by thousands of connected sensors, translating raw information into actionable insights for optimization. In smart buildings, AI utilizes sensor input to learn occupancy patterns, dynamically adjust climate controls, and optimize lighting schedules, moving beyond simple programmed automation to sophisticated, personalized resource management. This capability not only maximizes user comfort but dramatically improves energy conservation, directly contributing to the market's value proposition.

Moreover, AI significantly contributes to network health and reliability. Through continuous monitoring of signal strength, latency, and packet loss, AI systems can proactively identify potential network bottlenecks or device failures, automatically rerouting traffic or alerting maintenance personnel. For Industrial IoT applications, the integration of AI models enables high-precision predictive maintenance, analyzing vibration, temperature, and current data collected via Thread sensors to foresee equipment failure hours or days in advance, thereby minimizing costly downtime and improving overall operational equipment effectiveness (OEE).

- AI drives predictive maintenance in IIoT using sensor data analytics.

- Machine learning optimizes network topology and traffic routing for enhanced efficiency.

- AI algorithms facilitate intelligent power management, extending sensor battery life.

- Data fusion and anomaly detection capabilities improve security within the mesh network.

- Edge AI deployment enables faster, localized decision-making on low-power sensor nodes.

- Enhances smart building automation by dynamically adjusting environmental parameters based on learned patterns.

DRO & Impact Forces Of Zigbee and Thread Wireless Sensor Market

The market for Zigbee and Thread wireless sensors is predominantly driven by the pervasive growth of the Internet of Things (IoT) across diverse sectors, mandating reliable, low-power connectivity solutions that these protocols inherently provide. The key restraining factor involves the historical complexity associated with device interoperability and the persistent security concerns related to widespread mesh network deployment. However, the emergence of the Matter standard presents a significant opportunity by unifying these disparate protocols under a single application layer, effectively mitigating interoperability issues and drastically reducing market fragmentation, which acts as a powerful accelerating force shaping the market trajectory.

Drivers for market growth include the robust demand for energy-efficient smart building solutions, particularly in commercial and residential construction, coupled with global regulatory pressures to reduce carbon footprints. The scalability and robustness of mesh topologies, allowing thousands of devices to communicate reliably over extensive areas, make them ideal for modern industrial environments seeking high-density sensor deployments. Furthermore, the low cost and availability of supporting hardware components, especially SoCs compatible with both standards, enable manufacturers to rapidly integrate these technologies into diverse product lines, boosting consumer accessibility and market volume.

Restraints primarily revolve around the challenges of legacy system integration, where older industrial or building management systems are not natively compatible with these modern IP-based protocols. While Thread addresses many security concerns inherent to older wireless standards, managing cryptographic keys and ensuring end-to-end security across a vast, dynamic mesh network still presents complexity for deployment engineers. Opportunities are vast, focused on leveraging the Matter protocol to dominate the standardized smart home ecosystem and expanding into specialized fields such as elderly care monitoring and asset tracking in logistical chains, where the low power consumption is critical for long-term viability. The impact forces show strong acceleration due to standardization and high consumer pull for simple, interconnected devices.

- Drivers: Growing demand for low-power, wide-area IoT connectivity; standardization via the Matter protocol; increasing adoption in industrial automation (IIoT) for monitoring; regulatory push for energy-efficient smart infrastructure.

- Restraints: Interoperability challenges with fragmented legacy systems; persistent concerns regarding network security and data privacy management in mesh networks; limited range compared to other wireless standards like LoRaWAN for extremely distant applications.

- Opportunities: Expansion into high-growth vertical markets such as smart healthcare and large-scale urban infrastructure; leveraging native IP addressing capabilities of Thread for seamless cloud integration; development of highly specialized, ultra-low power sensor nodes.

- Impact Forces: High Standardization Impact (accelerated by Matter); Moderate Technological Advancement Impact (chip efficiency improvements); High Market Penetration Impact (driven by mass consumer electronics adoption).

Segmentation Analysis

The Zigbee and Thread Wireless Sensor Market is meticulously segmented based on components, technology, application, and end-use, providing a granular view of market dynamics and potential investment areas. Analyzing these segments helps stakeholders understand which parts of the value chain are driving revenue and where future innovation is concentrated. The component segmentation highlights the reliance on specialized hardware, particularly System-on-Chips (SoCs) that handle complex mesh networking functions efficiently, alongside the crucial role of embedded software and system integration services necessary for successful network deployment and management.

Technology-based segmentation clearly distinguishes between Zigbee, the mature and widely deployed standard, and Thread, the innovative, IP-based newcomer, allowing for focused analysis on growth trajectories. While Zigbee maintains market dominance in installed base, Thread’s growth is outpacing it due to its alignment with future-proof protocols and the standardization mandates of the Connectivity Standards Alliance (CSA). The application analysis underscores the dominance of the residential sector, which demands user-friendly, interconnected devices, while simultaneously recognizing the high revenue potential within the stringent reliability requirements of the industrial sector (IIoT).

Furthermore, end-use segmentation differentiates between commercial, residential, and industrial deployments, each having distinct requirements regarding network density, security levels, and necessary maintenance protocols. Commercial installations, such as office buildings and retail spaces, prioritize scalability and centralized monitoring, driving demand for robust Thread networks, whereas residential users prioritize ease of setup and cost-effectiveness, where both Zigbee and Thread solutions compete fiercely. Understanding these nuances is critical for manufacturers to tailor their product offerings and marketing strategies effectively.

- By Component:

- Hardware (Transceivers, Microcontrollers, Sensors, Gateways/Bridges)

- Software & Services (Firmware, Network Stack Software, Cloud Platforms, System Integration, Maintenance Services)

- By Technology:

- Zigbee

- Thread

- Dual-Mode (Zigbee/Thread Compatible)

- By Application:

- Smart Homes and Buildings (Lighting, HVAC Control, Security Systems, Energy Management)

- Industrial Automation (Asset Monitoring, Predictive Maintenance, Process Control)

- Healthcare (Patient Monitoring, Assisted Living)

- Retail (Inventory Management, Electronic Shelf Labels)

- Agriculture (Precision Farming, Environmental Monitoring)

- By End-Use:

- Residential

- Commercial (Offices, Retail, Hospitality)

- Industrial

Value Chain Analysis For Zigbee and Thread Wireless Sensor Market

The value chain for the Zigbee and Thread Wireless Sensor Market begins with upstream activities involving foundational hardware and protocol development. This stage is dominated by semiconductor manufacturers and intellectual property (IP) providers who design the specialized low-power chips (SoCs) and embed the complex network stack firmware for both Zigbee and Thread protocols. The quality and efficiency of these components dictate the final product's performance, battery life, and cost. Key players here include silicon providers and companies contributing heavily to the development of the Matter standard and the core open-source Thread stack, ensuring compatibility and high security standards are met at the foundational level.

Midstream activities encompass the manufacturing and integration phase, where OEMs and sensor module vendors transform chips into usable products, such as wireless modules, smart plugs, and integrated sensor devices. This stage involves sophisticated manufacturing, calibration, and quality control processes to ensure the sensor accuracy and radio reliability necessary for mesh networking. Downstream activities involve distribution, implementation, and maintenance. Distribution channels are varied, including direct sales to large industrial customers, indirect sales through system integrators for commercial projects, and mass retail channels (online and physical stores) for consumer-grade smart home devices.

The reliance on distribution channels is heavily segment-dependent; industrial sensors typically utilize direct sales or specialized integrators (indirect), requiring high levels of technical support and customized networking solutions. Conversely, residential products heavily leverage large e-commerce platforms and big-box retailers (indirect) to achieve high volume penetration. System integrators play a critical role in complex commercial deployments, ensuring seamless integration with existing building management systems (BMS) and providing ongoing maintenance and scaling services, thus defining the final value delivery to the end-user.

Zigbee and Thread Wireless Sensor Market Potential Customers

Potential customers for Zigbee and Thread wireless sensors span a wide range of industries and consumer segments, reflecting the versatility of low-power mesh networking. The primary end-users are households seeking to modernize their living spaces with smart home technology, including automated lighting, climate control, and security systems that require simple setup and reliable operation. This residential segment is highly sensitive to price and ease-of-use, favoring products compliant with major platforms like Google Home, Apple HomeKit, and Amazon Alexa, all of which are increasingly adopting the Thread/Matter standard for seamless interaction.

The second major customer segment is the Commercial Real Estate sector, including owners and facility managers of office buildings, retail malls, and hospitals. These entities utilize the technology for advanced Building Management Systems (BMS), focusing on reducing operational costs through energy optimization, predictive maintenance of HVAC systems, and real-time occupancy tracking for space utilization efficiency. Reliability, enterprise-grade security, and scalability are non-negotiable requirements for this demanding customer base, often relying on specialized system integrators for large-scale deployment.

Finally, the Industrial sector represents a high-value customer base, particularly in manufacturing, logistics, and resource extraction (oil and gas, mining). Industrial End-Users require robust, high-density sensor networks for critical process monitoring, structural health monitoring, and precise asset tracking within harsh environments. These customers are willing to invest significantly in solutions that provide real-time data for optimizing production lines and ensuring worker safety, viewing Zigbee and Thread as critical components for their Industry 4.0 initiatives and digital transformation strategies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.25 Billion |

| Market Forecast in 2033 | $4.01 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Silicon Labs, NXP Semiconductors, Texas Instruments, Qualcomm, Nordic Semiconductor, STMicroelectronics, Infineon Technologies, Amazon (Ring, Eero), Google (Nest), Apple, Samsung SmartThings, Honeywell, Schneider Electric, Bosch Sensortec, Ubiquiti Networks, LEEDARSON, The Kroger Co. (IoT), Eltako, Midea Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Zigbee and Thread Wireless Sensor Market Key Technology Landscape

The technology landscape is defined by the underlying standards and the advanced hardware components that enable mesh networking functionality. Both Zigbee and Thread utilize the IEEE 802.15.4 physical and media access control (MAC) layers, operating primarily in the 2.4 GHz industrial, scientific, and medical (ISM) band, although regional variations exist. The core technology involves the ability of devices to form self-healing, low-power mesh networks where data packets can hop from device to device until reaching the gateway or destination node, ensuring broad coverage even in large, complex physical environments. Key innovations focus on optimizing the sleep cycles of battery-powered nodes to achieve multi-year battery life, crucial for sensor applications.

A critical divergence exists in the network and transport layers. Zigbee employs a proprietary networking stack optimized for low-bandwidth applications, managed by the Connectivity Standards Alliance (CSA). Conversely, Thread is built on standard Internet Protocol (IPv6) and uses 6LoWPAN (IPv6 over Low-Power Wireless Personal Area Networks) for header compression. This native IP capability of Thread is revolutionary as it eliminates the need for complex, application-specific translation layers, simplifying integration with cloud services and enterprise IT infrastructure. The adoption of the Matter application layer atop both Zigbee (via bridges) and natively Thread is the most significant technological development, ensuring device interoperability previously unattainable.

The hardware backbone relies heavily on high-performance System-on-Chips (SoCs) from leading semiconductor vendors. These SoCs integrate the radio transceiver, microcontrollers, and often embedded security hardware accelerators (e.g., for AES encryption). Recent technological advancements include dual-mode chips capable of simultaneously supporting Zigbee and Thread communication, allowing manufacturers flexibility. Furthermore, energy harvesting technology is becoming increasingly relevant, potentially eliminating batteries for certain stationary sensor applications, leveraging ambient energy (light, kinetic, thermal) to power the wireless modules and further solidifying the market's sustainability profile.

Regional Highlights

The geographical analysis reveals distinct patterns of market maturity and growth potential across key global regions. North America holds the largest market share, predominantly driven by high consumer adoption of smart home ecosystems and substantial commercial investment in advanced IoT infrastructure. The region benefits from established tech giants heavily promoting Thread and Matter compliance, creating a strong market pull. Furthermore, robust IIoT spending in the manufacturing and energy sectors of the U.S. and Canada requires the reliable, scalable backbone provided by these mesh networks, particularly Thread's IP-based architecture.

Europe represents a mature market characterized by stringent energy efficiency regulations and a strong focus on sustainable building practices. Countries like Germany and the Netherlands are leading in implementing Zigbee and Thread for smart utility metering, environmental monitoring, and optimizing heating and lighting systems in accordance with the European Union’s Energy Performance of Buildings Directive (EPBD). The fragmentation of standards across the continent is rapidly being addressed by the Matter protocol, which is expected to unlock significant growth by simplifying cross-border product deployment and increasing consumer trust in interoperability.

Asia Pacific (APAC) is projected to be the fastest-growing region throughout the forecast period. This rapid expansion is fueled by massive urbanization, burgeoning middle-class consumer spending, and large-scale smart city projects initiated by governments in China, India, and Southeast Asia. The region’s strength lies in its manufacturing base, driving down the cost of components and making high-volume production of Zigbee and Thread devices highly competitive. While initial adoption was fragmented, the drive toward large, integrated projects ensures that standardized, scalable protocols will see exponential growth, particularly within industrial complexes and new residential developments.

- North America: Market leader; driven by high residential smart home penetration, robust IIoT adoption in manufacturing, and strong technological support from leading tech companies promoting Matter.

- Europe: Mature market; growth spurred by environmental and energy efficiency regulations, high utilization in commercial building management systems (BMS), and early adoption of smart metering infrastructure.

- Asia Pacific (APAC): Fastest growing region; fueled by smart city initiatives, rapid urbanization, high volume manufacturing capabilities, and expanding middle-class adoption of connected devices.

- Latin America (LATAM): Emerging growth market; focused on initial deployment of smart lighting and security systems, slowly increasing industrial adoption in resource-intensive sectors like agriculture and mining.

- Middle East and Africa (MEA): Niche but growing market; concentrated development in large-scale residential and commercial real estate projects (e.g., UAE, Saudi Arabia) requiring integrated smart building solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Zigbee and Thread Wireless Sensor Market.- Silicon Labs

- NXP Semiconductors

- Texas Instruments

- Qualcomm

- Nordic Semiconductor

- STMicroelectronics

- Infineon Technologies

- Amazon (Ring, Eero)

- Google (Nest, Google Home)

- Apple

- Samsung SmartThings

- Honeywell

- Schneider Electric

- Bosch Sensortec

- Ubiquiti Networks

- LEEDARSON

- The Kroger Co. (IoT)

- Eltako

- Midea Group

- Qorvo

Frequently Asked Questions

Analyze common user questions about the Zigbee and Thread Wireless Sensor market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Zigbee and Thread technology?

Zigbee is a proprietary, application-layer protocol optimized for low-power operation, while Thread is an IP-based (IPv6) mesh networking protocol. Thread's native IP capability simplifies integration with standard internet networks and cloud services, aligning better with the universal communication requirements of the Matter standard.

How does the Matter protocol affect the adoption of Zigbee and Thread sensors?

The Matter protocol acts as a unified application layer built upon technologies like Thread, significantly boosting adoption by guaranteeing interoperability across devices, regardless of the brand or underlying network protocol. This standardization reduces fragmentation and enhances consumer experience.

Which market segment currently drives the highest revenue for these sensors?

The Smart Homes and Buildings segment, particularly the residential sector, generates the highest revenue. This is due to the mass market adoption of devices like smart lighting, thermostats, and security systems that rely heavily on the low-power, mesh networking capabilities of Zigbee and Thread.

What are the key security advantages of using Thread over older wireless standards?

Thread offers robust security features, including mandatory end-to-end encryption (AES), secure commissioning processes, and support for authenticated network joins, addressing many of the vulnerabilities present in earlier, less complex wireless personal area networks.

What role does Artificial Intelligence (AI) play in optimizing Zigbee and Thread networks?

AI is crucial for network optimization, enabling predictive power management, optimizing traffic routing in large mesh deployments, and providing real-time data analysis for applications like predictive maintenance in industrial settings, making the networks more autonomous and efficient.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager