Zinc Sulfide Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441704 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Zinc Sulfide Market Size

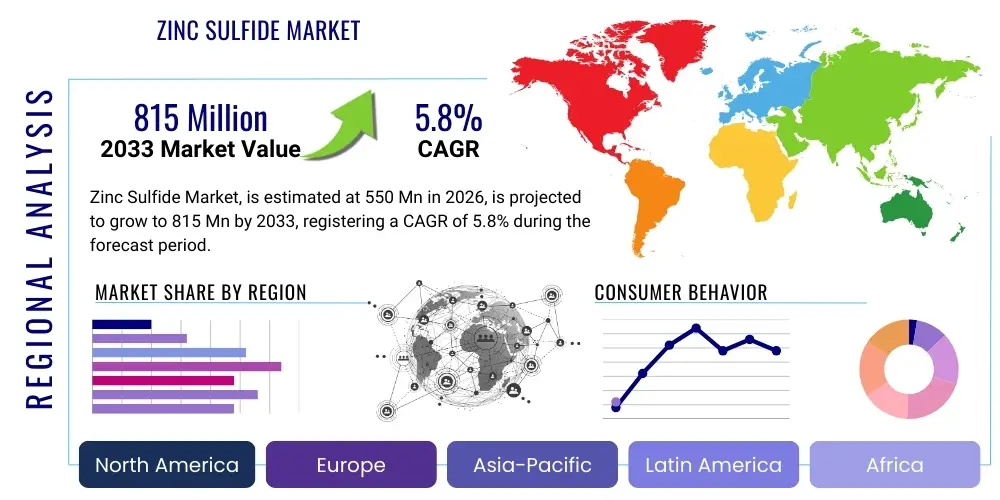

The Zinc Sulfide Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $550 Million in 2026 and is projected to reach $815 Million by the end of the forecast period in 2033.

Zinc Sulfide Market introduction

Zinc Sulfide (ZnS) is an inorganic compound widely recognized for its unique optical and electronic properties. As a fundamental material, it exists in two primary crystalline forms: cubic (sphalerite) and hexagonal (wurtzite), depending on the temperature during formation. Its most significant characteristics include a wide bandgap, high refractive index, and transparency across a broad spectrum, particularly in the infrared and visible regions. These attributes make it indispensable in advanced technological applications ranging from high-performance optical windows and lenses to phosphors used in displays and X-ray screens, and increasingly, as a critical component in thin-film solar cells and light-emitting diodes (LEDs).

The core application driving market expansion is the demand for efficient optical materials in defense, aerospace, and advanced medical imaging. High-purity zinc sulfide, often synthetically manufactured, offers superior durability and resistance to harsh environmental conditions compared to alternatives, positioning it as the material of choice for infrared thermal imaging systems used in surveillance and military guidance. Furthermore, the pigment sector utilizes ZnS extensively due to its high opacity and non-toxic nature, particularly in paints, plastics, and rubber, where it acts as a safer alternative to heavy metal-based pigments.

Key driving factors accelerating the growth of the Zinc Sulfide Market include the rapid global expansion of the optoelectronics industry, coupled with stringent regulatory standards promoting the adoption of non-toxic materials in consumer and industrial products. The continuous innovation in display technologies, particularly the development of high-resolution micro-LEDs and plasma screens that require high-efficiency phosphors, also bolsters demand. Moreover, the increasing investment in renewable energy infrastructure, specifically thin-film photovoltaics utilizing zinc sulfide as a buffer layer, ensures a sustained positive trajectory for the market throughout the forecast period.

Zinc Sulfide Market Executive Summary

The Zinc Sulfide Market is experiencing robust growth fueled primarily by technological advancements in infrared optics and the accelerating transition toward green energy solutions. Business trends indicate a strong focus on scaling production of high-purity, spectroscopic-grade ZnS powder and targets to meet the stringent quality requirements of the semiconductor and defense sectors. Strategic mergers, acquisitions, and long-term supply agreements between primary manufacturers and end-users, especially in North America and Europe, are defining the competitive landscape, aiming to secure reliable access to specialized material grades and stabilize pricing against raw material volatility.

Regional trends highlight the dominance of the Asia Pacific (APAC) region, driven by massive manufacturing capacities in electronics, solar technology, and consumer displays, notably in China, South Korea, and Japan. While APAC leads in consumption and production volume, North America and Europe maintain technological leadership, focusing on high-value military optics and advanced sensor systems, which necessitate ultra-high purity and customized ZnS forms. Investment in R&D across these Western regions is concentrated on exploring quantum dot applications of ZnS, promising future revenue streams and expanding the material's utility beyond traditional uses.

Segment trends demonstrate that the Optical Materials application segment holds the largest market share due to critical use in thermal imaging and ruggedized optical systems. Simultaneously, the Phosphors segment is projected to exhibit the highest CAGR, primarily propelled by the explosive growth in micro-LEDs and advanced medical imaging devices that rely on highly efficient luminescent properties of doped zinc sulfide. Furthermore, the powder form segment remains the backbone of the market due to its versatility in pigmentation and standard chemical manufacturing, although the demand for highly specialized target and single crystal forms for deposition processes is rapidly increasing, commanding premium pricing.

AI Impact Analysis on Zinc Sulfide Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Zinc Sulfide Market frequently center on three core themes: first, how AI-driven optimization affects manufacturing processes, particularly crystal growth and impurity control; second, whether AI can accelerate the discovery of novel ZnS composites for enhanced optical or electronic performance; and third, the indirect effect of AI proliferation—specifically, the increased demand for advanced sensors and display interfaces that utilize ZnS components. Users seek clarity on whether AI adoption will reduce operational costs, enhance material quality predictability, and potentially shorten the R&D cycle for next-generation materials derived from ZnS. The collective expectation is that AI integration will primarily streamline complex synthesis methods, ensuring tighter quality control for high-specification applications required by the defense and semiconductor industries, thereby increasing efficiency and reducing material waste.

The direct application of AI in the manufacturing process focuses on modeling complex thermodynamic conditions necessary for large-scale, high-purity ZnS crystal growth. Traditional methods often involve trial-and-error, leading to material inconsistencies and high failure rates. AI algorithms, particularly machine learning and predictive modeling, can analyze real-time processing parameters—such as temperature gradients, pressure fluctuations, and precursor flow rates—to predict material defects before they occur. This capability ensures batch-to-batch consistency for optical-grade ZnS required for sensitive infrared detectors and thermal cameras, where minute impurities can drastically impair performance. Furthermore, AI facilitates predictive maintenance on sophisticated manufacturing equipment, minimizing downtime and optimizing yield, which is critical for maintaining competitive pricing in a raw material sensitive market.

Indirectly, the exponential growth in AI hardware, including high-performance computing (HPC) infrastructure and autonomous systems, significantly influences the demand for products utilizing zinc sulfide. AI-powered systems require advanced sensors for data collection, autonomous vehicle navigation, and sophisticated display technology for visualization interfaces. Zinc sulfide is a vital material in many next-generation infrared sensors (as windows or protective coatings) and high-resolution displays (as a phosphor component). Therefore, the broad societal and industrial adoption of AI fundamentally creates a downstream pull for high-specification ZnS materials, indirectly driving market growth and demanding higher volumes of specialized, high-purity product forms necessary for reliable, AI-enabled devices.

- AI optimizes crystal growth processes, reducing defects and ensuring ultra-high purity necessary for optical and semiconductor applications.

- Predictive maintenance driven by AI minimizes operational downtime and enhances overall manufacturing yield efficiency.

- Machine learning accelerates the discovery and testing of novel ZnS alloys and composites for enhanced photoluminescence and electronic properties.

- Increased proliferation of AI-driven autonomous systems drives higher demand for ZnS in advanced thermal sensors and robust optical windows.

- AI assists in real-time quality control, ensuring stringent material specifications are met consistently for defense and aerospace end-users.

DRO & Impact Forces Of Zinc Sulfide Market

The Zinc Sulfide Market is subject to a complex interplay of Drivers, Restraints, and Opportunities (DRO) that shape its trajectory. Primary drivers include the escalating demand for high-performance infrared optics in military and commercial surveillance, alongside the increasing adoption of ZnS as a non-toxic alternative pigment. These factors are further amplified by continuous technological breakthroughs requiring materials with specific bandgap properties, such as advanced LEDs and thin-film solar devices. However, the market faces significant restraints, chiefly concerning the high cost and volatility associated with procuring high-purity zinc precursors, which directly impacts the final product price and profit margins. Furthermore, the intricate synthesis processes required to achieve optical-grade purity present substantial technical challenges and limit the number of qualified producers, creating supply chain bottlenecks.

Opportunities for market expansion are strongly concentrated in the renewable energy sector, where zinc sulfide acts as an environmentally friendly buffer layer in Copper Indium Gallium Selenide (CIGS) solar cells, offering a non-toxic substitute for traditional cadmium sulfide layers. This transition aligns with global sustainability mandates and presents a significant, long-term avenue for volume growth. Additionally, the nascent field of ZnS quantum dots (QDs) offers immense potential for next-generation display technologies and biosensing, promising higher efficiency and tailored emission characteristics compared to conventional QDs. These QDs represent a high-value opportunity segment that could redefine the material's application spectrum in the coming decade, justifying significant ongoing research investment.

The overall impact forces are strongly positive, driven by technological necessity. As militaries globally upgrade their surveillance and targeting systems and commercial infrastructure incorporates thermal imaging for safety and inspection, the demand for robust, transparent optical materials like ZnS is cemented. While raw material cost fluctuation poses a periodic threat (Restraint), the indispensable nature of ZnS in specific, high-specification applications (Driver) mitigates this risk by allowing manufacturers to command premium prices for specialty grades. The overarching societal shift towards non-toxic and environmentally benign materials (Opportunity) provides a sustainable foundation for long-term market growth, ensuring that the cumulative effect of these forces steers the market towards expansion throughout the forecast period.

Segmentation Analysis

The Zinc Sulfide Market segmentation provides a granular view of demand distribution based on material purity, application, and physical form. Analysis by purity—specifically differentiating between standard grade and high-purity/optical grade—is critical, as optical-grade ZnS, despite being lower in volume, commands significantly higher pricing and is subject to stringent regulatory standards (e.g., ITAR in the US). Application-wise, the market is broadly segmented across optical components, phosphors, and pigments, each driven by distinct end-user industries (defense, consumer electronics, and construction, respectively). Understanding these segments is key to strategic resource allocation and pricing strategies.

The segmentation by form (powder, targets, single crystals) reflects the manufacturing stage and intended use. Powder is the most common and versatile form, utilized in pigments and chemical synthesis. Targets, usually large, dense, and custom-shaped, are critical for thin-film deposition techniques like sputtering, essential in semiconductor and advanced coating industries. Single crystals represent the highest end of the purity spectrum, used almost exclusively in high-end scientific and specialized optical windows, where atomic-level structural perfection is non-negotiable. The growth rates within these segments vary significantly, with targets and single crystals showing above-average CAGR due to rapid expansion in high-tech manufacturing sectors.

Geographically, the segmentation confirms that manufacturing and consumption are heavily concentrated in industrialized regions. Asia Pacific leads due to its dominance in electronics and solar PV production, while North America and Europe excel in high-purity material production and consumption for defense and specialized medical optics. These regional variances dictate market penetration strategies, necessitating localized product formulations—for instance, focusing on pigment and standard-grade powders in emerging markets, versus optical and semiconductor-grade materials in mature economies. This detailed analysis allows market participants to tailor R&D investments to the most promising and profitable segments.

- By Purity:

- Standard Grade ZnS

- High-Purity/Optical Grade ZnS

- By Application:

- Optical Materials (e.g., Infrared Windows, Lenses)

- Phosphors (e.g., CRT Screens, X-ray Detectors, LEDs)

- Pigments and Fillers (e.g., Paints, Plastics, Rubber)

- Semiconductors and Thin-Film Devices (e.g., Solar Cells, Photovoltaics)

- By Form:

- Powder

- Sputtering Targets

- Single Crystal and Substrates

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Zinc Sulfide Market

The Zinc Sulfide value chain begins with upstream activities centered on the extraction and refinement of precursor materials, primarily zinc ore (sphalerite) and elemental sulfur. The quality and purity of the zinc concentrate are paramount, particularly for optical-grade ZnS production, where impurities must be measured in parts per million (ppm) or parts per billion (ppb). Key upstream challenges involve managing the volatility in global zinc prices, ensuring sustainable and ethically sourced materials, and applying complex purification steps like chemical vapor deposition (CVD) or precipitation methods to produce the necessary high-purity intermediates before final ZnS synthesis. Manufacturers often integrate backwards into purification processes to maintain quality control and mitigate supply risks.

Midstream processing involves the actual synthesis and formation of the final ZnS product, categorized by form (powder, targets, crystals). This stage is capital-intensive and technologically demanding, requiring specialized equipment for techniques such as hot pressing for targets, or elaborate crystal growth methods (e.g., chemical vapor transport) for single crystals. Manufacturers must adapt production lines to meet diverse product specifications—from low-cost, high-volume pigment powder to highly customized, defect-free optical windows. The complexity of this stage dictates the competitive structure, favoring companies with proprietary manufacturing technologies and deep material science expertise.

Downstream analysis focuses on distribution and end-user consumption. Direct distribution channels are prevalent for high-specification products (e.g., single crystals sold directly to defense contractors or optical manufacturers) to ensure technical support and controlled logistics. Indirect channels, involving chemical distributors and regional agents, handle standard-grade powders for pigment, paint, and plastics industries. End-users in the optical and defense sectors require specialized certification and regulatory compliance, making the distribution highly specialized. The ultimate consumers dictate the technical requirements: defense drives demand for IR windows, while consumer electronics drives demand for phosphors and targets, completing the value flow from mine to final device.

Zinc Sulfide Market Potential Customers

The potential customer base for Zinc Sulfide is highly diversified but centers around industries requiring advanced optical performance, non-toxic pigment alternatives, and specialized electronic components. Primary customers include manufacturers of advanced infrared (IR) systems, such as thermal imaging cameras and night-vision equipment used extensively by military, aerospace, and security agencies globally. These customers require ultra-high-purity ZnS in the form of optical domes and windows due to its excellent transmission properties across the mid- and far-infrared spectra. Their purchasing decisions are driven by material durability, spectral performance, and compliance with strict quality certifications.

Another significant customer segment comprises the electronics and display manufacturing industries. Companies producing high-resolution consumer displays, X-ray detectors for medical imaging, and specialized lighting solutions (LEDs/phosphors) are major buyers of doped ZnS phosphors and high-density sputtering targets. These buyers prioritize luminescence efficiency, color purity, and consistency for mass production applications. Furthermore, the burgeoning solar energy sector, particularly manufacturers of CIGS thin-film solar panels, represents a growing customer segment, utilizing ZnS as an environmentally preferred buffer layer over traditional, toxic alternatives. This segment is characterized by large-volume, price-sensitive procurement.

Lastly, industrial customers in the paints, coatings, plastics, and rubber sectors form a large volume-based customer group. These end-users utilize standard-grade ZnS powder (Lithopone or pure ZnS) as a non-toxic white pigment and filler. Their purchasing criteria are primarily focused on opacity, dispersion characteristics, and competitive pricing relative to substitutes like titanium dioxide. The diversity across these customer segments—ranging from high-value, low-volume optical buyers to high-volume, low-margin pigment consumers—requires manufacturers to maintain flexible production capabilities and tailored sales strategies across their product portfolio.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $550 Million |

| Market Forecast in 2033 | $815 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | American Elements, Materion Corporation, Shanghai Xinglu Chemical Technology, Hebei Metal Chemicals, Sigma-Aldrich (Merck KGaA), Foster Chemicals, Nippon Chemical Industrial, Jiangxi Ketai Advanced Material, Wuxi Nengli Powder Material, Hunan Jingshang Chemical, Loba Chemie, H.C. Starck, Alfa Aesar, Goodfellow Corporation, Treibacher Industrie AG, Washington Mills, Saint-Gobain, Kyocera Corporation, CoorsTek, Cerac Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Zinc Sulfide Market Key Technology Landscape

The technological landscape of the Zinc Sulfide market is defined by sophisticated processes aimed at maximizing purity, controlling crystal structure, and enabling thin-film deposition. The production of optical-grade ZnS heavily relies on advanced Chemical Vapor Deposition (CVD) techniques. CVD allows for the synthesis of large, optically homogeneous sheets of ZnS used for robust infrared windows. This process involves reacting zinc vapor and hydrogen sulfide gas at high temperatures, ensuring minimal structural defects and excellent broadband transmission. Furthermore, refinement technologies such as zone refining and specialized precipitation methods are crucial for purifying raw materials to 5N (99.999%) or higher, which is necessary for semiconductor and high-end optical applications where trace elements severely impact performance.

In the thin-film deposition segment, the technology focuses on creating uniform, high-density zinc sulfide layers. Sputtering, particularly magnetron sputtering using high-purity ZnS targets, is a fundamental technique for manufacturing buffer layers in CIGS solar cells and protective coatings for sensors. The quality of the sputtering target—its density, purity, and grain size—is directly dependent on advanced powder metallurgy and hot-pressing techniques employed during its manufacture. Technological advancement here is centered on improving target utilization rates and ensuring uniform film thickness across large substrate areas, thereby reducing manufacturing costs and improving device efficiency.

Furthermore, research into nano-scale ZnS, specifically quantum dots (QDs), represents the forefront of technological innovation. Synthesis methods like colloidal chemistry and high-temperature organic solution techniques are utilized to precisely control the size and shape of ZnS nanoparticles. Controlling the particle size allows manufacturers to tune the quantum dot’s emission wavelength, opening doors for applications in advanced, high-gamut displays, biological fluorescent labeling, and novel photovoltaic structures. The ongoing shift toward non-cadmium quantum dots positions ZnS QDs as a highly promising, environmentally sound substitute, driving significant R&D efforts across academic institutions and corporate material labs.

Regional Highlights

Regional dynamics in the Zinc Sulfide Market are differentiated by specialization, demand volume, and technological maturity. Asia Pacific (APAC) dominates the global market, both in terms of production capacity and consumption. This dominance is primarily driven by the colossal presence of the consumer electronics industry, including major manufacturers of displays, LEDs, and semiconductor components in countries like China, South Korea, and Taiwan. Furthermore, APAC’s aggressive investment in solar photovoltaic technology, particularly CIGS manufacturing, creates a massive underlying demand for standard-grade and intermediate-purity ZnS powder. The region benefits from lower operating costs, allowing it to serve as the global hub for volume manufacturing of standard-grade products.

North America and Europe, while lagging in sheer volume, lead the high-value, technological segments. Demand here is heavily concentrated in the defense, aerospace, and advanced medical equipment sectors. Countries like the United States, Germany, and France require ultra-high-purity, spectroscopic-grade ZnS for complex infrared optics, missile guidance systems, and scientific instrumentation. These regions enforce stringent material certifications (e.g., ITAR compliance), necessitating highly controlled manufacturing processes, often relying on domestic or allied supply chains. Technological innovation, including research into ZnS quantum dots and advanced CVD techniques, is largely spearheaded by key players and research institutions in these Western regions, setting global quality benchmarks.

The Middle East & Africa (MEA) and Latin America (LATAM) currently hold smaller market shares, but exhibit significant potential growth. In MEA, infrastructure development and increased spending on internal security and defense (particularly in the GCC states) are driving higher demand for robust surveillance and thermal imaging equipment, creating a pull for specialized optical ZnS components. LATAM’s market growth is tied to industrial expansion, particularly in mining, where ZnS is used in specialized chemical processes, and construction, where ZnS-based pigments are utilized. However, these regions generally remain reliant on imports from APAC and Europe for specialized, high-ppurity material forms.

- Asia Pacific (APAC): Dominates in volume consumption; driven by consumer electronics, solar PV manufacturing (CIGS), and high production capacity, particularly in China and South Korea.

- North America: Leads in high-value specialization; primary consumer in defense and aerospace for IR optics, driving demand for CVD ZnS and high-purity single crystals.

- Europe: Strong focus on high-precision industrial optics and sophisticated medical imaging systems; substantial R&D in quantum dots and advanced phosphor technologies.

- Middle East & Africa (MEA): Emerging market driven by increased security spending and infrastructure projects requiring thermal surveillance equipment.

- Latin America (LATAM): Growth tied to industrial pigment use, chemical processing, and expanding domestic electronics assembly plants.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Zinc Sulfide Market.- American Elements

- Materion Corporation

- Shanghai Xinglu Chemical Technology

- Hebei Metal Chemicals

- Sigma-Aldrich (Merck KGaA)

- Foster Chemicals

- Nippon Chemical Industrial

- Jiangxi Ketai Advanced Material

- Wuxi Nengli Powder Material

- Hunan Jingshang Chemical

- Loba Chemie

- H.C. Starck

- Alfa Aesar

- Goodfellow Corporation

- Treibacher Industrie AG

- Washington Mills

- Saint-Gobain

- Kyocera Corporation

- CoorsTek

- Cerac Inc.

Frequently Asked Questions

Analyze common user questions about the Zinc Sulfide market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Zinc Sulfide primarily used for in high-tech industries?

Zinc Sulfide is predominantly used as a core material for infrared optical components (windows and domes) in defense and thermal imaging systems due to its high transmission properties in the IR spectrum. It is also critical as a non-toxic phosphor material in various advanced display and X-ray screen applications.

How does the quality of Zinc Sulfide impact its market price?

Market price is highly dependent on purity and form. Optical and semiconductor-grade ZnS, which requires complex synthesis like CVD to achieve ultra-high purity (5N or 6N), commands a significant premium over standard-grade ZnS powder used for pigments, reflecting the intense manufacturing complexity and stringent performance requirements.

What is the key driver of the Zinc Sulfide market growth in the Asia Pacific region?

The primary driver in APAC is the massive scale of consumer electronics manufacturing, particularly in flat panel displays, LEDs, and semiconductor devices, which utilize ZnS sputtering targets and phosphors. Additionally, regional expansion in CIGS thin-film solar technology contributes substantially to volume demand.

Is Zinc Sulfide considered a sustainable or environmentally friendly material?

Yes, ZnS is increasingly preferred as an environmentally benign material. It serves as a non-toxic pigment alternative to lead or cadmium compounds and is used as a safer buffer layer replacement for toxic cadmium sulfide in advanced solar cell manufacturing, aligning with global sustainability mandates.

What technological advancements are expected to impact the future demand for ZnS?

Future demand will be significantly influenced by the commercialization of ZnS quantum dots (QDs) for highly efficient, non-toxic displays and lighting, offering superior color purity and performance. Advancements in thin-film deposition techniques for next-generation micro-LEDs also represent a key area of technological growth.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Zinc Sulfide Market Size Report By Type (Purity 99.99%, Purity 99.9%, Purity 97.0%), By Application (Pigment, Optical material, Luminescent material), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Zinc Sulfide Market Statistics 2025 Analysis By Application (Pigment, Optical material, Luminescent material), By Type (Purity?99.99%, Purity?99.9%, Purity?97.0%), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager