EV Charging Ports Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433427 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

EV Charging Ports Market Size

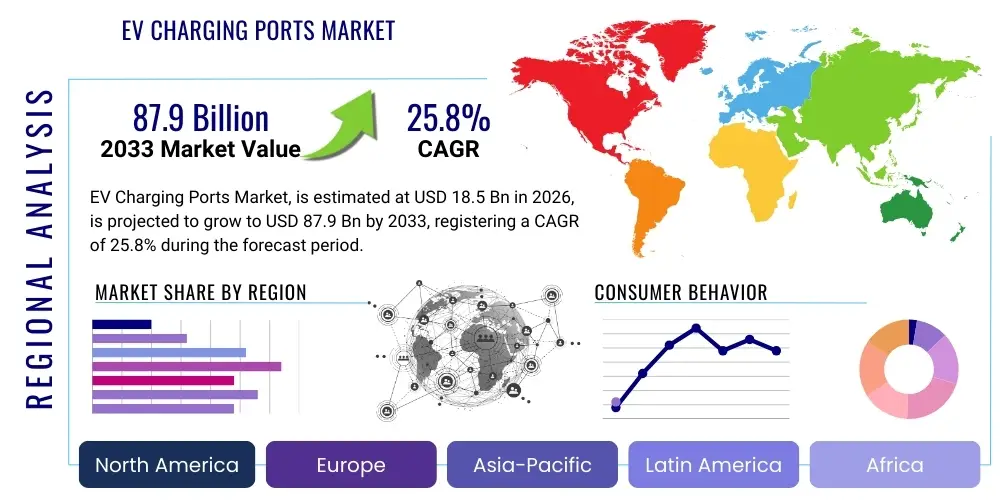

The EV Charging Ports Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 25.8% between 2026 and 2033. The market is estimated at $18.5 Billion in 2026 and is projected to reach $87.9 Billion by the end of the forecast period in 2033.

EV Charging Ports Market introduction

The EV Charging Ports Market encompasses the global infrastructure required to power Battery Electric Vehicles (BEVs) and Plug-in Hybrid Electric Vehicles (PHEVs). This infrastructure is crucial for mass EV adoption, bridging the gap between vehicle manufacturing and consumer usability. Charging ports, often referred to as Electric Vehicle Supply Equipment (EVSE), range significantly in power output and application, including Level 1 (slow residential AC charging), Level 2 (faster AC charging typically used in commercial settings and workplaces), and high-power DC Fast Charging (DCFC) utilized for long-distance travel and rapid turnaround requirements. The core function of these ports is to safely and efficiently convert utility power to replenish the vehicle battery, managing the communication protocol between the vehicle and the grid.

The product description for EV charging ports spans physical hardware, integrated software, and network services. Hardware includes the charging station unit, power electronics (rectifiers, converters), internal monitoring systems, and the physical connector interface (such as CCS, CHAdeMO, or Type 2). Major applications are broadly categorized into residential charging (for convenience and overnight charging), commercial fleet management (for logistics and operational efficiency), and public charging networks (addressing range anxiety and urban mobility). The increasing complexity of the EV ecosystem necessitates sophisticated port technologies capable of managing variable grid loads, facilitating payment systems, and ensuring interoperability across different vehicle models and manufacturers.

The primary benefits derived from robust charging port infrastructure include reduced reliance on fossil fuels, decreased transportation emissions, and enhanced energy security. Driving factors propelling market growth are fundamentally rooted in stringent government regulations mandating zero-emission vehicles, substantial public and private investment in charging networks, and continuous advancements in battery technology that increase vehicle range and necessitate higher power charging capabilities. Furthermore, the standardization efforts across major regions, particularly the increasing dominance of the CCS standard in North America and Europe, are streamlining deployment and boosting consumer confidence in the long-term viability of the electric mobility transition.

EV Charging Ports Market Executive Summary

The EV Charging Ports Market is undergoing rapid transformation, characterized by significant business model innovations and strategic partnerships focused on scaling infrastructure. Key business trends include the convergence of hardware manufacturing with specialized software platforms, enabling smart charging, dynamic pricing, and Vehicle-to-Grid (V2G) capabilities. Energy service providers and oil majors are increasingly entering the market through acquisitions or large-scale build-outs, shifting the competitive landscape from pure technology provision to integrated energy management solutions. Furthermore, the focus on interoperability and reliability, driven by both consumer demand and regulatory oversight, is pushing providers toward standardized hardware specifications and open-source communication protocols, accelerating global market maturity.

Regional trends highlight distinct development paces influenced heavily by policy and existing grid infrastructure. Asia Pacific, led by China, dominates the market volume, driven by massive domestic EV sales and aggressive state investment in public charging networks, particularly high-power DC infrastructure necessary for its burgeoning fleet of commercial electric buses and trucks. Europe is focusing intensely on cross-border charging consistency and integrating renewable energy sources into the charging process, underpinned by directives like AFIR (Alternative Fuels Infrastructure Regulation). North America is experiencing accelerated growth driven by federal initiatives like the National Electric Vehicle Infrastructure (NEVI) Formula Program, emphasizing reliability and accessibility across major highway corridors, shifting the strategic focus toward robust, high-utilization charging hubs.

Segmentation trends reveal that DC Fast Charging is the fastest-growing segment by revenue, catering to the needs of modern high-range EVs and fleet operators demanding minimal downtime. Concurrently, the residential segment remains foundational, driven by the convenience of overnight charging, though its growth is relatively stable compared to the rapid expansion of public and commercial applications. The software and services sub-segment is demonstrating superior profitability, as data analytics, network management, and energy optimization services become indispensable for maximizing the efficiency and return on investment of deployed physical infrastructure. The rise of destination charging (e.g., retail centers, parking garages) signifies a critical segment trend focusing on integrating charging into the daily routines of EV owners.

AI Impact Analysis on EV Charging Ports Market

Common user questions regarding AI's impact on the EV Charging Ports Market center primarily on how smart technology can prevent grid strain, optimize charging costs, and improve the overall reliability of the charging network. Users frequently inquire about the feasibility of dynamic load balancing, where AI predicts energy consumption patterns based on time of day, weather, and traffic flow, subsequently managing the charging rate of multiple vehicles simultaneously to avoid expensive demand charges for site hosts and prevent localized grid overloads. Furthermore, there is significant interest in predictive maintenance capabilities, seeking to understand how AI-driven diagnostics can anticipate equipment failures, minimizing downtime and maximizing charger utilization, which directly addresses current pain points regarding non-operational public chargers. The key themes summarized from user concerns point toward a demand for AI to transform charging from a static energy transaction into a dynamic, reliable, and cost-effective component of the smart grid.

AI is fundamentally restructuring the operational and strategic dynamics of the EV charging ecosystem by introducing unprecedented levels of efficiency and foresight. Through advanced machine learning algorithms, Charging Network Operators (CNOs) can now process vast datasets—including real-time vehicle telemetry, grid availability signals, energy market prices, and localized charging patterns—to make instantaneous decisions regarding power distribution. This capability is vital for managing the transition to renewable energy sources, ensuring that charging events are preferentially scheduled when solar or wind generation is abundant, thereby maximizing the sustainability of the electric mobility transition. The predictive power of AI enables utilities and CNOs to proactively manage their assets, moving away from reactive maintenance toward preventative measures based on degradation modeling and anomaly detection, ultimately improving the user experience through enhanced uptime.

Moreover, the integration of AI is critical for unlocking the potential of complex bidirectional charging technologies, specifically Vehicle-to-Grid (V2G). AI algorithms are necessary to manage the sophisticated communication and contractual agreements between the vehicle battery, the charger, and the utility grid, determining the optimal times to discharge energy back into the grid to support peak demand, while ensuring the longevity and warranty compliance of the EV battery. This optimization function, powered by AI, transforms parked EVs from simple consumers of energy into distributed energy resources (DERs), offering new revenue streams for vehicle owners and contributing significantly to grid stability and resilience. The deployment of AI-enabled optimization software represents a crucial competitive differentiator for hardware providers and network operators seeking to offer superior energy management services.

- AI-driven Dynamic Load Balancing (DLB) optimizes power distribution across multiple charging ports at a single location, minimizing infrastructure upgrade costs and managing site utilization efficiently.

- Predictive Maintenance relies on machine learning models to analyze operational data, identify component wear and tear, and schedule maintenance before catastrophic failure, drastically improving charger uptime (reliability).

- Smart Grid Integration uses AI to align charging schedules with renewable energy availability and grid congestion signals, facilitating decarbonization and preventing system instability.

- Optimized V2G Transaction Management determines the precise timing and quantity of energy withdrawal or injection, maximizing financial returns for EV owners while protecting battery health.

- Personalized User Experience through AI recommends charging locations, preferred power levels, and optimal times based on user habits, vehicle state of charge, and current energy costs.

- Enhanced Cybersecurity protocols are supported by AI algorithms that detect and mitigate unusual network traffic or unauthorized access attempts within the charging infrastructure.

DRO & Impact Forces Of EV Charging Ports Market

The EV Charging Ports Market is driven by three primary impact forces: significant governmental regulatory push, sustained technological innovation leading to higher power density, and strong consumer acceptance catalyzed by expanding vehicle range and model availability. Government mandates and incentives, such as ambitious targets for phase-out of internal combustion engines and substantial infrastructure subsidies (e.g., in the US, EU, and China), act as the primary structural drivers ensuring consistent market expansion. This regulatory environment provides the necessary long-term certainty for large-scale private investment. Simultaneously, the continuous evolution of charging technology, particularly in DC fast charging standards (400kW+ outputs), directly addresses range anxiety and reduces charging duration, making EVs more practical for mass adoption.

However, the market faces considerable restraints, notably the high upfront capital expenditure required for deploying high-power infrastructure and persistent challenges related to grid capacity limitations in dense urban areas and rural settings. The integration of high-demand DCFC stations necessitates significant utility upgrades, often incurring long wait times and substantial costs that can slow deployment timelines. Furthermore, the lack of complete standardization and interoperability across all legacy charging networks and payment systems continues to cause friction for consumers, sometimes resulting in frustrating charging experiences. The complexity of managing disparate network protocols and ensuring roaming capabilities across different CPOs remains a technical hurdle that requires ongoing industry collaboration to overcome.

Opportunities for exponential growth reside primarily in the development and monetization of advanced services, particularly Vehicle-to-Everything (V2X) technologies, and the expansion into currently underserved segments such as commercial fleets (heavy-duty trucks, logistics vehicles) and marine/aviation applications. V2G technology offers a dual revenue stream opportunity—charging services and grid balancing services—positioning charging infrastructure as a crucial component of future smart energy systems. Additionally, the proliferation of modular and prefabricated charging solutions that simplify installation and minimize civil engineering requirements presents a key opportunity for faster infrastructure scaling in both emerging and established markets. Addressing the need for robust, reliable charging solutions in multi-unit dwellings (MUDs) also remains a significant untapped commercial opportunity.

Segmentation Analysis

The EV Charging Ports Market segmentation is comprehensive, reflecting the diversity in charging technology, required power output, location of deployment, and end-user application. The market is fundamentally segmented by Charging Type (AC vs. DC), which differentiates between slower, often overnight charging (AC) and high-speed, on-the-go charging (DC). The Level of Charging (Level 1, Level 2, DC Fast Charging) further refines this based on power output, directly correlating to installation cost and potential usage rate. Application segmentation (Residential, Commercial, Public) dictates the specific feature requirements, such as access control, payment processing, and network management capabilities. Understanding these segments is crucial for manufacturers to tailor hardware and software solutions that meet specific regulatory and user requirements across diverse geographical markets.

The connector type segment is critical due to historical and regional variations, though standardization efforts are consolidating options. While Type 2 (Mennekes) dominates Europe and CCS (Combined Charging System) is rapidly becoming the global standard, legacy systems like CHAdeMO and older Type 1 connectors still influence maintenance and upgrade cycles. Lastly, segmentation by installation type (Wallbox, Charging Pole, Charging Station) reflects the physical deployment environment, from individual home garages to large public charging hubs. This multi-dimensional segmentation allows market participants to accurately forecast demand and allocate resources to the fastest-growing and most profitable sub-segments, particularly those involving high-utilization DCFC infrastructure deployed in major transport corridors and urban hubs.

The ongoing shift toward connected and intelligent charging solutions means that software and services are increasingly viewed as distinct, high-value segments. Network management software, energy management platforms, and sophisticated payment gateways, which integrate with third-party applications and utility services, represent the most significant areas of value creation beyond the physical hardware. This segmentation highlights the transformation of the market from a commodity hardware business to an integrated energy service provider industry, where data analytics and optimized energy flow management dictate competitive advantage and long-term sustainability.

- By Charger Type:

- AC Chargers (Level 1 & Level 2)

- DC Chargers (DC Fast Chargers)

- By Connection Type:

- Type 1 (J1772)

- Type 2 (Mennekes)

- Combined Charging System (CCS)

- CHAdeMO

- Tesla Connector

- By Application:

- Residential Charging

- Commercial Charging (Workplaces, Retail, Fleet Depots)

- Public Charging Stations (Highway Corridors, Urban Centers)

- By Installation Type:

- Wall-Mounted (Wallbox)

- Pedestal/Pole-Mounted

- Portable Chargers

- By Component:

- Hardware (Chargers, Connectors, Cabinets, Power Modules)

- Software and Services (CMS, Billing, Energy Management Systems)

Value Chain Analysis For EV Charging Ports Market

The value chain of the EV Charging Ports Market is complex and multi-layered, beginning with upstream activities focused on component sourcing and manufacturing. Upstream analysis involves key raw material providers, particularly those supplying high-performance semiconductors, power electronics (IGBTs, MOSFETs), copper for cabling, and specialized plastics/metals for durable enclosures. Component standardization, quality control, and securing supply chain resilience for critical power modules are defining characteristics of this stage. Companies involved in power conversion technology and smart meter integration hold significant leverage upstream, as their innovations directly influence the efficiency and capacity of the final charging station. Strategic focus on vertical integration or reliable long-term contracts with key component suppliers is essential to mitigate the risks associated with global semiconductor shortages and commodity price volatility, ensuring predictable production cycles for EVSE manufacturers.

Midstream activities encompass the manufacturing, integration, and assembly of the charging ports (EVSE). This stage involves sophisticated system design, software development for the charging station’s operating system (firmware), and compliance testing for regional standards (e.g., UL, CE). EVSE manufacturers transform sourced components into certified, operable charging units. Downstream analysis focuses on the deployment, operation, and maintenance of the charging infrastructure. This involves three primary distribution channels: direct sales to large fleet operators and government entities; indirect sales through authorized installers and electricians (common for residential and Level 2 commercial setups); and the deployment through Charging Point Operators (CPOs) who own and manage large public networks, acting as the primary point of contact for the end consumer. The increasing shift towards managed service contracts elevates the importance of ongoing maintenance and network uptime guarantees.

The distribution channel is predominantly managed through a combination of CPOs, e-mobility service providers (EMSPs), and utility companies. Direct channels are crucial for high-volume government tenders or large corporate clients deploying private fleet infrastructure, allowing for custom solutions and direct technical support. Indirect channels, particularly the partnership between hardware manufacturers and local electrical contractors, are vital for penetration into the residential and small-to-medium enterprise (SME) segments. The convergence of CPOs and EMSPs is significant: CPOs handle the physical infrastructure and power delivery, while EMSPs provide the user interface, billing, and roaming services. The value chain is increasingly shifting its focus towards the monetization of data and energy management services, indicating that the greatest value accrues at the downstream operational and service provision stages rather than solely in the upstream hardware manufacturing.

EV Charging Ports Market Potential Customers

The potential customer base for the EV Charging Ports Market is highly diversified, reflecting the multiple usage scenarios and power requirements across the electric mobility landscape. The largest and most immediate segment comprises residential property owners and tenants who seek the convenience of overnight charging, typically utilizing Level 2 AC wallboxes. This segment is characterized by high volume, standardization, and sensitivity to installation costs. A second critical segment involves Commercial Property Owners and Operators (CPOs), including retail centers, corporate campuses, hotels, and parking garage operators. These customers install charging ports as an amenity to attract and retain customers or employees, often requiring sophisticated load management and integrated payment systems for monetization and access control.

A third, high-growth segment includes Fleet Operators and Logistics Companies, encompassing last-mile delivery vans, public transit buses, and increasingly, heavy-duty trucks. These end-users demand robust, reliable DC fast charging solutions located at strategically vital depots or along key transport routes, prioritizing operational uptime and energy efficiency. Their purchasing decisions are heavily influenced by Total Cost of Ownership (TCO) calculations, emphasizing durable hardware and predictive maintenance services. Furthermore, Government and Municipalities form a foundational customer group, purchasing ports for public infrastructure deployment, often driven by legal mandates and public service requirements, necessitating compliance with regional access and payment standards.

Finally, Utilities and Energy Service Providers represent a specialized, high-volume customer segment, often purchasing or managing infrastructure to fulfill regulatory obligations, integrate distributed energy resources, or manage grid stability. They are the primary buyers of V2G-enabled charging equipment and large-scale, networked charging hubs near substations. The convergence of energy and mobility means that these buyers require advanced software capabilities for network management, aggregation of charging demand, and interaction with energy markets, positioning them as key drivers for sophisticated, AI-enabled charging solutions in the next decade.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $18.5 Billion |

| Market Forecast in 2033 | $87.9 Billion |

| Growth Rate | 25.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB Ltd., Siemens AG, Tesla Inc., ChargePoint Holdings Inc., EVBox Group, Webasto Group, Blink Charging Co., Shell Global, BP Pulse, Schneider Electric SE, Eaton Corporation plc, FLO, Wallbox N.V., Tritium DCFC Limited, General Electric Co., Star Charge, Phoenix Contact, Alfen N.V., Rectifier Technologies, Continental AG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

EV Charging Ports Market Key Technology Landscape

The technology landscape of the EV Charging Ports Market is defined by intense innovation aimed at increasing charging speed, improving grid integration, and enhancing user experience. A major technological focus remains on Direct Current Fast Charging (DCFC) hardware, pushing power outputs from the conventional 50kW to ultra-fast levels exceeding 350kW and even 400kW, catering to next-generation vehicle architectures utilizing 800V systems. This requires significant advancements in power electronics, particularly robust, high-efficiency silicon carbide (SiC) and gallium nitride (GaN) components, which enable smaller, lighter, and more heat-efficient power modules. Liquid cooling technologies are becoming standard in high-power DCFC stations to manage the immense heat generated during rapid charging sessions, ensuring safety and longevity of the equipment and cables. Furthermore, the development of modular and scalable charging hardware allows CPOs to incrementally increase station capacity without replacing the entire unit, offering flexibility for future proofing investments.

Another crucial technological pillar is smart charging infrastructure, enabled by sophisticated software platforms. This involves the integration of advanced Charging Management Systems (CMS) and Energy Management Systems (EMS) that utilize cloud computing and IoT (Internet of Things) connectivity. These systems facilitate real-time communication between the charging port, the vehicle (via protocols like OCPP 2.0.1), and the utility grid. Smart charging permits dynamic load balancing (DLB), which intelligently allocates available power based on real-time grid conditions and specific vehicle needs, optimizing energy flow and minimizing infrastructure cost. This software layer is pivotal for enabling complex energy services like demand response (DR) and frequency regulation, positioning the charging infrastructure as a viable grid asset rather than merely a burden.

Emerging technologies, while nascent, are set to significantly disrupt the market. Wireless EV Charging (Inductive Charging) is gaining traction, promising simplified charging by eliminating the physical plug-in requirement, which is highly desirable for autonomous vehicles and commercial fleets (e.g., electric buses charging during short stops). While currently less efficient and slower than high-power DCFC, advances in resonant inductive coupling are improving power transfer efficiency and range. Furthermore, the commercialization of Vehicle-to-Grid (V2G) technology represents a paradigm shift. V2G requires specialized bidirectional power converters within the charging port, allowing energy to flow both into and out of the EV battery. This technology relies heavily on robust communication standards and sophisticated software to manage complex contractual and regulatory agreements, transforming the EV battery into a distributed energy storage resource capable of stabilizing the local grid during peak periods, thus adding significant intrinsic value to the charging port infrastructure.

Regional Highlights

- Asia Pacific (APAC): This region dominates the global market, primarily driven by China, which boasts the largest EV fleet and the most extensive charging network globally. Government policy, particularly in China, mandates high levels of public infrastructure deployment, focusing heavily on urban DC fast charging and fleet applications (electric buses and taxis). India and Southeast Asian nations like South Korea and Japan are accelerating their deployment efforts, spurred by rising internal market demand and government incentives. APAC’s market is characterized by a strong presence of domestic manufacturers and a rapid adoption of localized standards, though CCS adoption is growing.

- Europe: Europe is characterized by a strong focus on interoperability, standardization, and the integration of renewable energy sources. Key drivers include stringent EU carbon emission reduction targets and the Alternative Fuels Infrastructure Regulation (AFIR), which mandates dense charging coverage along major transnational corridors. Germany, Norway, France, and the UK are leading in terms of both public and private investment. The market emphasizes Level 2 AC charging for residential and commercial use, supplemented by high-power DC charging hubs (HPCs). Standardization around the Type 2 connector and CCS is nearly universal, facilitating cross-border mobility.

- North America: The market is experiencing accelerated growth, largely fueled by the Bipartisan Infrastructure Law (BIL) and specific programs like NEVI, which aim to establish a seamless national charging network. The US market is highly focused on reliability standards and domestic manufacturing requirements for infrastructure eligible for federal funding. DC fast charging, particularly along interstates, is a major investment area. Canada is also aggressively promoting EV adoption through rebates and infrastructure investments, focusing on overcoming challenges posed by vast geographic distances and extreme climate conditions. The region primarily utilizes the CCS connector standard, with Tesla's recent announcement to open its proprietary connector standard further reshaping the market dynamic.

- Latin America (LATAM): While still a nascent market compared to established regions, LATAM is showing potential, driven by pilot programs in major economies like Brazil, Mexico, and Chile. The focus is currently on electrifying public transport fleets (buses) and building foundational urban charging hubs. Regulatory frameworks and infrastructure investment remain dependent on national governments and private partnerships, with significant opportunities existing for smart grid integration solutions to manage often limited grid capacity.

- Middle East and Africa (MEA): Growth is primarily concentrated in the Gulf Cooperation Council (GCC) countries, driven by high disposable incomes and government diversification strategies moving away from oil reliance (e.g., Saudi Arabia’s Vision 2030, UAE’s sustainability goals). The MEA region presents unique challenges related to high operating temperatures, demanding specialized, robust hardware. Deployment is currently focused on high-end urban centers and smart city projects, with long-term potential for solar-integrated charging solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the EV Charging Ports Market.- ABB Ltd.

- Siemens AG

- Tesla Inc.

- ChargePoint Holdings Inc.

- EVBox Group

- Webasto Group

- Blink Charging Co.

- Shell Global

- BP Pulse

- Schneider Electric SE

- Eaton Corporation plc

- FLO

- Wallbox N.V.

- Tritium DCFC Limited

- General Electric Co.

- Star Charge

- Phoenix Contact

- Alfen N.V.

- Rectifier Technologies

- Continental AG

Frequently Asked Questions

Analyze common user questions about the EV Charging Ports market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver of growth in the DC Fast Charging segment?

The primary driver is the accelerating consumer adoption of long-range EVs equipped with 800V architectures, necessitating ultra-high-power charging (350kW+) to match refueling speeds comparable to gasoline vehicles, thereby reducing travel downtime and alleviating range anxiety.

How does Vehicle-to-Grid (V2G) technology impact the profitability of charging ports?

V2G technology significantly increases profitability by enabling charging ports to function as distributed energy assets. They earn revenue not only from selling electricity for charging but also from selling stored energy back to the grid during peak demand or providing grid stability services (frequency regulation).

What major regulatory factors are influencing infrastructure deployment in Europe?

The key factor is the Alternative Fuels Infrastructure Regulation (AFIR), which mandates specific density and power requirements for charging stations along the TEN-T core and comprehensive networks, ensuring seamless, interoperable, and standardized charging access across EU member states.

What are the greatest technological challenges facing large-scale EV charging network deployment?

The greatest challenges are managing high peak power demands without overburdening localized grid infrastructure, ensuring robust cybersecurity across connected networks, and maintaining high uptime (reliability) through predictive maintenance in varying environmental conditions.

Why is software development increasingly important for the EV Charging Ports Market?

Software is crucial for enabling smart charging capabilities, including dynamic load balancing, real-time remote diagnostics, payment processing, and integration with energy management systems (EMS). This shift transforms hardware into a service platform, optimizing energy costs and maximizing operational efficiency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager