EV Charging Station and Charging Pile Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437479 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

EV Charging Station and Charging Pile Market Size

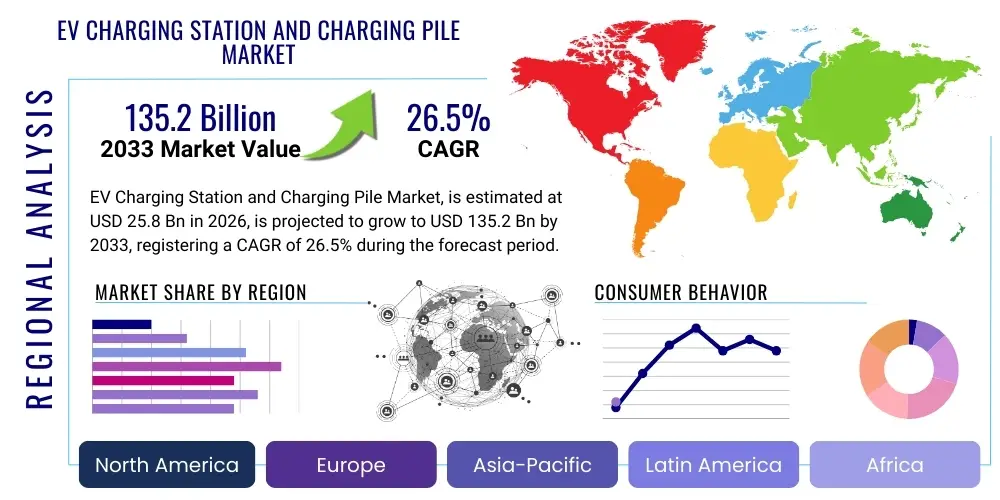

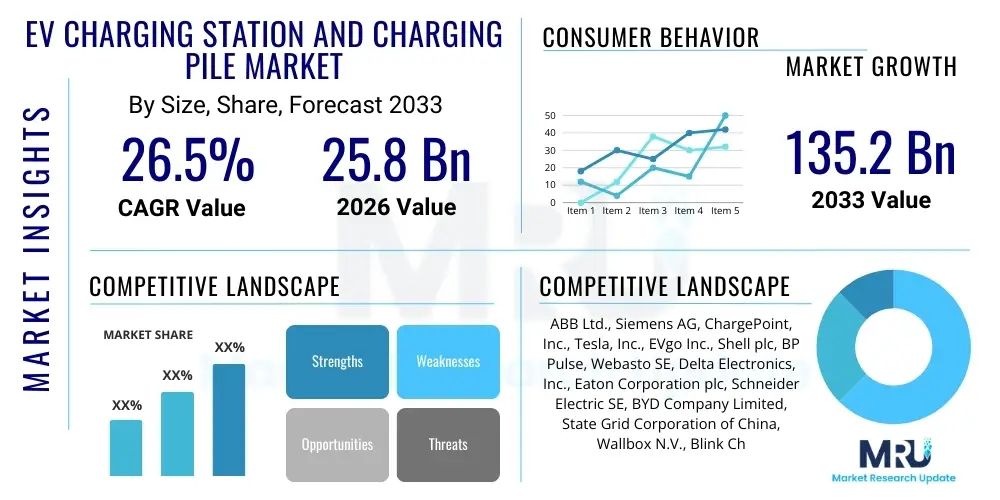

The EV Charging Station and Charging Pile Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 26.5% between 2026 and 2033. The market is estimated at USD 25.8 Billion in 2026 and is projected to reach USD 135.2 Billion by the end of the forecast period in 2033.

EV Charging Station and Charging Pile Market introduction

The EV Charging Station and Charging Pile Market encompasses the ecosystem required to power electric vehicles, including alternating current (AC) charging stations, direct current (DC) fast chargers, and specialized charging piles deployed across residential, commercial, and public infrastructure. This infrastructure is critical for the global transition toward sustainable mobility, directly addressing range anxiety and facilitating the mass adoption of battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs). The primary product categories include Level 1 (slow, residential), Level 2 (medium-speed, public/commercial), and Level 3 or DC Fast Charging (rapid charging capabilities), catering to diverse consumer needs and deployment scenarios, from single-family homes to high-traffic highway corridors and urban charging hubs. Standardization efforts, such as the adoption of CCS, CHAdeMO, and NACS connectors, are central to market development.

Major applications of charging infrastructure span several crucial sectors. Residential charging represents the foundational use case, offering convenience for daily commuters utilizing Level 1 or Level 2 chargers overnight. Commercial applications involve deploying charging facilities at workplaces, retail centers, parking garages, and hospitality venues, serving as a demand driver for extended dwell times and customer convenience. Furthermore, the burgeoning application of charging piles in public transport and fleet management, particularly for electric buses and last-mile delivery vehicles, highlights the scalability and robustness required of modern charging systems. These systems are increasingly integrated with smart grid technologies to manage peak load demand effectively and enable vehicle-to-grid (V2G) functionality, turning stationary EVs into distributed energy resources (DERs).

The driving factors for market growth are multifaceted, anchored by stringent governmental regulations promoting zero-emission zones and providing substantial subsidies or tax credits for EV purchases and infrastructure development. Technological advancements, particularly in increasing charging speeds (high-power charging exceeding 350 kW), improving energy storage efficiency, and deploying sophisticated energy management software, enhance the user experience and grid resilience. The inherent benefits of this market include significant reductions in greenhouse gas emissions, decreased reliance on volatile fossil fuel markets, and the creation of new economic opportunities in manufacturing, installation, and software services. The continuous expansion of EV model availability from major automotive manufacturers further stimulates the essential investment required for widespread charging network deployment, making the market highly dynamic and capital-intensive.

EV Charging Station and Charging Pile Market Executive Summary

The global EV Charging Station and Charging Pile Market is experiencing robust expansion, fundamentally driven by accelerating EV sales and supportive public policy frameworks across key geographies. Business trends indicate a strong shift toward consolidation and strategic partnerships, where utility companies, energy providers, and automotive original equipment manufacturers (OEMs) collaborate to fund and construct high-density charging corridors and metropolitan charging hubs. A crucial trend is the transition from purely hardware-centric offerings to integrated solutions incorporating sophisticated network management software, cloud-based services, and subscription models, enhancing revenue predictability for operators. Furthermore, the market sees significant investment in ultra-fast DC charging technology and the development of reliable, seamless payment and authentication systems, which are vital for improving customer satisfaction and driving commercial viability.

Regionally, Asia Pacific (APAC), led by China, remains the dominant force due to massive domestic EV production, comprehensive governmental support, and proactive public infrastructure rollout. Europe demonstrates strong growth, particularly in Western nations like Germany and the Netherlands, focusing heavily on interoperability (Roamability) and standardized charging protocols mandated by the European Union’s Alternative Fuels Infrastructure Regulation (AFIR). North America is witnessing rapid acceleration, fueled by the substantial financial backing provided through the US National Electric Vehicle Infrastructure (NEVI) Formula Program and state-level initiatives aimed at building a cohesive national network. These regional trends underscore a global commitment to electrification, though the pace and technological focus—be it hydrogen in some European niche markets or battery electric standardization in the US—vary significantly.

Segment trends reveal that the DC charging segment is projected to exhibit the highest CAGR, primarily due to consumer demand for reduced charging times, particularly for long-distance travel and commercial fleet operations. By end-use, the commercial segment (including fleet and public charging) is rapidly catching up to the residential segment, reflecting the necessity of "destination charging" and fast en-route refueling. The competitive landscape is intensely focused on proprietary software development, smart grid integration capabilities, and superior hardware durability to withstand various environmental conditions. Utility providers are increasingly becoming essential players, leveraging their grid expertise to manage the massive energy demands imposed by widespread EV adoption, moving the market toward a V2G-enabled future where charging infrastructure actively participates in grid stabilization.

AI Impact Analysis on EV Charging Station and Charging Pile Market

Users frequently inquire about how Artificial Intelligence (AI) can resolve grid strain, optimize dynamic pricing strategies, and improve the reliability and operational efficiency of charging networks. Key concerns often revolve around the security of data generated by AI systems, the fairness of optimized pricing models (especially during peak demand), and the effectiveness of predictive maintenance in minimizing station downtime. There is also significant interest in AI's role in facilitating seamless roaming and integrating diverse payment systems. The consensus expectation is that AI will be the foundational technology enabling the true scalability of charging networks, moving beyond simple power delivery to complex energy management, enhancing resource allocation, and providing personalized user experiences based on driving patterns and charging history.

AI's role in optimizing the utilization and longevity of charging infrastructure is becoming paramount. Machine learning algorithms are crucial for predictive maintenance, analyzing real-time performance data—such as temperature fluctuations, power quality anomalies, and historical usage—to anticipate hardware failures before they occur. This proactive approach significantly reduces operational expenditures (OPEX) for Charge Point Operators (CPOs) and drastically improves network reliability, addressing one of the major consumer pain points: finding an operational charger. Furthermore, AI models are employed for intelligent load balancing within charging hubs, ensuring that available power capacity is distributed efficiently among multiple connected EVs, thereby maximizing throughput while adhering to local utility constraints and avoiding costly demand charges.

Beyond hardware optimization, AI drives sophisticated energy management and consumer engagement. AI-powered smart charging systems use predictive analytics to forecast energy demand based on weather, time of day, and mobility patterns, allowing CPOs to strategically purchase or store electricity when prices are low. This capability is foundational for Vehicle-to-Grid (V2G) implementation, where AI orchestrates the bidirectional flow of energy, enabling EVs to feed power back into the grid during peak demand events. On the user experience front, AI algorithms personalize the charging journey by recommending optimal charging locations, dynamically adjusting pricing based on current grid conditions, and integrating with navigational tools to provide accurate wait times, ultimately creating a highly efficient and customized service ecosystem.

- AI enables sophisticated predictive maintenance, reducing station downtime and enhancing reliability.

- Machine learning algorithms optimize load balancing and power distribution in high-density charging hubs.

- AI facilitates dynamic pricing based on real-time grid conditions and energy spot market prices.

- Predictive analytics supports Vehicle-to-Grid (V2G) and Vehicle-to-Home (V2H) energy flow orchestration.

- AI improves cybersecurity by detecting anomalies and unauthorized access attempts in network operations.

- Intelligent routing and recommendations powered by AI enhance the user experience and reduce range anxiety.

- AI models are critical for demand forecasting and optimal energy procurement in large-scale networks.

DRO & Impact Forces Of EV Charging Station and Charging Pile Market

The market growth is primarily driven by supportive government policies globally, mandating the transition to electric mobility and offering fiscal incentives for infrastructure deployment. However, this progress is constrained by significant challenges related to grid capacity constraints and the high upfront capital expenditure (CAPEX) required for deploying DC fast chargers in remote or underserved areas. Opportunities arise from technological leaps in battery technology, which mandate faster charging times and encourage innovation in high-power charging standards, coupled with the burgeoning trend of fleet electrification (buses, logistics), which requires dedicated, large-scale charging depots. These forces interact dynamically; for instance, while range anxiety drives demand for fast chargers (Driver), the resulting load on aging grid infrastructure (Restraint) necessitates investment in smart charging technology and energy storage (Opportunity) to mitigate the impact.

The core drivers are the rapid decline in battery manufacturing costs, making EVs more affordable, and corporate sustainability mandates compelling large businesses to electrify their fleets and provide employee charging amenities. Restraints include the lack of standardization across certain regional markets (though improving), complex permitting processes for infrastructure installation, and the significant challenge of land acquisition in densely populated urban centers. Furthermore, consumer perception regarding the reliability and interoperability of public charging networks acts as a soft restraint that needs consistent industry effort to overcome. The reliance on public funding and subsidies also creates market volatility, as policy shifts can quickly alter the economic viability of new projects.

Opportunities are largely centered on innovation in proprietary software platforms that offer seamless integration, robust data management, and revenue optimization tools for CPOs. The development of next-generation power electronics based on Silicon Carbide (SiC) and Gallium Nitride (GaN) materials allows for smaller, more efficient, and faster charging piles. Impact forces stem predominantly from regulatory pressure (e.g., net-zero emission goals) and increasing environmental, social, and governance (ESG) investor interest, which channels massive private capital into the sector. The collective impact of these forces is the accelerated deployment of highly sophisticated, interconnected, and geographically dispersed charging infrastructure, shifting the market emphasis from pure quantity of stations to quality, speed, and intelligence of the network.

- Drivers: Supportive government policies and mandates for fleet electrification; rapid increase in global EV sales; falling battery costs; increasing corporate sustainability goals.

- Restraints: Grid capacity limitations and potential strain; high initial capital investment for DC fast charging infrastructure; lack of charging infrastructure standardization across all regions; complex permitting and interconnection processes.

- Opportunity: Integration of charging stations with renewable energy sources (solar, wind); development of V2G technology; expansion into emerging markets; use of advanced power semiconductors (SiC/GaN).

- Impact Forces: Stringent net-zero emission regulations; high consumer demand for ultra-fast charging; substantial private and public investment in charging networks; technological convergence of automotive and energy sectors.

Segmentation Analysis

The EV Charging Station and Charging Pile Market is comprehensively segmented across several dimensions, including charger type, connector type, application (end-use), and installation type, providing a granular view of market dynamics and investment pockets. Analyzing the market by charger type—AC (Level 1 and Level 2) versus DC (Level 3 or Fast Charging)—is crucial, as DC charging dominates the public and highway charging sectors due to its speed, while AC remains foundational for residential and workplace applications. This segmentation highlights the duality of the market, catering to both convenience-driven overnight charging and high-speed transit refueling needs. The market's structure reflects a necessary balance between affordability and speed, influencing technological focus and deployment strategy globally.

Further segmentation by end-use (Residential, Commercial, Fleet) illuminates distinct demand characteristics. The residential segment, while high in volume, relies on lower power outputs and simpler hardware, whereas the commercial segment (public parking, retail) requires network management capabilities, payment integration, and robust uptime assurance. The fast-growing fleet segment, which includes municipal buses, ride-sharing services, and logistics vehicles, demands specialized depot charging solutions, smart energy management software to optimize fleet readiness, and high-power utilization factors. Understanding these end-use needs allows manufacturers to tailor hardware specifications, ranging from robust, weatherproof designs for public street furniture to customized depot software for synchronized fleet charging operations.

From a technological standpoint, segmenting the market by connector type—CCS, CHAdeMO, and the increasingly prominent North American Charging Standard (NACS)—is essential for gauging regional interoperability challenges and adoption rates. The shifting landscape toward NACS, particularly in North America, influences supplier strategies and infrastructure investment decisions. Furthermore, installation type—Wall Mount versus Pedestal Mount—affects deployment flexibility, especially in urban environments where space constraints dictate form factor. These segments collectively define the competitive matrix, revealing that future success lies in providing scalable, interoperable, and software-defined charging solutions that can efficiently manage power flow and data across diverse geographic and application settings.

- By Charger Type:

- AC Charging Stations (Level 1, Level 2)

- DC Charging Stations (Level 3, Fast/Ultra-Fast Charging)

- By Application (End-Use):

- Residential

- Commercial (Workplace, Retail, Parking Lots)

- Fleet (Bus, Taxi, Logistics, Government)

- By Connector Type:

- Combined Charging System (CCS)

- CHAdeMO

- North American Charging Standard (NACS)

- GB/T (China Standard)

- By Installation Type:

- Wall Mount

- Pedestal Mount

- Portable Chargers

- By Component:

- Hardware (Power Modules, EVSE, Cables, Connectors)

- Software (Charging Network Management Systems, Billing, V2G Platforms)

- Services (Installation, Maintenance, Cloud Services)

Value Chain Analysis For EV Charging Station and Charging Pile Market

The value chain for the EV charging market begins with upstream activities focused on the sourcing and manufacturing of critical components. Upstream analysis involves suppliers of power electronics, particularly advanced components like Silicon Carbide (SiC) and Gallium Nitride (GaN) modules, which are crucial for high-efficiency DC fast charging. It also includes manufacturers of high-power transformers, specialized cabling, and durable enclosure materials. The increasing demand for robust and intelligent charging piles has amplified the importance of semiconductor suppliers and software developers who provide the operating systems and communication protocols (e.g., OCPP) embedded within the hardware. Efficiency and supply chain resilience in this upstream phase are vital, as geopolitical tensions and component shortages can significantly impact production timelines and costs for Charge Point Equipment Manufacturers (CPEMs).

Moving downstream, the value chain involves Charge Point Operators (CPOs), Energy Service Providers (ESPs), and utility companies that handle the installation, maintenance, and network management. CPOs invest in and operate the public and commercial charging infrastructure, focusing heavily on site selection, grid interconnection, and maximizing utilization rates. The distribution channel is bifurcated into direct sales, primarily used for large-scale fleet and utility contracts, and indirect channels, utilizing electrical wholesalers, specialized installers, and integrators for residential and small commercial deployments. Utilities play a critical indirect role by managing the grid infrastructure required to support the increased electrical load and often act as partners or regulators for charging network expansion, ensuring safe and reliable energy delivery.

Direct engagement, such as automotive OEMs bundling home charging solutions with new vehicle sales or CPOs signing long-term leases with property owners, ensures rapid market penetration and standardization. Indirect channels, however, are essential for widespread accessibility, relying on a fragmented network of certified electrical contractors for installation and local maintenance. The convergence of energy management software and charging hardware dictates that strong partnerships between CPOs and software platform developers are necessary for effective operations, billing, and V2G capabilities. The ultimate goal across the entire value chain—from component manufacturing to consumer service—is to create a seamless, reliable, and cost-effective charging experience that accelerates mass EV adoption.

EV Charging Station and Charging Pile Market Potential Customers

The potential customer base for the EV Charging Station and Charging Pile Market is highly diverse, spanning individual vehicle owners, large corporate entities, government bodies, and utility providers, each possessing unique needs concerning power level, usage patterns, and management complexity. Individual residential EV owners represent a foundational customer segment, typically purchasing Level 2 AC chargers for overnight use, valuing convenience, reliability, and low installation costs above ultra-fast charging speed. This segment is highly sensitive to total cost of ownership (TCO) and requires simple, often smart-enabled, hardware that interfaces seamlessly with home energy management systems. The purchasing decision is often influenced by vehicle manufacturers' recommendations or installer partnerships, highlighting the importance of the installer and retail channel in reaching this segment.

The commercial sector constitutes a significant and rapidly expanding customer group, including workplaces, retail chains, hospitality venues, and real estate developers. These customers are primarily interested in utilizing charging infrastructure as an amenity to attract and retain tenants or customers, or to meet corporate sustainability mandates. Their requirements go beyond simple hardware and necessitate robust, networked charging solutions that include integrated payment systems, access control, and comprehensive reporting capabilities managed via sophisticated Charging Network Management Systems (CNMS). Investment decisions in the commercial space are driven by Return on Investment (ROI) metrics, leveraging charging fees or enhanced property value as justification for the substantial capital outlay required for Level 2 and shared DC fast chargers.

Finally, the fleet and utility segments represent the highest-value, high-volume customers, requiring customized, heavy-duty charging solutions. Fleet operators (logistics, public transport, ride-sharing) demand intelligent depot charging infrastructure capable of optimizing schedules, ensuring 100% vehicle readiness, and minimizing energy costs through sophisticated load management software. Utility companies and CPOs, often partnering with government agencies, are the primary customers for public DC fast charging networks deployed along highways and major corridors. Their purchasing decisions are based on network scalability, hardware ruggedness, and advanced grid integration features (V2G capability), aiming to build resilient, future-proof infrastructure compliant with national standards and energy regulations, making them buyers of both large volumes of hardware and advanced software services.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 25.8 Billion |

| Market Forecast in 2033 | USD 135.2 Billion |

| Growth Rate | 26.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB Ltd., Siemens AG, ChargePoint, Inc., Tesla, Inc., EVgo Inc., Shell plc, BP Pulse, Webasto SE, Delta Electronics, Inc., Eaton Corporation plc, Schneider Electric SE, BYD Company Limited, State Grid Corporation of China, Wallbox N.V., Blink Charging Co., Trina Solar Co., Ltd., Star Charge, Kempower Oyj, Alfen N.V., SemaConnect (now part of Blink Charging) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

EV Charging Station and Charging Pile Market Key Technology Landscape

The technological landscape of the EV Charging Station and Charging Pile market is undergoing rapid evolution, primarily driven by the imperative for faster charging, greater efficiency, and seamless grid integration. A central technological focus is the adoption of high-power charging (HPC) standards, pushing DC charging capabilities beyond 350 kW and toward 500 kW and above. This shift is critically dependent on advancements in power electronics, specifically the transition from traditional silicon-based components to next-generation materials like Silicon Carbide (SiC) and Gallium Nitride (GaN). These wide-bandgap semiconductors enable chargers to operate at higher voltages and frequencies with significantly reduced power losses and smaller form factors, directly addressing constraints related to space, cooling, and conversion efficiency within the charging pile hardware. This power density increase is essential for maximizing the throughput of charging depots and highway stations.

Another crucial technological development is the maturation and widespread implementation of Vehicle-to-Grid (V2G) and smart charging technologies. V2G requires bidirectional power flow capabilities in the charging hardware (inverters) and sophisticated software protocols to communicate with grid operators and energy aggregators. Smart charging relies heavily on standardized communication protocols such as Open Charge Point Protocol (OCPP) and Open Smart Charging Protocol (OSCP), which facilitate remote management, dynamic load balancing, and demand-response capabilities. These technologies allow CPOs to manage energy consumption efficiently, minimizing grid impact and capitalizing on arbitrage opportunities by charging when electricity is cheap and potentially selling power back during peak demand periods, transforming EVs from passive consumers into active grid assets.

Further innovation is concentrated in cooling solutions and user interface technologies. As DC charging power levels surge, advanced thermal management systems, including highly efficient liquid cooling for cables, connectors, and power modules, are essential to prevent overheating and ensure safety and longevity. Concurrently, the user interface experience is being refined through technologies like Plug and Charge (based on the ISO 15118 standard), which automates authentication and billing simply by plugging in the vehicle, eliminating the need for RFID cards or mobile apps. This focus on seamless user experience, combined with robust, future-proof hardware capable of handling escalating power requirements, defines the technological trajectory of the entire charging ecosystem, emphasizing reliability, security, and superior energy efficiency as core competitive differentiators.

- High-Power Charging (HPC): Systems delivering 350 kW to 500 kW, utilizing specialized liquid-cooled cables.

- Silicon Carbide (SiC) and Gallium Nitride (GaN): Next-generation semiconductors improving power conversion efficiency and reducing hardware size.

- Vehicle-to-Grid (V2G) Technology: Bidirectional charging capability allowing EVs to supply power back to the grid.

- Plug and Charge (ISO 15118): Automated authentication and billing processes for enhanced user convenience.

- Open Charge Point Protocol (OCPP) and Open Smart Charging Protocol (OSCP): Standardized protocols enabling interoperability and remote network management.

- Advanced Thermal Management: Liquid cooling systems used in high-power DC chargers to manage heat dissipation effectively.

Regional Highlights

- North America (NA): The North American market is characterized by robust policy support, most notably the US Infrastructure Investment and Jobs Act, which allocates significant federal funds (e.g., NEVI program) for building a national charging network focused heavily on DC fast chargers along major interstates. The region is seeing rapid standardization convergence around the NACS connector, driven by major automotive OEM commitments, fundamentally reshaping future infrastructure investment and manufacturing priorities. Canada and Mexico are also expanding their EV infrastructure, albeit at a slower pace, focusing on urban centers. The primary challenges in NA revolve around ensuring grid resiliency against high-power demand spikes and streamlining the bureaucratic processes for utility interconnection and permitting. The emphasis is on public-private partnerships to achieve wide-scale deployment quickly.

- Europe: Europe is a mature and highly regulated market, driven by ambitious EU climate targets and the Alternative Fuels Infrastructure Regulation (AFIR), which mandates specific deployment targets for charging capacity along the Trans-European Transport Network (TEN-T) and urban nodes. The European market is distinctively characterized by a focus on interoperability, ensuring seamless cross-border charging experiences (roaming) facilitated by standardized protocols like OCPP and mandated payment methods. Countries like Norway, the Netherlands, and Germany exhibit the highest penetration rates, benefiting from early and consistent government subsidies and consumer incentives. The region boasts a strong presence of local and pan-European CPOs, often collaborating with major energy utilities to manage the grid impacts of large-scale electrification.

Regulatory harmonization, particularly concerning connector standards (CCS being dominant) and transparent pricing, provides a clear framework for investment. However, the varying national implementation speeds and diverse energy mixes across member states create fragmented micro-markets. Northern European countries lead in V2G pilot projects and smart charging implementation, leveraging high EV penetration rates and advanced smart grid infrastructure. Southern and Eastern European markets are emerging growth areas, requiring substantial foreign direct investment to catch up with mandated AFIR deployment timelines, particularly in rural and intercity routes.

A key trend in Europe is the integration of charging infrastructure with renewable energy sources and stationary storage to maximize sustainability and manage high energy costs. Urban deployment is often challenged by space constraints, leading to innovative solutions such as retractable, street-side charging posts and battery-buffered charging stations that bypass local grid limitations. The fleet segment, especially in logistics and public transit, is growing rapidly, fueled by strict urban low-emission zones. The market emphasizes not just fast charging, but smart, sustainable, and entirely seamless user authentication and billing processes across the continental network.

- Asia Pacific (APAC): APAC is the global leader in sheer volume of EV sales and deployed charging infrastructure, largely dominated by the Chinese market. China’s centralized planning and massive government investment have resulted in the world's most extensive charging network, emphasizing public and fleet charging and utilizing the domestic GB/T charging standard. The rapid pace of deployment in China dictates technological leadership in high-power density and smart charging solutions, frequently integrating charging piles with sophisticated cloud management platforms designed to handle immense scale. South Korea and Japan are also significant markets, focusing on advanced V2G pilots, reliable hardware, and unique charging solutions (e.g., automated parking and charging systems).

Beyond the leading nations, India and Southeast Asian countries (e.g., Thailand, Indonesia) are emerging as high-growth markets, driven by mandates to electrify two- and three-wheelers, along with public buses. These markets require lower-cost, scalable, and decentralized charging solutions, often integrating swappable battery technology alongside conventional charging piles. The primary challenges in the broader APAC region include infrastructure disparity between Tier 1 and Tier 2/3 cities, ensuring energy reliability in developing economies, and navigating the differences in connector standards (GB/T in China, CCS/CHAdeMO elsewhere). Investment is heavily focused on public infrastructure and dedicated fleet depots to manage the logistical shift towards electric transport.

The unique feature of the APAC market, particularly China, is the intense competition among local manufacturers, leading to rapid iteration and competitive pricing strategies. South Korea and Japan focus on leveraging their expertise in automotive and consumer electronics to develop premium, highly reliable charging systems. The market is increasingly adopting centralized data platforms for real-time monitoring and capacity planning, crucial for managing the demands of mega-cities. The growth trajectory remains steeply inclined, with the region continuing to drive global standards in volume deployment and smart network management capabilities.

- Latin America (LATAM), Middle East, and Africa (MEA): These regions represent the emerging frontiers for the EV charging market, characterized by highly localized development influenced by specific economic and energy priorities. In LATAM, countries like Brazil and Chile are leading in EV adoption and charging infrastructure, often driven by mining and corporate fleet electrification rather than mass consumer adoption. Infrastructure deployment is concentrated in capital cities and key economic corridors, typically relying on imported technology and public-private funding initiatives. The major hurdles include economic volatility, ensuring grid stability across large geographic areas, and developing localized supply chains.

The Middle East, particularly the UAE and Saudi Arabia, is investing heavily in charging infrastructure as part of their national vision for diversification and smart city development. These nations emphasize high-specification, reliable charging stations suited for extreme climatic conditions (high heat) and integrating them into planned smart urban areas. Due to high-income levels, there is strong demand for high-end DC fast chargers. Investment is largely driven by government entities and major oil/energy companies pivoting towards sustainable energy solutions, focusing on building prestigious, state-of-the-art charging facilities.

In Africa, the market is nascent, with activity focused mainly in South Africa and North African nations. Growth is closely tied to the availability of reliable electricity supply and affordability constraints. The market potential is vast, especially for two- and three-wheeler electrification, requiring decentralized, micro-grid compatible, and affordable AC charging solutions. The development pace in MEA and LATAM is largely dependent on regulatory clarity, utility cooperation, and sustained government commitment to EV incentives, making these regions highly attractive long-term investment opportunities once foundational economic stability and policy frameworks are established.

The competitive landscape in North America is dynamic, featuring strong domestic CPOs alongside international giants seeking market share fueled by government incentives. States like California and New York lead the charge with aggressive state-level mandates for vehicle electrification, creating localized high-demand markets for both residential and public charging solutions. Fleet electrification, particularly for last-mile delivery and school buses, is a major growth driver, necessitating large-scale depot charging facilities equipped with intelligent load management software. Furthermore, the region is highly innovative in integrating renewable energy generation (solar canopies) with charging stations and battery energy storage systems (BESS) to mitigate peak load impact and improve economic viability.

Investment trends show a clear preference for robust, interconnected, and reliable DC fast charging equipment capable of future V2G integration. Policy focus is shifting from simply installing chargers to ensuring uptime and interoperability, leading to increasing regulatory scrutiny on performance metrics for federally funded stations. The dominance of private vehicle ownership dictates that workplace and retail destination charging remain critical subsets of the commercial market, alongside the core mission of building out cohesive highway charging corridors necessary to eliminate intercity travel range anxiety. The swift adoption of NACS requires immediate retrofitting and future-proofing of existing charging hardware across the continent.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the EV Charging Station and Charging Pile Market.- ABB Ltd.

- Siemens AG

- ChargePoint, Inc.

- Tesla, Inc.

- EVgo Inc.

- Shell plc

- BP Pulse

- Webasto SE

- Delta Electronics, Inc.

- Eaton Corporation plc

- Schneider Electric SE

- BYD Company Limited

- State Grid Corporation of China

- Wallbox N.V.

- Blink Charging Co.

- Trina Solar Co., Ltd.

- Star Charge

- Kempower Oyj

- Alfen N.V.

- SemaConnect (now part of Blink Charging)

Frequently Asked Questions

Analyze common user questions about the EV Charging Station and Charging Pile market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the current primary barrier to widespread EV charging infrastructure deployment?

The primary barrier remains the high cost of installation, particularly for DC fast charging, coupled with significant delays and complexities associated with utility grid interconnection, permitting, and securing sufficient power capacity in high-demand areas. Grid modernization is essential to support mass adoption.

How significant is Vehicle-to-Grid (V2G) technology in the future market growth?

V2G technology is highly significant as it transitions EVs into active energy assets, enabling bidirectional energy flow. It is crucial for balancing the electrical grid, monetizing vehicle downtime for owners, and optimizing energy costs for Charge Point Operators, positioning it as a key technological driver beyond 2030.

Which charging connector standard is dominating the global market?

Globally, the Combined Charging System (CCS) holds wide acceptance, especially in Europe and North America. However, the North American Charging Standard (NACS), previously proprietary to Tesla, is rapidly gaining momentum after being adopted by major US and European automotive OEMs, posing a significant challenge to the CCS standard.

What role does Artificial Intelligence (AI) play in improving charging station reliability?

AI utilizes predictive maintenance algorithms to analyze real-time operational data, forecasting potential hardware failures (e.g., power module faults or connector wear) before they lead to downtime. This proactive management significantly increases charging station reliability and network uptime, improving customer satisfaction.

What are the key differences between AC and DC charging stations in terms of application?

AC charging (Level 1 and 2) is slower and is primarily used for residential and workplace charging where long dwell times (6-12 hours) are acceptable. DC charging (Level 3 or Fast Charging) is rapid, used for public highway corridors and fleet depots where vehicles require fast turnaround times (20-60 minutes).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager