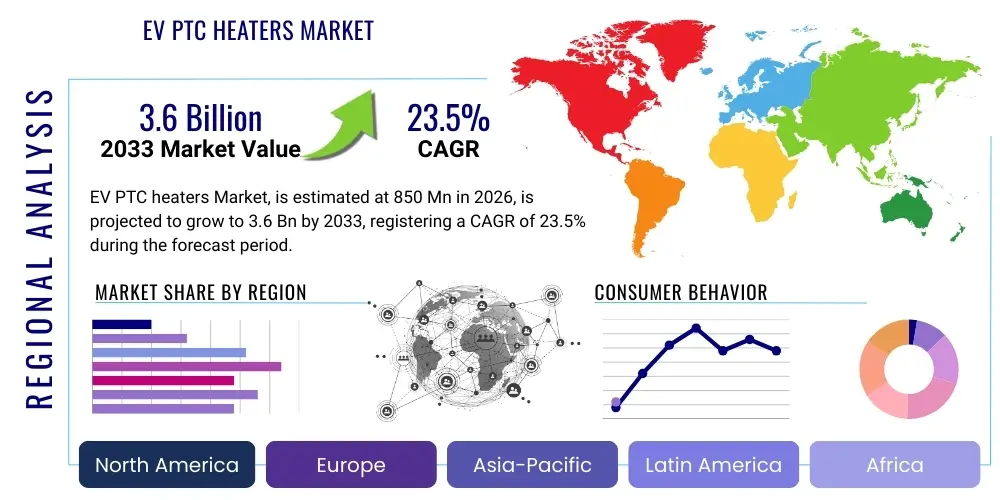

EV PTC heaters Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439577 | Date : Jan, 2026 | Pages : 243 | Region : Global | Publisher : MRU

EV PTC heaters Market Size

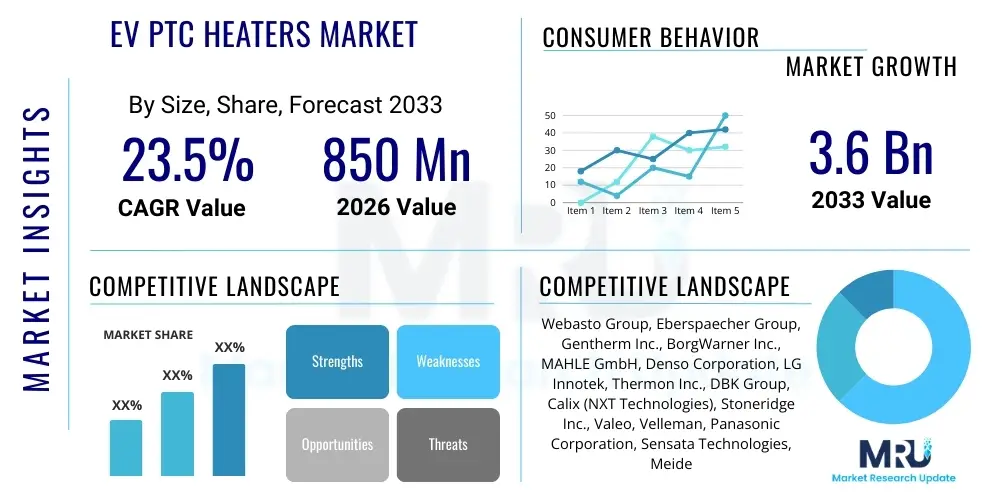

The EV PTC heaters Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 23.5% between 2026 and 2033. The market is estimated at USD 850 Million in 2026 and is projected to reach USD 3.6 Billion by the end of the forecast period in 2033.

EV PTC heaters Market introduction

The Electric Vehicle (EV) Positive Temperature Coefficient (PTC) heaters market is a critical component within the rapidly expanding global automotive electrification landscape. PTC heaters are essential for ensuring cabin comfort and battery thermal management in electric vehicles, particularly in colder climates where traditional internal combustion engine waste heat is absent. These heaters utilize specialized ceramic components that increase their electrical resistance as their temperature rises, providing a self-regulating heating mechanism that enhances safety and efficiency compared to conventional resistive heaters.

Major applications of EV PTC heaters primarily include cabin heating systems, ensuring passenger comfort and defogging functions, and battery pre-heating systems. Battery pre-heating is crucial for maintaining optimal battery operating temperatures, which directly impacts charging efficiency, discharge performance, and overall battery longevity. The benefits of PTC heaters extend to their inherent safety features due to self-regulation, rapid heat-up times, and a compact design, making them suitable for space-constrained EV architectures. Their ability to deliver immediate and precise heating without complex liquid-based systems offers significant advantages in electric vehicles.

The market's robust growth is primarily driven by the accelerating global adoption of electric vehicles, fueled by stringent emission regulations and increasing consumer awareness regarding environmental sustainability. Governments worldwide are implementing various incentives and policies to promote EV sales, creating a surging demand for all associated EV components, including advanced heating solutions. Furthermore, advancements in PTC technology, leading to more energy-efficient and powerful heating elements, are playing a pivotal role in driving market expansion, addressing critical performance requirements for modern EVs.

EV PTC heaters Market Executive Summary

The global EV PTC heaters market is characterized by dynamic business trends, marked by significant investment in research and development to enhance energy efficiency and reduce the overall power consumption of heating systems. Automotive OEMs are increasingly integrating advanced PTC heater solutions as standard features, moving beyond basic heating to intelligent thermal management systems that optimize energy use across the vehicle. The competitive landscape is evolving with established automotive suppliers and new entrants focusing on innovation in material science and control electronics. Strategic partnerships and collaborations between component manufacturers and EV producers are becoming prevalent, aiming to streamline supply chains and integrate bespoke heating solutions directly into vehicle platforms from the design phase, thereby driving economies of scale and accelerating market penetration.

Regionally, Asia Pacific, particularly China, stands as the dominant force in the EV PTC heaters market, driven by its massive EV production and adoption rates. Europe and North America are also experiencing substantial growth, supported by robust regulatory frameworks promoting electrification and a growing consumer base for premium electric vehicles that demand sophisticated comfort features. Emerging markets in Latin America and the Middle East and Africa are showing nascent but promising growth, as electric vehicle infrastructure slowly expands and consumer interest in sustainable transportation solutions begins to take hold. Each region presents unique challenges and opportunities, influenced by local regulations, climate conditions, and consumer purchasing power, necessitating tailored market strategies for manufacturers.

Segment-wise, the market is primarily segmented by type, application, and sales channel. PTC coolant heaters are gaining prominence over PTC air heaters due to their superior efficiency in distributing heat throughout the cabin and their ability to double as battery thermal management components. Passenger vehicles continue to be the largest application segment, though commercial electric vehicles are emerging as a significant growth area. The OEM sales channel dominates, reflecting the direct integration of these heaters during vehicle manufacturing, while the aftermarket segment is gradually expanding to cater to replacement and upgrade needs. Continuous innovation across these segments, particularly in smart thermal management and higher voltage system compatibility, is shaping the market's trajectory.

AI Impact Analysis on EV PTC heaters Market

Users frequently inquire about how Artificial Intelligence (AI) can revolutionize the efficiency, control, and overall integration of PTC heaters within electric vehicles. Key themes center around AI's potential to optimize energy consumption, enhance thermal comfort through predictive analytics, and improve system reliability. Concerns often involve the complexity of AI integration, data security, and the initial investment required for such sophisticated systems. Expectations are high for AI to enable more intuitive, responsive, and energy-efficient thermal management, moving beyond static temperature controls to dynamic, personalized climate experiences, while also contributing to extended EV range by minimizing auxiliary power draw. Users anticipate AI to elevate the intelligent operation of EV PTC heaters significantly.

- AI-driven predictive thermal management systems can optimize PTC heater operation by analyzing driving patterns, external weather conditions, and cabin occupancy, thereby reducing unnecessary energy consumption and extending EV range.

- Integration of AI algorithms allows for dynamic adjustment of heating output based on real-time vehicle data, passenger preferences, and energy availability, enhancing personalized comfort and overall efficiency.

- AI can facilitate advanced diagnostics and predictive maintenance for PTC heater components, identifying potential failures before they occur and improving system reliability and longevity.

- Machine learning models can optimize the energy distribution between cabin heating and battery thermal management, ensuring priority is given to critical functions while maintaining passenger comfort efficiently.

- AI can enable adaptive climate control, learning individual user preferences over time and automatically adjusting heater settings for optimal comfort without manual intervention, leading to a more seamless user experience.

- Enhanced manufacturing processes for PTC heaters, leveraging AI for quality control, defect detection, and optimization of production lines, leading to higher quality products and reduced costs.

- AI-powered simulation and design tools can accelerate the development of next-generation PTC heaters, allowing engineers to test various configurations and materials virtually for optimal performance and energy efficiency.

- Supply chain optimization using AI analytics can predict demand fluctuations for PTC heater components, manage inventory more effectively, and ensure timely delivery, reducing lead times and operational costs for manufacturers.

- The development of AI-enabled sensors and control units specifically designed for PTC heaters will allow for more granular control and real-time feedback, further refining heating performance and energy utilization.

- AI contributes to the overall intelligent vehicle ecosystem, allowing PTC heaters to communicate with other vehicle systems like navigation and battery management for holistic energy management and route optimization.

- Personalized thermal profiles generated by AI can adapt to individual passengers, offering customized heating zones and intensity, enhancing the premium experience in electric vehicles.

- AI analysis of operational data from millions of vehicles can identify optimal operating parameters for PTC heaters across diverse environmental conditions, feeding back into product improvement cycles.

- Cybersecurity measures for AI-enabled PTC heater systems will become increasingly important to prevent unauthorized access or manipulation of critical vehicle functions.

- The application of AI in material science research can lead to the discovery of new PTC ceramic compounds with even higher efficiency, faster response times, and increased durability, pushing the boundaries of current technology.

DRO & Impact Forces Of EV PTC heaters Market

The EV PTC heaters market is significantly influenced by a confluence of driving forces, formidable restraints, and promising opportunities, all shaped by various impact forces. The primary driver is the global surge in electric vehicle adoption, propelled by ambitious decarbonization goals and supportive government policies such as subsidies and tax incentives. This exponential growth in EV sales directly translates to an increased demand for essential components like PTC heaters, critical for both cabin comfort and battery thermal management, particularly in colder climates. Furthermore, ongoing technological advancements are leading to more efficient, compact, and responsive PTC heater designs, enhancing their appeal to vehicle manufacturers and consumers alike. The continuous innovation in material science and control electronics is enabling these heaters to become less power-intensive and more integrated into sophisticated thermal management systems, thereby improving overall EV range and performance.

Despite the robust growth, the market faces several restraining factors. The relatively high initial cost of advanced PTC heating systems compared to basic resistive heaters can be a deterrent, especially in cost-sensitive EV segments. A major concern is the power consumption of heaters, which can significantly impact an EV's driving range, especially during prolonged use in cold conditions. This range anxiety remains a key challenge for EV consumers and manufacturers, pushing for alternative or more efficient heating solutions. Competition from other thermal management technologies, such as advanced heat pumps, which can offer superior energy efficiency by moving heat rather than generating it, also poses a significant restraint, forcing PTC heater manufacturers to continually innovate and demonstrate competitive advantages.

Opportunities for market expansion are abundant, particularly in the development of highly integrated and intelligent thermal management systems where PTC heaters can work synergistically with other components like heat pumps to achieve optimal efficiency. The growing demand for specialized applications, such as direct battery pre-heating and localized surface heating, presents niche market opportunities. Furthermore, expansion into emerging EV markets in Asia Pacific, Latin America, and Africa, where EV adoption is still in its early stages but rapidly accelerating, offers substantial long-term growth prospects. The continuous push for enhanced passenger comfort and safety features in premium EVs also creates a fertile ground for sophisticated PTC heater solutions, encouraging further product differentiation and value addition. The impact forces acting on this market include stringent regulatory landscapes regarding vehicle emissions and energy efficiency, rapidly evolving consumer preferences for comfort and sustainable mobility, fluctuating raw material prices for ceramic components and electronic controls, and the intense competitive intensity among component suppliers striving for market share and technological leadership.

Segmentation Analysis

The EV PTC heaters market is comprehensively segmented to provide a detailed understanding of its diverse components and dynamics, facilitating targeted market strategies and product development. These segmentations typically involve categorizing the market based on the type of heater technology, the specific application within an electric vehicle, and the primary sales channel through which these products reach the end-user. This layered approach helps in identifying key growth areas, understanding customer needs, and assessing competitive landscapes across different market dimensions. Each segment reflects unique technological requirements, performance expectations, and market penetration strategies, contributing to the overall complexity and potential of the EV thermal management sector. Understanding these segments is crucial for stakeholders aiming to capitalize on the burgeoning EV market and its evolving demands for advanced heating solutions.

- By Type

- PTC Air Heaters: Primarily used for direct cabin heating, circulating warm air directly into the passenger compartment.

- PTC Coolant Heaters: Integrated into the vehicle's cooling circuit to heat the coolant, which then distributes heat to the cabin and/or the battery pack for thermal management.

- By Application

- Passenger Vehicles: The largest segment, including various car types from compact sedans to luxury SUVs, where cabin comfort and battery performance are paramount.

- Commercial Vehicles: Encompassing electric buses, trucks, and vans, requiring robust heating solutions for larger cabins and heavy-duty battery systems.

- By Sales Channel

- Original Equipment Manufacturer (OEM): Sales directly to vehicle manufacturers for integration into new vehicles during assembly.

- Aftermarket: Sales of replacement or upgrade PTC heaters through distributors, repair shops, and online platforms.

- By Voltage Type

- 400V Systems: Standard voltage for many current EVs, influencing heater design and power output.

- 800V Systems: Emerging high-voltage architecture in newer EVs, demanding compatible and often more powerful PTC heaters.

- By Power Output

- Low Power (e.g., < 3kW): Suitable for auxiliary heating or smaller vehicle segments.

- Medium Power (e.g., 3kW-6kW): Common for primary cabin heating in many passenger EVs.

- High Power (e.g., > 6kW): Used for larger vehicles, rapid heating, or intensive battery thermal management.

Value Chain Analysis For EV PTC heaters Market

The value chain for the EV PTC heaters market is intricate, involving several distinct stages from raw material procurement to the final integration into an electric vehicle, encompassing both upstream and downstream activities. Upstream activities begin with the sourcing of specialized raw materials, primarily ceramic powders (such as barium titanate, strontium titanate), electrode materials (silver, copper), and various semiconductor components crucial for the PTC effect. This stage also includes the manufacturing of PTC ceramic elements, which requires specialized knowledge in material science and advanced sintering processes. Key players at this stage focus on optimizing material properties for enhanced thermal efficiency, durability, and cost-effectiveness, navigating challenges related to supply chain stability and quality control of these critical base components. Research and development in new composite materials or improved manufacturing techniques also forms a significant part of this upstream segment, driving innovation in heater performance.

Midstream in the value chain involves the assembly and integration of these PTC elements into complete heater modules, including housing, electrical connections, control units, and safety features. This stage sees component suppliers designing and manufacturing the final PTC heater units, often customized to specific OEM requirements regarding form factor, power output, and communication protocols. Rigorous testing for performance, reliability, and safety is paramount here. The downstream activities focus on the distribution and sales channels, primarily Original Equipment Manufacturers (OEMs). Direct sales to major automotive OEMs are the predominant channel, where heater manufacturers work closely with vehicle designers to ensure seamless integration and optimal performance within the EV’s overall thermal management system. Indirect channels, through aftermarket distributors, cater to replacement parts and specialized upgrade markets, though this segment is comparatively smaller.

The distribution channel, therefore, operates through both direct and indirect models. Direct sales to OEMs involve long-term contracts, collaborative design processes, and just-in-time delivery systems, forming highly integrated partnerships. This direct engagement is critical for large-volume orders and ensuring compatibility with rapidly evolving EV platforms. Indirect distribution, primarily serving the aftermarket, involves a network of wholesalers, retailers, and service centers. These channels focus on availability, quick delivery, and technical support for maintenance and repair purposes. Understanding the dynamics of these channels is crucial for market penetration and sustaining competitive advantage, requiring different strategies for product branding, pricing, and logistical support across the value chain.

EV PTC heaters Market Potential Customers

The primary potential customers and end-users for EV PTC heaters are overwhelmingly electric vehicle manufacturers, who integrate these essential components directly into their production lines during vehicle assembly. This encompasses a broad spectrum of automotive OEMs, from established global giants diversifying into electric mobility to nimble pure-play EV startups. These manufacturers require PTC heaters for various applications, including passenger cabin heating, defogging systems, and critically, for the thermal management of high-voltage battery packs to ensure optimal performance and longevity, especially in diverse climatic conditions. Their purchasing decisions are driven by factors such as heater efficiency, power consumption, size and weight, reliability, cost-effectiveness, and the ability of the supplier to meet stringent automotive quality standards and production volumes.

Beyond the direct integration by OEMs, a secondary but growing segment of potential customers includes specialized manufacturers of electric commercial vehicles, such as electric buses, trucks, and delivery vans. These vehicles often require more robust and powerful heating solutions due to larger cabin volumes or more demanding operating cycles, making reliable PTC heaters a critical component. Furthermore, companies involved in converting conventional vehicles to electric platforms, or those specializing in custom electric vehicle solutions, also represent a niche customer base. These customers often seek versatile and adaptable PTC heating modules that can be integrated into diverse vehicle architectures with minimal modifications, emphasizing modularity and ease of installation.

The aftermarket segment, although smaller, also represents potential customers. This includes independent repair shops, authorized service centers, and individual EV owners who may require replacement PTC heaters due to wear and tear or malfunction. Additionally, a nascent market exists for performance upgrades or specialized modifications where enthusiasts or businesses seek to enhance existing thermal management systems. For all these customer groups, the core value proposition of EV PTC heaters lies in their ability to deliver safe, efficient, and reliable heating solutions that are paramount for both occupant comfort and the optimal functioning and durability of the electric vehicle's battery system, directly impacting driving range and overall user satisfaction.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 3.6 Billion |

| Growth Rate | 23.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Webasto Group, Eberspaecher Group, Gentherm Inc., BorgWarner Inc., MAHLE GmbH, Denso Corporation, LG Innotek, Thermon Inc., DBK Group, Calix (NXT Technologies), Stoneridge Inc., Valeo, Velleman, Panasonic Corporation, Sensata Technologies, Meidensha Corporation, Continental AG, Mitsubishi Electric Corporation, Hanon Systems, PRETTL group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

EV PTC heaters Market Key Technology Landscape

The EV PTC heaters market is characterized by a dynamic and evolving technology landscape, driven by the relentless pursuit of enhanced efficiency, safety, and integration within electric vehicle architectures. At the core of these heaters are specialized ceramic PTC elements, typically composed of barium titanate, which exhibit a rapid and significant increase in electrical resistance above a certain Curie temperature. This intrinsic property allows for self-regulation, preventing overheating and eliminating the need for complex external control circuits in many applications, thereby enhancing safety and simplifying design. Advancements in ceramic composition and manufacturing processes are continuously improving the heating efficiency, power density, and durability of these elements, allowing for smaller, lighter, and more powerful heater designs that minimize their impact on vehicle weight and space.

Beyond the core ceramic elements, a significant technological trend involves the development of thick-film PTC heating technology. This approach involves printing resistive paste onto ceramic or aluminum substrates, offering greater flexibility in heater shape and size, facilitating integration into complex vehicle structures, and enabling highly localized heating solutions. This technology allows for rapid heat-up times and precise temperature control, which is crucial for applications like battery cell pre-heating or localized cabin comfort zones. The shift towards higher voltage systems (e.g., 800V) in modern EVs also dictates the evolution of PTC heater technology, requiring components capable of operating safely and efficiently at elevated voltages, necessitating innovations in insulation materials, connection systems, and power electronics to handle increased power levels without compromising safety or performance.

Furthermore, the integration of intelligent control units and advanced thermal management systems represents a pivotal technological advancement. These systems leverage microcontrollers and sophisticated algorithms to optimize PTC heater operation by coordinating with other vehicle components, such as battery management systems (BMS) and climate control units. This holistic approach ensures that energy is utilized most effectively, balancing cabin comfort with battery thermal needs to maximize driving range. Innovations include predictive heating algorithms that anticipate thermal demands based on navigation data and external conditions, and modular PTC systems that allow for flexible power distribution. The ongoing research into solid-state PTC elements, which offer even greater reliability and potentially faster response times, alongside the exploration of novel materials for improved thermal conductivity and reduced energy consumption, continues to shape the future of the EV PTC heaters market, pushing the boundaries of what these essential components can achieve.

Regional Highlights

- Asia Pacific: Dominant market due to high EV production and sales in China, South Korea, and Japan. Government incentives, large domestic markets, and strong manufacturing bases drive demand. Focus on advanced thermal management for various climate conditions.

- Europe: Significant growth driven by stringent emission regulations and robust EV adoption targets. Germany, Norway, France, and the UK are key markets, emphasizing high-efficiency and integrated thermal solutions for premium EVs.

- North America: Rapidly expanding market with increasing EV sales in the United States and Canada. Demand for reliable cold-weather performance and advanced cabin comfort features is a key driver. Investment in domestic EV manufacturing strengthens the market.

- Latin America: Emerging market with nascent but growing EV adoption. Brazil and Mexico show potential, driven by urbanization and government interest in sustainable transport, though infrastructure development is still underway.

- Middle East and Africa (MEA): Smallest but developing market. UAE and Saudi Arabia are showing interest in EVs as part of diversification strategies. Long-term potential as EV infrastructure and consumer awareness increase.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the EV PTC heaters Market.- Webasto Group

- Eberspaecher Group

- Gentherm Inc.

- BorgWarner Inc.

- MAHLE GmbH

- Denso Corporation

- LG Innotek

- Thermon Inc.

- DBK Group

- Calix (NXT Technologies)

- Stoneridge Inc.

- Valeo

- Velleman

- Panasonic Corporation

- Sensata Technologies

- Meidensha Corporation

- Continental AG

- Mitsubishi Electric Corporation

- Hanon Systems

- PRETTL Group

Frequently Asked Questions

Analyze common user questions about the EV PTC heaters market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are EV PTC heaters and why are they essential for electric vehicles?

EV PTC (Positive Temperature Coefficient) heaters are self-regulating electric heating elements crucial for electric vehicles. They use ceramic materials whose resistance increases with temperature, providing safe, efficient, and rapid heating for the passenger cabin and critical battery thermal management, especially in cold climates where internal combustion engine waste heat is unavailable. Their self-regulating nature prevents overheating, enhancing safety and reliability for both occupant comfort and optimal battery performance, which directly impacts range and longevity.

How do PTC heaters impact the driving range of an electric vehicle?

PTC heaters, like all auxiliary systems, consume electrical energy from the EV's battery. During prolonged use, particularly in cold weather, their power draw can noticeably reduce the vehicle's driving range. However, ongoing technological advancements are focused on improving their energy efficiency and integrating them into smart thermal management systems to minimize this impact. Modern EVs often prioritize efficient heating and may combine PTC heaters with heat pumps to optimize energy consumption and preserve range, balancing comfort with operational efficiency.

What is the primary difference between PTC air heaters and PTC coolant heaters?

The primary difference lies in their heat transfer medium. PTC air heaters directly warm the air circulated into the cabin for passenger comfort and defogging. PTC coolant heaters, conversely, heat a liquid coolant that then circulates through various circuits to warm the cabin and/or the battery pack. Coolant heaters generally offer more uniform heat distribution and are often preferred for sophisticated thermal management systems that require precise temperature control for multiple components, including the battery, for optimal performance.

Are there more energy-efficient alternatives to PTC heaters for EV thermal management?

Yes, heat pumps are often considered a more energy-efficient alternative to pure resistive PTC heaters, especially in moderate cold. Heat pumps work by transferring ambient heat into the cabin or battery rather than generating it, consuming less electrical energy. However, heat pumps become less effective in extreme cold. Many modern EVs integrate both PTC heaters and heat pumps, using PTC heaters for rapid initial heating and supplementary heat in very cold conditions, while relying on heat pumps for sustained, energy-efficient warmth, thereby creating a hybrid and optimized thermal management system.

What future technological trends are expected in the EV PTC heaters market?

Future trends in the EV PTC heaters market include further advancements in ceramic materials for increased efficiency and power density, integration with sophisticated AI-driven predictive thermal management systems for optimal energy usage, and the development of heaters compatible with emerging 800V EV architectures. Expect to see more compact, modular designs that allow for flexible integration, alongside continued research into thick-film technology for localized heating and the development of hybrid systems that synergistically combine PTC elements with other thermal technologies like heat pumps to maximize overall energy efficiency and range.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager