EV Smart Charge Controller Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434697 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

EV Smart Charge Controller Market Size

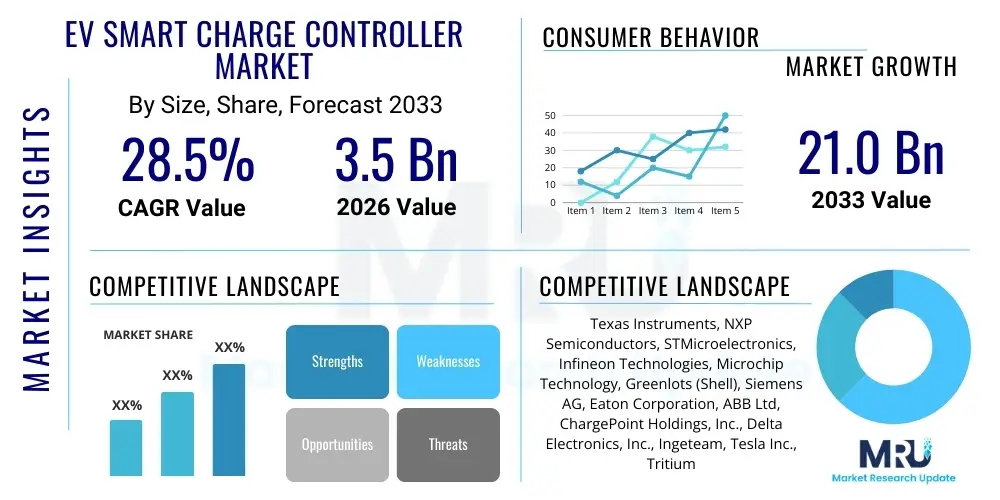

The EV Smart Charge Controller Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 28.5% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 21.0 Billion by the end of the forecast period in 2033.

EV Smart Charge Controller Market introduction

The EV Smart Charge Controller Market encompasses hardware and embedded software solutions designed to manage and optimize the electric vehicle charging process. These controllers serve as the central processing unit within charging stations (AC and DC) or onboard chargers, ensuring seamless communication between the electric vehicle, the charging infrastructure, and the utility grid. Their primary function is to monitor battery status, manage power flow based on grid availability, facilitate billing, and implement security protocols, thereby enabling smart charging features crucial for mass EV adoption.

Smart charge controllers are pivotal in enabling Vehicle-to-Grid (V2G) capabilities, demand response mechanisms, and dynamic load management. As global governments mandate minimum standards for smart charging infrastructure to alleviate grid strain and promote renewable energy integration, the complexity and intelligence of these controllers are rapidly increasing. Key applications span across residential charging (Level 1 and 2), commercial fleets, and public fast-charging networks, providing necessary functionalities such as authentication, state-of-charge monitoring, and remote diagnostics. The growing emphasis on energy efficiency and interoperability, driven by standards like OCPP (Open Charge Point Protocol) and ISO 15118, fundamentally dictates the technological trajectory of this market.

Major driving factors fueling this market include substantial government subsidies and mandates supporting EV charging infrastructure deployment, the need for efficient load management to prevent grid overload during peak charging times, and the consumer demand for seamless, interconnected charging experiences. The integration of high-speed communication technologies (e.g., 5G) and advanced microcontroller units (MCUs) ensures that modern smart charge controllers can handle complex data processing tasks required for dynamic energy tariffs and real-time optimization. Furthermore, the increasing penetration of bi-directional charging technologies highlights the critical role of these controllers in managing energy flow both to and from the vehicle battery.

EV Smart Charge Controller Market Executive Summary

The EV Smart Charge Controller Market is undergoing robust expansion, characterized by significant technological advancements focusing on interoperability, cybersecurity, and bi-directional power flow management. Business trends show strong consolidation among hardware manufacturers, who are increasingly partnering with software and utility providers to offer integrated smart energy management systems rather than standalone components. This shift towards end-to-end solutions is driven by the necessity for complex synchronization between charging hardware, grid operators, and energy management platforms, positioning the market for sustained high growth throughout the forecast period. Standardization efforts, particularly the global adoption of ISO 15118, are simplifying the plug-and-charge experience and accelerating market penetration in both commercial and residential sectors.

Regional trends indicate that the Asia Pacific (APAC) region, led by China and India, will maintain the fastest growth rate, fueled by aggressive governmental mandates for EV adoption and massive public investment in charging infrastructure deployment. Europe, particularly Germany and the UK, shows high adoption rates due to strict regulatory requirements concerning smart metering and demand response capabilities integrated into new charging stations. North America focuses intensely on grid resilience and cybersecurity aspects of smart controllers, spurred by significant federal funding programs aimed at building resilient, interconnected charging corridors. The maturity of grid infrastructure and regulatory support heavily influences the regional adoption patterns and technological focus.

Segmentation trends highlight the dominance of DC fast-charging applications in terms of revenue, driven by the need for rapid charging solutions for commercial fleets and highway networks. However, the AC segment (primarily used in residential and workplace settings) is expected to demonstrate considerable volume growth, supported by the mandatory incorporation of basic smart capabilities like load balancing in residential units. By component, the hardware segment (MCUs, power modules, communication modules) holds the largest share, but the embedded software and firmware segment is projected to show superior growth CAGR, reflecting the increasing complexity and value derived from sophisticated algorithms for energy optimization and grid services.

AI Impact Analysis on EV Smart Charge Controller Market

Users frequently inquire about how Artificial Intelligence (AI) can optimize charging schedules, manage large-scale fleet charging, predict battery degradation, and ensure grid stability under mass EV deployment scenarios. Key concerns revolve around the computational demands AI algorithms impose on embedded controllers and the security implications of utilizing cloud-based AI services for mission-critical energy management. The overwhelming expectation is that AI will move charging management beyond static scheduling to predictive, dynamic optimization. This involves leveraging deep learning models to analyze real-time grid pricing, renewable energy generation patterns, individual EV battery characteristics, and usage profiles, ensuring that charging occurs at the optimal time to minimize cost and grid stress while maximizing battery life. The integration of AI directly into the charge controller chipset, often via specialized edge computing processors, is summarized as the crucial theme for enabling truly intelligent, decentralized energy management across vast networks.

- AI enables predictive charging optimization based on real-time electricity pricing and renewable energy availability.

- Machine learning algorithms enhance Battery Management System (BMS) integration, predicting battery degradation and optimizing charge cycles to extend vehicle lifespan.

- AI facilitates sophisticated dynamic load balancing across multiple charging stations simultaneously, preventing localized grid overloads.

- Edge AI processing integrated into the controller reduces latency for critical demand response events and enhances cybersecurity anomaly detection.

- Advanced pattern recognition improves user authentication processes and ensures efficient energy trading in V2G environments.

- AI supports preventative maintenance by monitoring controller performance and predicting hardware failures.

DRO & Impact Forces Of EV Smart Charge Controller Market

The EV Smart Charge Controller Market is principally driven by strong global regulatory support for EV infrastructure and the compelling need for grid modernization through demand-side management. Restraints often center on the high initial cost of implementing intelligent, networked charging hardware and the persistent challenges related to cybersecurity vulnerabilities inherent in complex, interconnected systems. Opportunities are significantly expanding through the rise of bi-directional charging (V2G/V2H) services, positioning the controller as a crucial asset for energy arbitrage and resilience services. These factors collectively exert a powerful impact force, primarily pushing manufacturers towards highly integrated, secure, and future-proof controller platforms that can communicate seamlessly with diverse smart grid components and energy management software systems.

The pervasive impact of climate change mitigation policies compels widespread electrification, establishing a non-negotiable demand foundation for smart charging solutions. However, technical complexity remains a key hurdle; ensuring controllers meet stringent safety standards (like UL, CE) while simultaneously maintaining robust interoperability across diverse vehicle models and charging protocols requires substantial R&D investment. Furthermore, the standardization efforts, while beneficial long-term, create short-term volatility as manufacturers must rapidly update hardware and firmware to comply with evolving international standards such as OCPP 2.0.1 and ISO 15118-20, necessitating flexible, modular controller designs.

The impact forces are fundamentally transforming the competitive landscape. Utilities are increasingly influencing controller specifications to ensure integration with their Advanced Metering Infrastructure (AMI) and Distributed Energy Resource Management Systems (DERMS). This vertical integration pressures pure-play hardware providers to acquire deep software and communication expertise, thereby increasing the barrier to entry. The most significant opportunity lies in developing controllers capable of generating measurable revenue streams for site owners through participation in ancillary grid services, moving the controller from a cost center to a critical revenue generator in the distributed energy ecosystem.

Segmentation Analysis

The EV Smart Charge Controller Market is systematically segmented based on Charging Level, Component Type, Charging Location, and Communication Technology, providing a granular view of market dynamics and adoption patterns. The Charging Level segmentation distinguishes between AC (Level 1 and Level 2) and DC (Level 3 or Fast Charging) controllers, reflecting divergent requirements in power handling, communication speed, and thermal management. The Component Type segmentation clarifies the market structure by separating revenues derived from dedicated Hardware components (Microcontrollers, Power Relays, Communication Modules) versus the embedded Software and Firmware which manages the intelligent operations and connectivity. Analyzing these segments is essential for understanding where technological innovation and capital investment are concentrated within the EV charging value chain.

By Charging Location, the market is broadly divided into Residential, Commercial (Workplace, Retail), and Public Infrastructure. Each location imposes unique constraints and demands on the smart controller; for instance, residential controllers prioritize user-friendly interfaces and basic load balancing, whereas public controllers must manage authentication, secure payment processing, and high-power DC fast charging protocols. Furthermore, the segmentation by Communication Technology (e.g., Cellular, Wi-Fi, Ethernet, PLC) highlights the diverse technological approaches used to maintain reliable connectivity to the backend management systems and the grid. This multi-dimensional segmentation allows stakeholders to accurately gauge market potential within specific niche applications, such as fleet depot charging or urban fast-charging hubs, optimizing product development and market penetration strategies accordingly.

- By Charging Level:

- AC Charging Controllers (Level 1 and Level 2)

- DC Charging Controllers (Level 3 / Fast Charging)

- By Component Type:

- Hardware (MCU, Communication Modules, Power Electronics)

- Software and Firmware (OS, OCPP Stack, V2G Protocols)

- By Application/Location:

- Residential Charging

- Commercial Charging (Workplace, Fleet Depots)

- Public Charging Infrastructure

- By Communication Technology:

- Cellular (4G/5G)

- Wi-Fi and Ethernet

- Power Line Communication (PLC)

Value Chain Analysis For EV Smart Charge Controller Market

The value chain for EV Smart Charge Controllers begins upstream with the procurement of specialized semiconductors, microcontrollers, communication chips, and high-power switching components, primarily sourced from major global technology providers. Upstream dynamics are characterized by high reliance on key chip manufacturers, making the supply chain susceptible to global semiconductor shortages, which necessitates robust inventory management and multi-sourcing strategies by controller manufacturers. Successful differentiation at this stage often relies on securing reliable supplies of high-performance components capable of supporting complex algorithms and thermal management required for high-power DC applications. Suppliers focus on miniaturization and integration to reduce the overall Bill of Materials (BOM) cost for the final product.

In the midstream, dedicated EV smart charge controller manufacturers assemble and integrate these components, developing proprietary embedded firmware that handles protocol stacks (OCPP, ISO 15118) and power electronics management. Direct distribution channels involve selling finished controllers directly to large Electric Vehicle Supply Equipment (EVSE) manufacturers who integrate them into their charging stations, or directly to major fleet operators developing proprietary charging solutions. Indirect channels rely on specialized distributors and value-added resellers (VARs) who provide localized technical support and installation services, particularly crucial in fragmented European and North American markets where local grid standards vary significantly.

Downstream activities involve the installation, commissioning, and ongoing maintenance of the charging stations, often managed by utility companies, Charge Point Operators (CPOs), or Energy Service Companies (ESCOs). The performance of the smart controller directly impacts the quality of service provided downstream, including billing accuracy, uptime, and participation in grid flexibility programs. The shift towards V2G and smart grid integration is forcing strong collaboration between controller manufacturers and downstream CPOs, focusing on seamless communication and data exchange to unlock new revenue streams derived from grid optimization services, thus completing the loop from component production to energy management services.

EV Smart Charge Controller Market Potential Customers

The primary end-users and buyers of EV Smart Charge Controllers are broadly categorized based on their role in deploying and operating the charging infrastructure. The largest direct buyers are Electric Vehicle Supply Equipment (EVSE) Manufacturers, such as ABB, ChargePoint, and Siemens, who purchase controllers as critical components to integrate into their final charging station products sold globally. These manufacturers require controllers that offer high reliability, scalability, and compliance with multiple international safety and communication standards, driving demand for modular and highly certified components. Their purchasing decisions are heavily influenced by cost efficiency, integration ease, and the controller's ability to support emerging features like V2G.

A second significant customer base includes Charge Point Operators (CPOs) and e-Mobility Service Providers (EMSPs), especially those that engage in white-label production or custom infrastructure development. These entities require controllers optimized for fleet management or public networks, prioritizing remote diagnostic capabilities, robust security features, and seamless compatibility with their backend management software (CSMS). Utility companies and Distribution System Operators (DSOs) also act as indirect but influential customers, often mandating specific technical requirements for smart controllers deployed within their service territories to ensure grid stability and facilitate demand response programs, thereby shaping the procurement strategies of both EVSE manufacturers and CPOs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 21.0 Billion |

| Growth Rate | 28.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Texas Instruments, NXP Semiconductors, STMicroelectronics, Infineon Technologies, Microchip Technology, Greenlots (Shell), Siemens AG, Eaton Corporation, ABB Ltd, ChargePoint Holdings, Inc., Delta Electronics, Inc., Ingeteam, Tesla Inc., Tritium, Wallbox Chargers, Inc., EVBox Group, Enel X, Phoenix Contact, Bender GmbH & Co. KG, Kempower |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

EV Smart Charge Controller Market Key Technology Landscape

The technology landscape for EV Smart Charge Controllers is dominated by three critical areas: high-performance microcontrollers (MCUs) and System-on-Chips (SoCs), advanced communication protocol stacks, and robust power electronics integration. Modern controllers utilize powerful 32-bit MCUs, often incorporating specialized hardware acceleration for cryptography and complex power modulation, enabling real-time decision-making crucial for dynamic charging. Major semiconductor players are developing dedicated automotive-grade MCUs that meet stringent functional safety standards (ISO 26262), ensuring reliable operation in harsh environmental conditions typical of outdoor charging infrastructure. The continual drive for higher efficiency and smaller form factors is promoting the integration of multiple functionalities onto a single chip.

Communication protocols form the backbone of the smart controller's intelligence. The mandatory adoption of the Open Charge Point Protocol (OCPP), particularly the latest versions, ensures seamless communication with cloud-based Central Management Systems (CSMS). Critically, the implementation of ISO 15118 is a defining technology trend, enabling Plug & Charge functionality, which automates secure identification, authorization, and billing using digital certificates embedded within the vehicle and the controller. Furthermore, Power Line Communication (PLC) technology is gaining traction, particularly in contexts requiring robust communication across existing electrical infrastructure, offering a reliable, cost-effective alternative to cellular or Wi-Fi for localized smart grid interactions.

In terms of power handling, the transition to Silicon Carbide (SiC) and Gallium Nitride (GaN) based power semiconductors is fundamentally enhancing the efficiency and power density of DC fast charge controllers. These Wide Bandgap (WBG) materials allow controllers to manage higher voltages and faster switching speeds with minimal thermal loss, facilitating the development of ultra-fast 350 kW and 500 kW charging systems. The controller's firmware must integrate sophisticated algorithms to manage the thermal profiles and fault protection systems associated with these high-power components. Furthermore, the rising necessity for bi-directional charging compels controllers to incorporate complex bi-directional AC-DC conversion topologies and robust isolation technologies, pushing the boundaries of embedded power electronics management.

Regional Highlights

Regional dynamics play a significant role in shaping the EV Smart Charge Controller Market, influenced primarily by local EV adoption rates, regulatory frameworks, and grid maturity. Specific market demands, such as the preference for DC fast charging versus AC residential charging, dictate the types of controllers most widely deployed in a given region. Furthermore, governmental incentives and mandates supporting V2G trials and smart grid integration vary dramatically, leading to regional disparities in technology readiness and market maturity. The global market is not homogenous but rather a collection of regionally tailored ecosystems.

- Asia Pacific (APAC): Dominates the market in volume and projected growth rate, largely driven by aggressive EV policies in China, South Korea, and emerging markets like India. The focus here is on mass deployment and achieving cost efficiency, particularly in public fast-charging networks. Local standards (like China's GB/T) require regional specialization in controller firmware.

- Europe: Characterized by high technological maturity and stringent regulatory requirements emphasizing smart metering and interoperability (driven by the European Green Deal). Key countries like Germany, Norway, and the Netherlands lead in adopting controllers compatible with sophisticated grid balancing and V2G pilot projects, demanding high levels of certification (e.g., MID certification).

- North America: Focused on building resilient, interconnected charging corridors, supported by significant federal investment (e.g., NEVI program). Cybersecurity (meeting federal standards) and the implementation of ISO 15118 for seamless long-distance travel are crucial factors, making secure communication modules a premium requirement for controllers deployed in this region.

- Latin America (LATAM): Represents an emerging market with nascent but growing EV adoption, primarily centered in urban centers like Brazil and Mexico. Demand is generally focused on basic, reliable Level 2 and commercial AC charging controllers, with growth heavily dependent on future utility infrastructure upgrades.

- Middle East and Africa (MEA): Growth is primarily concentrated in the UAE and Saudi Arabia, driven by ambitious diversification and sustainability goals. The market requires controllers designed to withstand extreme temperatures and sand ingress, necessitating specialized thermal management and robust hardware design.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the EV Smart Charge Controller Market.- Texas Instruments

- NXP Semiconductors

- STMicroelectronics

- Infineon Technologies

- Microchip Technology

- Greenlots (Shell)

- Siemens AG

- Eaton Corporation

- ABB Ltd

- ChargePoint Holdings, Inc.

- Delta Electronics, Inc.

- Ingeteam

- Tesla Inc. (Internal systems)

- Tritium

- Wallbox Chargers, Inc.

- EVBox Group

- Enel X

- Phoenix Contact

- Bender GmbH & Co. KG

- Kempower

Frequently Asked Questions

Analyze common user questions about the EV Smart Charge Controller market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a smart charge controller in an EV charger?

The primary function of a smart charge controller is to serve as the brain of the charging station, managing all communication and power flow. It ensures secure communication (OCPP, ISO 15118) between the charger, the vehicle (BMS), and the grid utility. It performs critical tasks such as authentication, dynamic load balancing, metering, thermal management, and implementing demand response signals to optimize charging based on grid conditions and energy costs. Its intelligence differentiates a basic charger from a smart grid-ready system.

How does ISO 15118 influence the demand for advanced smart charge controllers?

ISO 15118 is a crucial standard driving controller complexity because it enables "Plug & Charge" functionality, removing the need for physical RFID cards or mobile apps. This requires the controller to securely manage Public Key Infrastructure (PKI) certificates and cryptographic operations for automatic vehicle identification and billing. Furthermore, ISO 15118 is essential for implementing bi-directional power transfer (V2G), dramatically increasing the computational demands and communication protocols required within the smart controller hardware and firmware.

What role do smart charge controllers play in Vehicle-to-Grid (V2G) technology?

Smart charge controllers are fundamental to V2G implementation. They manage the bi-directional power flow electronics, ensuring safe and controlled energy discharge from the EV battery back into the grid. The controller utilizes complex algorithms to interpret real-time grid signals, determine optimal energy arbitrage moments, and communicate approved charge/discharge schedules with both the EV's Battery Management System and the utility’s Distributed Energy Resource Management System, effectively turning the vehicle into a mobile energy storage asset.

Which component segment is expected to show the fastest growth rate in the market?

While the Hardware segment currently holds the largest market share by value, the embedded Software and Firmware segment is projected to exhibit the fastest Compound Annual Growth Rate (CAGR). This accelerated growth is attributed to the increasing complexity of necessary features, including sophisticated AI-driven optimization algorithms, enhanced cybersecurity protocols, continuous firmware over-the-air (FOTA) updates, and the rising adoption of complex protocol stacks like OCPP 2.0.1 and ISO 15118-20, which add substantial value and recurring revenue opportunities to the final product.

What are the key cybersecurity concerns addressed by modern smart charge controllers?

Key cybersecurity concerns include unauthorized access, data integrity breaches (especially billing and metering data), and denial-of-service (DoS) attacks that could compromise charging services or even destabilize the local grid through synchronized manipulation. Modern controllers mitigate these risks by integrating secure boot processes, hardware security modules (HSM) for key management, robust encryption protocols (TLS), secure firmware update mechanisms, and intrusion detection systems, ensuring the secure isolation of operational data and command streams from potential threats.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager