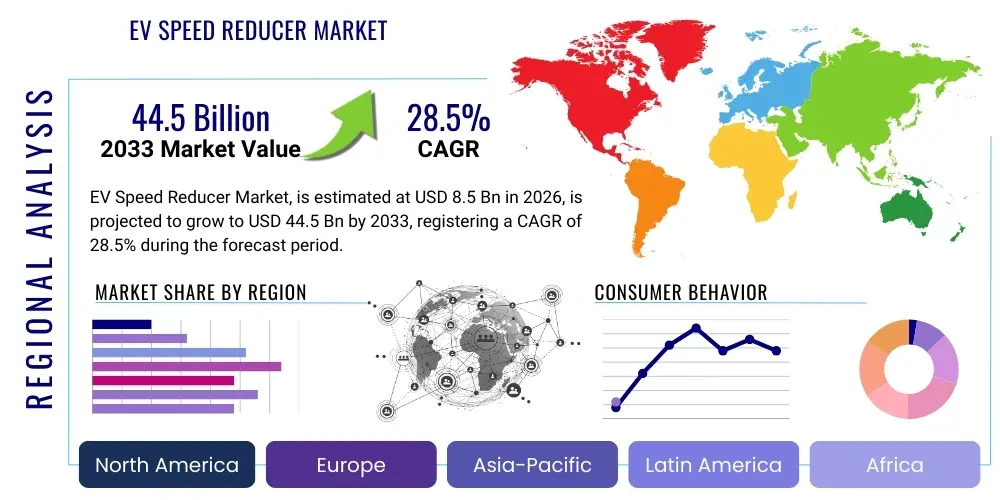

EV Speed Reducer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435872 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

EV Speed Reducer Market Size

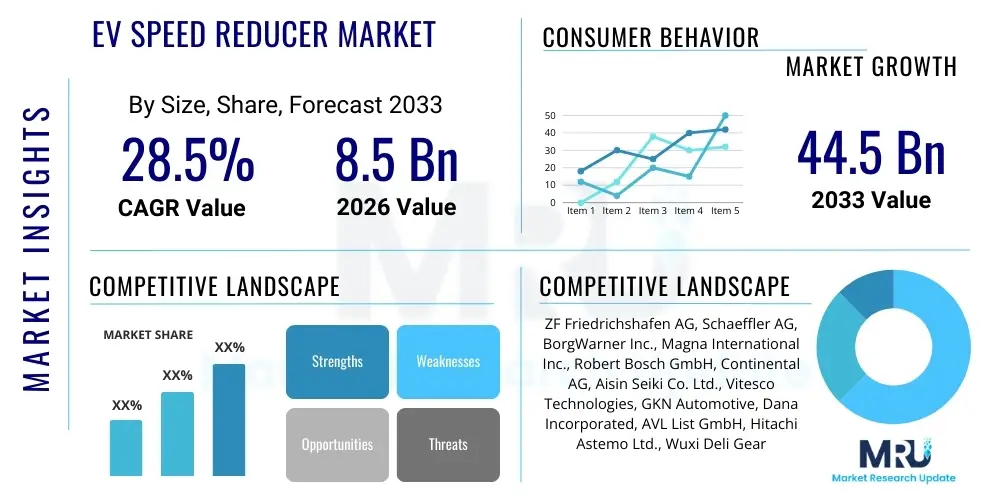

The EV Speed Reducer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 28.5% between 2026 and 2033. The market is estimated at USD 8.5 Billion in 2026 and is projected to reach USD 44.5 Billion by the end of the forecast period in 2033.

EV Speed Reducer Market introduction

The Electric Vehicle (EV) Speed Reducer Market encompasses specialized gearbox systems designed to manage the high rotation speeds of electric motors while providing the necessary torque multiplication for vehicular propulsion. These components are vital elements within the electric powertrain, serving as the mechanical interface between the high-speed electric motor and the low-speed drive axle. Unlike conventional internal combustion engine (ICE) transmissions, EV speed reducers typically employ simpler, single-speed or two-speed configurations, prioritizing efficiency, noise reduction (NVH), and compact integration within the limited space of electric vehicles. The primary function involves reducing the high rotational speed of the e-motor output shaft to an optimal range suitable for wheel rotation, thereby enhancing torque delivery, which is critical for acceleration and sustained speed.

Major applications of EV speed reducers span the entire electric mobility spectrum, including Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicles (PHEVs), and Fuel Cell Electric Vehicles (FCEVs). Furthermore, dedicated solutions are required for light commercial vehicles (LCVs), heavy-duty trucks, and electric buses, where the demand for robust torque management and durability is significantly higher. The benefit proposition is centered on improving overall energy efficiency, extending battery range, reducing mechanical complexity compared to multi-gear transmissions, and meeting stringent acoustic comfort standards mandatory in modern EVs. Integration challenges often necessitate co-design with the electric motor and inverter, leading to highly compact '3-in-1' or 'e-axle' systems.

The market growth is fundamentally driven by the accelerating global transition towards electric mobility, supported by increasingly stringent emission regulations and substantial government incentives aimed at phasing out ICE vehicles. Technological advancements in gearing materials, lubrication systems, and noise, vibration, and harshness (NVH) reduction techniques are simultaneously fueling market expansion. Specifically, the push towards higher power density motors and the need for optimized thermal management within the gearbox housing are major factors dictating innovation. As EV adoption rates climb rapidly in major automotive markets across Asia Pacific, Europe, and North America, the demand for specialized, high-performance speed reduction units is set to maintain a steep upward trajectory throughout the forecast period, positioning this component as a cornerstone of the modern electric driveline.

EV Speed Reducer Market Executive Summary

The EV Speed Reducer market is experiencing transformative growth, primarily characterized by the rapid integration of e-axle architectures and a critical focus on enhancing power density and acoustic performance. Key business trends indicate a shift towards modular design platforms, allowing manufacturers to quickly adapt reducer designs for various vehicle segments, from passenger cars to heavy-duty applications. Furthermore, the market is consolidating around Tier 1 suppliers who possess sophisticated manufacturing capabilities, particularly in precision machining and heat treatment, necessary to produce durable yet lightweight gear sets. Strategic partnerships between traditional transmission manufacturers and emerging EV component specialists are becoming common, driving innovation in lubrication and sealing technologies essential for high-speed operation, often exceeding 15,000 RPM.

Regionally, Asia Pacific, led by China and South Korea, maintains dominance due to robust domestic EV production volumes and substantial government support for electrification mandates. This region serves as both the largest consumer and the primary manufacturing hub, benefiting from localized supply chains and rapid adoption of newer, more efficient powertrain designs. Europe and North America are projected to exhibit high growth rates, driven by escalating consumer demand for premium EVs and significant investments by established OEMs in dedicated electric vehicle platforms. European growth is particularly propelled by strict CO2 emission targets and the rapid commercialization of electric heavy-duty transport, necessitating specialized, high-torque reducers. Localization of manufacturing in these Western regions is a crucial emerging trend aimed at mitigating geopolitical supply chain risks and reducing logistics costs.

Segmentation trends highlight the increasing preference for single-speed reducers in entry-level and mid-range passenger vehicles due to their simplicity, cost-effectiveness, and minimal complexity. However, the multi-speed (2-speed) reducer segment, although currently smaller, is projected to witness accelerated growth, particularly in high-performance EVs and commercial vehicle sectors. These multi-speed systems offer superior trade-offs between acceleration, high-speed cruising efficiency, and overall range optimization, addressing the persistent anxiety concerning EV range limitations in certain use cases. Furthermore, helical and planetary gearing configurations remain predominant, with ongoing research focusing on novel gear tooth geometries and specialized coatings (like DLC – Diamond-Like Carbon) to further minimize friction, enhance thermal performance, and drastically reduce NVH characteristics, which are inherently more noticeable in the silent operation of an EV.

AI Impact Analysis on EV Speed Reducer Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the EV Speed Reducer market frequently revolve around how AI can optimize the design cycle, enhance manufacturing quality control, and implement sophisticated predictive maintenance in operational systems. Common questions focus on the feasibility of AI-driven topology optimization for lightweighting components, the use of machine learning algorithms to predict gear wear and failure before critical events, and AI’s role in acoustic signature analysis to eliminate high-frequency noise. These concerns underscore a market expectation that AI will transition speed reducer manufacturing from traditional deterministic engineering to adaptive, data-driven precision engineering, thereby addressing the conflicting demands for high durability, low noise, and extreme compactness.

The primary themes emerging from this analysis indicate that AI will fundamentally disrupt both the conceptual design phase and the operational lifespan of speed reducers. In design, Generative Design coupled with AI can explore thousands of complex geometrical solutions for gear teeth and housing structures, which are impossible for human engineers to model manually, resulting in components that are lighter and inherently quieter while maintaining structural integrity. During manufacturing, AI-powered vision systems and sensor fusion can monitor critical processes like gear grinding, honing, and heat treatment in real-time, instantly identifying micro-defects or deviations from required tolerances, leading to near-zero defect rates for high-precision components.

Operationally, machine learning models analyze vast datasets derived from integrated sensors—monitoring temperature, vibration, and torque—within the e-axle. This capability enables highly accurate predictive maintenance schedules, moving away from time-based servicing to condition-based servicing. For fleet operators of electric buses or trucks, this translates directly into maximized uptime and reduced lifetime operational costs by accurately identifying precursors to bearing failure or lubrication degradation. Ultimately, AI serves as an essential tool for achieving the highest levels of efficiency and reliability required for the next generation of high-speed, high-power density EV powertrains, cementing its influence across the entire product lifecycle.

- AI-driven topology optimization for lightweight gear housing design.

- Machine learning algorithms for predictive maintenance and failure prognosis based on vibration data.

- Real-time quality control using AI vision systems during precision machining and surface finishing.

- Optimization of lubrication flow and thermal management using AI simulations in dynamic conditions.

- Enhancement of Noise, Vibration, and Harshness (NVH) characteristics through deep learning acoustic analysis.

DRO & Impact Forces Of EV Speed Reducer Market

The EV Speed Reducer Market is shaped by a confluence of powerful drivers, technological restraints, and significant opportunities, with the overall impact forces exerting strong pressure towards innovation and mass adoption. A core driver is the rapid global expansion of the EV manufacturing base, fueled by governmental mandates and incentives promoting zero-emission vehicles, particularly in major automotive economies like China, the European Union, and the United States. Furthermore, consumers increasingly demand vehicles with extended range and high-performance acceleration, requirements that mandate highly efficient and reliable speed reduction units capable of interfacing with powerful e-motors operating at speeds up to 20,000 RPM. This demand for efficiency compels continuous investment in advanced material science and gearing geometry optimization.

Despite robust growth, the market faces several inherent restraints, primarily revolving around manufacturing complexity and cost. Producing speed reducers requires extremely high precision machining (e.g., Gleason honing and grinding) to ensure minimal backlash and low acoustic emissions, leading to high capital expenditure for production setup and strict quality control processes. Another significant restraint is the technical challenge of managing Noise, Vibration, and Harshness (NVH). Since EVs operate silently, mechanical noises originating from the gearbox (whining, rattling) are highly perceptible, requiring costly acoustic engineering solutions, specialized gear coatings, and optimized bearing configurations. The integration of efficient thermal management systems to dissipate heat generated during high-speed, high-load operation without compromising compactness also presents a persistent technical hurdle.

Opportunities for market players are substantial, particularly in the development of multi-speed (2-speed and 4-speed) reducers for high-performance sports cars and heavy commercial vehicles, where single-speed units reach their operational limits. Furthermore, there is a burgeoning opportunity in the supply of high-voltage systems (800V architecture), which impose new demands on component durability and insulation capabilities, necessitating new materials and design approaches. The focus on developing modular e-axle solutions, integrating the motor, inverter, and speed reducer into a single compact unit, offers Tier 1 suppliers a chance to provide comprehensive, high-value systems rather than discrete components. The impact forces are decisively positive, driven by sustained global regulatory support and continuous technological advancement aiming for smaller, lighter, quieter, and more robust powertrains, thereby accelerating the replacement cycle of older, less efficient EV drivelines.

Segmentation Analysis

The EV Speed Reducer market segmentation provides crucial insights into diverse product categories and application fields, allowing market participants to target specific high-growth areas. The primary segmentation dimensions include the type of speed reducer (single-speed versus multi-speed), the type of gearing mechanism (planetary, helical, spur), the application type (BEV, PHEV, FCEV), and the vehicle class (Passenger Car, Commercial Vehicle). Single-speed reducers currently dominate the volume market due to their cost-effectiveness and simplicity, fulfilling the requirements of most urban and mainstream passenger vehicles. These reducers prioritize lightweight design and high acoustic quality in a compact package, focusing on maximizing efficiency within a standard operating speed envelope.

In terms of technology, helical gearsets are widely utilized for their superior load-carrying capacity and relatively quiet operation compared to spur gears, though planetary gear systems are gaining traction, particularly in applications requiring extremely high torque density and coaxial motor integration, often seen in highly compact e-axles. The emergence of two-speed reducers is primarily driven by the luxury and commercial vehicle sectors. While adding complexity and cost, these systems significantly enhance energy consumption at higher vehicle speeds and improve launch performance for heavy loads, fundamentally addressing performance trade-offs inherent in single-speed designs. The adoption curve for multi-speed units is steepening as battery costs plateau and vehicle manufacturers look for other avenues to optimize range and performance.

From an application perspective, Battery Electric Vehicles (BEVs) represent the largest and fastest-growing segment, closely followed by commercial vehicles, including heavy-duty trucks and buses. Commercial applications require speed reducers designed for relentless durability, higher torque input, and rigorous thermal cycling due to continuous operation under heavy load conditions. Passenger vehicle segments focus heavily on refinement, emphasizing NVH suppression and weight minimization. Understanding these differing needs is critical; for instance, PHEV reducers might require specialized clutch mechanisms for seamless transition between electric and ICE modes, a complexity not found in pure BEV applications, thus mandating tailored design approaches across the value chain.

- By Type:

- Single-Speed Reducers

- Multi-Speed Reducers (2-Speed, 4-Speed)

- By Gearing:

- Helical Gear Systems

- Planetary Gear Systems

- Spur Gear Systems

- By Vehicle Type:

- Passenger Electric Vehicles (PEV)

- Commercial Electric Vehicles (CEV)

- Buses

- Trucks

- Vans/LCVs

- By Application:

- Battery Electric Vehicles (BEVs)

- Plug-in Hybrid Electric Vehicles (PHEVs)

- Fuel Cell Electric Vehicles (FCEVs)

- By Torque Range:

- Low Torque (up to 200 Nm)

- Medium Torque (200 Nm to 500 Nm)

- High Torque (above 500 Nm)

Value Chain Analysis For EV Speed Reducer Market

The value chain for the EV Speed Reducer market is structured around highly specialized upstream component suppliers, sophisticated manufacturing and assembly processes, and a concentrated downstream distribution network dominated by major automotive Original Equipment Manufacturers (OEMs) and Tier 1 suppliers. Upstream analysis focuses on raw materials, primarily high-grade alloy steels (for gear teeth robustness), aluminum alloys (for lightweight housing), and specialized lubricants and bearing suppliers. The quality and purity of these materials are paramount, as they directly influence the durability, NVH performance, and thermal resilience of the final product. Key upstream activities involve precision forging, casting, and advanced heat treatments, which are capital-intensive processes requiring strict material provenance and quality certification. Ensuring a stable and cost-effective supply of high-performance steel, such as 20CrMnTi, is crucial for maintaining competitive manufacturing costs.

The core manufacturing and assembly stage involves complex midstream operations, including gear cutting, grinding, and honing, where micrometer precision is non-negotiable for acoustic performance. Tier 1 manufacturers, such as ZF, Schaeffler, and Magna, invest heavily in highly automated production lines capable of producing thousands of units with minimal tolerance variation. This stage also includes the integration of advanced sealing solutions, specialized bearings, and complex lubrication delivery systems designed to withstand the high peripheral speeds of the gears. Downstream activities are predominantly characterized by direct distribution channels, where speed reducers are supplied directly to large EV OEMs (e.g., Tesla, BYD, Volkswagen) for integration into their e-axle assemblies or vehicle platforms. The relationship here is often highly collaborative, involving extensive R&D co-development to ensure perfect fit and performance optimization within the specific vehicle architecture.

Indirect distribution plays a smaller but growing role, mainly through aftermarket service providers and independent repair shops, especially as the installed base of EVs ages, requiring maintenance and replacement parts. However, due to the critical nature and complexity of the speed reducer integrated within the e-axle, most OEM replacements still flow through authorized service networks. The dominant trend in the value chain is vertical integration, where major Tier 1 players are consolidating component sourcing and increasing their control over high-precision machining steps to minimize external dependencies and maintain quality control over NVH performance. Optimization of logistics, given the large size and weight of assembled e-axles, remains a key focus area for ensuring cost-competitive delivery to global assembly plants.

EV Speed Reducer Market Potential Customers

The potential customer base for the EV Speed Reducer market is highly concentrated and dominated by global automotive Original Equipment Manufacturers (OEMs) specializing in electric vehicle production. These OEMs act as the primary end-users/buyers, procuring millions of units annually for integration into their diverse electric vehicle lineups, spanning sedans, SUVs, trucks, and buses. Major buyers include established automotive giants rapidly transitioning their portfolios (e.g., Volkswagen Group, General Motors, Ford), dedicated EV specialists (e.g., Tesla, Lucid, Rivian), and large Asian manufacturers (e.g., BYD, Geely, Hyundai-Kia). Procurement decisions are fundamentally driven by component efficiency, reliability ratings, manufacturing scalability, and, critically, NVH performance specifications, which often involve bespoke testing and validation protocols.

Beyond the primary OEMs, Tier 1 suppliers who specialize in e-axle or integrated powertrain solutions represent a crucial intermediary customer segment. Companies like Magna, Bosch, and Continental frequently purchase specialized gearsets, bearings, and housing components from lower-tier suppliers to assemble complete speed reducer units or e-axles before delivering the finished product to the OEM. These Tier 1 customers demand exceptionally high volumes and often dictate stringent standardization requirements to ensure modularity across multiple OEM programs. Their role is pivotal as they bridge the gap between component specialization and final vehicle integration, offering turnkey powertrain solutions that reduce complexity for the final vehicle assemblers.

A burgeoning segment of potential customers includes manufacturers of specialized electric vehicles, such as electric construction machinery, agricultural tractors, and high-performance motorsports applications. These niche buyers require bespoke, ultra-durable, and often highly specialized speed reducers capable of managing extreme torque loads and intermittent high-stress operations. Furthermore, the future growth of the aftermarket—driven by independent repair facilities and authorized dealer service centers requiring replacement units—will expand the customer landscape beyond initial manufacturing volumes. However, for the foreseeable future, sales volumes remain overwhelmingly dictated by the high-volume purchasing power and strategic sourcing decisions of the top 20 global automotive OEMs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.5 Billion |

| Market Forecast in 2033 | USD 44.5 Billion |

| Growth Rate | 28.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ZF Friedrichshafen AG, Schaeffler AG, BorgWarner Inc., Magna International Inc., Robert Bosch GmbH, Continental AG, Aisin Seiki Co. Ltd., Vitesco Technologies, GKN Automotive, Dana Incorporated, AVL List GmbH, Hitachi Astemo Ltd., Wuxi Deli Gearbox Co. Ltd., Ningbo Tianlong Electronic Co. Ltd., Great Wall Motor (GWM) Parts Division, Oerlikon Group, Höner GmbH, Allison Transmission Inc., Fairfield Manufacturing, Linamar Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

EV Speed Reducer Market Key Technology Landscape

The core technology landscape of the EV Speed Reducer market is dominated by advancements aimed at increasing power density, reducing acoustic emissions, and improving system efficiency under extreme operating conditions. Gearing technology primarily revolves around high-precision helical gears, which offer a smooth meshing characteristic essential for NVH reduction, coupled with sophisticated planetary gear sets that provide high torque density and coaxial motor integration, optimizing packaging space within the vehicle chassis. A critical technological trend is the evolution of gear micro-geometry optimization, leveraging advanced simulation tools to design specific tooth profiles that minimize friction losses and suppress high-frequency gear whine, a pervasive issue in high-speed EV powertrains. Material science plays an equally vital role, with a transition towards high-strength, lightweight materials like specialized aluminum alloys for housing to minimize overall powertrain weight, and carburized alloy steels treated with surface hardening techniques (e.g., shot peening, laser hardening) for gears, ensuring exceptional fatigue resistance and lifespan.

A second major pillar of technological innovation is lubrication and thermal management. Given that modern EV motors operate at speeds often exceeding 15,000 RPM, the speed reducer experiences extreme oil churning losses and thermal loading. To combat this, manufacturers are adopting highly efficient splash lubrication systems optimized through Computational Fluid Dynamics (CFD) simulations, alongside advanced synthetic transmission fluids (ATFs or specialized EV fluids) designed for specific electrical properties (low conductivity) and enhanced heat transfer capabilities. Innovations like direct oil injection or spray cooling mechanisms targeting high-speed gear meshes are emerging, particularly for high-performance and commercial EV applications, where sustained high power output generates substantial heat that must be rapidly managed to prevent component degradation and efficiency drop-off. Furthermore, specialized sealing technologies are necessary to ensure the integrity of the oil pathways, especially in integrated e-axle designs where the motor and reducer share a common housing.

The third critical technological frontier involves the transition to multi-speed gearboxes, predominantly 2-speed systems, which employ sophisticated shifting mechanisms—often dog clutches or electro-hydraulically actuated systems—to seamlessly manage torque delivery and optimize motor operation across varied driving conditions. While single-speed simplicity is preferred for mass market appeal, 2-speed reducers maximize the operational efficiency window of the electric motor, offering superior highway efficiency and extended range capabilities, thereby justifying the added complexity and cost for premium or heavy-duty vehicles. Furthermore, the manufacturing process itself represents a technology focus, with increased adoption of automated inspection systems, including non-destructive testing (NDT) and advanced acoustic testing chambers, to guarantee that every speed reducer assembly meets the ultra-low noise specifications required by demanding OEMs, pushing the technological limits of high-volume, high-precision component manufacturing.

Regional Highlights

The global EV Speed Reducer market exhibits pronounced regional variations in terms of production volume, technology adoption, and growth trajectory, largely mirroring the maturity and size of regional EV markets.

- Asia Pacific (APAC): APAC is the global leader in both consumption and production, driven primarily by China’s massive domestic EV market and the robust manufacturing base across South Korea and Japan. China’s governmental commitment to electrification and the presence of high-volume domestic manufacturers (e.g., BYD, Geely) create an unparalleled demand. This region is a hotbed for rapid iteration and cost optimization, focusing heavily on standardized, cost-effective single-speed reducers for mass-market vehicles. The technological focus here is on scaling production efficiently while adhering to stringent domestic quality standards.

- Europe: Europe represents the fastest-growing market in terms of CAGR, propelled by stringent EU emission regulations (Fit for 55) and strong consumer inclination towards premium electric models. European OEMs (e.g., VW, BMW, Mercedes-Benz) are heavily investing in proprietary modular electric platforms (like MEB and PPE), demanding high-performance, complex speed reducers, particularly multi-speed units for luxury and performance segments, and highly robust systems for burgeoning electric truck fleets. Innovation in acoustic performance and e-axle integration is central to the European market strategy.

- North America: The market is characterized by significant investment in electric trucks and SUVs, reflecting local consumer preferences (e.g., Ford F-150 Lightning, Tesla Cybertruck). The region is witnessing a rapid buildup of localized manufacturing capacity spurred by policy initiatives like the Inflation Reduction Act (IRA). Demand focuses on highly durable, high-torque reducers capable of handling the loads associated with heavy vehicle weights and towing capabilities. While production volumes lag behind APAC, the revenue per unit is often higher due to the premium nature of the vehicles produced.

- Latin America (LATAM) & Middle East and Africa (MEA): These regions are emerging markets with low current market penetration but significant long-term potential. Growth is currently sporadic, focused mainly on electric public transport (buses) in major metropolitan areas and limited private vehicle adoption. The demand profile is focused on reliability and cost-effectiveness, often relying on imported technology and components from APAC and Europe. As local charging infrastructure matures and governmental policies favor electrification, these regions are expected to serve as future expansion frontiers for low-cost, durable speed reducer solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the EV Speed Reducer Market.- ZF Friedrichshafen AG

- Schaeffler AG

- BorgWarner Inc.

- Magna International Inc.

- Robert Bosch GmbH

- Continental AG

- Aisin Seiki Co. Ltd.

- Vitesco Technologies

- GKN Automotive

- Dana Incorporated

- AVL List GmbH

- Hitachi Astemo Ltd.

- Wuxi Deli Gearbox Co. Ltd.

- Ningbo Tianlong Electronic Co. Ltd.

- Great Wall Motor (GWM) Parts Division

- Oerlikon Group

- Höner GmbH

- Allison Transmission Inc.

- Fairfield Manufacturing

- Linamar Corporation

Frequently Asked Questions

Analyze common user questions about the EV Speed Reducer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of an EV speed reducer compared to a traditional gearbox?

The primary function of an EV speed reducer is to manage the high RPM output of the electric motor, typically operating at 10,000 RPM or more, and reduce it to a speed suitable for the wheels while multiplying torque for acceleration. Unlike a traditional multi-speed ICE gearbox, EV reducers are usually single-speed or two-speed, simplifying the transmission system, prioritizing efficiency, and managing Noise, Vibration, and Harshness (NVH).

Why is NVH reduction a critical challenge in the EV speed reducer market?

NVH reduction is critical because electric vehicles operate silently, making mechanical noise, particularly high-frequency gear whine, highly perceptible to occupants. Manufacturers must employ extremely high-precision gear machining, optimized tooth geometry, specialized surface coatings (like DLC), and advanced housing designs to suppress acoustic emissions and ensure passenger comfort, significantly increasing manufacturing complexity and cost.

What are the key technical differences between single-speed and multi-speed reducers?

Single-speed reducers are simpler, lighter, and more cost-effective, ideal for mainstream passenger vehicles. Multi-speed (2-speed) reducers, though more complex, offer superior range optimization and enhanced acceleration by allowing the electric motor to operate closer to its peak efficiency zone across a wider vehicle speed range, making them preferable for high-performance EVs and heavy commercial vehicles.

How is the adoption of 800V architectures impacting speed reducer design?

The shift to 800V electric architectures demands higher power density and requires speed reducers that can withstand greater thermal stress and higher input speeds. Designers must optimize thermal management systems and ensure that lubricants and materials within the gearbox maintain their integrity and insulating properties under higher voltage loads, driving rapid innovation in component robustness and thermal design.

Which regions are leading the growth and technological innovation in the speed reducer market?

Asia Pacific (specifically China) leads in volume and scale due to robust EV manufacturing, focusing on cost optimization. However, Europe is driving significant technological innovation, particularly in advanced NVH solutions, multi-speed technology, and integrated e-axle systems, supported by strict regional emission regulations and a strong luxury EV segment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager