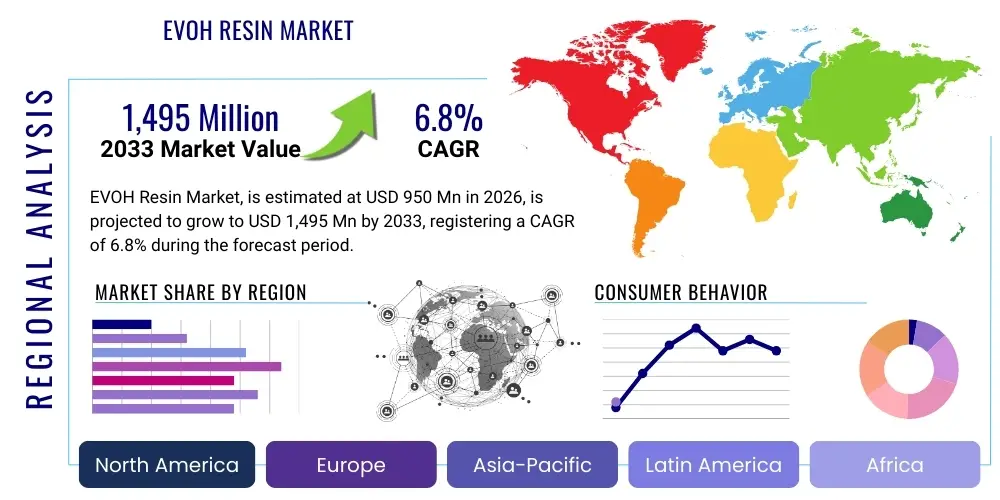

EVOH Resin Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437989 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

EVOH Resin Market Size

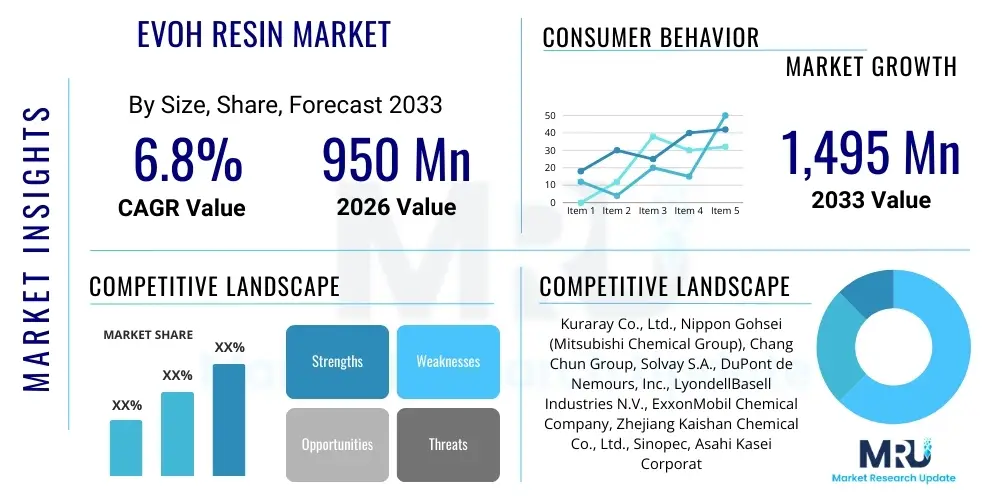

The EVOH Resin Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 950 million in 2026 and is projected to reach USD 1,495 million by the end of the forecast period in 2033. This steady growth is primarily attributed to the increasing global demand for high-performance barrier packaging solutions across the food and beverage and pharmaceutical sectors, driven by stricter food safety regulations and the need for extended product shelf life.

EVOH Resin Market introduction

Ethylene Vinyl Alcohol (EVOH) resin is a high-performance thermoplastic copolymer of ethylene and vinyl alcohol, renowned specifically for its exceptional barrier properties against gases, particularly oxygen, carbon dioxide, and nitrogen. This superior gas barrier capability makes EVOH an indispensable component in multi-layer packaging structures, protecting oxygen-sensitive products from degradation, spoilage, and flavor loss. EVOH is typically utilized as a thin barrier layer, often co-extruded with polyolefins like PE or PP, forming complex films or containers used widely across various industries.

The primary applications of EVOH resin span across food packaging (e.g., meat, cheese, ready meals, aseptic containers), pharmaceutical packaging (blister packs, medical devices), and industrial uses such as agricultural films, automotive fuel tanks, and construction materials. Key benefits of utilizing EVOH include significantly extended shelf life, enhanced food quality preservation, excellent processability in co-extrusion and molding techniques, and good chemical resistance to oils and organic solvents. The unique characteristics of EVOH, particularly its clarity and flexibility when plasticized, position it as a critical material enabling advanced packaging design globally.

Driving factors for the EVOH market growth encompass the rapid expansion of the processed and packaged food industry in developing regions, increased consumer preference for convenience foods requiring longer preservation times, and technological advancements in co-extrusion and lamination that optimize the use of EVOH in complex barrier structures. Furthermore, the global shift towards sophisticated pharmaceutical packaging that ensures drug integrity and efficacy throughout its shelf life significantly bolsters the demand for high-grade EVOH resins. Sustainability initiatives, paradoxically, also drive demand, as barrier properties allow for material reduction and minimized food waste, though EVOH's recyclability in current systems remains a complex technological challenge being addressed by industry innovation.

EVOH Resin Market Executive Summary

The EVOH Resin Market is poised for robust expansion, fueled by sustained demand from the food and beverage industry where high barrier properties are non-negotiable for product preservation and safety. Business trends indicate a strong focus on developing thinner, more efficient barrier layers, necessitating higher-performance EVOH grades, particularly those with reduced ethylene content for enhanced oxygen barrier capabilities. Manufacturers are heavily investing in capacity expansion in Asia Pacific to meet surging regional consumption, while simultaneously focusing on innovation related to improved recyclability, particularly developing solutions that allow separation or compatibility of EVOH in polyolefin recycling streams, addressing a major regulatory and consumer concern in developed economies.

Regionally, Asia Pacific maintains its dominance in terms of consumption and production, driven by massive population density, rapid urbanization, and increasing penetration of modern retail chains demanding sophisticated barrier packaging. North America and Europe, while mature markets, are experiencing growth largely through regulatory mandates enforcing reduced food waste and pharmaceutical safety, pushing converters towards premium EVOH grades. Key segments show differential growth: the food packaging application segment remains the largest volume driver, while the pharmaceutical and medical packaging segment is exhibiting the highest growth CAGR due to stricter packaging standards and the increasing global adoption of unit-dose drug delivery systems requiring precise barrier protection.

The competitive landscape is characterized by high barriers to entry due to complex polymerization technology and significant capital investment, resulting in market consolidation around a few major global players, primarily Kuraray and Nippon Gohsei (Mitsubishi Chemical). Strategic movements involve long-term supply agreements with major packaging converters and integrated supply chain management from monomer production to finished resin pellet distribution. Sustainability remains a central theme influencing product development and strategic partnerships, focusing on bio-based EVOH alternatives and optimizing barrier structures to minimize overall material usage without compromising preservation performance. The convergence of strict global food safety standards and the inherent technical advantages of EVOH ensure its continued critical role in modern packaging solutions.

AI Impact Analysis on EVOH Resin Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) can optimize the notoriously complex production and application processes associated with EVOH resins. Common concerns revolve around predictive maintenance for continuous polymerization reactors, enhancing the consistency of the ethylene-to-vinyl alcohol ratio which is critical for barrier performance, and optimizing the multi-layer co-extrusion process to ensure uniform thin barrier layers without defects. Furthermore, there is significant interest in how AI can be deployed to speed up R&D cycles for developing new, sustainable, and recyclable EVOH grades, and how computer vision could be used in real-time quality control checks for EVOH-containing film production lines, detecting microscopic pinholes or inconsistencies that compromise barrier integrity. The key theme is leveraging AI to achieve higher yield, lower production costs, and accelerate the transition towards next-generation, environmentally compliant barrier materials.

- AI-driven optimization of polymerization kinetics, enhancing the control over ethylene content and molecular weight distribution, directly impacting the resin's barrier performance and processability.

- Predictive maintenance schedules for high-pressure reactors and extruders, minimizing unscheduled downtime in capital-intensive EVOH production facilities, improving asset utilization, and reducing operational expenditure.

- Implementation of machine learning algorithms for real-time quality control in co-extrusion processes, identifying defects such as layer non-uniformity, gel formation, or pinholes in the EVOH barrier layer.

- Supply chain risk modeling and demand forecasting, using AI to manage volatile feedstock prices (ethylene, vinyl acetate) and align complex global distribution networks for high-specialty resin pellets.

- Accelerated simulation and modeling of new barrier film structures, utilizing generative AI to design optimal multi-layer combinations that meet specific shelf-life requirements while minimizing overall material thickness and maximizing recyclability potential.

- Automated monitoring of packaging line performance metrics, ensuring EVOH application parameters (temperature, pressure) are consistently maintained for various end-user converters.

DRO & Impact Forces Of EVOH Resin Market

The EVOH Resin Market is primarily driven by the imperative to extend the shelf life of perishable goods, particularly food and pharmaceuticals, aligning with global efforts to reduce waste and improve public health safety. Significant restraints include the complex, multi-layer nature of EVOH packaging, which traditionally complicates recycling efforts, drawing regulatory scrutiny and consumer resistance in regions prioritizing circular economy models. Opportunities are abundant in the development of specialized grades for highly demanding applications, such as large-volume automotive fuel tanks and advanced electronic displays requiring ultrathin, high-performance barrier films. These forces create a dynamic environment where technological innovation focused on both performance and sustainability dictates market direction, requiring producers to balance high-barrier integrity with end-of-life material recovery considerations.

The key driving force is the relentless growth in flexible packaging adoption, replacing rigid containers due to advantages in logistics, material reduction, and consumer convenience. EVOH’s ability to prevent oxygen ingress is crucial here, supporting the shift to modified atmosphere packaging (MAP) and aseptic processing across the food industry. However, the high manufacturing cost of EVOH compared to standard commodity resins like polyethylene and polypropylene acts as a commercial restraint, limiting its application primarily to premium or high-barrier requirement products. This necessitates highly efficient barrier layer design, utilizing EVOH only as a minimal, targeted layer within complex structures, which in turn demands sophisticated co-extrusion machinery and expertise, forming a secondary entry barrier for smaller packaging converters.

The most compelling opportunity lies in the transition to monomaterial-friendly barrier solutions. Manufacturers are actively pursuing EVOH grades that are compatible with polyolefin recycling streams or can be easily separated, ensuring compliance with future European and North American packaging directives. Furthermore, the burgeoning demand for sterile medical packaging, particularly for moisture and oxygen-sensitive diagnostic devices and injectables, presents a high-value opportunity segment. Impact forces include stringent environmental regulations (Restraining Force), which necessitate rapid material innovation, and the volatile prices of key feedstocks (External Economic Force), which frequently challenge the stability of production margins and necessitate robust supply chain management by primary manufacturers.

Segmentation Analysis

The EVOH resin market is critically segmented based on the percentage of ethylene content, which dictates the fundamental barrier and thermal properties of the resin, alongside its primary end-use application and physical form. The ethylene content defines the grade: lower ethylene content yields superior oxygen barrier capabilities (high barrier grade) but reduces flexibility and moisture resistance, while higher ethylene content improves flexibility, processability, and moisture tolerance, balancing properties for less extreme barrier needs (standard grade). Understanding these technical nuances is crucial as packaging manufacturers select specific grades to optimize the performance-cost ratio for diverse applications, ranging from simple dairy packaging to complex automotive components.

Application-based segmentation highlights the market's dependence on the food and beverage industry, which utilizes EVOH extensively in retort pouches, thermoformed trays, and hot-fill containers to prevent microbial growth and chemical oxidation. Beyond food, the industrial and agricultural sectors are substantial consumers, particularly in the production of multilayer pipes for underfloor heating and barrier films for soil fumigation. Furthermore, the form segmentation—whether the resin is supplied as pellets for extrusion, or already incorporated into pre-formed sheets or finished films—affects distribution channels and the value chain dynamics. The continuous requirement for innovative packaging formats and the expansion of packaged goods consumption ensure that segmentation analysis remains a vital tool for strategic market positioning and capacity planning across the globe.

- By Grade:

- Standard Grade EVOH (Higher Ethylene Content)

- High Barrier Grade EVOH (Lower Ethylene Content)

- By Application:

- Food & Beverage Packaging (e.g., Aseptic, Retort, Processed Meats)

- Pharmaceutical & Medical Packaging (e.g., Blister Packs, IV Bags)

- Industrial Packaging (e.g., Chemical Containers)

- Automotive (e.g., Fuel Tanks, Fuel Lines)

- Agricultural (e.g., Fumigation Films)

- Construction (e.g., Multi-layer Pipes)

- By Form:

- Pellets (Resin form for converters)

- Films & Sheets (Ready-to-use barrier layers)

Value Chain Analysis For EVOH Resin Market

The EVOH resin value chain is highly integrated and capital-intensive, starting with the upstream supply of key petrochemical feedstocks, primarily ethylene and vinyl acetate monomer (VAM). Manufacturers typically possess highly specialized polymerization technology to co-polymerize these monomers into EVOH pellets, a stage characterized by high barriers to entry due to the complexity of the reaction control required to achieve the desired barrier performance. Upstream stability in VAM and ethylene pricing is crucial, as fluctuations directly impact the cost of production and the final market price of the resin pellets, making robust procurement strategies essential for key players.

The middle segment of the value chain involves the resin manufacturers, such as Kuraray and Nippon Gohsei, who transform the raw monomers into specialized EVOH grades. These pellets are then distributed directly or via specialized distributors to downstream processors. Downstream activities involve packaging converters who utilize sophisticated technologies, mainly co-extrusion, co-injection molding, or lamination, to integrate the EVOH barrier layer into multi-material structures like films, bottles, or trays. The success of these downstream operations relies heavily on the technical support provided by the resin suppliers to ensure optimal processing and adhesion between the disparate material layers.

The final stage encompasses the end-use applications, where the finished barrier packaging is used by brands in the food, beverage, pharmaceutical, and automotive industries. Distribution channels are typically a mix of direct sales for major global packaging groups (providing customized solutions and technical support) and indirect sales through specialized chemical and plastics distributors for smaller regional converters. The effectiveness of the value chain is increasingly judged not just on cost efficiency and performance, but also on the ability of all stakeholders to manage the end-of-life cycle of the composite packaging, pushing the onus of innovation upstream to develop recyclable solutions.

EVOH Resin Market Potential Customers

The primary end-users and buyers of EVOH resins are large-scale packaging converters and film manufacturers specializing in flexible and rigid barrier packaging solutions, who purchase EVOH pellets in bulk for integration into multi-layer structures. These companies are driven by the specific shelf-life requirements dictated by their major clients—the global Food & Beverage (F&B) and pharmaceutical brand owners. For F&B companies, the focus is on maintaining freshness, preventing oxidation, and enabling advanced preservation techniques like retort and hot-filling, making EVOH the material of choice for demanding applications like pet food, processed meats, and dairy products.

In the pharmaceutical sector, potential customers include manufacturers of medical devices, blister packaging for sensitive drugs, and diagnostic kits where moisture and oxygen protection are critical to maintaining efficacy and regulatory compliance. These buyers demand ultra-pure, high-barrier EVOH grades and often require extensive documentation regarding traceability and regulatory compliance. Furthermore, specialized industrial customers, particularly automotive manufacturers, constitute a growing segment. They use EVOH for manufacturing multi-layer fuel tanks and lines to meet stringent environmental regulations regarding fuel permeation (e.g., PZEV standards), capitalizing on EVOH’s excellent chemical resistance to gasoline and alternative fuels. Thus, the market demand is segmented across large-volume commodity barrier packaging and high-specification, low-volume technical applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 950 million |

| Market Forecast in 2033 | USD 1,495 million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Kuraray Co., Ltd., Nippon Gohsei (Mitsubishi Chemical Group), Chang Chun Group, Solvay S.A., DuPont de Nemours, Inc., LyondellBasell Industries N.V., ExxonMobil Chemical Company, Zhejiang Kaishan Chemical Co., Ltd., Sinopec, Asahi Kasei Corporation, Sekisui Chemical Co., Ltd., Toray Industries, Inc., Polyplastics Co., Ltd., Mitsui Chemicals, Inc., UBE Industries, Ltd., TPC Group, Sumitomo Chemical Co., Ltd., Arkema S.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

EVOH Resin Market Key Technology Landscape

The core technology surrounding the EVOH market centers on advanced polymerization and sophisticated co-extrusion techniques, both of which are critical for commercial success. EVOH is synthesized via the co-polymerization of ethylene and vinyl acetate, followed by hydrolysis (saponification) of the vinyl acetate moiety to vinyl alcohol. The precise control over the saponification degree and the ethylene content within the reactor determines the final grade's thermal stability, barrier capability, and overall processability. Recent technological advances focus on improving the yield and purity of this complex synthesis process, alongside developing continuous mass polymerization methods to increase efficiency and reduce production costs, which is highly confidential and patented among the leading producers.

In downstream processing, the most critical technology is co-extrusion, which allows packaging converters to sandwich the thin, high-cost EVOH barrier layer between structural layers (usually PE or PP) and tie layers (adhesives) in a single, highly efficient process. This technology enables the creation of multi-layer films, sheets, or containers with up to nine or more layers, maximizing barrier effectiveness while minimizing material usage and cost. Innovation in co-extrusion involves developing specialized dies and feedblocks that ensure laminar flow and uniform thickness across all layers, mitigating common defects like layer flow imbalance or interface instabilities, which can severely compromise barrier integrity.

Looking forward, the technological landscape is rapidly shifting towards sustainable processing and material innovation. Key focus areas include the development of easier-to-recycle barrier solutions, such as thinner EVOH layers that constitute less than 5% of the total structure (making the package technically recyclable as a polyolefin), or the creation of specialized compatibilizers that allow EVOH to remain chemically compatible with the bulk polyolefin material during mechanical recycling. Furthermore, research into bio-based feedstocks for EVOH, replacing petroleum-derived ethylene, represents a major avenue of technological development aimed at improving the material’s overall environmental profile and meeting evolving consumer and regulatory expectations regarding sustainable polymers.

Regional Highlights

The global EVOH resin market exhibits distinct consumption patterns and growth drivers across major geographical regions, influencing strategic investment and localized product development priorities. Asia Pacific (APAC) stands as the largest and fastest-growing market, primarily due to the rapid industrialization, burgeoning middle-class population, and subsequent surge in demand for processed and packaged foods, especially in major economies like China and India. The rapid expansion of modern retail infrastructure, coupled with growing domestic production capacity, solidifies APAC’s central role in the global EVOH supply and demand landscape.

Europe and North America represent mature markets characterized by high per capita consumption of sophisticated barrier packaging, stringent regulatory frameworks concerning food contact materials, and a strong emphasis on sustainability and circular economy principles. In Europe, the focus is heavily skewed toward developing recyclable packaging solutions, pushing demand for EVOH grades optimized for monomaterial structures and driving significant R&D collaboration between resin manufacturers and packaging converters. North America’s growth is sustained by the high demand from the pharmaceutical sector and regulatory mandates that require reduced fuel permeation in automotive components, ensuring a stable market for high-grade EVOH resins used in specialized technical applications.

Latin America and the Middle East & Africa (MEA) are emerging markets for EVOH, experiencing accelerating growth driven by improved logistics infrastructure, increased foreign direct investment in food processing, and population growth requiring extended shelf life in challenging climates. While these regions currently represent a smaller share, the increasing adoption of modern packaging practices to combat food spoilage and meet import/export standards signals high future growth potential, necessitating the establishment of more localized distribution networks and application support centers by major EVOH producers.

- North America: High demand driven by stringent automotive permeation standards (fuel tanks) and sophisticated pharmaceutical packaging requirements; emphasis on high-performance, specialized grades.

- Europe: Focus on circular economy initiatives; significant regulatory pressure driving innovation towards recyclable, monomaterial packaging; robust demand in fresh produce and retort food applications.

- Asia Pacific (APAC): Dominates global consumption and production; rapid growth fueled by urbanization, retail expansion, and increasing consumption of packaged food; investment concentrated on capacity expansion and cost optimization.

- Latin America: Growing utilization of barrier packaging to combat high rates of food spoilage; market development accelerated by retail sector modernization and cold chain improvements.

- Middle East and Africa (MEA): Emerging demand spurred by extreme climatic conditions necessitating ultra-high barrier protection; growth centered around dairy, poultry, and beverage packaging industries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the EVOH Resin Market.- Kuraray Co., Ltd.

- Nippon Gohsei (Mitsubishi Chemical Group)

- Chang Chun Group

- Solvay S.A.

- DuPont de Nemours, Inc.

- LyondellBasell Industries N.V.

- ExxonMobil Chemical Company

- Zhejiang Kaishan Chemical Co., Ltd.

- Sinopec

- Asahi Kasei Corporation

- Sekisui Chemical Co., Ltd.

- Toray Industries, Inc.

- Polyplastics Co., Ltd.

- Mitsui Chemicals, Inc.

- UBE Industries, Ltd.

- TPC Group

- Sumitomo Chemical Co., Ltd.

- Arkema S.A.

Frequently Asked Questions

Analyze common user questions about the EVOH Resin market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is EVOH resin primarily used for, and why is it considered a high-performance material?

EVOH resin is predominantly used as an ultra-high barrier layer in multi-layer packaging structures, specifically for food, beverage, and pharmaceutical products. It is considered high-performance due to its exceptional capability to block the permeation of gases, particularly oxygen, which significantly extends the shelf life and preserves the quality of perishable contents.

How does the ethylene content in EVOH affect its barrier properties and processing?

The ethylene content is inversely related to the oxygen barrier capability. Lower ethylene content (High Barrier Grade) results in superior oxygen barrier properties but reduced moisture tolerance and flexibility. Conversely, higher ethylene content (Standard Grade) improves flexibility, moisture resistance, and processability, making it easier to co-extrude in complex film structures.

Is EVOH packaging recyclable, and what challenges does it face regarding sustainability?

EVOH, when integrated into traditional multi-layer films, poses a recycling challenge because conventional mechanical recycling systems struggle to separate the disparate polymer layers. However, the industry is addressing this by developing specialized thin-layer EVOH solutions and compatible grades that allow the overall structure to be recycled within polyolefin streams, aligning with circular economy demands.

Which application segment drives the largest demand for EVOH resin globally?

The Food and Beverage Packaging segment drives the largest global demand for EVOH resin. This includes applications such as flexible pouches, aseptic cartons, retort trays, and thermoformed containers, all requiring high oxygen barriers to ensure product safety, quality, and extended market distribution.

What are the primary feedstock materials required for manufacturing EVOH resin?

The primary feedstock materials for EVOH production are petrochemical derivatives: ethylene (often sourced from cracker units) and vinyl acetate monomer (VAM). These are copolymerized and then subjected to hydrolysis (saponification) to form the final Ethylene Vinyl Alcohol resin pellet.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager