Examination Latex and Nitrile Rubber Medical Gloves Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433259 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Examination Latex and Nitrile Rubber Medical Gloves Market Size

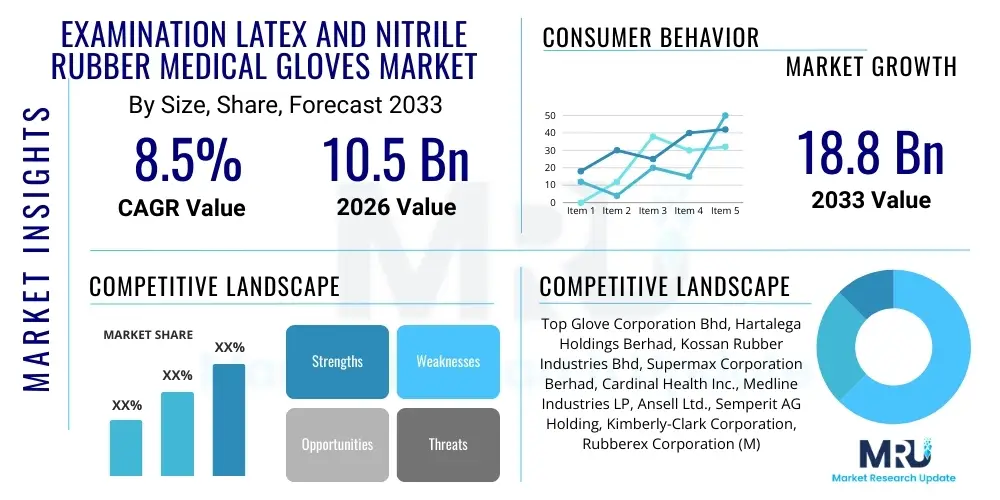

The Examination Latex and Nitrile Rubber Medical Gloves Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 10.5 Billion in 2026 and is projected to reach USD 18.8 Billion by the end of the forecast period in 2033.

Examination Latex and Nitrile Rubber Medical Gloves Market introduction

The Examination Latex and Nitrile Rubber Medical Gloves Market encompasses the manufacturing, distribution, and sale of disposable gloves used primarily in healthcare settings to prevent cross-contamination between caregivers and patients. These gloves are essential personal protective equipment (PPE), categorized mainly by their base material: natural rubber latex, which offers high elasticity and tactile sensitivity, and nitrile rubber (acrylonitrile butadiene), a synthetic polymer favored for its superior puncture resistance and absence of allergic proteins associated with latex. The primary product description centers around single-use, non-sterile gloves designed for short-duration general medical examinations and procedures where barrier protection is paramount.

Major applications of these gloves span across hospitals, outpatient clinics, diagnostic laboratories, dental offices, and long-term care facilities. Beyond traditional clinical environments, the demand has significantly expanded into non-medical sectors requiring hygiene protocols, such as food processing, pharmaceutical handling, and cosmetic applications. The central benefits provided by these products include robust infection control, effective chemical splash protection, and enhanced dexterity for users, depending on the material and thickness selected. Nitrile, in particular, has seen massive adoption due to its reliability in preventing pathogen transmission and mitigating latex hypersensitivity risks among both patients and healthcare workers.

The market is primarily driven by continuously escalating global healthcare expenditure, increasingly stringent regulatory standards mandating the use of PPE, and heightened public awareness regarding infectious disease transmission, particularly post-pandemic scenarios. Furthermore, technological advancements leading to thinner yet stronger synthetic gloves (nitrile) and improved manufacturing efficiency are stimulating market growth. The intrinsic need for safety barriers across all points of patient interaction solidifies these gloves as indispensable medical consumables, ensuring persistent, high-volume demand worldwide.

Examination Latex and Nitrile Rubber Medical Gloves Market Executive Summary

The Examination Latex and Nitrile Rubber Medical Gloves Market is characterized by resilient business trends driven by capacity expansion and vertical integration among major manufacturers, primarily located in Southeast Asia, aimed at controlling raw material supply and optimizing logistics. The shift in product preference continues to strongly favor nitrile gloves over latex due to allergy concerns and superior durability, influencing investment decisions towards synthetic rubber processing capabilities. Strategic partnerships between large glove manufacturers and major group purchasing organizations (GPOs) and distributor networks are crucial for maintaining high market share, emphasizing supply chain reliability and long-term volume contracts as critical competitive advantages in this consolidated market.

Regionally, Asia Pacific maintains its undisputed leadership, dominating both production output and consumption growth, fueled by vast manufacturing bases (Malaysia, Thailand, China) and rapidly improving healthcare infrastructure across developing economies like India and Indonesia. North America and Europe remain high-value markets, characterized by premium pricing, stringent quality controls (e.g., FDA 510(k) clearance, CE marking), and a high adoption rate of specialized, accelerator-free nitrile formulations. Emerging markets in Latin America and the Middle East are experiencing accelerated demand growth driven by increased medical tourism and investments in public health services, although these regions often face challenges related to stable import supply chains and tariff structures.

Segmentation trends indicate that the Powder-Free segment is globally dominant, nearly eclipsing powdered gloves entirely due to regulatory pressures against airborne particulates, which can carry latex proteins or glove chemicals. The market application segmentation highlights hospitals and ambulatory surgical centers as the largest revenue generators, yet laboratory and specialized diagnostic services are showing the fastest proportional growth rates, requiring specific glove attributes for chemical handling and sensitive testing procedures. Material-wise, while latex still holds a niche for superior dexterity in specific surgical contexts, the examination market overwhelmingly relies on standard and specialty nitrile rubber variants for general-purpose protection.

AI Impact Analysis on Examination Latex and Nitrile Rubber Medical Gloves Market

User inquiries regarding the role of Artificial Intelligence (AI) in the examination gloves market frequently center on three critical areas: supply chain resilience, manufacturing quality control, and predictive demand forecasting. Users are concerned about how AI can mitigate the volatility experienced during recent global health crises, specifically seeking solutions for optimizing raw material procurement (butadiene and acrylonitrile pricing), streamlining complex production schedules in high-volume dipping facilities, and reducing waste or defects through enhanced inspection systems. The key expectation is that AI integration will lead to a more stable, higher-quality, and cost-efficient supply of gloves, directly addressing past issues related to price spikes and shortages.

The application of AI extends significantly into the manufacturing process, where machine learning algorithms are being developed to analyze real-time data from dipping tanks, curing ovens, and quality testing labs. This allows for predictive maintenance, anticipating equipment failures before they occur, and dynamic adjustments to polymerization parameters, ensuring consistent barrier integrity and tensile strength across batches. Furthermore, advanced computer vision systems powered by AI are dramatically improving visual inspection accuracy, identifying minute pinholes or tears far more reliably than manual or traditional automated systems, thereby safeguarding the overall product quality that is critical for medical use and regulatory compliance.

From a market strategy perspective, AI is transforming demand forecasting and inventory management. By analyzing global infectious disease trends, seasonal variations, public health policy changes, and historical consumption data from large hospital networks, AI models provide remarkably accurate predictions of future glove needs. This predictive capability allows manufacturers and major distributors to strategically adjust inventory levels, optimize warehousing logistics, and prioritize production lines for specific glove types (latex vs. nitrile, various sizes), thereby reducing the risk of overstocking or stockouts, leading to a more efficient and responsive global distribution system, which ultimately benefits end-users by ensuring timely availability.

- AI-powered predictive maintenance minimizes production downtime and optimizes dipping line efficiency.

- Machine learning enhances quality control by automating visual inspection for micro-defects and pinholes.

- Advanced algorithms optimize raw material blending and processing parameters to ensure consistent barrier integrity.

- AI-driven demand forecasting stabilizes supply chains by accurately anticipating regional and global consumption patterns based on epidemiological data.

- Robotics integrated with AI is increasing automation in packaging and sorting, improving throughput and hygiene.

DRO & Impact Forces Of Examination Latex and Nitrile Rubber Medical Gloves Market

The Examination Latex and Nitrile Rubber Medical Gloves Market is significantly shaped by a confluence of influential factors, categorized as Drivers, Restraints, and Opportunities (DRO). Key drivers include the mandatory implementation of rigorous infection control protocols in healthcare worldwide, sustained growth in the number of surgical procedures and patient visits, and the demographic trend of an aging population requiring more frequent medical interventions. These demand-side drivers are reinforced by regulatory mandates, particularly in developed regions, ensuring high, perpetual consumption volumes. Conversely, market growth faces restraints, primarily stemming from the inherent volatility of raw material prices—natural latex and synthetic monomers—and severe labor cost pressures in key manufacturing hubs. Furthermore, intense competition from generic and low-cost manufacturers, coupled with growing environmental concerns regarding disposable plastic waste, presents systemic challenges to premium market participants.

Opportunities for expansion are abundant, centered around product innovation and geographic expansion. There is a strong market opportunity in developing advanced, biodegradable nitrile formulations that address sustainability concerns without compromising barrier performance, appealing to increasingly environmentally conscious healthcare systems. Furthermore, penetration into specialized, high-demand segments, such as chemotherapy-rated gloves or those with integrated antimicrobial coatings, offers higher margin potential. The continuous expansion of healthcare access and infrastructure development across emerging economies in Asia, Africa, and Latin America provides untapped consumption bases, driving strategic investments in localized distribution and production capabilities. The overall impact forces are high, characterized by strong underlying demand being challenged by equally high sensitivity to supply chain disruptions and input material costs.

Segmentation Analysis

The Examination Latex and Nitrile Rubber Medical Gloves Market is comprehensively segmented based on material type, product form, application, and distribution channel, providing a granular view of market dynamics and consumer preferences. Understanding these segmentations is critical for manufacturers to tailor their production capabilities and marketing strategies effectively. The delineation between latex and nitrile remains the most fundamental split, dictating barrier properties, tactile sensitivity, and allergic risk profile. Further segmentation by product form, notably between powdered and powder-free gloves, reflects regulatory shifts and end-user demands for safer working environments, with powder-free options commanding the vast majority of the market share due to regulations against the use of cornstarch powder as a potential carrier of allergens and irritants.

Segmentation by application highlights distinct performance requirements across various end-user segments. Hospitals and clinical diagnostics require massive volumes of general-purpose gloves, whereas specialized segments like dental care or oncology treatments necessitate gloves with enhanced resistance to specific chemicals or punctures. The distribution channel segmentation, covering direct sales, distributor networks, and online portals, reflects the varied procurement strategies of large-scale healthcare systems versus small clinics or individual practitioners. This detailed market breakdown allows for precise forecasting and targeted sales efforts, identifying segments with the highest growth trajectory, such as non-healthcare professional use (e.g., laboratory research and food handling).

Geographic segmentation remains paramount, defining market maturity, pricing structures, and regulatory hurdles. While North America and Europe prioritize high-quality, specialty nitrile gloves often subject to strict regulatory approval, Asia Pacific focuses intensely on volume production and competitive pricing, often serving as the primary export base for global consumption. The increasing shift towards synthetic materials globally continues to reshape the revenue distribution across these segments, encouraging innovation in material science to bridge the performance gap with traditional latex gloves while eliminating allergic risks.

- By Material Type:

- Latex Rubber Gloves

- Nitrile Rubber Gloves (Standard and Accelerator-Free)

- By Product Form:

- Powder-Free Gloves

- Powdered Gloves

- By Application/End-User:

- Hospitals and Clinics (Primary Care, Diagnostic Centers)

- Ambulatory Surgical Centers (ASCs)

- Diagnostic and Clinical Laboratories

- Dental Practices

- Pharmaceutical and Biotech Industries

- Others (Veterinary, Food Processing)

- By Distribution Channel:

- Direct Sales

- Distributors and Wholesalers (GPOs)

- Online Retails and E-commerce

Value Chain Analysis For Examination Latex and Nitrile Rubber Medical Gloves Market

The value chain for examination gloves starts with the upstream segment, dominated by the sourcing and processing of raw materials. For latex gloves, this involves rubber tapping and processing into natural rubber latex concentrate, heavily concentrated in Southeast Asian nations like Malaysia, Thailand, and Indonesia. For nitrile gloves, the key upstream components are synthetic monomers (acrylonitrile and butadiene), primarily derived from petrochemical processes, leading to the polymerization into nitrile latex. Price volatility in both natural and synthetic raw materials significantly impacts the profitability and stability of the entire chain. Efficient procurement strategies, often involving long-term contracts or backward integration, are essential for manufacturers to mitigate these risks and secure a stable supply of high-quality base materials for the dipping process.

The middle segment of the value chain involves the complex and highly specialized manufacturing process. This includes formulation preparation, glove dipping (using automated production lines, typically ceramic formers), curing, leaching (to remove residual chemicals and proteins), chlorination or polymer coating (for powder-free variants), and final quality testing and packaging. This stage is characterized by high capital investment in machinery and stringent quality control measures, particularly for compliance with international standards such as ASTM and ISO. Key players often maintain massive, highly efficient manufacturing plants, leveraging scale to reduce the per-unit cost of production, which is crucial given the commoditized nature of general-purpose examination gloves.

The downstream analysis focuses on distribution and consumption. Distribution channels are varied, involving direct sales to massive hospital systems or government entities via Group Purchasing Organizations (GPOs), and indirect distribution through medical product wholesalers and regional dealers who handle logistics for smaller clinics, dental offices, and laboratories. Direct channels offer greater margin control but require extensive sales infrastructure, while indirect channels provide wider market penetration. Potential customers, including all forms of healthcare facilities, procure based heavily on supply reliability, regulatory compliance, and competitive pricing. The final stage is consumption and disposal, with increasing emphasis on sustainable disposal methods and addressing the massive volume of single-use waste generated by this necessary protective barrier.

Examination Latex and Nitrile Rubber Medical Gloves Market Potential Customers

The primary and largest volume potential customers for examination latex and nitrile rubber medical gloves are institutional healthcare providers, including large hospital networks and multispecialty clinics. These customers purchase gloves in massive quantities through centralized procurement systems or via GPOs, demanding reliable supply, stringent quality assurance documentation (proof of sterilization or barrier efficacy), and favorable long-term contractual pricing. For these buyers, consistency in size, texture, and barrier integrity across billions of units is paramount, making vendor stability and regulatory track record key purchasing criteria. They consume gloves across virtually all departments, from emergency rooms and operating theaters to general patient care units, driving a perpetual, high-volume requirement.

A second major customer segment includes specialized medical settings such as ambulatory surgical centers (ASCs), diagnostic laboratories, and independent dental practices. While their individual purchasing volumes are smaller than major hospital networks, their collective demand is significant, often preferring synthetic nitrile gloves due to the high frequency of use and the need for precision in procedures. Diagnostic laboratories, in particular, often require specialized gloves resistant to specific chemicals or solvents, making them potential customers for premium, specialty-formulation nitrile products. These customers typically rely on established regional distributors for inventory management and just-in-time delivery services.

Emerging potential customers are increasingly found in non-traditional healthcare sectors. This includes the rapidly expanding home healthcare market, where individual caregivers require reliable protective equipment; veterinary medicine practices; and high-volume, regulated industrial settings like pharmaceutical manufacturing, biotechnology research labs, and increasingly, regulated segments of the food processing industry. These customers value compliance with industry-specific standards and are often more receptive to innovative products, such as accelerator-free gloves designed to reduce contact dermatitis among heavy users. Expanding market penetration into these adjacent industries represents a significant long-term growth opportunity for glove manufacturers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 10.5 Billion |

| Market Forecast in 2033 | USD 18.8 Billion |

| Growth Rate | CAGR 8.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Top Glove Corporation Bhd, Hartalega Holdings Berhad, Kossan Rubber Industries Bhd, Supermax Corporation Berhad, Cardinal Health Inc., Medline Industries LP, Ansell Ltd., Semperit AG Holding, Kimberly-Clark Corporation, Rubberex Corporation (M) Bhd, Adventa Berhad, Dynarex Corporation, Unigloves, Midas Safety, Molnlycke Health Care AB, VWR International, Inc., Shield Scientific B.V., Top Glove Corporation Bhd, Hartalega Holdings Berhad, Kossan Rubber Industries Bhd |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Examination Latex and Nitrile Rubber Medical Gloves Market Key Technology Landscape

The technological landscape of the examination glove market is primarily focused on achieving higher manufacturing efficiency, enhancing material performance, and improving user safety through advanced chemical engineering. A key technological focus is the continuous refinement of automated dipping line technology. Modern production lines utilize advanced robotics and process control systems to ensure uniformity in glove thickness, consistent polymerization, and efficient leaching processes. These sophisticated automation techniques are vital for reducing operational costs and maintaining the high-volume output necessary to meet global demand, minimizing human error and maximizing throughput speeds while handling temperature and chemical composition precisely.

Material science innovation, particularly in nitrile formulation, is another critical technology driver. Manufacturers are heavily investing in developing accelerator-free nitrile gloves. Traditional nitrile gloves often use chemical accelerators (like thiurams and carbamates) to speed up vulcanization, which can cause Type IV contact dermatitis. The shift to accelerator-free alternatives is a significant technological leap, requiring new curing agents and processes that maintain the glove's elasticity, tensile strength, and puncture resistance while mitigating allergic reactions. This technological advancement allows manufacturers to address regulatory demands and improve acceptance among healthcare workers with sensitivities, creating a premium market niche.

Furthermore, technology is enhancing the barrier integrity and functionality of the gloves. This includes the development of thinner gauge gloves that provide superior tactile sensitivity—a feature traditionally associated with latex—without compromising regulatory-mandated minimum barrier protection. Coating technology, such as specialized polymer coatings for interior donning, facilitates ease of use, while advancements in testing equipment allow for ultra-precise, non-destructive measurement of pinholes and defect detection during production. Integration of AI and Industrial Internet of Things (IIoT) sensors across the manufacturing floor is also emerging as a key technology, enabling real-time monitoring and predictive quality adjustments.

Regional Highlights

The Asia Pacific (APAC) region stands as the undisputed global powerhouse in the Examination Latex and Nitrile Rubber Medical Gloves Market, holding a dominant position in both production and consumption capacity. Countries like Malaysia, Thailand, and Indonesia collectively account for the majority of the world's glove manufacturing, benefiting from abundant raw material availability (natural rubber), well-established infrastructure, and competitive labor costs. The growth in APAC consumption is driven by rapidly expanding healthcare sectors, increasing governmental focus on public health and hygiene standards, and massive populations requiring frequent medical services. This region dictates global pricing and supply stability, making investment in APAC manufacturing crucial for any global market contender.

North America and Europe represent mature, high-value markets characterized by stringent regulatory oversight (e.g., FDA, MDR) and a strong preference for premium, synthetic nitrile gloves, often demanding specific attributes like chemotherapy drug permeability rating or accelerator-free formulations. Although these regions have limited domestic manufacturing due to high operational costs, they command significant market share in terms of revenue due to higher average selling prices (ASPs). The purchasing landscape in these regions is heavily influenced by large GPOs, which prioritize long-term supply agreements and quality compliance, making market entry challenging but highly lucrative for established, compliant manufacturers.

The Latin America (LATAM) and Middle East & Africa (MEA) regions are emerging as high-growth markets. Growth in LATAM is spurred by investments in primary healthcare and increasing awareness of occupational safety standards, while MEA benefits from expanding medical tourism and large-scale public health infrastructure projects. These regions are heavily reliant on imports, making them susceptible to international supply chain disruptions. However, as healthcare spending rises and regulatory frameworks mature, these regions offer substantial long-term market penetration opportunities, particularly for manufacturers able to offer cost-effective, high-quality nitrile solutions.

- Asia Pacific (APAC): Dominant global production hub; rapidly expanding domestic consumption; strong growth in healthcare infrastructure.

- North America: Highest average selling prices (ASPs); strict regulatory environment (FDA); preference for premium, accelerator-free nitrile gloves.

- Europe: Driven by EU Medical Device Regulation (MDR) compliance; high adoption of safety standards; significant demand for specialty gloves.

- Latin America (LATAM): High reliance on imports; increasing healthcare access driving demand; growing focus on infection control protocols.

- Middle East & Africa (MEA): Market expansion fueled by government healthcare investments and medical tourism; growing opportunities for distribution partnerships.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Examination Latex and Nitrile Rubber Medical Gloves Market.- Top Glove Corporation Bhd

- Hartalega Holdings Berhad

- Kossan Rubber Industries Bhd

- Supermax Corporation Berhad

- Cardinal Health Inc.

- Medline Industries LP

- Ansell Ltd.

- Semperit AG Holding

- Kimberly-Clark Corporation

- Rubberex Corporation (M) Bhd

- Adventa Berhad

- Dynarex Corporation

- Unigloves

- Midas Safety

- Molnlycke Health Care AB

- VWR International, Inc.

- Shield Scientific B.V.

- Crosstex International Inc.

- Shandong Intco Medical Products Co., Ltd.

- Riverstone Holdings Limited

Frequently Asked Questions

Analyze common user questions about the Examination Latex and Nitrile Rubber Medical Gloves market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the shift from latex to nitrile gloves in the examination market?

The primary driver is the widespread concern over Type I (immediate) allergic reactions to natural rubber latex proteins, which affect both patients and healthcare workers. Nitrile gloves offer a comparable barrier performance, superior puncture resistance, and are protein-free, making them the standard choice for allergen mitigation and general examination procedures globally. Regulatory pressures and occupational safety guidelines heavily reinforce this transition.

How significant is the impact of raw material price volatility on glove manufacturing margins?

Raw material price volatility is highly significant, particularly fluctuations in synthetic nitrile butadiene rubber (NBR) and natural rubber latex concentrate. Since raw materials constitute a substantial portion of the production cost for commoditized gloves, price swings directly impact manufacturers' operating margins. This instability necessitates advanced risk mitigation strategies, including backward integration and long-term supply contracts, to ensure cost stability and predictable pricing for distributors.

Which geographical region dominates the global production of medical gloves?

Asia Pacific, specifically Southeast Asian countries such as Malaysia, Thailand, and Indonesia, overwhelmingly dominates global medical glove production. These nations possess critical advantages, including proximity to natural rubber resources, extensive infrastructure dedicated to automated dipping processes, and favorable operational cost structures, allowing them to supply the majority of the world's examination glove demand.

What are the key technological advancements expected to influence the future of the glove market?

Future technological advancements are focused on sustainable and safe materials, including the commercialization of biodegradable or compostable nitrile formulations to address waste concerns, and the continued development of accelerator-free nitrile gloves to eliminate chemical dermatitis risks. Additionally, enhanced automation and AI integration in quality control will ensure higher barrier integrity and production efficiency.

What is the regulatory landscape for medical examination gloves in major markets?

In major markets like the U.S. and Europe, medical examination gloves are classified as Class I medical devices, requiring strict regulatory clearance (e.g., FDA 510(k) in the U.S. and adherence to the EU Medical Device Regulation, MDR). Compliance mandates rigorous testing for barrier integrity (AQL standards), tensile strength, and biocompatibility, ensuring that products meet essential safety and performance requirements before entering the market.

The Examination Latex and Nitrile Rubber Medical Gloves Market is a critical component of global healthcare infrastructure, experiencing sustained, volume-driven growth tempered by intense competition and supply chain complexities. The shift toward synthetic alternatives like nitrile is permanent, driven by safety and performance demands. Future success in this market relies on operational efficiency, technological innovation in material science, and strategic regional expansion, particularly in manufacturing optimization within Asia Pacific and targeted distribution across high-value Western markets and emerging economies. Continuous quality assurance and adaptation to evolving global regulatory standards remain paramount for leading market participants, ensuring reliable protective barriers for healthcare professionals worldwide, solidifying the market's trajectory towards sustainable expansion and specialization. The fundamental demand for high-quality disposable protective equipment ensures the stability and longevity of this indispensable segment of the medical consumables industry. Manufacturers focusing on vertical integration and sustainable practices are best positioned to capture increased market share in the coming forecast period.

Advanced market analysis indicates that while commoditization pressures keep prices competitive for standard nitrile products, opportunities exist in premium segments focusing on specialized attributes, such as thinner gloves with high tactile sensitivity or those offering proven chemical resistance for chemotherapy use. Investment in supply chain resilience has become non-negotiable following recent global disruptions, prompting strategic reserves and diversification of raw material sourcing. Furthermore, the integration of advanced manufacturing technologies, including IIoT and data analytics, is transforming large-scale production facilities into smart factories, capable of maximizing output while maintaining stringent quality control measures. This focus on efficiency and specialization will define the competitive landscape through 2033, rewarding enterprises that can scale capacity while upholding the highest standards of medical safety and compliance.

The examination gloves sector is also increasingly subject to environmental scrutiny, prompting manufacturers to explore sustainable alternatives to traditional single-use plastics. While fully biodegradable medical-grade gloves remain challenging to develop without compromising barrier function, incremental improvements in packaging efficiency, reduced material weight, and responsible manufacturing waste management are current operational priorities. Addressing these sustainability concerns not only aligns with corporate social responsibility goals but also creates a competitive edge, as healthcare procurement groups increasingly factor environmental impact into their purchasing decisions. Ultimately, the market trajectory is firmly upward, underpinned by essential public health functions and robust regulatory mandates globally.

The Examination Latex and Nitrile Rubber Medical Gloves Market is fundamentally non-discretionary, meaning consumption is directly tied to the utilization of healthcare services and mandatory occupational safety requirements. This inelastic demand structure ensures market resilience even during economic downturns, solidifying the continuous investment in manufacturing capacity. However, the market remains highly fragmented at the consumption end, with thousands of end-users relying on efficient distribution networks. The strategic importance of Group Purchasing Organizations (GPOs) in North America and Europe cannot be overstated, as they act as gatekeepers, aggregating demand and negotiating bulk procurement contracts that often dictate volume commitments for several years. Successful market navigation requires a sophisticated understanding of these procurement channels and the ability to demonstrate long-term supply stability and quality consistency. Furthermore, the rising awareness of hand health among healthcare workers is pushing demand for gloves with improved internal coatings and ergonomic fits, demonstrating a nuanced shift toward user comfort and skin protection alongside basic barrier function. This requires ongoing R&D investment in new polymer formulations and post-processing treatments.

Technological differentiation is becoming less about the fundamental material—as nitrile dominance is established—and more about specialty features and manufacturing consistency. For example, low-dermatitis risk gloves (accelerator-free) and barrier film technology applied to gloves to enhance grip or chemical resistance are areas attracting significant research investment. Compliance with global quality standards, such as ISO 13485 for medical device manufacturing, is table stakes, but exceeding baseline requirements through proprietary quality control processes offers a powerful differentiator in a highly competitive arena. The ongoing expansion of diagnostic testing, telemedicine, and home care services will continue to broaden the application base, necessitating flexible packaging and distribution strategies that cater to smaller, decentralized users alongside large institutional buyers. The strategic objective for market leaders remains capacity expansion coupled with aggressive cost control and sustained quality leadership, particularly in the mass production of synthetic gloves.

In summary, the market exhibits characteristics of a mature industry experiencing high volume growth, driven by external forces (health crises, regulation) and internal innovation (material science, automation). While the core product remains a disposable commodity, the complexity of the global supply chain, regulatory environment, and evolving user preferences create significant barriers to entry and require established players to continually invest in efficiency and quality assurance. The global trend towards healthcare digitalization and smart inventory management also impacts the distribution side, requiring manufacturers to integrate seamlessly with digital ordering systems utilized by major GPOs and hospital networks. This digital transformation is key to optimizing delivery timelines and reducing logistical bottlenecks, contributing significantly to customer satisfaction and loyalty in the fiercely contested market for examination protective equipment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager