Excavator Attachments Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434027 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Excavator Attachments Market Size

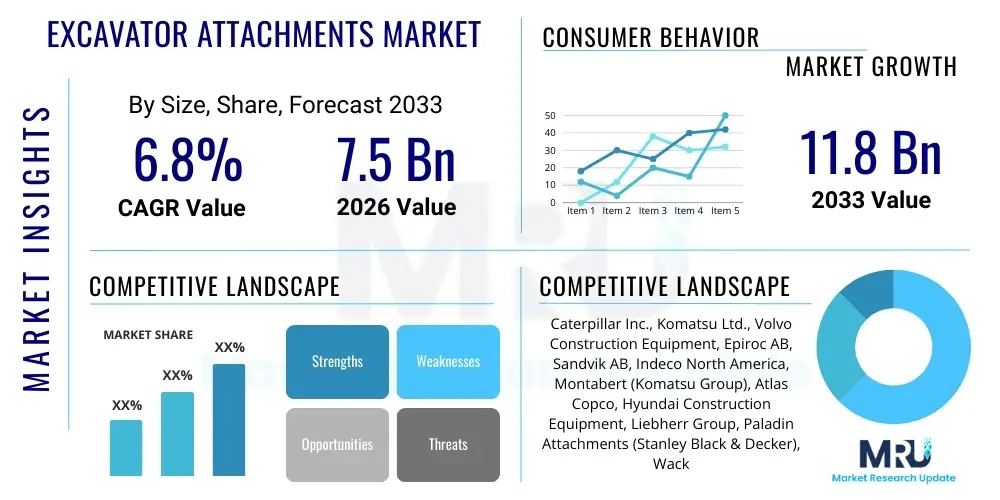

The Excavator Attachments Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $7.5 Billion in 2026 and is projected to reach $11.8 Billion by the end of the forecast period in 2033.

Excavator Attachments Market introduction

The Excavator Attachments Market encompasses the industry involved in manufacturing, distributing, and utilizing auxiliary tools and devices designed to be mounted onto hydraulic excavators to enhance their versatility and functionality. These attachments transform standard excavators into multi-purpose machines capable of performing tasks far beyond basic digging, such as demolition, material handling, crushing, sorting, and landscaping. The core objective of these attachments is to improve operational efficiency, reduce the need for specialized single-function machinery, and ultimately lower overall project costs, driving adoption across various heavy industries globally. This introduction of specialized tools like hydraulic breakers, quick couplers, shears, grapples, and augers allows construction and mining companies to maximize the return on investment from their existing excavator fleet.

Major applications for excavator attachments span a wide spectrum, with significant utilization observed in construction, particularly infrastructure development (roads, bridges), residential and commercial building projects, and urban renewal efforts. Beyond construction, the mining and quarrying sectors rely heavily on hydraulic breakers and rippers for rock fragmentation and extraction, while waste management utilizes sorting grapples and compactors for efficient material processing. Furthermore, forestry and agriculture employ specialized attachments such as mulchers and stump grinders. The primary benefit derived from these products is the drastic increase in machine flexibility and productivity on job sites, allowing operators to switch between different operations rapidly and safely, thereby accelerating project timelines and improving workforce utilization.

Key driving factors propelling market expansion include the sustained global emphasis on infrastructure modernization and expansion, especially in emerging economies like India and China, which necessitates high-performance earthmoving equipment. Secondly, stringent environmental regulations requiring more efficient demolition and material sorting techniques push contractors toward sophisticated attachments like shears and rotating grapples. Finally, technological advancements, such as the integration of advanced sensor technology, telematics, and quick coupling systems, are enhancing attachment performance and ease of use, making them indispensable tools in modern heavy equipment fleets. This combination of strong end-user demand and continuous product innovation ensures robust market trajectory throughout the forecast period.

Excavator Attachments Market Executive Summary

The Excavator Attachments Market is characterized by robust business trends driven primarily by the global surge in infrastructure investment and the growing demand for automation and versatility in construction equipment. Market players are heavily focused on developing sophisticated hydraulic attachments and smart tooling solutions, integrating IoT capabilities for predictive maintenance and performance monitoring. A significant trend involves the increasing popularity of high-pressure hydraulic breakers and specialized demolition tools, reflecting the ongoing cycles of urban renewal and sustainable waste management practices. Furthermore, quick coupler systems are becoming standard installations, significantly reducing machine downtime and optimizing operational fluidity across diverse job site requirements, prompting OEMs and aftermarket suppliers to prioritize compatibility and interoperability.

Regionally, the Asia Pacific (APAC) stands out as the undisputed leader in market growth, fueled by massive government spending on public works and rapid urbanization, particularly in Southeast Asia and mainland China. North America and Europe, representing mature markets, continue to drive demand for highly specialized and complex attachments, focusing intensely on efficiency, safety compliance, and reduced environmental footprint. The Latin American and Middle Eastern and African (MEA) regions are emerging as key opportunity areas, spurred by significant investments in oil and gas infrastructure, mining activities, and large-scale residential projects. Local manufacturing capacity and strategic partnerships are increasingly defining competitive landscapes within these developing regions, aiming to bypass high import tariffs and lengthy supply chains.

Segment trends reveal that the hydraulic breaker category maintains its dominance due to its essential role in quarrying, mining, and heavy demolition tasks. However, the fastest-growing segment is expected to be quick couplers and tiltrotators, which offer unparalleled flexibility and dramatically improve the operational scope of standard excavators, appealing strongly to rental fleets and medium-sized contractors seeking maximum asset utilization. In terms of excavator weight class, attachments for mid-sized excavators (10-30 metric tons) hold the largest market share, as this machine class provides the optimal balance between power, mobility, and cost-efficiency for the majority of construction and utility work. The aftermarket segment is also expanding rapidly, driven by the need for maintenance, repairs, and replacement of older, high-wear components, offering sustainable revenue streams for third-party suppliers.

AI Impact Analysis on Excavator Attachments Market

User inquiries regarding AI in the Excavator Attachments Market primarily revolve around how artificial intelligence and machine learning can enhance operational precision, improve safety on demolition sites, and optimize attachment maintenance schedules. Users are specifically concerned with the feasibility of autonomous operation for high-risk attachments like shears and pulverizers, the use of AI-driven vision systems for material sorting quality control, and the deployment of predictive analytics to forecast hydraulic component failure. Key expectations center on achieving higher operational accuracy, reducing costly downtime through proactive maintenance alerts generated by AI algorithms analyzing usage patterns, and minimizing manual intervention in complex or hazardous tasks. The overarching theme is the transition from reactive maintenance and manual control to proactive, intelligent asset management and automated performance tuning.

- AI integration in smart attachments enables real-time performance monitoring and self-calibration, optimizing hydraulic flow and pressure based on material resistance.

- Predictive maintenance algorithms, powered by machine learning, analyze sensor data (vibration, temperature, pressure) to forecast failure points in hydraulic breakers and quick couplers.

- AI-driven vision systems enhance safety by identifying unauthorized personnel near the working radius of heavy attachments and automating precise tasks like sorting and grading materials.

- Optimization of duty cycles using AI minimizes energy consumption and wear rate, significantly extending the lifespan of high-value attachments such as hydraulic grapples and rock saws.

- Autonomous control systems, guided by AI, allow excavators fitted with specialized attachments (e.g., demolition shears) to execute pre-programmed, repetitive, and hazardous tasks with high precision.

DRO & Impact Forces Of Excavator Attachments Market

The dynamics of the Excavator Attachments Market are shaped by a strong interplay of Drivers, Restraints, and Opportunities, collectively influencing the market’s trajectory and resilience. Primary drivers include rapid global urbanization and infrastructure spending, which necessitate versatile and high-performance earthmoving machinery capable of diverse applications. These drivers are bolstered by the industry's continuous focus on mechanization to overcome skilled labor shortages, pushing contractors to adopt specialized attachments that maximize machine utility. Restraints largely center around the volatility of raw material prices (steel and specialized alloys) necessary for manufacturing durable attachments, alongside the high initial investment cost associated with advanced hydraulic tools, which can deter smaller contractors. Opportunities emerge prominently through the integration of digital technologies (telematics, IoT) into attachments, the expansion of rental fleets offering these specialized tools, and the growing demand for attachments optimized for compact and mini-excavators for utility and urban projects.

The market is subjected to powerful impact forces originating from both the demand side and technological advancements. Increasing demand for sophisticated demolition and recycling attachments, driven by stringent environmental standards regarding waste processing, constitutes a significant positive force. Conversely, economic instability and cyclical patterns inherent in the construction industry pose restraining forces, potentially leading to delayed capital expenditure on non-essential equipment upgrades. The force of technological evolution, specifically in materials science leading to lighter yet stronger attachment designs and improvements in quick coupler speed and security, ensures continued innovation and replacement cycles. These forces dictate strategic choices for manufacturers, compelling them toward R&D focused on durability, ease of maintenance, and enhanced versatility to maintain competitive edge and mitigate cyclical market downturns.

Segmentation Analysis

The Excavator Attachments Market is highly segmented based on product type, mechanism, application, excavator weight, and distribution channel, reflecting the wide operational scope and diversity of end-user requirements. Product segmentation is crucial, differentiating high-impact hydraulic tools like breakers and pulverizers from general-purpose tools such as buckets and grapples. Mechanism segmentation typically involves hydraulic, mechanical, and pneumatic classifications, with hydraulic attachments commanding the dominant share due to superior power and control. Furthermore, the market is differentiated significantly by the end-use application, encompassing construction, mining, forestry, and utility sectors, each demanding specific characteristics and performance metrics from their tools. Analyzing these segments provides strategic insights into high-growth niches and identifies areas where specialized product development is most likely to yield high returns on investment.

- By Product Type:

- Buckets (Digging, Trenching, Grading)

- Hydraulic Breakers/Hammers

- Quick Couplers/Hitches

- Grapples (Demolition, Sorting, Log)

- Augers & Drills

- Shears & Pulverizers (Crushing)

- Rippers

- Tiltrotators

- By Excavator Weight:

- Mini/Compact (Below 6 Metric Tons)

- Medium (6 to 30 Metric Tons)

- Heavy (Above 30 Metric Tons)

- By Application:

- Construction & Infrastructure

- Mining & Quarrying

- Forestry & Agriculture

- Demolition & Recycling

- Utility & Municipal Works

- By Distribution Channel:

- Original Equipment Manufacturers (OEMs)

- Aftermarket

- Rental Fleets

- By Mechanism:

- Hydraulic

- Mechanical

Value Chain Analysis For Excavator Attachments Market

The value chain for the Excavator Attachments Market begins with upstream activities, which primarily involve the sourcing and processing of critical raw materials, most notably high-grade steel, specialized alloy metals, and advanced hydraulic components (pumps, valves, hoses). Success in this upstream segment relies heavily on maintaining stable supply chain relationships and managing commodity price volatility to ensure cost-effective manufacturing. Manufacturers then engage in meticulous design and fabrication processes, focusing on engineering precision, material toughness, and hydraulic integration to ensure the attachment can withstand extreme operational stress and meet stringent safety standards. Intellectual property protection for patented designs, particularly for quick couplers and advanced crushers, represents a significant value-add at this stage, establishing brand differentiation and justifying premium pricing within the highly competitive landscape.

The midstream segment is dominated by assembly, quality control, and strategic inventory management. Given the customized nature of many attachments (fitting various excavator models), flexible manufacturing and adherence to diverse regional regulatory standards are essential. Once manufactured, the attachments move through robust distribution channels. Direct sales through Original Equipment Manufacturers (OEMs) often involve bundling attachments with new excavator sales, capitalizing on integrated service and warranty packages. Alternatively, indirect channels, including independent dealers, specialized attachment distributors, and increasingly large-scale equipment rental companies, facilitate broader market penetration, especially targeting smaller and medium-sized enterprises (SMEs) that prioritize rental over ownership.

Downstream activities center on aftermarket support, installation services, and end-user engagement. Installation and commissioning, particularly for complex hydraulic shears and tiltrotators, require specialized technical expertise, creating value for service providers. The aftermarket segment, comprising replacement parts, repairs, and maintenance services, is crucial for long-term revenue generation and customer loyalty, as wear parts (like teeth, blades, and pins) frequently require replacement due to harsh operating environments. Successful participation in the downstream segment necessitates a global presence, accessible parts inventories, and responsive technical support, ensuring maximum uptime for the end-user. The growth of e-commerce platforms and digital marketplaces is further streamlining the indirect distribution of smaller, standardized wear components.

Excavator Attachments Market Potential Customers

The primary customers for excavator attachments are entities operating within heavy industries that rely on earthmoving and material processing capabilities. This core group includes large-scale construction contractors involved in major infrastructure projects (road building, bridge construction, utilities installation) who require diverse, heavy-duty attachments to manage varying site conditions and tasks efficiently. Infrastructure development bodies and public works departments often drive demand, setting specifications that necessitate the use of specialized tools for compliance and efficiency. Mining and quarrying companies constitute another major segment, particularly demanding robust hydraulic breakers, rippers, and heavy-duty buckets designed for high-abrasion environments and rock extraction. These customers prioritize durability and high impact energy over all other features, making the total cost of ownership a key purchasing criterion.

Beyond traditional heavy industries, the market serves specialized niche sectors. Demolition and recycling companies represent a high-growth customer segment, driving significant demand for hydraulic pulverizers, steel shears, and sorting grapples, as regulatory focus increases on efficient and clean material separation. Forestry and logging operations purchase specialized mulchers, tree shears, and grapple loaders tailored for vegetation management and biomass handling. Furthermore, utility companies and municipalities are key buyers of compact and mini-excavator attachments—such as trenching buckets, asphalt cutters, and specialized augers—used for repairing underground services, laying fiber optic cables, and maintaining urban infrastructure, where space constraints necessitate smaller, maneuverable tools.

The increasing prominence of equipment rental companies as key customers cannot be overstated. Rental houses purchase a broad spectrum of attachments to maintain a versatile inventory that meets the fluctuating needs of short-term contractors and SMEs who cannot justify the capital expenditure of owning every specialized tool. Rental companies prioritize attachments that are easy to install, highly durable, and compatible across multiple excavator brands (hence the demand for high-quality quick couplers). Serving this segment requires manufacturers to focus on standardization, easy maintenance procedures, and robust build quality to withstand continuous rotation between different users and job sites, ensuring the rental fleet maintains high utilization rates and minimizes service interruptions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $7.5 Billion |

| Market Forecast in 2033 | $11.8 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Caterpillar Inc., Komatsu Ltd., Volvo Construction Equipment, Epiroc AB, Sandvik AB, Indeco North America, Montabert (Komatsu Group), Atlas Copco, Hyundai Construction Equipment, Liebherr Group, Paladin Attachments (Stanley Black & Decker), Wacker Neuson SE, Doosan Bobcat, Rotar International B.V., Okada Aiyon Corporation, NPK Construction Equipment, Geith International, Werk-Brau Co. Inc., Kinshofer GmbH, LaBounty (Stanley Infrastructure) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Excavator Attachments Market Key Technology Landscape

The technological landscape of the Excavator Attachments Market is rapidly evolving, moving toward 'smart' and interconnected tools that maximize efficiency and safety. A primary technological focus is on advanced hydraulic system design, particularly for high-energy attachments like breakers and shears. Innovations here involve energy recovery systems, often using nitrogen chambers, which enhance impact force while minimizing wasted energy and reducing the heat load on the excavator’s hydraulic circuit. Furthermore, sophisticated valve technology is being implemented to allow for variable flow control, enabling operators to fine-tune the attachment’s performance precisely to the material being processed, whether it is soft sandstone or dense granite. This level of hydraulic precision improves productivity and significantly reduces wear and tear on the attachment's internal components.

Another critical area of innovation is the development and adoption of quick coupler and tiltrotator technologies. Quick couplers have moved beyond basic mechanical systems to highly engineered hydraulic and fully automatic locking mechanisms, which prioritize safety by incorporating double-locking security systems and electronic proximity sensors to prevent accidental detachment. Tiltrotators, originating largely from Northern Europe, are fundamentally transforming excavator utility by providing 360-degree rotation and up to 45-degree tilt capability, essentially turning the machine into a sophisticated 'wrist' that allows for intricate grading, positioning, and maneuvering tasks previously requiring manual labor or multiple machine movements. These advanced systems require robust computerized controls and integration with the excavator’s main control unit (MCU) through CAN bus technology.

Digital integration, encompassing telematics, sensors, and the Internet of Things (IoT), represents the most profound technological shift. Attachments are increasingly equipped with embedded sensors that monitor crucial parameters such as pressure, temperature, vibration, and hours of usage. This data is transmitted wirelessly (via cellular or satellite connectivity) to fleet management platforms, enabling predictive maintenance alerts, usage tracking for rental billing, and operational efficiency analysis. Furthermore, augmented reality (AR) and virtual reality (VR) are beginning to play a role in training operators on the optimal use of complex attachments, minimizing damage and maximizing output, thereby driving the overall professionalism and technical proficiency across the end-user base. The material science advancements, involving the use of wear-resistant alloys and specialized coatings for high-contact components, also contribute significantly to reducing maintenance frequency and extending product lifecycle.

Regional Highlights

The regional analysis provides a comprehensive overview of the market dynamics, demand drivers, and competitive landscape across key geographical segments, offering strategic insights for market participants regarding expansion and resource allocation.

- Asia Pacific (APAC): APAC is the dominant and fastest-growing region, driven by unparalleled infrastructure investment, large-scale urbanization projects, particularly in China, India, and Southeast Asian nations (Indonesia, Vietnam). The demand here is massive, focusing on high-volume earthmoving attachments (buckets) and essential demolition tools (hydraulic breakers) needed for rapid construction and resource extraction. Government initiatives aimed at developing smart cities and expanding logistics networks solidify the region's top position in terms of unit sales and overall market value potential.

- North America: This mature market is characterized by high adoption rates of advanced, specialized attachments. Demand is centered around high-technology products like sophisticated quick couplers, tiltrotators, and heavy-duty specialty tools for oil and gas infrastructure, complex utility work, and environmentally focused demolition and recycling. The presence of large rental fleets is a critical driver, necessitating reliable and high-quality attachments with robust telematics integration for efficient asset tracking and management.

- Europe: Europe exhibits strong demand, heavily influenced by strict environmental regulations favoring advanced recycling and demolition attachments (shears, pulverizers). The region, particularly the Nordic countries, leads the global adoption of highly productive and integrated tiltrotator technology. Focus areas include optimizing efficiency for compact and midi-excavators used in tightly regulated urban environments and adhering to stringent noise and emission standards (Stage V compliance), driving innovation in quieter hydraulic systems.

- Latin America (LATAM): Growth in LATAM is primarily linked to recovering economies, investments in mining (especially Chile, Peru, Brazil), and large-scale public infrastructure projects. The market favors cost-effective and robust attachments, with hydraulic breakers and heavy-duty buckets being core components. Market expansion is sensitive to commodity price fluctuations and political stability, but the long-term potential in resource extraction remains substantial.

- Middle East and Africa (MEA): This region shows significant potential due to vast oil and gas infrastructure projects (pipelines, refineries) and mega-construction endeavors in the GCC states (Saudi Arabia, UAE). Demand focuses on heavy-duty, reliable attachments capable of operating efficiently in harsh, high-temperature desert environments. African markets are driven by burgeoning mining activities and necessary infrastructure upgrades, although logistical challenges often favor simplified, easily maintained mechanical attachments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Excavator Attachments Market.- Caterpillar Inc.

- Komatsu Ltd.

- Volvo Construction Equipment

- Epiroc AB

- Sandvik AB

- Indeco North America

- Montabert (Komatsu Group)

- Atlas Copco

- Hyundai Construction Equipment

- Liebherr Group

- Paladin Attachments (Stanley Black & Decker)

- Wacker Neuson SE

- Doosan Bobcat

- Rotar International B.V.

- Okada Aiyon Corporation

- NPK Construction Equipment

- Geith International

- Werk-Brau Co. Inc.

- Kinshofer GmbH

- LaBounty (Stanley Infrastructure)

- FAE Group S.p.A.

- Allu Group Oy

- VTN Europe S.p.A.

Frequently Asked Questions

Analyze common user questions about the Excavator Attachments market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the Excavator Attachments Market?

The primary factor driving market growth is the massive global investment in infrastructure development and urban construction projects, particularly in the Asia Pacific region, coupled with the increasing need for machinery versatility to overcome skilled labor shortages.

How do technological advancements, such as tiltrotators, impact excavator operational efficiency?

Tiltrotators significantly enhance operational efficiency by providing 360-degree rotation and high-degree tilting capability, reducing machine repositioning time, increasing precision in grading, and allowing a single excavator to perform tasks previously requiring multiple specialized machines.

Which type of excavator attachment holds the largest market share by revenue?

While standard digging buckets constitute high volume, hydraulic breakers (or hammers) typically hold the largest market share by revenue, driven by their critical and sustained use in high-impact applications such as quarrying, mining, and heavy demolition projects globally.

What is the role of the aftermarket in the Excavator Attachments Market?

The aftermarket plays a crucial role by supplying replacement wear parts (like teeth, blades, and pins), performing necessary maintenance, and offering repair services for attachments, ensuring the longevity and continuous operational readiness of the equipment fleet.

What major restraints hinder the overall adoption rate of advanced excavator attachments?

Major restraints include the high initial capital investment required for specialized hydraulic attachments and volatility in the cost of high-grade raw materials (steel alloys), which impacts manufacturing costs and, consequently, end-user pricing.

The market analysis concludes that the trend toward highly integrated, versatile, and technologically advanced attachments is irreversible. The integration of IoT and predictive maintenance into hydraulic systems represents the future standard, pushing market leaders to focus on smart manufacturing and comprehensive digital support services. Furthermore, the burgeoning rental segment will continue to reshape distribution strategies, prioritizing robust, standardized, and easily serviced attachment designs. Regional dynamics underscore a pivot toward APAC for volume growth, while mature markets like North America and Europe drive innovation in specialized, high-precision tooling necessary for complex urban and environmental projects. Navigating these regional and technological shifts successfully will define market leadership in the coming decade, demanding continuous R&D investment and agile supply chain management to maintain competitiveness. The forecasted CAGR of 6.8% reflects sustained confidence in global construction recovery and the indispensable role these tools play in achieving modern construction efficiency and sustainability goals.

Manufacturers are also increasingly focusing on environmental performance, responding to stricter global emissions and noise regulations. This translates into the development of attachments with lower vibration levels, particularly hydraulic breakers utilizing advanced dampening technology, and attachments optimized for use with electric excavators. The shift towards electrification in heavy equipment is a crucial, emerging opportunity, requiring attachments that are highly energy-efficient and hydraulically optimized to minimize battery drain. Addressing these ecological demands, alongside safety enhancements such as proximity sensors and fail-safe locking mechanisms in quick couplers, is paramount for securing long-term contracts with major governmental and corporate construction firms. The synergy between high-performance engineering and sustainable operational practices is therefore key to unlocking future market potential.

Finally, the competitive environment is characterized by a balance between global Original Equipment Manufacturers (OEMs), who offer integrated solutions and leverage their expansive dealer networks, and specialized, independent attachment providers, who often lead in niche innovation (e.g., tiltrotators and specialized demolition shears). Strategic partnerships and mergers & acquisitions are commonplace as OEMs seek to broaden their attachment portfolio quickly, incorporating best-in-class specialized technologies. Price wars are generally avoided in high-end specialized segments where performance and reliability justify premium costs, but competition remains fierce in standardized, high-volume products like buckets and basic couplers. Success requires a dual strategy: maintaining cost efficiency in core products while aggressively innovating in proprietary, value-added technology segments to capture high-margin revenue streams and establish technological superiority in the evolving digital construction ecosystem. This strategic divergence ensures market stability while fostering continuous advancement.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager