Excavator Bucket Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433387 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Excavator Bucket Market Size

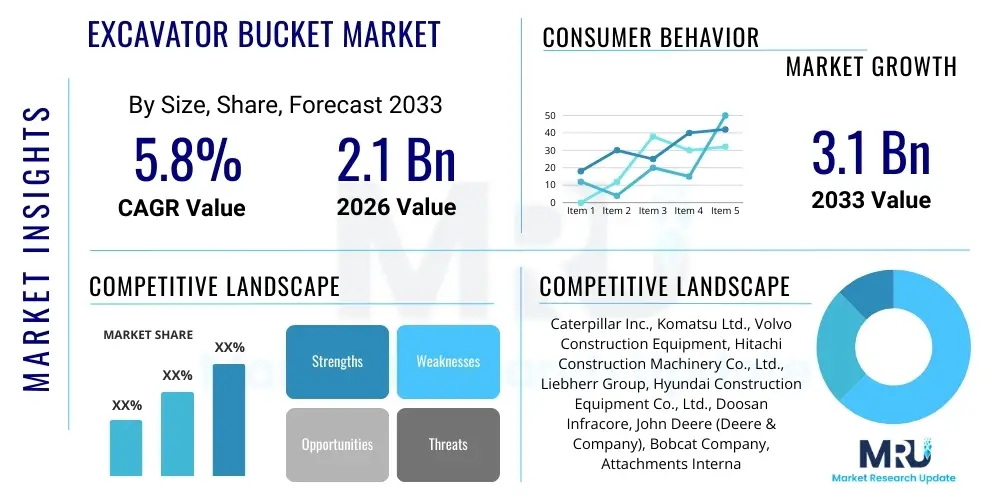

The Excavator Bucket Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $2.1 Billion in 2026 and is projected to reach $3.1 Billion by the end of the forecast period in 2033.

Excavator Bucket Market introduction

The Excavator Bucket Market encompasses the design, manufacturing, and distribution of various attachments utilized with hydraulic excavators for digging, loading, demolition, and trenching applications across multiple industries. These specialized components are crucial tools in construction, mining, and infrastructural development projects, acting as the primary interfacing mechanism between the machine and the material being handled. The diversity of tasks necessitates a wide range of bucket types, including standard digging buckets, heavy-duty rock buckets, grading buckets, and specialized trenching buckets, each engineered with specific material composition and structural rigidity to optimize performance and durability in varied operational environments. The fundamental function is to maximize material throughput while minimizing wear and tear on the machinery, leading manufacturers to continually innovate in material science and structural design to enhance longevity and efficiency.

Excavator buckets are indispensable across major applications such as large-scale urban development, road construction, resource extraction (mining and quarrying), and waste management. The primary benefit of a high-quality excavator bucket lies in its ability to withstand extreme stresses, abrasion, and impact loads, thereby increasing the operational uptime of the excavator and reducing maintenance costs. Furthermore, advancements in quick coupler systems have dramatically improved job site flexibility, allowing operators to rapidly switch between specialized buckets, thus improving overall project efficiency and productivity. The superior design of modern buckets incorporates high-strength steel alloys and strategically placed wear plates, offering significant longevity advantages over legacy designs.

Driving factors for market growth include exponential growth in global infrastructure spending, particularly in emerging economies focused on urbanization and industrial expansion. The persistent demand for mineral resources globally mandates continuous investment in the mining sector, requiring robust and high-capacity buckets. Moreover, stringent governmental regulations regarding project timelines and operational safety push end-users toward premium, certified attachments that offer reliability and superior performance characteristics. The replacement cycle for excavator buckets, which are consumable attachments subject to high wear rates, further sustains steady market demand, irrespective of new equipment sales fluctuations.

Excavator Bucket Market Executive Summary

The Excavator Bucket Market is characterized by robust growth driven primarily by unprecedented global investments in infrastructure and the sustained buoyancy of the mining and quarrying sectors. Business trends indicate a strong shift towards specialized and custom-engineered buckets, particularly those incorporating advanced materials like abrasion-resistant steels (AR steel) to enhance longevity and reduce replacement frequency. Consolidation among major original equipment manufacturers (OEMs) and independent attachment producers is intensifying competition, leading to accelerated technological development focused on improving fuel efficiency and operational precision. Digitalization in the construction industry, including the adoption of telematics and job site monitoring, is influencing procurement decisions, favoring buckets designed for optimal performance metrics tracked by such systems.

Regionally, the Asia Pacific (APAC) market, spearheaded by China and India, commands the highest market share due to massive urbanization projects and extensive mining operations. North America and Europe demonstrate mature markets focused on efficiency, safety, and specialized applications, driving demand for hydraulic and tilt buckets. Latin America and the Middle East & Africa (MEA) are emerging as high-growth regions, fueled by energy infrastructure development and large-scale public works projects. Regional trends are heavily influenced by local raw material availability and specific regulatory requirements regarding equipment certification and environmental impact.

Segment trends highlight the dominance of standard digging buckets by volume, essential for general construction tasks. However, the fastest growth is observed in the heavy-duty and specialized bucket segments (e.g., severe-duty rock buckets and riddle buckets), reflecting the increasing complexity and harshness of modern operational environments, particularly in heavy mining and demolition. By excavator size, the medium-sized excavator bucket segment (6 to 30 tons) retains the largest market share, correlating with the versatility and widespread adoption of mid-range excavators in general civil engineering. The aftermarket segment, providing replacement buckets and wear parts, continues to be a substantial revenue stream, capitalizing on the high rate of wear experienced by these components.

AI Impact Analysis on Excavator Bucket Market

User inquiries regarding AI's impact on the Excavator Bucket Market frequently revolve around two core themes: how AI-driven automation affects bucket design and usage, and how predictive maintenance supported by machine learning can extend the lifespan of these high-wear components. Users are keen to understand if AI can optimize digging cycles, reducing stress on the bucket structure, and if real-time data analysis from sensors integrated into the boom or stick can inform operators about the optimal attack angle and fill factor. Concerns often include the cost of integrating smart technology into traditionally mechanical attachments and the practical benefits derived from analyzing wear patterns through AI, leading to customized material recommendations for specific operational profiles.

The convergence of AI with heavy equipment operations is primarily manifested through advanced telematics and integrated machine control systems that directly influence bucket performance. AI algorithms analyze massive datasets from integrated sensors—measuring factors like pressure, tilt, vibration, and material density—to provide real-time adjustments or feedback to the operator or autonomous system. This optimization minimizes energy expenditure, enhances precision digging, and, crucially for the bucket, reduces non-uniform wear, preventing premature failure. For instance, predictive maintenance models utilizing machine learning can forecast the precise moment when bucket teeth or side cutters require replacement based on operational history and perceived load stress, minimizing costly unplanned downtime and maximizing the useful life of the asset.

Furthermore, AI-driven design simulation software is revolutionizing the manufacturing process. Instead of traditional physical prototyping, manufacturers can use generative design algorithms that optimize the bucket's geometry for specific tasks (e.g., achieving maximum payload in cohesive soil while minimizing structural weight). This leads to lighter, stronger, and more efficient buckets tailored precisely to the expected duty cycle, driven by historical operational data gathered and analyzed by machine learning systems deployed across fleets globally. This digital transformation ensures that future excavator buckets are not just passive attachments but integral components of a smart, optimized earthmoving ecosystem.

- AI-enabled Predictive Maintenance: Uses machine learning to analyze sensor data (vibration, load) to forecast wear and schedule precise component replacement (teeth, cutting edges), significantly extending bucket lifespan and reducing downtime.

- Operational Optimization: AI systems provide real-time feedback or control for automated digging cycles, ensuring optimal bucket fill factor and reduced stress on structural welds, improving energy efficiency.

- Generative Design: Machine learning algorithms optimize bucket geometry and material distribution during the R&D phase, resulting in lighter, stronger, task-specific attachments with superior performance metrics.

- Fleet Management Integration: AI integrates bucket performance data into broader telematics systems, allowing centralized monitoring of attachment health and utilization across large construction or mining fleets.

- Advanced Material Selection: AI analyzes operational abrasion data to recommend optimal alloy compositions (e.g., specific AR steel grades) for cutting edges and wear plates based on the geological conditions of the job site.

DRO & Impact Forces Of Excavator Bucket Market

The market is fundamentally driven by escalating global infrastructure expenditures and the persistent demand for minerals, necessitating high-performance earthmoving equipment. Restraints primarily involve the volatile pricing of raw materials, especially high-strength steel and specialized alloys, which significantly impacts manufacturing costs and profit margins. Opportunities are vast in the development of lightweight yet highly durable composites and specialized hydraulic quick couplers that enhance machine versatility. The industry is significantly impacted by factors such such as stringent environmental standards compelling equipment manufacturers to optimize material usage and minimize waste, and technological advancements focusing on reducing total cost of ownership through enhanced durability and minimized weight.

Drivers: The most significant driver is the global population growth leading to massive urbanization and corresponding demands for residential, commercial, and transport infrastructure projects. Government stimulus packages focused on public works, particularly in response to economic downturns, provide substantial impetus for equipment sales and aftermarket parts, including excavator buckets. Furthermore, the push towards autonomous and semi-autonomous excavators requires highly specialized and rugged buckets capable of enduring consistent, high-intensity operational cycles managed by sophisticated control systems, generating demand for premium products.

Restraints: Raw material price volatility, specifically for high-grade manganese and chrome steels used in wear parts, creates significant uncertainty in the supply chain and hampers stable pricing for end products. Additionally, the fragmented nature of the aftermarket segment, often flooded with lower-quality, non-OEM buckets, poses a competitive challenge to established manufacturers who prioritize certified performance and safety standards. Economic slowdowns or political instability in major developing markets can temporarily halt large-scale infrastructure projects, directly dampening demand for new equipment and attachments.

Opportunities: Significant growth pathways exist in the development and proliferation of specialized buckets for niche applications such as deep-sea dredging, specific waste handling (e.g., biomass), and precision demolition. The transition towards lighter, fuel-efficient buckets utilizing advanced composite materials or ultra-high-strength steel represents a critical opportunity for technological differentiation. Furthermore, the rapid growth in rental markets worldwide necessitates investments in durable, multi-purpose buckets that can handle a broad range of applications while maximizing rental return on investment.

Impact Forces: The market is subject to intense competitive pressure from both global OEMs that produce proprietary buckets and numerous independent, regional attachment specialists, forcing continuous innovation in material science. The replacement cycle, driven by wear and tear (a function of operational intensity and geological conditions), acts as a self-sustaining demand factor. Furthermore, global supply chain resilience, tested by recent geopolitical events and logistical constraints, dictates manufacturing schedules and distribution efficiency, profoundly impacting market responsiveness and inventory levels across regions.

Segmentation Analysis

The Excavator Bucket Market is extensively segmented based on the product type, the material used, the size of the accompanying excavator, and the primary application. This detailed segmentation allows manufacturers to target specific end-user needs, ranging from lightweight trenching in urban environments to extreme material handling in large-scale mining operations. Type segmentation differentiates between standard digging buckets (general purpose), heavy-duty buckets (for abrasive materials), and specialized variants like tilt buckets, grapple buckets, and skeletal buckets, each designed for optimal performance in distinct operational niches. Material choice is critical, with high-strength low-alloy (HSLA) steel dominating standard offerings, while chromium and manganese alloy steels are reserved for severe-duty applications requiring superior abrasion resistance.

Application-based segmentation clearly highlights the dominance of the construction sector, encompassing residential, commercial, and heavy civil engineering projects, which utilizes the widest variety of bucket types. The mining sector, conversely, demands buckets optimized for volume and extreme durability against hard rock and abrasive ore. Excavator size serves as a crucial determinant of bucket dimensions, volume capacity, and structural requirements, ranging from compact buckets for mini-excavators (under 6 tons) to massive buckets used on large production excavators (over 100 tons). This multi-faceted classification is vital for market sizing, strategic positioning, and identifying high-growth sub-segments, particularly in specialized niche markets driven by technological advancements.

- By Type:

- Standard Digging Bucket

- Heavy Duty Bucket

- Rock Bucket (Severe Duty)

- Trenching Bucket

- Grading/Ditch Cleaning Bucket

- Clamshell/Grapple Bucket

- Skeleton/Screening Bucket

- By Excavator Size:

- Mini Excavator Buckets (Up to 6 Tons)

- Medium Excavator Buckets (6-30 Tons)

- Large Excavator Buckets (Above 30 Tons)

- By Application:

- Construction (Residential, Commercial, Civil Engineering)

- Mining and Quarrying

- Forestry and Agriculture

- Waste Management and Recycling

- Oil & Gas and Utility Infrastructure

- By Sales Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket

Value Chain Analysis For Excavator Bucket Market

The Value Chain for the Excavator Bucket Market begins with upstream activities centered on the procurement and processing of raw materials, primarily high-grade steel alloys. Key inputs include high-tensile strength steel (like S690QL) and abrasion-resistant (AR) steel grades (like AR400 to AR600), sourced from specialized steel mills globally. The upstream segment involves complex logistics and quality control to ensure the materials meet the rigorous specifications required for heavy equipment use. Steel processors then supply cut and shaped plates to the manufacturers. Price volatility and supply chain resilience concerning these specialized raw materials significantly influence the manufacturing cost base and lead times across the entire chain.

The core manufacturing stage involves sophisticated processes such as computer numerical control (CNC) cutting, precision welding using robotic systems, and rigorous quality assurance testing, including ultrasonic and radiographic inspections of critical welds. Manufacturers either operate as proprietary attachment divisions of major OEMs (like Caterpillar or Komatsu) or as independent attachment specialists (IAS). These companies invest heavily in R&D to optimize bucket geometry, material selection, and ground engaging tool (GET) design. The direct distribution channel primarily involves OEMs supplying buckets bundled with new excavators, or IAS companies leveraging their own dealer networks and direct sales teams to reach large construction and mining firms.

Downstream activities focus on distribution, sales, and aftermarket support. The distribution channel is bifurcated: direct sales to large fleet operators and indirect sales through a global network of authorized dealers and independent parts retailers. Dealers play a crucial role in providing local inventory, technical support, installation services, and most importantly, replacement wear parts (GETs, shrouds, and cutting edges), which form a substantial part of the aftermarket revenue stream. The successful management of the downstream chain relies heavily on efficient inventory management and rapid fulfillment capabilities to minimize customer machine downtime, ensuring that the necessary durable and wear parts are readily available worldwide.

Excavator Bucket Market Potential Customers

The primary customer base for the Excavator Bucket Market spans a wide array of industrial users centered around earthmoving and material handling activities. These customers can be broadly categorized into heavy construction companies, which include civil engineering firms specializing in roads, bridges, and dams; general contractors involved in commercial and residential building development; and specialized demolition contractors requiring unique, high-force attachments. These entities prioritize versatility, demanding buckets that can switch rapidly between various tasks using quick couplers while offering robust durability to ensure project timelines are met under demanding conditions.

Another critically important segment comprises mining and quarrying corporations, which are the heaviest consumers of severe-duty and high-capacity buckets. These customers operate 24/7 in extremely abrasive environments, necessitating the toughest buckets constructed from advanced AR steels and specialized proprietary wear packages. For these end-users, the metric of concern is not only longevity but also maximum volume capacity (fill factor) and minimized operational weight to boost productivity per cycle. Governments and municipal public works departments also constitute a stable customer base, primarily procuring standard and grading buckets for utility installation, maintenance, and public infrastructure projects.

Furthermore, the rental equipment industry represents a rapidly growing customer segment. Rental companies require robust, versatile, and standardized buckets that can withstand use by multiple different operators and diverse job sites without specialized maintenance. As fleet owners, they also drive significant demand in the aftermarket for high-quality, long-lasting replacement parts. Specialized customers include forestry companies utilizing brush-clearing buckets, and waste management facilities requiring grapple and sorting buckets optimized for handling bulky, irregularly shaped materials, showcasing the market's reliance on highly tailored solutions for specific industrial challenges.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.1 Billion |

| Market Forecast in 2033 | $3.1 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Caterpillar Inc., Komatsu Ltd., Volvo Construction Equipment, Hitachi Construction Machinery Co., Ltd., Liebherr Group, Hyundai Construction Equipment Co., Ltd., Doosan Infracore, John Deere (Deere & Company), Bobcat Company, Attachments International, Paladin Attachments, Miller UK, Esco Group (Weir Group PLC), Geith International, Amulet Manufacturing, Werk-Brau Co., Rockland Manufacturing, JRB Attachments, OilQuick AB, NPK Construction Equipment |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Excavator Bucket Market Key Technology Landscape

The technology landscape of the Excavator Bucket Market is primarily defined by advancements in material science, manufacturing techniques, and integration with intelligent machine systems. The core technological focus remains on improving wear resistance and structural integrity while simultaneously reducing overall weight to maximize payload and improve fuel efficiency. Key material innovations involve the utilization of advanced abrasion-resistant (AR) steel alloys, often reaching grades like AR500 and higher, which provide superior hardness and tensile strength without excessive weight penalty. Furthermore, manufacturers are increasingly employing specialized cladding and surface hardening techniques, such as tungsten carbide coating or chrome overlays, specifically on high-impact zones like cutting edges and bucket heel shrouds, dramatically extending the service life of these critical components in aggressive environments.

Manufacturing technology has shifted towards high-precision automated processes, including robotic welding and plasma cutting, which ensure dimensional accuracy and consistent weld quality—a critical factor given the immense stress buckets endure. Modern bucket designs leverage Finite Element Analysis (FEA) software extensively during the design phase to simulate operational stresses and optimize the distribution of material, ensuring that reinforcements are strategically placed only where maximum loads are expected. This iterative process allows for the production of geometrically optimized buckets that offer enhanced performance characteristics compared to traditional, heavier designs, supporting the global trend towards greater operational efficiency and reduced environmental impact through lower fuel consumption per cubic meter moved.

Furthermore, technology is increasingly focused on the interface between the bucket and the excavator. The rapid adoption of hydraulic and fully automatic quick coupler systems (like those offered by OilQuick or Geith) is a major technological differentiator, enabling operators to safely and quickly switch buckets and other attachments from the cab within seconds, maximizing machine utilization across diverse tasks. Integration with 3D machine control and GPS systems is also becoming standard, where the bucket's position and orientation are precisely controlled and tracked, enhancing the accuracy of excavation and grading tasks, particularly in complex civil engineering projects and highly regulated construction zones requiring millimeter-level precision.

Regional Highlights

- Asia Pacific (APAC): The APAC region maintains its position as the largest and fastest-growing market globally, driven by massive governmental investments in residential, commercial, and transportation infrastructure, particularly in China, India, and Southeast Asian nations. The region's extensive mining and mineral processing activities (coal, iron ore, copper) demand a substantial volume of heavy-duty and rock buckets. The proliferation of local and regional manufacturing hubs, coupled with lower labor costs, makes APAC a critical supply and demand center.

- North America: This mature market is characterized by high demand for specialized, high-quality, and technologically integrated buckets. Focus is placed on enhancing operational efficiency and safety. The market sees significant uptake of hydraulic tilting buckets and fully automatic quick couplers. Demand is strong across housing construction, oil & gas pipeline infrastructure, and large-scale public works repairs and upgrades, necessitating compliance with stringent local safety and environmental standards.

- Europe: The European market is highly regulated and emphasizes sustainability and fuel efficiency. This drives demand for lightweight buckets made from high-grade materials (Ultra High Strength Steels) designed to maximize performance on smaller or mid-sized excavators commonly used in dense urban environments. Countries like Germany, France, and the UK focus heavily on replacement parts and advanced attachment technologies, including highly specialized demolition and recycling buckets crucial for circular economy initiatives.

- Latin America: The market exhibits high growth potential, largely fueled by resource extraction industries (copper in Chile, iron ore in Brazil) and large infrastructure projects linking major cities and ports. Economic volatility can temper investment, but consistent demand from the mining sector provides a baseline for heavy-duty attachment sales. Pricing sensitivity often leads to competition between global OEMs and more cost-effective regional manufacturers.

- Middle East and Africa (MEA): Growth in MEA is highly concentrated in the Gulf Cooperation Council (GCC) states due to mega-projects in construction (e.g., NEOM, tourism infrastructure) and ongoing oil and gas expansion. The African continent sees growing demand linked to mining activities and basic road infrastructure development. Buckets deployed in this region must withstand extreme heat and abrasive sandy conditions, demanding specialized wear packages and robust design specifications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Excavator Bucket Market.- Caterpillar Inc.

- Komatsu Ltd.

- Volvo Construction Equipment

- Hitachi Construction Machinery Co., Ltd.

- Liebherr Group

- Hyundai Construction Equipment Co., Ltd.

- Doosan Infracore

- John Deere (Deere & Company)

- Bobcat Company

- Attachments International

- Paladin Attachments (A Stanley Infrastructure Brand)

- Miller UK

- Esco Group (A Weir Group PLC Company)

- Geith International

- Amulet Manufacturing

- Werk-Brau Co. Inc.

- Rockland Manufacturing

- JRB Attachments

- OilQuick AB

- NPK Construction Equipment

Frequently Asked Questions

Analyze common user questions about the Excavator Bucket market and generate a concise list of summarized FAQs reflecting key topics and concerns.What factors primarily drive the growth of the Excavator Bucket Market?

Market growth is predominantly driven by global infrastructure development projects, increased urbanization, sustained demand from the robust mining and quarrying sectors for high-capacity material handling, and technological innovation focused on improving bucket durability and operational efficiency through advanced materials.

Which type of steel is most commonly used to manufacture severe-duty excavator buckets?

Severe-duty buckets predominantly utilize high-grade Abrasion-Resistant (AR) steels, such as AR400 to AR500 and sometimes higher, due to their superior hardness and impact resistance. Manufacturers also employ proprietary high-strength, low-alloy (HSLA) steels in the main structure for maximized tensile strength and reduced weight.

How does the aftermarket segment contribute to the overall Excavator Bucket Market revenue?

The aftermarket segment constitutes a critical revenue stream, driven by the replacement demand for high-wear components like Ground Engaging Tools (GETs—teeth, adapters, cutting edges) and the total replacement of worn-out buckets, providing continuous demand irrespective of new equipment sales cycles.

What role does quick coupler technology play in the modern excavator bucket market?

Quick coupler technology, especially hydraulic or fully automatic systems, significantly enhances machine utilization and job site flexibility by allowing operators to change various specialized buckets and attachments rapidly from the cab, thereby increasing efficiency across multi-tasking operations.

Which region currently holds the largest share in the global Excavator Bucket Market?

The Asia Pacific (APAC) region, largely fueled by massive infrastructure expansion and intensive mining activities in countries like China and India, holds the largest market share and is projected to maintain the fastest growth rate throughout the forecast period due to persistent urbanization trends.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Excavator Bucket Market Statistics 2025 Analysis By Application (Construction Excavator, Mining Excavator, Others), By Type (Digging Bucket, Rock Bucket, V Bucket, Others), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Excavator Bucket Market Statistics 2025 Analysis By Application (Construction Excavator, Mining Excavator), By Type (Digging Bucket, Rock Bucket, V Bucket), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager