Excavator Pulverizers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433506 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Excavator Pulverizers Market Size

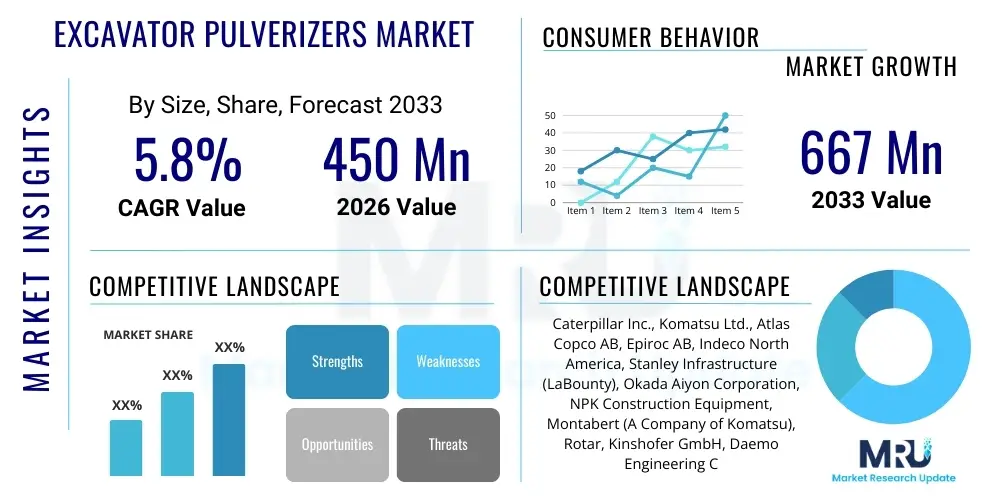

The Excavator Pulverizers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 667 Million by the end of the forecast period in 2033.

Excavator Pulverizers Market introduction

The Excavator Pulverizers Market encompasses the manufacturing, sales, and service of specialized hydraulic attachments designed for use on excavators, primarily utilized in demolition, material processing, and recycling operations. These robust attachments, often categorized into primary (for initial structural breakdown) and secondary (for further processing and separation) types, are instrumental in breaking down concrete, separating rebar, and efficiently reducing debris volume on construction and demolition sites. The core function of a pulverizer is to deliver high crushing force to dense materials, drastically improving the speed and safety of material reduction compared to traditional methods like breakers or manual labor. The market is fundamentally driven by the global imperative for sustainable construction practices, emphasizing resource efficiency and high-volume material recovery.

Excavator pulverizers are highly specialized tools distinguished by their powerful jaws, often featuring interchangeable teeth and wear parts made from high-strength alloys like Hardox. Product descriptions typically highlight technical specifications such as operating weight, jaw opening size, crushing force, and the required hydraulic flow of the host excavator. Major applications span urban renewal projects, bridge dismantling, infrastructure demolition, and dedicated concrete recycling facilities. The efficiency gains delivered by these tools, especially in crowded urban environments where noise and vibration must be minimized, cement their importance in the modern construction ecosystem. They transform unusable demolition rubble into recyclable aggregates, thus closing the loop in the construction material supply chain.

The primary benefits associated with adopting hydraulic pulverizers include enhanced operational safety by reducing the need for personnel near unstable structures, significant reduction in processing time, and superior material purity essential for high-quality recycling. Driving factors for market growth include stringent environmental regulations mandating high recycling rates for construction and demolition (C&D) waste, rapid global infrastructure development necessitating specialized demolition techniques, and technological advancements leading to lighter yet more powerful attachment designs. Furthermore, the increasing complexity of urban demolition projects demands precision tools capable of selective deconstruction, which modern rotating pulverizers are uniquely positioned to provide, accelerating market penetration across developed and rapidly urbanizing economies.

Excavator Pulverizers Market Executive Summary

The Excavator Pulverizers Market is experiencing robust expansion, fundamentally supported by global legislative shifts promoting the circular economy and infrastructure renewal initiatives. Key business trends indicate a strong move toward advanced hydraulic systems that offer superior energy efficiency and multi-functionality, allowing operators to switch seamlessly between primary breaking and secondary sorting tasks. Manufacturers are heavily investing in lighter, stronger materials and modular designs to ensure compatibility across various excavator classes, thereby expanding the potential customer base from large-scale demolition contractors to smaller specialized recycling firms. The competitive landscape is characterized by innovation in quick-coupling systems and telematics integration, providing contractors with critical data on operational performance and predictive maintenance needs, enhancing the overall total cost of ownership (TCO).

Regionally, the market exhibits divergent growth patterns. Asia Pacific (APAC) is emerging as the fastest-growing region, fueled by massive urbanization projects in China and India, coupled with increasing environmental awareness driving the adoption of C&D waste management regulations. North America and Europe, while mature markets, maintain high demand due to sustained infrastructure replacement cycles and rigorous enforcement of recycling quotas, focusing primarily on high-end rotating models that offer maximum precision. Conversely, the growth trajectory in Latin America and the Middle East and Africa (MEA) is accelerating, dependent on fluctuating commodity prices and the commitment to major construction mega-projects, representing significant long-term opportunities for market penetration by major global vendors.

Segmentation trends highlight the dominance of the rotating pulverizer segment due to its versatility and superior positioning capabilities necessary for complex, multi-story demolition. In terms of application, the demolition segment remains the largest volume consumer, but the recycling and material processing segment is demonstrating the highest CAGR, spurred by dedicated waste processing facilities requiring specialized secondary pulverizing attachments for material homogenization. Furthermore, the trend toward specialized attachments tailored specifically for concrete slab processing or rebar separation, rather than generic tools, is shaping product development strategies, ensuring that vendors address the highly specific needs of end-users across civil engineering and resource management domains.

AI Impact Analysis on Excavator Pulverizers Market

User inquiries regarding AI's impact on the Excavator Pulverizers Market frequently center on the potential for automation, predictive maintenance, and operational optimization. Key concerns include how AI algorithms can enhance the efficiency of material sorting and separation processes, particularly the identification of valuable materials within heterogeneous demolition waste. Users also seek information on AI-driven diagnostics for hydraulic systems, aiming to minimize costly downtime associated with attachment failure. Expectations revolve around achieving 'smart demolition' capabilities where AI guides the operator or semi-autonomous machinery to maximize structural reduction efficiency while ensuring precise material recovery, thereby linking operational data directly to profitability metrics. This analysis suggests a strong user interest in practical, implemented AI solutions that offer tangible improvements in resource management and attachment longevity, moving beyond simple telematics to genuine machine learning-based operational intelligence.

While the mechanical operation of the pulverizer itself remains dependent on hydraulic power, the integration of AI is transforming ancillary processes, particularly in system diagnostics and workflow planning. Machine learning algorithms are now being trained on vast datasets of usage patterns, hydraulic pressures, and material hardness encountered during demolition tasks. This allows for highly accurate predictive modeling of component wear, such as jaw plate fatigue or pin failure, enabling maintenance crews to intervene preemptively. This shift from reactive to predictive maintenance significantly boosts uptime and extends the effective lifespan of high-value attachments, providing substantial economic advantages to contractors operating under tight project deadlines.

Furthermore, AI-enhanced vision systems are increasingly being paired with excavator attachments, including pulverizers, to automate or assist in the final sorting stage. Cameras and sensors mounted near the attachment can feed real-time visual data to an AI platform capable of instantaneously classifying debris (e.g., concrete, brick, wood, light metals). Although the pulverizer's core function is crushing, AI guides the subsequent material handling process, optimizing the transfer of processed material to specific collection bins for recycling. This integration drives up the purity of recycled aggregates, making them more valuable and marketable, thus fundamentally enhancing the profitability of C&D waste management operations and strengthening the market for highly efficient processing tools.

- AI-driven predictive maintenance forecasts wear rates of jaw components, maximizing operational uptime.

- Machine learning optimizes hydraulic flow settings based on material density, improving crushing efficiency.

- AI-enhanced vision systems improve secondary sorting purity of processed C&D waste.

- Automation of repetitive tasks in large-scale material reduction using semi-autonomous excavators guided by AI pathfinding.

- Advanced telematics utilizing AI for generating comprehensive performance reports and fuel efficiency recommendations.

DRO & Impact Forces Of Excavator Pulverizers Market

The Excavator Pulverizers Market is shaped by a potent combination of Drivers, Restraints, and Opportunities, collectively forming the key Impact Forces influencing its trajectory. The primary driver is the global emphasis on environmental sustainability and the implementation of stringent governmental regulations concerning Construction and Demolition (C&D) waste management. Many jurisdictions now impose mandatory recycling targets (often exceeding 70-80% for inert waste), making efficient mechanical processing, achievable through specialized pulverizers, a necessity rather than an option. Coupled with this is the continuous global boom in urbanization and necessary infrastructure replacement, which generates high volumes of demolition waste requiring specialized, efficient on-site processing methods. The resultant demand for high-performance, low-vibration demolition attachments is fundamentally propelling market expansion, especially in densely populated urban centers where noise abatement is critical.

However, the market faces significant restraints. The initial capital investment required for high-end hydraulic pulverizers is substantial, often representing a barrier to entry for smaller contractors or those in developing economies with tighter budgetary constraints. Furthermore, the specialized nature of these attachments requires highly trained operators for safe and optimal performance, and a persistent shortage of skilled labor in the construction and demolition sectors globally limits immediate widespread adoption. Another major restraint is the cyclical nature of the construction industry; economic downturns can lead to the postponement of large infrastructure projects, directly impacting the demand for specialized demolition equipment. Variability in material composition and the risk of damage to the attachment from embedded non-crushable materials (like large steel beams) also pose operational challenges and increase maintenance costs, restraining rapid growth.

Opportunities within the market center on technological innovation and market penetration in emerging economies. The development of modular, multi-function pulverizers that can quickly adapt to various demolition needs (e.g., swapping out teeth for different concrete strengths) offers significant value propositions to contractors, broadening the equipment's utility. Moreover, the massive, untapped market potential in rapidly industrializing regions, particularly Southeast Asia and Africa, represents a long-term opportunity, provided that localized service networks and financing options are established. The increasing focus on concrete recycling for manufacturing high-quality secondary aggregates presents a niche opportunity for specialized, high-throughput secondary pulverizers. The overall impact force driving the market forward is the undeniable economic benefit of material recycling: reducing landfill costs and generating revenue from recovered materials, outweighing the initial capital expenditure and positioning pulverizers as essential tools in sustainable construction practices.

Segmentation Analysis

The Excavator Pulverizers Market is systematically segmented based on Type, Material Processed, Application, and End-User, enabling a granular understanding of demand dynamics and product specialization. The segmentation analysis reveals distinct purchasing behaviors and technological preferences across various industry verticals. Type segmentation, distinguishing between fixed (static) and rotating (hydraulic) models, is crucial as it dictates the attachment’s versatility and suitability for different demolition environments. Rotating pulverizers, offering 360-degree positioning, command a higher price point but dominate high-precision demolition tasks, indicating a preference for operational flexibility among leading contractors globally.

Segmentation by the material processed is becoming increasingly critical, differentiating pulverizers optimized for dense concrete crushing, those designed for concrete and rebar separation, and specialized models for processing other inert materials like asphalt or brick. This specialization trend is driven by the necessity of achieving high material purity for premium recycling outcomes. The application segment clearly outlines the primary consumption centers, with large-scale urban demolition and bridge deconstruction representing major revenue streams, while the high-growth recycling segment necessitates specialized secondary processing tools aimed at volume reduction and material homogenization.

Understanding the End-User segmentation provides insight into market distribution channels and customer service needs. While the core customer base remains large Construction and Demolition (C&D) contractors, the increasing participation of dedicated Waste Management and Recycling Facilities highlights a shift toward industrial processing environments. Infrastructure development authorities, often acting as project owners, indirectly drive demand by setting stringent environmental standards for contractors. Analyzing these segments ensures that manufacturers tailor their product portfolios—from compact fixed jaws for mini-excavators used by local contractors to heavy-duty rotating models for multi-ton machines used in high-reach demolition—to meet diverse market requirements efficiently.

- Type

- Fixed (Static) Pulverizers

- Rotating (Hydraulic) Pulverizers

- Material Processed

- Concrete

- Concrete with Rebar Separation

- Asphalt and Brick

- Application

- Primary Demolition (Structural Breakdown)

- Secondary Demolition (Material Reduction and Sorting)

- Material Recycling and Processing

- End-User

- Construction and Demolition (C&D) Contractors

- Waste Management and Recycling Facilities

- Infrastructure Development Authorities

- Mining and Quarrying (Limited Scope)

- Excavator Class

- Light-Duty (Up to 15 Ton)

- Medium-Duty (15 to 30 Ton)

- Heavy-Duty (Above 30 Ton)

Value Chain Analysis For Excavator Pulverizers Market

The Value Chain for the Excavator Pulverizers Market begins with the upstream sourcing of specialized raw materials, predominantly high-strength, abrasion-resistant steels (such as Hardox and proprietary alloys) necessary for manufacturing the robust jaws and cutter blades. Upstream analysis involves assessing the reliability and pricing volatility of key suppliers of these metals, hydraulic components (cylinders, seals, valves), and advanced casting services. Effective cost management and quality control at this initial stage are paramount, as the durability and performance of the final product are directly dependent on material integrity. Manufacturers often enter into long-term strategic partnerships with steel mills to ensure a stable supply of certified materials, mitigating risks associated with supply chain disruptions.

The core manufacturing stage involves complex fabrication, precision machining, and integration of sophisticated hydraulic systems. Key activities include advanced welding, heat treatment processes to enhance steel hardness, and rigorous quality assurance testing of the assembled attachment. Downstream analysis focuses on the distribution channels, which are typically bifurcated into direct sales to large, global demolition contractors and indirect sales through a well-established network of authorized equipment dealers and rental companies. The rental market plays a significant role, particularly for contractors who require specialized tools for short-term projects or seek to avoid high capital expenditures. Rental fleets often serve as a crucial showcase for manufacturers, influencing direct purchasing decisions.

Distribution channels for excavator pulverizers require specialized knowledge in heavy equipment logistics and hydraulic system integration. Direct distribution offers manufacturers greater control over pricing and customer relationships but requires substantial investment in regional sales and service teams. Indirect distribution, leveraging existing heavy equipment dealer networks, provides broader geographic reach and localized support, including maintenance, repairs, and spare parts supply—a critical element given the high wear nature of the attachments. Successful market players prioritize the accessibility of genuine replacement wear parts, as the speed and ease of maintenance significantly influence the end-user’s total cost of ownership (TCO) and repeat purchasing decisions, thereby strengthening the downstream relationship.

Excavator Pulverizers Market Potential Customers

The primary end-users and buyers in the Excavator Pulverizers Market are defined by organizations engaged in the systematic deconstruction of built environments and the subsequent processing of waste materials. The largest segment comprises large-scale Construction and Demolition (C&D) contractors, who rely on pulverizers as essential tools for structural demolition, specializing in complex projects such as high-rise buildings, bridges, and industrial facilities. These contractors seek high-performance, heavy-duty rotating pulverizers capable of operating on large excavators (30 tons and up) to maximize output and efficiency while adhering to strict safety protocols and timelines. Their purchasing decisions are heavily influenced by factors such as attachment weight-to-power ratio, ease of maintenance, and compatibility with proprietary quick-coupler systems.

A rapidly growing customer base includes dedicated Waste Management and Material Recycling Facilities (MRFs). Unlike demolition contractors who use pulverizers for initial breakdown, MRFs utilize secondary pulverizers for processing pre-sorted concrete and rubble into specific sizes required for aggregate production. These facilities require high-throughput machines with continuous duty ratings and robust mechanisms for efficiently separating ferrous materials (rebar) from concrete matrix, ensuring the purity necessary for high-value recycled products. These buyers prioritize operational uptime, low energy consumption per ton of processed material, and excellent hydraulic efficiency to handle continuous, intensive processing tasks.

Additional potential customers include specialized civil engineering companies focused on infrastructure maintenance and replacement (e.g., road removal, tunnel refurbishment), mining and quarrying operations requiring tools for specialized rock sizing (though less common than dedicated crushers), and governmental or municipal entities responsible for disaster recovery and rapid cleanup operations. For all potential buyers, the primary value proposition of the pulverizer lies in its ability to significantly reduce logistical costs associated with material handling—by crushing debris on-site, the density of the load increases, dramatically cutting transportation costs and landfill tipping fees. This economic imperative ensures continuous demand across all major customer segments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 667 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Caterpillar Inc., Komatsu Ltd., Atlas Copco AB, Epiroc AB, Indeco North America, Stanley Infrastructure (LaBounty), Okada Aiyon Corporation, NPK Construction Equipment, Montabert (A Company of Komatsu), Rotar, Kinshofer GmbH, Daemo Engineering Co., Ltd., VTN Europe S.p.A., TreviBenne S.p.A., Wimmer International, Rammer, Cangini Benne, Hydraulic Attachments Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Excavator Pulverizers Market Key Technology Landscape

The technological landscape of the Excavator Pulverizers Market is focused intensely on enhancing durability, maximizing crushing force relative to weight, and improving ease of maintenance. A core technological advancement is the continuous development of proprietary high-tensile and abrasion-resistant steel alloys, such as those used in wear parts and jaw structures. Manufacturers are implementing advanced heat treatment processes and specialized casting techniques to produce jaws that resist micro-fracturing and abrasion, significantly extending service life in demanding concrete and steel environments. This material science focus is complemented by engineering innovations aimed at optimizing the geometry of the crushing teeth and cutter blades, ensuring maximum material penetration and efficient rebar shearing, thereby boosting overall productivity per hour of operation.

Another pivotal area of innovation involves the hydraulic system design, particularly the integration of specialized pressure regeneration valves. These systems are designed to maximize the speed of the jaw opening and closing cycle while minimizing the required hydraulic flow from the host excavator. This hydraulic efficiency is critical as it allows smaller excavators to run powerful attachments, expanding the market for mid-range models. Furthermore, the incorporation of fully rotating hydraulic systems (360-degree rotation) utilizes high-torque rotation units and robust swivel joints, enabling precision positioning in demolition tasks that are otherwise inaccessible or dangerous. This technology is a primary differentiator between premium and standard offerings, driving growth in the high-end segments of the market.

The increasing adoption of telematics and Internet of Things (IoT) sensors represents a crucial technological shift. Modern pulverizers are often equipped with sensors that monitor internal metrics such as hydraulic pressure spikes, temperature, and cycle counts. This operational data is transmitted wirelessly, enabling predictive maintenance alerts, usage tracking for rental fleets, and data-driven performance analysis. The ability to monitor the condition of critical components remotely minimizes unplanned downtime, a major cost factor for contractors. Future technology developments are anticipated to include semi-autonomous operating modes, where sensor feedback guides the machine to optimize crushing parameters based on material density, further maximizing the efficiency gains inherent in high-tech pulverizer attachments.

Regional Highlights

The global Excavator Pulverizers Market demonstrates diverse adoption rates and technological preferences across major geographical regions, influenced heavily by regulatory frameworks, construction activity levels, and economic maturity.

- North America (U.S. and Canada): This is a highly mature market characterized by rapid adoption of advanced, high-efficiency rotating pulverizers and a strong focus on attachment versatility. Demand is driven by consistent infrastructure renewal (bridges, highways) and strict regulatory requirements for C&D recycling, promoting the use of specialized secondary processing attachments. The large fleet size of heavy excavators ensures strong continuous demand for heavy-duty pulverizer models, supported by robust aftermarket service networks.

- Europe (Germany, UK, France): Europe is a leader in implementing aggressive environmental standards regarding C&D waste management, making pulverizers indispensable tools. The market is characterized by high demand for precise, low-noise equipment, especially in urban environments. Scandinavian countries, in particular, show high penetration rates for advanced hydraulic attachments, emphasizing efficiency and safety. The European market favors high-quality materials and durability over initial cost savings.

- Asia Pacific (APAC) (China, India, Japan, Southeast Asia): APAC is projected to exhibit the highest growth rate due to unprecedented urbanization, massive infrastructure expansion (e.g., high-speed rail, new airports), and increasing government focus on formalizing waste management systems. While cost sensitivity remains a factor, particularly in developing economies, the sheer volume of demolition waste generated ensures burgeoning demand. China and India are emerging as critical manufacturing and consumption hubs, driving the adoption of both domestic and imported technology.

- Latin America (Brazil, Mexico): Market growth in Latin America is steady but often dependent on governmental capital investment in infrastructure projects and resource extraction activities. Demand is concentrated in major metropolitan areas, with purchasing decisions often heavily weighted by price competitiveness and localized service availability. The market potential is significant but constrained by economic volatility and slower regulatory adoption of mandatory C&D recycling.

- Middle East and Africa (MEA): The MEA market is highly project-specific, driven by major national development visions and mega-projects (e.g., Saudi Arabia’s NEOM, UAE’s urban expansion). These projects require heavy-duty equipment for processing vast quantities of concrete and aggregate. Africa presents long-term growth opportunities as resource management practices mature and specialized demolition needs increase, although current demand is localized and often supplied through European distributors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Excavator Pulverizers Market.- Caterpillar Inc.

- Komatsu Ltd.

- Atlas Copco AB

- Epiroc AB

- Indeco North America

- Stanley Infrastructure (LaBounty)

- Okada Aiyon Corporation

- NPK Construction Equipment

- Montabert (A Company of Komatsu)

- Rotar

- Kinshofer GmbH

- Daemo Engineering Co., Ltd.

- VTN Europe S.p.A.

- TreviBenne S.p.A.

- Wimmer International

- Rammer (A Brand of Sandvik)

- Geith International

- Cangini Benne S.r.l.

- Hydraulic Attachments Inc.

- Allied Construction Products

Frequently Asked Questions

Analyze common user questions about the Excavator Pulverizers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a fixed and a rotating excavator pulverizer?

Fixed (static) pulverizers are rigid attachments primarily used for secondary crushing and processing materials on the ground, offering high stability and cost-effectiveness. Rotating (hydraulic) pulverizers offer 360-degree rotation capability, allowing for highly precise positioning and structural demolition at height, commanding a higher initial investment but offering superior operational versatility and efficiency in complex urban sites.

How is C&D recycling legislation driving the demand for pulverizers?

Stringent governmental regulations mandate high recycling rates for Construction and Demolition (C&D) waste, reducing reliance on landfills. Pulverizers are essential tools for efficiently processing large volumes of concrete and separating rebar, reducing material volume on-site, minimizing transportation costs, and producing high-purity recycled aggregates necessary to meet these legislative mandates.

What factors should contractors consider when selecting the correct pulverizer size?

Contractors must match the pulverizer weight and hydraulic requirements precisely to the operating weight and flow capacity of the host excavator to ensure safe and optimal performance. Other crucial factors include the maximum jaw opening needed for the material size, the required crushing force, and the type of demolition task (primary versus secondary processing) being undertaken.

Which geographical region exhibits the fastest growth potential for the Excavator Pulverizers Market?

The Asia Pacific (APAC) region, particularly driven by rapid urbanization and infrastructure expansion in China and India, is projected to show the highest Compound Annual Growth Rate (CAGR). This growth is supported by large volumes of demolition waste generated and the increasing adoption of specialized recycling technologies across developing economies.

How does the integration of telematics benefit the owners of hydraulic pulverizers?

Telematics integration, often enhanced by AI analysis, provides real-time data on attachment performance, usage hours, hydraulic pressures, and component wear. This enables predictive maintenance scheduling, reduces unexpected downtime, optimizes operational efficiency by flagging suboptimal settings, and ultimately lowers the total cost of ownership (TCO) for the high-value equipment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager