Exercise and Stationary Bike Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433778 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Exercise and Stationary Bike Market Size

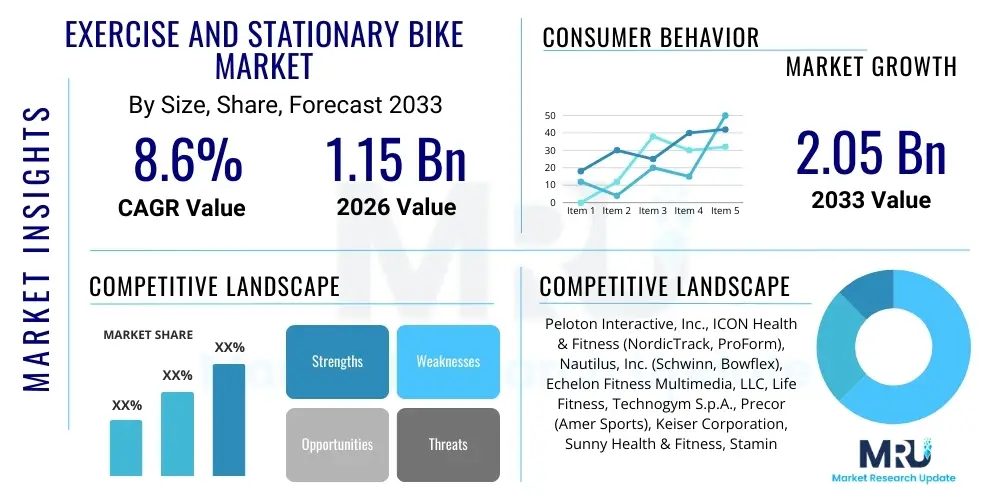

The Exercise and Stationary Bike Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.6% between 2026 and 2033. The market is estimated at $1.15 Billion in 2026 and is projected to reach $2.05 Billion by the end of the forecast period in 2033.

Exercise and Stationary Bike Market introduction

The Exercise and Stationary Bike Market encompasses equipment designed for indoor cardiovascular fitness, simulating the motion of cycling. These machines, ranging from basic mechanical models to highly sophisticated connected devices, serve as essential tools for weight management, cardiovascular health improvement, and rehabilitation programs. Stationary bikes, including upright, recumbent, and indoor cycling models, provide a low-impact workout suitable for a broad demographic. The primary applications span residential settings, commercial gyms, corporate wellness centers, and physiotherapy clinics. Key benefits include improved cardiac function, joint protection due to minimal impact, and accessibility, enabling users to maintain fitness routines regardless of weather conditions or time constraints. Driving factors include increasing global awareness regarding lifestyle diseases, the growing popularity of at-home fitness subscriptions, technological integration (such as gamification and virtual classes), and governmental initiatives promoting physical activity and preventative healthcare measures.

Exercise and Stationary Bike Market Executive Summary

The global Exercise and Stationary Bike Market demonstrates robust growth, primarily propelled by sustained demand for connected fitness solutions and the permanent shift toward hybrid fitness models blending gym attendance with home workouts. Business trends indicate a consolidation among major players, who are increasingly focusing on vertical integration, controlling both hardware manufacturing and software subscription services (e.g., live and on-demand classes). Regional trends show North America and Europe maintaining dominance due to high discretionary spending and established digital infrastructure, although the Asia Pacific region is expected to exhibit the fastest CAGR, driven by rising disposable incomes and expanding middle-class penetration into premium fitness products, particularly in urban centers. Segment trends highlight the exponential growth of the Connected Bike segment, which offers personalized metrics, competitive leaderboards, and interactive training, significantly enhancing user engagement compared to traditional, non-smart alternatives. The residential application segment remains the primary revenue driver, but the commercial segment is revitalized by high-end gyms upgrading their fleets with digitally integrated equipment.

AI Impact Analysis on Exercise and Stationary Bike Market

User inquiries regarding Artificial Intelligence (AI) in the stationary bike market frequently center on how these technologies can personalize fitness experiences, enhance motivation, and optimize training efficiency. Common questions involve the capabilities of AI in generating adaptive workout routines, real-time biometric analysis for safety and performance, and the seamless integration of user data across various health platforms. Users are keen to understand how AI-powered coaching algorithms differ from standard programmed workouts, specifically focusing on the ability of AI to detect fatigue, predict overtraining risks, and dynamically adjust resistance or pacing based on individual physiological responses observed during the session. The expectations are high for AI to move beyond simple data aggregation toward truly intelligent, personalized, and predictive health coaching, ensuring that the stationary bike becomes an integral component of a holistic, data-driven wellness regime.

The practical application of AI is transforming stationary bike functionality from mere physical exercise equipment into sophisticated health management tools. AI algorithms analyze vast datasets, including heart rate variability, power output, cadence, and historical performance, to construct hyper-personalized training programs that maximize calorie expenditure and muscle gain while minimizing the risk of injury or burnout. This capability positions smart stationary bikes as competitors to traditional personal trainers, offering expert guidance available 24/7. Furthermore, generative AI is impacting content creation, allowing fitness platform providers to scale the production of diverse, niche virtual cycling routes and instructional videos, catering to highly specific user interests, geographical preferences, and athletic objectives, thereby significantly boosting the appeal of subscription-based services attached to the hardware.

Crucially, the integration of predictive maintenance via AI is improving the operational efficiency and longevity of stationary bike fleets, particularly in high-traffic commercial environments. AI systems monitor component stress, usage patterns, and potential failure indicators in real-time, proactively alerting operators to required maintenance before equipment failure occurs. This enhances user satisfaction by minimizing downtime and reduces capital expenditure for commercial facilities by optimizing replacement schedules. For residential users, AI facilitates a more engaging and responsive virtual environment, utilizing Natural Language Processing (NLP) to interpret voice commands and feedback, making the interaction with the fitness machine more intuitive and less screen-dependent, which is a major area of competitive differentiation.

- Real-time biometric analysis for adaptive resistance and intensity adjustments.

- Predictive maintenance alerts for commercial and high-end residential models.

- AI-driven personalized coaching that adjusts training loads based on recovery metrics (e.g., sleep, heart rate variability).

- Enhanced gamification and virtual reality integration through machine learning optimizing environmental rendering based on user speed.

- Natural Language Processing (NLP) integration for intuitive voice control and feedback interpretation.

- Optimization of content delivery, recommending classes and instructors based on past performance and engagement data.

DRO & Impact Forces Of Exercise and Stationary Bike Market

The Exercise and Stationary Bike Market dynamics are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively shaping the impact forces on the industry's trajectory. Key drivers include the escalating global prevalence of obesity and cardiovascular diseases, necessitating accessible and consistent forms of exercise, coupled with the rising consumer preference for at-home fitness solutions accelerated by pandemic-era behavioral shifts. The rapid advancement in connectivity technologies, such as 5G and IoT, allows for seamless integration of smart features, virtual coaching, and social networking capabilities, transforming static equipment into engaging, community-driven platforms. The opportunity landscape is vast, centered around penetrating emerging markets, developing specialized equipment for geriatric or rehabilitation use, and establishing deep partnerships with healthcare providers to integrate exercise prescriptions into patient wellness plans. The ability of manufacturers to transition toward a subscription-based revenue model, coupling hardware sales with high-margin digital content, represents a fundamental shift in profitability and market valuation.

However, significant restraints temper the market’s aggressive growth projections. The primary challenge remains the high initial investment cost associated with premium connected stationary bikes, placing them outside the financial reach of lower- and middle-income demographics, particularly in developing economies. Intense competition from alternative home fitness equipment, such as treadmills, rowers, and weight training systems, creates substitution threats, requiring stationary bike providers to continuously innovate their value proposition. Furthermore, the longevity and durability of stationary bikes, while a selling point, paradoxically slow down the replacement cycle, constraining recurring revenue from hardware sales. Regulatory hurdles regarding data privacy and security, particularly concerning the collection and transmission of sensitive biometric data generated by smart fitness devices, also pose compliance and consumer trust challenges that manufacturers must meticulously address to maintain market credibility and avoid legal sanctions across diverse jurisdictions.

The impact forces analysis reveals that technological disruption is the strongest accelerating force, as continuous software updates and new AI integrations maintain user engagement and minimize equipment obsolescence, supporting premium pricing. Conversely, supply chain vulnerabilities, particularly those impacting the procurement of electronic components like microcontrollers and sensors necessary for connected features, act as a significant moderating force on production scalability and cost optimization. The shifting consumer behavior towards experiential spending, valuing digital content and community interaction over mere mechanical function, dictates that companies must invest heavily in content production and community management. If manufacturers fail to innovate the user experience beyond simple cycling metrics, the market risks stagnation due to user fatigue and churn from digital subscriptions, emphasizing the critical balance required between hardware quality and software sophistication for sustained market relevance and differentiation.

Segmentation Analysis

The Exercise and Stationary Bike Market is comprehensively segmented based on product type, application, and technology, reflecting the diverse needs and purchasing power of global consumers. The segmentation highlights the shift from traditional, mechanical products toward high-value, digitally enhanced equipment, driven by consumer demand for immersive and measurable fitness experiences. Understanding these segments is critical for manufacturers to tailor their product development strategies and marketing initiatives, addressing specific demographic cohorts, such as high-income residential users seeking luxury connectivity or budget-conscious consumers prioritizing basic functionality and durability. The market structure emphasizes a bifurcation, where premium connected bikes command high average selling prices and recurring subscription revenue, while entry-level models compete fiercely on cost and reliability, serving the mass market and initial adoption phases.

- Type:

- Upright Bikes

- Recumbent Bikes

- Indoor Cycling Bikes (Spin Bikes)

- Dual-Action Bikes

- Application:

- Residential

- Commercial (Gyms, Health Clubs, Corporate Wellness)

- Institutional (Hospitals, Physiotherapy Centers, Educational Institutions)

- Technology:

- Connected/Smart Bikes (Interactive screens, streaming capability, AI integration)

- Traditional/Standard Bikes (Non-digital consoles, basic resistance monitoring)

- Distribution Channel:

- Online Retail

- Offline Retail (Specialty Stores, Sporting Goods Stores)

- Direct Sales (Manufacturer-to-Consumer)

Value Chain Analysis For Exercise and Stationary Bike Market

The value chain for the Exercise and Stationary Bike Market commences with upstream analysis, focusing on the procurement of raw materials and specialized components. Key upstream activities involve sourcing high-grade steel, aluminum, and durable plastics for the frame and mechanical components, alongside crucial electronic parts like microcontrollers, sensors, display screens, and connectivity modules (Wi-Fi, Bluetooth). Efficiency at this stage is dictated by strong supplier relationships, effective inventory management, and mitigating exposure to global commodity price volatility. Manufacturers specializing in connected bikes must also establish secure and redundant supply chains for complex electronics, which are often subject to geopolitical and logistical constraints. The successful navigation of the upstream segment ensures product quality, consistency, and cost-effective manufacturing, directly influencing the final retail price and profitability margins.

Midstream activities encompass design, manufacturing, and assembly. Innovation in design centers on ergonomics, footprint optimization for urban dwelling, and aesthetic appeal. The manufacturing process involves precision welding, powder coating, and final assembly, often utilizing highly automated facilities to ensure standardized quality and high production volume. For smart bikes, this stage also includes the integration of proprietary software, rigorous quality assurance testing for connectivity features, and ensuring compliance with regional electrical and safety standards. The logistics segment involves efficient warehousing and global shipping, minimizing transit damage and optimizing routes to key distribution hubs. Companies that manage in-house manufacturing often benefit from greater control over quality, while those relying on Original Equipment Manufacturers (OEMs) focus primarily on design, branding, and intellectual property management.

Downstream analysis focuses on distribution channels, marketing, and post-sale services. Direct-to-Consumer (D2C) channels, especially prevalent among leading connected fitness brands like Peloton, minimize intermediary costs and allow for greater control over the customer experience and brand narrative. This is often supplemented by strong online retail partnerships (e.g., Amazon, specialized e-commerce sites) and, for traditional models, offline retail through sporting goods stores and department chains. Post-sales support, including installation, maintenance, and especially the delivery of high-quality digital content, is a critical differentiator. The subscription revenue generated from digital content represents a high-margin, sticky revenue stream that transforms the bike from a one-time purchase into a long-term service relationship, securing significant customer lifetime value and fostering brand loyalty within a competitive ecosystem.

Exercise and Stationary Bike Market Potential Customers

The primary cohort of potential customers for the Exercise and Stationary Bike Market spans affluent residential users and digitally engaged fitness enthusiasts who prioritize convenience, data tracking, and immersive workout experiences. This demographic is characterized by high disposable income, a willingness to invest in premium lifestyle products, and a desire to integrate fitness seamlessly into busy professional schedules. These end-users are the target market for connected bikes, focusing on live classes, competitive leaderboards, and integrated social features. Additionally, the market targets individuals undergoing physical rehabilitation or those with specific joint issues, where low-impact exercise is medically recommended. These customers often seek specialized recumbent bikes that offer enhanced back support and easy access, typically recommended or purchased through institutional channels like physiotherapy clinics and medical supply vendors, valuing safety and biomechanical precision over high-intensity performance metrics.

A secondary, yet significant, customer segment includes commercial establishments such as large health clubs, boutique cycling studios, corporate wellness centers, and hospitality businesses (hotels and resorts). These buyers prioritize durability, heavy-duty construction, networked fleet management capabilities, and equipment that can withstand continuous, high-volume usage. For commercial buyers, the total cost of ownership (TCO), including maintenance expenses and uptime reliability, is a key purchasing criterion. The trend toward corporate wellness programs is driving institutional purchasing, as organizations recognize the benefit of providing on-site fitness amenities to improve employee health, reduce healthcare costs, and boost productivity. This institutional segment typically favors commercial-grade indoor cycles or high-end upright bikes known for their robust build and standardized console interfaces, often requiring bulk purchases and specialized service contracts.

Emerging market customers, primarily located in rapidly urbanizing regions of Asia and Latin America, constitute a growing potential base, although they often lean towards mid-range traditional or entry-level smart bikes due to budget constraints. This segment values core functionality, space-saving designs, and incremental technological upgrades that provide value without the heavy subscription burden associated with luxury connected brands. Manufacturers are strategically developing affordable, high-quality models tailored for apartment living and first-time fitness equipment buyers in these regions. Successful penetration into this mass market requires optimizing local distribution networks and offering accessible financing options, recognizing that even minor enhancements in connectivity—such as basic Bluetooth integration for third-party apps—can significantly increase the attractiveness of the product to this value-conscious consumer base.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.15 Billion |

| Market Forecast in 2033 | $2.05 Billion |

| Growth Rate | 8.6% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Peloton Interactive, Inc., ICON Health & Fitness (NordicTrack, ProForm), Nautilus, Inc. (Schwinn, Bowflex), Echelon Fitness Multimedia, LLC, Life Fitness, Technogym S.p.A., Precor (Amer Sports), Keiser Corporation, Sunny Health & Fitness, Stamina Products, Inc., XTERRA Fitness, Horizon Fitness, Sole Fitness, Cybex International, Johnson Health Tech Co., Ltd., Matrix Fitness, Tunturi New Fitness. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Exercise and Stationary Bike Market Key Technology Landscape

The technological landscape of the Exercise and Stationary Bike Market is rapidly evolving, driven primarily by the convergence of IoT, advanced sensor technology, and high-fidelity digital interfaces. Core technology focuses on achieving highly accurate and reliable metrics, including power output (watts), cadence, and heart rate, often utilizing sophisticated strain gauges and optical sensors integrated directly into the pedals and handlebars. High-definition touchscreen displays, capable of streaming live 4K video, are standard on premium models, replacing simple LCD consoles. Crucially, proprietary operating systems and embedded software are foundational, enabling seamless connectivity to cloud-based fitness platforms, facilitating over-the-air (OTA) software updates, and managing user profiles and subscription authentication. The reliance on robust Bluetooth and Wi-Fi connectivity protocols ensures stable streaming and data synchronization, minimizing user frustration and supporting the consistent delivery of premium services required for subscription retention.

A significant area of innovation is in the resistance mechanism, moving beyond traditional friction brakes toward magnetic resistance systems that offer smoother, quieter, and more precise control. Electromagnetic resistance (often used in high-end spin bikes) allows for rapid, digitized changes in intensity, enabling the bike's software or live instructor to instantaneously adjust the workload based on the prescribed workout or AI feedback. Furthermore, haptic feedback and dynamic tilting mechanisms are emerging technologies aimed at enhancing the realism and immersion of virtual cycling experiences. These features simulate uphill climbs, downhill coasting, and lateral movements experienced during outdoor riding, significantly boosting the sensory engagement. Data analytics platforms, housed in the cloud, process millions of data points generated by users daily, providing manufacturers and content creators with critical insights into engagement patterns, class preferences, and optimal training loads, driving personalized content recommendations and future product development cycles based on empirical evidence.

The integration of Augmented Reality (AR) and Virtual Reality (VR) technologies represents the next frontier, moving the workout experience from a simple flat screen to a fully immersive environment. While VR applications still face challenges related to motion sickness and headset comfort during intense exercise, AR overlays are increasingly utilized to project real-time performance metrics onto physical objects or scenic routes displayed on the screen, blending the digital and physical environments effectively. Furthermore, companies are investing heavily in secure data architectures and encryption technologies to protect sensitive personal and biometric data collected by the devices, ensuring compliance with global privacy regulations such as GDPR and CCPA. The ability to guarantee data security and provide transparent data usage policies is becoming a critical competitive advantage, fostering consumer trust in the sophisticated technology ecosystem that underpins the modern stationary bike market.

Regional Highlights

- North America: Dominates the global market, characterized by high consumer spending on health and wellness, established connected fitness ecosystems (led by companies like Peloton and Nautilus), and a strong early adoption rate of smart home exercise equipment. The region benefits from high internet penetration and a culture prioritizing performance tracking and digital social fitness interaction, driving high revenue from both hardware sales and recurring content subscriptions.

- Europe: Represents a mature market with significant contributions from countries like Germany, the UK, and France. Demand is driven by strong regulatory support for physical health initiatives and a preference for high-quality, durable commercial-grade equipment. The region is seeing rapid growth in mid-tier connected bikes as consumers seek value-driven alternatives to premium US brands, fostering innovation in localized digital content creation and multilingual platform support.

- Asia Pacific (APAC): Expected to register the highest CAGR during the forecast period. Growth is fueled by rapid urbanization, rising disposable incomes in countries like China and India, and increasing awareness of preventative healthcare. While traditionally focused on value products, the premium connected segment is rapidly gaining traction in major metropolitan areas, requiring localized content, smaller footprints suitable for dense housing, and tailored marketing strategies that resonate with cultural fitness preferences.

- Latin America: Characterized by nascent but growing demand, particularly in Brazil and Mexico. Market growth is reliant on improving economic stability and the expansion of digital infrastructure. The segment is price-sensitive, with strong interest in durable, multi-functional bikes that offer hybrid indoor/outdoor capabilities or basic connectivity features without high subscription fees.

- Middle East and Africa (MEA): A developing market focused primarily on high-end commercial installations in luxury fitness centers, hotels, and high-net-worth residential complexes, particularly in the UAE and Saudi Arabia. Market expansion is driven by government investment in large-scale health and tourism projects, although affordability remains a major constraint for mass market adoption.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Exercise and Stationary Bike Market.- Peloton Interactive, Inc.

- ICON Health & Fitness (NordicTrack, ProForm)

- Nautilus, Inc. (Schwinn, Bowflex)

- Echelon Fitness Multimedia, LLC

- Life Fitness

- Technogym S.p.A.

- Precor (Amer Sports)

- Keiser Corporation

- Sunny Health & Fitness

- Stamina Products, Inc.

- XTERRA Fitness

- Horizon Fitness

- Sole Fitness

- Cybex International

- Johnson Health Tech Co., Ltd.

- Matrix Fitness

- Tunturi New Fitness

- Core Health & Fitness

- Star Trac

- WaterRower

Frequently Asked Questions

Analyze common user questions about the Exercise and Stationary Bike market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Stationary Bike Market?

The Stationary Bike Market is projected to experience a Compound Annual Growth Rate (CAGR) of 8.6% during the forecast period spanning 2026 to 2033. This robust growth is primarily fueled by the accelerating global adoption of connected fitness technologies and the sustained consumer trend toward home-based cardiovascular training solutions.

How is AI fundamentally changing the stationary cycling experience for consumers?

AI is transforming the stationary cycling experience by enabling hyper-personalized training programs that adapt in real-time to the user's physiological data, such as heart rate variability and power output. This technology moves beyond basic programmed routines to offer intelligent, fatigue-aware coaching, maximizing efficiency and minimizing injury risk, thereby creating a highly customized and engaging workout environment.

Which segmentation technology type is driving the most significant revenue growth in the stationary bike market?

The Connected/Smart Bikes technology segment is the dominant revenue driver. These bikes feature high-definition touchscreens, integrated streaming capabilities, and access to subscription-based content (live and on-demand classes), generating significant recurring revenue streams and commanding higher average selling prices compared to traditional, non-digital models.

What are the primary restraints affecting the market expansion of premium stationary bikes?

The primary restraints include the high initial capital investment required for premium connected equipment, making it inaccessible to broader demographics. Additionally, intense substitution threats from competing low-impact fitness equipment, and supply chain volatility for necessary electronic components, particularly semiconductors and sensors, impact production scale and overall market penetration.

Which region currently holds the largest market share for exercise and stationary bikes, and why?

North America currently holds the largest market share. This dominance is attributed to high consumer discretionary spending on health and wellness, mature digital infrastructure supporting subscription models, and the early and aggressive adoption of market leaders specializing in connected fitness platforms and D2C distribution strategies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager